Santoli's Tuesday Market Summary: Stocks Steady as Fed Meeting Approaches, Notable Sector Rotations Observed

Market Hesitation Ahead of Fed Decision: Stocks are showing caution as they approach record highs, with the S&P 500 experiencing a 5% pullback since April, influenced by a dovish shift from the Federal Reserve and expectations of a rate cut.

Sector Rotations and Consumer Trends: Recent market activity has seen a rotation towards sectors like transports and financials, but comments from JPMorgan's CFO about fragile consumer trends led to a sell-off in banks and consumer stocks.

Contrasting Market Signals: While financial markets indicate loose monetary conditions, labor market indicators suggest tightness, creating a complex environment for the Fed as it prepares for a likely rate cut.

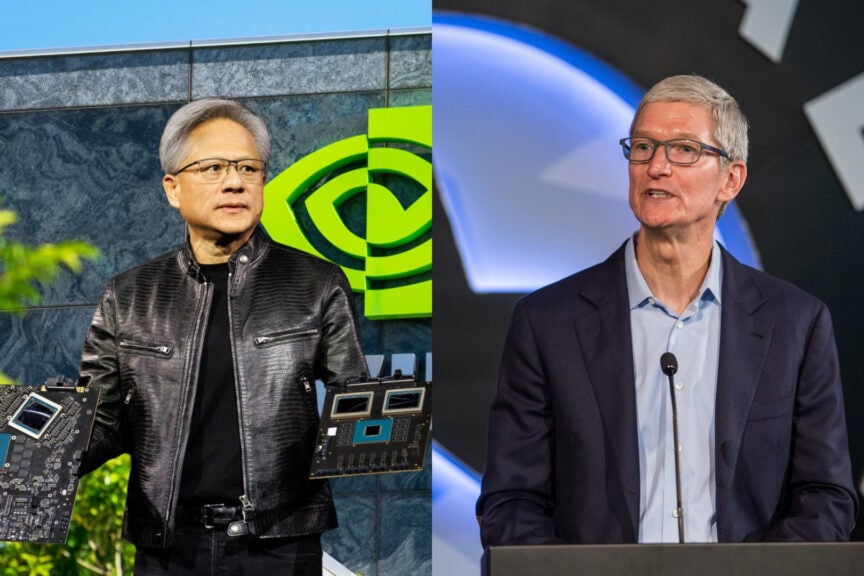

AI and Stock Performance Dynamics: The market is favoring certain AI stocks over others, with Nvidia struggling while Broadcom and Google gain traction; defensive stocks like consumer staples are underperforming significantly, raising questions about future investment strategies.

Trade with 70% Backtested Accuracy

Analyst Views on AVGO

About AVGO

About the author

- Strong Performance: Broadcom reported Q1 fiscal 2026 revenue of $19.3 billion, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, demonstrating robust performance amid ongoing demand for AI hardware, which solidifies its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of growth in AI business, indicating that the widespread adoption of AI technology is driving sustained performance improvements.

- Optimistic Outlook: Broadcom projects Q2 revenue to reach $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future growth, particularly with AI semiconductor revenue expected to surge 140% to $10.7 billion.

- Broader Market Implications: The strong results and positive outlook from Broadcom further corroborate Nvidia CEO's assertion that AI technology has reached an inflection point, suggesting that accelerating demand for AI will create significant opportunities across the industry.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

- Broadcom's Strong Earnings: Broadcom reported record revenue of $19.3 billion for Q1 2026, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, highlighting robust demand for AI hardware and reinforcing its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of AI growth, indicating a significant share in the rapidly expanding AI market.

- Optimistic Future Outlook: Broadcom anticipates Q2 revenue of $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future AI chip demand.

- Bright Prospects for Nvidia: Nvidia controls 92% of the data center GPU market, and as AI adoption expands downstream, demand for its GPUs is expected to rise, presenting a favorable entry point for investors despite market uncertainties.

- Market Recovery: The S&P 500 closed up 0.8% at 6,869.50 on Wednesday, ending a three-day losing streak, driven by a strong rebound in technology and semiconductor stocks, although it remains in negative territory for 2026.

- Job Data Beats Expectations: The ADP report revealed that U.S. private employers added 63,000 jobs in February, significantly exceeding the 48,000 consensus and marking a sharp rebound from January's downwardly revised 11,000, indicating a robust economic recovery.

- Investor Sentiment Improves: Investor jitters regarding U.S.-Iran tensions eased as oil prices stabilized and President Trump's comments on protecting shipping lanes provided reassurance, boosting overall market confidence.

- Future Outlook: Despite the encouraging rebound on Wednesday, S&P 500 futures were down 0.43% at 6,846.75 at last check, suggesting potential challenges for Thursday's open, especially with upcoming weekly jobless claims and the non-farm payroll report set to test market direction.

- Strong Earnings Report: Veeva Systems Inc. reported fourth-quarter results with revenue guidance between $3.585 billion and $3.600 billion, exceeding the market estimate of $3.56 billion, indicating robust performance in the market.

- Earnings Per Share Forecast: The company anticipates fiscal 2027 earnings per share of $8.85, significantly above the Street estimate of $8.58, reflecting a sustained enhancement in its profitability.

- Stock Price Surge: In after-hours trading, Veeva's shares jumped 11.3% to $209.80, indicating investor optimism regarding the company's future growth prospects.

- Market Attention: With U.S. stock futures trading lower, investors are keenly focused on Veeva's earnings report and outlook, which may influence overall market sentiment.

- Software Segment Slowdown: Broadcom's infrastructure software segment reported a mere 1% revenue growth in Q1 2026, sharply down from 19.2% in Q4 2025 and 46.7% in Q1 2025, indicating diminishing returns from its major acquisition of VMware, which could impact future market competitiveness.

- Strong Overall Performance: The company achieved a 29% increase in total revenue for Q1, reaching $19.31 billion, surpassing estimates of $19.13 billion, while the Q2 revenue forecast of approximately $22 billion reflects robust performance in its AI semiconductor business and key customer partnerships.

- AI Demand Boosts Outlook: Despite the slowdown in the software segment, management anticipates a 9% increase in Q2 software sales to $7.2 billion, with the CEO asserting that the growth in AI will drive demand for VMware software, highlighting its critical role in modern data centers.

- Share Buyback Program: Broadcom announced a new $10 billion share repurchase program aimed at enhancing shareholder value, and although its stock has declined 8.3% year-to-date, shares rose 5.3% in after-market trading following the release of strong earnings.