Key Takeaways

- Steel stocks are cyclical and present special growth prospects linked to worldwide manufacturing and infrastructure patterns.

- Prominent steel firms demonstrate strong financials, market penetration, and green steel innovation.

- Steel Dynamics (STLD) and Nucor (NUE) are notable for their robust margins and returns to shareholders.

- You can precisely choose the best steel stocks, time entries, and trend analysis with Intellectia AI.

- Using AI signals for swing or day trading, ETFs, and cyclical timing are examples of smart investing techniques.

Introduction

Have you been asking yourself whether it is prudent to invest in steel stocks in these volatile markets? Steel prices fluctuate as the economy does, and when things get noisy, it is hard without the proper tools to not feel lost. But this is the reality: the steel sector continues to be the bedrock of world infrastructure, manufacturing, and renewable energy, and the most superior steel equities can frequently neutralize strongly during industry upsurge.

This is where clever analysis and AI-based insights enter the game. Intellectia AI provides advanced tools that track steel stocks through trends, find good companies, and create actionable trading signals. So, without further ado, let us dive into what makes steel stocks such a valuable addition to your portfolio and what stocks you should be using in 2025.

What Are Steel Stocks?

Steel stocks are the stocks of companies that are involved in the production of steel, processing, fabrication, or distribution of steel and steel-related products. These companies can be divided into several categories:

- Steel Producers: Massive integrated mills that are involved in the production of steel by utilizing primary materials such as iron ore.

- Steel Processors and Fabricators: Firms that process steel into forms used in construction, vehicles, and manufacturing.

- Steel Distributors: Companies that hold and sell steel products to smaller firms and contractors.

When you buy steel shares, you are gambling on how much construction, vehicles, renewable energy, and infrastructure the world needs.

Why Invest in Steel Stocks?

Steel Industry Outlook

The global steel market is an anchor of industrial development, particularly with the increased investments in infrastructure, clean energy, and vehicle production. Steel demand recovered in 2024 despite the economic difficulties, and the experts predict it will keep expanding up to 2025.

Cyclical Nature

Steel inventory is very cyclical, increasing by large margins during economic booms and dropping during recessions. This volatility presents opportunities to both traders and long-term investors to buy low and sell high, at least as long as they get the timing right.

Key Sectors Driving Demand

Steel has a significant area of demand, which includes global infrastructure projects, electric vehicle production, wind and solar energy installations, housing, and commercial real estate

Inflation Hedge

Being a tangible commodity, steel can serve as an inflation hedge, preserving purchasing power as prices increase throughout the economy.

Diversification

The introduction of steel stocks to your portfolio will offer commodity exposure and an investment in the industrial sector, assisting in the diversification of your portfolio beyond technically inclined stock holdings.

Criteria for Selecting Best Steel Stocks

When choosing steel stocks to buy, consider:

- Revenue and Earnings Growth: Revenues that are steady and increasing demonstrate robust demand and effective operations.

- Profit Margins and Cost Efficiency: Despite fluctuations in the price of raw materials, leading companies maintain healthy margins.

- Balance Sheet Strength: During recessions, having a strong financial position lowers risk.

- Diversification of Products and Markets: Companies serving various industries and regions reduce reliance on any single sector.

- Vertical Integration: Owning the entire supply chain helps control costs and improve margins.

- ESG & Green Steel Innovation: Firms investing in low-carbon steel production are positioned for future growth as sustainability becomes critical.

5 Best Steel Stocks to Buy

| Company | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Nucor Corporation | NUE | Steel Production | $40B+ | Low-cost leadership, strong dividends |

| Steel Dynamics | STLD | Steel Production | $20B+ | Vertical integration, high margins |

| ArcelorMittal | MT | Global Steel | $25B+ | International presence, cost efficiency |

| Reliance Steel & Aluminum | RS | Distribution & Fabrication | $18B+ | Diversified products, stable margins |

| Cleveland-Cliffs | CLF | Integrated Steel | $12B+ | Raw material self-sufficiency |

Nucor Corporation (NUE)

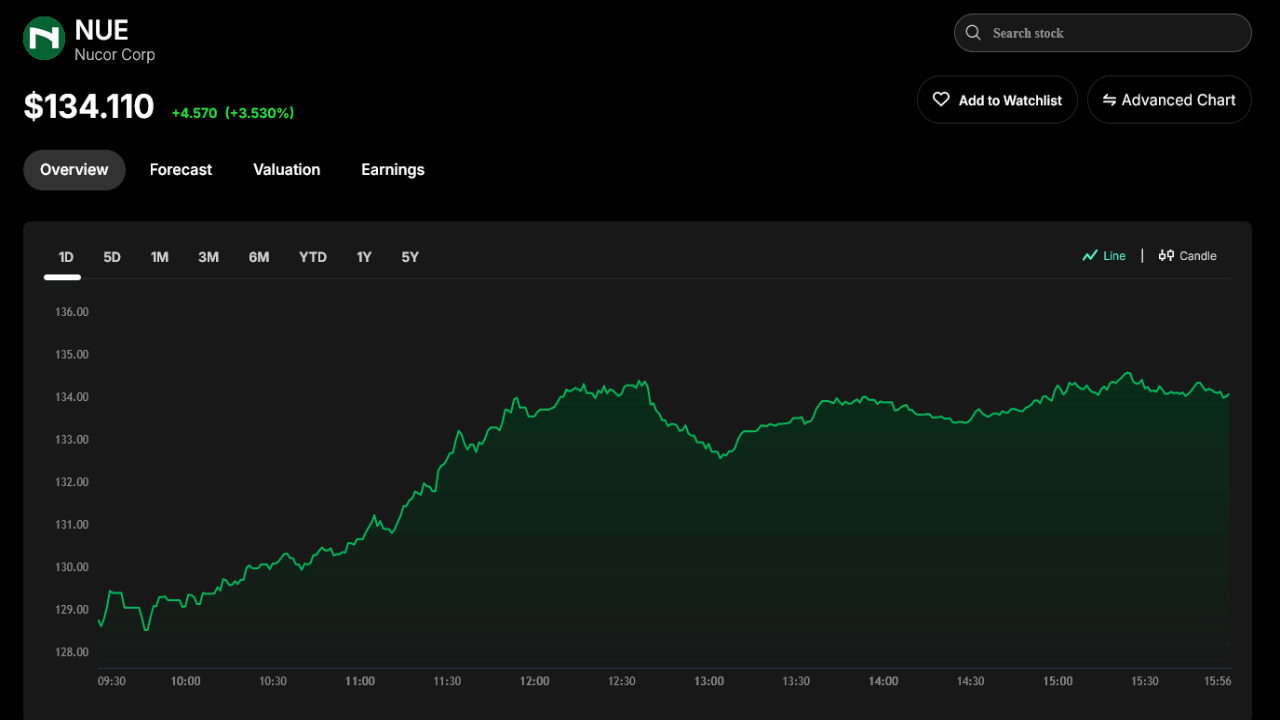

Nucor Corporation (NUC), America's largest steel manufacturing company, specializes in electric arc furnace (EAF) steel production, which is more efficient and environmentally sound than traditional steelmaking. Nucor shares remained consistent at about $134 in the initial half of 2025, with strong margins despite declining steel prices and solid cash flow. The firm also intends to increase the capacity of sustainable steel products to meet growing infrastructure and EV needs.

Nucor stands out due to a stable balance sheet, stable dividends, and being a pioneer in green steel, making it an ideal choice if you want a stable, progressive player in the U.S. steel industry. It is also a popular choice among income investors and is liked for its ability to dish out reliable income and leadership in the industry.

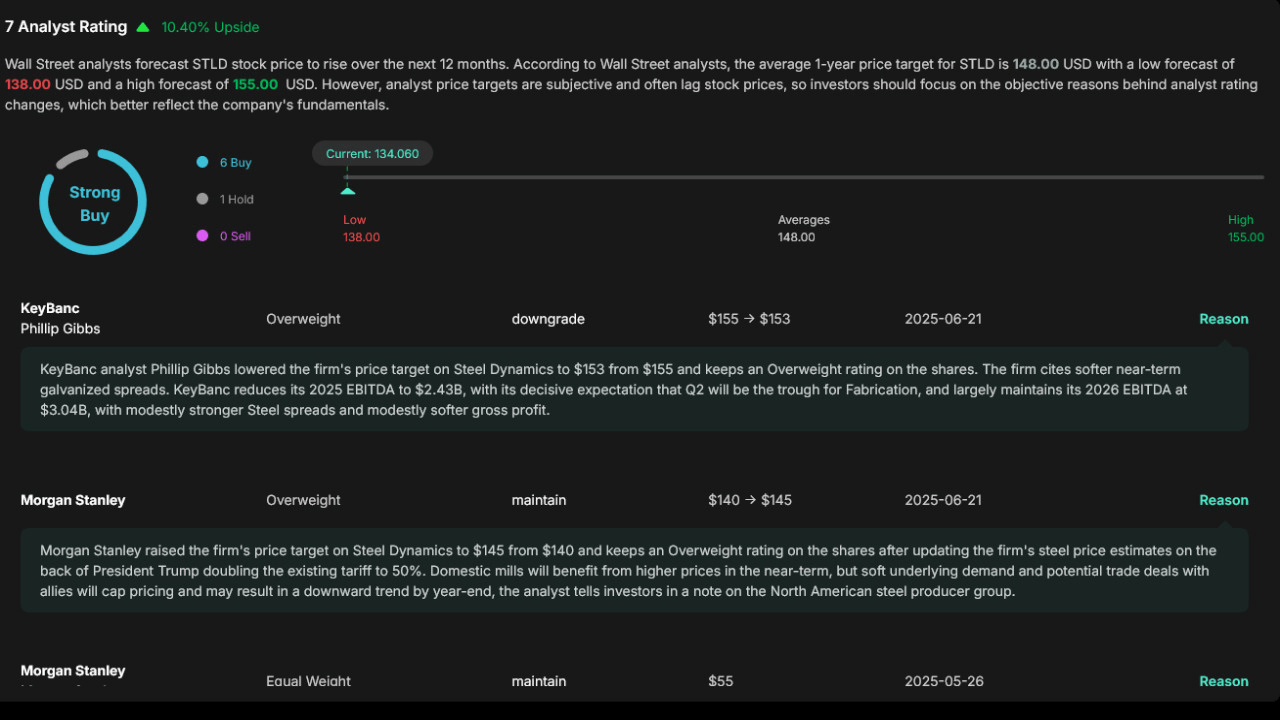

Steel Dynamics (STLD)

Steel Dynamics is a leading steel manufacturer in the United States, and it is characterized by vertically integrated facilities that use steel scrap to make high-quality steel products. STLD trades near $123 as of mid-2025 and it is rated as a strong buy, having posted substantial profits and performing healthy share repurchases caused by lower commodity prices. Recently, the company invested in additional flat roll steel capacity to meet demand in the construction and automotive markets.

Its cheap build and forecast efficiency are terrible reasons why it is an exceptional preference in an investor searching for solid income and devilish returns amid economic fluctuations. STLD also attracts investors who desire access to sustainability and manufacturing power.

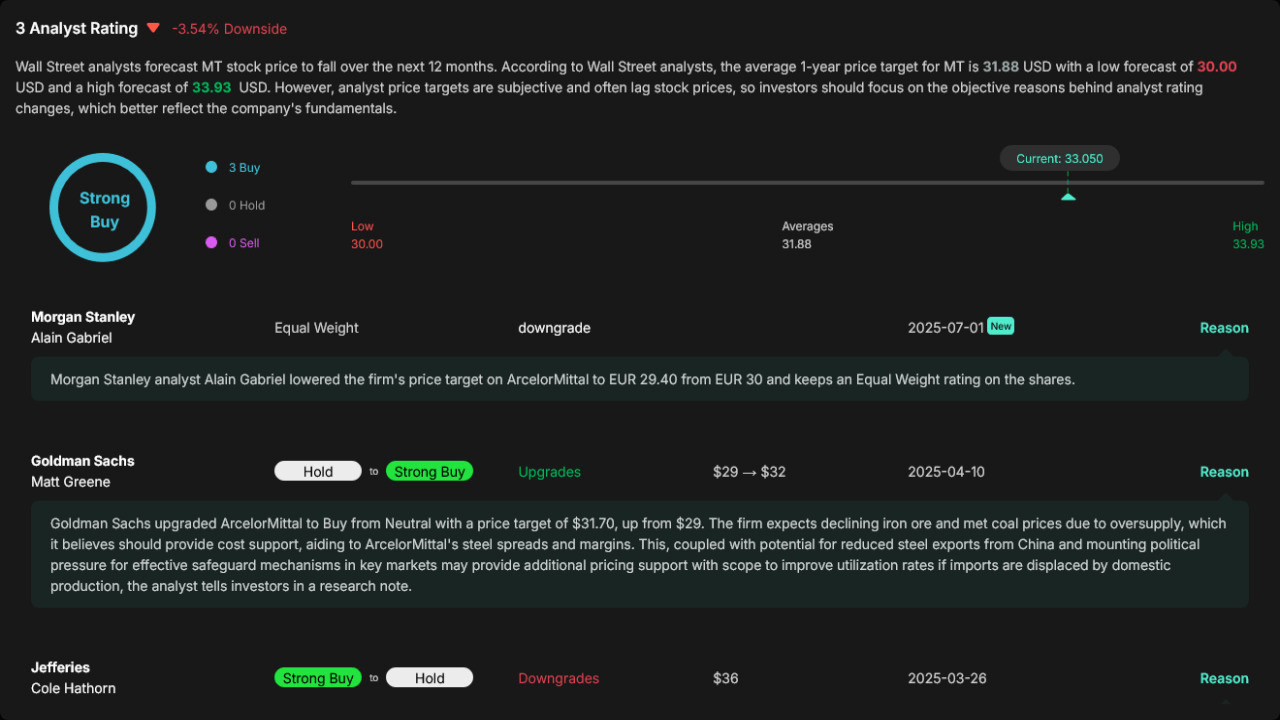

ArcelorMitta (MT)

ArcelorMittal (MT) is the largest steelmaker in the world, based in Luxembourg, with over 60 countries' production facilities and a wide variety of steel products. By 2025, it will trade around the fringe of $27 after weathering volatility because of European demand and cost pressures and according to analysts it is regarded as a strong buy. The company has announced additional investment in low-carbon steel production to meet the EU green targets.

The international presence, cost-cutting initiatives, and exposure to the emerging markets suggest that ArcelorMittal has good rebound potential, which investors would want as an international diversification steel stock. It is a good choice for people who have confidence in the future expansion of the world's infrastructure.

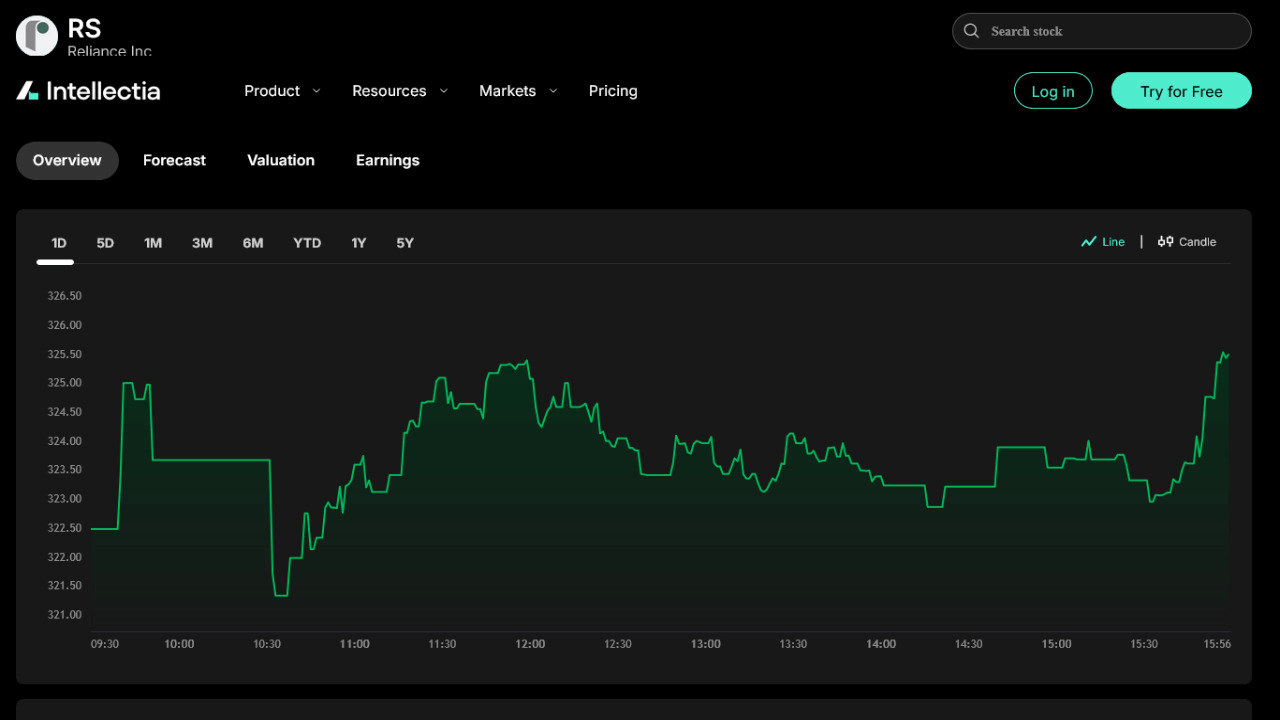

Reliance Inc (RS)

Reliance Inc (RS) is one of the largest metal service centers, selling steel and aluminum products to aerospace, energy, and construction industries. RS stock is currently priced at approximately $325 by mid-2025, with steady revenue realized despite a cooling metals market. This is motivated by the recent expansion of the company's distribution footprint across the Southeast of the U.S., as demand has increased.

Compared to the pure steelmaker, Reliance can shine due to diversified products and reliable margins, so it is a safe selection when you want less volatility and stable dividends. It fits well with investors who want exposure to the business cycle without the volatility of commodity prices.

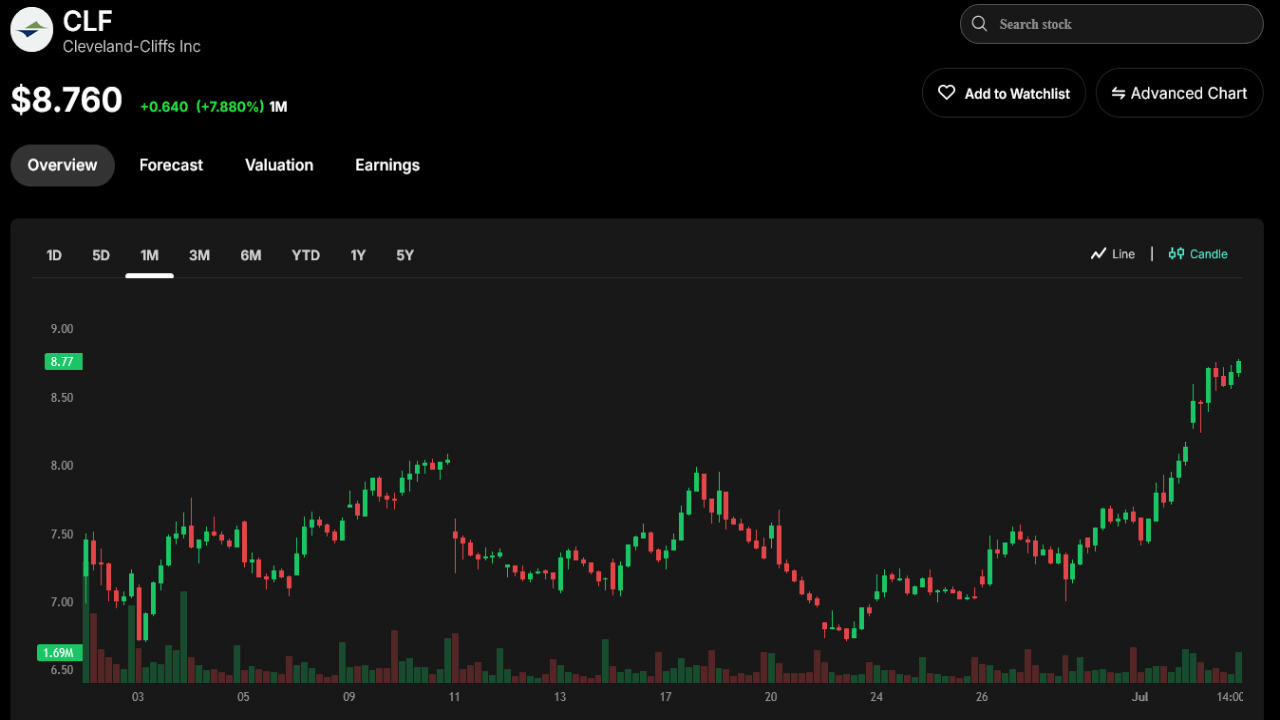

Cleveland-Cliffs (CLF)

Cleveland-Cliffs transformed into a full-scale steel producer with a high degree of control over its raw materials as an iron ore miner. As of July third 2025, CLF is trading at around $8.7, given the upside and volatility associated with these factors (steel prices and automotive demand). The company is also investing in electrical steel manufacturing, which is essential to EV motors, another avenue of growth.

It has a special advantage in vertical integrations and close connections to American automakers' manufacturing. It gives investors huge upside when commodity prices rally--though they have to hold on through rough patches. CLF is an alluring choice among investors who bet on U.S. industrial strength and U.S. electrification trends.

Investment Strategies for Steel Stocks

The cyclical nature of steel means you should approach this sector strategically. Here’s how to invest smarter:

Cyclical Investing — Timing the Economic Cycle

Steel prices typically surge during economic expansion and soften in recessions. Intellectia AI’s Swing Trading and Day Trading Center tools help you spot trend reversals to enter or exit positions at optimal times.

Thematic or ETF Investing

Prefer a diversified approach? Consider ETFs tracking steel producers or industrial metals. Alternatively, use Intellectia’s AI Screener to find thematic plays focusing on green steel or infrastructure growth.

Pair Trades or Sector Rotation

You might trade steel stocks against other cyclical sectors like energy or mining. Intellectia’s AI Trading Signals and Stock Technical Analysis help you identify pair trades and manage risk.

Conclusion

Steel inventories are always interesting to the market, where different investors can make money through their long-term holding, and traders can make money in the short-term market. The industry's profitability can be confirmed by companies such as Nucor, Steel Dynamics, and Reliance Steel, and it is particularly effective when supported by the potential of AI tools.

Want to take your next step in steel stocks? Sign in to your Intellectia AI account to receive daily AI stock recommendations, trading alerts, and analysis to keep you ahead of the market.