Key Takeaways

- Artificial intelligence has been around for numerous years it has only just expanded due to the collection of big data and advanced training

- The AI bubble has grown exponentially and will likely continue to do so with the rate of market penetration and adoption

- The valuation that AI has brought to the stock market has led to the potential overvaluation of specific stocks

- AI stocks have the potential to continue to grow over the next several years, leading to potentially good investment opportunities

Introduction

Wherever we turn it seems like everyone is talking about artificial intelligence (AI), it has been further amplified by the recent surges in the stock market, is AI all just a fad and if so when will the AI bubble burst?

It seems AI companies are here to stay, and even expand over the next several years, meaning the likelihood of the AI bubble bursting is relatively slim, but there are potential signals we can identify that may indicate otherwise.

What is artificial intelligence?

Artificial intelligence, or AI, is a complex piece of technology that enables computers and machines to simulate human intelligence. AI has been around for many years, but the recent capability of collecting and storing big data has now advanced AI's development, with many companies monetizing from its rise.

What are key AI stocks?

Across the entire stock market, it seems that almost every company is integrating AI in some shape or form across their industry and departments. But, who are the biggest AI stocks inflating this AI bubble and should I consider buying them?

Nvidia (NVDA)

Market cap: $3.26 Trillion

Revenue: $60.90 billion

52-week range: $54.74 - $153.13

There is no company like Nvidia that is a key driver in the surge of AI development. Due to Nvidia's recent announcements regarding their AI processing chips, Nvidia's stock has skyrocketed exponentially inflating the AI bubble further.

Tesla (TSLA)

Market cap: $1.29 Trillion

Revenue: $96.77 billion

52-week range: $138 - $488

Tesla, although an automotive company, is another pioneering company in the rollout and adoption of AI. With Elon Musk being a very vocal individual about the dangers of AI and accusing OpenAi's Sam Altman of manipulating its AI. Elon is set to develop his own AI platform Xai.

Microsoft (MSFT)

Market cap: $3.10 Trillion

Revenue: $245.1 billion

52-week range: $384.82 - $468.35

Microsoft has been less in the spotlight when it comes to the development of AI, however, it recently invested $13 billion into OpenAI and is investing a further $80 billion into new AI data centres cementing the company's potential to be a strong future AI disruptor.

Handful of startups

Aside from these big three AI stocks, there are thousands of startups and small businesses that are benefiting immensely from the AI boom. With many of these companies utilizing API keys provided by companies such as OpenAI, these companies can offer "AI-generated" services to their existing clients across their industries.

What could burst the AI bubble?

Although AI is seemingly well received, with multiple companies integrating its use into their businesses, there are signs that could burst the AI bubble.

Too much reliance on one AI system

As more and more startups and companies integrate AI into their products and services provided by third-party AI providers, the reliance on these AI vendors becomes highly risky.

For example, according to Master of Code, over 2 million developers are utilizing ChatGPT with 92% of Fortune 500 companies integrating its services into their own. Digital services have been known to occasionally be unreliable, and if OpenAI's servers go down, then a domino effect will happen.

Geo-political issues

The AI bubble has been drastically inflated by the production and manufacturing of AI infrastructure, for example, semiconductor chips. With the heating tensions between the US and China, this could potentially disrupt key AI supply lines leading to a shortage in companies being able to expand in the field.

Furthermore, AI has been known to be biased toward the people of train it along with the data it is fed. With the rise of multiple countries developing and rolling out their own AI models, the market may begin to saturate leading to a sharp decline in paying consumers.

AI itself

Surely you, like I, have considered the possibility that AI may become an uncontrollable entity that will have to ultimately be shut down. We never know, but with the continuous improvement of AI systems, the concerns are also amplified, leading to potentially stricter regulation of the industry.

Are we in an AI bubble now?

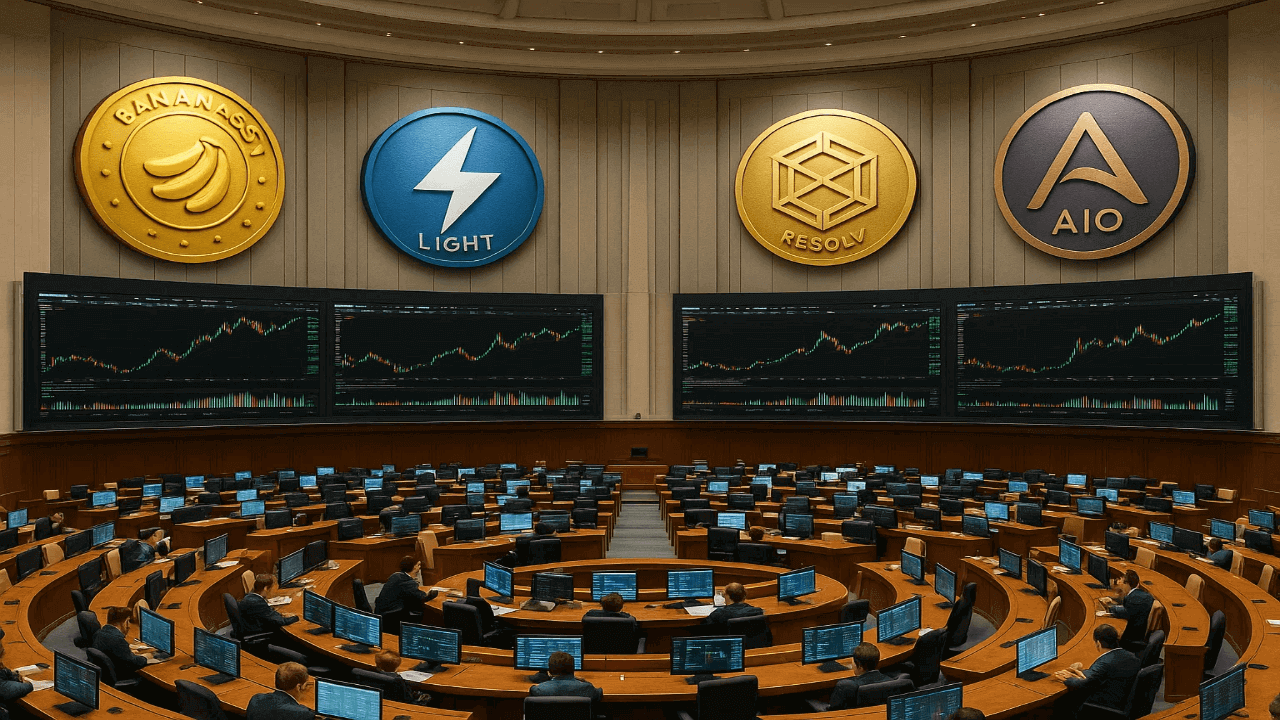

It is very difficult to attain a specific number around this. When I asked ChatGPT to consolidate all the largest AI companies' potential added valuation due to AI, it gave me the number $6.162 trillion. This was based on nine companies see chart below.

Based on this information and this added valuation to the global market, some might ask the question, "How long can this AI bubble go before bursting?". For this AI bubble to avoid bursting, AI stock companies need to consistently drive revenue and growth to support their potentially overvalued market caps.

| Company name | Reason | Added valuation due to AI |

|---|---|---|

| Nvidia (NVDA) | GPUs and AI training drive 90% of Nvidia's revenue growth. | $2.95 trillion |

| Microsoft (MSFT) | Tools such as AzureAI, OpenAI's investment, and other AI software tools, potentially account for 30-40% of its valuation. | $1 trillion |

| Alphabet (Google) | Products such as DeepMind, Google's Bard, and utilizing AI in ads account for roughly 25-40% of its valuation. | $805 billion |

| Amazon (AMZN) | Amazon's AWS services, its Alexa product, and other AI tools contribute roughly 20-25% of its valuation. | $460 billion |

| Meta Platforms (META) | Utilizing AI for content moderation and deploying AI in VR/AR, contributing roughly 20-25% of its valuation. | $300 billion |

| Tesla (TSLA) | Integrating AI into its driving systems for automated driving accounts for roughly 25-30% of its valuation. | $390 billion |

| OpenAI | A valuation solely attributed to its AI products and deployment. | $157 billion |

| Anthropic | Utilizing AI entirely in its safety and products. | $60 billion |

| xAI | A valuation tied to its AI initiatives. | $40 billion |

Should I buy AI stocks?

As you can see, AI is here to stay, and with the majority of companies and businesses integrating AI into their products and services, you may already have invested in AI stocks without knowing it. Regardless, investing in AI stocks driving this expansive growth might be worth exploring.

AI will continue to creep into our day-to-day activities, and with it, the AI bubble will continue to expand. This indicates that there are many upsides to investing in AI stocks, as there is still potentially a lot of growth across the industry.

Conclusion

It certainly seems that the AI bubble won't burst any time soon, with the high market penetration for its use and the number of companies working on improving and developing the technology further. It could still be a potentially good investment opportunity.

For me, when I analyze any kind of stock, I use Intellectia's AI to do all the heavy lifting for me. I highly recommend you begin integrating Intellectia into your trading strategies to remain constantly informed on which stocks are good or bad investments.

Frequently Asked Questions

Is there going to be an AI bubble burst?

Although many companies are highly valued, there is no indication that AI as a technology won't continue to grow. With the development and rollout of the new version of AI, it is hard to see how the AI bubble can burst.

Is AI the next big investment?

Personally, I think there is still time to invest in AI, but the returns may not be as high as they once were. The next big investment to look out for may revolve around quantum and space exploration.

What's the total valuation of AI right now?

Based on analyzing nine of the largest AI-driven tech companies, the current valuation is roughly around $6.162 trillion. This number is not reflective of startups or smaller companies, meaning the number is likely much greater.