Key Takeaways

- Natural gas ETFs make it easy to invest in one of the most vigorous energy markets on the planet.

- The top performers for 2026 include UNG, BOIL, KOLD, FCG, and XOP.

- Each fund is suitable for a range of investors, including short-term traders and long-term investors.

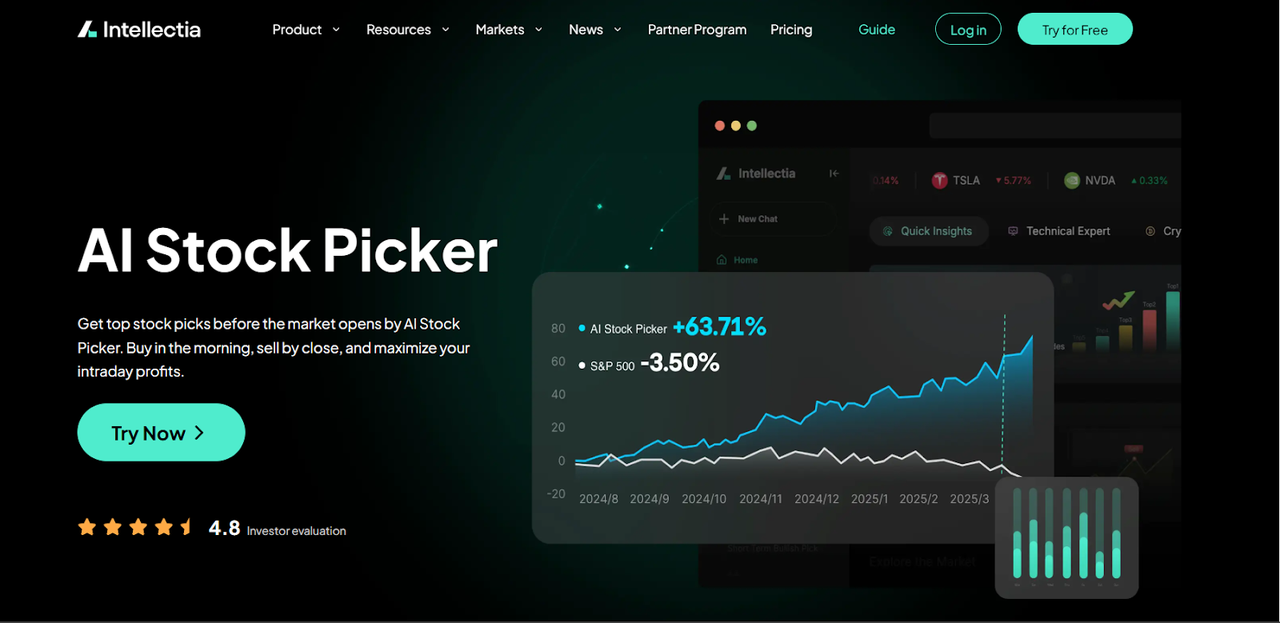

- Intellectia.ai has tools (AI Screener and AI Stock Picker) that use AI to analyze volatility, predict performance, and identify the ETF that best matches your goals.

- As global energy demand is set to skyrocket, natural gas ETFs are likely to remain strong performers in 2026.

Introduction

If you’ve been watching the energy markets lately, you already know natural gas is stealing the show. Prices have swung up and down over the past few years — and while that kind of volatility can scare some investors away, others see it as a fantastic opportunity.

But here’s the problem: buying and selling natural gas directly is complicated. You’re dealing with futures contracts, storage costs, and expiration dates — basically, a headache for most retail investors.

That’s exactly where natural gas ETFs come in. They let you tap into the price movements of natural gas — or the companies that produce it — without touching the futures market yourself.

And now, with AI-powered trading insights from Intellectia.ai, finding and managing the right natural gas ETFs is easier than ever. In this guide, you’ll discover which funds deserve a place on your radar for 2026, why they’re different, and how to use AI tools to sharpen your investment strategy.

What Is a Natural Gas ETF?

Let’s start from the basics.

An ETF, or exchange-traded fund, is a portfolio of investments that trades on the stock exchange like any other stock. When you purchase a share of an ETF, you are actually purchasing all the assets that the ETF owns.

An ETF based on natural gas is meant to track:

The cost of natural gas itself (under futures contracts), or

The shares of natural gas firms, such as producers, transporters, and distributors.

These funds give you a simple, low-barrier way to gain exposure to the natural gas market. You don’t need to open a commodities account or worry about rolling over futures.

That simplicity is a huge part of the deal — and if you use tools like Intellectia’s AI Screener or AI Stock Picker, you can instantly compare these ETFs based on performance, volatility, and potential returns.

Types of Natural Gas ETFs

Not all natural gas ETFs work the same way. Here are the main types you’ll find:

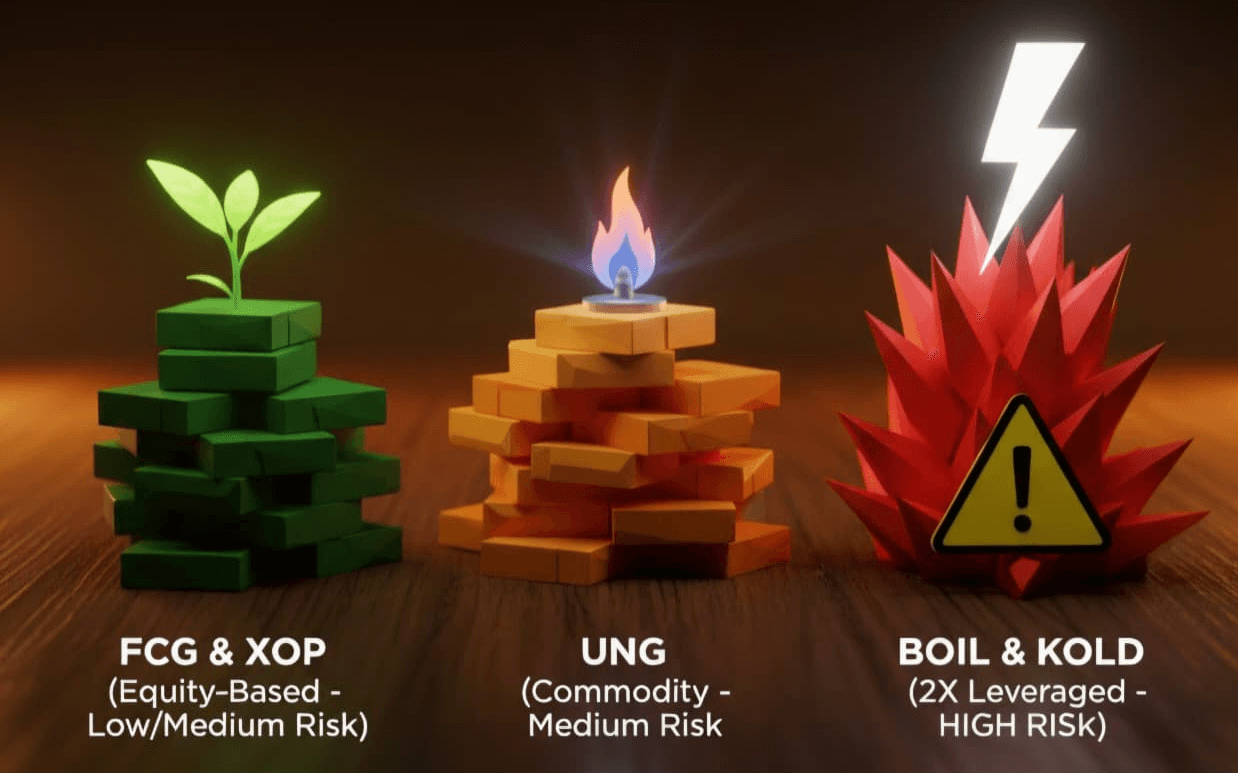

- Commodity-Based ETFs These track the natural gas price by investing in futures contracts. They are perfect if you wish to be exposed to the commodity itself.

- Equity-Based ETFs These hold shares of firms engaged in the natural gas industry, including exploration, production, storage, and pipeline transportation. They are more stable, and they usually pay dividends.

- Leveraged ETFs (2x or 3x) These amplify daily price movements of natural gas — ideal for short-term traders who can afford high risk and volatility.

- Inverse ETFs These have the reverse effect; they increase with a decrease in the prices of natural gas. Traders commonly use them to hedge or bet against the market. So, depending on your strategy — whether you’re a steady long-term investor or a high-speed swing trader — there’s a natural gas ETF tailor-made for you.

Why Investors Choose Natural Gas ETFs

Natural gas isn’t going anywhere. Regardless of the hype surrounding renewable energy, gas continues to play a crucial role in the world as a bridge fuel, less polluting than coal, less expensive than oil, and necessary to both heat and power the world.

Here is why investors are still rushing towards natural gas ETFs:

- Rising Global Demand Nations such as China and India are consuming energy at record levels. Meanwhile, Europe is in the process of diversifying its gas supply beyond Russia, which is expected to generate long-term demand for U.S. exports.

- LNG Expansion The U.S. has become one of the world’s largest exporters of liquefied natural gas (LNG). That’s a tailwind for natural gas producers and ETFs tied to them.

- Portfolio Diversification Adding energy exposure — especially natural gas — helps balance portfolios dominated by tech or financials.

- Convenience and Liquidity Unlike buying gas futures or drilling stocks individually, ETFs provide instant exposure and can be bought or sold at any time during market hours.

- And with Intellectia’s AI-powered features like the Day Trading Center and Stock Monitor, you can analyze trends, track volatility, and even receive real-time trading signals to stay ahead of the market.

Top Natural Gas ETFs to Watch in 2026

Now, let’s get into what you’re really here for — the ETFs that deserve your attention this year, moving to 2026.

Below is a quick comparison table summarizing each fund’s core details:

| Name | Ticker | Type | Focus | Expense Ratio | Why it’s on the list |

|---|---|---|---|---|---|

| United States Natural Gas Fund | UNG | Futures | Tracks the daily natural gas futures price | 1.24% | Pure play commodity exposure, highly liquid. |

| ProShares Ultra Bloomberg Natural Gas | BOIL | 2x Leveraged | 2x daily performance of natural gas futures | 0.95% | High risk, high reward for aggressive day traders. |

| ProShares UltraShort Bloomberg Natural Gas | KOLD | -2x Inverse Leveraged | -2x daily performance of natural gas futures | 0.95% | Speculating on a price drop; highly risky. |

| First Trust Natural Gas ETF | FCG | Equity | Stocks of natural gas-focused companies | 0.57% | Focus on companies in the natural gas value chain. |

| SPDR S&P Oil & Gas Exploration & Production ETF | XOP | Equity | Broader E&P sector, includes natural gas | 0.35% | Broader energy play with significant natural gas exposure. |

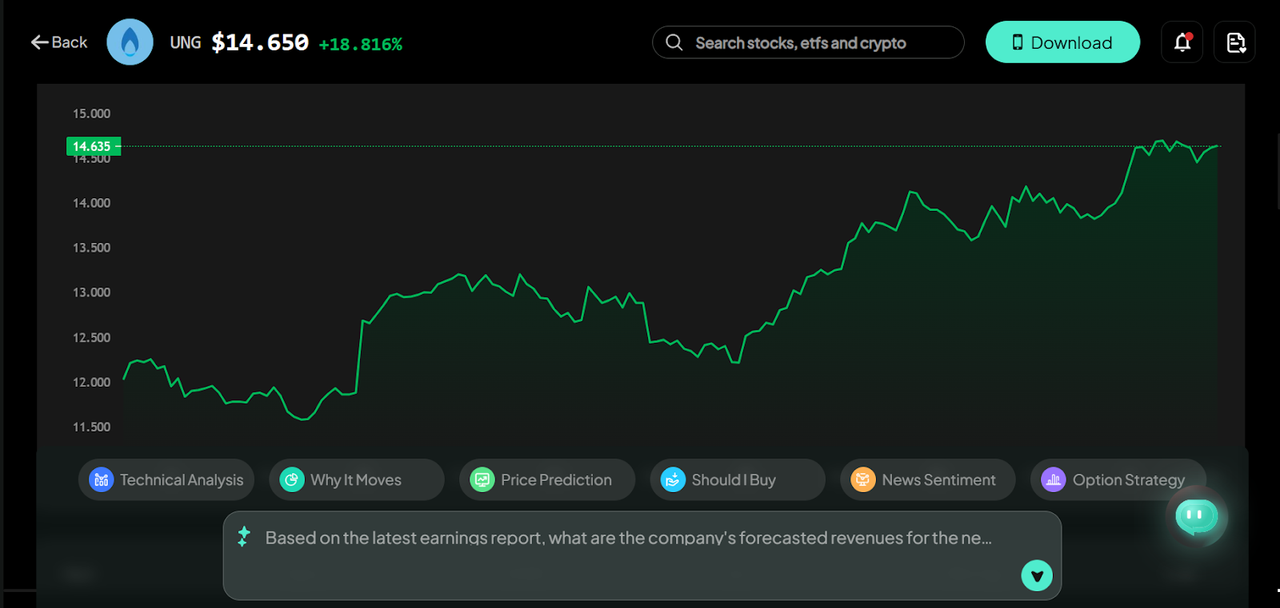

United States Natural Gas Fund (UNG)

If you’re looking for direct exposure to natural gas prices, UNG is your go-to ETF. It tracks near-month natural gas futures traded on the NYMEX.

Because it follows futures, UNG’s performance can differ significantly from spot gas prices due to a phenomenon known as “contango” — a situation where future prices are higher than current ones. Still, it’s a favorite among short-term traders who thrive on volatility.

According to Intellectia’s stock technical analysis, UNG remains one of the best tools for traders who want to ride large price swings without directly touching the futures market.

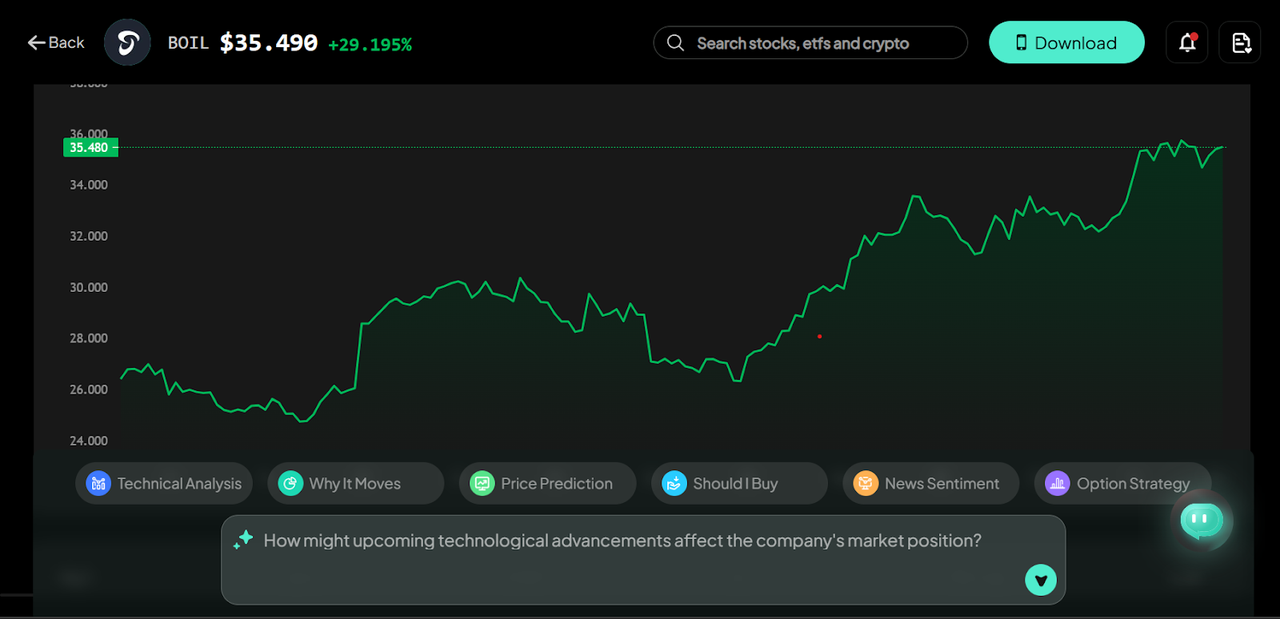

ProShares Ultra Bloomberg Natural Gas (BOIL)

BOIL is the adrenaline junkie’s ETF. It’s a 2x leveraged fund, meaning it seeks to double the daily performance of the Bloomberg Natural Gas Subindex.

If natural gas increases by 2% in a day, BOIL should rise by about 4%. The flip side is true too — it can drop just as fast.

This ETF is not something everyone would love, but for active traders who employ AI-powered swing strategies, it’s gold. Tools like Intellectia’s Swing Trading feature can identify the most suitable entry and exit points with the aid of pattern recognition and real-time momentum analysis.

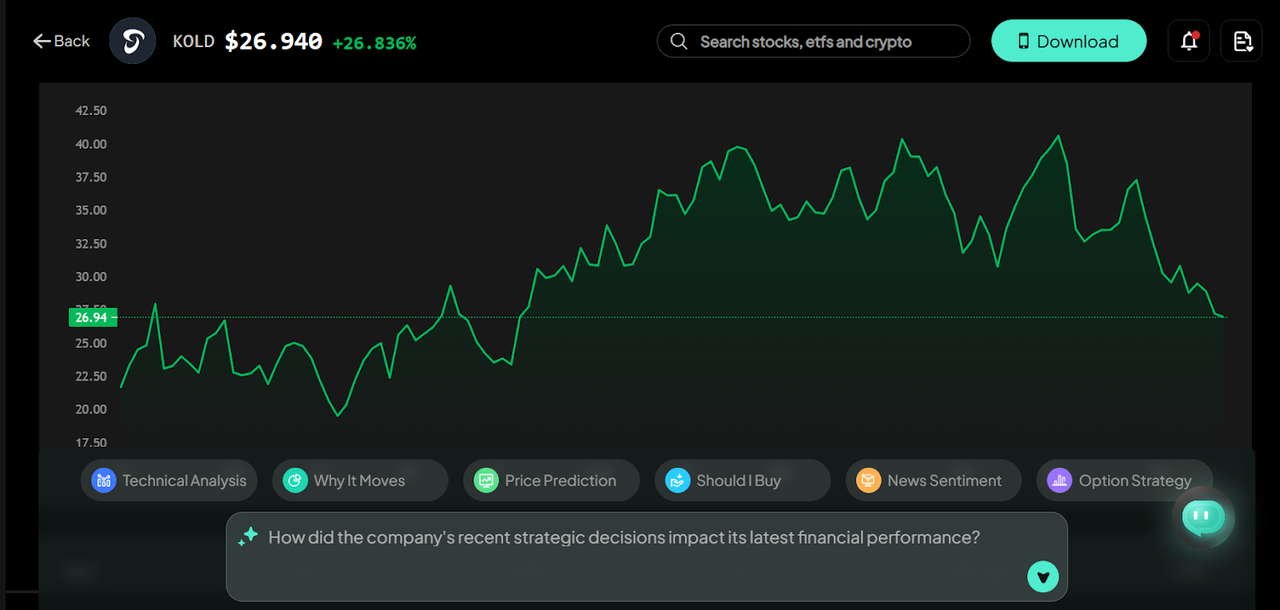

ProShares UltraShort Bloomberg Natural Gas (KOLD)

KOLD, being a mirror image of BOIL, moves in a different direction — it increases when the price of natural gas decreases. It is basically a 2x inverse ETF and is applicable to traders who are planning to hedge their positions or bet on market pullback.

Being incredibly volatile and rapidly moving, KOLD needs to be timed accurately. That’s where Intellectia’s AI Agentcomes in handy — allowing predictive analytics to detect reversals of trends and give early warnings.

If you know how to use it, KOLD can be a powerful weapon in your trading toolkit.

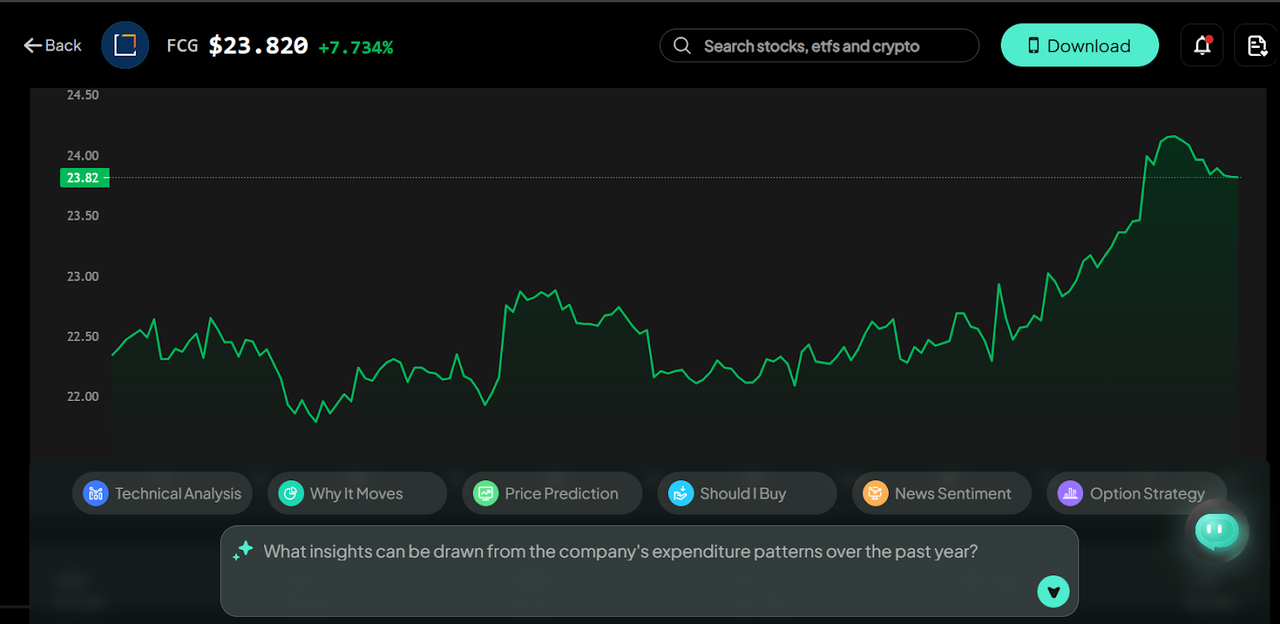

First Trust Natural Gas ETF (FCG)

Now, FCG is a great choice for long-term investors. However, it does not follow the price of gas like the others on this list do, but rather invests in the companies that manufacture and distribute it. FCG offers a solid dividend yield of 2.59%, good liquidity, and a diversified portfolio comprising leading U.S. players, which provides an opportunity to generate returns through the natural gas boom without the need for daily price fluctuations.

According to Intellectia’s Stock Monitor, FCG has been one of the most stable energy ETFs over the past year. Its performance is tied to overall industry health rather than short-term volatility — making it a great fit for investors who prefer “set it and forget it.”

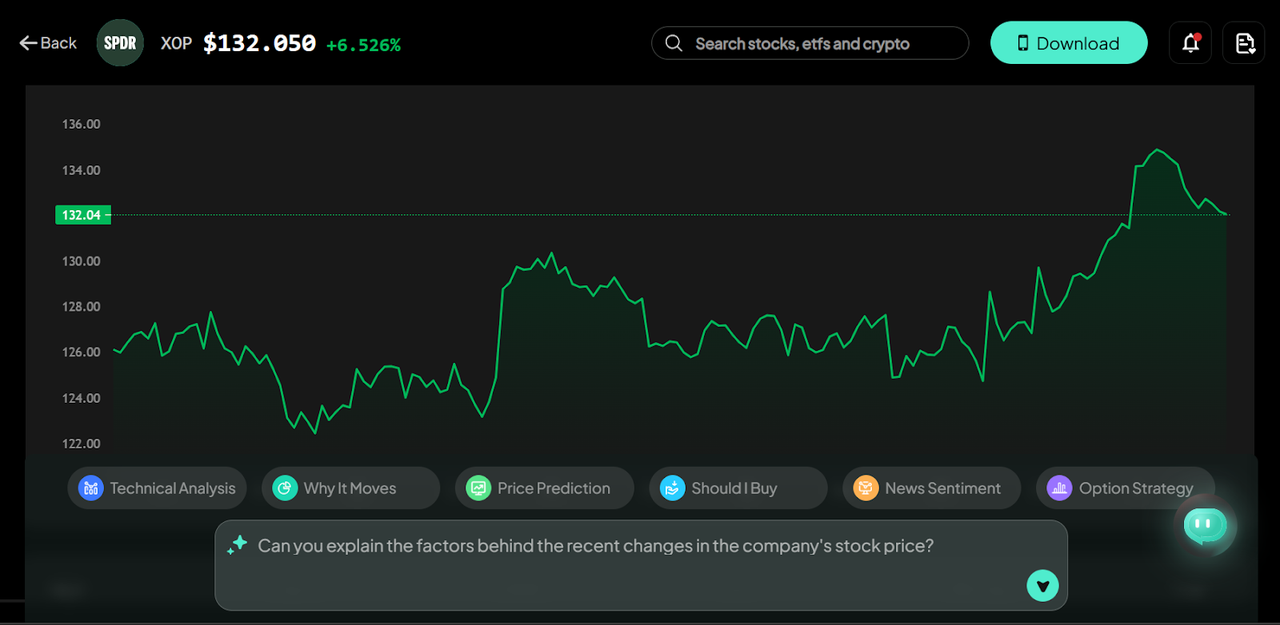

SPDR S&P Oil & Gas Exploration & Production ETF (XOP)

Although it’s not exclusively focused on natural gas, XOP contains large companies engaged in exploration and production, which have a substantial exposure to natural gas.

Its main advantages are broad diversification and a low expense ratio (0.35%), which helps it outperform peers over the long haul.

Energy-heavy ETFs, such as XOP, are also popular in AI-assisted hedge fund tracking strategies, which utilize cross-sector analysis to balance exposure between oil and gas. You can explore similar tactics using Intellectia’s Hedge Fund Tracker.

Investment Strategies for Natural Gas ETFs

Okay, so you know what you need to focus on — but how do you actually invest in these ETFs strategically?

Let’s break it down by approach:

Short-Term Trading Strategies

If you’re into short-term or swing trading, natural gas ETFs are fantastic.

Price movements can be extreme — and that’s a good thing if you know how to time them. Leveraged ETFs, such as BOIL, or inverse ones, like KOLD, are designed for fast-paced traders.

Here’s where Intellectia’s AI comes in. Its Day Trading Center identifies real-time breakouts, support/resistance zones, and intraday momentum shifts. You can also sync alerts with historical volatility data to predict when a price spike might be coming.

AI-generated signals remove emotion from your trading decisions — which, let’s be honest, is the hardest part of short-term investing.

Long-Term Portfolio Diversification

If your goal is steady growth and income, you’ll want exposure that can weather volatility.

Funds like FCG or XOP are perfect for this because they hold actual stocks — which means dividends, earnings growth, and a bit more stability.

They’re also great for portfolio diversification. Adding a slice of natural gas to your portfolio can decrease your overall risk, particularly when most of your holdings are in tech or consumer industries.

And with tools like the AI Stock Picker, you can create a diversified portfolio based on these ETFs—pairing them with complementary assets that balance risk and reward.

AI-Assisted ETF Screening

Here’s where things get really interesting.

Traditional investors rely on charts and analyst reports. But AI can process millions of data points — technical indicators, sentiment analysis, and even news headlines — in seconds.

Using Intellectia’s AI Screener and Stock Technical Analysis, you can:

- Compare dozens of natural gas ETFs by volatility, volume, and returns.

- Spot early momentum trends before retail traders jump in.

- Select a group of ETFs that align with your risk tolerance and time horizon.

In other words, it’s like having a digital analyst working 24/7 for you without the human bias or guesswork.

Conclusion

Natural gas may not grab as many headlines as tech stocks, but it’s quietly becoming one of the most important investment themes of the decade.

The shift toward cleaner energy, combined with global supply shifts and export growth, means demand isn’t going away anytime soon.

Whether you’re looking to trade short-term trends or create a balanced long-term portfolio, the appropriate natural gas ETF can allow you to seize that potential, and the available tools, such as Intellectia.ai, make the process faster, smarter, and more precise than ever.

Sign up today at Intellectia.ai to access real-time AI stock picks, ETF forecasts, and trading signals designed to help you stay ahead of market moves.