TPG announces Q3 earnings per share of 20 cents compared to a loss of 8 cents last year.

Q3 Revenue Growth: TPG reported a Q3 revenue of $1.22 billion, a significant increase from $855.4 million in the same period last year.

Capital Formation and Deployment: The firm raised over $18 billion in capital during the quarter and deployed nearly $15 billion, marking a 70% year-over-year increase in investment activity.

CEO's Statement: Jon Winkelried, CEO, highlighted the strong performance driven by robust capital formation and a record quarter for deployment, emphasizing the firm's diversified investment strategy.

Future Outlook: TPG's scale and diversification are expected to support accelerated growth and long-term value for shareholders as they approach the end of 2025.

Trade with 70% Backtested Accuracy

Analyst Views on TPG

About TPG

About the author

- Liquidity Issues Escalate: Boaz Weinstein of Saba Capital highlights that liquidity problems in private credit are worsening during the bull market, leading to dividend cuts for investors and increasing market focus on redemption requests, reflecting potential risks and uncertainties within the industry.

- Surge in Redemption Requests: Blue Owl Capital Corp. II halted quarterly redemptions and sold $1.4 billion in direct lending investments to provide liquidity, becoming one of the first non-traded private credit funds affected by redemption requests, indicating urgent market demand for liquidity.

- Investment Opportunities Arise: Despite market challenges, Weinstein remains optimistic about major private credit managers like Ares, Apollo, and Blackstone, believing these firms will emerge as winners after market fluctuations, demonstrating confidence in the industry's future.

- Cliffwater Monitoring: Weinstein is closely watching Cliffwater's redemption rate, expected to be between 10% and 20%, indicating potential difficulties in meeting redemption requests, further reflecting the fragility of the private credit market.

- Rising Credit Risk: Oracle's five-year credit default swaps (CDS) have surged past 160 basis points this year, marking the highest level since the 2008 financial crisis, which raises concerns about its over $100 billion debt and could impact its financing capabilities and investor confidence.

- Liquidity Issues: Investor Steve Eisman highlighted that the CDS market is “extremely illiquid,” where a single hedge fund's trades can cause significant spread fluctuations, complicating the market's assessment of Oracle's credit risk.

- Transparency Concerns: Eisman noted that Oracle's reinsurance transactions through its offshore subsidiaries are “very opaque,” which may dramatically increase the company's leverage, further intensifying market worries about its financial health.

- Industry Impact: Over 70% of Blue Owl's loan book is concentrated in the software sector, and while fears of AI disruption have affected public SaaS stocks, CEO Craig Packer stated that the recent sale of $1.4 billion in loans at 99.7 cents on the dollar suggests that the underlying credit quality may not be as poor as the market perceives.

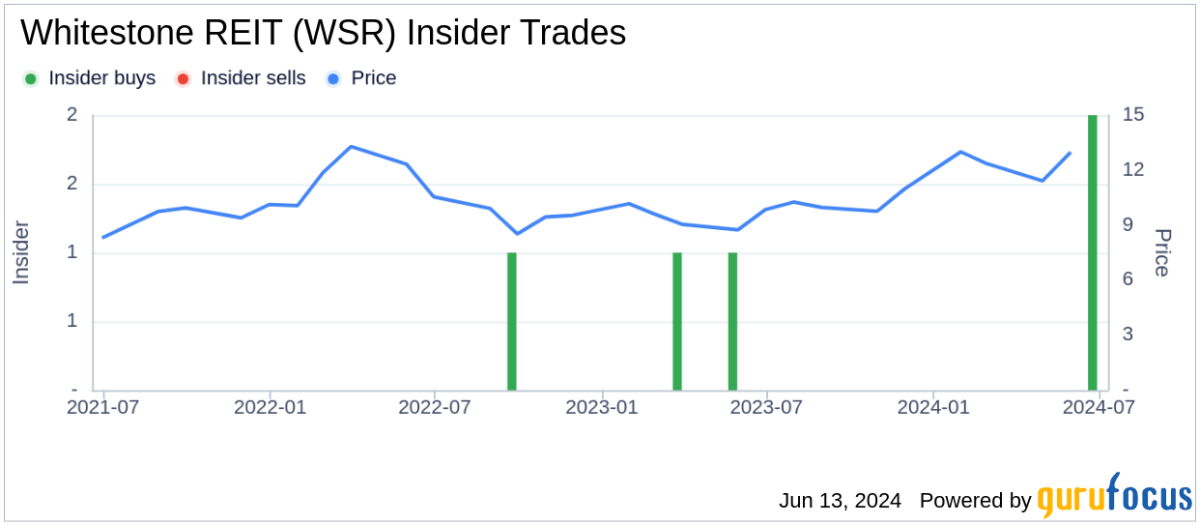

- Increased Buyout Interest: Whitestone REIT (WSR) is attracting buyout interest from private equity firms, including Blackstone (BX), indicating market recognition of its asset value and potentially driving up the company's stock price.

- Positive Market Reaction: The news of this buyout interest may draw more investor attention to WSR, enhancing its market liquidity and providing more opportunities for future capital operations.

- Industry Consolidation Trend: The interest from private equity firms in REITs reflects a trend of industry consolidation, which may prompt other REITs to consider strategic acquisitions or mergers to enhance their competitive position in the market.

- Investor Confidence Boost: As buyout interest increases, investor confidence in WSR may strengthen, potentially driving long-term shareholder value and attracting further attention from institutional investors.

Market Reaction: Whitestone's stock rose by 5.3% in pre-market trading following a report that attracted interest from Blackstone and TPG.

Investor Interest: The report indicates a potential stake acquisition in Whitestone, highlighting the company's appeal to major investment firms.

- Surge in Redemption Requests: Blackstone's BCRED private credit fund is experiencing record redemption requests, with investors seeking to withdraw approximately $3.8 billion, or 7.9% of total assets, posing a significant challenge to the firm's liquidity management.

- Liquidity Structure Scrutiny: The expansion of private credit into retail investors has intensified scrutiny over its liquidity structures, with Moody's warning that balancing high returns with retail-like liquidity will continue to be tested as the sector evolves.

- Asset Management Strategy Adjustment: Blackstone plans to increase its share buyback to 7% to meet redemption requests, demonstrating its response strategy under liquidity pressure while also reflecting a commitment to maintaining market confidence.

- Market Risk Intensification: Concerns over loan quality and AI-related risks have led to declines in stock prices for Blackstone and other alternative asset managers, indicating a weakening market confidence in the private credit industry.

- Large Transaction Size: TPG Inc. completed a $440 million portfolio transaction with Acadia Realty Trust involving seven retail properties through newly formed joint ventures, showcasing TPG's strong investment capabilities in the market.

- Asset Structure Details: The transaction includes six Fund V assets and The Avenue West Cobb, with TPG acquiring an 80% interest across the portfolio while Acadia retains a 20% stake, ensuring its continued involvement in asset management.

- Financing Support: Acadia provided approximately $27 million in financing within the capital structure of the new joint ventures, which not only enhances the financial stability of the joint ventures but also lays the groundwork for future expansion.

- Market Performance Potential: Over the past 14 months, Acadia has completed over $1.2 billion in asset transactions in partnership with TPG, demonstrating the strength and market appeal of its investment management platform.