Cactus Takes Majority Stake In Baker Hughes' SPC For Global Reach

Joint Venture Announcement: Cactus Inc. will acquire a 65% stake in a new joint venture with Baker Hughes Co., taking control of its Surface Pressure Control business, while Baker Hughes retains a 35% stake. The deal aims to enhance both companies' global oilfield equipment presence and is valued at $530 million.

Financial Implications: The acquisition adds a $600 million order backlog for Cactus and reduces its U.S. market exposure, providing strong revenue visibility. The transaction is expected to close in the second half of 2025, with funding sourced from existing cash and potential credit facilities.

Trade with 70% Backtested Accuracy

Analyst Views on XLE

About the author

Trump's Announcement: President Donald Trump announced that the U.S. Development Finance Corporation will provide risk insurance and military escorts for all shipping lines, particularly those involved in energy trade, traveling through the Gulf.

Market Reactions: Following Trump's announcement, oil prices experienced a slight increase, while stock markets continued to trade in the red, reflecting ongoing concerns about geopolitical tensions and inflation.

War Risk Insurance: The announcement comes amid global maritime insurance mutuals withdrawing coverage for vessels entering the Persian Gulf due to rising war risks, highlighting the impact of Middle Eastern conflicts on energy prices.

Commitment to Energy Flow: Trump emphasized the U.S. commitment to ensuring the free flow of energy to the world, indicating that further actions are being considered to address the situation.

Oil Prices Surge: Oil prices have reached their highest levels in four years following attacks on three oil tankers in the Strait of Hormuz amid the ongoing U.S.-Israel conflict with Iran.

Impact on Cryptocurrency Market: The cryptocurrency market experienced a significant downturn, with major cryptocurrencies like Bitcoin and Ethereum posting substantial losses, influenced by rising oil prices and inflation concerns.

Retail Sentiment Shifts: Retail sentiment around cryptocurrencies has shifted to a more bullish outlook, particularly for Bitcoin, while Ethereum sentiment has turned bearish, reflecting market volatility.

Market Trends: The overall cryptocurrency market capitalization fell by 1.8%, with Ethereum trading below $2,000, and altcoins like Cardano and Solana also experiencing declines in value.

Energy Sector Forecast: The energy sector is expected to experience tempered performance in 2026, with analysts predicting a global oil surplus and weaker demand following a modest growth of 8.7% in 2025.

Mixed Earnings Reports: Major oil companies are reporting mixed earnings, with Chevron beating earnings per share expectations but missing revenue forecasts, while ExxonMobil and others show strong year-to-date gains despite some misses.

Future Growth Projections: Chevron forecasts a compound annual growth rate of around 10% for cash flow from operations by 2026, while ConocoPhillips and Shell aim to reduce operating costs significantly this year.

Market Trends and Investment Opportunities: The energy sector remains favorable for investors, with recommendations for stocks like ExxonMobil and Chevron, as well as ETFs that provide exposure to top natural gas and oil producers.

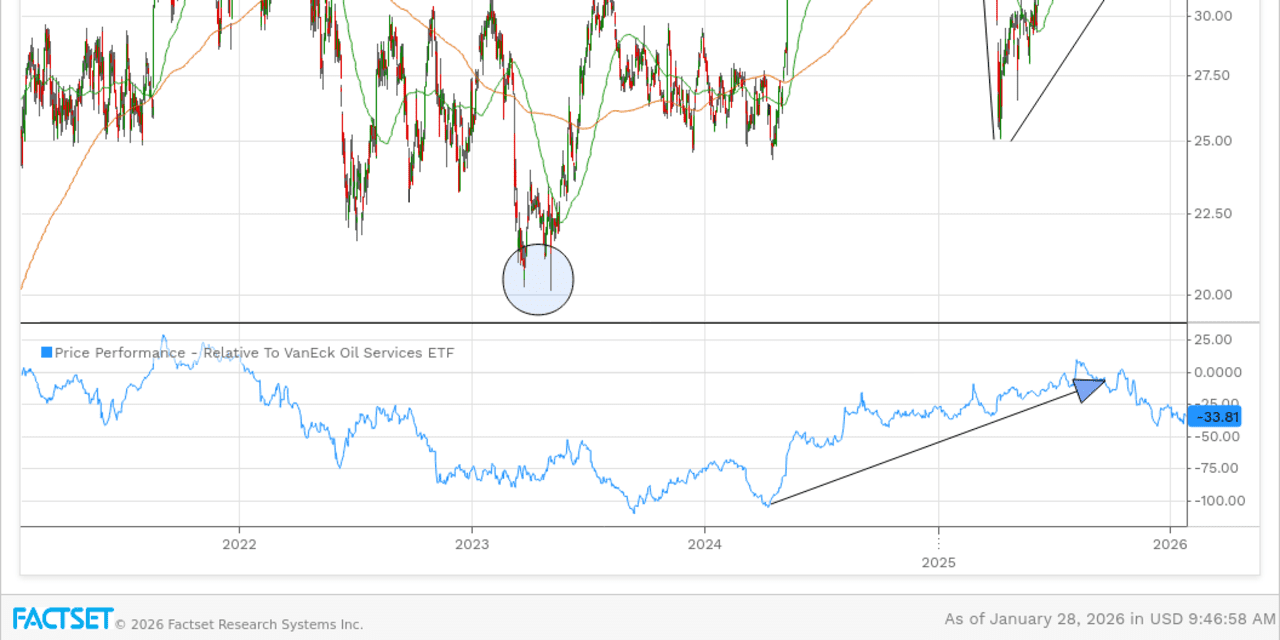

- Market Opportunities: Investors may find renewed opportunities in previously recommended stocks from healthcare, oil services, and consumer staples sectors.

- Signs of Momentum: These stocks are showing signs of renewed momentum, suggesting potential upside for investors.

- Sector Rotation: The leadership in these sectors has already rotated, indicating a shift in market dynamics.

- Investor Consideration: Investors are encouraged to take a fresh look at these stocks as they may present attractive investment options.