Key Takeaways

Natural gas stocks offer strategic investment opportunities as the sector serves as a critical bridge fuel during the energy transition, with specific companies positioned for substantial growth through 2026.

• LNG exports drive growth: Global LNG demand projected to grow 60% by 2040, with US export capacity expanding 50% between 2025-2030, creating opportunities for export leaders like Cheniere Energy.

• Infrastructure provides stability: Companies like Kinder Morgan controlling 40% of US gas transmission offer steady cash flows through "toll booth" business models, reducing commodity price volatility.

• Focus on financial health: Evaluate dividend sustainability, debt levels, and production costs—most profitable operations need $2.70-$3.20/MMBtu breakeven points to remain viable.

• Start with large-cap stability: Begin with market-cap leaders above $10 billion or diversified ETFs before moving to higher-risk producers for direct price exposure.

• Monitor market signals: Track inventory levels, contango-to-backwardation shifts, and new LNG terminal developments to identify optimal entry and rebalancing opportunities.

The sector's role supporting renewable energy intermittency and serving as the cleanest fossil fuel alternative positions quality natural gas investments for long-term relevance despite energy transition pressures.

Want to add the best natural gas stock to your portfolio? Natural gas continues to be a crucial fuel source, and the United States produces over 30 trillion cubic feet each year. The Morningstar US Energy Index has risen 6.70% year to date, while the broader market gained 18.91%. Several natural gas companies now offer attractive investment possibilities.

Natural gas plays a vital role as a "bridge fuel" in the transition to lower-carbon alternatives. This creates growth opportunities for top energy stocks, particularly companies like Cheniere Energy—currently the largest LNG producer in the U.S. and second-largest worldwide. Kinder Morgan stands out among infrastructure giants. The company's natural gas transmission network, the largest in America, moves 40% of U.S.-produced natural gas and provides both stability and growth potential.

This piece helps you learn about the best energy stocks and natural gas investments for 2026. You'll find companies with solid fundamentals and strategic advantages. We'll show you why specific natural gas stocks matter, how to review them using essential metrics, and ways to handle both risks and opportunities in this dynamic energy sector.

Why Natural Gas Stocks Are Gaining Attention in 2026

Natural gas stocks are getting investors excited for 2026 as market forces come together. You need to know these driving forces to spot the best natural gas stocks and opportunities in this changing digital world.

Cleaner alternative among fossil fuels

Natural gas beats other fossil fuels in environmental benefits. It creates only half the carbon dioxide emissions that coal does for the same power output. This difference helped America cut emissions. The switch from coal to natural gas cut CO2 emissions by 532 million metric tons between 2005 and 2022.

Natural gas burns much cleaner than other fuels. It releases very little sulfur, mercury, and particulate matter. This makes it a better choice than coal or oil. The numbers tell the story - natural gas produces 90,000 fewer pounds of carbon dioxide per billion British thermal units (Btu) than coal. That equals the yearly CO2 output of more than 9 average-sized cars.

Support for renewable energy intermittency

Natural gas helps make renewable energy possible. Gas-fired plants can start almost right away, unlike coal plants that take much longer. This quick response provides backup when solar or wind power changes.

Renewable energy needs this flexibility as it grows. McKinsey's research shows that "in the coming decades, a fully 'dispatchable' backup energy supply will be required to ensure the reliability of the power grid for multiday swings". The best batteries only provide up to 8 hours of backup power, so natural gas remains vital for keeping the grid stable.

The gas sector stays relevant even as renewables grow. Companies now pair gas infrastructure with low-carbon technologies like hydrogen blending and carbon capture. This makes natural gas even more important as we move toward cleaner energy systems.

Growing global LNG demand

Liquefied natural gas (LNG) exports make natural gas investments look promising. The U.S. Energy Information Administration expects LNG exports to grow from 15 billion cubic feet per day in 2025 to 16 billion cubic feet per day in 2026.

Global LNG demand should jump 60% by 2040. Europe wants to move away from Russian pipeline gas after the 2022 Ukraine invasion. Asia's industrial growth also drives this increase.

New LNG export capacity will grow by 300 billion cubic meters yearly between 2025 and 2030 - a 50% increase. The United States will provide about 45% of this growth. This makes America the world's top LNG exporter and creates opportunities for energy stocks with export capabilities.

U.S. LNG volumes hit new records in 2025, running "5 bcfd above a year ago". Bernstein analysts expect USD 5.00/mcf long-term. Others predict prices around USD 3.90 per MMBtu in 2026. These numbers suggest good value for investors who want to get into natural gas.

Expert Picks: 8 Best Natural Gas Stocks for 2026

Image Source: MacroMicro

Let's get into the best natural gas stocks you should think about for your 2026 investment portfolio. These expert picks come from different parts of the natural gas value chain and give you various ways to tap into this vital energy sector.

1. Cheniere Energy – LNG export leader

Cheniere Energy leads America's natural gas exports and ranks as the second-largest producer worldwide. The company made history in 2016 by becoming the first American business to export liquefied natural gas. Right now, Cheniere runs two major LNG facilities: Sabine Pass in Louisiana and Corpus Christi in Texas.

The company's growth story makes it really interesting. Cheniere just gave the green light to its Corpus Christi Midscale Trains 8 & 9 project. This will add more than 3 million tons per annum (mtpa) of liquefaction capacity. Once finished, along with other improvements, the Corpus Christi terminal will reach over 30 mtpa in total capacity. The company has boosted its platform-wide production outlook by more than 10%, and this is a big deal as it means that it will exceed 60 mtpa.

2. EQT Corporation – Largest U.S. gas producer

EQT Corporation produces 6% of America's natural gas. If it were a country, it would be the world's 12th largest natural gas producer. The company aims to take back its crown as America's biggest natural gas producer with about 2.5 Bcf/d of growth opportunities.

These growth plans include nearly 1.5 Bcf/d in supply deals with planned natural gas-fired power plants that serve AI data centers. EQT also plans to pump up flow through its Mountain Valley Pipeline, which now runs at 1.2-1.4 Bcf/d against a 2 Bcf/d capacity.

3. Kinder Morgan – Infrastructure powerhouse

Kinder Morgan runs North America's largest natural gas infrastructure network, with about 83,000 miles of pipelines and 143 terminals. Their massive system moves about 40% of all natural gas used in the United States.

The company's network links to every major natural gas resource play in America, including the Eagle Ford, Marcellus, Bakken, and Permian basins. This strategic setup lets Kinder Morgan profit from gas flows no matter which production region is doing well.

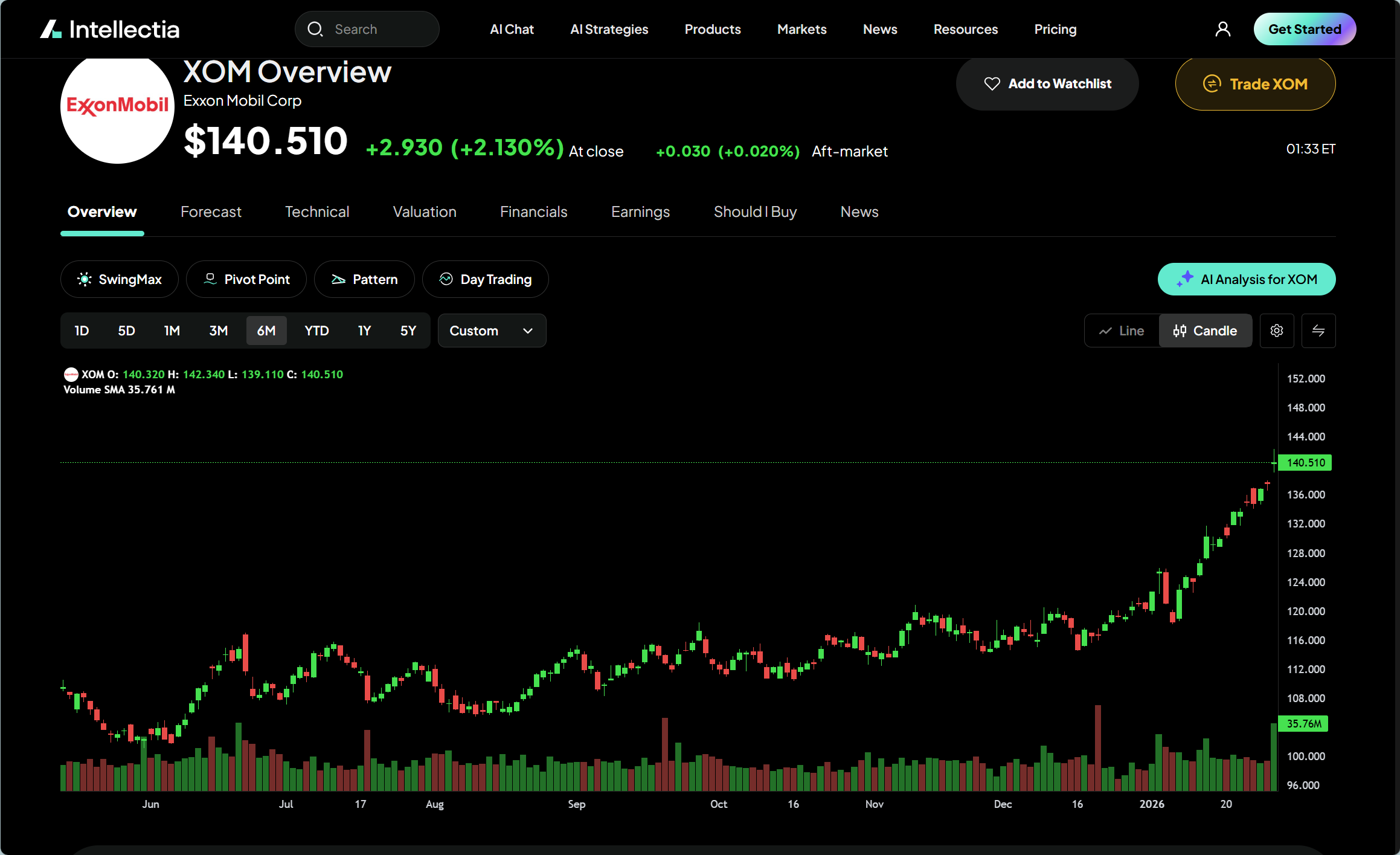

4. Exxon Mobil – Integrated energy giant

Exxon Mobil has big natural gas operations in the United States, Papua New Guinea, Mozambique, and Qatar, while staying diverse in other energy sectors. Their Global Outlook sees natural gas making up over 25% of global energy use by 2050.

The company is growing its natural gas presence through the Golden Pass LNG export terminal in Texas, working with QatarEnergy. Operations should start by late 2025. This facility will give America's LNG export capabilities a major boost.

5. Range Resources – Appalachian basin focus

Range Resources is a top U.S. independent natural gas and NGL producer that works only in the Appalachian Basin. The company pioneered the Marcellus Shale and uses its local expertise to run more efficiently.

The latest quarterly report shows better 2025 production targets with lower capital costs thanks to improved operations. Production averaged 2.20 Bcfe per day, with natural gas making up about 68%.

6. Antero Resources – Strong reserve base

Antero Resources has impressive proved reserves of 17.9 Tcfe, and proved developed reserves make up 13.7 Tcfe (77% of total). Production should average between 3.35 and 3.45 Bcfe/d in 2025.

The company has set itself up for growth by improving its Appalachian assets. They sold off non-core dry Utica gas land while building up their liquids-rich Marcellus position. This smart move improves their liquids exposure and creates longer laterals with shared infrastructure, which cuts breakeven costs.

7. Energy Transfer – Midstream growth play

Energy Transfer owns and runs one of America's biggest and most diverse energy asset portfolios. They plan to spend $5.0-$5.5 billion on growth in 2026, mostly on natural gas network expansion.

The company is putting this money into projects linked to data center and power needs. They want to turn their big backlog of organic projects into contracted volumes that support 3-5% yearly distribution increases.

8. Black Stone Minerals – Royalty income model

Black Stone Minerals gives you a different way to invest as one of the largest owners of oil and natural gas mineral interests in the United States. They own mineral and royalty interests in 41 states.

The Intellectia.ai AI Screener is a great tool to find similar opportunities. You can filter the entire market quickly to find companies that show clear signs of benefiting from the Gemini 3 trend—maybe even by spotting suppliers to Google or competitors buying more chips.

Black Stone stands out because of its non-cost-bearing mineral and royalty interests model. This creates stable to growing production and reserves over time. Their structure lets them distribute most of their cash flow to unitholders, making it an attractive choice for income-focused natural gas investors.

Key Metrics to Compare Natural Gas Stocks

The best natural gas stocks evaluation requires a look at key financial metrics to identify sustainable investments. These indicators help you determine which energy stocks truly deserve a place in your portfolio.

Dividend yield and payout sustainability

Natural gas companies offer varying dividend yields. Kinder Morgan stands out with an impressive 4.33% yield. EQT Corporation and Cheniere Energy provide lower returns at 1.22% and 1.06% respectively.

Companies with consistent dividend growth catch the eye of income-focused investors. ExxonMobil leads the oil and gas sector with 43 consecutive years of dividend increases. Chevron follows closely with a robust 4.6% yield and 38 years of steady increases.

Earnings per share (EPS) trends

Natural Gas Services' profitability soared with EPS jumping from $0.38 in 2023 to $1.37 in 2024, marking a 260% increase.

Natural gas utilities have posted mixed quarterly results. Three distributors—Chesapeake Utilities, Atmos Energy, and One Gas—managed to surpass their previous year's EPS during one reporting period.

Debt levels and credit ratings

Access to affordable financing is vital in this capital-intensive industry, making investment-grade credit ratings essential. Major players have strong ratings—typically in the BBB range from Standard & Poor's.

Debt-to-equity ratios need careful review since highly leveraged companies become vulnerable during price drops. Free cash flow generation offers better insights than net income.

Production costs and breakeven points

Breakeven costs differ by basin:

Dry gas wells need $2.70-$3.20/MMBtu to stay profitable

Wet gas areas with valuable natural gas liquids have lower breakeven points—Marcellus wet: $1.77/MMBtu vs. dry: $2.43/MMBtu

Canadian plays have lower full cycle costs than U.S. basins due to favorable exchange rates and reduced operational expenses

Recent industry data shows 95% of shale producers now need at least $4.00/MMBtu to justify continued development. This indicates a fundamental change in the market's floor price.

Risks and Opportunities in Natural Gas Investing

You need to think about both risks and rewards when you invest in natural gas stocks. This knowledge will help you make smart choices about adding these energy stocks to your portfolio.

Volatility in commodity prices

Natural gas markets saw major price swings. The Henry Hub front-month futures price volatility dropped from 81% in Q4 2024 to 69% by mid-2025. A polar vortex hit in January 2025 and led to the fourth-largest weekly withdrawal from storage on record. This pushed the 30-day historical volatility to 102%. The prices stabilized when resilient storage injections exceeded 100 Bcf weekly for seven straight weeks in 2Q25.

Regulatory and environmental pressures

The industry keeps changing because of environmental rules. The EPA released final rules in December 2023 to cut methane emissions from oil and natural gas operations. Natural gas companies face close watch since methane emissions make up about 33% of total U.S. methane emissions and about 4% of total U.S. greenhouse gas emissions.

M&A activity and consolidation trends

The natural gas sector saw record-breaking deals worth $206.60 billion in 2024—331% more than 2023. Five mega-deals worth over $10 billion each drove this surge. Companies changed their investment strategy and put 42% of acquired assets' value into unproved properties, up from 18% in 2023.

Emerging tech and energy transition impact

New breakthroughs offer chances while transition brings challenges. Carbon capture and storage (CCS) technology might help natural gas stay relevant as we move toward clean energy. The industry might decline quickly without big investments in CCS. AI data centers need more power, and natural gas has become their go-to energy source.

Smart Strategies for Natural Gas Investors

Natural gas investments need strategic planning to succeed in this volatile yet promising sector. Here's what you need to know to make smart investment choices:

Start with large-cap, stable companies

Your natural gas trip should begin with companies that have market capitalizations above $10 billion. These organizations provide better stability during market swings. Infrastructure companies make great first investments because they generate steady cash flow through "toll booth" business models. They collect fees whenever gas moves through their networks. Lower exposure to commodity price changes creates a more stable investment base.

Use ETFs for diversified exposure

Individual stock picking isn't always the best approach. The First Trust Natural Gas ETF (FCG) tracks companies that earn substantial revenue from natural gas exploration and production. The AI Stock Picker gives applicable information daily. The Hennessy Gas Utility Fund serves as another option. It invests in publicly traded members of the American Gas Association, with no company taking more than 5% of fund assets.

Rebalance based on market signals

The market's change toward backwardation in late 2025 creates opportunities to position for short-term price spikes from supply constraints. Natural gas investors should adjust their holdings when inventory levels hit multi-year lows. These conditions often trigger market volatility.

Track LNG infrastructure developments

New export terminal projects deserve your attention as the US expands facilities like Plaquemines LNG in Louisiana and Corpus Christi Stage 3 in Texas. These developments boost global supply by a lot and create investment opportunities in terminal operators. On top of that, floating storage and regasification units (FSRUs) are vital services in areas with limited onshore facilities.

Conclusion

Natural gas stocks show promising opportunities for investors who want to look beyond 2025. The broader energy sector hasn't kept pace with market gains. However, several natural gas companies show strong fundamentals and smart positioning. Their status as a cleaner fossil fuel and vital support for renewable energy without doubt strengthens their future outlook.

Smart investors match their investment approach to their risk tolerance and portfolio goals. Companies like Cheniere Energy, Kinder Morgan, and ExxonMobil provide stability through their 20+ year old operations and infrastructure advantages. EQT Corporation and Range Resources give investors direct exposure to natural gas prices, though with higher volatility.

Your evaluation of potential investments should focus on key financial health metrics. These include dividend sustainability, EPS trends, debt levels, and production costs. Such indicators help identify companies that can succeed whatever the short-term price changes might be. On top of that, market signals can point to the right moments for adjusting your allocations.

LNG export growth emerges as a major catalyst for this sector. Global demand is set to rise 60% by 2040, which creates big opportunities for companies with export capabilities. America's growing role as the world's top LNG exporter makes export-focused companies worth a serious look.

The market will stay volatile, but smart investments in natural gas stocks can deliver both growth and income. You can choose individual stocks or ETFs for diverse exposure - this sector belongs in a balanced energy portfolio. The shift to cleaner energy takes time, and natural gas will keep its vital bridging role for years ahead.