Key Takeaways

- Stocks under $10 are budget-friendly, enabling you to build a diverse portfolio with less capital.

- Small-cap or recovering companies under $10 can offer significant returns with the right research.

- Not all cheap stocks are undervalued; thorough analysis is essential to avoid poor performers.

- GEVO, RIG, SHLS, HL, and AMPY are promising due to their financial strength and market positioning.

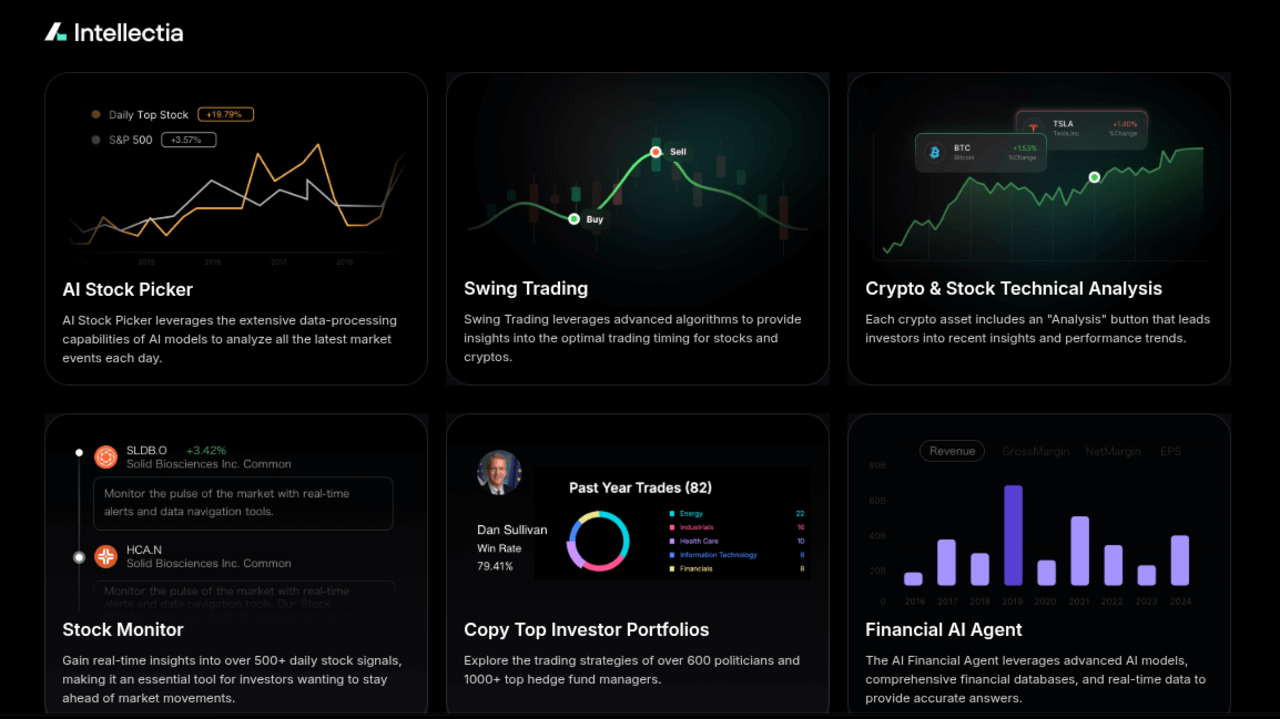

- You can use Intellectia AI’s features to identify and analyze high-potential stocks efficiently.

Introduction

Are you itching to invest in the stock market but find most stocks too expensive? Stocks under $10 are a fantastic way to start, letting you buy more shares with a smaller budget. The problem is, many investors avoid these stocks, fearing they’re too risky or lack growth potential. This misconception overlooks hidden gems that can deliver impressive returns.

With Intellectia AI’s AI-powered analysis, you can confidently navigate this space. In this expanded guide, we’ll explore the best stocks under $10 for 2025, share expert criteria for selecting them, and reveal strategies to boost your success.

Source: intellectia.ai

What Are Stocks Under $10?

Stocks under $10 are shares of companies trading below $10 per share on major exchanges like NASDAQ or NYSE. They’re distinct from other categories:

- Penny Stocks: Often under $5, traded over-the-counter (OTC), with higher risk due to low liquidity, minimal regulation, and volatile price swings.

- Small-Cap Stocks: Companies with market caps between $300 million and $2 billion, some of which trade under $10 but offer growth potential.

- Established Companies: Larger firms temporarily below $10 due to market downturns, operational challenges, or sector-specific pressures.

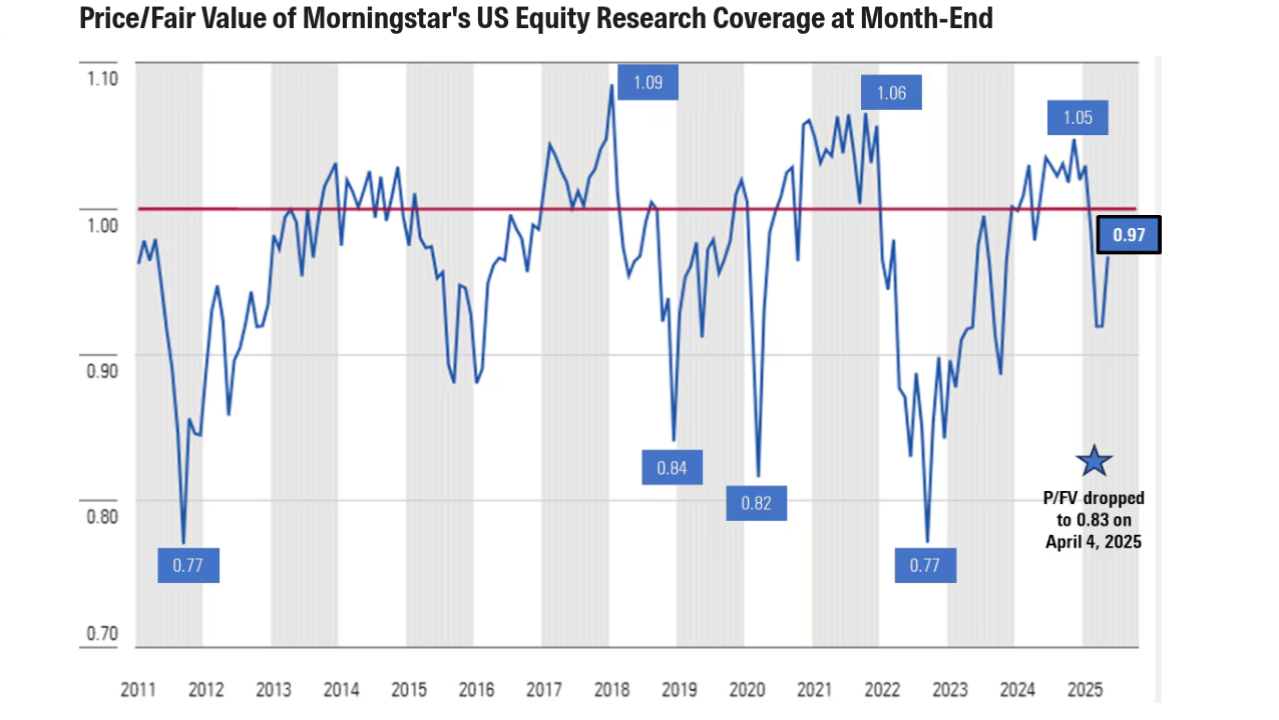

Understanding these differences is critical for assessing risk and reward. Stocks under $10 listed on major exchanges typically provide more transparency and stability than OTC penny stocks, making them a safer entry point for investors. Use Intellectia AI’s Stock Monitor to track their performance in real time.

Source: morningstar.com

Why Invest in Best Stocks Under $10

Investing in stocks under $10 offers compelling benefits:

- Accessibility for Beginners: Low share prices mean you can invest with modest capital, building a diversified portfolio without significant upfront costs.

- High Growth Potential: Small-cap companies or innovative startups under $10 may experience rapid expansion, leading to substantial price appreciation.

- Turnaround Plays: Established companies trading below $10 due to temporary setbacks can rebound, offering value for patient investors.

- Acquisition Targets: Promising small-cap firms are often acquired by larger companies, potentially yielding quick gains.

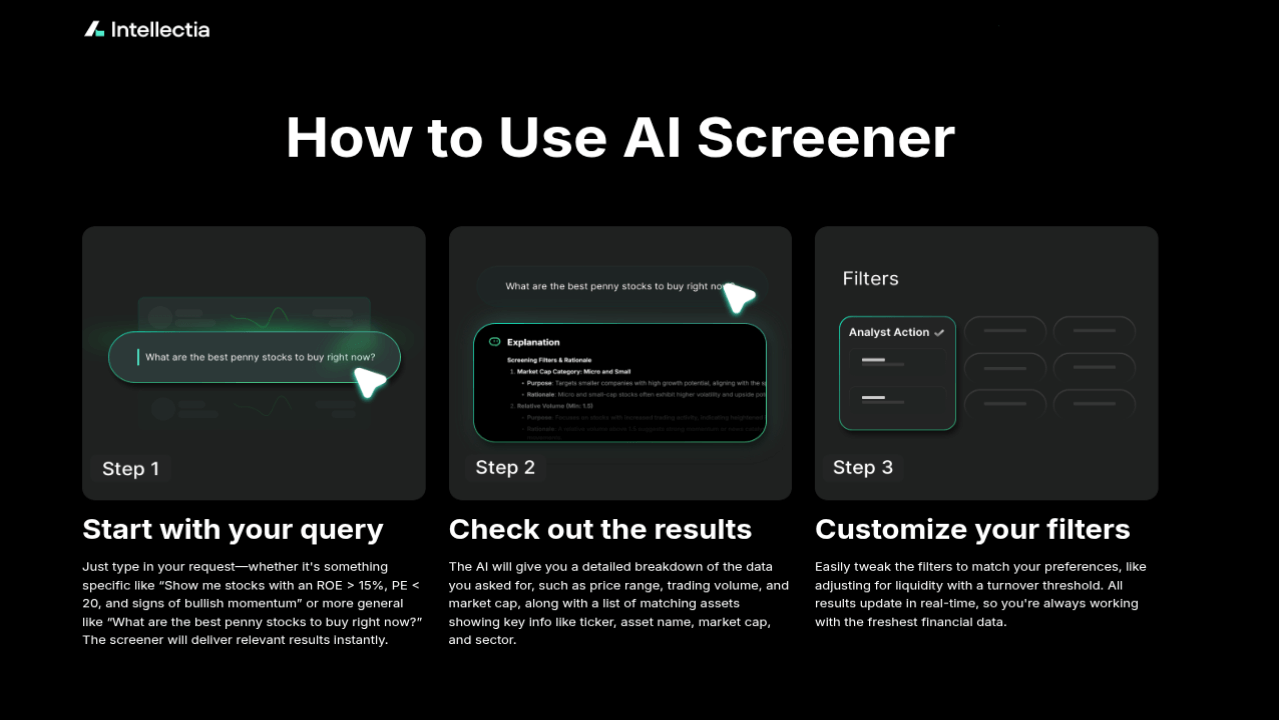

However, risks are real. Some stocks are cheap due to declining revenues, high debt, or weak management. To avoid pitfalls, prioritize companies with strong fundamentals and clear growth catalysts. Intellectia AI’s AI Screener helps you filter for these qualities, ensuring smarter investment choices.

Source: intellectia.ai

Criteria for Selecting Best Stocks Under 10 Dollars

Choosing the best stocks under $10 requires a disciplined approach. Focus on these key factors:

- Revenue Growth and Earnings Trends: Look for consistent revenue increases and improving profitability, signaling a sustainable business model.

- Cash Flow and Balance Sheet Strength: Positive cash flow and manageable debt levels indicate financial resilience, even in tough markets.

- Competitive Edge or Niche Market: Companies with unique products, proprietary technology, or dominance in a niche market have a stronger growth outlook.

- Insider Buying or Institutional Ownership: When company insiders or large institutions buy shares, it reflects confidence in future performance.

- Catalysts for Growth: Events like new product launches, strategic acquisitions, or regulatory approvals can drive stock prices higher.

Leveraging tools like Intellectia AI’s AI Stock Picker simplifies this process by picking top stocks under $10 premarket, saving you time and enhancing accuracy.

Best Stocks to Buy Under $10

Here’s a detailed look at five best stocks under $10 with strong growth potential, summarized in a comparative table:

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Gevo, Inc. | GEVO | Energy | $350M | Sustainable fuels, cost-cutting measures, analyst support |

| Transocean Ltd. | RIG | Energy | $4.2B | Global offshore drilling leader, robust backlog |

| Shoals Technologies | SHLS | Technology | $1.5B | Solar EBOS solutions, renewable energy growth |

| Hecla Mining Company | HL | Basic Materials | $2.8B | Major silver producer, rising metal prices |

| Amplify Energy Corp. | AMPY | Energy | $280M | Low-cost oil & gas, strong cash flow, dividends |

Gevo, Inc. (GEVO)

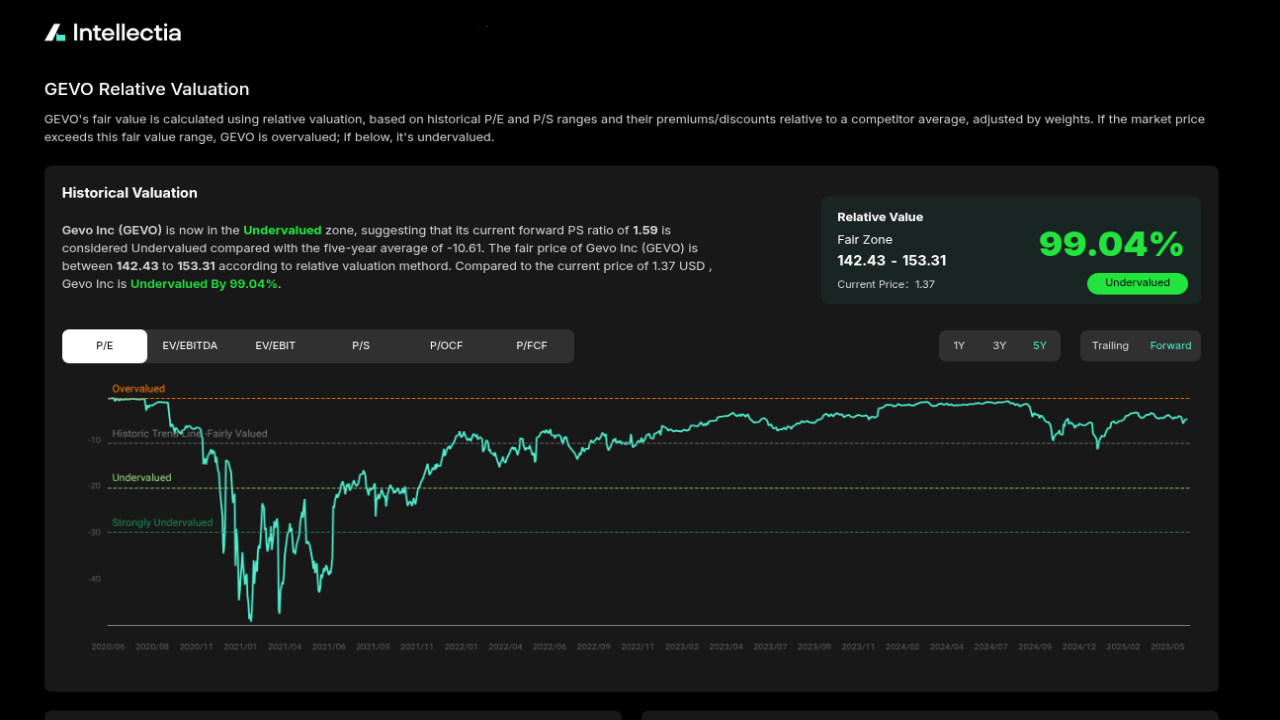

Gevo, Inc. is a trailblazer in sustainable energy, specializing in net-zero greenhouse gas emission fuels like sustainable aviation fuel (SAF), renewable gasoline, and renewable natural gas. The company operates three key segments: Gevo (research and development), Agri-Energy (Luverne Facility for ethanol and isobutanol production), and Renewable Natural Gas (RNG production from agricultural waste).

Recent strategic moves, such as selling its Luverne ethanol facility to focus on high-margin SAF production, have strengthened its financial position. Gevo’s partnerships with major airlines and energy firms signal strong demand for its products. Analysts rate it a moderate buy with a $14 price target, suggesting over 100% upside potential from current levels.

Its alignment with global decarbonization trends and innovative technology make it a standout for eco-conscious investors seeking growth in the green energy sector.

Source: intellectia.ai

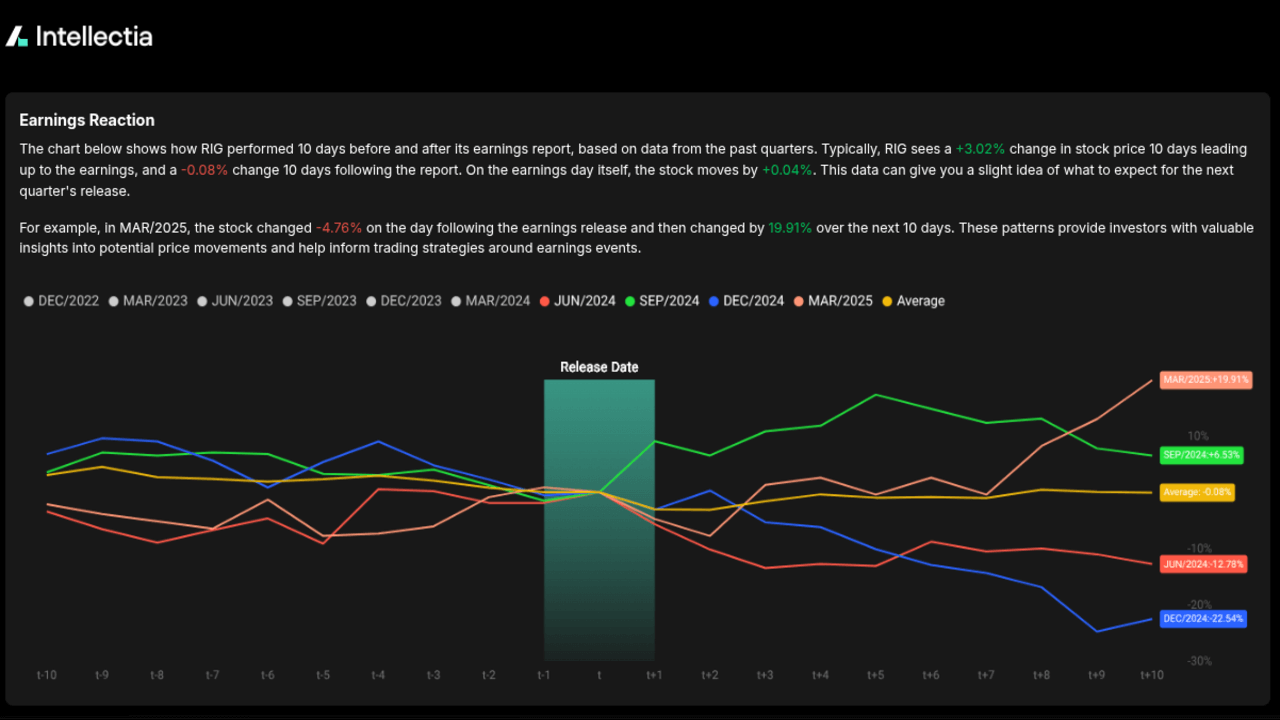

Transocean Ltd. (RIG)

Transocean Ltd. is a global leader in offshore drilling services, operating one of the world’s largest fleets of high-specification, deepwater drilling rigs. With a $4.2 billion contract backlog, the company is well-positioned to benefit from rising global energy demand and higher oil prices.

Recent efforts to reduce debt, streamline operations, and secure long-term contracts with major oil producers have bolstered its financial stability. Transocean’s expertise in ultra-deepwater drilling and its global presence give it a competitive edge in the energy sector.

Its ability to navigate cyclical oil markets makes it a compelling pick for investors seeking exposure to energy without the volatility of smaller players.

Source: intellectia.ai

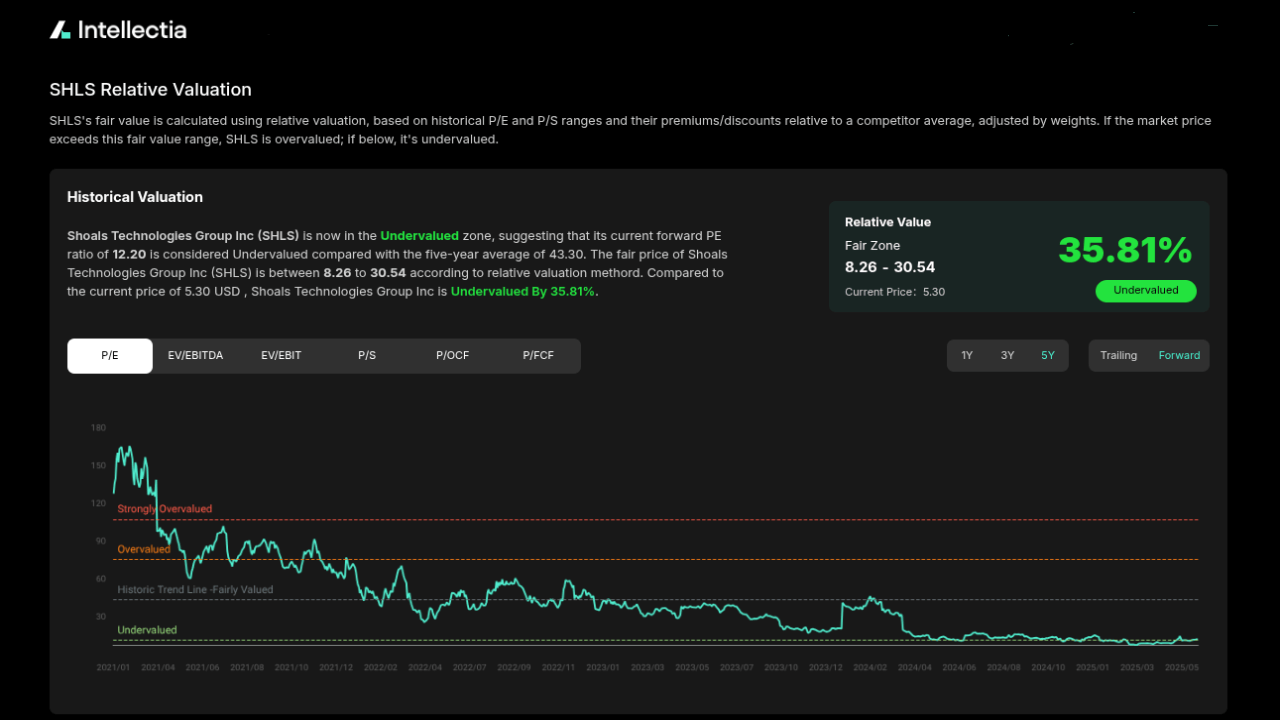

Shoals Technologies Group (SHLS)

Shoals Technologies Group is a key player in the renewable energy sector, providing electrical balance of systems (EBOS) solutions for solar energy projects. Its products, including wiring systems and combiners, are critical for efficient solar installations.

Shoals has capitalized on the global shift to clean energy, reporting consistent revenue growth, expanding profit margins, and a robust order pipeline. Recent contracts with major solar developers underscore its leadership in the fast-growing renewable energy market.

With solar adoption accelerating worldwide, Shoals is poised for sustained growth, making it an excellent choice for investors bullish on green technology and sustainable infrastructure.

Source: intellectia.ai

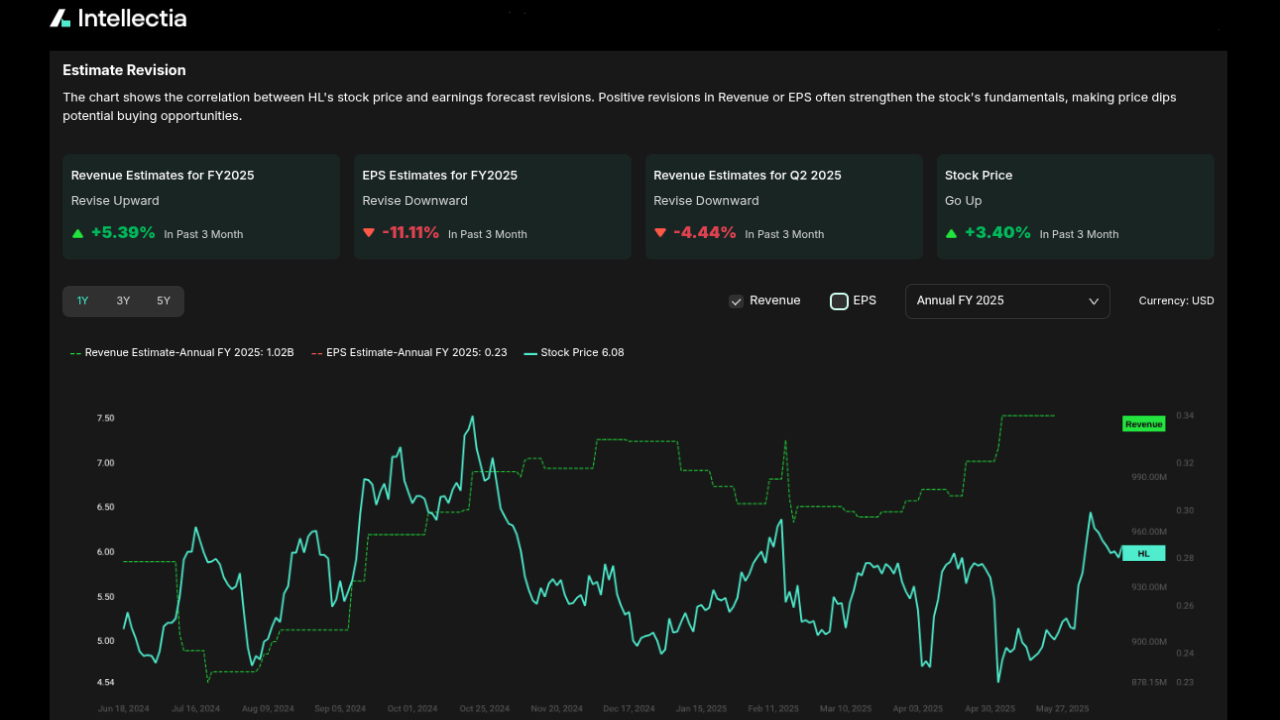

Hecla Mining Company (HL)

Hecla Mining Company is a leading U.S. producer of silver, with additional operations in gold, lead, and zinc mining. Operating mines in North America, Hecla benefits from rising precious metal prices driven by inflation concerns and industrial demand.

The company has increased production capacity while maintaining a commitment to sustainable mining practices, appealing to socially responsible investors.

Recent operational improvements and exploration successes have strengthened its growth outlook. Hecla’s diversified portfolio and established market position provide stability, making it a top pick for investors seeking exposure to commodities with long-term growth potential.

Source: intellectia.ai

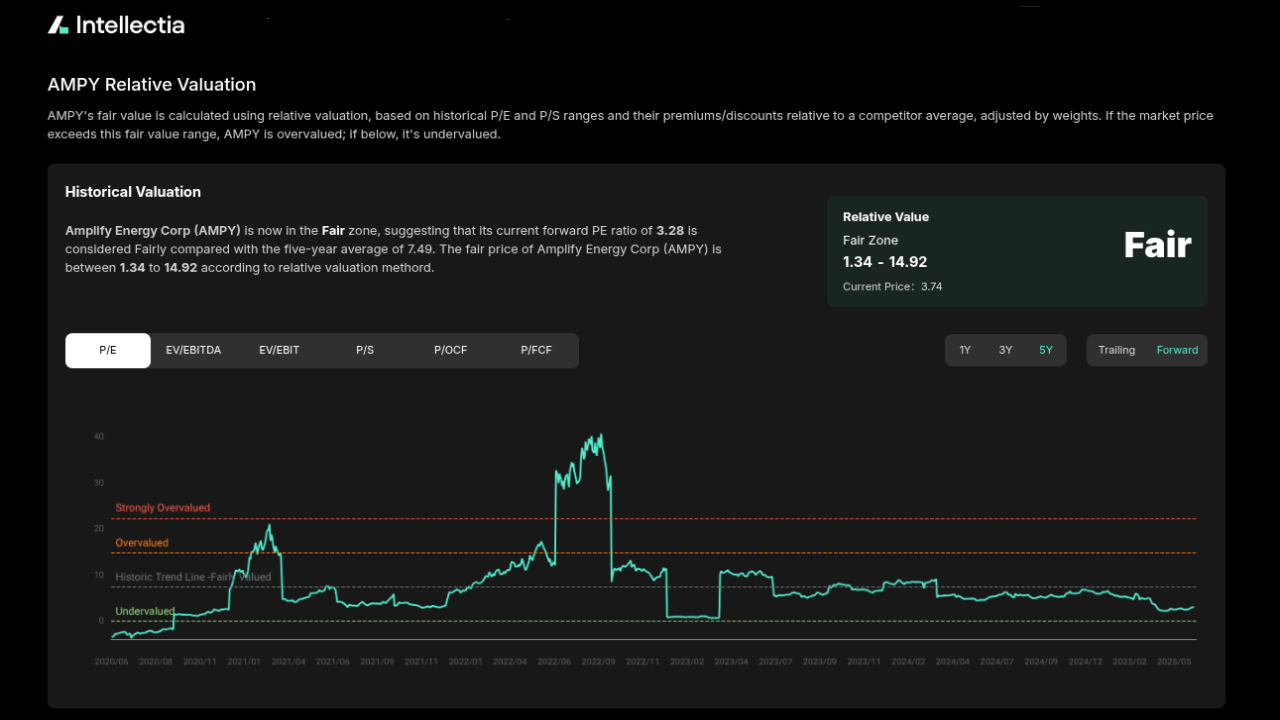

Amplify Energy Corp. (AMPY)

Amplify Energy Corp. is an independent oil and gas producer with a focus on low-cost, high-margin operations in the U.S. Its assets, primarily in Oklahoma and the East Texas Basin, have low decline rates, ensuring consistent production. The company generates strong free cash flow, which it uses to reduce debt and pay dividends, appealing to income-focused investors.

Recent operational efficiencies and favorable oil and gas prices have enhanced its financial health. Amplify’s disciplined approach to capital allocation and its resilience in volatile energy markets make it a standout choice for investors seeking both income and growth in the energy sector.

Source: intellectia.ai

Investment Strategies for Best Stocks Under 10

To maximize returns with stocks under $10, adopt these proven strategies:

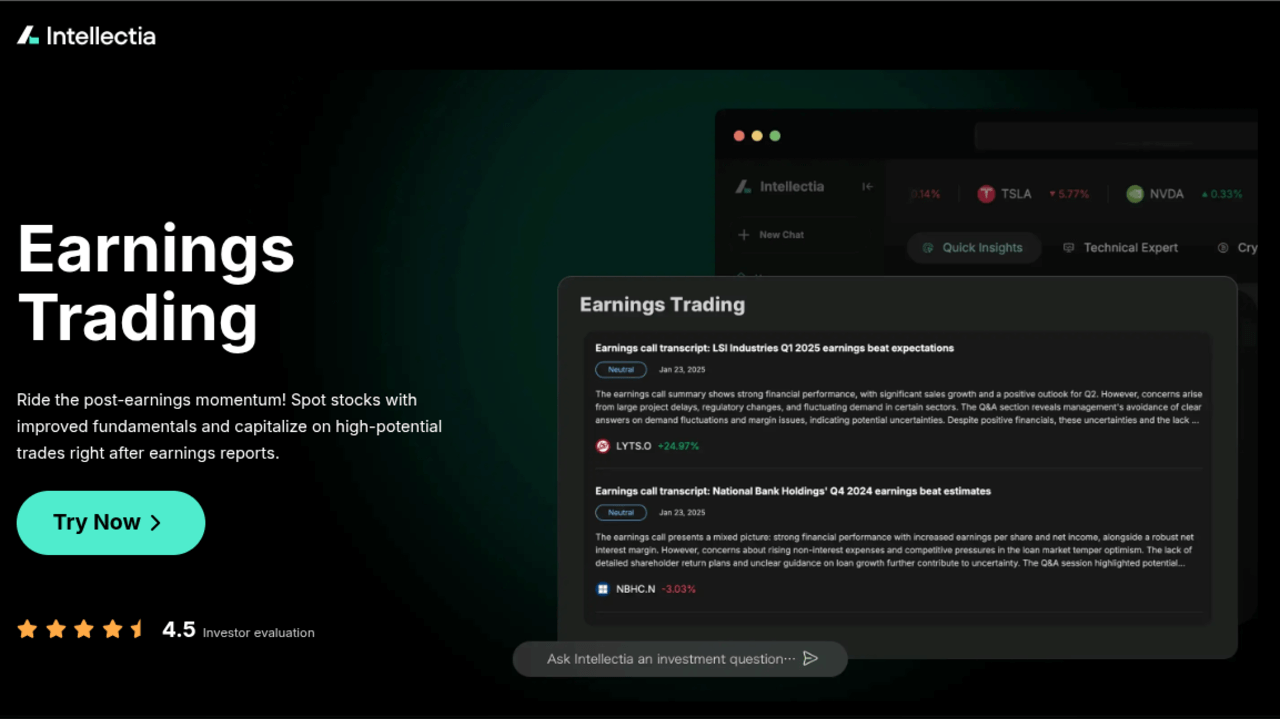

- Fundamental Analysis: Dive into financial statements to assess revenue, earnings, and debt levels. Intellectia AI’s Earnings Trading feature highlights stocks with strong post-earnings potential.

- Technical Analysis: Use chart patterns, moving averages, and indicators like RSI to time your entry and exit points. Intellectia AI’s Stock Chart Patterns and Stock Technical Analysis tools provide actionable signals.

- Diversification: Reduce risk by spreading investments across sectors or pairing stocks with ETFs. Intellectia AI’s AI Stock Picker suggests complementary assets.

- Short-Term Trading: Capitalize on price swings with day or swing trading. Explore Intellectia AI’s Day Trading Center and Swing Trading features for real-time signals.

Integrating these strategies with Intellectia AI’s AI-driven insights ensures you make informed decisions tailored to your risk tolerance and goals.

Source: intellectia.ai

Conclusion

Stocks under $10 are an exciting avenue for growing your portfolio without a large upfront investment. Companies like GEVO, RIG, SHLS, HL, and AMPY offer compelling opportunities due to their strong fundamentals, market positioning, and growth catalysts. However, success requires diligent research and strategic planning to avoid low-quality stocks.

Empower your investing journey with Intellectia AI. Sign up at intellectia.ai/sign-up to access daily AI stock picks, trading signals, and market analysis. Subscribe at intellectia.ai/pricing for personalized insights and start building your wealth with confidence today.