Enterprise Products Partners Exceeds Earnings Expectations

Enterprise Products Partners' stock rose by 3.16% as it reached a 20-day high.

The company reported a GAAP EPS of $0.75, surpassing market expectations of $0.69, indicating strong performance in revenue and profitability. Additionally, fourth-quarter revenue of $13.79 billion exceeded the anticipated $13.636 billion, showcasing its competitive position. Analysts maintained a 'Hold' rating, reflecting recognition of its stable income streams despite a projected 13% year-over-year revenue decline, suggesting a durable income phase that may attract investors seeking stability.

This positive earnings report highlights Enterprise Products Partners' resilience and ability to perform well in challenging market conditions, potentially enhancing investor confidence moving forward.

Trade with 70% Backtested Accuracy

Analyst Views on EPD

About EPD

About the author

- Significant Investment Potential: In 2026, as oil and gas prices soared, investors flocked to Enterprise Products Partners (EPD), with its unit price up 16% year-to-date as of March 9, indicating strong investment appeal and market confidence.

- Stable Cash Flow: Enterprise Products Partners has maintained a double-digit return on invested capital (ROIC) every year since 2005, with an average ROIC of 12% over the past decade, demonstrating its stability and resilience across various economic cycles.

- Consistent Dividend Growth: Despite its distribution yield nearing a five-year low, Enterprise Products Partners maintains a yield above 5.9% and has increased its distribution for 27 consecutive years, recently raising it by 2.8%, reflecting strong financial flexibility and commitment to shareholders.

- High Management Ownership: Approximately one-third of Enterprise's common units are owned by its management and affiliates, which typically indicates a strong alignment of interests and accountability among executives regarding company performance.

- Historic Investment: President Trump announced that the U.S. will get its first oil refinery in 50 years, funded by Indian billionaire Mukesh Ambani's Reliance Industries, with a staggering $300 billion deal marking the largest in U.S. history.

- Enhanced National Security: The new refinery, located at the port of Brownsville, Texas, is designed to process 100% American shale oil, aiming to bolster national security and significantly increase U.S. energy production capabilities.

- Significant Economic Impact: Trump stated that the project will deliver billions of dollars in economic impact, further driving the domestic energy sector's growth and creating numerous job opportunities in related industries.

- Environmental Commitment: The refinery is set to be the cleanest in the world, reflecting a commitment to environmental sustainability while showcasing the U.S.'s strategic shift towards sustainable energy production.

- Brookfield Renewable: Brookfield Renewable is expected to double its revenue from $5.1 billion to $10.7 billion by 2028, driven primarily by the rapid growth of cloud computing and AI markets, while long-term renewable power agreements with Microsoft and Google will further solidify its market position.

- Stable Dividend Yield: Brookfield Renewable offers a forward yield of 5.2%, and although it has not yet achieved consistent profitability, its adjusted EBITDA is projected to grow at an 8% CAGR from 2025 to 2028, indicating strong future earnings potential.

- Enterprise Products Partners: Enterprise Products Partners operates over 50,000 miles of pipeline across 27 states, with an expected operational distributable cash flow of $7.9 billion in 2025, easily covering its $4.8 billion in distributions, ensuring a sustainable 5.9% yield.

- Market Competitive Advantage: While Enterprise Products Partners is less aggressive in expanding its pipeline network compared to competitors, its lower debt levels and stable revenue model provide relative safety and attractiveness in turbulent market conditions.

- Energy Transition Potential: Energy Transfer (ET) currently boasts a 7.1% dividend yield and plans to increase distributions by 3% to 5% moving forward, leveraging its extensive midstream operations and stable fee-based business to provide long-term passive income for investors.

- Consistent Growth Performance: Enterprise Products Partners (EPD) has increased its distribution for 27 consecutive years, with a current yield of 5.9%, and is projected to achieve double-digit growth in adjusted EBITDA and cash flow by 2027, demonstrating its reliability and resilience in uncertain markets.

- High Yield Appeal: Western Midstream (WES) offers an 8.6% yield, ranking among the highest in the midstream sector, and while facing some short-term challenges, it expects a 3% increase in distributions in 2026 and maintains financial stability through a restructured fixed-fee agreement with Occidental.

- Strategic Diversification: Western Midstream is actively expanding its footprint in the produced water business through acquisitions like Aris Water Solutions and the Pathfinder Pipeline project, and despite the transition period, it is still poised for adjusted EBITDA growth, enhancing its competitive position in the market.

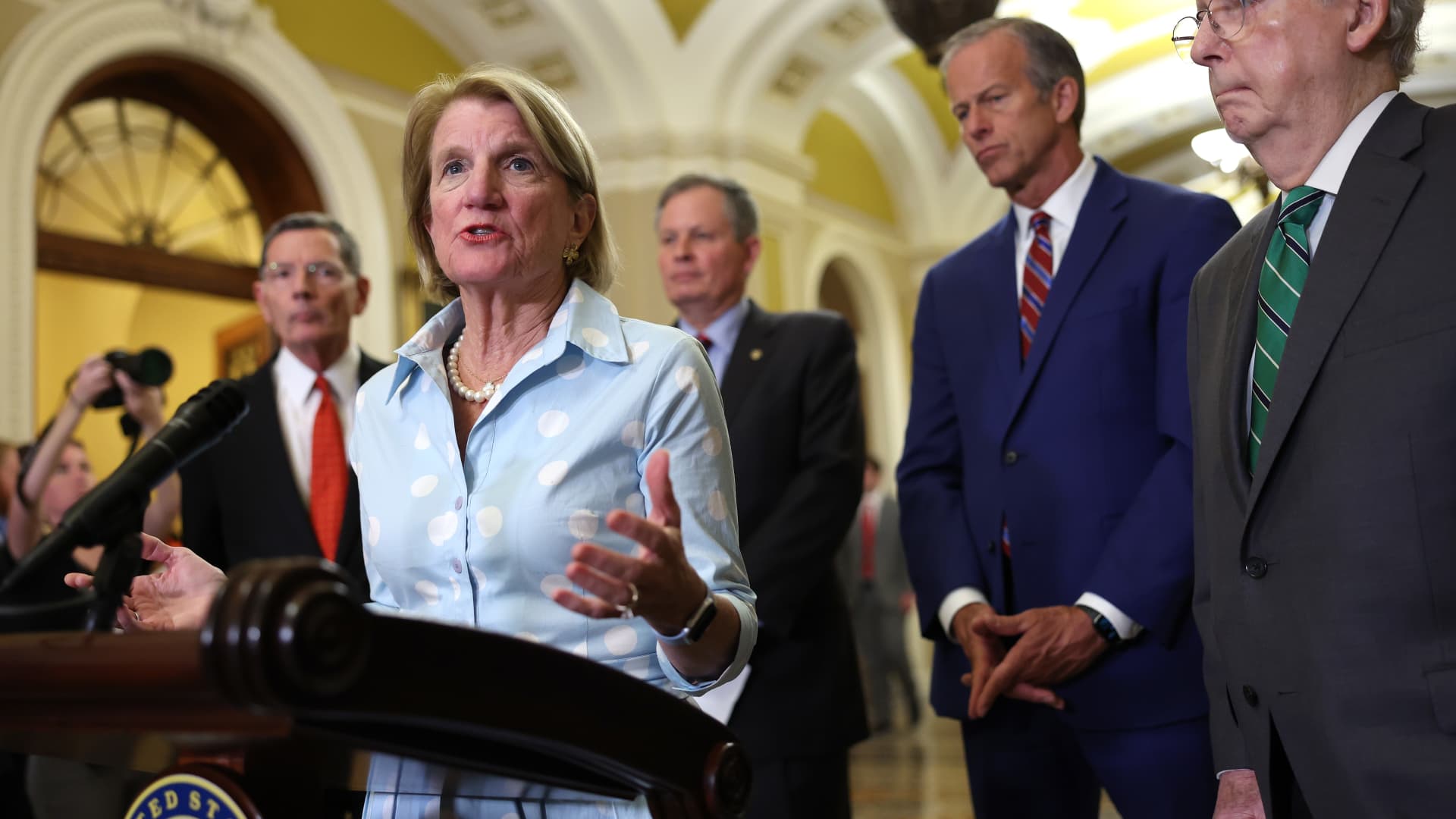

- Bipartisan Cooperation Resumes: Senate Environment and Public Works Committee Chair Shelley Moore Capito and ranking Democrat Sheldon Whitehouse are meeting again to discuss energy permitting reform, indicating a willingness for bipartisan collaboration on energy infrastructure development.

- Frequent Negotiations: Sources indicate that both parties will be communicating frequently this week, although no specific meeting times have been set, suggesting that the reform process is gaining momentum with committee staff actively negotiating.

- Increased Political Pressure: With energy prices soaring, lawmakers are under significant political pressure to reach a permitting reform agreement this year to lower energy costs and meet the rising demand for energy, particularly from power-hungry data centers.

- Complex Legislative Background: Despite the House passing the SPEED Act last year to streamline permitting, negotiations in the Senate are ongoing, and any final agreement may involve changes to longstanding environmental laws to expedite approvals for both renewable and traditional energy projects.

- Dividend Yield Advantage: Kinetik currently boasts a 7.1% dividend yield, surpassing most peers, with expectations for a 3% to 5% increase this year, which will enhance investor appeal, particularly against the backdrop of rising energy prices.

- Strong Market Performance: The stock has surged 26% year-to-date due to soaring oil and gas prices driven by the Iran conflict, indicating increasing investor interest in energy stocks, which may propel future growth for the company.

- Acquisition Potential: Analysts are turning bullish on Kinetik, with Raymond James upgrading its rating to outperform in January, suggesting the company could become a takeover target for several midstream players, thereby increasing market attention.

- Improving Profitability: Kinetik's current dividend coverage ratio stands at 1.2, expected to rise to 1.5 by year-end, and with increasing cash flows, the dividend growth plan will be strengthened, potentially achieving a 7% growth by 2027.