Most Active Stocks in Pre-Market Trading on November 14, 2025: IVVD, TSLL, SQQQ, IBIT, IONZ, NVDA, NIO, QBTS, BBAI, IONQ, CRCL, TE

NASDAQ 100 Pre-Market Indicator: The NASDAQ 100 is down by 426.22 points, currently at 24,567.24, with a total pre-market volume of 670,374,034 shares traded.

Most Active Stocks: Invivyd, Inc. (IVVD) shows a notable increase, while Direxion Daily TSLA Bull 2X Shares (TSLL) and iShares Bitcoin Trust ETF (IBIT) are experiencing declines.

NVIDIA Corporation Earnings Forecast: NVIDIA (NVDA) is down 5.44 points, with an upcoming earnings report scheduled for November 19, 2025, and a consensus EPS forecast of $1.17, indicating a significant year-over-year increase.

Stock Recommendations: Several companies, including D-Wave Quantum Inc. (QBTS) and IonQ, Inc. (IONQ), are currently rated in the "buy range" according to Zacks, despite some experiencing declines in their stock prices.

Trade with 70% Backtested Accuracy

Analyst Views on T

About T

About the author

- Acquisition Completed: AT&T finalized its acquisition of Lumen's Mass Markets fiber business ahead of schedule on February 2, adding over 1 million fiber subscribers and significantly enhancing its network coverage across the U.S.

- Market Expansion: This acquisition expands AT&T's fiber reach to over 4 million locations, positioning the company to increase its fiber penetration from about 25% to levels more consistent with its existing network, thereby strengthening its competitive edge.

- Financial Outlook: AT&T reaffirmed its adjusted EPS guidance for 2026 at $2.25 to $2.35, projecting a double-digit CAGR through 2028, which reflects the company's confidence in future growth.

- Capital Investment Plans: The company plans to invest $23 billion to $24 billion annually from 2026 to 2028, aiming to reduce its net debt-to-adjusted EBITDA ratio to around 3x by the end of 2026, thereby enhancing its financial stability.

- Acquisition of Fiber Assets: AT&T completed its acquisition of Lumen's Mass Markets fiber business on February 2, adding over 1 million fiber subscribers across more than 4 million locations, significantly enhancing its market share in 32 states and unlocking substantial growth opportunities.

- Expansion of Fiber Coverage: AT&T's fiber services now reach over 36 million customer locations, with expectations to grow to 40 million by the end of 2026 and over 60 million by 2030, thereby strengthening its competitive position in the home internet market.

- Financial Guidance Reaffirmed: The company reiterated its financial and operational guidance for 2026 and beyond, including projected growth in adjusted EBITDA and EPS, as well as plans to return over $45 billion to shareholders from 2026 to 2028, reflecting strong confidence in future growth.

- Debt Management Strategy: Following the EchoStar transaction, AT&T expects its net debt-to-adjusted EBITDA ratio to rise to approximately 3.2x but to decline to 3x by the end of 2026, indicating ongoing efforts to reduce leverage while maintaining a consistent capital return strategy.

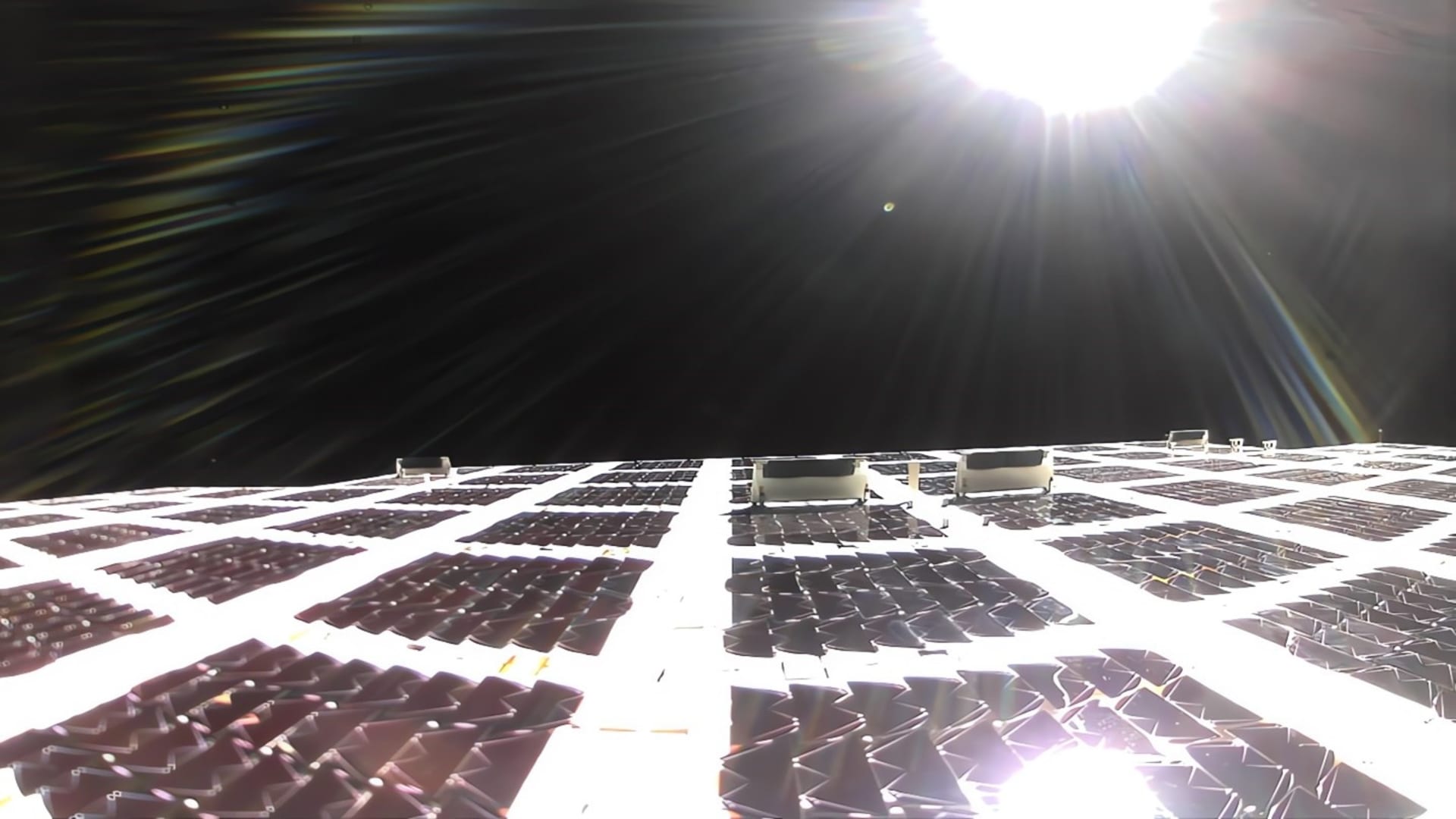

- Company Performance: AST SpaceMobile's stock experienced a significant rise on Wednesday, indicating a recovery from a previous decline.

- New Investment: The company has attracted a new investor, which is contributing to its positive momentum.

- Market Competition: AST SpaceMobile is gearing up to compete with SpaceX, led by Elon Musk, in the satellite-to-cell communications sector.

- Future Prospects: The developments suggest a strategic positioning for AST SpaceMobile in a competitive market, potentially enhancing its growth opportunities.

- Rate Cut Impact: The Federal Reserve's six consecutive rate cuts in 2024 and 2025 have drawn income-seeking investors back to blue chip stocks, particularly as geopolitical tensions rise, enhancing their appeal in turbulent markets.

- AT&T Restructuring: By divesting assets like DirecTV and Time Warner, AT&T has successfully freed up cash flow, generating $16.6 billion in free cash flow in 2025, comfortably covering $12 billion in dividends and buybacks, with adjusted EBITDA expected to grow at a 4% CAGR from 2025 to 2028.

- Philip Morris Transformation: Despite declining smoking rates globally, Philip Morris has raised cigarette prices and expanded its smoke-free product portfolio, achieving a 14% organic revenue increase in smoke-free products in 2025, which now accounts for nearly 43% of total revenue, indicating its viability as a long-term investment.

- Optimistic Market Outlook: Analysts project Philip Morris's EPS to grow at a steady 9% CAGR from 2025 to 2028, driven by new products like iQOS and Zyn, and despite exposure to international conflicts, its stock remains a solid defensive investment.

Stock Performance: AST SpaceMobile shares experienced significant volatility, gaining over 46% in January before falling nearly 29%, but saw a 6% rise following a positive market reaction to its earnings report on March 3.

Revenue Growth: The company reported quarterly revenue of $54.31 million, exceeding analyst expectations and marking a year-over-year growth rate of nearly 2,758%, despite a loss per share of 26 cents.

Future Contracts: AST SpaceMobile secured over $1.2 billion in contracted revenue commitments for 2025, indicating strong future prospects and a growing list of clients, including major telecommunications companies.

Market Positioning: The company is positioning itself as a key federal government contractor, having recently secured a $30 million prime contract from the U.S. Space Development Agency, enhancing its role in national security communications.

- Collaboration Background: Geoforce's partnership with AT&T Business provides customers with asset intelligence solutions for rugged, non-powered industrial equipment, aimed at enhancing asset management capabilities in sectors such as oil & gas, transportation, and construction.

- Technical Advantages: Geoforce's asset tracking devices are engineered for harsh field conditions, enabling activation of containers, tanks, and trailers, thereby optimizing asset utilization and reducing loss risks.

- Market Demand: As enterprise IoT deployments mature, AT&T Business customers can leverage Geoforce's platform for standardized asset tracking, addressing the need for long-term procurement and support models, which enhances competitive positioning.

- Global Impact: With over 300,000 assets tracked across 110 countries, Geoforce continues to expand its influence in the global asset intelligence market, building on its leadership in GPS tracking solutions for industrial equipment.