Key Takeaways

- A deep analysis of cryptocurrency's fundamentals, including its whitepaper, tokenomics, and the team's credibility, is non-negotiable for making informed investment decisions.

- Crypto portfolio diversification is a sophisticated strategy; using models like the "Core-Satellite" approach helps you balance stability with high-growth potential across different market sectors.

- Advanced risk management, including understanding risk/reward ratios and disciplined portfolio rebalancing, is essential for protecting your capital in a volatile market.

Introduction

Have you ever felt like you're navigating a minefield when trying to invest in cryptocurrency? You see stories of massive gains, but you're also overwhelmed by thousands of coins, conflicting advice, and constant market volatility.

What investors truly lack isn’t opportunity, but clarity and strategy. To succeed, you need a systematic way to evaluate projects, manage risk, and identify true potential. This is where expertise and technology converge. By adopting an analytical framework and leveraging powerful AI-driven insights from platforms like Intellectia.ai, you can transform from a hopeful speculator into a strategic investor. The article will provide you with a comprehensive process for how to choose cryptocurrencies for investment, backed by data and sound strategy.

Understanding Cryptocurrency Investing: The "Why" and "What"

At its core, a cryptocurrency is a digital asset secured by cryptography on a decentralized network called a blockchain. Unlike traditional currencies, it operates without a central authority like a bank. But the "why" of investing goes deeper than just technology. Investors are drawn to crypto for its potential for high returns, its emerging role as a potential hedge against inflation (particularly Bitcoin), and its foundational role in building Web3—the next evolution of the internet.

However, this innovation comes with extreme volatility. The crypto market is famously turbulent, with prices influenced by regulatory news, technological breakthroughs, and massive shifts in market sentiment. Understanding and respecting this volatility is the first step. Your goal is not to predict every peak and valley, but to build a resilient portfolio that can weather the storms and capitalize on long-term growth.

Key Factors to Evaluate Cryptocurrencies: An Analytical Deep Dive

A professional approach to crypto investing requires looking beyond the price chart. Here are the critical factors you must analyze to determine which are the best cryptocurrencies to invest in.

Market Cap, Liquidity, and Supply Dynamics

Market capitalization is your first filter. It signals a project's maturity and relative stability. But you need to dig deeper:

- Circulating vs. Total Supply: Look at how many coins are currently in circulation versus the total that will ever exist. A significant difference could mean future inflation as more coins are released.

- Fully Diluted Valuation (FDV): This is the market cap if all coins are in circulation. A high FDV compared to the current market cap can be a red flag, suggesting the current price may be inflated relative to its future potential.

- Liquidity: High trading volume on reputable exchanges means you can buy and sell without drastically affecting the price. Low liquidity can trap you in a position.

Use Case and Technology (The Power of Tokenomics)

This is where you separate hype from substance.

- How to Read a Whitepaper: The whitepaper is a project's blueprint. Don't just skim it. Look for a clear problem statement, a technically sound solution, a detailed system architecture, and a realistic roadmap. If it's full of marketing buzzwords and lacks technical depth, be cautious.

- Tokenomics: The Economic Engine: Tokenomics is the science of a token's economic model. It's one of the most critical factors for long-term value.

- Utility: Does the token have a real function within its ecosystem (e.g., paying for transaction fees, participating in governance, securing the network)?

- Supply Schedule: Is token inflationary (new coins are constantly created) or deflationary (coins are burned or removed from circulation)? Deflationary models can be bullish for price over time.

- Token Distribution: Who owns the tokens? Be wary if a large percentage is held by the team and early VCs, especially if their tokens unlock soon. This can create massive sell pressure.

- Real-World Utility: A great project solves a real problem. Ethereum's smart contracts created the DeFi revolution. Chainlink's oracles provide secure data to blockchains. You can use an AI screener to filter for projects in promising sectors like DeFi, GameFi, or decentralized infrastructure.

The Strength of the Team and Community

- Vetting the Team: Look for a public-facing team with verifiable experience on platforms like LinkedIn. Do they have a history in software development, cryptography, or finance? Anonymous teams are a major red flag, though there are rare exceptions.

- Developer and Community Activity: A thriving project has an active GitHub repository with consistent updates—this shows the technology is actually being built. A vibrant, intelligent community on Discord and Twitter is also crucial, as it drives adoption and provides support.

Market Trends and AI-Powered Sentiment Analysis

The market mood can override even the best fundamentals in the short term.

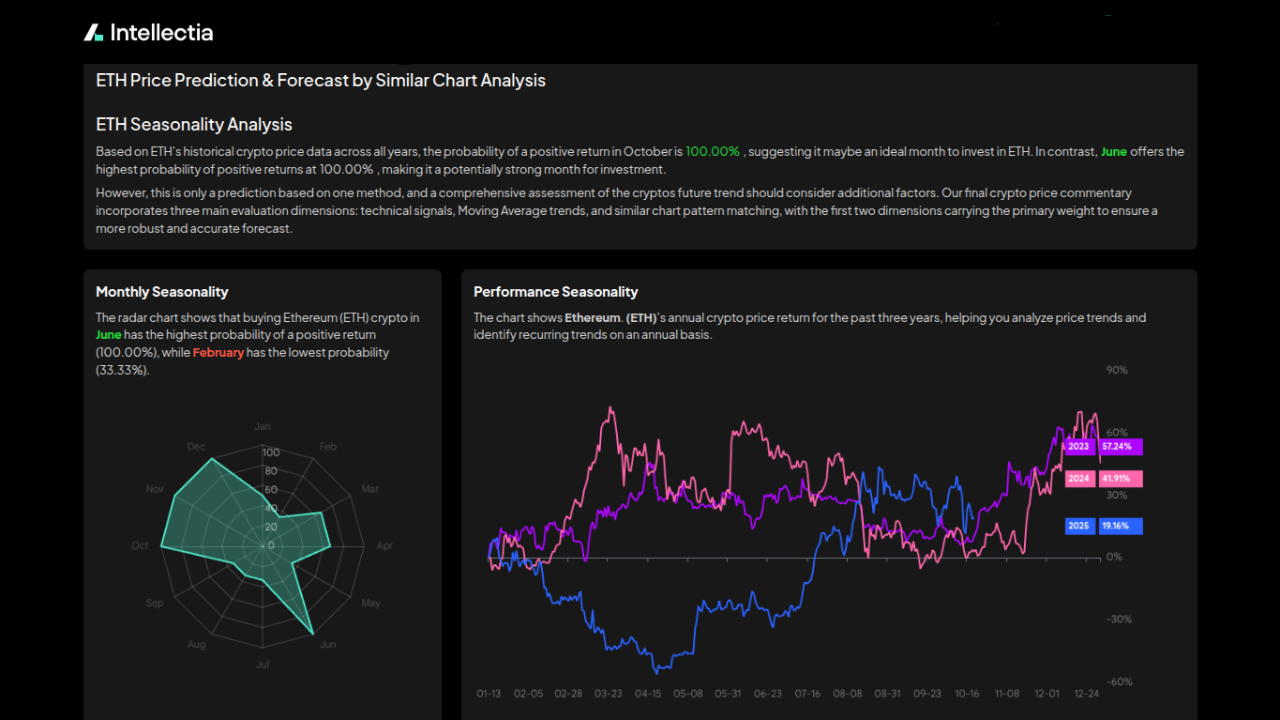

- Technical Analysis (TA): This involves analyzing statistical trends from trading activity, such as price movement and volume. You can use tools for crypto technical analysis to identify key support and resistance levels, trends, and potential reversal points.

- Sentiment Analysis: How does the market feel about a project? AI tools can analyze millions of data points from social media, news articles, and forums to give you a real-time sentiment score, helping you gauge whether the market is overly fearful or greedy. Platforms like Intellectia.ai's stock chart patterns analyzer can also be applied to crypto charts to spot recurring formations that may predict future price action.

Building a Diversified and Resilient Crypto Portfolio

Diversification is your primary defense against volatility. A sophisticated approach is the "Core-Satellite" model.

- The Core (50-70%): This portion of your portfolio consists of the most established, liquid, and relatively stable assets: Bitcoin (BTC) and Ethereum (ETH).They are the bedrock of your crypto holdings.

- The Satellites (30-50%): These are your higher-risk, higher-reward holdings, which you can further diversify by sector:

- Large-Cap Altcoins: Established projects in the top 20 by market cap.

- Sector-Specific Plays: Promising projects in high-growth areas like DeFi, blockchain gaming (GameFi), NFTs, or Layer-2 scaling solutions.

- Speculative Bets: A very small allocation to new, innovative, but unproven projects.

Portfolio Management Strategies

- Dollar-Cost Averaging (DCA): Investing a fixed amount regularly (e.g., $100 every week) is a powerful way to smooth out your entry price and reduce the stress of trying to "time the market."

- Portfolio Rebalancing: Once or twice a year, review your portfolio. If one of your satellite holdings has grown to be a disproportionately large part of your portfolio, sell some of the profit and reallocate it to your core holdings or other underperforming assets to maintain your desired risk balance.

- Constant Monitoring: Use a stock monitor or crypto-equivalent dashboard to track your performance and stay on top of your investments.

Advanced Risk Management Strategies

- Set Strict Rules: Use take-profit orders to lock in gains and stop-loss orders to protect your downside on every single trade.

- Understand Risk/Reward Ratios: Before entering a position, define your potential profit (reward) and potential loss. A good rule of thumb is to only enter trades with at least a 1:2 risk/reward ratio (e.g., risking $50 to make $100).

- Control Your Emotions: The biggest enemy of a trader is their own psychology. Create a detailed investment plan and stick to it. Never make decisions based on fear or greed.

Staying Ahead with AI-Powered Tools for Your Cryptocurrencies

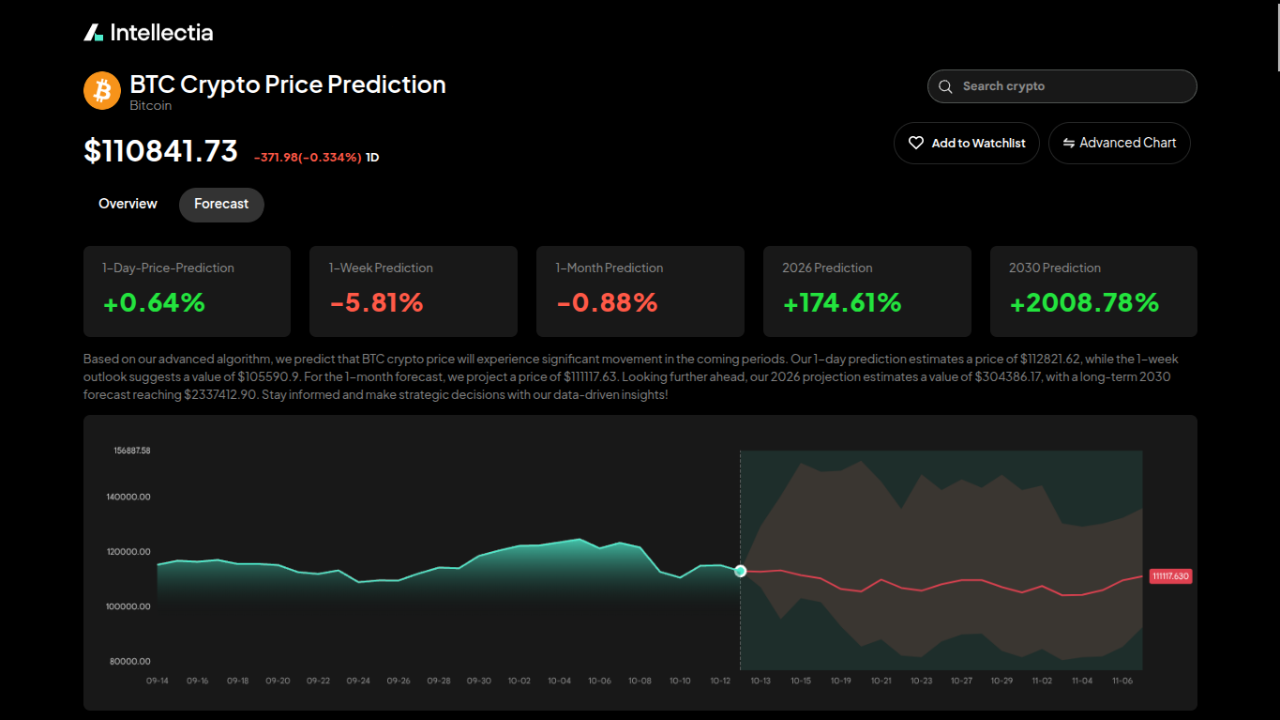

The crypto market moves faster than ever — AI gives investors a real-time edge by turning complexity into clarity.

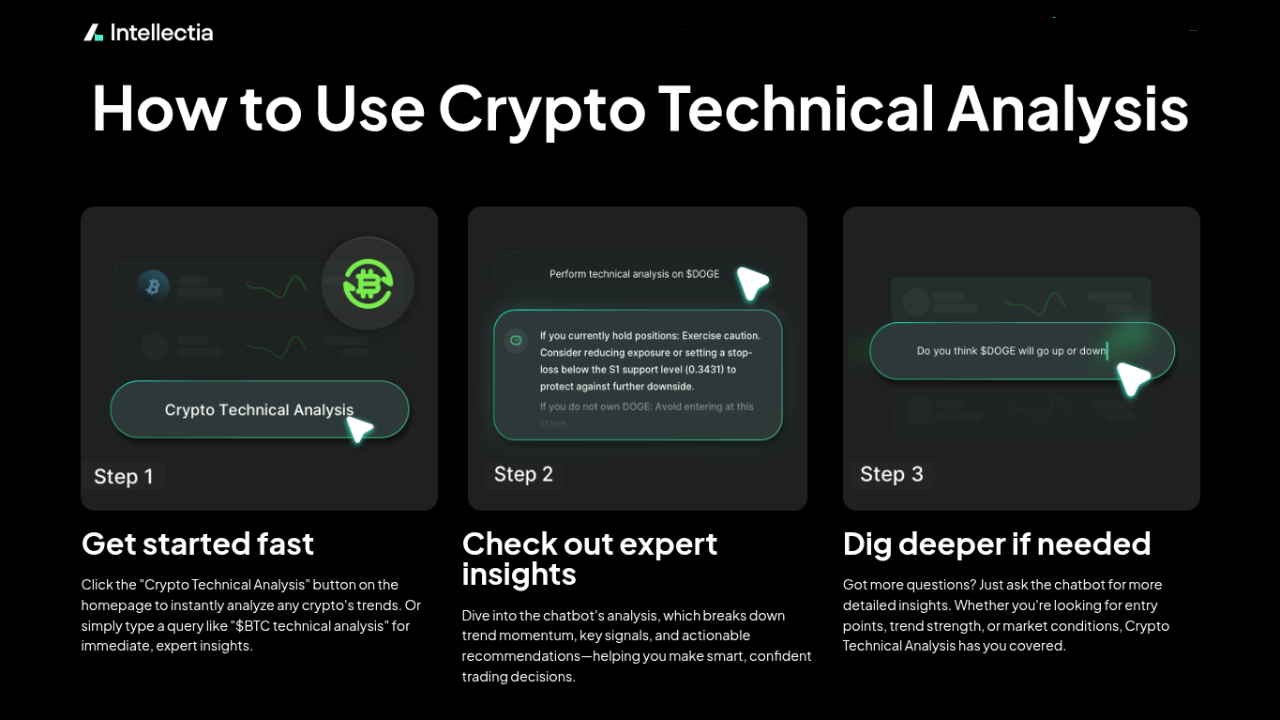

- AI Screener: Let an AI algorithm scan the entire market for you, surfacing high-potential opportunities based on a combination of fundamentals, technicals, and sentiment.

- AI Crypto Radar: Get actionable alerts for entry and exit points, allowing you to act decisively without being glued to the charts. This is invaluable for swing trading.

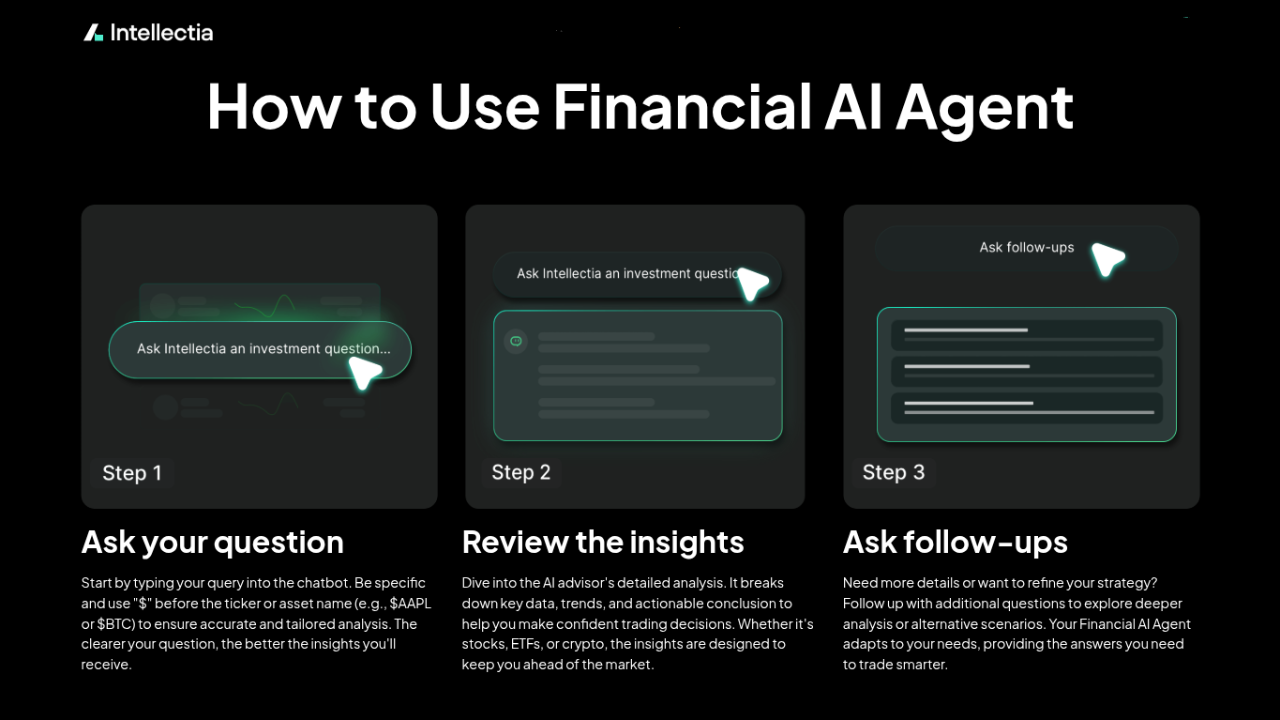

- AI Crypto Agent: Have a complex question? Use a conversational AI Crypto agent to get personalized, data-driven analysis and insights on any crypto asset.

- Hedge Fund Tracker: While focused on equities, a hedge fund tracker can reveal broader market trends and risk appetite among major financial players, which often spills over into the crypto markets.

Making Informed Crypto Investment Choices with Analytical Precision

- Choosing the right cryptocurrency requires a rigorous, multi-faceted analysis of its market cap, tokenomics, team credibility, and underlying technology.

- Tools like Intellectia.ai’s suite of crypto analytics and screeners are essential for cutting through market noise, automating research, and improving your decision-making with data.

- A well-diversified portfolio, managed with disciplined strategies like DCA and rebalancing, combined with strict risk controls, is the key to successfully navigating the volatile crypto market.

Conclusion

Investing in cryptocurrency is a journey that rewards diligence, strategy, and the right tools. By moving beyond hype and adopting an analytical framework, you can confidently identify promising projects and build a resilient portfolio. The days of guessing are over. Empower your strategy with the precision and speed of artificial intelligence.

Ready to transform your approach to crypto investing? Sign up on Intellectia.ai today. Subscribe to unlock a full suite of AI-powered tools, including daily crypto picks, actionable trading signals, and in-depth market analysis to guide your every move.

Ready to transform your crypto investing approach? Sign up on Intellectia.ai today to access AI-powered insights, daily crypto picks, and actionable trading signals that help you invest smarter.