Amphenol, Uber, Alphabet, and Others Featured in CNBC's 'Final Trades'

Amphenol Acquisition: Joe Terranova from Virtus Investment Partners highlighted Amphenol Corporation's acquisition of CommScope's Connectivity and Cable Solutions segment for $10.5 billion.

Alphabet's Legal Issues: Jim Lebenthal of Cerity Partners mentioned Alphabet Inc.'s recent $36 million fine in Australia due to anti-competitive practices involving major telecom companies.

Uber's Strong Earnings: Stephen Weiss from Short Hills Capital Partners noted Uber Technologies, Inc.'s positive fiscal second-quarter results, reporting an 18% revenue growth year-over-year and adjusted EPS exceeding expectations.

Market Performance: On the trading front, Amphenol shares rose by 1.7%, Uber shares increased by 1.5%, while Alphabet shares fell by 0.2% on the reported day.

Trade with 70% Backtested Accuracy

Analyst Views on GOOGL

About GOOGL

About the author

- Concerns Over Blacklisting: A bipartisan coalition of 30 former defense officials and policy experts has urged Congress to investigate the Pentagon's decision to designate Anthropic as a supply chain risk, arguing that this move undermines America's competitive position in the AI sector.

- National Security Implications: The letter characterizes Defense Secretary Hegseth's decision as a 'profound departure' that sets a dangerous precedent, potentially jeopardizing the U.S. standing in the ongoing AI race.

- Strong Industry Response: The Information Technology Industry Council also expressed concerns in a letter to Hegseth, advocating for contract disputes to be resolved through negotiation rather than designating American companies as supply chain risks.

- Widespread Impact: Several defense tech firms have instructed their employees to cease using Anthropic's Claude service, indicating the direct ramifications of this policy, while Anthropic's annual revenue rate has surpassed $19 billion, underscoring its significance in the market.

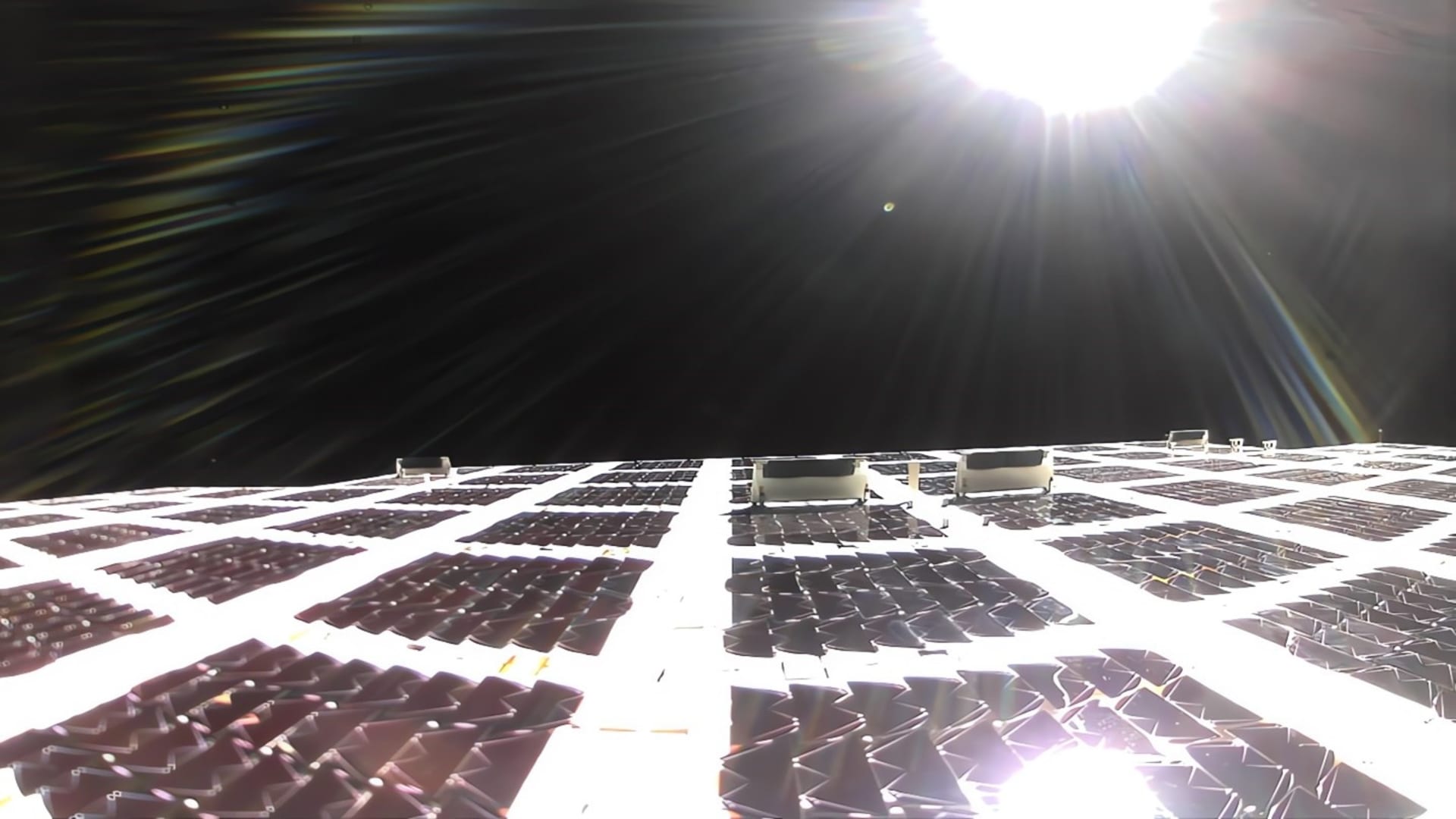

- Portfolio Highlight: Alphabet's fourth-quarter 13F filing reveals that 25% of its nearly $2.6 billion investment portfolio is tied to its largest holding, AST SpaceMobile, indicating a strong commitment and potential for future growth.

- Stock Performance: AST SpaceMobile's stock has surged over 300% in the past year and more than 2,800% over the last two years, reflecting strong interest and confidence from institutional investors.

- Market Collaboration Advantage: By partnering with over 50 global mobile network providers serving nearly 6 billion users and utilizing existing smartphone technology, AST SpaceMobile lowers market entry barriers, paving the way for future sales growth.

- Financial Outlook: AST SpaceMobile's sales are projected to explode from $59 million in 2025 to nearly $3.1 billion by 2029, despite challenges such as satellite launch delays and inflation, showcasing robust growth potential.

- Portfolio Overview: Alphabet allocates 25% of its nearly $2.6 billion investment portfolio to AST SpaceMobile, highlighting its strategic focus on the company amidst a $3.7 trillion market cap.

- Stock Performance: AST SpaceMobile's shares have surged over 300% in the past year and more than 2,800% over the last two years, indicating its growing popularity among institutional investors.

- Market Outlook: Full-year sales for AST SpaceMobile are projected to explode from an estimated $59 million in 2025 to nearly $3.1 billion by 2029, showcasing its immense growth potential in the global mobile network market.

- Risk Factors: Despite AST SpaceMobile's promising outlook, its success hinges on timely satellite launches and ongoing innovation, while facing challenges from inflation and supply chain issues that could disrupt its operating model.

- Significant Market Potential: With a market cap of $1.6 trillion, Meta could see an 81% potential return if it joins the $3 trillion club, indicating strong growth prospects in the coming years.

- Ad Impression Growth: Meta reported an 18% increase in ad impressions in Q4, driven by AI-enhanced user engagement, showcasing the company's strengthening position in the digital advertising market.

- Revenue Continues to Rise: Meta is expected to generate $251 billion in revenue by 2026, a 22% increase from 2025, further solidifying its global market position, particularly with significant expansion potential in international markets.

- Increased Capital Expenditure: Meta plans to raise capital expenditures to $125 billion in 2026, a 73% increase from last year, reflecting the company's commitment to AI technology and its strategic importance for future growth.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

- Market Bubble Debate: Amid President Trump's trade wars, experts argue that the record-high market valuations reflect corporate agility rather than a bubble, prompting short-sellers to scrutinize companies with unsustainable fundamentals.

- Geopolitical Impact: U.S. military strikes against Iran are projected to last four to five weeks; while traditionally unsettling for markets, this situation may lead to windfall profits for U.S. energy companies, especially with the Strait of Hormuz closed.

- Federal Reserve Discrepancies: The Federal Reserve faces a historic lack of consensus as Jerome Powell's term ends and Kevin Warsh prepares to take over, with members divided on interest rate hikes or cuts amid conflicting economic signals.

- Index Performance Variance: As of Wednesday, the Dow Jones index rose 0.74% year-to-date, while the S&P 500 increased by 0.16%, contrasting with a 1.84% decline in the Nasdaq Composite, highlighting performance disparities among major indices.