Turkey aims to return Russian missile systems in an effort to re-enter the F-35 program, according to reports.

Turkey's S-400 Systems: Turkey is seeking to return the S-400 air defense systems purchased from Russia in 2017, which could improve relations with the U.S. and facilitate the purchase of F-35 fighter jets.

Discussions with Russia: Turkish President Erdoğan discussed the potential return of the S-400 with Russian President Putin, although the Kremlin denied any such request was made.

Impact on U.S. Relations: If Turkey relinquishes the S-400, it may lead to the U.S. lifting sanctions on Turkey's defense industry and possibly re-integrating Turkey into the F-35 program.

Financial Considerations: Turkey is reportedly seeking a refund for the S-400 purchase, which could involve negotiating deductions from its energy import bills with Russia.

Trade with 70% Backtested Accuracy

Analyst Views on LMT

About LMT

About the author

- Dividend Growth Advantage: The Schwab U.S. Dividend Equity ETF focuses on high-quality dividend stocks, with the S&P 500 members historically delivering a 7.7% annualized total return, while dividend-paying companies achieved an average of 9.2%, highlighting the superiority of dividend stocks.

- Quality Holdings Performance: The ETF's top holding, Lockheed Martin (LMT), boasts a 2.1% dividend yield, nearly double that of the S&P 500, and has increased its dividend for 23 consecutive years, demonstrating strong cash flows and ongoing growth potential.

- Income and Value Growth: With an average yield of 3.5% and over 8% annual dividend growth over the past five years, the Schwab U.S. Dividend Equity ETF not only provides investors with a stable cash flow but also enhances asset value through the earnings growth of its holdings.

- Long-Term Return Expectations: Since its inception in 2011, the ETF has achieved an annualized return of 12.88%, and its strategy of combining high-yield dividends with capital appreciation positions it to continue delivering strong total returns in the future, making it a preferred choice for investors.

- GDP Growth Target: China has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, indicating significant challenges for economic recovery amid persistent deflationary pressures and trade tensions with the U.S.

- Defense Spending Increase: Defense spending is projected to rise by 7%, the slowest increase since 2021, although analysts believe the official figures may be understated, which could impact national security and military modernization efforts.

- Data Center Attack: Amazon's data center in Bahrain was targeted by Iran for supporting the U.S. military, with damage reported from a drone strike, potentially affecting Amazon's cloud computing operations in the Middle East in the short term.

- Global Tariff Increase: U.S. Treasury Secretary announced that global tariffs will rise from 10% to 15%, with expectations that tariff rates will return to pre-Supreme Court ruling levels by August, which will have profound implications for international trade and the cost structures of U.S. businesses.

- Defense Budget Growth: China plans to increase its defense spending by 7% in 2025, marking the slowest growth rate since 2021, reflecting a cautious approach amid escalating conflicts in the Middle East and rising geopolitical tensions.

- Historical Growth Comparison: Over the past three years, China's defense spending has averaged a 7.2% annual increase, with 7.1% in 2022 and 6.8% in 2021, indicating a trend of stable growth, but the slowdown in 2025 may impact future military modernization efforts.

- Support for Modernization: China aims to accelerate the development of advanced combat capabilities and promote the

- Military Action Background: The U.S. and Israel's strikes on Iran resulted in the killing of Supreme Leader Khamenei, and while the initial phase was successful, experts warn that the conflict may become complicated, affecting public support in the U.S.

- Public Support Survey: A Reuters/IPSOS poll indicates that only one in four Americans supports the attacks on Iran, reflecting public aversion to prolonged military actions, which could influence Trump's policy decisions.

- Unclear Strategic Goals: Initially aimed at destroying Iran's nuclear program, the U.S. objectives have shifted to protecting the American public from unspecified Iranian threats, indicating a lack of clarity in strategic direction.

- Potential for Extended Conflict: Analysts suggest that despite Trump's claim of a four to five-week military operation, the complexity of Iran's security apparatus may prolong the conflict, leading to economic and market instability.

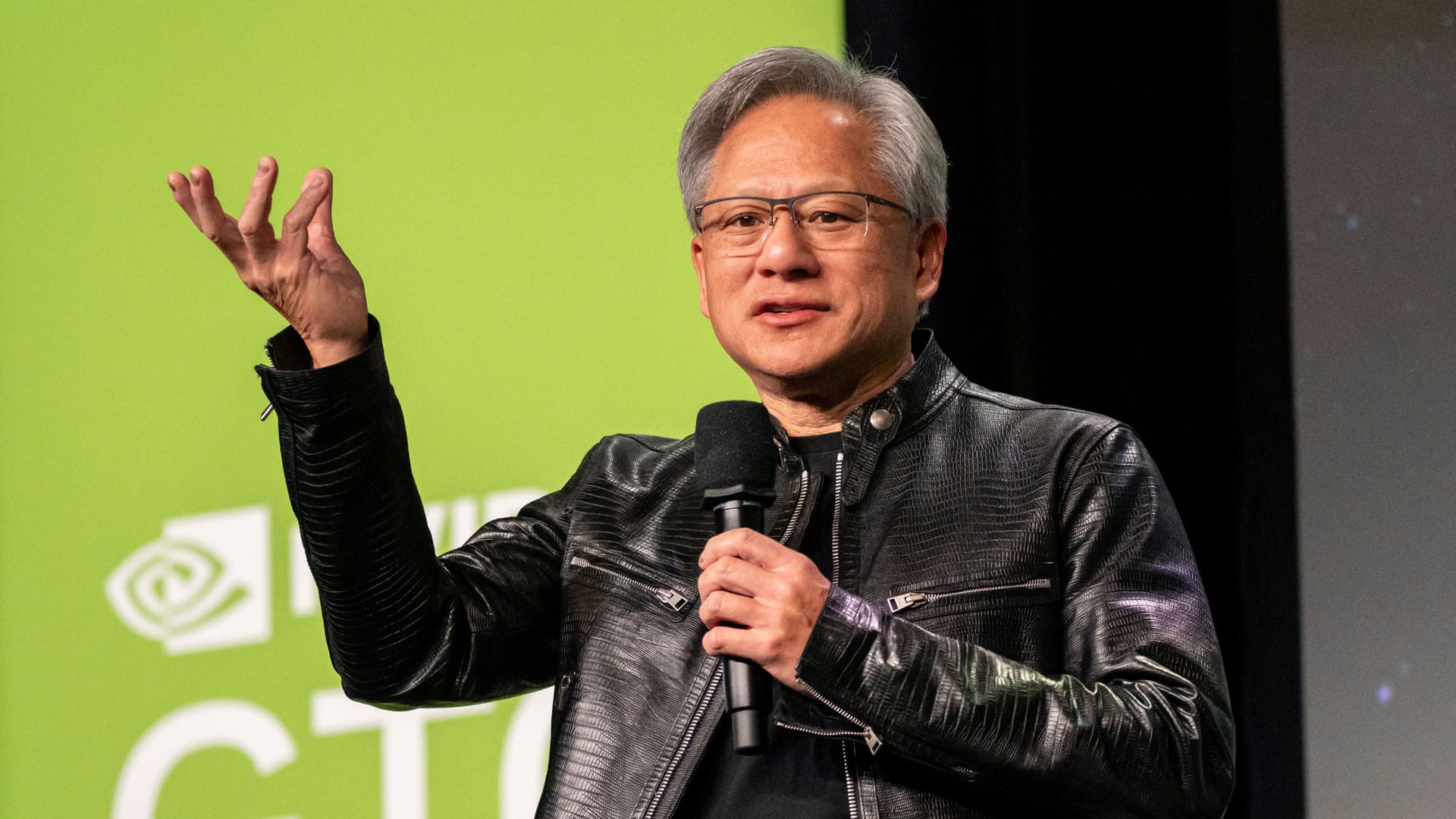

- Supply Chain Risk Warning: On March 2, Defense Secretary Pete Hegseth announced the designation of AI company Anthropic as a supply chain risk to national security, prompting strong opposition from the tech industry, particularly from ITI members including Nvidia and Google.

- Contract Dispute Resolution: The Information Technology Industry Council (ITI) stated in their letter that contract disputes should be resolved through negotiations or by the Department selecting alternative providers, rather than imposing supply chain risk designations, which could adversely affect U.S. companies.

- Historic Decision: Anthropic, awarded a $200 million DoD contract in July, had its request to ensure its technology wouldn't be used for autonomous weapons or mass surveillance rejected by the Pentagon, leading to this unprecedented risk designation, which ITI argues has never been applied to an American company before.

- Industry Reaction: OpenAI CEO Sam Altman remarked that enforcing the SCR designation on Anthropic would have detrimental effects on the industry and the country, highlighting the tech sector's significant concern and unease regarding government policies.

- Surge in Enterprise Demand: Anthropic's business now derives 80% from enterprise customers, with an annual revenue run rate nearing $20 billion, up from $14 billion just weeks ago, indicating strong demand and potential market leadership in the enterprise AI sector.

- Regulatory Risk: The Trump administration's designation of Anthropic as a supply chain risk after it refused the Pentagon's terms has led to defense contractors dropping its technology, which could significantly impact customer trust and market share.

- Shift in Technology Reliance: As the government scrutinizes Anthropic, companies are reassessing their reliance on a single AI provider, with many evaluating multiple vendors simultaneously to mitigate risks, potentially altering the supply chain dynamics across the industry.

- Legal Challenges and Brand Impact: Anthropic plans to contest the government's supply chain risk designation legally; while its brand has benefited from consumer safety concerns, ongoing legal battles may affect investor confidence and the pace of market expansion.