Verizon (VZ) to Acquire Frontier (FYBR) for $20 Billion, Closing Expected January 2026

- Acquisition Progress: Verizon and Frontier Communications have received all necessary regulatory approvals and expect to finalize the $20 billion all-cash acquisition on January 20, 2026, marking a significant milestone in the strategic integration of both companies.

- Fiber Network Expansion: Upon completion of the transaction, Verizon's fiber footprint will expand to nearly 30 million passings across 31 states and Washington, D.C., which is expected to deliver enhanced value and more choices to millions of customers nationwide, strengthening market competitiveness.

- Stock Delisting Arrangement: Following the closing, Frontier's common stock will be delisted from Nasdaq, with the last day of trading anticipated to be January 16, 2026, impacting investors' holding strategies and market liquidity.

- Market Reaction Expectations: This acquisition is expected to not only increase Verizon's market share but also enhance service quality through resource and technology integration, likely resulting in positive impacts on future revenue growth.

Trade with 70% Backtested Accuracy

Analyst Views on VZ

About VZ

About the author

- Cost-Cutting Strategy: Verizon is reportedly considering trimming or exiting its decade-long sponsorship deal with the NFL, valued at over $1 billion, to address declining subscriptions and increased competition in the wireless and home internet sectors.

- Sponsorship Cost Impact: With annual sponsorship expenditures exceeding $250 million, the potential penalties and legal hurdles associated with terminating the contract are significant, yet the company is reviewing all expenses to enhance operational efficiency.

- Executive Statements: A Verizon spokesperson indicated that the company is examining all investments and expenses, with CEO Daniel Schulman mentioning a plan for $5 billion in cost transformation by 2026 during the latest earnings call.

- Stock Performance: Despite these challenges, Verizon's stock reached an all-time high of $51.09 on Tuesday, reflecting market confidence in its long-term strategy, even as it navigates the complexities of its sponsorship agreements.

Market Concerns: The markets are experiencing a downturn due to escalating fears of a prolonged conflict in Iran.

Oil Price Impact: Investors are worried that rising oil prices could negatively affect the global economy and reignite inflation fears.

AI Trade Vulnerability: The situation poses particular challenges for the previously thriving artificial intelligence sector.

Investment Climate: Overall, it is becoming increasingly difficult for investors to find safe investment opportunities amid these uncertainties.

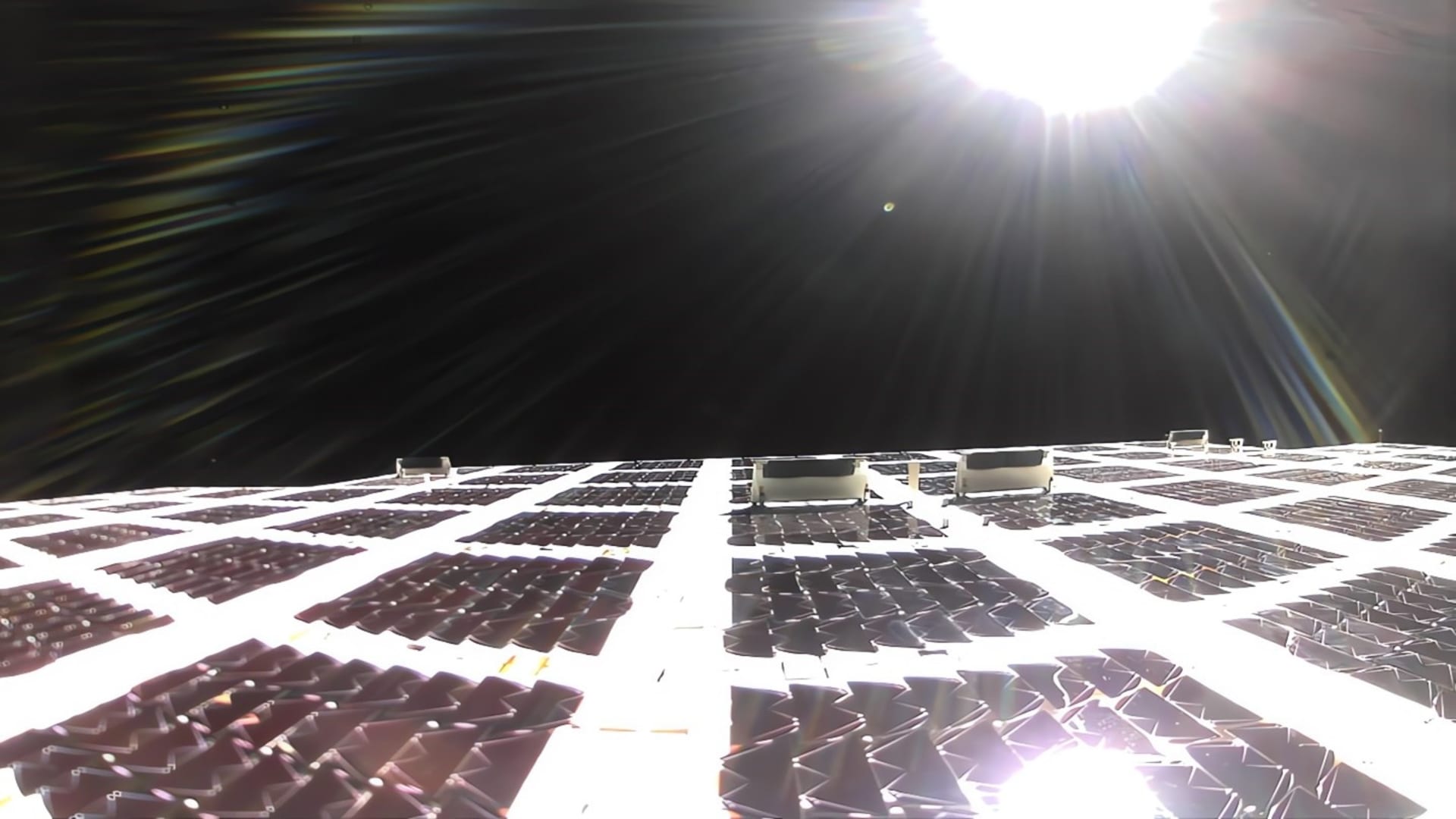

Stock Performance: AST SpaceMobile shares experienced significant volatility, gaining over 46% in January before falling nearly 29%, but saw a 6% rise following a positive market reaction to its earnings report on March 3.

Revenue Growth: The company reported quarterly revenue of $54.31 million, exceeding analyst expectations and marking a year-over-year growth rate of nearly 2,758%, despite a loss per share of 26 cents.

Future Contracts: AST SpaceMobile secured over $1.2 billion in contracted revenue commitments for 2025, indicating strong future prospects and a growing list of clients, including major telecommunications companies.

Market Positioning: The company is positioning itself as a key federal government contractor, having recently secured a $30 million prime contract from the U.S. Space Development Agency, enhancing its role in national security communications.

- Lawsuit Background: T-Mobile has filed a lawsuit against Verizon in Manhattan, accusing its rival of using 'bait-and-switch' advertising tactics to mislead consumers into switching carriers, highlighting the intense competition in the telecom market.

- False Promise Allegations: T-Mobile claims that Verizon's 'better deal' promise is a ruse, as Verizon cannot provide service plans and prices comparable to those of T-Mobile or AT&T, potentially misleading consumers in their choices.

- Counterclaim History: This lawsuit is a response to Verizon's February lawsuit against T-Mobile for false advertising, where T-Mobile asserted that Verizon's misleading claims caused irreparable harm with promises of over $1,000 in annual savings, indicating escalating legal disputes between the two companies.

- Market Impact: The outcome of this case could affect the public perception and market share of both companies, especially as consumer sensitivity to telecom service pricing increases, potentially leading to broader industry repercussions.

- Digital Skills Training Program: NJIT's partnership with Verizon launches a training initiative in early April, offering no-cost training in AI, cybersecurity, and IT to New Jersey residents, which is expected to significantly enhance participants' employability and bridge the digital skills gap.

- Cybersecurity Community of Practice: Central to the program is the establishment of a Cybersecurity Community of Practice, where participants, industry experts, and NJIT graduate students engage in peer learning and mentorship, ensuring students are integrated into a professional network from day one, thereby enhancing career development opportunities.

- Comprehensive Curriculum: The training includes CompTIA A+ certification prep and an AI Literacy microcredential, designed to equip participants with essential technical skills and ethical applications of AI, helping them adapt to the rapidly evolving technological landscape demanded by employers.

- Flexible Training Format: Most training is conducted online, with qualifying participants receiving laptops and internet access, and a variety of schedules are available to accommodate those with other commitments, ensuring broader participation in this vital skills enhancement initiative.

- Increased Bid: Paramount raised its offer for Warner Bros. Discovery from $30 to $31 per share, surpassing Netflix's $27.75 bid, demonstrating its competitive stance and acquisition ambitions in the media sector.

- Regulatory Approval Outlook: Analysts suggest that Paramount's acquisition is likely to face a smoother regulatory path compared to Netflix's proposal, although it still encounters a complex political and market landscape that could affect the deal's timing and conditions.

- Breakup Fee Arrangements: Paramount has committed to a $7 billion breakup fee in case of regulatory rejection, alongside covering the $2.8 billion fee Warner Bros. would owe Netflix, indicating its serious commitment to the transaction's success.

- Market Competition Impact: The merger between Paramount and Warner Bros. could lead to increased market concentration, with experts warning that this may reduce consumer choices and raise prices, particularly in the streaming and cable sectors, potentially triggering stricter regulatory scrutiny.