Wall Street's Latest Rating Changes Overview

- GE Vernova Upgrade: Guggenheim upgraded GE Vernova from Neutral to Buy with a price target of $910, indicating that the market may be underestimating its cash generation potential and capital returns, suggesting further margin improvements in its electrification segment.

- Apple Remains Bullish: Bank of America reiterated its Buy rating on Apple, forecasting that iPhone upgrades will exceed expectations by 2026, while gross margins continue to rise despite commodity pressures, showcasing the company's robust performance across multiple sectors.

- Western Digital Price Target Raised: Morgan Stanley increased Western Digital's price target from $260 to $306, emphasizing the market's underappreciation of its sustainable pricing tailwinds and margin flow-through, reflecting a strong demand outlook.

- Spotify Rating Upgrade: Citi upgraded Spotify from Neutral to Buy, citing attractive valuation and beatable consensus estimates, with several positive catalysts expected to drive stock price increases.

Trade with 70% Backtested Accuracy

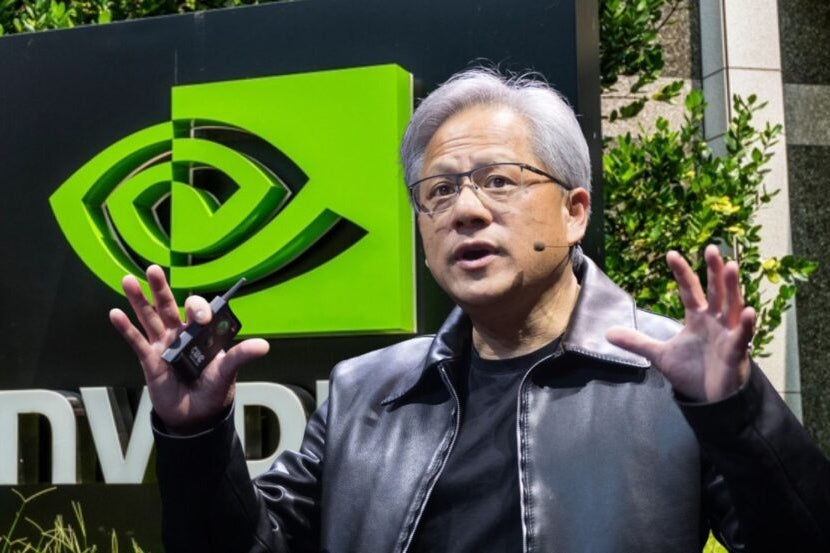

Analyst Views on NVDA

About NVDA

About the author

NVIDIA's Q4 Earnings Performance: NVIDIA's Q4 earnings report for fiscal 2026 shows strong revenue growth driven by AI, with a revenue of $68.3 billion, surpassing market expectations and indicating robust cash flow and investment potential.

Market Segments Growth: The company experienced significant growth across critical markets, particularly in data centers, automotive, and gaming, with data center revenue accounting for over 90% of total revenue and growing by 75% year-over-year.

Future Projections: Analysts project continued strong performance for NVIDIA, forecasting $78 billion in revenue for Q1 FY 2027, reflecting a 14.7% sequential increase and a 77% year-over-year growth, excluding China.

Investor Sentiment and Stock Outlook: Analysts maintain a bullish outlook on NVIDIA's stock, with a consensus target price suggesting significant upside potential, supported by strong cash flow and a healthy balance sheet, positioning the company well for future growth.

- Strong Performance: Nvidia reported an adjusted earnings per share of $1.62 for the quarter ending January 25, with revenue soaring 73% year-over-year to $68.13 billion, significantly exceeding Wall Street's forecast of $65.91 billion, indicating robust market demand and execution.

- Data Center Revenue Surge: Data center revenue reached $62.13 billion, surpassing expectations of $60.36 billion, reflecting a surge in enterprise demand for AI computing, further solidifying Nvidia's leadership in the AI sector.

- Optimistic Outlook: The company anticipates revenue of $78 billion for the upcoming fiscal first quarter, excluding any revenue from China, showcasing confidence in global markets while also indicating a cautious stance towards the Chinese market.

- Dividend Announcement: Nvidia declared a quarterly dividend of $0.01 per share to be paid on April 1, enhancing investor confidence and demonstrating the company's ability to return value to shareholders supported by strong cash flow.

- Market Underestimation: Dan Ives from Wedbush Securities pointed out that Wall Street analysts have severely underestimated Nvidia's valuation, particularly ahead of the upcoming fourth-quarter earnings report, indicating a neglect of the company's potential.

- Surge in AI Demand: Ives emphasized that with the skyrocketing demand for artificial intelligence, Nvidia's chips play a crucial role in driving the AI revolution, making its future earnings pivotal.

- Performance Expectations: Ives anticipates a 'gold medal performance' from Nvidia, reflecting not only his confidence in the company's strong earnings but also potentially influencing investor perceptions of its stock.

- Stock Price Reaction: At the time of writing, Nvidia's shares were trading 2% higher, indicating a positive market response to the optimistic expectations surrounding the upcoming earnings report and analyst sentiments.

- Market Spending Forecast: The four largest U.S. hyperscalers are projected to spend $700 billion on AI data center infrastructure by 2026, representing an increase of over $300 billion from last year's levels, indicating a strong commitment to AI technology that could drive rapid growth in related sectors.

- TSMC's Market Advantage: As the world's largest semiconductor foundry, TSMC plans to allocate $52 billion to $56 billion in capital expenditures in 2026, significantly higher than last year's $40.9 billion, with AI accelerator revenue expected to grow at a mid-to-high fifties CAGR, solidifying its leadership position in the global market.

- ASML's Order Growth: ASML's net bookings surged by 48% in 2025 to over €28 billion (approximately $33 billion), indicating that its monopoly in the extreme ultraviolet (EUV) lithography market will continue to drive revenue growth, with 2026 revenue expected to reach between €34 billion and €39 billion.

- Future Outlook: With the increase in AI infrastructure spending, ASML is likely to exceed its 2026 revenue expectations, and its 12-month median price target of $1,675 suggests a potential 13% upside, making it an attractive buy for investors looking to capitalize on future gains.

- Massive Layoffs: Block has announced layoffs of nearly 4,000 employees, which is almost half of its 10,000 workforce, aiming to position the company for long-term growth, demonstrating decisive action in response to market changes.

- Strategic Shift: CFO Amrita Ahuja stated that these layoffs will enable the company to leverage AI technology to automate more tasks, thereby accelerating operational efficiency and enhancing competitiveness, reflecting the company's keen insight into future market opportunities.

- Industry Wake-Up Call: CEO Jack Dorsey anticipates that other companies will follow Block's lead in making similar structural adjustments to achieve greater efficiency, potentially leading to widespread layoffs across the global tech industry and impacting the employment landscape significantly.

- Deep Impact of AI: Dorsey emphasized that as intelligent tools become more prevalent, most companies will face similar transformation pressures within the next year, which not only alters business operations but also raises profound concerns about the future job market.

- Market Pressure: Nebius Group shares fell 3.55% to $101.16 in premarket trading on Friday, pressured by broader weakness in AI infrastructure stocks, particularly after CoreWeave's mixed earnings report dampened investor sentiment.

- Earnings Impact: CoreWeave reported an adjusted fourth-quarter loss of 56 cents per share, missing the 50 cents estimate, with operating expenses reaching $1.66 billion, leading to a negative sentiment across the sector that also affected Nebius.

- Stock Performance: Despite the current dip, Nebius has shown a remarkable 12-month performance increase of 227.24%, trading above several key moving averages, indicating sustained bullish trends and long-term investor confidence.

- Future Outlook: Nebius is set to provide its next financial update on May 19, with an estimated loss of 75 cents per share and revenue expectations of $343.32 million, highlighting potential for revenue growth, although a high P/E ratio of 915.0x indicates premium valuation.