New BOBP ETF Targets US Large-Caps Using CORE16's Proprietary Skewness Model

Written by Emily J. Thompson, Senior Investment Analyst

Updated: May 27 2025

0mins

Should l Buy KVUE?

Source: Benzinga

New ETF Launch: Exchange Traded Concepts has launched the CORE16 Best of Breed Premier Index ETF (BOBP), which aims to capitalize on market opportunities through a dynamic rebalancing strategy based on equity skewness, allowing for tactical investment decisions.

Investment Strategy: The fund utilizes a proprietary algorithm to select 50 large-cap U.S. securities, focusing on stocks with favorable performance asymmetries, and represents ETC's expansion into niche ETFs in the U.S. market.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy KVUE?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on KVUE

Wall Street analysts forecast KVUE stock price to rise

8 Analyst Rating

1 Buy

7 Hold

0 Sell

Hold

Current: 18.150

Low

17.00

Averages

18.86

High

23.00

Current: 18.150

Low

17.00

Averages

18.86

High

23.00

About KVUE

Kenvue Inc. is a consumer health company. The Company’s differentiated portfolio of brands includes Tylenol, Neutrogena, Listerine, Johnson’s, BAND-AID, Aveeno, Zyrtec, and Nicorette. It operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. Its Self Care product categories include pain care; cough, cold, and allergy; digestive health; smoking cessation; eye care; and other products. Self Care segments include brands such as Tylenol, Motrin, Nicorette, Benadryl, Zyrtec, Zarbee’s, ORSLTM, Rhinocort, and Calpol. The Skin Health and Beauty segment is focused on face and body care, as well as hair, sun, and other products. The Essential Health segment includes oral care, baby care, women’s health, wound care, and other products. Its portfolio includes Self Care, Skin Health and Beauty, and Essential Health products which connect with consumers across North America, Asia Pacific (APAC), Europe, Middle East, and Africa (EMEA), and Latin America (LATAM).

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- New Investment Activity: Starboard Value LP initiated a new position in Fluor Corporation (FLR) by acquiring 5,191,327 shares in Q4 2025, amounting to a total investment of $205.73 million, indicating confidence in Fluor's future growth prospects.

- Ownership Proportion Analysis: This acquisition accounts for 3.9% of Starboard's reportable AUM in its 13F filing, highlighting its significance within a diversified investment portfolio.

- Market Performance Review: As of February 17, 2026, Fluor's shares were priced at $48.57, reflecting a 22.2% increase over the past year, showcasing the company's recovery potential in the engineering and construction sector.

- Strategic Transformation Progress: Fluor has focused on restoring project discipline in recent years, shifting towards projects with more proportional risk structures, and if it can effectively manage project costs, it may enhance its profitability and cash flow stability.

See More

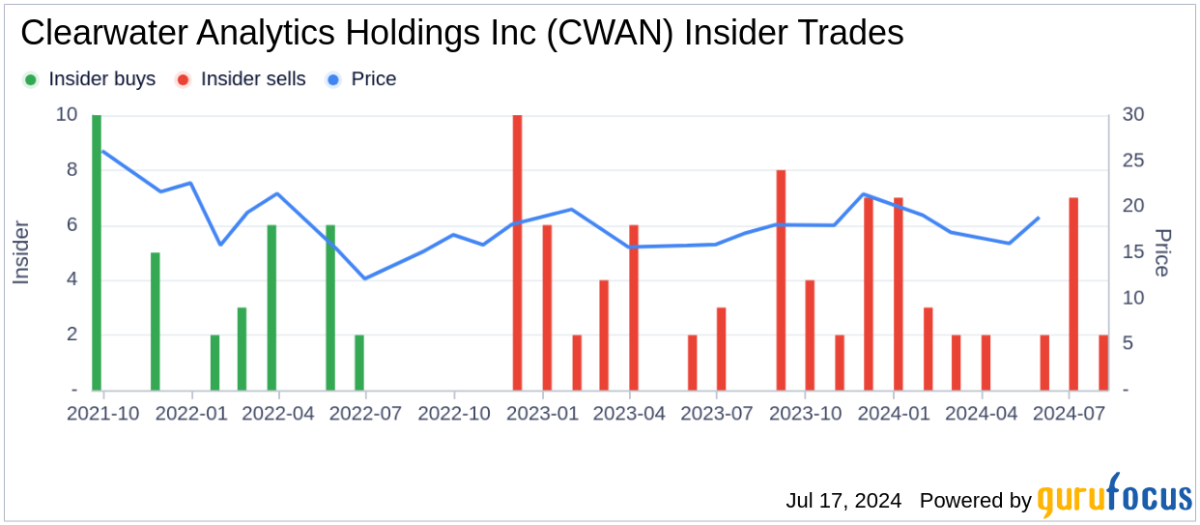

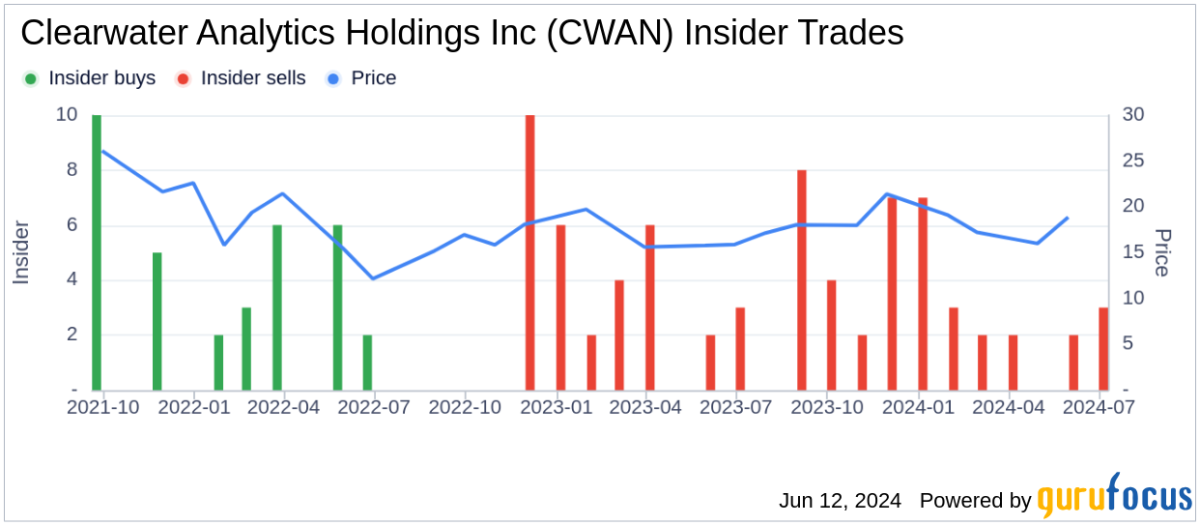

- New Investment Disclosure: According to a February 17, 2026 SEC filing, Starboard Value LP disclosed a new position in Clearwater Analytics by purchasing 9,959,031 shares valued at $240.21 million, indicating confidence in the company's growth potential.

- Asset Management Proportion: This acquisition represents 4.55% of Starboard's reportable assets under management as of December 31, 2025, highlighting the importance of Clearwater in their investment strategy and potentially influencing future allocations.

- Market Performance Analysis: As of February 17, 2026, Clearwater's shares were priced at $22.93, reflecting a 17% decline over the past year and underperforming the S&P 500 by 26.7 percentage points, which suggests market caution regarding its growth outlook.

- Business Model and Challenges: Clearwater Analytics focuses on providing automated investment data management solutions for institutional clients; while its cloud platform ensures steady recurring revenue, the complexity of client onboarding may slow margin growth, prompting investors to assess whether revenue can outpace service delivery costs.

See More

- Acquisition Overview: Starboard Value LP acquired 9,959,031 shares in Clearwater Analytics, with an estimated transaction value of $240.21 million, reflecting a new position in its investment portfolio.

- Asset Management Proportion: The newly acquired stake represents 4.55% of Starboard's 13F reportable assets under management, indicating a significant investment despite not being among the top five holdings.

- Market Performance Analysis: As of February 17, 2026, Clearwater Analytics shares were priced at $22.93, down 17% over the past year, underperforming the S&P 500 by 26.7 percentage points, raising concerns about its growth potential.

- Business Model and Challenges: Clearwater Analytics focuses on providing SaaS solutions for automated investment data management, ensuring stable recurring revenue through its subscription model, but the client onboarding process may slow margin growth, making future growth reliant on deeper usage by existing clients.

See More

- New Investment Disclosure: On February 17, 2026, Starboard Value LP disclosed a purchase of 9,959,031 shares in Clearwater Analytics, valued at $240.21 million, indicating a significant new investment that could influence market performance.

- Asset Management Proportion: This acquisition represents 4.55% of Starboard's reportable assets under management as of December 31, 2025, highlighting Clearwater's importance in its portfolio and potentially attracting more investor interest.

- Market Performance Analysis: As of February 17, 2026, Clearwater's shares were priced at $22.93, down 17.0% over the past year and underperforming the S&P 500 by 26.7 percentage points, reflecting market concerns about its future growth prospects.

- Business Model and Challenges: Clearwater Analytics focuses on automated investment data management, and while its cloud platform provides steady recurring revenue, the complexities of client onboarding and data integration may hinder margin growth, prompting investors to monitor whether revenue growth can outpace service delivery costs.

See More

- Lawsuit Progress: A Texas judge rejected Kenvue's attempt to dismiss a lawsuit filed by Attorney General Ken Paxton, which accuses the company of concealing the risks of autism and ADHD in children whose mothers took Tylenol, highlighting the legal scrutiny surrounding the company's potential liabilities.

- Details of Allegations: Paxton's case claims that Kenvue and Johnson & Johnson violated the Texas Uniform Fraudulent Transfer Act by fraudulently transferring liabilities to Kenvue to shield their assets from lawsuits, which could expose the company to greater legal risks.

- Company's Response Measures: Kenvue has yet to respond to media requests for comments but has set up a dedicated website to address the claims, indicating the company's proactive approach to crisis management.

- Historical Context: Tylenol was previously sold by Johnson & Johnson Consumer Health before Kenvue's spin-off via IPO in 2023, and the ongoing lawsuit could impact its market image and future business development.

See More

- Lawsuit Rejection: A Texas judge denied Kenvue's bid to dismiss a lawsuit filed by state Attorney General Ken Paxton, accusing the company of concealing risks associated with Tylenol use during pregnancy, indicating strict legal scrutiny of the company's marketing practices.

- Legal Basis: Judge LeAnn Rafferty's ruling did not provide detailed reasoning, but the case involves Texas's Deceptive Trade Practices Act, which could negatively impact Kenvue's market strategy and brand image.

- Market Impact: The allegations against Kenvue claim that using Tylenol during pregnancy may lead to autism, an unproven assertion that could undermine consumer trust in the product, potentially affecting sales performance.

- Free Speech Defense: Kenvue argues that prohibiting its marketing of Tylenol consistent with

See More