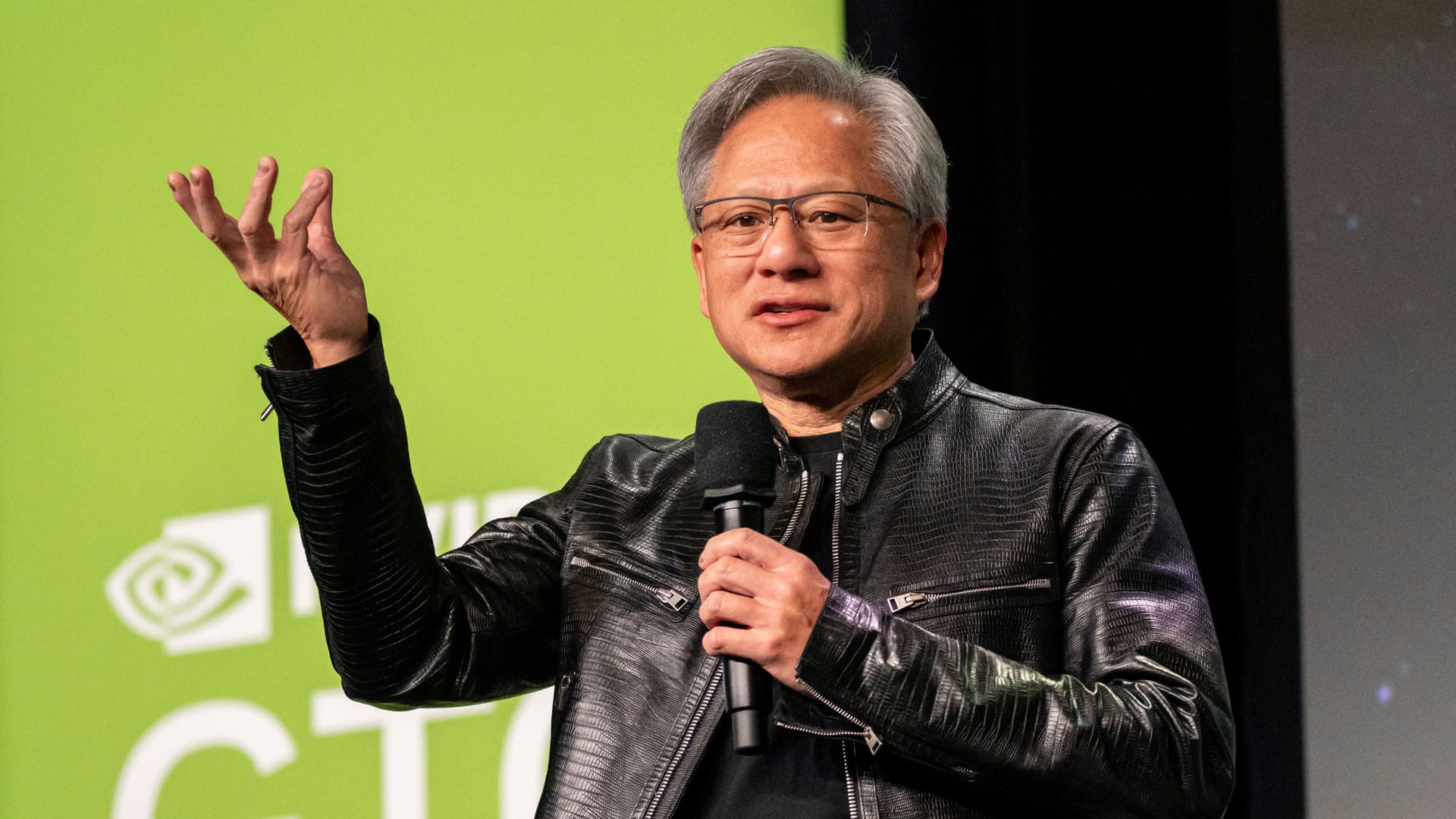

Nvidia Highlights Surge in AI Chip Demand at CES 2026

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 18 2026

0mins

Should l Buy NVDA?

Source: NASDAQ.COM

- Surge in AI Chip Demand: Nvidia CEO Jensen Huang highlighted at CES 2026 that AI development is accelerating, with projected revenue of $213 billion for fiscal 2026, reflecting a 50% increase from last year and showcasing the company's strong growth potential in the AI market.

- Opportunities in Older Chips: As the new Rubin chips are rolled out, Nvidia's older chip prices are expected to decline by a factor of 10 annually, attracting more developers and companies to purchase them, thus creating a secondary market and further expanding Nvidia's market share.

- Strong Data Center Revenue: In Q3 of fiscal 2026, Nvidia's data center revenue reached $51.2 billion, a 66% year-over-year increase, indicating robust demand in cloud computing and AI infrastructure, particularly with strong sales of Blackwell chips.

- AI Workload Share: Meta's open-source AI model Llama accounts for 25% of AI workload volume, driving demand for Nvidia chips and further solidifying its critical position in the AI ecosystem.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy NVDA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on NVDA

Wall Street analysts forecast NVDA stock price to rise

41 Analyst Rating

39 Buy

1 Hold

1 Sell

Strong Buy

Current: 183.040

Low

200.00

Averages

264.97

High

352.00

Current: 183.040

Low

200.00

Averages

264.97

High

352.00

About NVDA

NVIDIA Corporation is a full-stack computing infrastructure company. The Company is engaged in accelerated computing to help solve the challenging computational problems. The Company’s segments include Compute & Networking and Graphics. The Compute & Networking segment includes its Data Center accelerated computing platforms and artificial intelligence (AI) solutions and software; networking; automotive platforms and autonomous and electric vehicle solutions; Jetson for robotics and other embedded platforms, and DGX Cloud computing services. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating industrial AI and digital twin applications.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Earnings Growth: Nvidia's latest earnings report reveals a revenue of $68.1 billion for the quarter ending January 25, reflecting an impressive growth rate of 73%, which is exceptionally rare among tech companies, indicating robust market demand and business performance.

- Stock Price Volatility: Despite strong performance, Nvidia's stock price has declined following the earnings release, currently trading at a P/E ratio of 37, which drops to 23 based on expected earnings, highlighting market concerns over its high valuation.

- Market Position Consolidation: As the world's most valuable company with a market cap of $4.4 trillion, Nvidia maintains a strong investment appeal despite overall bearish sentiment in tech, thanks to its leadership in the AI chip sector.

- Cautious Investor Sentiment: Analysts suggest that investors should approach Nvidia with caution in the current market environment, as while its business remains strong, the likelihood of the stock doubling in value in the short term is low, necessitating realistic expectations.

See More

- Core Investment: The Vanguard Total Stock Market ETF (VTI) tracks the entire U.S. stock market and owns over 3,500 stocks, providing investors with the convenience of investing in thousands of stocks with a single click, making it ideal for those looking to simplify their investments.

- Cost Advantage: With an expense ratio of just 0.03%, investing $10,000 incurs only $3 in annual fees, significantly lowering investment costs and enhancing long-term return potential for investors.

- Long-Term Return Potential: Since its inception in 2001, the ETF has averaged a 9.2% annual total return, meaning a $10,000 investment would be worth over $90,000 today, demonstrating its effectiveness as a wealth-building tool.

- Concentration Risk and Lack of Diversification: Despite holding many stocks, the ETF's performance is heavily reliant on the top 10 companies, presenting significant concentration risk, while lacking exposure to international stocks and fixed-income assets, which may hinder portfolio diversification.

See More

- Technology Integration: Texas Instruments is combining its real-time control, sensing, and power tools with Nvidia's advanced robotics computing and ethernet-based sensing technologies to help developers validate complete humanoid robot systems earlier, thereby accelerating the transition from prototypes to commercialization.

- Sensor Fusion Solution: TI's designed sensor fusion solution integrates its mmWave radar technology with Nvidia's Jetson Thor, utilizing the Holoscan Sensor Bridge to enable low-latency 3D perception and safety awareness, significantly enhancing the operational safety of humanoid robots.

- Market Showcase: Texas Instruments plans to showcase this development at the upcoming Nvidia GTC event from March 16 to 19 in San Jose, California, further promoting the safe operation of humanoid robots in unpredictable environments.

- Industry Outlook: While several companies like Tesla and Boston Dynamics are developing humanoid robots, a UC Berkeley professor warns that engineers may need years to achieve humanoid robots with real-world skill levels, emphasizing the need for realistic expectations regarding technological advancements.

See More

- Government and Corporate Relations: OpenAI CEO Sam Altman stated at the Morgan Stanley conference that the government should be more powerful than private companies, emphasizing the responsibility of businesses in the democratic process, which could impact corporate-government collaborations.

- Anthropic's Challenges: Anthropic CEO Dario Amodei criticized Altman's relationship with the Trump administration, noting that the company has not given 'dictator-style praise' to Trump, which may affect its reputation and partnership opportunities in the industry.

- Tensions with the Department of Defense: The Defense Secretary labeled Anthropic as a 'Supply-Chain Risk to National Security' and directed all federal agencies to cease using its technology, potentially leading to a decline in its market share.

- Rapid Growth of OpenAI: OpenAI recently announced a $110 billion funding round at a $730 billion valuation, with an annual revenue run rate of $25 billion, showcasing its ability to expand rapidly in a highly competitive market.

See More

- Doubling AI Revenue: Broadcom's AI revenue has more than doubled due to demand for AI accelerators and networking, with CEO Hock Tan projecting that AI chip revenue will be 'significantly in excess of $100 billion' by 2027, far exceeding Wall Street's bullish estimates and indicating strong demand and growth potential in the AI market.

- Capacity Expansion: The company is nearing 10 gigawatts of capacity, with analysts estimating revenue of $12 billion to $15 billion per gigawatt by 2027, which is expected to drive substantial revenue growth and further solidify Broadcom's leadership position in the semiconductor industry.

- Supply Chain Assurance: Despite facing shortages in high-bandwidth memory, Tan assured analysts that the company has secured memory and leading-edge wafer supply through 2028, which will support ongoing growth and alleviate concerns about profitability.

- Competitive Market Advantage: Tan emphasized that Broadcom's AI chips offer cost and performance advantages over competitors like Nvidia, which is expected to attract more hyperscaler customers and ensure the company's market share and profitability in the coming years.

See More

- China's Economic Target Shift: China has set its 2026 GDP growth target at 4.5%-5%, marking the lowest target since 1991, which reflects the reality of slowing economic growth and may lead to decreased investor confidence in the Chinese market.

- Historical Context Analysis: Historically, China's economy grew as high as 12%, but as economic cycles change, market optimism about China has waned, indicating that the country's supercycle is over, prompting investors to reassess risks.

- Market Money Flows: Currently, portfolios are heavily concentrated in the 'Magnificent Seven' stocks, with early trading showing neutral money flows in Apple and Google, indicating a cautious market sentiment towards these tech stocks.

- Cryptocurrency Legislation Hurdles: Bitcoin staged a significant rally on hopes of favorable legislation, but faces roadblocks as banks refuse to back a White House proposal, necessitating cautious responses from investors to market volatility.

See More