United Bancorp Declares Special Dividend of $0.1750 per Share

The Board of Directors of United Bancorp approved a one-time, special dividend of $0.1750 per common share, which is payable on March 20, 2026 to shareholders of record on March 10, 2026. The Board of Directors approved this special cash dividend based on the Company's continued solid earnings, ample liquidity and strong capital position as of year-end 2025. At the current quarterly cash dividend payment level on a forward basis and inclusive of this special dividend payment, United Bancorp, Inc. is projected to pay cash dividends of $0.9450 in the current year.

Trade with 70% Backtested Accuracy

Analyst Views on UBCP

About UBCP

About the author

- Quarterly Performance Boost: United Bancorp reported net income of $2.035 million and diluted earnings per share of $0.35 for Q4 2025, marking increases of 10% and 12.9% year-over-year, demonstrating the company's ability to maintain profitability amidst economic uncertainty.

- Annual Financial Performance: For the full year 2025, net income reached $7.753 million and diluted earnings per share were $1.34, reflecting year-over-year growth of 4.7% and 5.5%, indicating successful investments in infrastructure and product development.

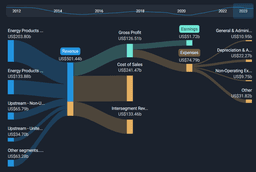

- Interest Income Growth: The company achieved net interest income of $26.460 million in 2025, a 6.7% increase from the previous year, primarily driven by total assets growing by $40.8 million to $857.4 million, showcasing strong demand for loans and deposits.

- Increased Shareholder Returns: United Bancorp paid total cash dividends of $0.92 in 2025, a 7.6% increase, resulting in a dividend yield of 6.4%, reflecting the company's ongoing commitment to enhancing shareholder value.

- Quarterly Earnings Growth: United Bancorp reported a net income of $2.035 million and diluted earnings per share of $0.35 for Q4 2025, reflecting respective increases of 10% and 12.9% over the previous year, demonstrating the company's ability to maintain profitability amid economic uncertainty.

- Annual Performance Improvement: For the full year 2025, net income reached $7.753 million and diluted earnings per share were $1.34, marking increases of 4.7% and 5.5% year-over-year, reflecting the company's ongoing investments in infrastructure and product development.

- Interest Income Growth: The company saw a 6.7% year-over-year increase in net interest income to $26.460 million, primarily driven by growth in loans and deposits, showcasing its adaptability in a changing interest rate environment.

- Enhanced Shareholder Returns: United Bancorp paid total cash dividends of $0.92 in 2025, a 7.6% increase from the previous year, achieving a dividend yield of 6.4%, underscoring the company's commitment and capability to reward its shareholders.

Zacks Research Daily Highlights: The report features research on 12 major stocks, including Home Depot, Boeing, and Progressive, along with two micro-cap stocks, Frequency Electronics and United Bancorp, emphasizing unique insights into smaller companies.

Home Depot's Performance: Home Depot has outperformed its industry with strong sales growth and a focus on digital innovation, although it faces challenges from softer demand in big-ticket items and macroeconomic uncertainties.

Boeing's Outlook: Boeing has seen significant stock performance improvements, driven by growing commercial air travel and a positive defense outlook, but it faces risks from labor shortages and trade tensions.

Progressive and Micro-Cap Stocks: Progressive's shares have underperformed despite strong premium growth, while micro-cap stocks Frequency Electronics and United Bancorp show promising revenue visibility and stable earnings growth, respectively, but also face specific risks.

Regional Banks' Recovery: Several regional banks have improved their quality rankings significantly, indicating better operational efficiency and financial health, attracting income-focused investors.

Top Performers: The five leading banks in quality rankings include Middlefield Bancorp, Provident Bancorp, United Bancorp, National Bankshares, and FVCBankcorp, all showing notable gains in profitability and stock performance.

Market Context: These banks are competing in the middle-market lending space against business development companies like Ares Capital Corp, which currently has poor quality rankings despite a stronger price trend.

Investor Caution Advised: Despite the positive trends, investors should remain cautious due to potential risks from economic slowdowns or rising loan defaults in cyclical sectors.

Financial Performance: United Bancorp reported a revenue of US$7.78 million and a net income of US$1.91 million for the second quarter of 2024, with profit margins increasing to 25% and EPS rising to US$0.35.

Market Outlook: Despite recent growth, revenue is expected to remain flat over the next three years, contrasting with a projected 7.6% growth in the US banking industry, while the company's shares have declined by 2.5% recently.

Dividend Increases and Declarations: Companies such as Avnet, United Bancorp, and Altria announced dividend increases this week, while Estée Lauder, Nordstrom, and Northrop Grumman declared new dividends.

Upcoming Ex-Dividend Dates: Next week, Johnson & Johnson, Hyatt, and Yum Brands will have ex-dividend dates on August 27, with payout dates scheduled for early September.