Key Takeaways

- War stocks, particularly in aerospace and defense, provide portfolio stability during geopolitical instability due to long-term government contracts.

- The backlog of major defense contractors like Lockheed Martin and RTX reached record highs in late 2025, signaling sustained demand.

- Modern warfare is shifting towards software and AI, making companies like Palantir essential "war time stocks" alongside traditional hardware manufacturers.

- Evaluating balance sheets, free cash flow, and technological innovation is critical when selecting the best stocks to buy during war.

- Tools like Intellectia.AI can help you time your entries and exits using advanced AI stock analysis and trading signals.

Introduction

Have you ever looked at your portfolio during times of global conflict and wondered why the broader market is bleeding while specific sectors are reaching all-time highs? It is a frustrating experience to see your hard-earned capital erode because of geopolitical events entirely out of your control. However, seasoned investors know that while uncertainty creates volatility, it also creates specific, predictable opportunities in the defense sector.

By analyzing market sentiment and the order backlogs of major defense contractors, you can gauge which companies are positioned to thrive when global tensions rise. In the article, there is an analysis of the Q3 2025 earnings data to identify the companies that are not just surviving, but accelerating their growth through government contracts and technological innovation.

Here, you will learn exactly what characterizes a strong defense investment, how to analyze these companies, and discover the top 5 war stocks that are poised for growth in the current economic climate.

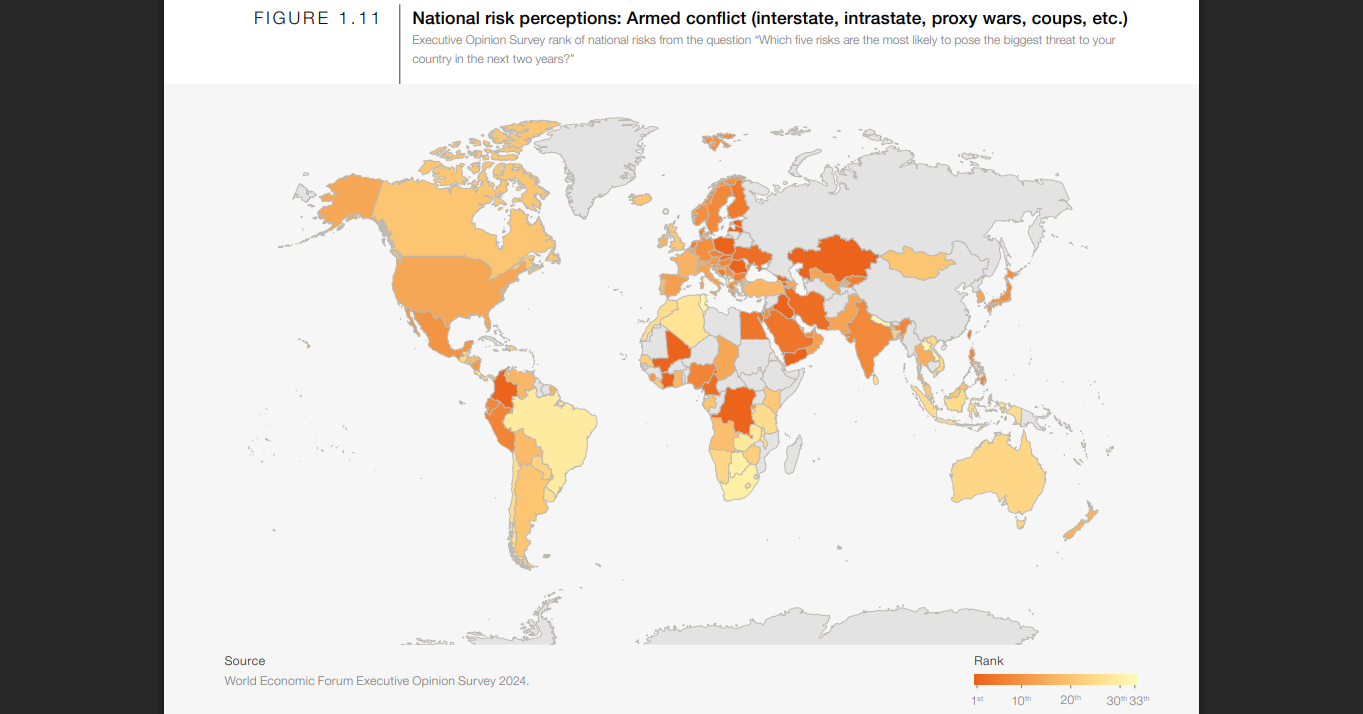

Source: The Global Risks Report 2025

What Are War Stocks?

When investors discuss war stocks or war time stocks, they are generally referring to the Aerospace and Defense (A&D) sector. These are publicly traded companies that develop, manufacture, and service the equipment, software, and logistics required by military forces.

Unlike consumer discretionary stocks, which rely on a healthy economy and confident shoppers, stocks that go up during war are driven by government budgets and geopolitical necessity. When global tensions escalate, governments do not cut defense spending; they increase it. This creates a floor for these stocks, often making them recession-resistant.

The definition of a war stock has evolved. Historically, this category was dominated by manufacturers of tanks, planes, and ammunition. Today, the best war stocks also include cybersecurity firms, satellite communications providers, and data analytics companies. Modern warfare is kinetic, but it is also digital.

Why do these sectors surge? It comes down to the "flywheel effect" of defense spending. A conflict usually triggers immediate replenishment of munitions (short-term revenue). It also highlights technological gaps, leading to massive R&D contracts for next-generation equipment (long-term revenue). For example, recent conflicts have underscored the need for missile defense systems and autonomous drones, driving capital directly into companies like RTX and Northrop Grumman.

Investing in top war stocks is not about capitalizing on conflict; it is about recognizing the reality of the geopolitical landscape and hedging your portfolio against the volatility that usually negatively impacts other sectors.

How to Choose the Best War Stocks

Identifying the best stocks to buy during war requires looking beyond the headlines. You need to analyze the fundamentals that ensure a company can convert government interest into shareholder value. Here is what you should look for.

Government Defense Contracts

The lifeblood of any defense stock is its backlog—the total value of signed contracts that have not yet been fulfilled. A growing backlog indicates future revenue visibility. For instance, in Q3 2025, Lockheed Martin reported a record backlog of $179 billion. When you see a backlog that is 2x or 3x the company's annual revenue, you are looking at a highly stable investment.

Revenue Stability During Conflict

During economic downturns, commercial revenue (like civilian air travel) might drop. The best defense companies often have a mix of commercial and defense revenue. However, during conflict, you want to prioritize companies where the defense segment acts as a buffer. Look for "Program of Record" status, which means the US government has committed to funding a specific weapon system for years or decades.

Source: Intellectia.ai

Balance Sheet Strength & Cash Flow

Developing a new fighter jet or missile system requires billions in upfront capital. You must ensure the company has a strong balance sheet to weather development costs. Pay close attention to Free Cash Flow (FCF). Companies like Boeing have struggled recently due to cash flow issues, whereas mature primes like Northrop Grumman utilize their cash flow to pay dividends and buy back shares, rewarding you for holding the stock.

Geopolitical Exposure

Not all conflicts require the same equipment. A naval conflict benefits shipbuilders; a land war benefits artillery manufacturers; a symmetric cyber war benefits software companies. You should diversify your holdings to cover different domains: Air, Land, Sea, Space, and Cyber. Currently, there is a massive demand for "integrated deterrence," which benefits companies that can connect these domains.

Long-Term Demand for Military Tech

The top 10 stocks that rise during war are often those innovating for the next war, not just fighting the last one. Look for companies investing in hypersonics, directed energy (lasers), and autonomous systems. These technologies are high-priority funding areas for the Pentagon.

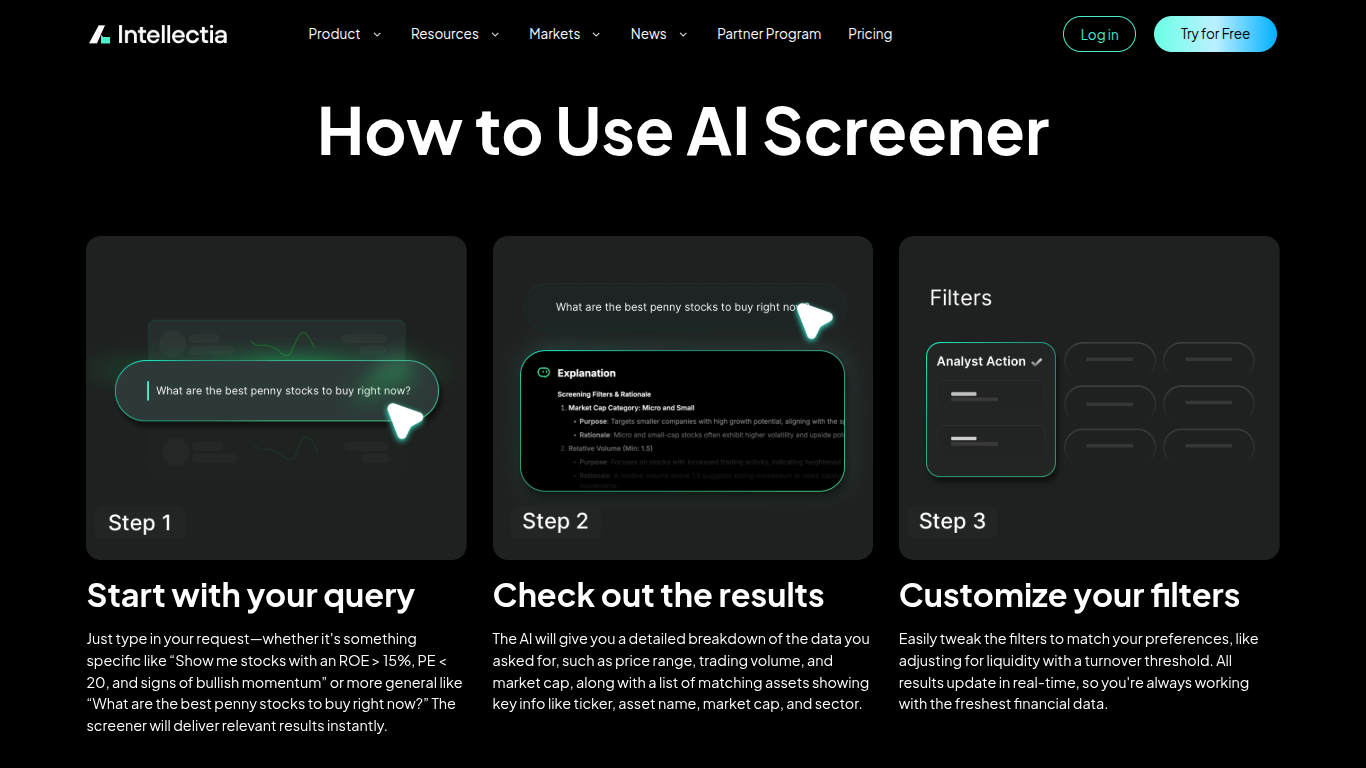

Using AI Tools Like Intellectia for Analysis

Analyzing government budgets and 10-K filings can be overwhelming. This is where you can leverage technology. Intellectia.AI’s stock analysis features allow you to scan fundamental data, track institutional buying, and get AI-driven summaries of earnings calls. Using an AI tool helps you separate the hype from the actual numbers, ensuring you pick stocks with genuine momentum.

Source: Intellectia.ai

5 Top War Stocks That Rise During War

Based on Q3 2025 performance, backlogs, and strategic positioning, these are the companies you should be watching.

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

| RTX Corporation | RTX | Aerospace/Defense | ~$234.5B | Diverse portfolio (Missiles + Engines), Strong Commercial Aftermarket |

| Palantir | PLTR | Software/AI | ~$401.4B | Dominance in AI-driven warfare & decision making |

| Lockheed Martin | LMT | Aerospace/Defense | ~$105.9B | World’s largest defense contractor, F-35 Program |

| Northrop Grumman | NOC | Aerospace/Defense | ~$81.6B | Space dominance, Nuclear Triad (B-21, Sentinel) |

| Boeing | BA | Aerospace/Defense | ~$143.6B | Turnaround potential, massive production capacity |

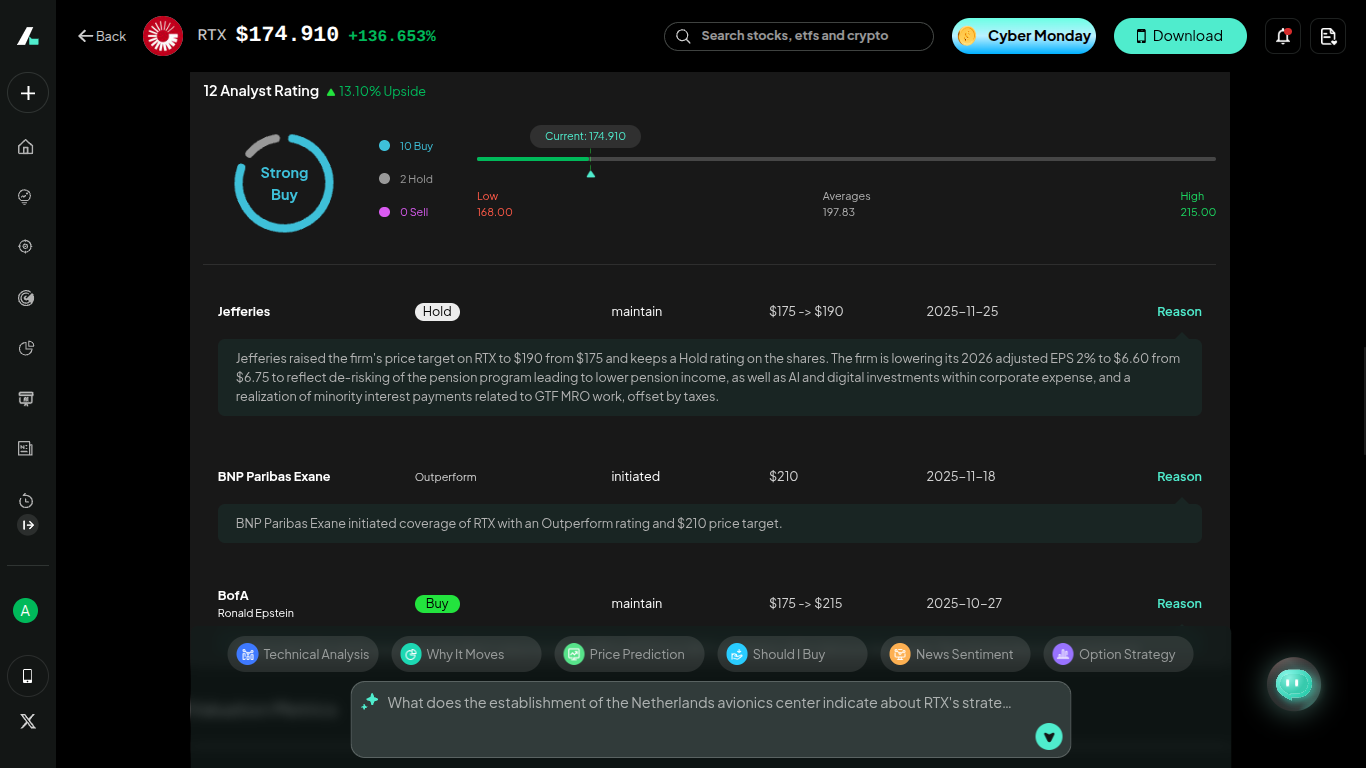

1. RTX Corporation (RTX)

RTX Corporation is a powerhouse that offers you the best of both worlds: commercial aviation recovery and defense stability. In Q3 2025, RTX reported a massive backlog of $251 billion, with $23 billion in new defense awards alone.

RTX manufactures the Patriot missile defense system, which is in incredibly high demand globally due to conflicts in Eastern Europe and the Middle East. Furthermore, their Pratt & Whitney division provides engines for the F-35.

Despite some supply chain challenges, their organic sales grew 13% in the last quarter. If you want a stock that covers missile defense and commercial travel simultaneously, RTX is a prime candidate.

Source: Intellectia.ai

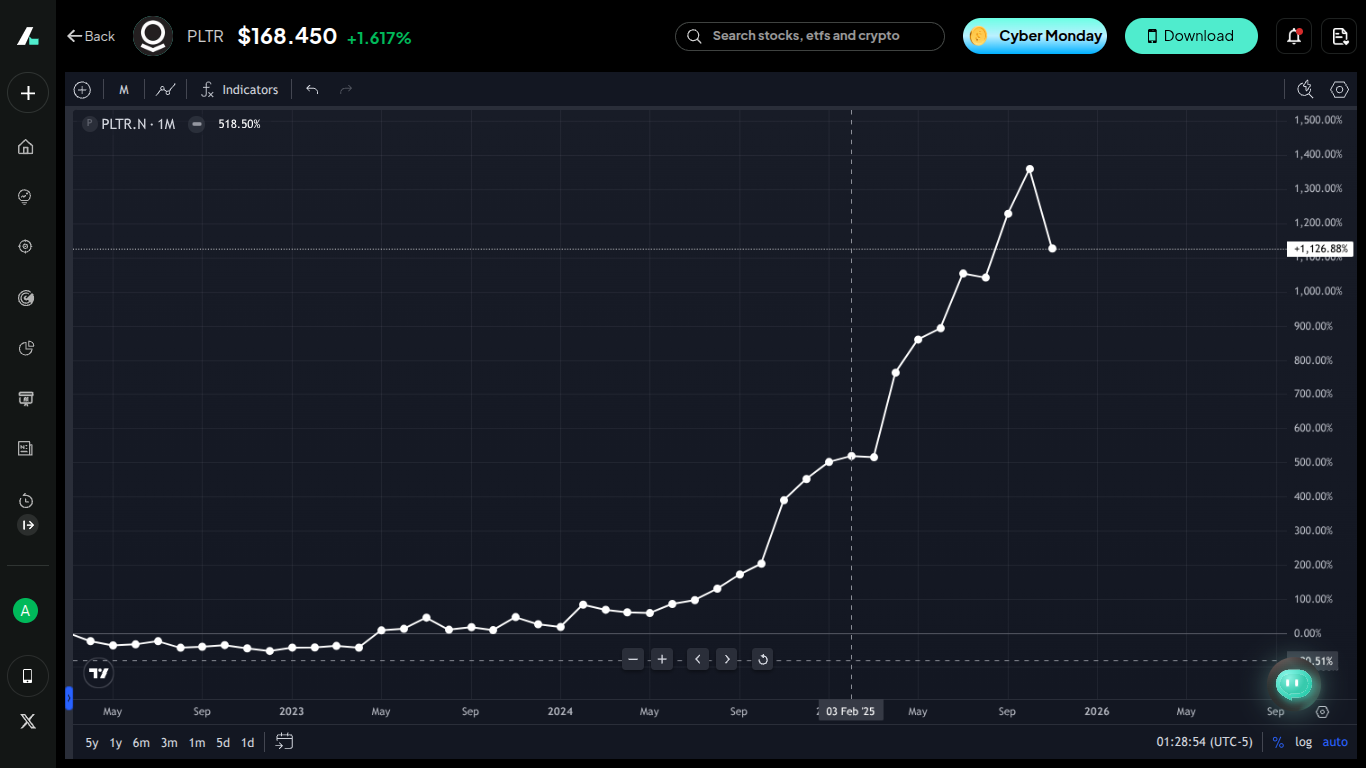

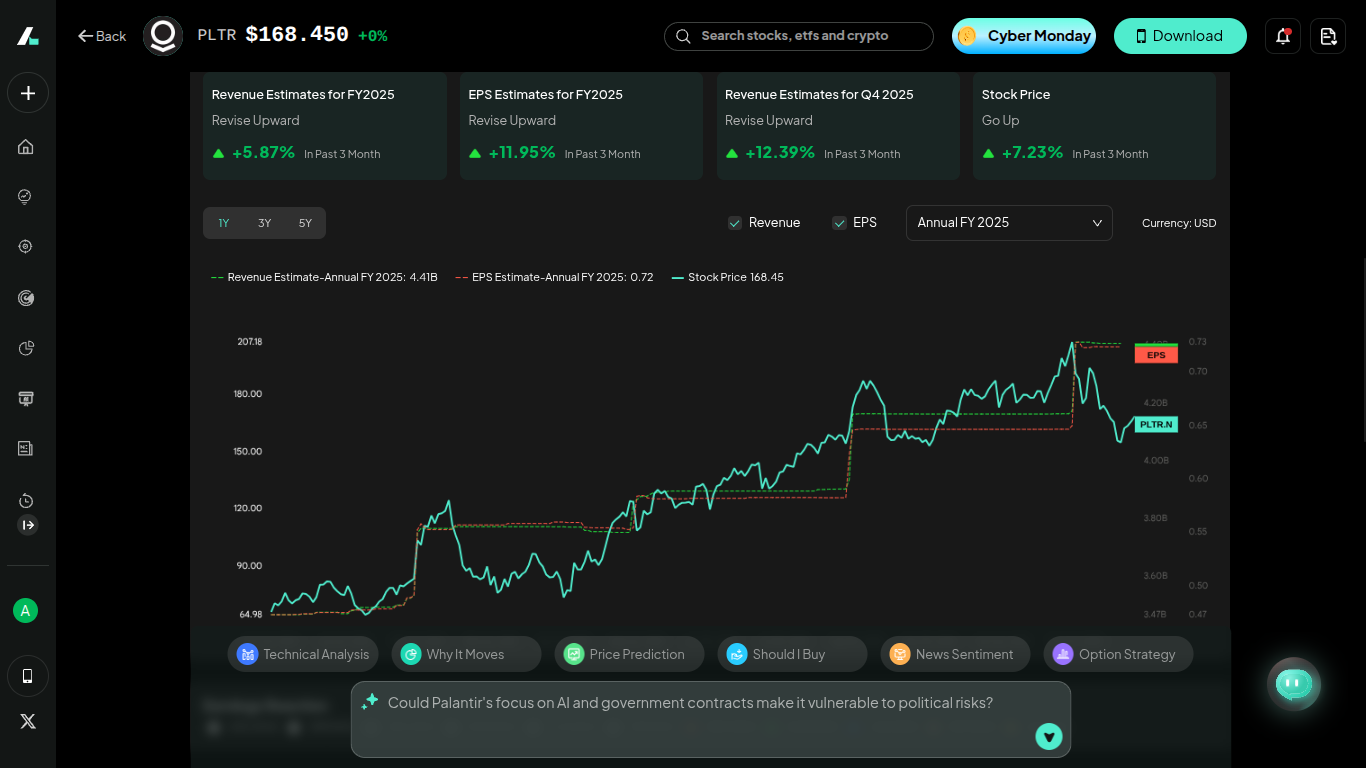

2. Palantir Technologies (PLTR)

If you are looking for modern war stocks, you cannot ignore software. Palantir has fundamentally changed how military decisions are made. In Q3 2025, they shattered expectations with 63% year-over-year revenue growth.

Palantir is not building tanks; they are building the "operating system" of war. Their AIP (Artificial Intelligence Platform) is being used to integrate data from satellites, drones, and troops to provide real-time battlefield intelligence.

With their US Government revenue growing by 52% and a "Rule of 40" score of 114%, Palantir represents the future of defense. This is your high-growth aggressive play in the sector.

Source: Intellectia.ai

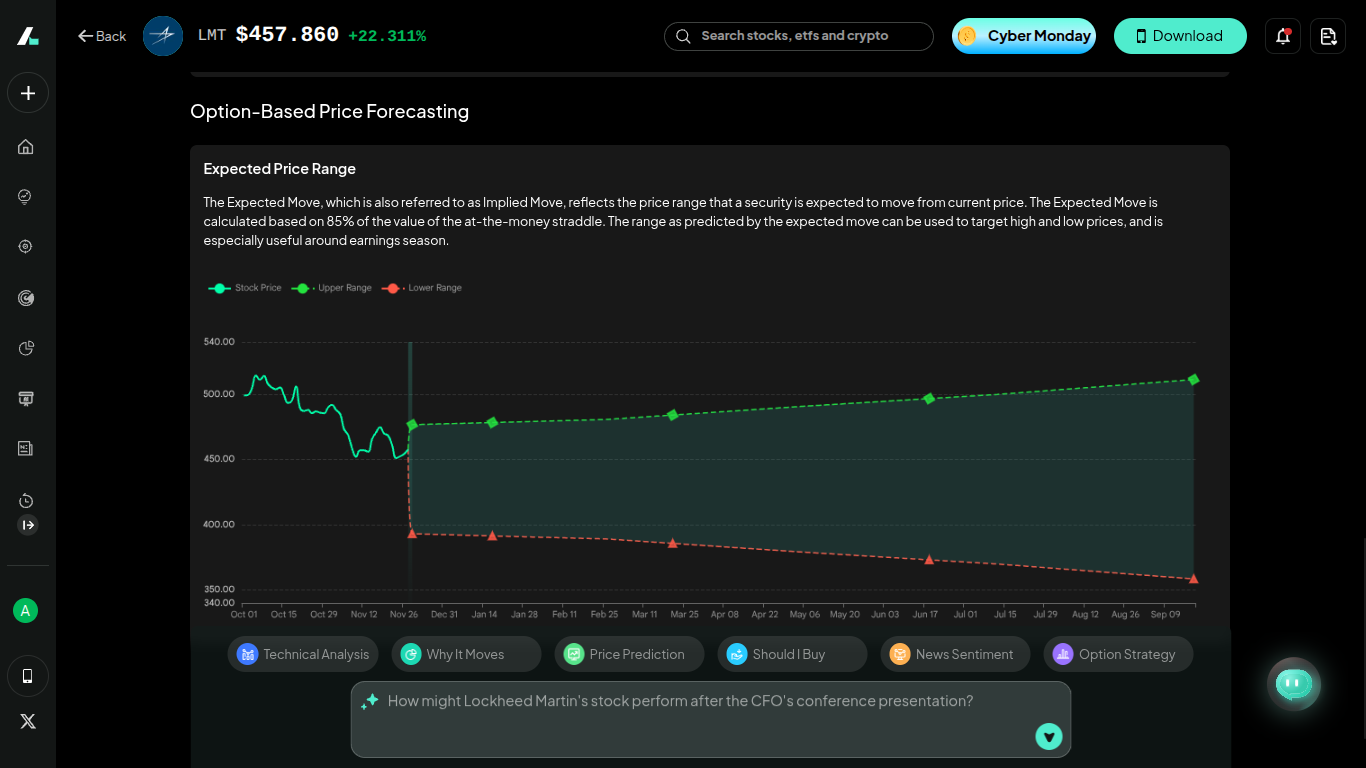

3. Lockheed Martin (LMT)

Lockheed Martin remains the gold standard for stocks to buy during war. As the manufacturer of the F-35 fighter jet, they have secured revenue streams for decades. In Q3 2025, they reported a record backlog of $179 billion.

Lockheed is heavily involved in the "Golden Dome" initiative and missile defense (PAC-3). They recently won multi-year awards totaling $30 billion for missiles and helicopters.

Management is confident in mid-single-digit growth through 2026. LMT is a dividend-paying stock, making it an excellent choice if you prefer stability and income along with capital appreciation during uncertain times.

Source: Intellectia.ai

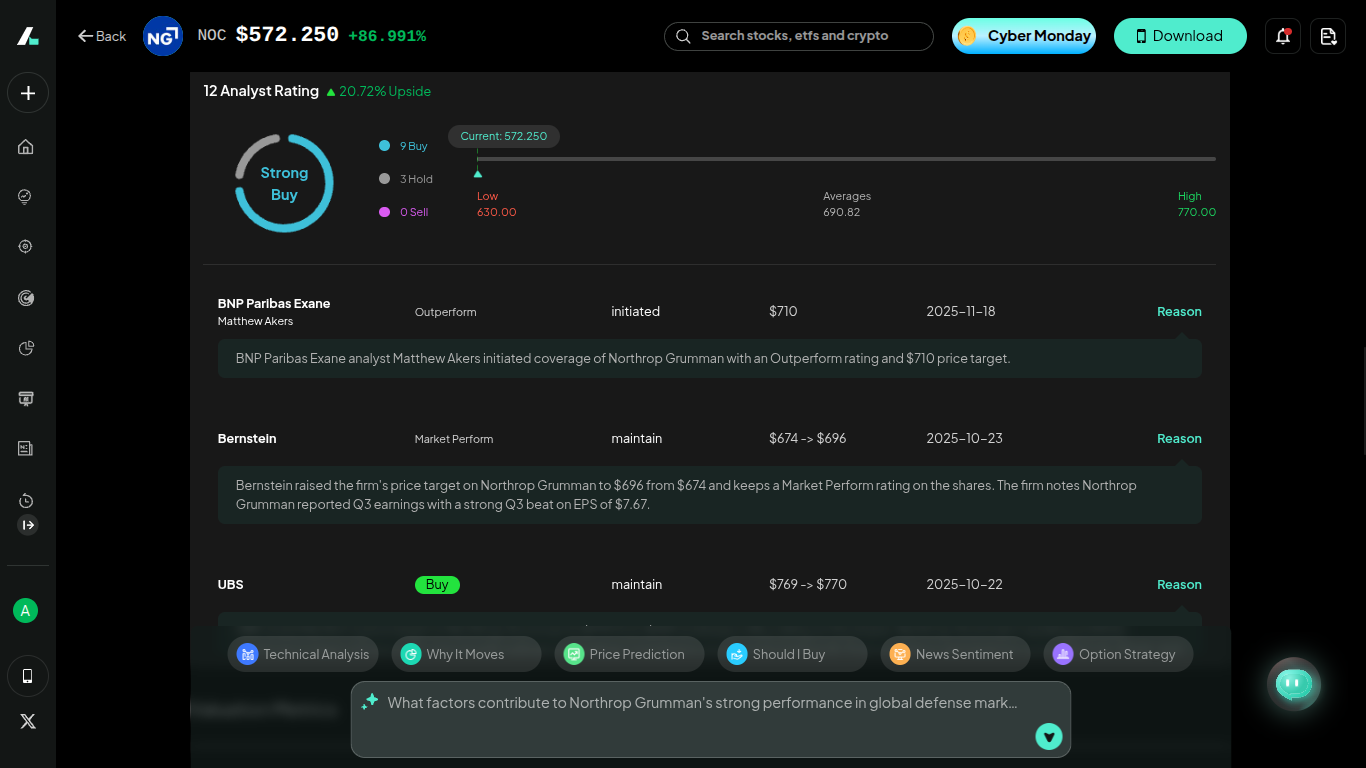

4. Northrop Grumman (NOC)

Northrop Grumman is the leader in strategic deterrence. They are currently building the B-21 Raider (the newest stealth bomber) and the Sentinel ICBM (nuclear modernization).

In Q3 2025, NOC beat earnings expectations significantly. They are seeing massive demand for solid rocket motors and space systems. Space is the next frontier of warfare, and Northrop is the best positioned among the primes to capitalize on this.

If you believe the future of conflict involves space dominance and nuclear deterrence, this is the stock for your portfolio.

Source: Intellectia.ai

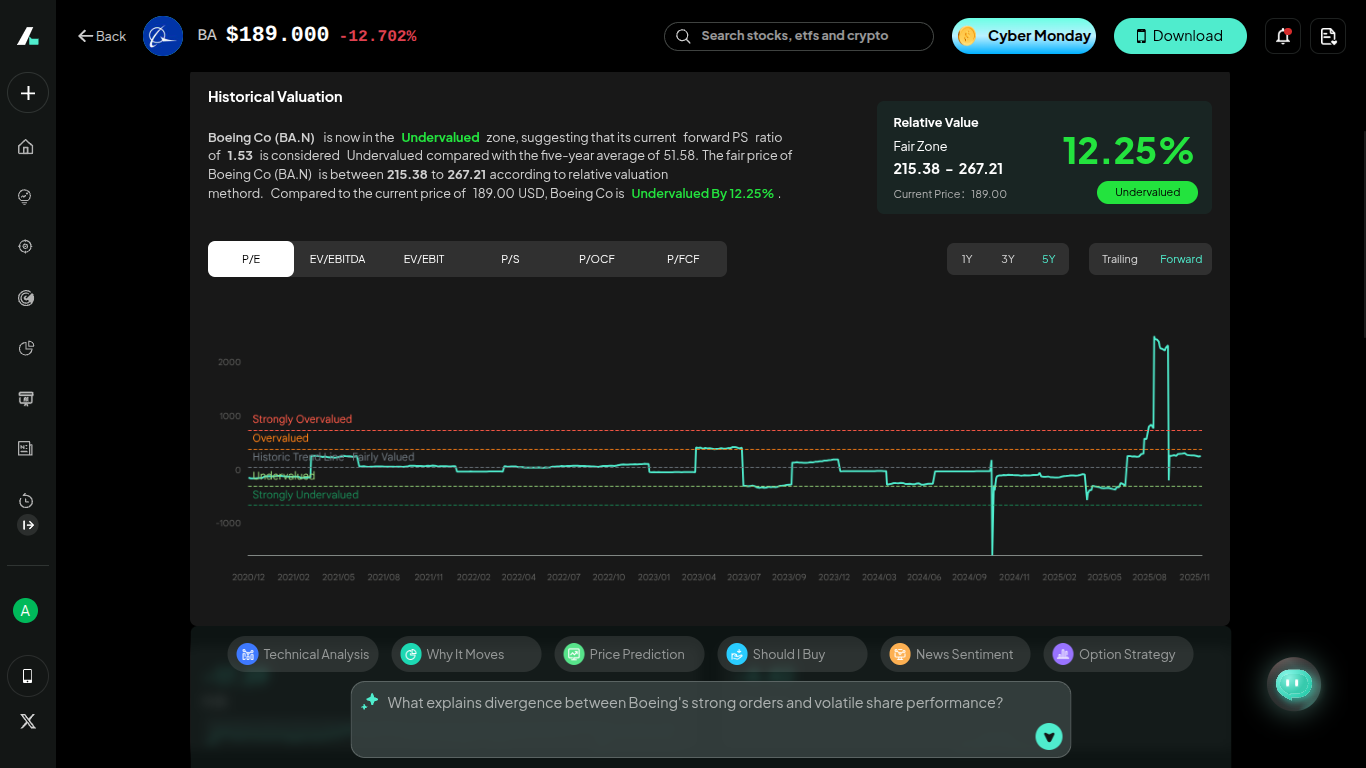

5. Boeing (BA)

Boeing is a controversial pick due to recent production struggles, but it remains a titan in the industry. Q3 2025 showed a pivotal turning point: operations generated positive free cash flow for the first time since 2023, and they settled major labor strikes.

Boeing is a "turnaround play." Despite the 777X delays, they have a backlog of over $600 billion. Their defense unit produces the F-15EX, the KC-46 tanker, and the Apache helicopter.

As they stabilize production rates (aiming for 42 737s per month), the stock has significant upside potential from its current depressed levels. If you have a higher risk tolerance, Boeing offers a value entry point into the aerospace duopoly.

Source: Intellectia.ai

Investment Strategies for War Stocks

Knowing what stocks go up during war is only half the battle; you need a strategy to manage them.

Understand Market Cycles

Defense stocks often spike at the onset of a conflict due to fear and speculation. However, the real value is generated over the long term as government contracts are awarded and paid out. Do not just buy the spike. Look for sustainable trends in government spending bills (like the NDAA in the US).

Long-Term Growth vs. Short-Term Trading

Are you investing for the next decade or trading the news?

- Long-Term: Focus on "Prime Contractors" like LMT and RTX. Reinvest the dividends and hold through the volatility.

- Short-Term: Use Intellectia.AI’s Trading Signals to identify momentum shifts. When a new conflict breaks out, smaller cap stocks (like drone makers) often experience sharper, faster moves than the giants.

Consider ETFs for Broader Exposure

If picking individual war stocks to buy feels too risky, you can use the Intellectia AI Screener to find ETFs that hold a basket of these companies. ETFs like the iShares U.S. Aerospace & Defense ETF (ITA) or the SPDR S&P Aerospace & Defense ETF (XAR) give you exposure to the whole sector, mitigating the risk of a single company failing execution.

Source: intellectia.ai

Diversify Across Sectors

Do not put 100% of your portfolio into defense. While these stocks are hedges, they can underperform during tech booms or periods of extended peace. Use them to balance out your exposure to tech and consumer goods.

Conclusion

The geopolitical landscape of 2025 has made the defense sector a critical component of a diversified portfolio. Whether you are looking for the stability of Lockheed Martin, the diversified strength of RTX, or the explosive AI growth of Palantir, top war stocks offer a hedge against global uncertainty.

The key to success is looking beyond the headlines and analyzing the order backlogs, cash flow, and technological advantages of these companies. The market moves fast, and during times of conflict, information is your most valuable weapon.

To stay ahead of the market, Sign up for Intellectia.AI today. Get access to daily AI stock picks, real-time trading signals, and deep market analysis to ensure your portfolio is ready for whatever the world throws at it. Don't just watch the news—profit from the data.