Key Takeaways

- You do not need thousands of dollars to start; fractional shares allow you to buy high-quality stocks with as little as $5 or $10.

- The best stocks for beginners combine stable cash flows with long-term growth potential, rather than high-risk speculation.

- Tech giants like Microsoft, Google, and Amazon offer high growth through AI, while staples like Coca-Cola and P&G provide safety and dividends.

- Using AI tools can help you analyze valuation metrics like P/E ratios to ensure you aren't overpaying for a stock.

- Consistency is key: Dollar-cost averaging allows you to build a substantial portfolio over time with small, regular investments.

Introduction

Do you feel locked out of the stock market because you don't have thousands of dollars sitting in a brokerage account? You are not alone. Many aspiring investors believe that wealth building is reserved for the already-wealthy, leaving their hard-earned cash to sit in bank accounts that barely keep up with inflation.

This hesitation is costing you money. Every day you wait is a day of missed compound interest. The reality is that the barrier to entry has never been lower. Thanks to fractional shares and zero-commission trading, you can own a piece of the world's most profitable companies for the price of a cup of coffee.

In this article, you will observe the latest Q3 and Q4 2025 earnings reports to cut through the noise. It will show you exactly how to invest in stocks for beginners with little money, identify safe yet profitable companies, and utilize AI stock analysis to make smarter decisions. Let’s get your money working for you.

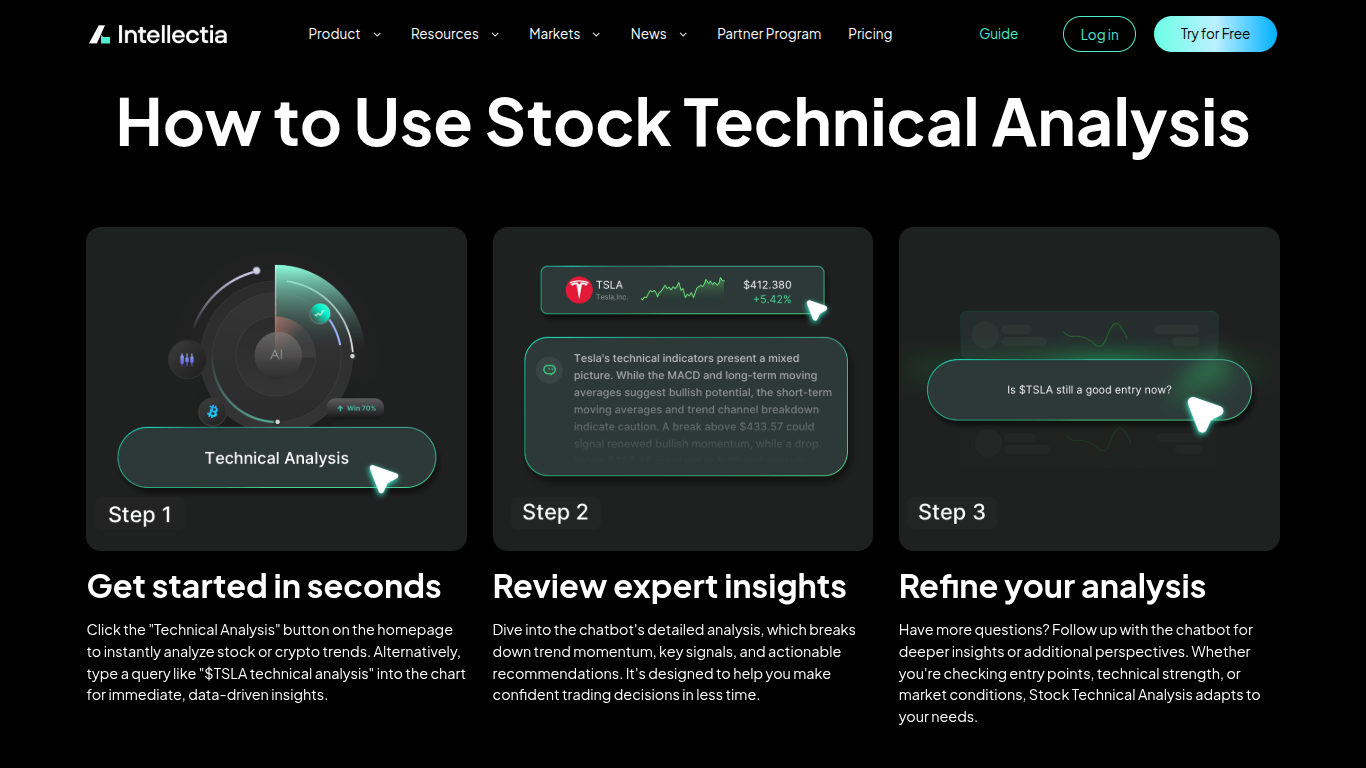

Source: intellectia.ai

How to Choose the Best Stocks for Beginners With Little Money

When you have limited capital, you cannot afford to gamble. Losing $100 hurts a lot more when it is your only $100 to invest. Therefore, your strategy must prioritize quality and consistency over "moonshots." Here is how you should evaluate potential investments.

Look for Stable Revenue & Strong Cash Flow

If you are buying individual stocks, you want companies that generate massive amounts of cash regardless of the economic climate. The Street calls these "cash cows." Look for companies with a history of consistent revenue growth.

For example, in the analysis of recent earnings, Amazon generated a staggering $100 billion in a single quarter, while Microsoft is sitting on a war chest of cash that allows them to weather any storm. When a company has strong free cash flow, they can reinvest in their business (like building new AI data centers) or return money to you via dividends and buybacks.

Why Beginners Should Avoid High-Volatility “Hype Stocks”

It is tempting to chase the stock that went up 50% yesterday. However, high volatility cuts both ways. For a beginner with a small account, a 50% drop can be psychologically devastating and might cause you to sell at the bottom.

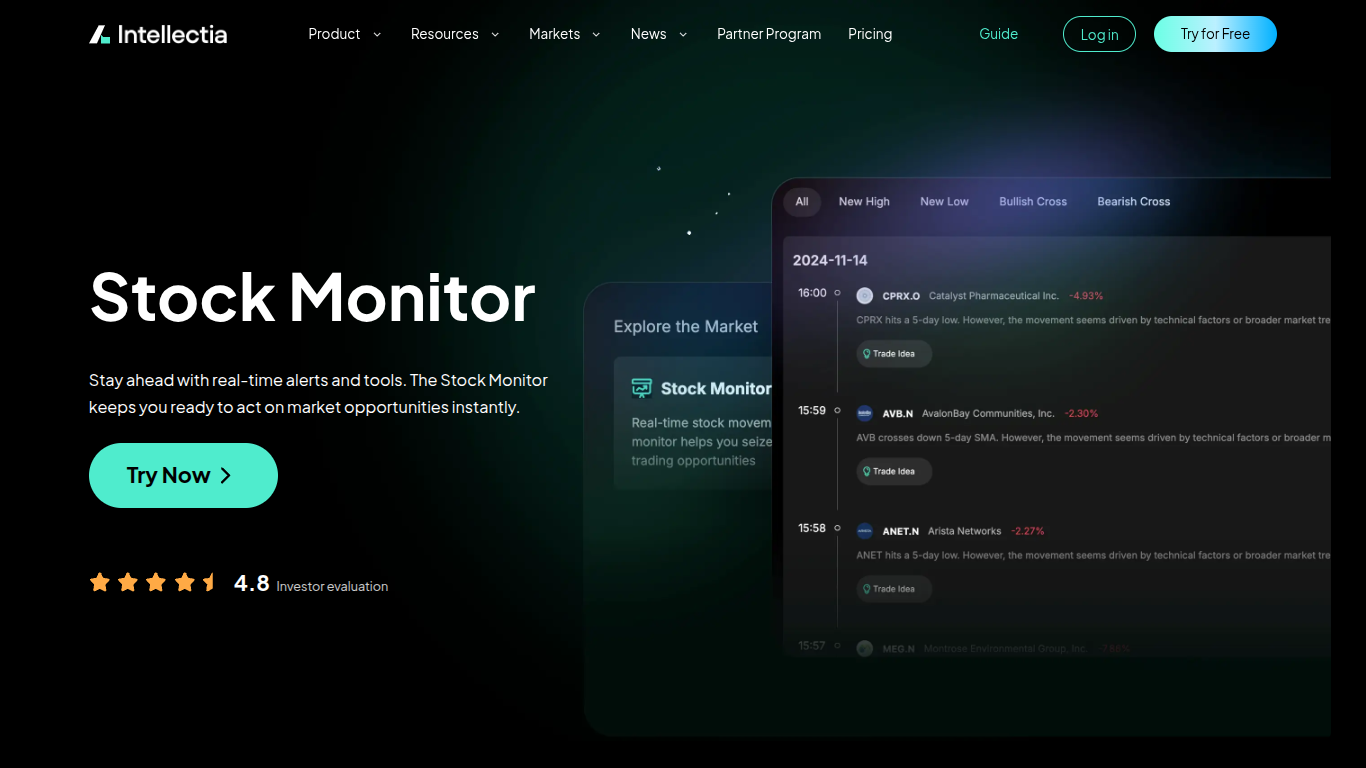

Avoid penny stocks or companies that are not yet profitable. Instead, focus on "blue-chip" stocks. These are established companies with a track record of reliability. They might not double overnight, but they are unlikely to go to zero. You can use Stock Monitor to track volatility and risk levels before you buy.

Source: intellectia.ai

Use Valuation Metrics to Avoid Overpaying

Just because a company is great doesn't mean its stock price is a good deal. You need to look at valuation metrics to see if the stock is expensive or cheap.

- P/E Ratio (Price-to-Earnings): This tells you how much you are paying for $1 of the company's earnings. A lower P/E is generally better, though high-growth tech stocks usually command higher P/Es.

- PEG Ratio: This adjusts the P/E ratio for growth. A PEG ratio under 1.0 is often considered undervalued.

- Price-to-Sales: Useful for companies that are reinvesting all their profits into growth (like many tech firms).

Using AI stock analysis can help you instantly interpret these numbers without needing a finance degree.

Diversify Even If You Start With $50

Never put all your eggs in one basket. If you have $50, don't buy $50 worth of one single stock. Modern brokerages allow you to buy "fractional shares." This means you can buy $5 of ten different companies. This spreads your risk; if one company has a bad quarter, the others can balance it out.

Top 10 Best Stocks for Beginners With Little Money (2026 List)

Based on recent financial performance, market dominance, and future growth potential (specifically in AI and cloud computing), here are the top picks for your portfolio.

| Company | Ticker | Sector | Key Strength |

| PDD Holdings | PDD | Consumer Cyclical | Dominant low-price e-commerce moat. |

| Apple | AAPL | Technology | Massive install base & services revenue. |

| Microsoft | MSFT | Technology | Leader in Cloud (Azure) & AI. |

| Amazon | AMZN | Consumer Cyclical | E-commerce king & AWS cloud profit machine. |

| Alphabet | GOOGL | Communication | Search dominance & AI integration. |

| Nvidia | NVDA | Technology | The "Kingpin" of AI hardware. |

| Coca-Cola | KO | Consumer Defensive | Recession-proof & reliable dividends. |

| Berkshire Hathaway | BRK.B | Financial | Massive cash pile & diverse holdings. |

| Visa | V | Financial | High margins & global payment duopoly. |

| Procter & Gamble | PG | Consumer Defensive | Essential products & pricing power. |

1. PDD Holdings (PDD)

Known for its Pinduoduo and Temu platforms, PDD Holdings is a powerhouse in value e-commerce. In their recent Q3 report, despite a slight revenue miss, they beat profit estimates significantly. The company is aggressively investing in its supply chain and merchant ecosystem to widen its "moat" against competitors. For a beginner, PDD represents a high-growth play in the global consumer market. They prioritize long-term value over short-term stock price fluctuations, which is a mindset you should adopt as well.

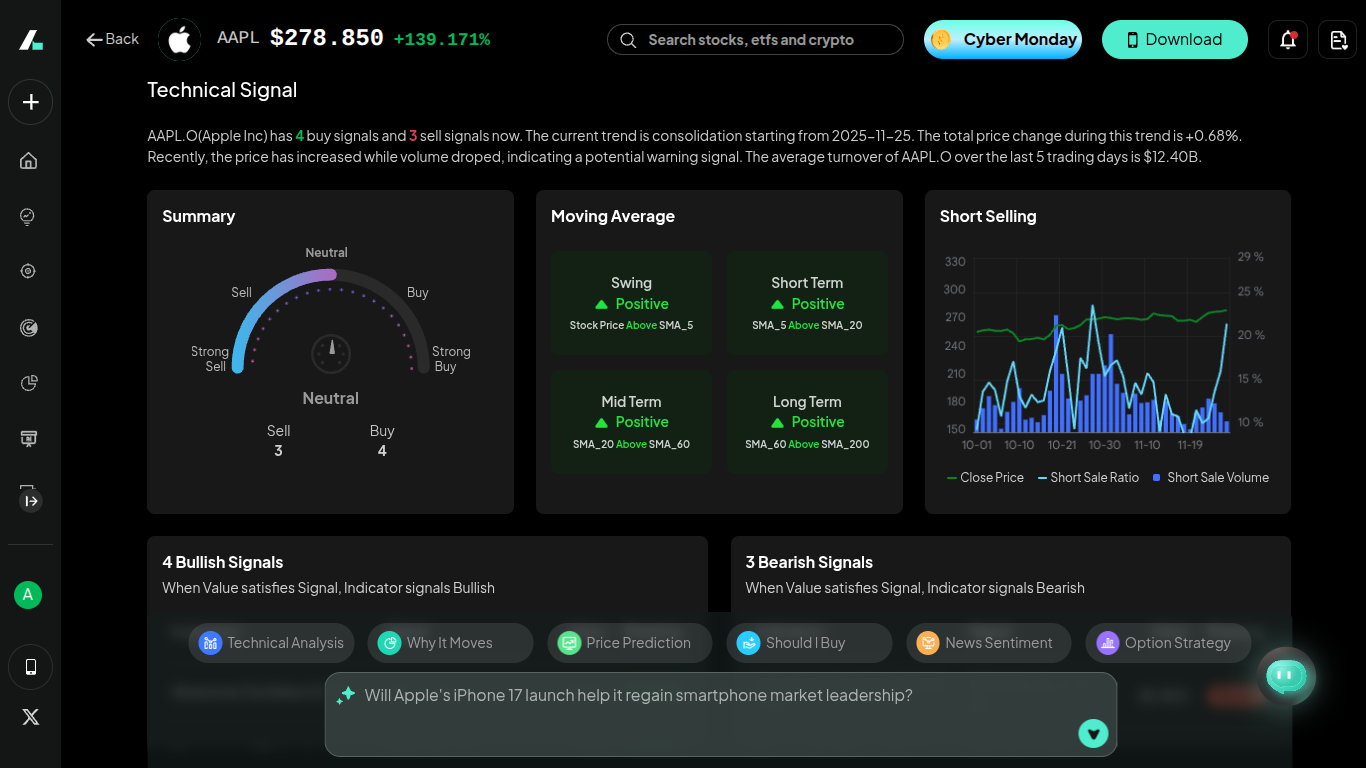

2. Apple (AAPL)

Apple recently reported a record-breaking September quarter with over $102 billion in revenue. The real story for beginners here is the "Services" revenue, which hit an all-time high. This includes the App Store, Apple Music, and iCloud. It makes Apple less reliant on just selling iPhones. With a massive cash pile and plans to integrate generative AI (Apple Intelligence) across its devices, Apple remains one of the safest ways to invest in tech.

Source: intellectia.ai

3. Microsoft (MSFT)

If you want exposure to AI without taking a massive risk, Microsoft is the answer. Their cloud business (Azure) grew by over 30% recently, driven largely by AI demand. They are investing heavily ($80 billion+) to build the infrastructure of the future. As a shareholder, you benefit from their diverse income streams: Office 365, LinkedIn, Gaming, and Cloud. It is a foundational stock for any portfolio.

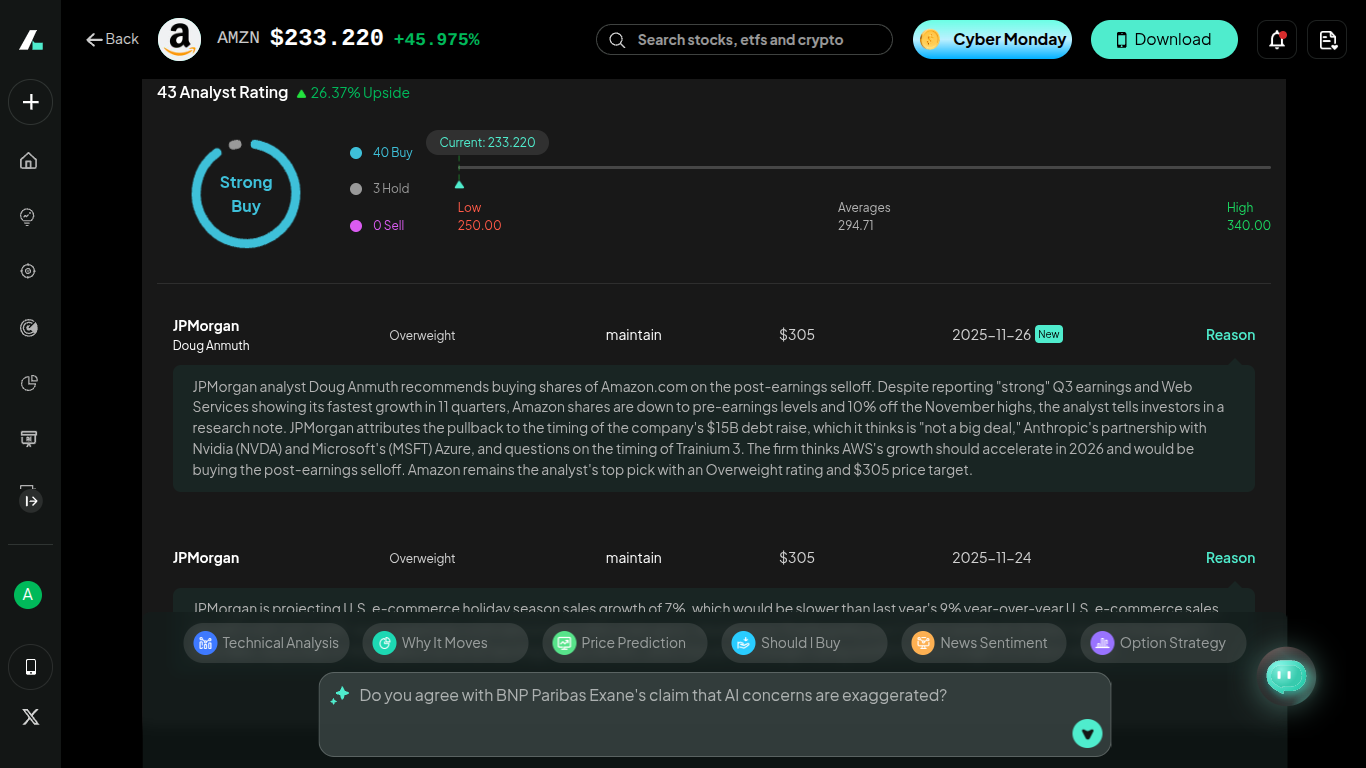

4. Amazon (AMZN)

Amazon is a two-part beast: the online store you know, and Amazon Web Services (AWS), the cloud platform that powers the internet. AWS is growing at 20% year-over-year and generates massive profits. Recently, Amazon has focused on efficiency and robotics in its warehouses to lower costs. For beginners, Amazon offers a blend of consumer retail stability and high-tech cloud growth.

Source: intellectia.ai

5. Alphabet (GOOGL)

Alphabet (Google) recently delivered its first-ever $100 billion revenue quarter. Despite fears about AI replacing search engines, Google Search volumes continue to grow. They are successfully integrating ads into their AI overviews, proving they can monetize new technology. Google often trades at a more reasonable valuation than its tech peers, making it a great entry point for new investors.

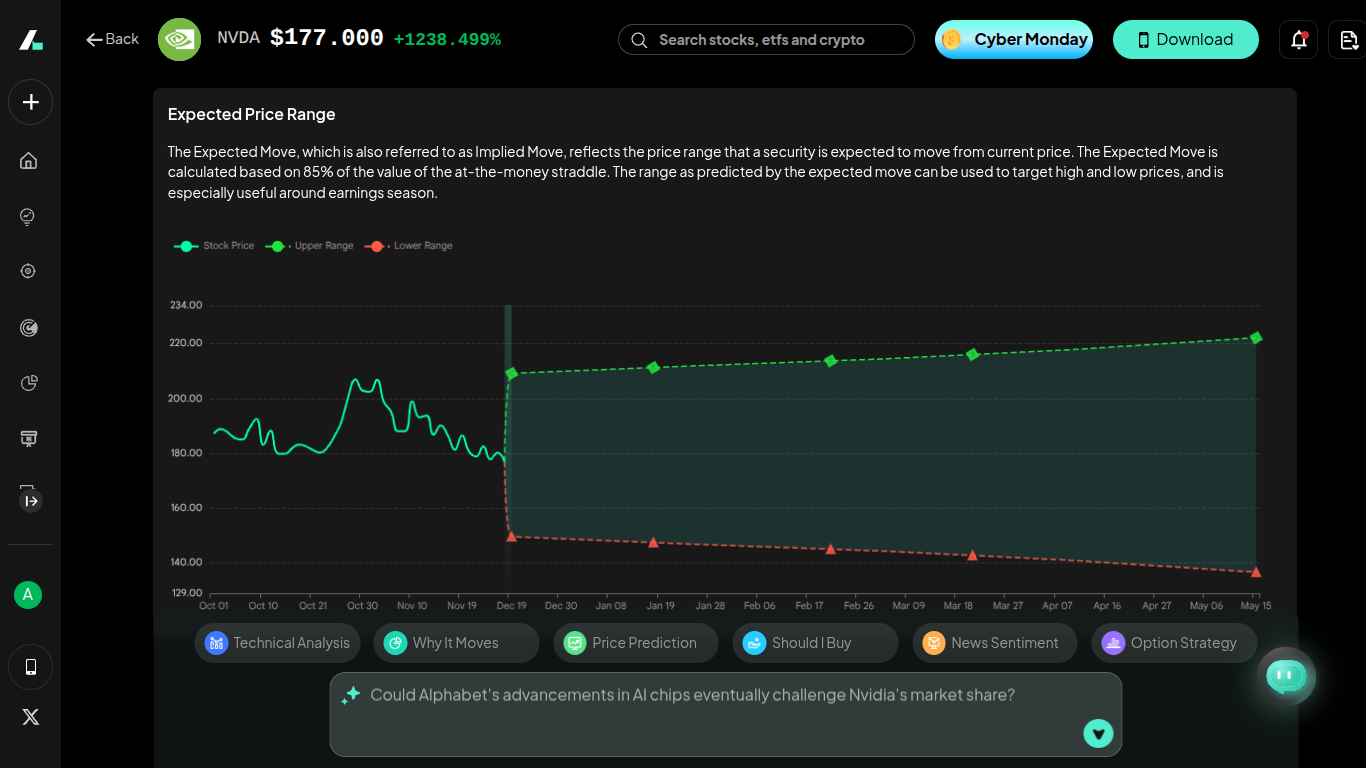

6. Nvidia (NVDA)

Nvidia is the engine room of the AI revolution. Their recent earnings showed a staggering 62% revenue increase year-over-year. Their "Blackwell" AI chips are sold out months in advance. While the stock can be volatile, Nvidia has a near-monopoly on the hardware needed to train AI. If you believe AI is the future, you need some exposure here. Use AI Stock Picker to help time your entry.

Source: intellectia.ai

7. Coca-Cola (KO)

Not every stock needs to be a tech giant. Coca-Cola is the definition of stability. Even in difficult economic environments, people still buy beverages. In Q3 2025, they grew organic revenue by 6% despite economic headwinds. Coca-Cola is a "Dividend King," meaning they have raised their dividend payout for over 50 consecutive years. This is perfect for beginners who want to see cash deposited into their account every quarter.

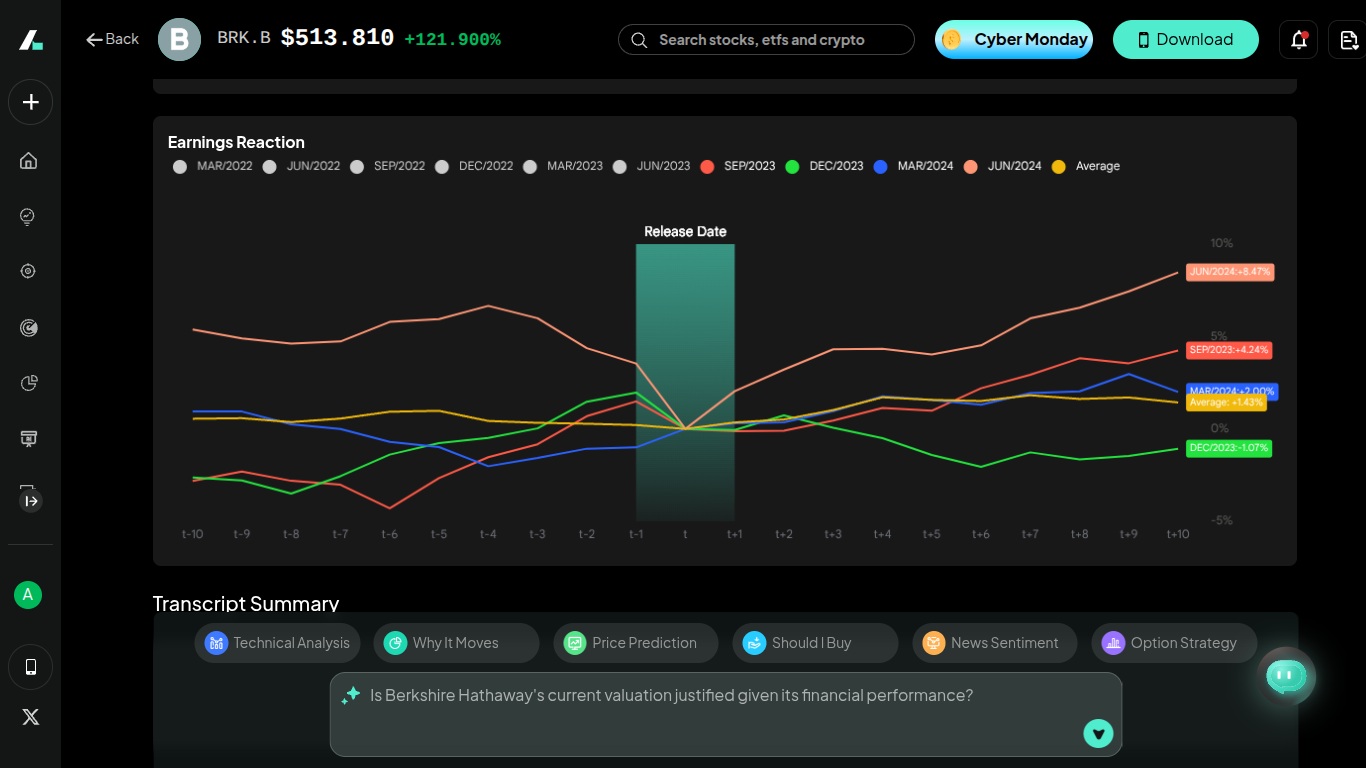

8. Berkshire Hathaway (BRK.B)

Managed by Warren Buffett, Berkshire Hathaway is essentially a diversified ETF wrapped in a single stock. They own businesses in insurance (Geico), rail (BNSF), energy, and retail. Currently, they are sitting on a record cash pile of over $380 billion, meaning they are ready to buy undervalued businesses when the market dips. It is the ultimate "sleep well at night" stock. Note: Buy the "Class B" shares (BRK.B), which are affordable for retail investors, rather than the "Class A" shares which cost hundreds of thousands of dollars.

Source: intellectia.ai

9. Visa (V)

Visa operates as a toll booth for the global economy. Every time someone swipes a card, Visa takes a cut. They recently reported strong earnings with a net revenue growth of 12%. Visa is essentially an inflation hedge; as prices of goods go up, the fees Visa collects go up as well. They are also innovating with new "Click to Pay" and fraud detection technologies, ensuring they remain dominant.

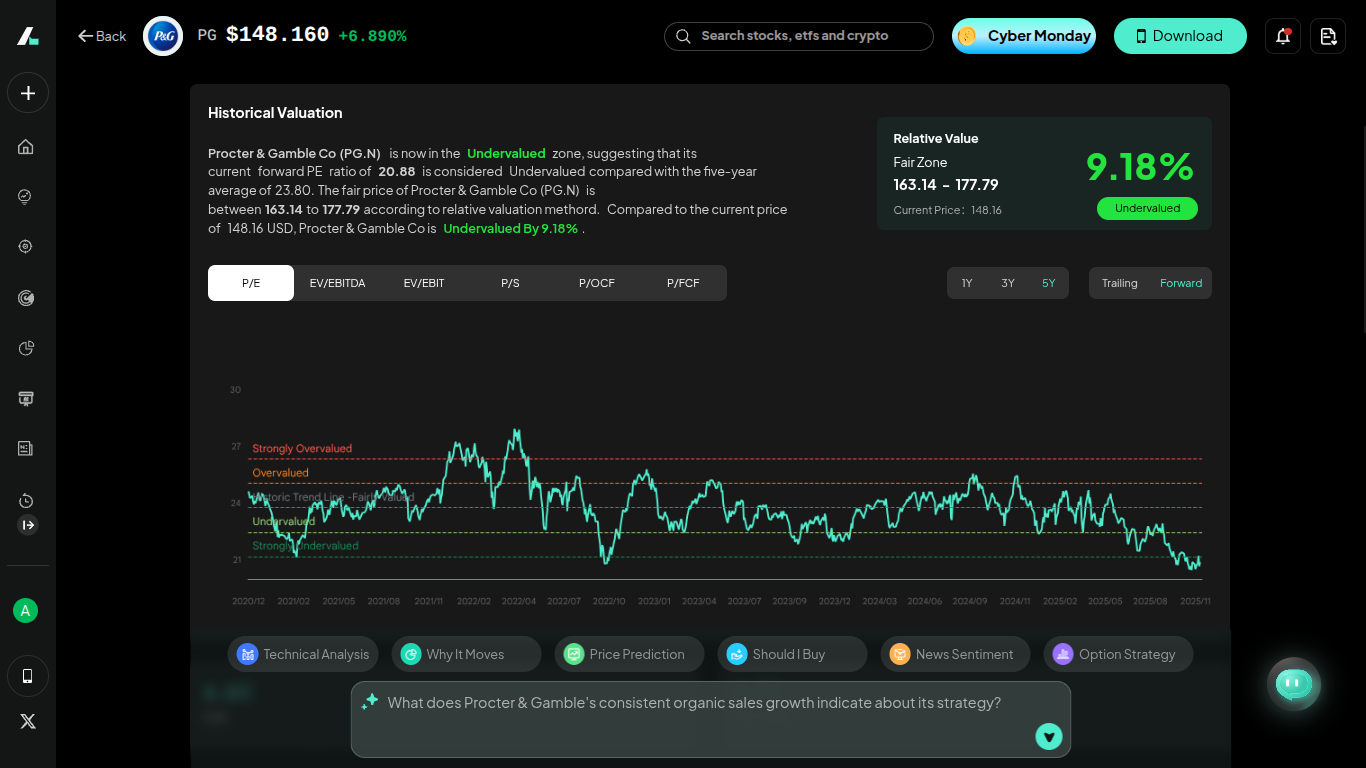

10. Procter & Gamble (PG)

Procter & Gamble owns brands like Tide, Pampers, and Gillette. In their recent quarter, they delivered organic sales growth and improved their profit margins despite a tough economy. Like Coca-Cola, PG is a defensive stock. If the economy crashes, people still need to brush their teeth and wash their clothes. It provides a solid foundation for a beginner's portfolio.

Source: intellectia.ai

Simple Investment Strategies for Beginners With Limited Capital

Knowing what to buy is only half the battle. Knowing how to buy is equally important.

Dollar-Cost Averaging (DCA Strategy)

This is the secret weapon for investors with little money. Instead of trying to time the market (buying low and selling high), you invest a fixed amount of money at regular intervals, regardless of the stock price.

Example: You invest $50 into the S&P 500 every month.

Result: When the market is down, your $50 buys more shares. When the market is up, your portfolio grows in value. Over time, this averages out your cost basis and removes the emotional stress of trading. You can use Quant AI features to backtest how different DCA strategies would have performed historically.

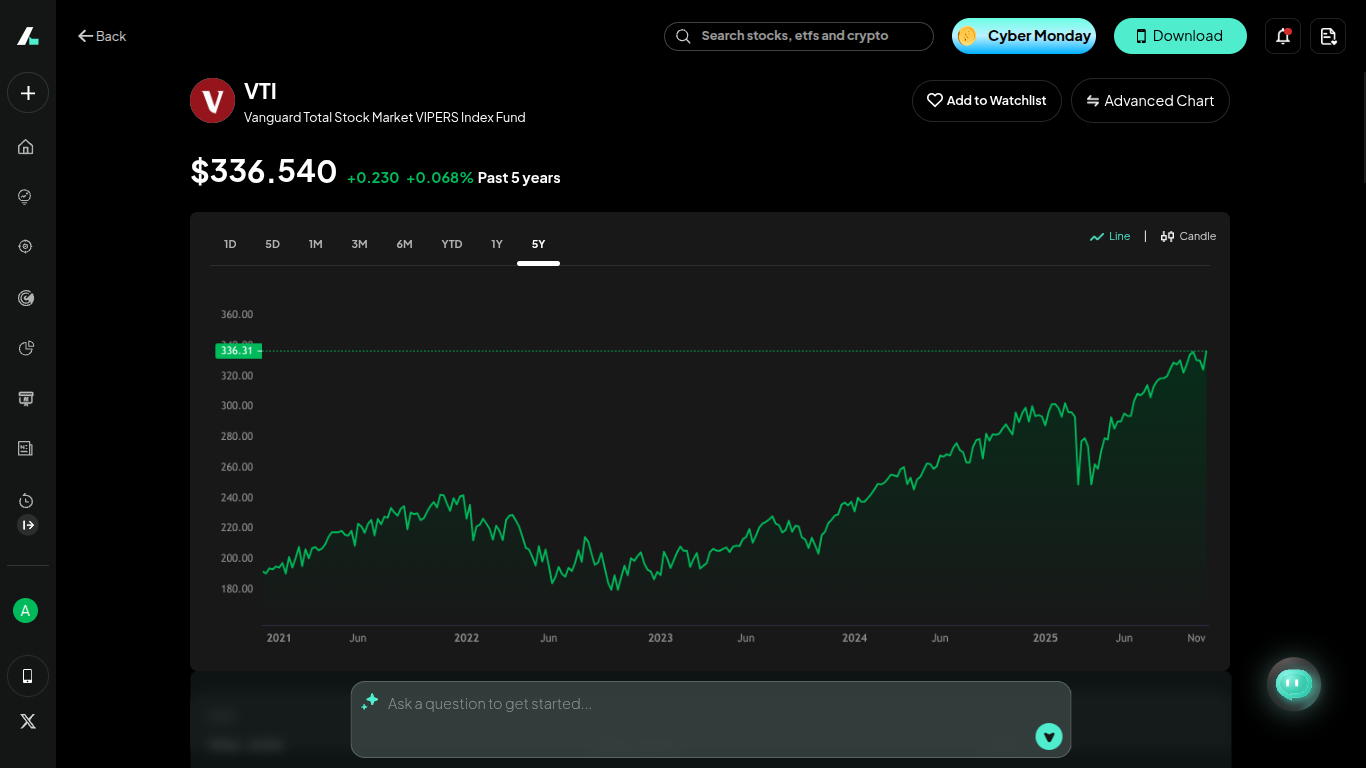

Using ETFs as a Foundation

If picking 10 individual stocks feels overwhelming, you can start with an Exchange Traded Fund (ETF). An ETF bundles hundreds or thousands of stocks into one ticker symbol.

- VTI (Vanguard Total Stock Market ETF): Buying this gives you a tiny piece of almost every public company in the US.

- VOO (Vanguard S&P 500 ETF): This gives you exposure to the top 500 largest US companies (including all the tech giants listed above).

For a beginner with $100, putting $80 into a broad ETF like VTI and $20 into a specific stock you love (like Apple or Nvidia) is a responsible way to start.

Source: intellectia.ai

Conclusion

Investing is no longer an exclusive club for the wealthy. With fractional shares and access to institutional-grade data through tools like Intellectia.AI, you have the power to build wealth starting with whatever is in your wallet right now.

The companies listed above—from the high-growth AI leaders like Nvidia to the steady dividend payers like Procter & Gamble—represent the best of the market. They are profitable, resilient, and positioned for the future.

Don't let a small bank balance stop you. Start small, stay consistent, and use the best tools available. Sign up for Intellectia.AI today to get daily AI stock picks, trading signals, and in-depth market analysis to guide your journey from beginner to pro.