United Bancorp increases Q3 cash dividend to 18.75 cents per share

Dividend Declaration: United Bancorp's Board of Directors announced a third quarter dividend payment of 18.75 cents per share.

Record Date: Shareholders must be on record by September 10, 2025, to receive the dividend, which will be paid on September 19, 2025.

Increase in Dividend: The new dividend represents a 1 cent increase, or 5.6%, compared to the Q3 dividend from the previous year.

Comparison with Previous Payments: This dividend is higher than the cash dividends of 18.25 cents and 18.50 cents paid in the first and second quarters of the current year, respectively.

Trade with 70% Backtested Accuracy

Analyst Views on UBCP

About UBCP

About the author

- Quarterly Performance Boost: United Bancorp reported net income of $2.035 million and diluted earnings per share of $0.35 for Q4 2025, marking increases of 10% and 12.9% year-over-year, demonstrating the company's ability to maintain profitability amidst economic uncertainty.

- Annual Financial Performance: For the full year 2025, net income reached $7.753 million and diluted earnings per share were $1.34, reflecting year-over-year growth of 4.7% and 5.5%, indicating successful investments in infrastructure and product development.

- Interest Income Growth: The company achieved net interest income of $26.460 million in 2025, a 6.7% increase from the previous year, primarily driven by total assets growing by $40.8 million to $857.4 million, showcasing strong demand for loans and deposits.

- Increased Shareholder Returns: United Bancorp paid total cash dividends of $0.92 in 2025, a 7.6% increase, resulting in a dividend yield of 6.4%, reflecting the company's ongoing commitment to enhancing shareholder value.

- Quarterly Earnings Growth: United Bancorp reported a net income of $2.035 million and diluted earnings per share of $0.35 for Q4 2025, reflecting respective increases of 10% and 12.9% over the previous year, demonstrating the company's ability to maintain profitability amid economic uncertainty.

- Annual Performance Improvement: For the full year 2025, net income reached $7.753 million and diluted earnings per share were $1.34, marking increases of 4.7% and 5.5% year-over-year, reflecting the company's ongoing investments in infrastructure and product development.

- Interest Income Growth: The company saw a 6.7% year-over-year increase in net interest income to $26.460 million, primarily driven by growth in loans and deposits, showcasing its adaptability in a changing interest rate environment.

- Enhanced Shareholder Returns: United Bancorp paid total cash dividends of $0.92 in 2025, a 7.6% increase from the previous year, achieving a dividend yield of 6.4%, underscoring the company's commitment and capability to reward its shareholders.

Zacks Research Daily Highlights: The report features research on 12 major stocks, including Home Depot, Boeing, and Progressive, along with two micro-cap stocks, Frequency Electronics and United Bancorp, emphasizing unique insights into smaller companies.

Home Depot's Performance: Home Depot has outperformed its industry with strong sales growth and a focus on digital innovation, although it faces challenges from softer demand in big-ticket items and macroeconomic uncertainties.

Boeing's Outlook: Boeing has seen significant stock performance improvements, driven by growing commercial air travel and a positive defense outlook, but it faces risks from labor shortages and trade tensions.

Progressive and Micro-Cap Stocks: Progressive's shares have underperformed despite strong premium growth, while micro-cap stocks Frequency Electronics and United Bancorp show promising revenue visibility and stable earnings growth, respectively, but also face specific risks.

Regional Banks' Recovery: Several regional banks have improved their quality rankings significantly, indicating better operational efficiency and financial health, attracting income-focused investors.

Top Performers: The five leading banks in quality rankings include Middlefield Bancorp, Provident Bancorp, United Bancorp, National Bankshares, and FVCBankcorp, all showing notable gains in profitability and stock performance.

Market Context: These banks are competing in the middle-market lending space against business development companies like Ares Capital Corp, which currently has poor quality rankings despite a stronger price trend.

Investor Caution Advised: Despite the positive trends, investors should remain cautious due to potential risks from economic slowdowns or rising loan defaults in cyclical sectors.

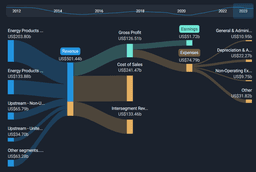

Financial Performance: United Bancorp reported a revenue of US$7.78 million and a net income of US$1.91 million for the second quarter of 2024, with profit margins increasing to 25% and EPS rising to US$0.35.

Market Outlook: Despite recent growth, revenue is expected to remain flat over the next three years, contrasting with a projected 7.6% growth in the US banking industry, while the company's shares have declined by 2.5% recently.

Dividend Increases and Declarations: Companies such as Avnet, United Bancorp, and Altria announced dividend increases this week, while Estée Lauder, Nordstrom, and Northrop Grumman declared new dividends.

Upcoming Ex-Dividend Dates: Next week, Johnson & Johnson, Hyatt, and Yum Brands will have ex-dividend dates on August 27, with payout dates scheduled for early September.