HPE's Financial Surge Led By AI Demand Despite Margin Pressures, Analysts Optimistic About Future Growth

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jun 05 2024

0mins

Should l Buy HPE?

Source: Business Insider

- Hewlett Packard Enterprise Q2 Financial Results: Shares trading higher after beating analyst estimates with quarterly earnings of 42 cents per share.

- Outlook and Projections: Company expects third-quarter EPS of $0.43-$0.48 and full-year EPS of $1.85-$1.95, with anticipated improvements in storage margins.

- Analyst Insights - Goldman Sachs: Storage margins showed weakness due to transition to as-a-service model, but improvements expected; Intelligent Edge revenue growth expected in the second half of the fiscal year.

- Analyst Insights - JP Morgan: Results reflect AI demand driving revenue growth, but margins affected by AI servers and pricing pressures; increased revenue forecast and EPS estimates for FY24 and FY25.

- Investor Opportunities: Analysts revise forecasts on Hewlett Packard Enterprise, suggesting exposure through specific ETFs; HPE shares up 11.91% at $19.71.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy HPE?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on HPE

Wall Street analysts forecast HPE stock price to rise

16 Analyst Rating

8 Buy

8 Hold

0 Sell

Moderate Buy

Current: 21.640

Low

21.00

Averages

27.13

High

31.00

Current: 21.640

Low

21.00

Averages

27.13

High

31.00

About HPE

Hewlett Packard Enterprise Company is a global technology company focused on developing intelligent solutions that allow customers to capture, analyze and act upon data seamlessly from edge to cloud. Its customers range from small-and-medium-sized businesses to large global enterprises and governmental entities. Its segments include Server, Hybrid Cloud, Networking, Financial Services, and Corporate Investments and Other. Its Server segment offerings consist of general-purpose servers for multi-workload computing, workload-optimized servers, and integrated systems. Its Hybrid Cloud segment offers a range of cloud-native and hybrid solutions across storage, private cloud and the infrastructure software-as-a-service space. The Networking segment develops and sells high-performance networking and security products and services. Its Financial Services segment provides flexible investment solutions, such as leasing, financing, IT consumption, utility programs, and asset management services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Investment Rating Upgrade: Loop Capital initiated coverage on Astera Labs with a buy rating and a $250 price target, indicating a potential upside of 120% from Wednesday's close, reflecting strong market optimism about its future growth prospects.

- Strong Customer Dependency: Amazon remains Astera Labs' largest customer, driving its lucrative Scorpio platform, and the analyst believes that Amazon's usage targets for Tranium 3 and 4 chips may materially exceed market expectations, further solidifying Astera's market position.

- AI Market Opportunities: The analyst noted that Astera Labs has opportunities across various generative AI silicon types (such as GPUs, Traniums, and TPUs), capable of addressing critical pain points in the AI server and cluster experience, with its value and importance increasing as server and cluster complexity grows.

- Industry Leadership Position: Despite facing intense competition and ongoing innovation, Astera Labs is viewed as a leader at the intersection of key AI infrastructure trends, with the potential for additional revenue growth, particularly benefiting from stronger Nvidia GPU and overall AI accelerator shipment increases.

See More

- Interoperability Demonstration: The Ethernet Alliance will showcase multi-vendor interoperability technologies at the 2026 Optical Fiber Communication Conference, supporting Ethernet solutions from 100G to 1.6T, aimed at addressing the demands of AI and data-intensive environments, thereby promoting industry standardization and development.

- Technological Advancements: The exhibition will highlight next-generation electrical and optical signaling technologies capable of supporting bandwidth growth from 200G/400G/800G to 1.6T, marking Ethernet's ongoing evolution to meet future network demands and reinforcing its core position in AI and cloud infrastructure.

- Industry Collaboration: The Ethernet Alliance invites leading companies to participate in the exhibition, showcasing innovations in high-performance networking, including Cisco's 51.2T systems and MaxLinear's 224G solutions, emphasizing the importance of cross-industry collaboration in driving technological advancements.

- 20th Anniversary Celebration: The Ethernet Alliance will celebrate its 20th anniversary during the conference with a free happy hour event, showcasing its leadership role in the Ethernet ecosystem and further promoting collaboration and communication within the industry.

See More

- Middle East Market Decline: Following the U.S. and Israeli airstrikes on Iran, Middle Eastern stock markets faced significant declines on their first trading day, with Saudi Arabia's Tadawul, Oman's Muscat index, and Bahrain's exchange all trading in the red, reflecting investor anxiety over the escalating conflict.

- Oil Price Surge Anticipation: Traders are predicting that Brent crude prices will spike above $80 per barrel due to the airstrikes, despite OPEC's recent decision to increase output, indicating heightened volatility in the global oil market.

- Strait of Hormuz Closure: The closure of the Strait of Hormuz has led global shipping companies to suspend all vessel transit, increasing shipping times and costs, which further exacerbates oil price instability in the wake of retaliatory strikes by Iran's Revolutionary Guard.

- Air Travel Disruption: The airspace across the Middle East has been largely closed since the strikes, resulting in over 1,500 flight cancellations and more than 19,000 global flight delays, placing immense operational pressure on airlines as they work to reopen routes and arrange repatriation flights.

See More

- Strong Earnings Report: Nvidia's revenue surged 73% year-over-year to $68 billion in the January quarter, with a forecast of 77% growth for the current quarter, indicating robust compute demand despite concerns about future growth deceleration.

- Negative Market Reaction: Despite the impressive earnings, Nvidia's stock fell 6% over the past week and is down 16% year-to-date, reflecting investor worries about peaking capital expenditures and increasing competition in the AI chip market.

- Intensifying Competition: OpenAI announced it will utilize 2 gigawatts of Amazon's Trainium AI chip capacity, reducing reliance on Nvidia's GPUs, while Meta is also exploring alternatives, further intensifying competitive pressures on Nvidia.

- Analyst Insights: Despite facing short-term challenges, Jefferies analysts view Nvidia's stock as attractive at current levels, recommending buying, with expectations of a future rebound as the stock becomes cheaper.

See More

- Dell's Strong Earnings: Dell Technologies reported a blowout quarter driven by AI buildout, resulting in a 12% stock increase, with AI server revenue expected to double to approximately $50 billion in the new fiscal year, highlighting the company's robust growth potential in the AI sector.

- CoreWeave's Capital Expenditure Surge: CoreWeave plans to invest $30 billion to $35 billion in data center construction for 2026, significantly exceeding the Street's estimate of $26.9 billion, and despite a sharp decline in shares, nearly all new capacity is allocated, indicating strong market demand.

- Block's Workforce Reduction: Jack Dorsey's Block announced a 40% workforce cut, stating that intelligence tools have changed company operations, and despite flat revenues in 2025, Morgan Stanley upgraded its rating from hold to buy, reflecting confidence in its potential growth.

- Zscaler's Underwhelming Performance: Although Zscaler delivered a beat-and-raise quarter, its shares fell 11% in premarket trading, indicating market caution regarding software valuations, as analysts remain skeptical about future profitability in the sector.

See More

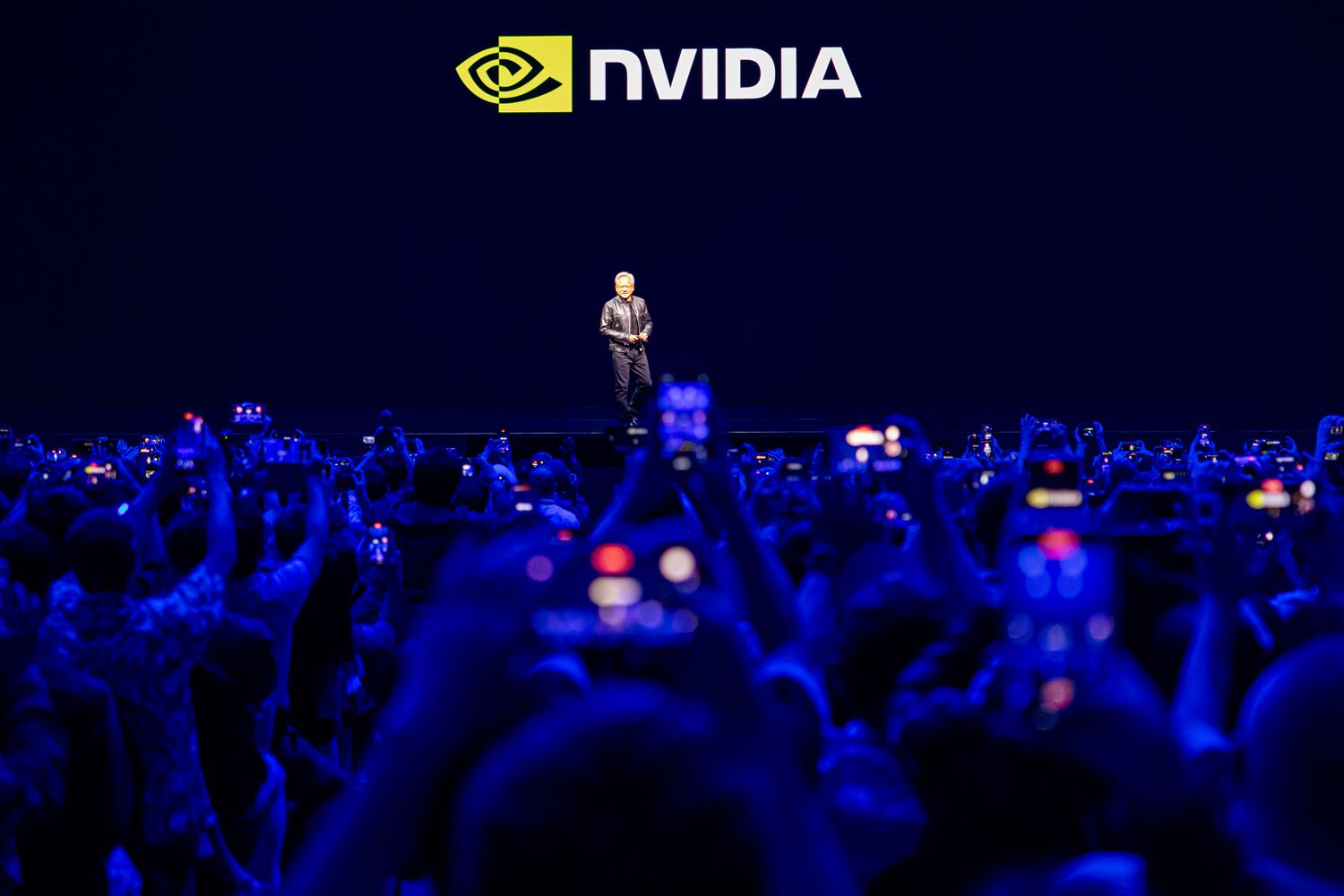

- Strong Earnings Report: Nvidia's latest earnings report revealed a 75% revenue growth in its core data center business, exceeding market expectations and resulting in a 1.4% stock price increase in after-hours trading, highlighting robust market demand and the company's leadership in AI.

- Positive Market Reaction: Nvidia's earnings and Oracle's rating upgrade collectively boosted U.S. markets, with the S&P 500 rising by 0.81% and the Nasdaq Composite increasing by 1.26%, indicating a gradual recovery in investor confidence towards AI technologies.

- Optimistic Industry Outlook: CEO Jensen Huang noted that the rapid advancement of AI technology has led to demand for computing that is

See More