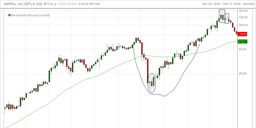

Technical Indicators Suggest Alcohol Stocks Could Be Overextended Following Staples Surge

- Consumer Staples Sector Performance: The consumer staples sector has been experiencing significant growth recently.

- S&P 500 Weighting: Its appeal may be partly due to its relatively small representation in the S&P 500, accounting for about 5%.

Trade with 70% Backtested Accuracy

Analyst Views on XLP

About the author

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

Market Performance: Consumer staples stocks have experienced a significant rally in 2026, indicating strong market performance in this sector.

Investment Opportunities: Despite the rally making it challenging to find undervalued stocks, there are still investment opportunities available for those willing to search.

- Consumer Staples Sector Performance: The consumer staples sector has been experiencing significant growth recently.

- S&P 500 Weighting: Its appeal may be partly due to its relatively small representation in the S&P 500, accounting for about 5%.

Morgan Stanley's Price Target Update: Morgan Stanley raised its price target on Dutch Bros to $85 from $82, maintaining an overweight rating, while RBC Capital lowered its target to $75 from $80 but kept an outperform rating.

Strong Q4 Performance: Dutch Bros reported Q4 revenues of $443.6 million, exceeding expectations of $424.9 million, and demonstrated a 29.4% increase in revenue year-over-year.

Analyst Ratings and Market Sentiment: Analysts have varied ratings on Dutch Bros, with some maintaining buy ratings and others lowering price targets, reflecting a mix of optimism and caution in the market.

Future Projections: Dutch Bros announced plans for significant capital expenditures in 2026, projecting revenues between $2 billion and $2.03 billion, with same-store sales growth estimated at 3% to 5%.

- Market Dynamics: The stock market is characterized by rapid changes, where previously popular stocks can quickly lose favor.

- Investor Strategy: Investors are increasingly looking back at former stock picks to identify potential opportunities for profit.

- Consumer Staples Performance: Consumer staples stocks have been performing well this month, surpassing technology stocks.

- Investor Sentiment: Renewed fears surrounding AI have prompted investors to seek safer investment options.