Key Takeaways

- Exposure to sectors such as military technology, cybersecurity, and aerospace is offered by defense exchange-traded funds (ETFs).

- Stability and expansion prospects for defense sector ETFs are provided by rising government contracts and military spending worldwide.

- Choosing the appropriate defense ETF entails looking at dividend yields, geographic focus, and expense ratios.

- Portfolio resilience is increased by diversifying within defense ETFs.

- Intellectia.ai's AI-powered analysis aids in trading strategy optimization.

Introduction

Have you noticed that defense stocks are rising due to geopolitical tensions? Defense ETFs are often overlooked by investors, despite the fact that they provide exposure to state-of-the-art military technology and steady returns.

You can make wise investment decisions if you are aware of important selection criteria, such as fees, risk levels, and industry focus. We'll examine the best defense ETFs, their performance, and how Intellectia AI's AI-powered trading strategies can improve your portfolio in this guide.

What is a Defense ETF

Defense ETFs are exchange-traded funds that invest in businesses in the defense industry, such as drone manufacturers, cybersecurity experts, aerospace companies, and providers of weapons systems. By offering diversified exposure to defense stocks, these exchange-traded funds (ETFs) lower the risk of individual securities.

Why Invest in Defense ETFs

Rising Military Expenditures

There is an increase in global defense expenditure, with the NATO members spending above 1.3 trillion in 2023 alone. Countries such as Germany, Poland, and Japan have also seen a remarkable increase in military spending due to tensions emerging in the world. This trend increases demand for companies specializing in defense, and ETFs in this related industry are highly relevant.

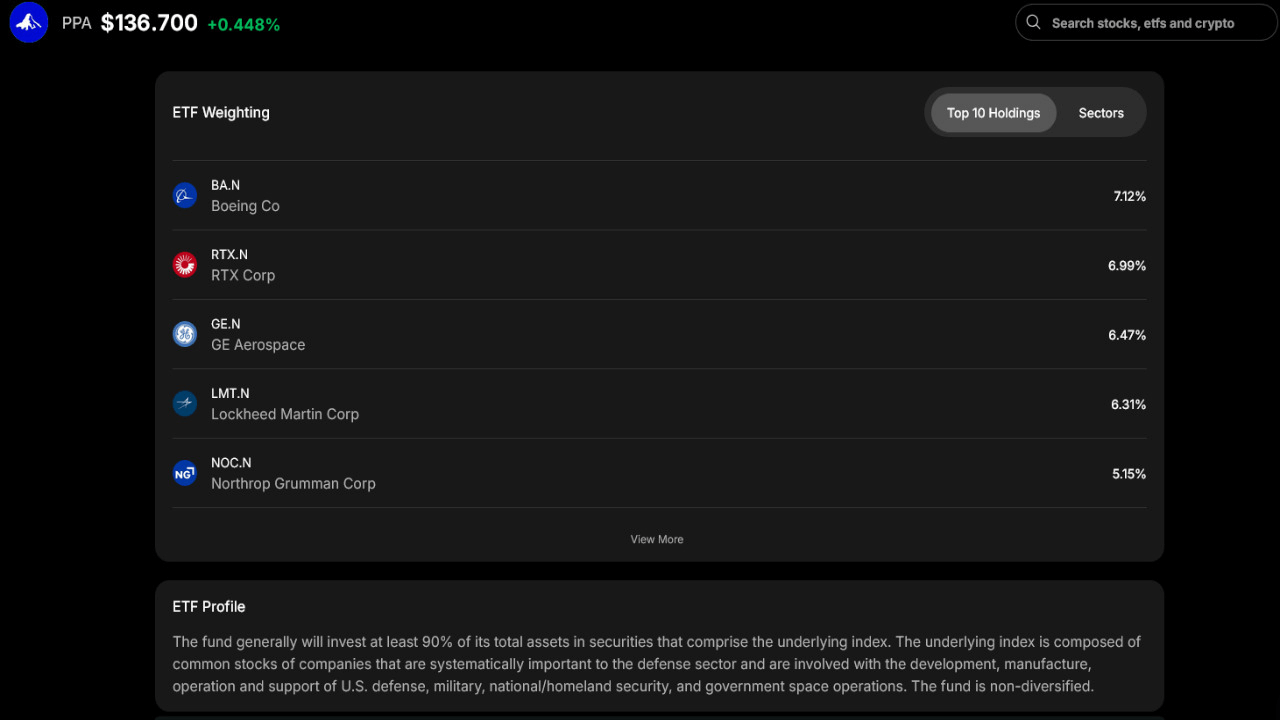

Government Contracts

Governments usually give defense companies long-term contracts, which are stable income sources, even in a down market environment. To illustrate, Lockheed Martin and Northrop Grumman are covered by multi-year contracts with the U.S. Department of Defense, making ETFs with stocks of these companies stable.

Growth Potential

The military industry is quickly transforming, incorporating AI, robotics, and cyber-security applications. Companies like Palantir and Raytheon Technologies are venturing into advanced warfare technology, which presents good growth potential. By investing in ETFs comprised of these innovators, you can enjoy that upside.

Diversification

Rather than placing a bet on one defense stock, ETFs provide in-depth diversification into aerospace, shipbuilding, defense software, and drone technology. For example, an ETF like the SPDR S&P Aerospace & Defense ETF XAR allocates more of its weight to mid-cap and large-cap players versus small-cap players, exposing you to less risk.

Criteria for Selecting Best Defense ETF

Before investing in a defense ETF, consider:

Expense Ratio & Fees

Smaller expense ratios also minimize the wear rate on your returns over the long run, particularly on a long-term holding. For example, XAR offers a competitive fee of 0.35 percent compared to 0.58 percent at PPA, which makes it more cost-efficient.

Geographic Exposure

Certain ETFs specialize in only U.S. defense stocks; others also contain international companies. An example is SHLD and EUAD, which provide exposure to European powerhouses such as Rheinmetall and BAE systems.

Industry Focus

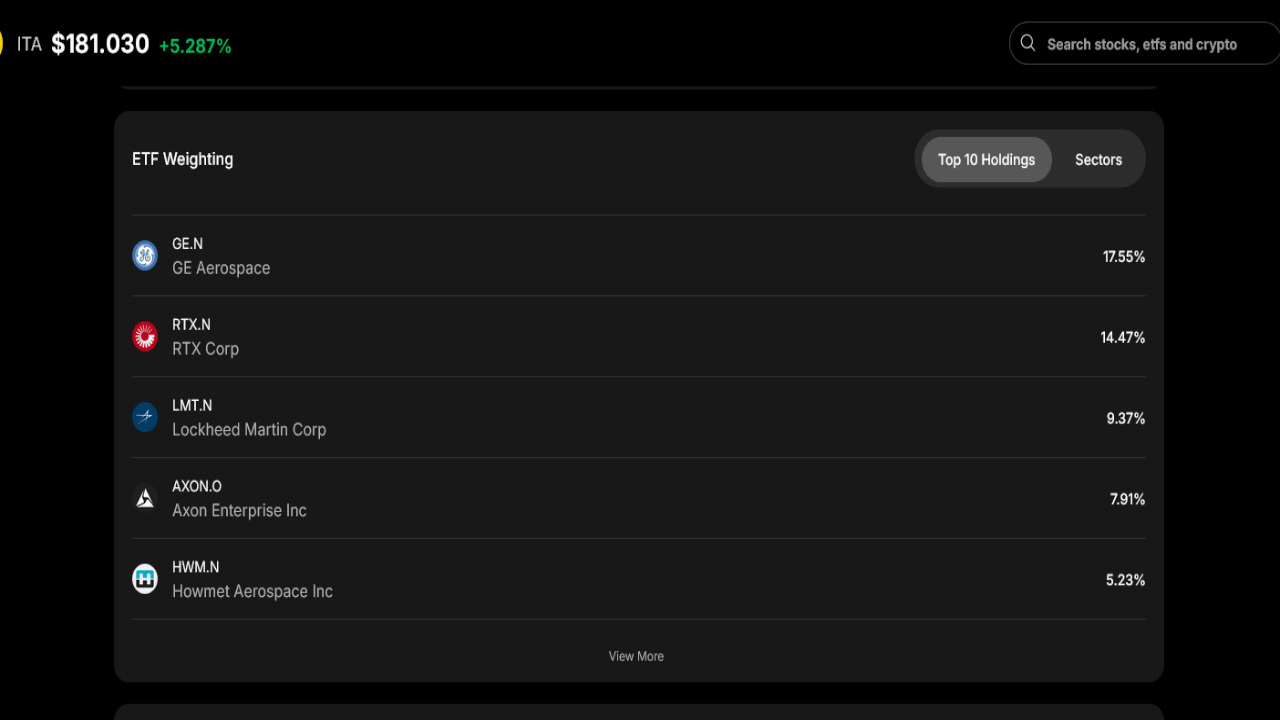

Various ETFs focus on aerospace, cybersecurity, and AI defense systems. ITA focuses more on aerospace, and SHLD incorporates more tech-savvy businesses and cybersecurity resources.

Risk Tolerance

Risk-averse investors should prefer non-leveraged ETFs such as ITA; those willing to take more risk/reward should consider equal-weight or active-managed ETFs. ETFs have leveraged defensive exposure, which is uncommon but will likely arise with increased market interest.

Dividend Yield & Growth Potential

Defense ETFs can provide competitive dividend income and capital appreciation. For example, the ITA currently yields ~0.92%, giving you automatic pay as you ride long-term trends within a sector.

5 Best Defense ETFs

| ETF | Ticker | Expense Ratio | Dividend Yield | Liquidity |

|---|---|---|---|---|

| iShares U.S. Aerospace & Defense ETF | ITA | 0.42% | 0.97% | High |

| Invesco Aerospace And Defense ETF | PPA | 0.58% | 1.11% | High |

| SPDR S&P Aerospace & Defense ETF | XAR | 0.35% | 1.25% | Moderate |

| Global X Defense Tech ETF | SHLD | 0.60% | 0.89% | Moderate |

| Select STOXX Europe Aerospace & Defense ETF | EUAD | 0.40% | 1.02% | Moderate |

iShares U.S. Aerospace & Defense ETF (ITA)

ITA is a market cap-indexed ETF that follows the performance of the U.S.-based aerospace and defense businesses, providing exposure to predominant manufacturers, assemblers, and distributors of military and commercial aircraft. It has 38 holdings, of which the most prominent positions comprise General Electric (GE), RTX Corporation (RTX), and Boeing (BA). Its AUM is 7.76 billion dollars, and its expense ratio is 0.40 percent.

ITA has had good returns, partially attributable to the rising defense expenditures and technological innovation in military airplanes. Its diverse portfolio subjects it to a mix of established defense contractors and up-and-coming aerospace innovators. Investors prefer ITA because of its stable performance and consistency; thus, it is among the ETFs in which to invest.

Invesco Aerospace And Defense ETF (PPA)

PPA is based in the United States and targets the defense and aerospace industries, with investments in military technology, homeland security, and government space activities. It has a diversified portfolio, and its top holdings include GE, Boeing, Lockheed Martin (LMT), and RTX. The AUM and performance fee of the fund include 5.29 billion and 0.58%, respectively.

PPA has recorded moderate growth with a YTD of 19.28%, and this has been due to increased defense budgets and increased geopolitical tensions. It has broad exposure to aerospace and defense, making it a viable investment option for investors who want security and want to make their investments grow over time. What is appealing about the ETF is its high dividend payout and its diverse portfolio.

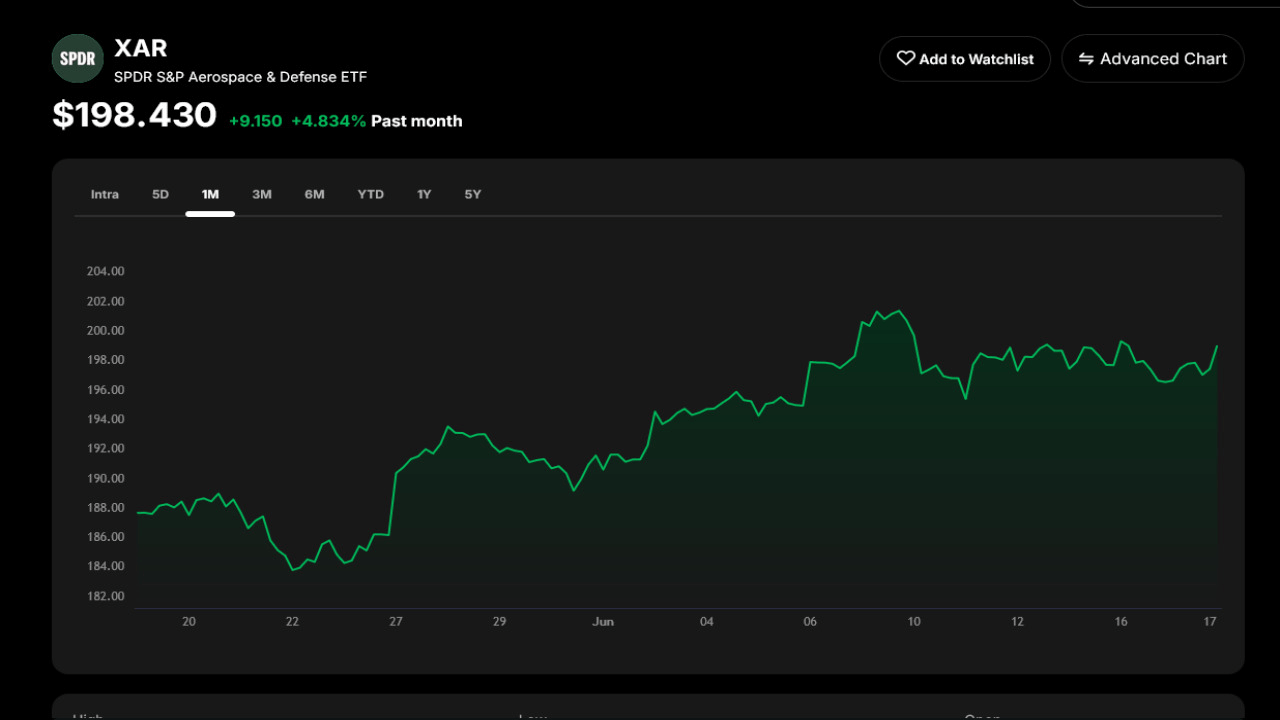

SPDR S&P Aerospace & Defense ETF (XAR)

XAR is a balanced, equal-weighted ETF that offers a balanced exposure to aerospace and defense companies. Among its most significant holdings are Archer Aviation (ACHR), AeroVironment (AVAV), and Curtiss-Wright (CW). With an AUM of $3.15 billion and an expense ratio of 0.35%, the fund costs 0.35% of the amount invested.

XAR's equal-weight approach helps mitigate the concentration risk because smaller defense firms are well-represented. Due to higher defense spending, it has outrun most of its competitors with a YTD return of 21.19%. XAR boasts of balanced exposure and cost-effectiveness, ensuring investors regard it as a solid competitor within the sector.

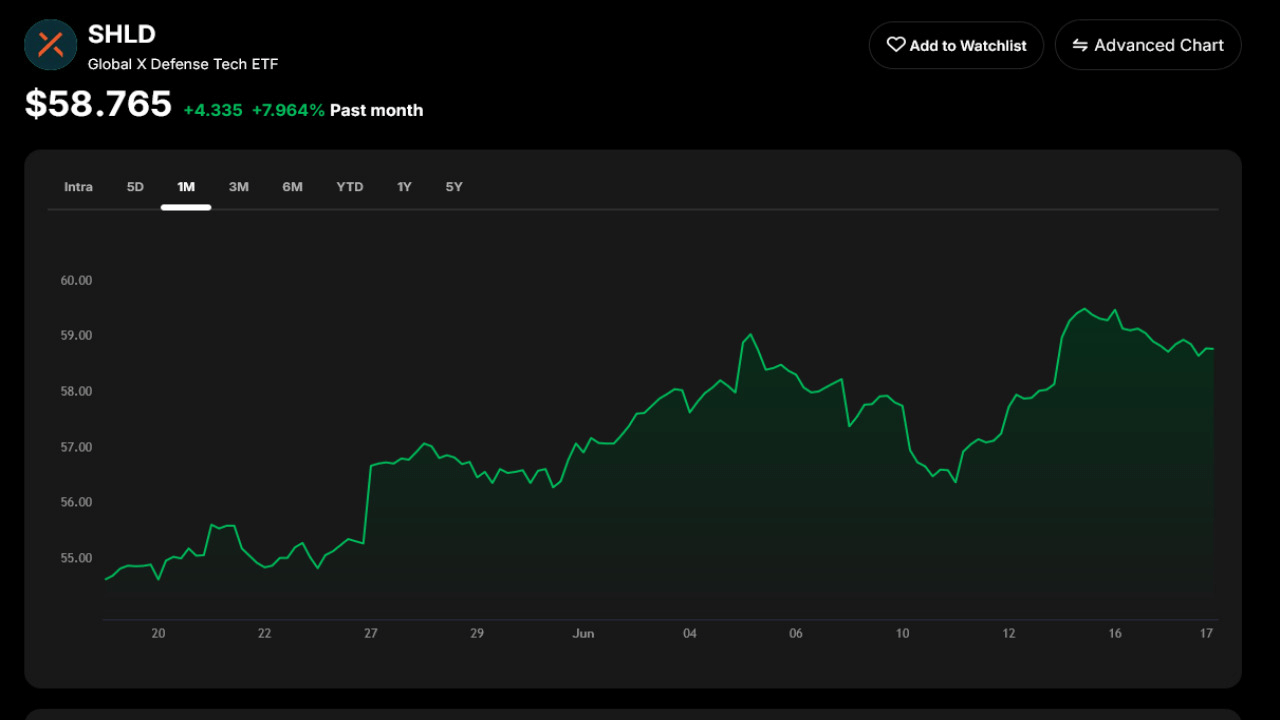

Global X Defense Tech ETF (SHLD)

SHLD is a technology-oriented defense ETF that invests in manufacturers of defense products, AI-based defense systems, and aerospace technology. Among its best investments are Palantir Technologies (PLTR), Rheinmetall AG, and RTX Corporation. The fund has an AUM of 2,57 billion USD and an expense ratio of 0,50%.

SHLD has generated impressive returns, where the YTD is 54.61 percent, owing to the rising global defense expenditure rates and the growth of AI-based military applications. SHLD is particularly appealing to investors because it specializes in emerging defense technologies and is a leading choice when an investor wishes to be exposed to next-generation military innovations.

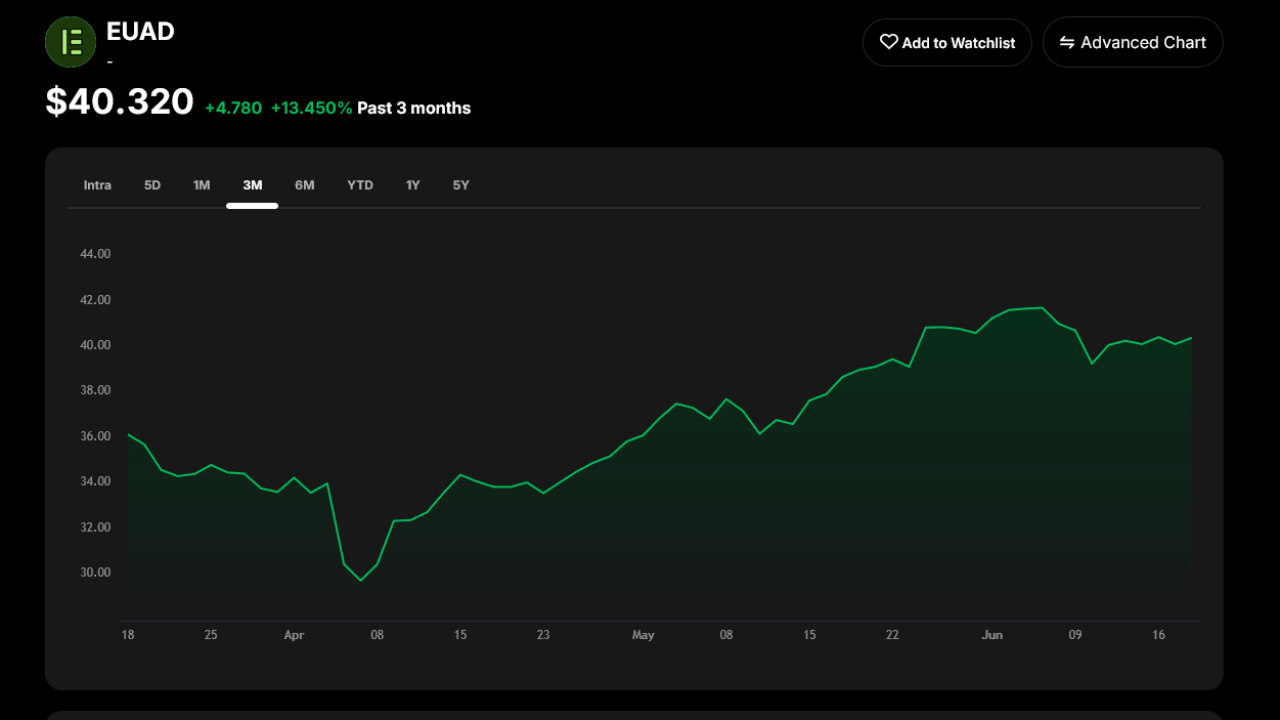

Select STOXX Europe Aerospace & Defense ETF (EUAD)

EUAD offers European-targeted defense access by investing in the continent's aerospace and military technology companies. Among its leading investments are Airbus (EADSY), Rheinmetall (RNMBY), and Safran (SAFRY). The fund has an asset under management of 902.7 million and an expense ratio of 0.50 percent.

The increased European defense budgets have proved favorable to EUAD, whose YTD performance was one of the best in the industry, recording 66.53%. Those investors seeking diversification outside of U.S. defense stocks are attracted to EUAD due to its broad exposure throughout Europe and its growth prospects.

Investment Strategies for Best Defense ETFs

Diversify Across Themes

Combine European (EUAD), tech-focused (SHLD), and broad-market (ITA/XAR) ETFs from the United States.

Blend Passive & Active Management

Funds such as the recently introduced actively managed IDEF provide more diversified, worldwide exposure.

Make Use of Intellectia AI's Resources

- AI screener to identify oversold defense ETFs.

- Stock pickers use premarket event-driven signals.

- Swing trading or intraday trading center for technical signals to determine entry points.

Rebalance Frequently

Utilize Intellectia's signals to automate some steps of the process, check your holdings monthly or quarterly, and reallocate based on relative strength.

Conclusion

Defense ETFs provide an access to a stable and promising market. Suppose you prefer centered giants such as ITA or more basic exposures such as SHLD and EUAD, built as active strategies such as IDEF. In that case, you can have a well-diversified portfolio.

Interested in tightening your strategy? Join Intellectia AI to get your AI-generated picks, notifications, and deep analysis that suits the defense industry every single day.