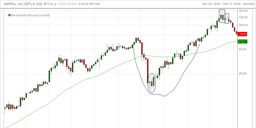

JBS.N Hits 20-Day High Amid Acquisition News

Shares of JBS.N surged to a 20-day high today, buoyed by the announcement of Mantiqueira USA's acquisition of Hickman's Egg Ranch, a leading U.S. egg producer. This strategic move is expected to enhance JBS's foothold in the U.S. protein market, creating synergies that could drive innovation in egg production. The joint venture between JBS and the Pinto Family aims to leverage their expertise for long-term success in the egg industry. Additionally, JBS reported record net sales of $21 billion, further solidifying investor confidence despite operational challenges in its beef and pork segments.

Trade with 70% Backtested Accuracy

Analyst Views on JBS

About JBS

About the author

- Beef Price Surge: The average price of beef in the U.S. has reached a record $6.67 per pound, reflecting a 20.5% increase over the past year, marking the fastest rise since 2018 and highlighting severe supply-demand imbalances.

- Historic Cattle Shortage: According to USDA data, U.S. cattle and calves inventory has fallen to approximately 85 million head, the lowest level since 1951, down about 45 million from the 1975 peak, contributing to ongoing price increases in beef.

- Future Supply Challenges: Even if ranchers begin expanding herds today, new supply is not expected to significantly reach grocery shelves until 2028 at the earliest, indicating the depth of the current cattle contraction and the slow recovery cycle ahead.

- Strong Demand and Price Forecast: The USDA projects total red meat and poultry production to reach 108.4 billion pounds in 2026, with beef production expected to decline again, yet strong consumer demand is anticipated to push beef prices up by 7%.

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

Investor Concerns: Investors are grappling with uncertainties related to artificial intelligence, U.S. interest rates, and geopolitical tensions, particularly between Washington and Tehran.

Shift in Asset Preference: As a result of these concerns, investors are now seeking protection in assets they previously avoided, indicating a shift in market sentiment.

Setting: The scene takes place in Central Texas Hill Country, where a Black Baldy cow is being prepared for auction.

Cow Characteristics: The Black Baldy breed is noted for its easy calving and attentive mothering, making it a desirable choice for cattle ranchers.

Auction Purpose: Tim Niedecken from the Jordan Cattle Auction indicates that the cow will be sold as a packer animal, meaning it is intended for slaughter.

Market Factors: The decision to sell the cow may be influenced by her declining breeding capabilities or the high market price of beef.

- Price Range Analysis: IEMG ETF's 52-week low is $47.29 per share, with a high of $74.699, and a recent trade at $74.17, indicating fluctuations near the high point that may influence investor buying decisions.

- Technical Analysis Tool: Comparing the current share price to the 200-day moving average provides valuable insights for investors, helping to assess market trends and potential buy or sell opportunities.

- ETF Unit Trading Mechanism: ETFs trade like stocks, where investors buy and sell 'units' that can be created or destroyed based on demand, impacting the ETF's liquidity and market performance.

- Inflows and Outflows Monitoring: Weekly monitoring of changes in shares outstanding helps identify significant inflows (new units created) or outflows (old units destroyed), which directly affect the ETF's underlying holdings and market dynamics.

- Investment Scale: JBS will invest $150 million to acquire an 80% stake in an Oman-based food company, involving the Oman Investment Authority, demonstrating the company's commitment to expanding in the Middle East market.

- Local Production Base: This acquisition will establish a local production base for JBS in Oman, ensuring fresh poultry supply from domestic breeders while beef and lamb processing will rely on livestock from Africa and the Middle East, enhancing supply chain stability.

- Strategic Positioning: JBS CEO Gilberto Tomazoni stated that Oman is viewed as a strategic entry point into the region, allowing the company to be closer to suppliers and end markets, with further investments planned to increase market share.

- Halal Food Expansion: This transaction is the latest move by JBS to expand its halal food operations, following its poultry processing business in Saudi Arabia, and the company plans to expand its facility in Jeddah, further solidifying its market position in the Middle East.