Corteva Increases Quarterly Dividend for Fifth Consecutive Year

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jul 29 2025

0mins

Should l Buy CTVA?

Source: PRnewswire

Corteva Dividend Announcement: Corteva, Inc. has declared a common stock dividend of $0.18 per share, marking a nearly 6% increase from the previous quarterly dividend, to be paid on September 15, 2025, to shareholders of record on September 2, 2025.

EIDP Preferred Stock Dividend: EIDP, Inc. announced preferred stock dividends of $1.12-1/2 per share for the $4.50 series and $0.87-1/2 per share for the $3.50 series, payable on October 24, 2025, to stockholders of record on October 3, 2025.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CTVA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CTVA

Wall Street analysts forecast CTVA stock price to rise

12 Analyst Rating

10 Buy

2 Hold

0 Sell

Strong Buy

Current: 74.110

Low

68.00

Averages

79.17

High

86.00

Current: 74.110

Low

68.00

Averages

79.17

High

86.00

About CTVA

Corteva, Inc. is a global pure-play agriculture company. It is a global provider of seed and crop protection solutions focused on the agriculture industry and contributing to a healthier, secure and sustainable food supply. The Seed segment is engaged in developing and supplying commercial seed combining advanced germplasm and traits that produce optimum yield for farms around the world. It operates in various key seed markets, including North American corn and soybeans, European corn and sunflower, as well as Brazil, India, South Africa and Argentina corn. The Crop Protection segment serves the global agricultural input industry with products that protect against weeds, insects and other pests, and disease, and that support overall crop health both above and below ground via nitrogen management and seed-applied technologies. Its crop protection solutions and digital solutions provide farmers with tools to improve productivity and help keep fields free of weeds, insects and diseases.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Financial Performance Overview: BP reported adjusted earnings of 60 cents per share, slightly exceeding the consensus estimate of 59 cents, yet total revenue of $47.38 billion fell short of analyst projections of $49.36 billion, indicating challenges in revenue growth.

- Debt Management Strategy: The company has decided to suspend stock buybacks to allocate excess cash towards debt reduction, aiming to lower net debt to between $14 billion and $18 billion by the end of 2027, reflecting a strong emphasis on financial stability.

- Segment Performance: The Oil Production & Operations segment recorded a replacement cost profit of $1.7 billion, with underlying profit adjusted down to $2.0 billion due to impacts from production mix and lower income share, highlighting pressures in the market environment.

- Future Outlook: BP anticipates capital expenditures in the range of $13 billion to $13.5 billion for 2026, with upstream production expected to slightly decline, demonstrating a cautious approach in response to industry challenges while also projecting approximately $1.6 billion in Gulf of America settlement payments.

See More

- Downgrade Rationale: UBS downgraded Corteva (CTVA) from Buy to Neutral, citing the stock's proximity to its price target and the upcoming separation of its seed and crop protection businesses, which introduces execution risks and potential negative surprises.

- Seed Business Outlook: UBS views Corteva's seed segment as its strongest asset, with seed EBITDA growing at approximately 17% annually over the past five years, and projects an 8% growth rate over the next three years, while the Bayer settlement is expected to generate around $1 billion in licensing income.

- Increased Crop Protection Risks: The crop protection segment faces heightened uncertainty as it transitions to a standalone model, with risks related to unbundling sales potentially pressuring volumes and margins, compounded by competitive pricing pressures from generics in China and India.

- Conservative Guidance and Valuation Reset: Despite the downgrade, UBS believes Corteva's earnings guidance is conservative, modeling seed pricing growth of about 2% annually, while lowering its price target from $81 to $80 to reflect separation risks and near-term earnings uncertainties.

See More

- Cost and Yield Comparison: Vanguard Consumer Staples ETF (VDC) charges an annual fee of just 0.09%, significantly lower than Invesco Food & Beverage ETF (PBJ) at 0.61%, while VDC also offers a higher dividend yield of 2.1% compared to PBJ's 1.7%, making VDC more appealing for income-focused investors.

- Portfolio Composition Differences: VDC encompasses over 100 consumer stocks, with 98% in consumer defensive, whereas PBJ focuses on 31 food and beverage companies, including Sysco and Corteva, which may increase specific company risk due to its concentrated investments.

- Market Performance and Risk: Over the past year, VDC achieved a return of 4.6%, while PBJ only managed 1.2%, and VDC's maximum drawdown of 16.55% is lower than PBJ's 15.84%, indicating VDC's relative stability amid market volatility.

- Investment Strategy Choices: As a pure index fund, VDC provides comprehensive defensive exposure to consumer staples, while PBJ employs quantitative analysis for a concentrated portfolio, charging nearly seven times the fees of VDC, yet recent performance suggests this may not justify the cost, prompting investors to choose wisely.

See More

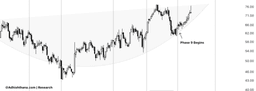

- Cakra Structure Overview: Corteva's stock entered Phase 4 in 2022 and formed a visible Cakra structure by the end of Phase 8 in November 2025, establishing a foundation for a breakout in Phase 9; however, the current trading position near the lower end of the Cakra indicates a lack of ideal breakout conditions.

- Increased Breakout Risk: Although Corteva initially bounced at the start of Phase 9, it has failed to decisively break above the upper boundary of the Cakra, facing repeated selling pressure, which suggests that if a breakout does not materialize, the risk of a significant downside increase is likely.

- Monthly Chart Warning: On the monthly charts, Corteva is currently in Phase 2 and has transitioned into the Buddhi segment, but the absence of prior consolidation during the Sankhya period further weakens the bullish case and adds to the structural caution already evident on the weekly charts.

- Investor Outlook: Investors should avoid chasing Corteva stock, and existing holders must closely monitor the Cakra structure, being prepared to act if a breakdown occurs, as a Cakra breakdown often indicates underlying fundamental risks that may not yet be fully reflected in the stock price.

See More

- Rating Downgrade: J.P. Morgan downgraded Corteva (CTVA) from Overweight to Neutral, citing that the stock is trading close to fair value despite improving fundamentals in the seed business, indicating limited upside potential.

- Price Target Increase: The bank raised its December 2026 price target from $75 to $77, reflecting an increase in its 2026 EBITDA forecast to $4.2 billion, driven by stronger-than-expected profitability in seeds.

- Cyclical Considerations: Analysts noted that U.S. corn acreage reached nearly 99 million acres in 2025, suggesting that Corteva is operating in a strong agricultural cycle, which could temper future earnings momentum.

- Separation Plan Impact: Corteva plans to split into two standalone companies in the second half of 2026, and the market may wait for clearer visibility on this separation before reassessing valuation multiples, even as the seed unit continues to show solid margins and market share gains.

See More

- Analyst Rating Updates: Top Wall Street analysts have adjusted their ratings on several companies, reflecting a shift in market sentiment regarding their prospects, which could influence investor decisions and market trends.

- Overview of Changes: While specific upgrades and downgrades are not detailed, the overall rating changes may lead to short-term volatility in related stocks, prompting investors to closely monitor these shifts.

- Expected Market Reaction: Analyst rating adjustments typically trigger immediate market responses, especially when investor interest in specific stocks increases, potentially impacting short-term price movements.

- Investor Focus: For those considering purchasing GOOGL stock, analysts' perspectives will serve as a crucial reference point, potentially affecting their investment decisions and market confidence.

See More