Key Takeaways

- Black Friday sales figures are a key indicator of consumer health, heavily influencing market sentiment and investor confidence for the entire fourth quarter.

- While individual stock performance on Black Friday itself can be unpredictable, the surrounding weeks offer trading opportunities driven by sales forecasts and results.

- Key sectors that benefit most from the holiday shopping season include e-commerce, retail, payment processors, and the logistics companies that support them.

- Top companies like Amazon, Shopify, Walmart, PayPal, and Target are strategically positioned to capitalize on holiday spending through their omnichannel presence and new AI-powered tools.

- You can approach Black Friday investing through long-term growth strategies focused on strong companies or short-term trades using AI tools to identify market signals.

Introduction

Have you ever wondered how to translate the chaos of crowded stores and online shopping carts into actual portfolio gains? The annual Black Friday shopping frenzy kicks off the most crucial sales period for many companies, but figuring out which Black Friday stocks will truly benefit can feel overwhelming.

Many investors watch the news, see reports of record spending, and assume it's a golden ticket for all retail stocks. However, the reality is more complex. The market is forward-looking, meaning much of the holiday hype is already priced in before the sales even begin.

By understanding how this event shapes market sentiment and identifying the specific companies with the strongest strategic advantages, you can move beyond speculation. This guide will show you how does Black Friday affects stocks, highlight the sectors poised to win, and give you a list of top companies to watch for the 2025 holiday season.

How Black Friday Impacts Market Sentiment

Black Friday is more than just a day of discounts; it's a powerful barometer for the health of the consumer. The results from this single weekend can set the tone for the entire stock market through the end of the year.

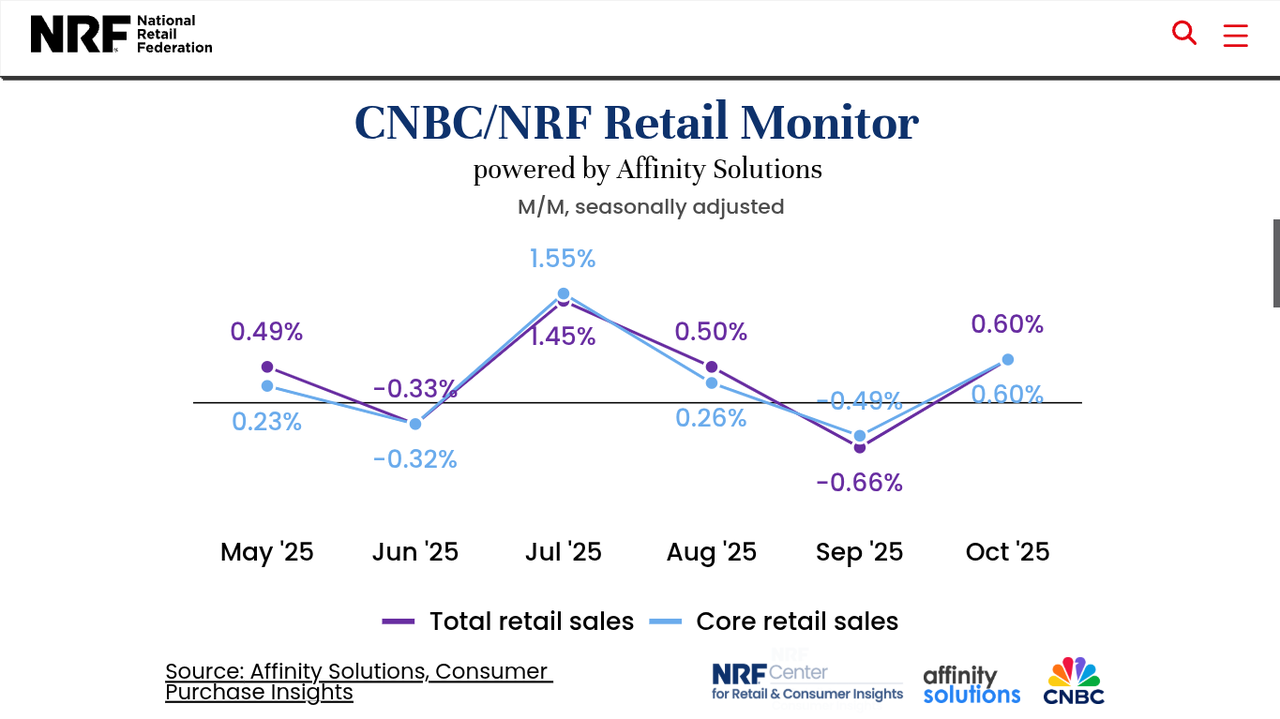

Major organizations like the National Retail Federation release spending forecasts and results that investors watch closely. Positive reports, suggesting that consumers are spending freely, can create a wave of bullish sentiment across the market, especially within the consumer discretionary sector. Analysts from APAC Investment News suggest the 2025 season will be a "K-shaped holiday," with wealthier households spending big while others hunt for deals.

This creates a narrative that can drive stock prices. News of crashing websites due to high traffic or long lines outside stores can be perceived as indicators of massive success. This excitement often leads to short-term trading spikes as investors look to capitalize on the positive buzz.

Ultimately, Black Friday provides a crucial data point on consumer confidence. Strong sales figures can ease fears about inflation or economic slowdowns, giving the broader market a reason to rally into the new year. Conversely, weak numbers can signal that consumers are pulling back, a warning sign for the economy.

Do Stocks Go Up on Black Friday?

So, do stocks go up on Black Friday? The answer isn't a simple yes or no. While the day is critical for retailers, it doesn't guarantee their stock prices will rise on the day itself. The market often anticipates these sales, with much of the expected success already "priced in" during the weeks prior.

The real opportunities often emerge from the difference between expectations and reality. If a company dramatically outperforms sales forecasts, its stock may rally. If it disappoints, it could fall, even if it had a profitable day.

Instead of focusing on a single day, it's more effective to look at the sectors that benefit from the overall trend of increased holiday spending.

Best Performing Sectors During Black Friday Season

- Retail & E-Commerce: This is the most obvious category. Companies with a strong online presence (e-commerce) and physical footprint (omnichannel) are positioned to capture sales wherever customers are shopping. Giants like Amazon, Walmart, and Target are perennial contenders.

- Payments & Fintech: Every transaction, whether online or in-store, needs a processor. Companies like PayPal see a massive surge in payment volume during this period. The rise of "Buy Now, Pay Later" (BNPL) services also provides a significant boost.

- Logistics & Delivery Stocks: The e-commerce boom runs on logistics. While not covered in our list, companies like UPS and FedEx are essential for getting billions of packages from warehouses to doorsteps, making them indirect beneficiaries of Black Friday.

- Advertising & Social Media Platforms: To capture your attention and dollars, retailers significantly increase their advertising budgets. This spending flows to digital advertising giants and social media platforms where consumers are scrolling for deals.

Black Friday Stocks List 2025

When looking for what stocks to buy before Black Friday, you should focus on companies with strong market positioning, innovative strategies, and a proven ability to execute during peak seasons. Here are five top contenders for 2025.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Amazon.com, Inc. | AMZN | Consumer Discretionary | $2.5 Trillion | E-commerce dominance, AWS infrastructure, robust advertising, Prime ecosystem |

| Shopify Inc. | SHOP | Information Technology | $190 Billion | E-commerce platform for SMBs, agentic commerce, strong international growth |

| Walmart Inc. | WMT | Consumer Staples | $817 Billion | Omnichannel leader, grocery dominance, Walmart+ membership, advertising growth |

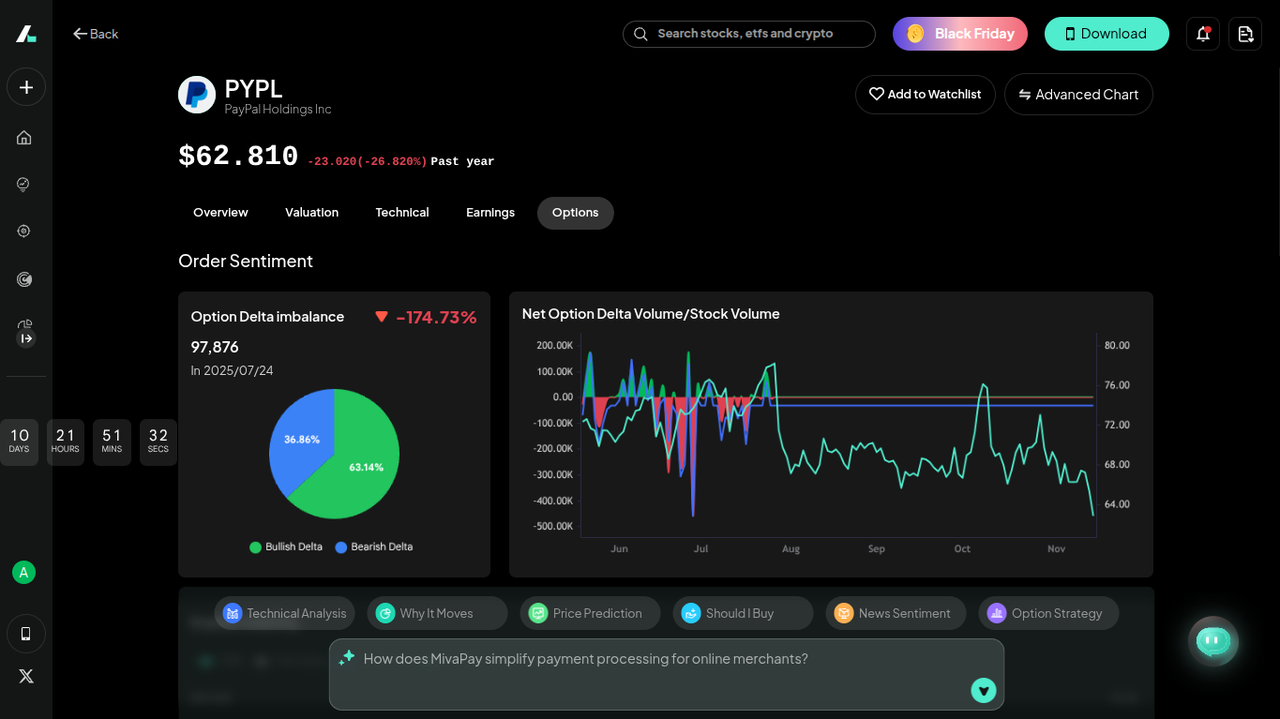

| PayPal Holdings, Inc. | PYPL | Information Technology | $59 Billion | Digital payments leader, BNPL and Venmo growth, AI commerce partnerships |

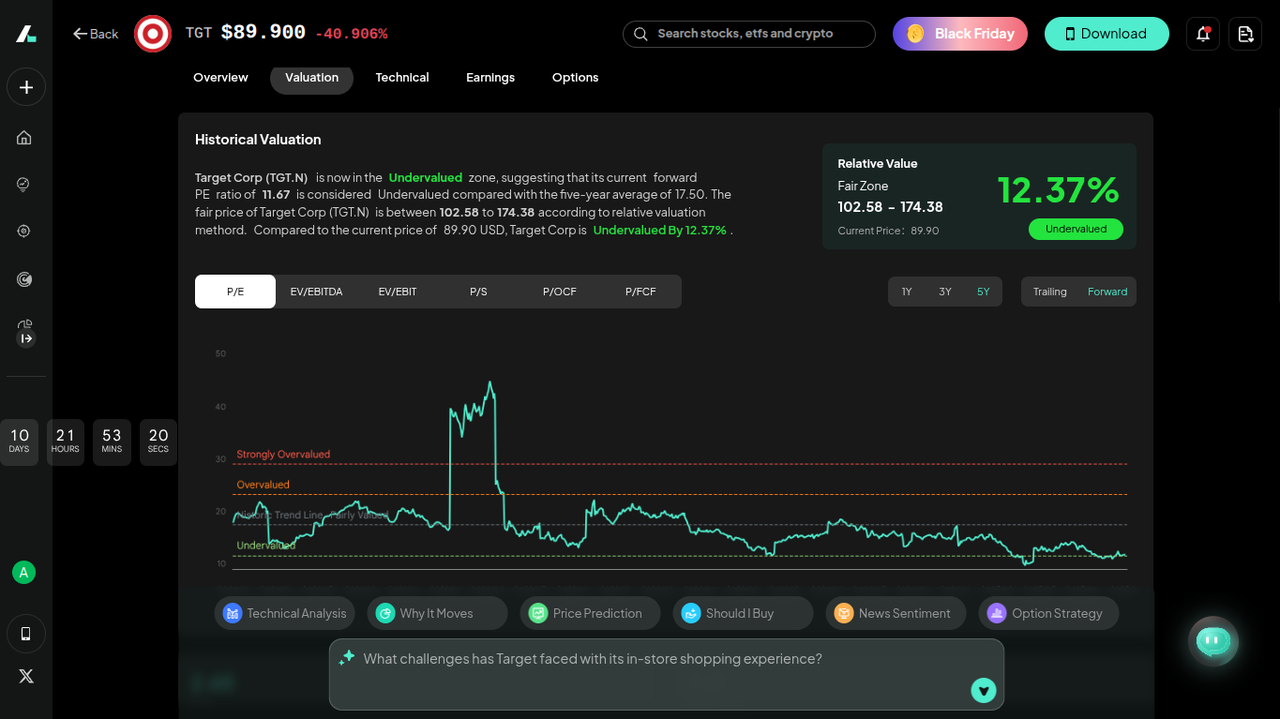

| Target Corporation | TGT | Consumer Discretionary | $41 Billion | Turnaround potential, strong brand loyalty, new AI-powered shopping tools |

Amazon (AMZN)

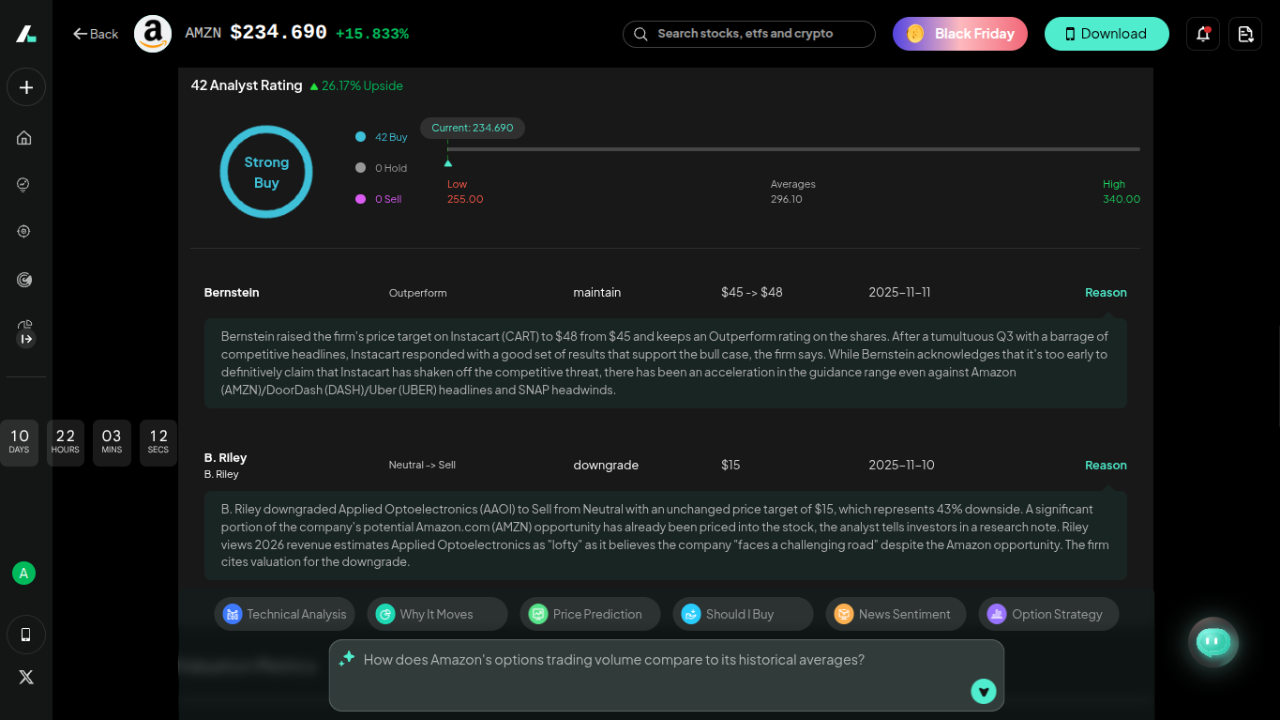

Amazon is the undisputed king of e-commerce, and the holiday season is its crowning moment. The company's massive logistics network, Prime membership program, and sophisticated recommendation algorithms are all designed to maximize holiday sales.

Amazon's Q3 results showcased strong growth across the board, with its AWS segment reaccelerating to over 20% year-over-year growth on a $132 billion annualized run rate. The company is aggressively investing in AI, expanding its capacity, and innovating with tools like its AI-powered shopping assistant, Rufus, which is on track to drive over $10 billion in incremental sales.

Amazon's flywheel is incredibly powerful. Its retail arm drives massive traffic, which fuels its high-margin advertising business ($17.6B in revenue in Q3). Meanwhile, its AWS cloud platform powers a huge portion of the internet, including many of the e-commerce sites it competes with, making it a picks-and-shovels play for the digital economy. The company's recent partnerships with Netflix and Spotify for its ad platform further expand its reach.

With plans to double its power capacity again by 2027 and a massive $125 billion projected for full-year cash CapEx in 2025, Amazon is investing heavily in the future of AI and cloud computing. This positions it to not only dominate retail but also the underlying infrastructure that powers the next generation of commerce.

Shopify (SHOP)

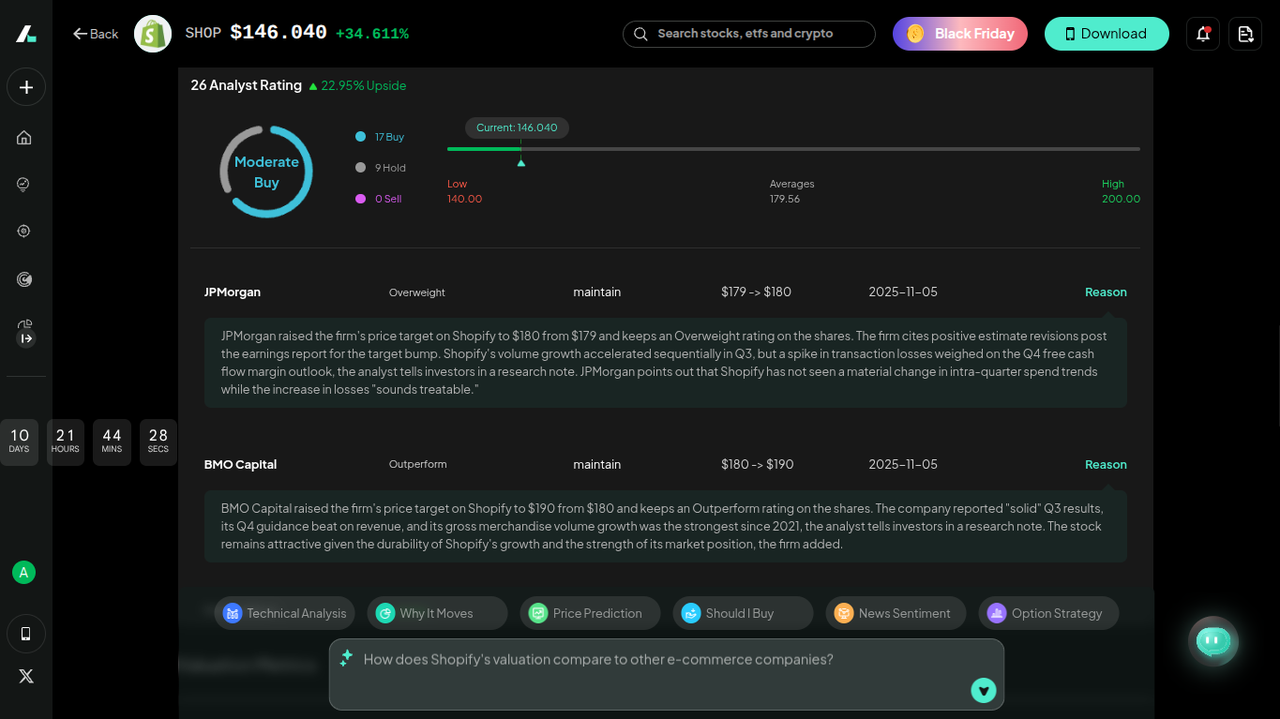

While Amazon is the giant, Shopify empowers the rebels. Its platform is the backbone for millions of small and medium-sized businesses, enabling them to compete online. During Black Friday, Shopify's success is a direct reflection of the health of the entire independent e-commerce ecosystem.

Shopify delivered a stellar Q3 with 32% GMV and revenue growth, alongside an 18% free cash flow margin. The company is seeing rapid adoption of its AI assistant, Sidekick, with over 750,000 shops using it for the first time in Q3 alone. Its international momentum is also impressive, with European revenue share growing significantly.

Shopify is at the forefront of "agentic commerce," partnering with leaders like ChatGPT and Microsoft Copilot to power product discovery and shopping within AI conversations. This positions its merchants for the next evolution of e-commerce. Its payment solution, Shop Pay, is also growing rapidly, processing $29 billion in Q3, up 67% year-over-year.

Shopify is successfully moving upmarket, attracting major enterprise brands like Estee Lauder, e.l.f. Cosmetics, and UGG Australia. This, combined with its leadership in AI-driven commerce and strong international expansion, gives it multiple avenues for sustained double-digit growth.

Walmart (WMT)

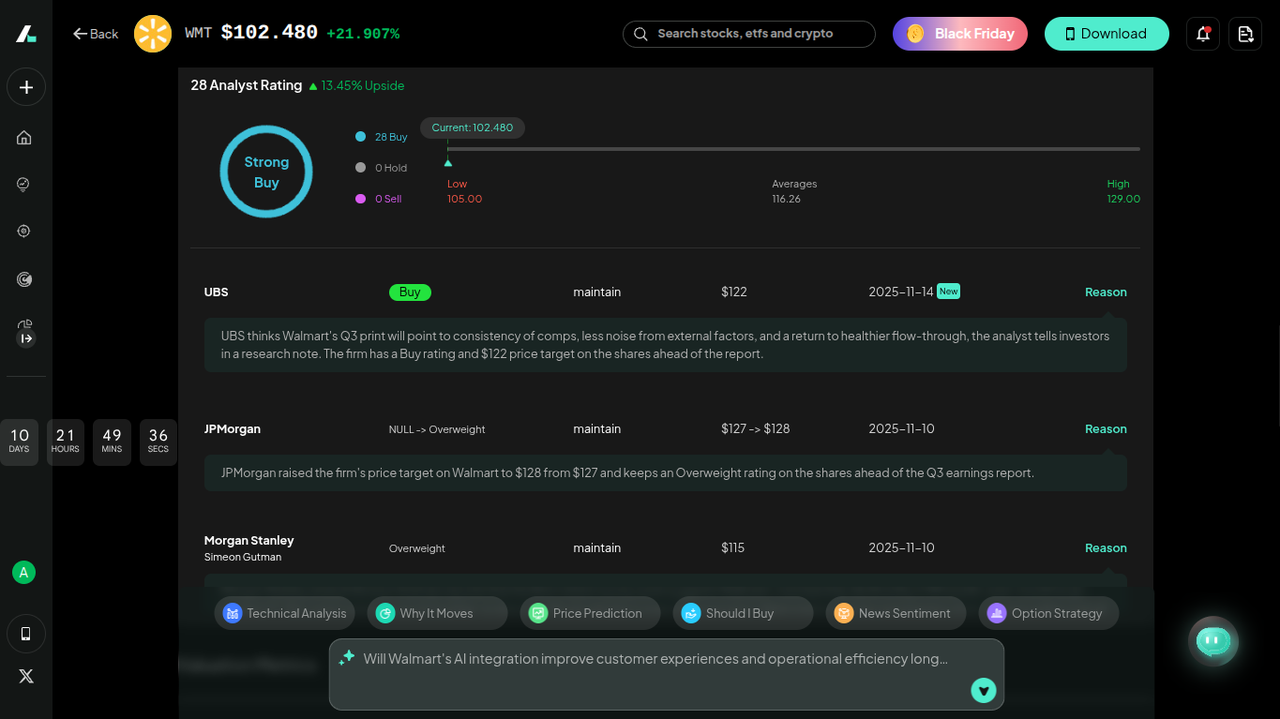

Walmart has successfully transformed from a brick-and-mortar behemoth into a formidable omnichannel player. Its strategy of leveraging its vast network of physical stores as fulfillment centers for online orders gives it a unique advantage in speed and convenience.

Walmart's Q2 2026 earnings showed strong top-line results, with e-commerce sales growing 25% globally and global advertising up 46%. The company is gaining market share across all income levels and is leaning into AI with its customer-facing assistant, Sparky, and a new partnership with OpenAI's ChatGPT.

Walmart's flywheel is accelerating. Its growing high-margin businesses, like its advertising arm Walmart Connect (up 31% in the U.S.) and its Walmart+ membership program, are transforming its profitability. The company's focus on low prices and value resonates strongly with consumers in an uncertain economic environment, as noted by analysts ahead of the holiday season.

By integrating AI into its core operations, Walmart aims to enhance customer experience and drive efficiency. The company is playing offense to gain market share, raising its full-year sales guidance to a range of 3.75% to 4.75% growth, signaling confidence heading into the holiday season.

PayPal (PYPL)

As a leader in digital payments, PayPal is a direct beneficiary of the e-commerce surge during Black Friday and the entire holiday season. The company is currently in a turnaround phase, focusing on profitable growth and innovation in key areas like branded checkout, Venmo, and BNPL.

In its Q3 2025 earnings call, PayPal reported accelerating revenue growth and announced it is on pace to deliver at least 15% non-GAAP EPS growth for the year. The company initiated its first-ever dividend, signaling confidence in its free cash flow. Key growth drivers are performing well, with BNPL volume growing over 20% and Venmo TPV growing 14%.

PayPal is strategically positioning itself for the future of commerce by partnering with AI leaders like OpenAI, Google, and Perplexity to embed its wallet into agentic commerce experiences. This ensures it remains relevant as shopping becomes more conversational. Its strong brand and massive user base provide a solid foundation for its growth initiatives.

Venmo, with nearly 66 million monthly active accounts, is still in the "early innings of monetization" and presents a massive upside. As PayPal deepens user engagement and expands its omnichannel and BNPL services globally, it has the potential to re-accelerate growth and capture a larger share of the expanding digital payments market.

Target (TGT)

Target is a brand with fierce customer loyalty, but it's currently in a turnaround period after a few challenging years. With a new CEO set to take the helm and a clear focus on revitalization, the holiday season is a critical test and a potential catalyst for the stock.

In its Q2 2025 earnings, Target showed signs of progress, with traffic and sales trends improving from the previous quarter. Digital comparable sales grew 4.3%, powered by its same-day delivery services. The company is focused on reestablishing its "merchandising authority" and improving the guest experience.

Target is rolling out new personalized AI tools for the holiday season, including a conversational AI "Target Gift Finder" and a "List Scanner" in its app. It's also implementing a "10-4 program" in stores to improve customer interaction, aiming to win back shoppers with superior service. These initiatives show a clear commitment to leveraging technology and its brand strength to drive a turnaround.

Target is a high-risk, high-reward play. If its new strategies and AI tools resonate with consumers during the holiday season, it could signal that the turnaround is taking hold, leading to a significant rally in the stock. The company has a strong brand and a loyal following, giving it a solid foundation to build upon.

Investment Strategies for Black Friday Stocks

So, how should you approach investing in these companies? There are a few strategies you can consider, depending on your goals and risk tolerance.

Long-Term Growth Investing vs. Short-Term Trading

For long-term investors, Black Friday is just one data point. The focus should be on a company's durable competitive advantages. All the companies listed have strong market positions that extend far beyond a single holiday season. Your goal is to buy and hold these innovators, trusting their ability to grow over many years.

For those interested in short-term opportunities, the volatility around the holiday season can be attractive. You can capitalize on swings in market sentiment driven by sales reports and analyst updates. To do this effectively, you need to time your entry and exit points precisely. You can use tools like Intellectia.ai's AI trading signals to identify these moments based on sophisticated technical analysis and real-time market data.

Consider ETFs for Broader Exposure

If you believe in the holiday spending trend but don't want to pick individual stocks, you can buy a consumer discretionary or retail ETF. These funds hold a basket of stocks in the sector, providing instant diversification. You can use an AI Screener to filter thousands of ETFs to find one that perfectly matches your investment criteria, whether it's focused on e-commerce, broad retail, or a specific market cap.

And as you prepare your portfolio for the holidays, supercharge your research with Intellectia.ai. Our powerful suite of AI-driven tools gives you everything from AI stock picks to institutional-grade analysis, helping you make smarter, more confident investment decisions.

Conclusion

The Black Friday shopping season serves as a powerful catalyst for the stock market, offering a real-time glimpse into the health of the consumer. While the day itself is filled with hype, the real opportunity for you lies in identifying the companies best positioned to capture a disproportionate share of that spending.

Companies like Amazon, Shopify, Walmart, PayPal, and Target have built resilient, omnichannel business models and are now integrating AI to further enhance their competitive advantages. By understanding their strategies, you can make informed decisions, whether you're investing for long-term growth or trading short-term volatility.

Ready to take your trading to the next level this holiday season? Sign up for Intellectia.ai to get daily AI stock picks, leverage powerful trading signals, and analyze the market like a pro. Explore our subscription plans and unlock the insights that can shape your portfolio for years to come.