Key Takeaways

- Industrial stocks are the shares of companies in manufacturing, construction, transportation, and related sectors, crucial to economic stability.

- The industrial sector may benefit from reshoring, infrastructure spending, and technological advancements in 2025.

- Selection criteria includes strong financial fundamentals, dividend stability, valuation metrics, and order backlogs are key to choosing top industrial stocks.

- Top picks for 2025 include CNH Industrial, GE Aerospace, Emerson Electric, Honeywell International, and Eaton Corporation that offer diverse growth opportunities.

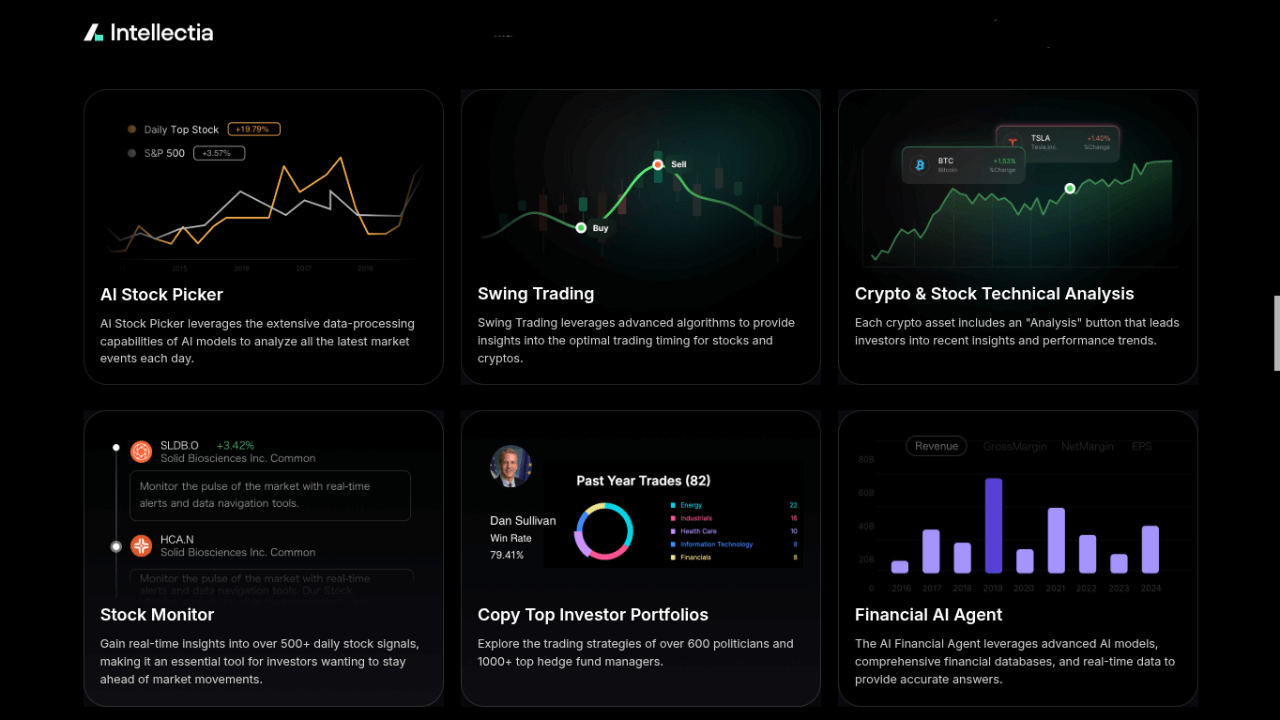

- For AI-powered investing, Intellectia.ai provides AI-driven tools like stock pickers and technical analysis to enhance investment decisions.

Introduction

Have you ever wondered how to navigate the stock market to find the best investment opportunities, especially in sectors that drive economic growth? The industrial sector, encompassing companies in manufacturing, construction, transportation, and machinery, is a cornerstone of the global economy.

In 2025, this sector is poised for growth due to trends like reshoring, infrastructure investments, and technological advancements. But picking the right stocks can be daunting without the right tools. That’s where Intellectia.ai comes in, offering AI-powered analysis, stock picks, and trading strategies to help you make informed decisions.

The article explores what industrial stocks are, why they’re worth your attention, how to select the best ones, and highlights five top industrial stocks to consider in 2025.

Source: intellectia.ai

What Are Industrial Stocks?

Industrial stocks represent companies within the industrials sector, which includes businesses involved in manufacturing, construction, transportation, machinery, and related services. These companies produce essential goods and services, such as heavy machinery, aerospace components, and logistics solutions, that keep economies running.

Notable examples include General Electric, Caterpillar, and Siemens. The sector is diverse, covering subsectors like aerospace and defense, construction equipment, and transportation services, making it a vital part of any diversified portfolio.

Why Invest in Industrial Stocks?

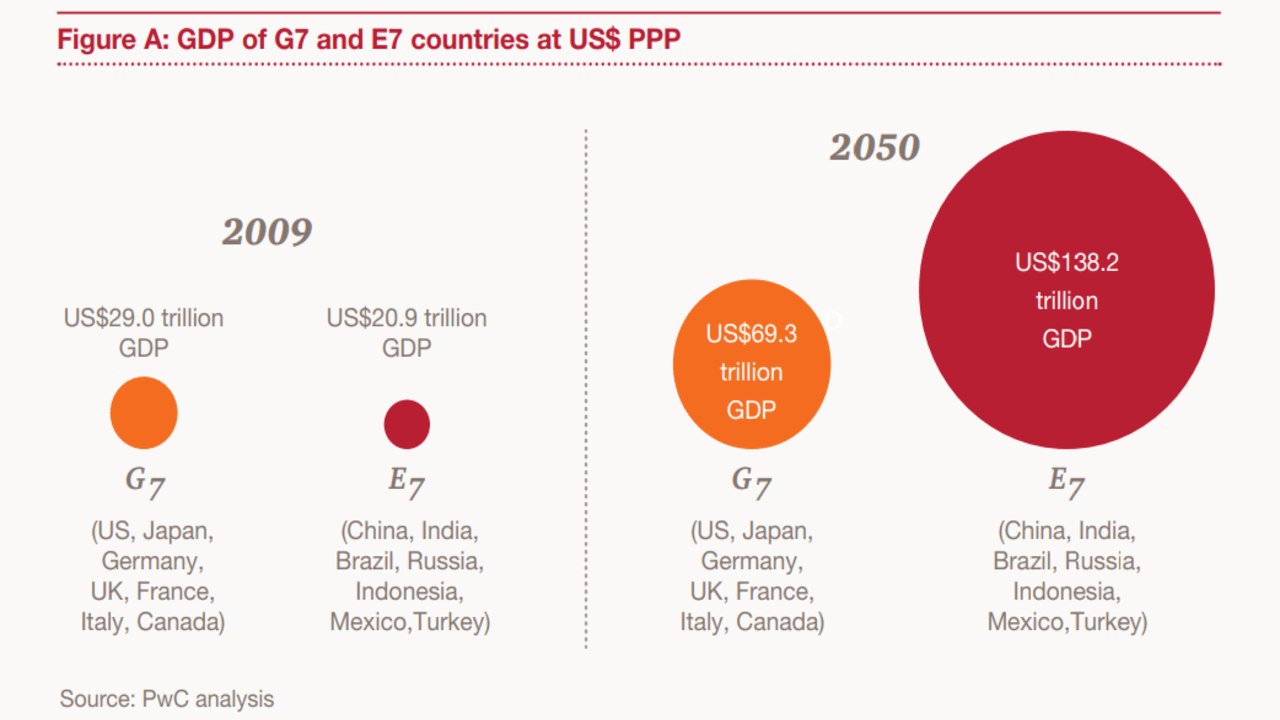

The industrial sector is often a bellwether for economic health and GDP growth, thriving during expansions and facing challenges during downturns. In 2025, several factors suggest industrial stocks could be a smart investment:

- Reshoring and Onshoring: A global push to bring supply chains back to domestic markets is boosting demand for industrial companies involved in manufacturing and construction.

- Infrastructure Spending: Governments worldwide are investing heavily in infrastructure, benefiting companies that supply equipment and materials.

Source: PwC Analysis

- Technological Advancements: Industrial firms are adopting automation, AI, and sustainable technologies, driving efficiency and growth.

- Resilience: Many industrial companies maintain stability through diversified operations, even in volatile markets.

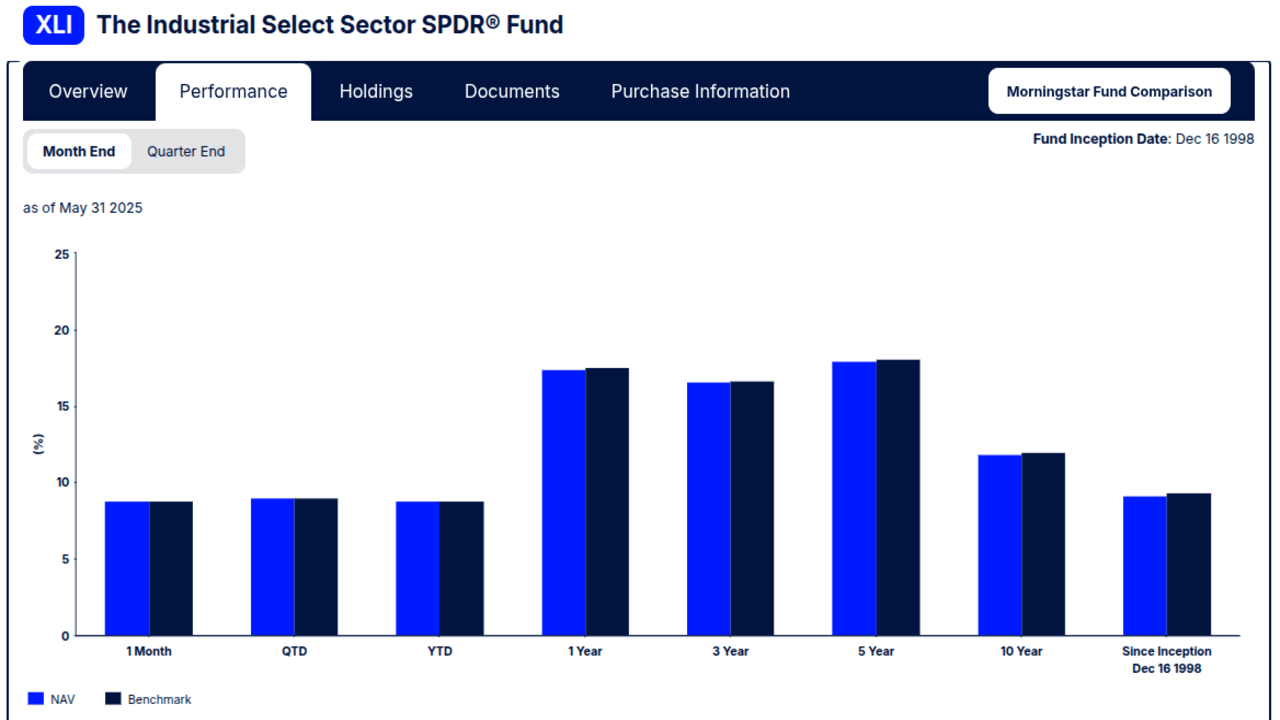

In 2024, the Industrial Select Sector SPDR ETF (XLI) outperformed many sectors, and analysts are optimistic about 2025 due to these trends.

Source: ssga.com

Criteria for Selecting Best Industrial Stocks

Choosing the right industrial stocks requires careful evaluation. Here are key criteria to consider, inspired by industry best practices :

- Financial Fundamentals: Seek companies with strong balance sheets, consistent revenue growth, and healthy profit margins. Metrics like return on equity (ROE), debt-to-equity ratio, and free cash flow are critical.

- Dividend Stability: For income-focused investors, prioritize companies with a history of reliable dividends. Check dividend yield and payout ratios for sustainability.

- Cyclicality and Economic Sensitivity: Understand how a company’s performance ties to economic cycles, as industrials can be cyclical.

- Valuation Metrics: Use price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) ratios to assess whether a stock is undervalued.

- Backlog and Order Pipeline: A robust order backlog signals future revenue potential.

- Innovation and R&D: Companies investing in research and development stay competitive in evolving markets.

Using Intellectia.ai’s AI screener can simplify this process by filtering stocks based on these metrics.

5 Top Industrial Stocks to Buy

Below is a comparative overview of five top industrial stocks for 2025, selected for their strong fundamentals and growth potential:

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| CNH Industrial | CNH | Farm & Heavy Machinery | $16.0B | Innovation in sustainable equipment, global reach |

| GE Aerospace | GE | Aerospace | $190B (est.) | Leadership in aviation, strong order growth |

| Emerson Electric | EMR | Industrial Automation | $60B (est.) | Digital transformation, stable dividends |

| Honeywell International | HON | Conglomerate | $140B (est.) | Diversified operations, sustainability focus |

| Eaton Corporation | ETN | Power Management | $120B (est.) | Electrification, global presence |

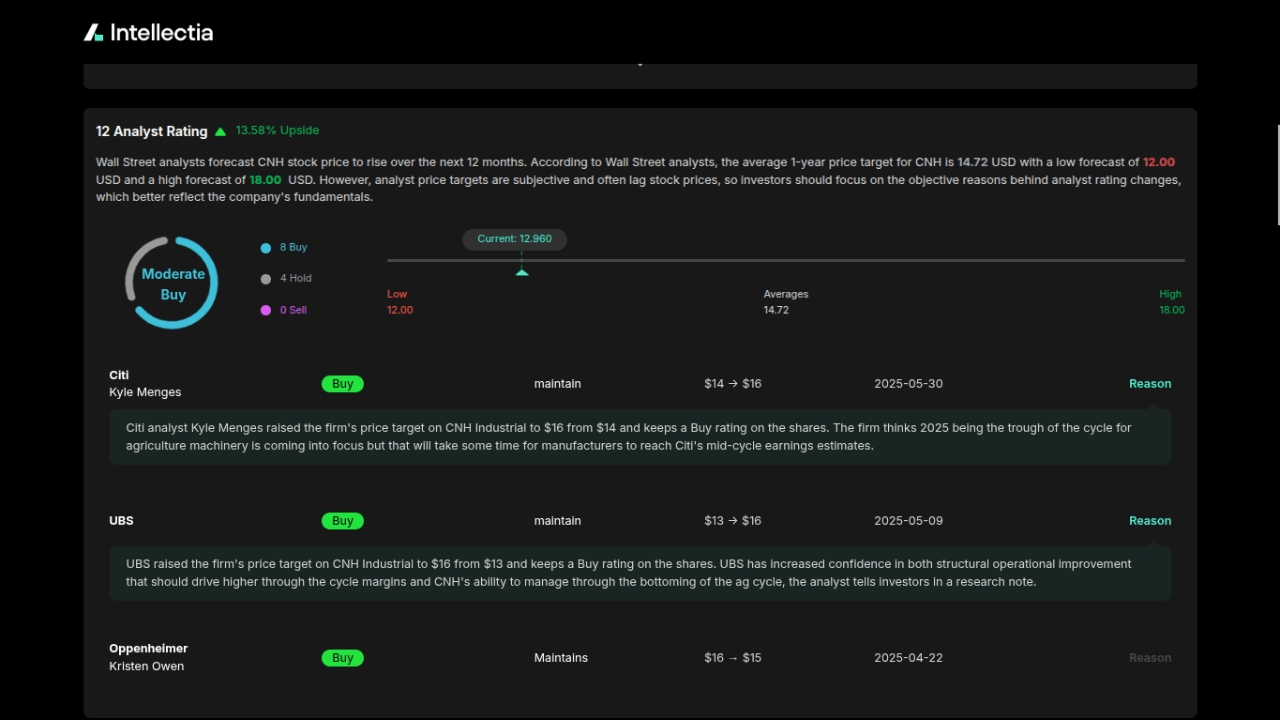

CNH Industrial (CNH)

CNH Industrial is a global leader in agricultural and construction equipment, operating renowned brands like Case IH and New Holland. Headquartered in London, it serves markets across North America, Europe, and Asia, producing tractors, combines, and construction machinery. The company’s commitment to sustainability and precision agriculture sets it apart in the heavy machinery sector.

In 2025, CNH launched innovative AI-driven sprayer technology, enhancing crop efficiency and reducing environmental impact. Its Case IH brand won a prestigious Red Dot Design Award for ergonomic design in 2024, reinforcing its reputation for innovation. CNH’s focus on digital farming solutions, like connected equipment, positions it for future growth.

Its global footprint and investment in sustainable technologies align with trends like precision agriculture and infrastructure growth, making it ideal for investors seeking growth and value. CNH’s modest dividend yield also appeals to income-focused investors.

Source: intellectia.ai

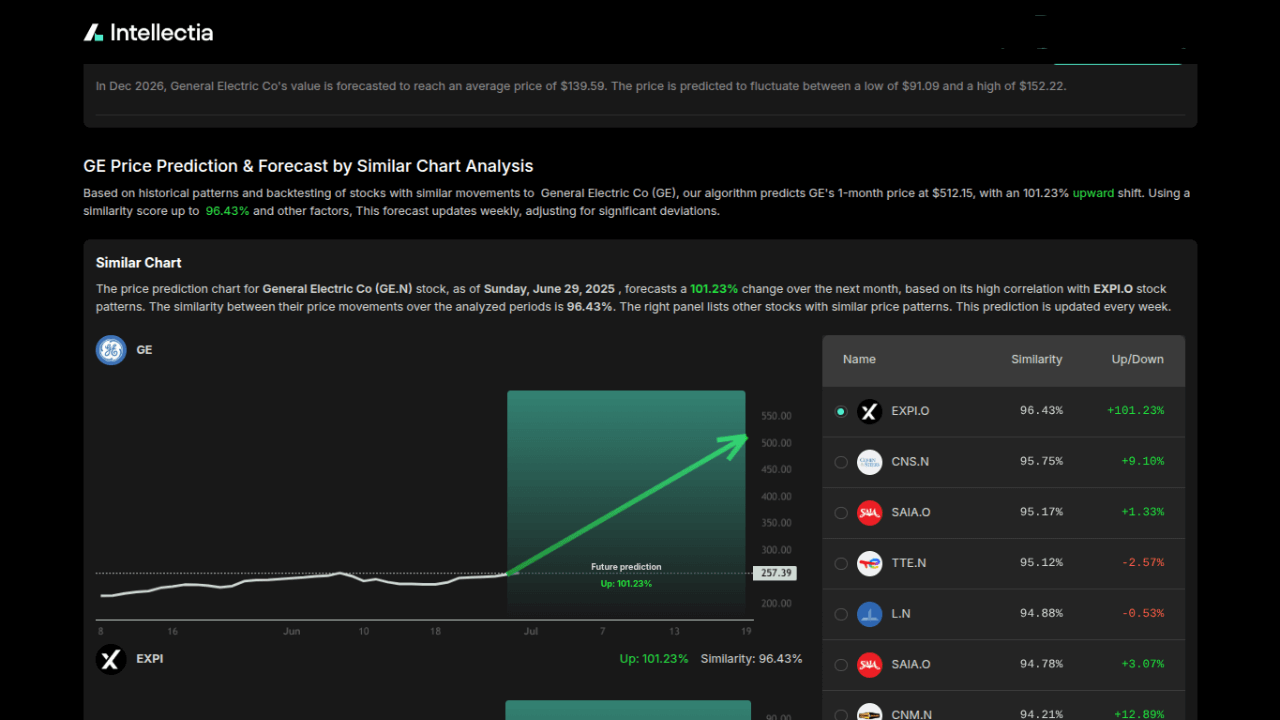

GE Aerospace (GE)

Following its 2024 restructuring, GE Aerospace focuses exclusively on aviation, producing jet engines, avionics, and aerospace systems for commercial and military applications. Headquartered in Cincinnati, Ohio, GE is a leader in the aerospace industry, serving airlines and defense contractors globally.

In Q1 2025, GE reported a 12% increase in orders and a 60% rise in adjusted EPS, driven by robust demand in commercial aviation and aftermarket services. The company’s $140B services backlog ensures revenue visibility, while its LEAP engine program continues to gain market share. GE’s investments in sustainable aviation technologies, like hybrid-electric engines, align with industry trends toward greener solutions.

GE’s leadership in aerospace, coupled with a strong order pipeline, makes it a standout for growth investors. Its focus on innovation and a recovering aviation sector positions GE for long-term success, especially for those betting on global travel demand.

Source: intellectia.ai

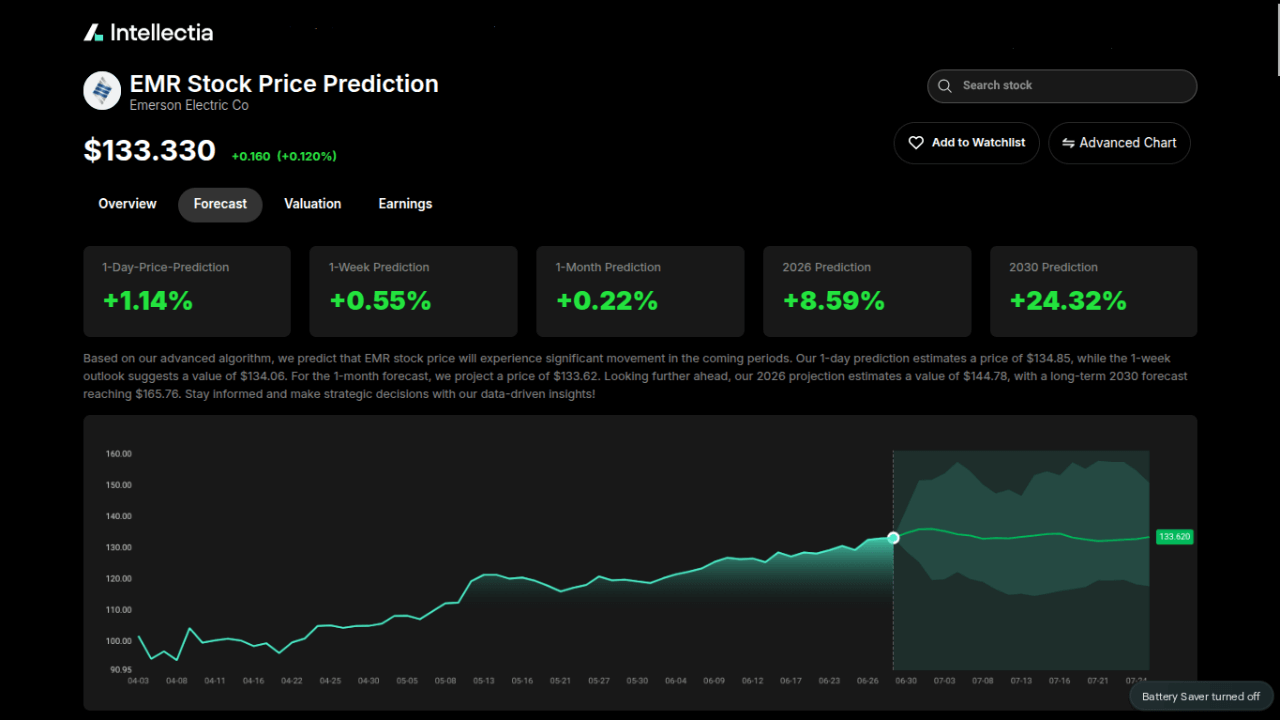

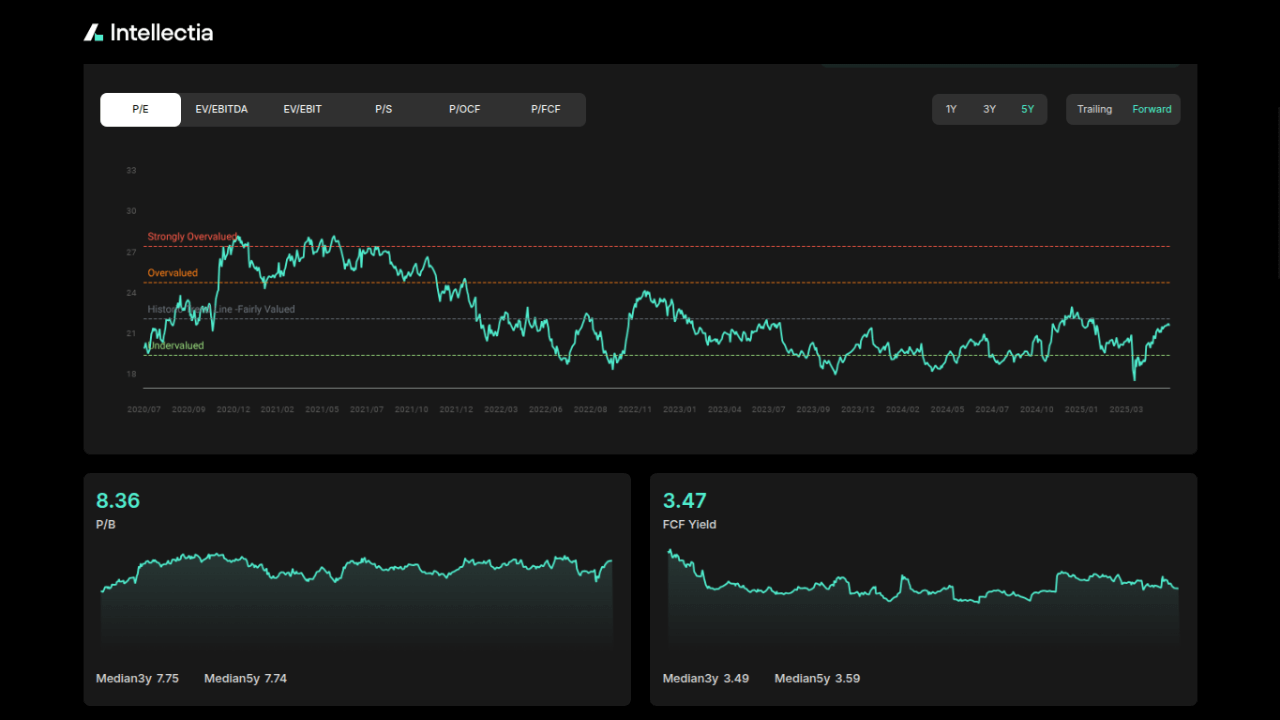

Emerson Electric (EMR)

Emerson Electric, based in St. Louis, Missouri, specializes in industrial automation, process control, and climate technologies. Its solutions cater to industries like oil and gas, chemicals, and manufacturing, making it a key player in industrial digitalization.

In Q1 2025, Emerson reported strong earnings growth, driven by its Industrial Internet of Things (IIoT) platforms and automation solutions. The company’s acquisitions, like its 2024 purchase of AspenTech, have bolstered its software capabilities, enhancing data-driven decision-making for clients. Emerson’s consistent dividend increases, with over 60 years as a Dividend Aristocrat, make it a favorite among income investors.

Emerson’s blend of digital transformation and reliable dividends offers both growth and stability. Its focus on automation aligns with Industry 4.0 trends, while its diversified customer base mitigates cyclical risks. The stock’s valuation, with a forward P/E of around 20x, is reasonable for its growth prospects, making it suitable for balanced portfolios.

Source: intellectia.ai

Honeywell International (HON)

Honeywell International, headquartered in Charlotte, North Carolina, is a diversified conglomerate operating in aerospace, building technologies, performance materials, and safety solutions. Its broad portfolio serves industries from aviation to commercial real estate, ensuring resilience across economic cycles.

In 2025, Honeywell reported strong growth across its segments, particularly in aerospace and sustainable building technologies. Its advancements in energy-efficient solutions, like low-carbon refrigerants, align with global sustainability goals. The company’s focus on AI and IoT integration enhances its competitive edge.

Honeywell’s diversified operations reduce sector-specific risks, while its innovation in sustainability appeals to ESG-focused investors. Its consistent dividend growth and strong cash flow make it a reliable choice for income and growth investors.

Source: intellectia.ai

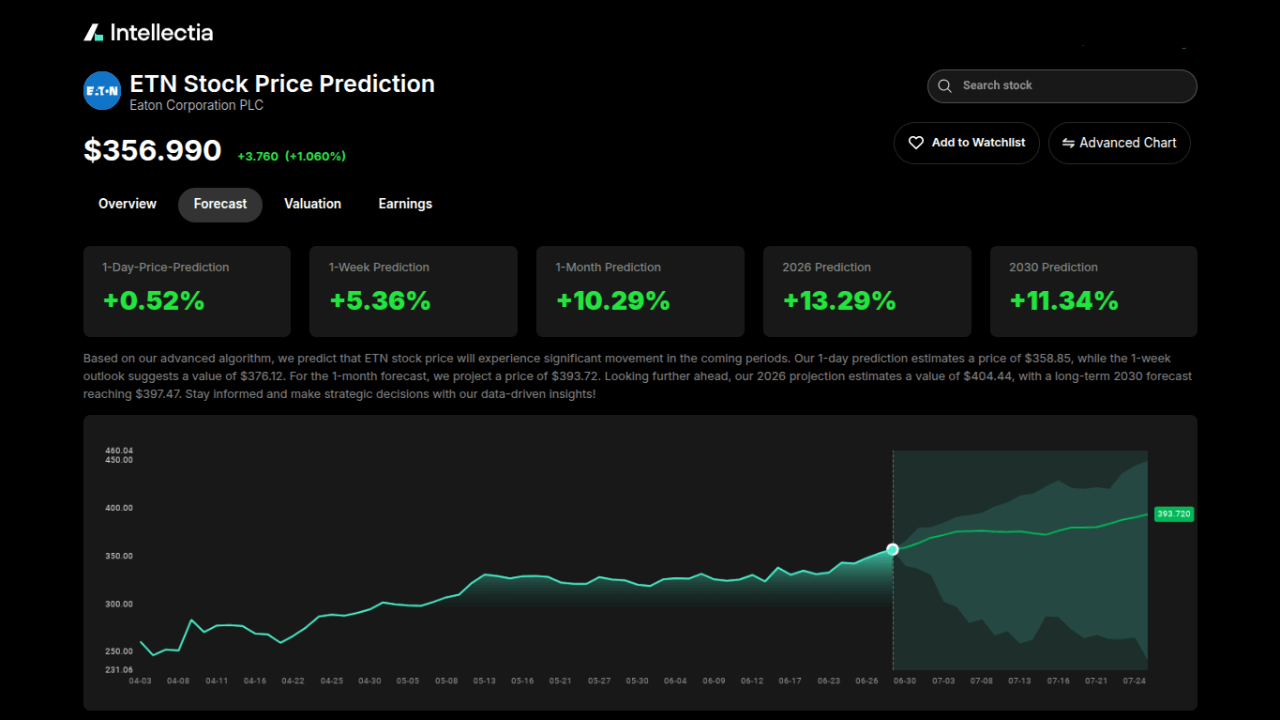

Eaton Corporation (ETN)

Eaton Corporation, based in Dublin, Ireland, is a global leader in power management solutions, serving aerospace, automotive, data centers, and electrical markets. Its products include electrical components, power distribution systems, and hydraulic systems.

Eaton’s Q1 2025 earnings highlighted strength in its electrical and aerospace segments, driven by global electrification trends and data center demand. The company’s investments in renewable energy solutions, like grid-scale storage, position it for growth in sustainable markets. Eaton’s consistent dividend increases and share buyback programs enhance shareholder value.

Eaton’s exposure to electrification and renewable energy trends makes it a forward-looking investment. Its global presence and diversified revenue streams provide stability and growth potential. Eaton is ideal for investors seeking exposure to both industrial and green energy trends.

Source: intellectia.ai

Investment Strategies for Industrial Stocks

Investing in industrial stocks requires a tailored approach. Here are strategies to consider:

- Long-Term Growth: Focus on companies with strong fundamentals and exposure to growth trends like electrification. Use Intellectia.ai’s AI stock picker to identify high-potential stocks.

- Dividend-Focused Investing: Seek stocks with stable dividends, like Emerson and Honeywell. Intellectia.ai’s AI screener can filter for dividend yield and payout ratios.

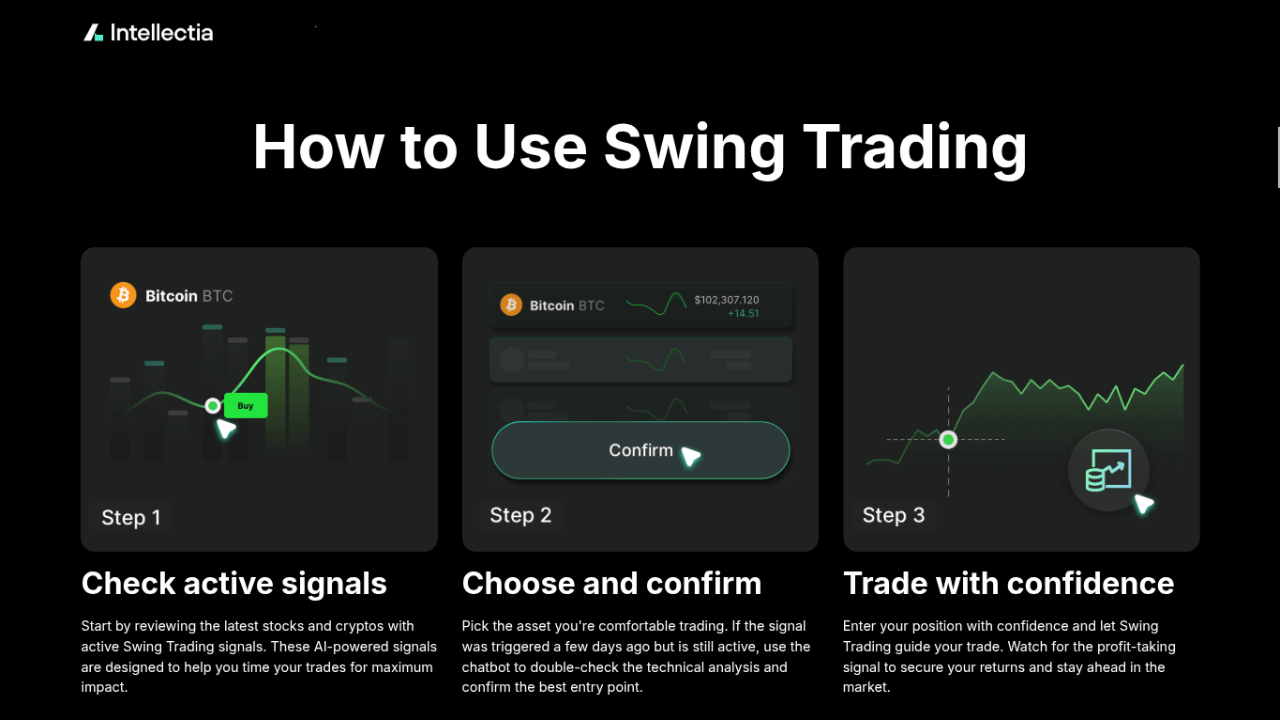

- Technical vs. Fundamental Analysis: Combine fundamental metrics with technical indicators like moving averages. Intellectia.ai’s technical analysis tools help identify entry and exit points.

- Sector Rotation: Time investments based on economic cycles, as industrials are cyclical. Intellectia.ai’s swing trading and day trading features can optimize timing.

Explore these strategies with Intellectia.ai’s tools to enhance your portfolio.

Source: intellectia.ai

Conclusion

Industrial stocks offer a compelling opportunity in 2025, driven by economic recovery, infrastructure investments, and technological innovation.

By focusing on financial fundamentals, dividend stability, and growth potential, you can select stocks like CNH Industrial, GE Aerospace, Emerson Electric, Honeywell International, and Eaton Corporation for your portfolio. These companies are well-positioned to capitalize on industry trends.

To stay ahead, sign up for Intellectia.ai and subscribe to pricing plans for daily AI stock picks, trading signals, and market analysis to guide your investments.