"Michael Burry of 'The Big Short' Shuts Down His Hedge Fund, Scion Asset Management"

Michael Burry's Hedge Fund Closure: Investor Michael Burry has de-registered his hedge fund, Scion Asset Management, with the SEC, officially terminating its registration on November 10, 2025, and indicating plans to liquidate funds and return capital to investors by year-end.

Final 13F Filing and Bearish Positions: Scion's last mandatory 13F filing revealed a significant bearish position on Palantir Technologies, which Burry later clarified was a $9.2 million investment, not the reported $912 million.

Transition to Private Management: The termination of Scion's SEC registration suggests Burry may convert the hedge fund into a private family office, allowing him to manage his wealth without public scrutiny.

S&P 500 Market Update: The S&P 500 index is nearing the 7,000 mark, closing at 6,850.92, with analysts speculating it could soon breach this threshold, while related ETFs showed mixed performance.

Trade with 70% Backtested Accuracy

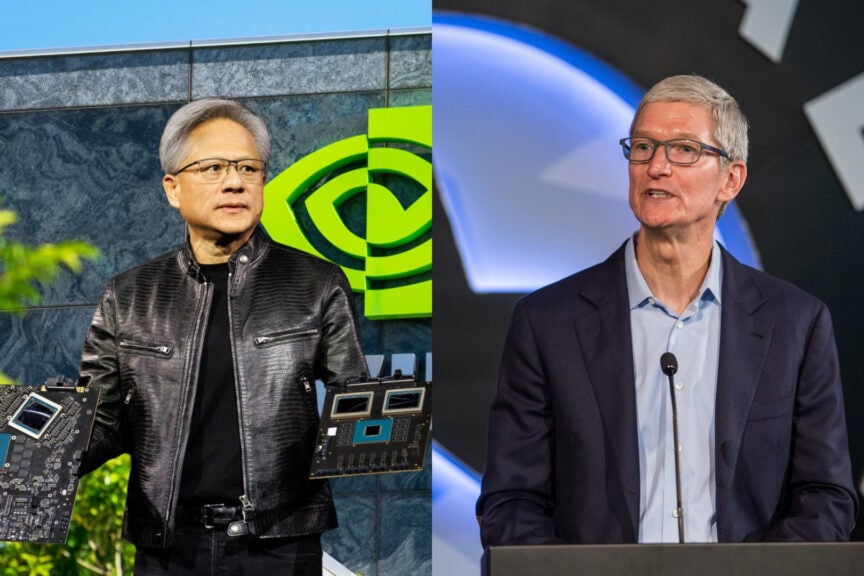

Analyst Views on NVDA

About NVDA

About the author

- Record Earnings: Nvidia reported a record revenue of $68.1 billion, up 73% year-over-year, with data center revenue soaring 75% to $62.3 billion, highlighting its strong demand and leadership in the AI market.

- Stock Reaction: Despite beating earnings expectations, Nvidia's stock fell approximately 5.5% post-earnings, marking its worst single-day drop since April 2025, reflecting market concerns over future AI investment returns.

- Expectation Issues: Analysts noted that Nvidia faces not a numbers problem but an expectations problem, as investors are anxious about whether AI infrastructure spending can remain high, leading to stock volatility.

- Strategic Direction: Nvidia aims to reduce inference costs to one-tenth of Blackwell through the Rubin platform, attracting major cloud providers to adopt its new technology, underscoring its strategic importance and competitive edge in the AI inference market.

- Global Collaboration Initiative: NVIDIA, along with industry leaders such as Booz Allen, BT Group, and Cisco, commits to building AI-native, open, and secure 6G networks, aiming to advance the future of global connectivity while ensuring infrastructure is intelligent and resilient.

- Technological Transformation: By embedding AI across the radio access network (RAN), edge, and core, 6G networks will enable real-time intelligence and rapid innovation to meet increasing demands for security and trust, thereby driving infrastructure buildout in the telecommunications sector.

- Foundation for Economic Growth: BT Group CEO Allison Kirkby noted that connectivity is the backbone of economic growth, and this collaboration will lay the groundwork for a future ecosystem that is intelligent, sustainable, and secure, ensuring 6G technologies unlock new capabilities built on the strengths of 5G.

- International Leadership Position: U.S. Assistant Secretary of Commerce Arielle Roth emphasized that leadership in 6G is critical for national economic prosperity and global competitiveness, with the formation of this international industry coalition showcasing the U.S. and its allies' lead in next-generation technology.

- Strong Revenue Growth: Nvidia achieved double-digit revenue growth in Q4 of fiscal 2026, with gross margins reaching the mid-70% range, showcasing the company's robust profitability and sustained growth potential in the AI market.

- Market Dependency Risk: Currently, 91% of Nvidia's revenue comes from its data center business, indicating a high dependence on AI; however, this also reflects its market leadership in a rapidly growing sector.

- Diversification Strategy: Despite the booming AI business, Nvidia has not abandoned other revenue sources such as gaming and professional visualization, while also exploring growth opportunities in emerging fields like automotive and robotics.

- Optimistic Long-Term Potential: Although there are dependency risks, Nvidia's adaptability in the AI sector and the ongoing high demand suggest a positive long-term outlook, allowing investors to maintain confidence in its future development.

- Nvidia Upgrade: Aletheia upgraded Nvidia (NASDAQ:NVDA) from Hold to Buy with a $250 price target, projecting data center revenue to reach $475 billion between F3Q26 and F4Q27, indicating robust market demand and significant growth potential.

- Qualcomm Outlook: Loop Capital upgraded Qualcomm (NASDAQ:QCOM) to Buy with a $185 price target; despite facing short-term challenges, automotive and IoT sales are expected to surpass smartphones by FY29, marking a successful diversification strategy for the company.

- IBM Rating Adjustment: UBS upgraded IBM (NYSE:IBM) from Sell to Neutral with a $236 price target; despite underperforming over the past year, the company's competitive edge in AI and stable cash flow position its risk-reward profile more favorably.

- U.S. Bancorp Optimism: Truist upgraded U.S. Bancorp (NYSE:USB) to Buy with a $66 price target, forecasting an EPS of $5.70 for 2027, reflecting improved financial health and increased market attractiveness.

- Net Selling Trend: Berkshire Hathaway has been a net seller of stocks for 13 consecutive quarters, totaling $187 billion, indicating Buffett's struggle to find attractive investments in the current market, which may impact the company's future investment strategies.

- Company Size and Investment Constraints: Despite Berkshire's tangible book value exceeding $580 billion, doubling since 2018, this also means a limited pool of investment options, constraining Buffett and Weschler's decision-making capabilities.

- Market Valuation Warning: Buffett's warning reflects concerns over elevated market valuations, with historical data suggesting that the S&P 500 could decline by 30% over the next three years when the CAPE ratio exceeds 39, posing significant risks for investors.

- Investment Strategy Adjustment: Investors are advised to approach the current market cautiously, recommending the sale of any stocks they would not want to hold through a downturn and to only buy stocks with reasonable valuations and expected significant earnings growth over the next five years to mitigate potential market volatility.

- Government Collaboration: OpenAI co-founder Sam Altman emphasized the importance of close cooperation with democratic governments in AI development, despite concerns over the concentration of power in private firms, particularly regarding national security issues.

- Trump Orders Ban on Anthropic: President Trump directed federal agencies to phase out Anthropic's technology within six months, labeling the company as 'leftwing' and a potential national security threat, escalating tensions with the Pentagon.

- Anthropic Pushes Back: CEO Dario Amodei rejected government demands to remove safeguards against mass surveillance and autonomous weapons, arguing that current AI systems are too unpredictable to operate without human oversight, highlighting the risks of unmonitored AI.

- OpenAI's Pentagon Agreement: OpenAI's agreement with the Pentagon stipulates that its models cannot control autonomous weapons independently and require human permission, underscoring the growing debate over who should govern powerful AI systems and under what conditions.