Key points:

- Blue chip stocks under $50, like AT&T and Pfizer, provide stability and dividends at a low entry cost.

- Stocks such as Verizon (6.38%) and Pfizer (6.79%) offer attractive income for investors.

- Companies like Ford, with its EV transition, balance reliability with future growth opportunities.

- Intellectia.ai’s stock screener and AI tools help identify undervalued blue chip stocks efficiently.

- These stocks offer a safe haven in volatile markets, ideal for long-term wealth building.

Introduction

Have you ever wanted to invest in blue chip stocks but found their high prices daunting? You're not alone. Many investors seek the stability and reliability of blue chip companies but are deterred by their often hefty share prices. Fortunately, there are blue chip stocks trading under $50 that offer the same benefits without requiring a large upfront investment. In the ever-changing landscape of the stock market, blue chip stocks have remained a beacon of stability.

As the market navigates through 2026, with its unique economic challenges and opportunities, investing in the best blue chip stocks under $50 can be a smart way to build a resilient portfolio. By leveraging tools like Intellectia.ai’s advanced stock screener, you can identify these gems and make informed investment decisions. Let’s explore why these stocks are attractive and which ones you should consider for your portfolio in 2026.

What Are Blue Chip Stocks?

Blue chip stocks are shares of large, well-established companies with a history of stable earnings and consistent dividend payments. These companies are often leaders in their industries and are included in major stock market indices like the S&P 500 or Dow Jones Industrial Average. Known for their strong brand names, financial stability, and dependable earnings, blue chip stocks are considered lower-risk investments compared to smaller or more volatile companies.

Their reputation for reliability makes them a favorite among investors looking to balance growth with security. Whether you’re a beginner or a seasoned investor, blue chip stocks can serve as a cornerstone of your portfolio, offering both income through dividends and potential for long-term capital appreciation.

Why Invest in Blue Chip Stocks Under $50?

Investing in blue chip stocks under $50 allows you to gain exposure to reputable companies without needing a significant amount of capital. These stocks often provide attractive dividend yields, which can be a reliable source of passive income. Their lower share prices make it easier to diversify your portfolio by purchasing shares of multiple companies, reducing your overall risk.

Additionally, blue chip stocks are known for their resilience during economic downturns, making them a safer bet in volatile markets. By focusing on affordable blue chip stocks, you can build a portfolio that combines stability, income, and growth potential, all while staying within your budget.

In 2026, with economic uncertainties like inflation and interest rate fluctuations, these stocks offer a compelling opportunity for budget-conscious investors.

Criteria for Selecting Blue Chip Stocks Under $50

When selecting the best blue chip stocks under $50, it’s important to consider several key metrics to ensure you’re making a sound investment:

- Market Capitalization: Look for companies with a market cap over $10 billion, indicating their size and stability in their respective industries.

- Dividend Yield: Seek stocks with attractive dividend yields, typically above 3%, to provide a steady income stream.

- Financial Stability: Evaluate the company’s financial health, including low debt levels, strong cash flow, and consistent profitability.

- Growth Potential: Consider the company’s future prospects, such as new product launches, market expansion, or technological advancements.

To simplify this process, you can use Intellectia.ai’s stock screener, which allows you to filter stocks based on these criteria and more. By setting parameters like price range, dividend yield, and market cap, you can quickly identify top blue chip stocks under $50. Visit Intellectia.ai to explore their AI-driven tools and start building your portfolio.

Best Blue Chip Stocks Under $50 to Buy

Based on the analysis, here are some of the best blue chip stocks under $50 to consider buying in 2026. These companies offer a balance of stability, dividends, and growth potential, making them ideal for investors seeking value and reliability.

| Company Name | Ticker | Sector | Market Cap | Dividend Yield | Key Strengths |

|---|---|---|---|---|---|

| Kinder Morgan | KMI | Energy | $417.12M | 4.10% | Reliable fee-based cash flows and steady dividends. |

| Pfizer | PFE | Pharmaceuticals | $144.18B | 6.79% | Robust pipeline and consistent dividends. |

| Ford | F | Automotive | $45.25B | 5.31% | Transitioning to electric vehicles with a solid dividend history. |

| Verizon | VZ | Telecommunications | $180.62B | 6.38% | Reliable dividends and 5G infrastructure growth. |

| Kraft Heinz | KHC | Consumer Staples | $34.25B | 5.78% | Strong brand recognition and steady dividends. |

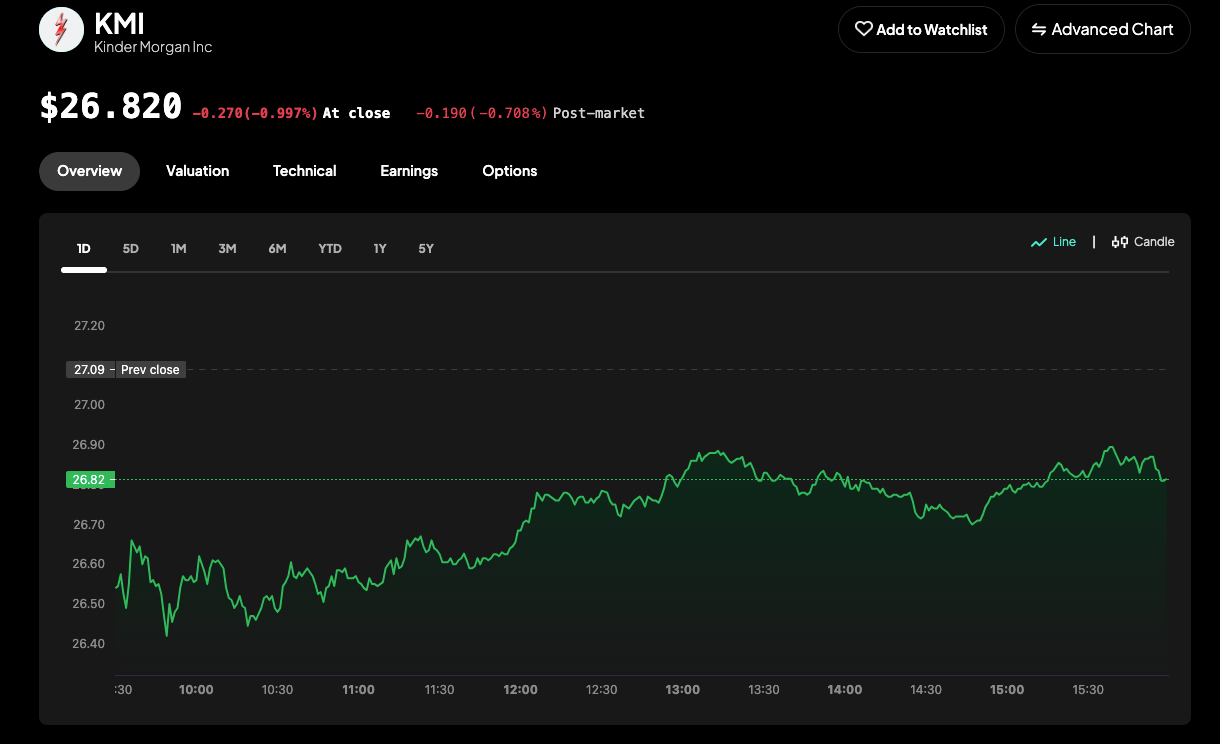

Kinder Morgan (KMI)

Kinder Morgan Inc. is one of North America’s largest energy infrastructure companies, operating an extensive network of pipelines and terminals that transport natural gas, refined petroleum products, CO₂, and other fuels. With a market capitalization of $59.67 billion, the company plays a critical role in the energy supply chain. Kinder Morgan has established a strong reputation for stable cash flows supported by long-term, fee-based contracts, which help reduce exposure to commodity price volatility.

Pfizer (PFE)

Pfizer, a global pharmaceutical giant, is renowned for its innovative medicines and vaccines, including its pivotal role in developing a COVID-19 vaccine. With a market cap of $144.18 billion, Pfizer boasts a robust pipeline of drugs across oncology, cardiology, and other therapeutic areas.

The company offers a high dividend yield of 6.79%, supported by its consistent earnings and substantial R&D investments. Pfizer’s commitment to innovation ensures a steady stream of new products, positioning it for long-term growth. Investors can expect both income and potential capital appreciation.

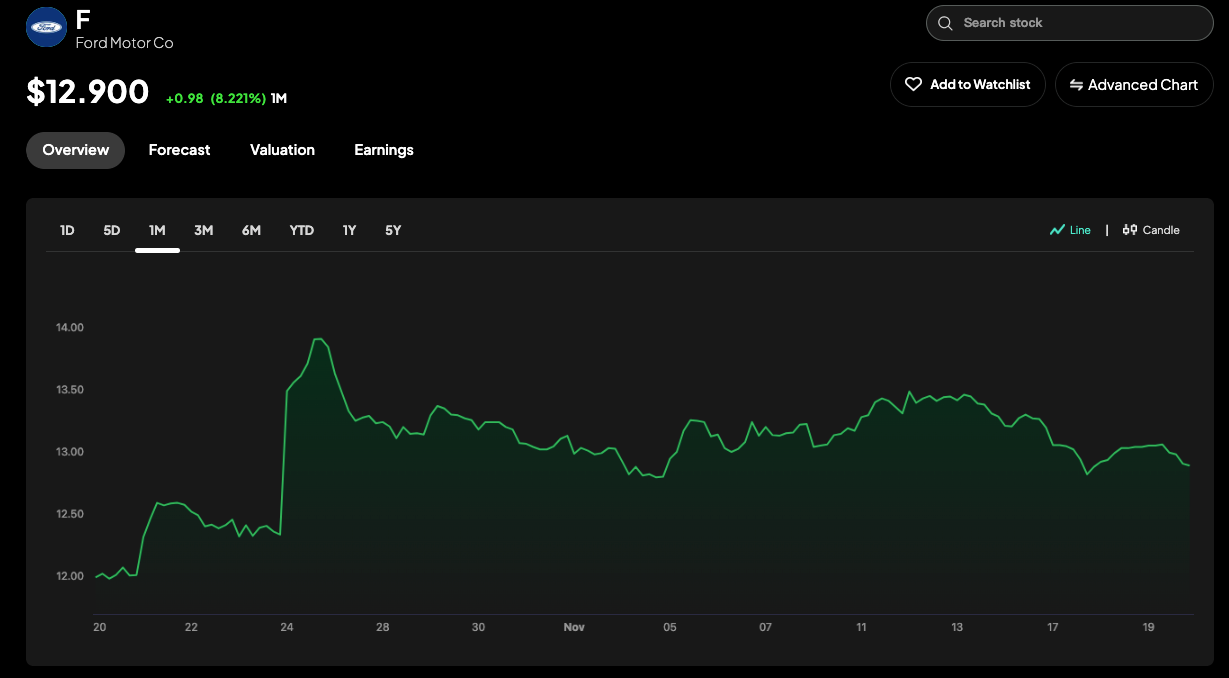

Ford (F)

Ford Motor Company, an iconic American automaker, is transitioning to lead the electric vehicle (EV) market. With a market cap of $45.25 billion, Ford is investing heavily in EV technology, with successful models like the Mustang Mach-E and F-150 Lightning.

The company offers a dividend yield of 5.31%, supported by a solid dividend history. Ford’s strategic shift towards EVs and its strong brand loyalty make it an attractive investment for those looking to capitalize on the future of transportation.

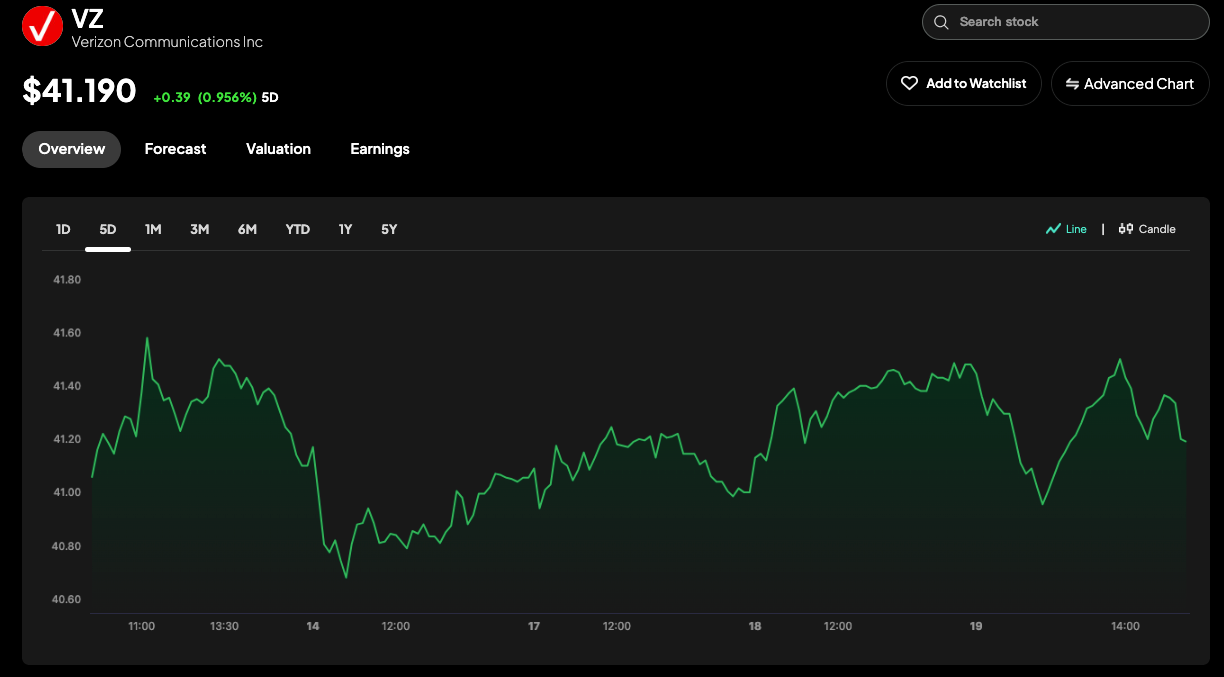

Verizon (VZ)

Verizon is a leading telecommunications provider known for its reliable network and advancements in 5G technology. With a market cap of $180.62 billion, Verizon offers a dividend yield of 6.38%, making it a favorite among income investors.

The company’s nationwide 5G network supports emerging technologies like the Internet of Things (IoT) and autonomous vehicles, positioning it for future growth. Verizon’s focus on customer retention and market expansion ensures a steady revenue stream.

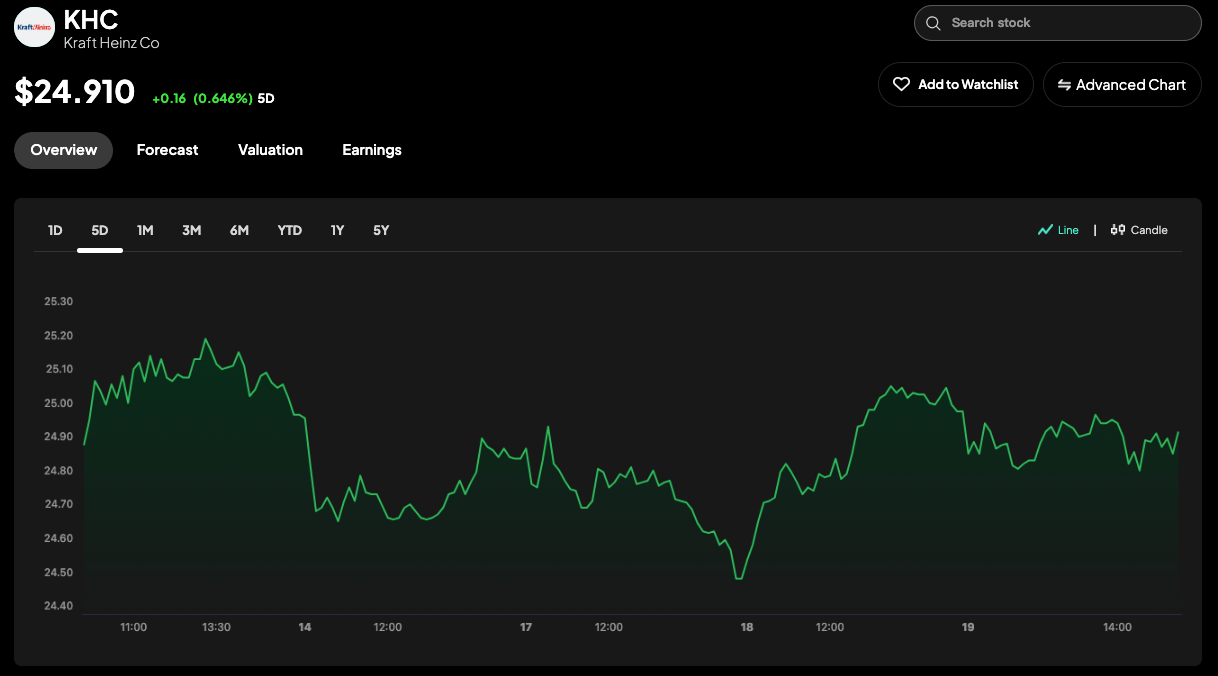

Kraft Heinz (KHC)

Kraft Heinz is a leading consumer staples company with a portfolio of iconic brands like Kraft, Heinz, Oscar Mayer, and Philadelphia. With a market cap of $34.25 billion, the company offers a dividend yield of 5.78%.

Despite challenges in adapting to changing consumer preferences, Kraft Heinz is working on revitalizing its product lines and improving operational efficiency. Its strong brand recognition and steady demand for its products make it a stable investment choice.

How to Use Intellectia.ai’s Tools to Find Blue Chip Stocks Under $50

To maximize your investment in blue chip stocks under $50, consider using Intellectia.ai’s suite of AI-driven tools. Their AI stock picker helps you identify potential investments based on your specific criteria, such as price range and dividend yield. The AI screener allows you to filter stocks based on financial metrics, market trends, and more.

For those interested in active trading, Intellectia.ai’s day trading center and swing trading features provide real-time insights and strategies. Additionally, tools like the stock monitor and technical analysis can help you track performance and optimize your entry and exit points.

Investment Strategies for Blue Chip Stocks Under $50

To make the most of your investments in blue chip stocks under $50, consider these strategies:

- Dividend Reinvestment: Reinvest your dividends to purchase additional shares, compounding your returns over time. This approach can significantly boost your portfolio’s growth, especially with high-yield stocks like Pfizer and Verizon.

- Long-Term Holding: Blue chip stocks are ideal for long-term investments due to their stability and consistent performance. Holding stocks like AT&T or Kraft Heinz for years can provide steady income and potential capital gains.

- Leverage AI Tools: Use Intellectia.ai’s AI-driven tools to analyze market trends and optimize your investment decisions. Their AI agent can provide personalized recommendations, while the hedge fund tracker offers insights into institutional investment trends.

By combining these strategies with Intellectia.ai’s advanced analytics, you can build a robust portfolio tailored to your financial goals.

Building Wealth with Affordable Blue Chip Stocks

Blue chip stocks under $50 offer a unique opportunity to invest in high-quality companies without a significant upfront cost. Stocks like AT&T, Pfizer, Ford, Verizon, and Kraft Heinz provide a balance of stability, dividends, and growth potential, making them ideal for budget-conscious investors.

In volatile markets, these companies’ resilience and reliable income streams can anchor your portfolio. By using Intellectia.ai’s advanced stock screener and analytics, you can identify undervalued opportunities and refine your investment strategy for 2026 and beyond. Start your investment journey with Intellectia.ai today and discover the potential of affordable blue chip stocks at Intellectia.ai.