Krystal Biotech Reports $107M VYJUVEK Revenue for Q4 2025

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 11 2026

0mins

Should l Buy KRYS?

Source: Globenewswire

- Strong Financial Performance: Krystal Biotech anticipates Q4 2025 VYJUVEK net revenue between $106 million and $107 million, with full-year revenue expected between $388 million and $389 million, highlighting robust growth potential in the rare disease market.

- Clinical Pipeline Expansion: The company plans to accelerate clinical development for KB801 in 2026, increasing the enrollment target for its registrational study from 27 to 60 patients, aiming to expedite treatment for neurotrophic keratitis and solidify its market position in rare diseases.

- Clear Strategic Vision: Krystal Biotech aims to launch at least four rare disease medicines by the end of 2030, potentially benefiting over 10,000 patients, demonstrating its commitment and capability to address global treatment gaps in rare diseases.

- Ongoing R&D Investment: The company expects non-GAAP R&D and SG&A expenses to range from $175 million to $195 million in 2026, indicating a continued strategic investment in its clinical pipeline and larger indication projects to support long-term growth.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy KRYS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on KRYS

Wall Street analysts forecast KRYS stock price to fall

9 Analyst Rating

8 Buy

1 Hold

0 Sell

Strong Buy

Current: 258.810

Low

198.00

Averages

229.25

High

278.00

Current: 258.810

Low

198.00

Averages

229.25

High

278.00

About KRYS

Krystal Biotech, Inc. is an integrated, commercial-stage biotechnology company. The Company is focused on the discovery, development, and commercialization of genetic medicines to treat diseases with high unmet medical needs. Its product candidates in various stages of clinical and preclinical development include KB407, KB408, KB707, KB105, KB801, KB803, KB304 and KB301. Its commercial product, VYJUVEK, is a redosable gene therapy, and a genetic medicine approved in the United States and Europe for the treatment of dystrophic epidermolysis bullosa. KB407 is being developed for the treatment of Cystic Fibrosis. KB408 is being developed for the treatment of Alpha-1 Antitrypsin Deficiency, a rare lung disease. KB707 is being developed for the treatment of solid tumors. KB105 is being developed for TGM1-Deficient Autosomal Recessive Congenital Ichthyosis. KB803 is a redosable eye drop formulation of B-VEC, designed for the treatment of ocular complications.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

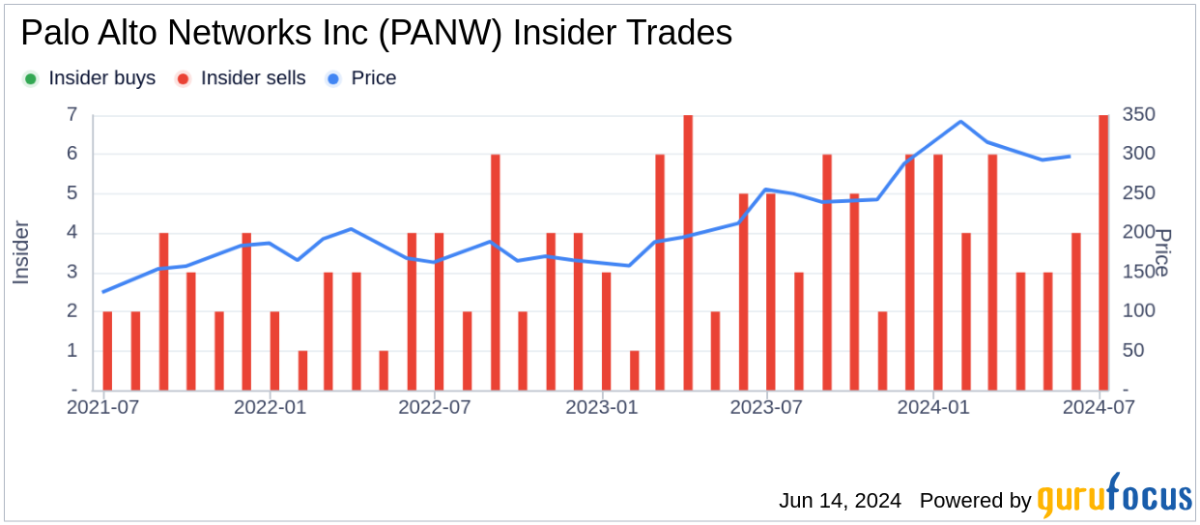

Stock Sale Announcement: Daniel S. Janney, director of Krystal Biotech (KRYS.US), plans to sell 11,803 shares of the company's common stock on February 27, with an estimated market value of around $3.25 million.

Reduction in Shareholding: Since February 24, 2026, Janney has reduced his shareholding in Krystal Biotech by 60,161 shares, valued at approximately $16.15 million.

See More

- Share Acquisition: Redmile Group reported an acquisition of 16,317 shares of Krystal Biotech in its SEC filing dated February 17, 2026, with an estimated transaction value of $3.43 million, indicating strong confidence in the company.

- Increased Ownership: Following this purchase, Krystal Biotech now represents 12.3% of Redmile's 13F-reportable AUM, highlighting its significance within the investment portfolio.

- Strong Financial Performance: Krystal Biotech achieved $107.1 million in VYJUVEK revenue for Q4 2025, contributing to total product sales of $389.1 million for the year, with a gross margin of 94%, demonstrating the sustainability of its business model.

- Outstanding Market Performance: The stock price of Krystal Biotech has risen 44% over the past year, significantly outperforming the S&P 500's 13% gain, reflecting market recognition of its future growth potential.

See More

- Share Acquisition: Redmile Group disclosed in an SEC filing on February 17, 2026, that it purchased 1,316,390 shares of Scholar Rock Holding Corporation, with an estimated transaction value of $49.37 million, indicating strong confidence in the company.

- Increased Ownership: Following this acquisition, Redmile Group's stake in Scholar Rock rises to 16.94%, representing 16.9% of the fund's 13F reportable assets, further solidifying its investment position in the biopharmaceutical sector.

- Strong Market Performance: As of February 17, 2026, Scholar Rock's share price stood at $46.45, reflecting a 25.7% increase over the past year, outperforming the S&P 500 by 13.39 percentage points, showcasing market recognition of its growth potential.

- Robust Financial Position: Scholar Rock reported approximately $365 million in cash as of December 31, 2026, projected to sustain operations into 2027, thereby reducing near-term dilution risk and providing confidence for long-term investors.

See More

- Market Rebound: The stock market experienced a slight rebound on Tuesday, despite remaining divided, indicating cautious optimism among investors that could provide some support for future trading.

- Nvidia Gains: Nvidia's stock rose late in the session due to a deal with Meta in the AI sector, reflecting ongoing market confidence in its capabilities, which may drive future earnings growth.

- AMD and Broadcom Decline: In contrast, AMD and Broadcom saw their stock prices slump, suggesting a cautious outlook from the market regarding these companies, which could affect their short-term investment appeal.

- Increased Industry Divergence: The overall market divergence has intensified, with some tech stocks performing well while others face pressure, potentially leading investors to be more selective in their stock choices, impacting overall market liquidity.

See More

- Market Rebound: The stock market experienced a slight rebound on Tuesday, despite remaining divided, indicating cautious optimism among investors that may provide some support for future trading.

- Nvidia Gains: Nvidia's stock rose late in the session due to a deal with Meta in the AI sector, highlighting its ongoing leadership in AI and potential new growth opportunities for the company.

- AMD and Broadcom Decline: In contrast, AMD and Broadcom saw their stock prices slump, reflecting market concerns about the semiconductor industry, which could impact investor confidence and future investment decisions in this sector.

- Divergent Investor Sentiment: While Nvidia performed strongly, the overall market sentiment remains divided, prompting investors to closely monitor industry dynamics and company fundamentals to make more informed investment choices.

See More

- Significant Sales Growth: Krystal Biotech reported net revenue of $107.1 million for Q4 2025, marking nearly a 10% increase from the previous quarter and an 18% rise year-over-year, indicating strong market demand and enhanced sales capacity.

- International Expansion Plans: The company signed distributor agreements covering over 20 countries and aims to expand to more than 40 countries in 2026, reflecting its proactive global market strategy and commitment to international growth.

- High Gross Margin Maintenance: The gross margin for Q4 was 94%, with expectations to remain in the 90% to 95% range moving forward, demonstrating the company's strong performance in cost control and profitability despite rising costs.

- Investment in R&D and Marketing: The guidance for 2026 non-GAAP operating expenses is set at approximately $175 million to $195 million, reflecting ongoing investments in global launches and pipeline development, aimed at supporting future growth and innovation.

See More