Key Takeaways

- Digital payments, AI automation, and the expansion of online lending are driving Fintech's performance better than traditional banking.

- SQ, PYPL, SOFI, HOOD, and GPN are the most promising long-term fintech stocks to invest in heading to 2026.

- AI tools like Intellectia’s AI Stock Picker and AI Stock Monitor help you analyze price trends and time your entries more accurately.

- Diversification, timing, and long-term conviction significantly contribute to creating a winning fintech stocks portfolio.

- Fintech stocks may present good long-term opportunities, although intelligent research and data-driven investment are essential.

Introduction

Are you tired of dealing with the slow, old-school ways of traditional banks? I totally get it. In today's fast-paced world, you need financial services that are instant, mobile, and totally seamless. That’s the core problem the Fintech sector—or financial technology—is solving right now, and it’s why it represents one of the biggest investment opportunities on the market.

This isn’t just about making banking apps look pretty; it's about fundamentally reshaping everything from how you pay for coffee to how you invest for retirement. Here at Intellectia AI, we’re focused on AI stock analysis and AI trading strategies, and we’ve been tracking this revolution closely. We’ve zeroed in on the top companies poised for significant growth. In this guide, we’ll not only show you 5 leading fintech stocks to invest in for 2026, but also give you the smart strategies you need to capitalize on this digital transformation.

What Are Fintech Stocks?

If you're new to this space, let me break it down. Fintech is a massive disruptive trend that integrates finance and innovative technology to offer financial services more efficiently, quickly, and inexpensively. Think about the last time you paid for something online without pulling out your credit card—you most probably used fintech.

Fintech stocks are simply the shares of companies driving this revolution. They range from digital payment superpowers and peer-to-peer lending sites to no-commission trading apps and advanced AI-based advisory services. They are the businesses that have looked at the massive, slow-moving financial institutions of the past and said, "We can do this better with code." Investing in these stocks means you’re placing your money on innovation and the global shift away from cash and complex bureaucracy.

Why Invest in Fintech Stocks?

You might be wondering, why put your money into fintech in 2026? The short answer is: massive, unrelenting growth and true disruption.

The global fintech market is still expanding at an astonishing rate, driven by a few major factors. These companies are actively taking market share from traditional banks by offering services that are simply superior—cheaper transfers, instant transactions, and products tailored specifically to your needs. They are the new leaders. More importantly, the most successful firms in this field are masters of data, and they employ sophisticated technologies, such as AI and machine learning, to conduct fraud checks and provide personalized financial recommendations. Such intensive use of smart automation and data aligns perfectly with Intellectia’s focus on AI-based stock analysis to gain an advantage. It’s an industry founded on technological advantage, which provides them with a sustainable competitive moat.

5 Leading Fintech Stocks to Invest in 2026

The fintech world is huge, but a handful of companies stand out. The goal here isn't just to tell you which stocks exist, but how they differentiate themselves so you can pick the one that aligns best with your own financial goals.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

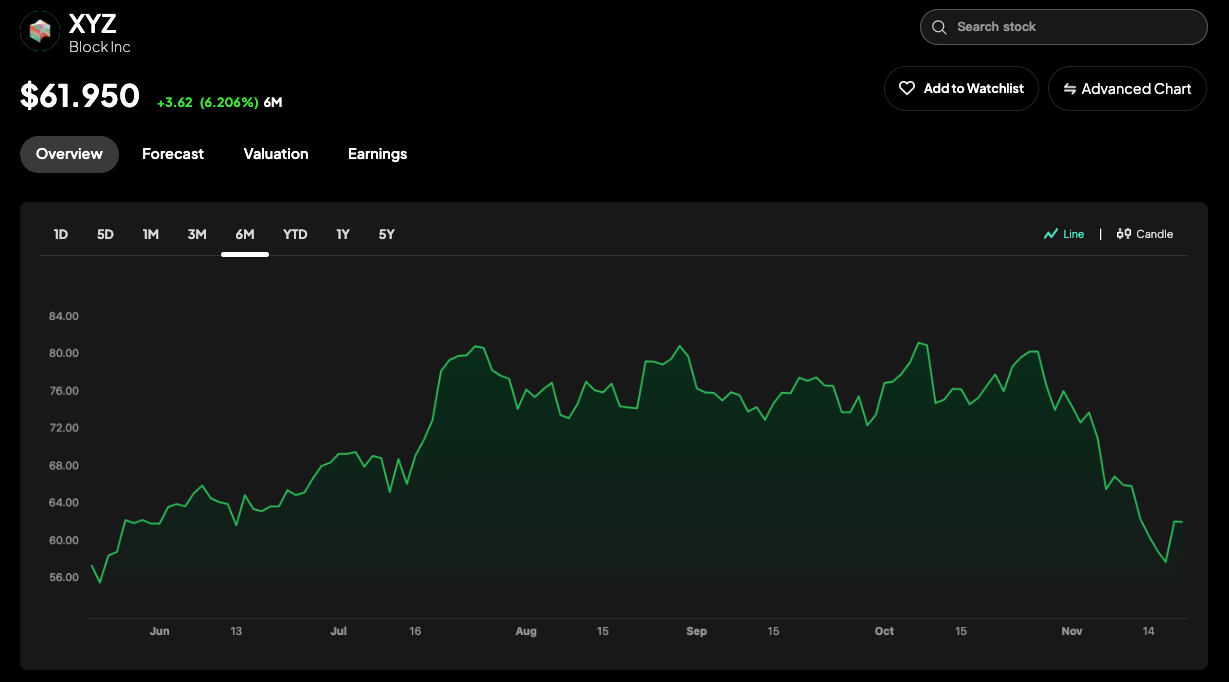

| Block (formerly Square) | SQ | Digital Payments, POS, E-commerce | $35.03B | Cash App ecosystem, seamless seller/consumer integration, Bitcoin focus |

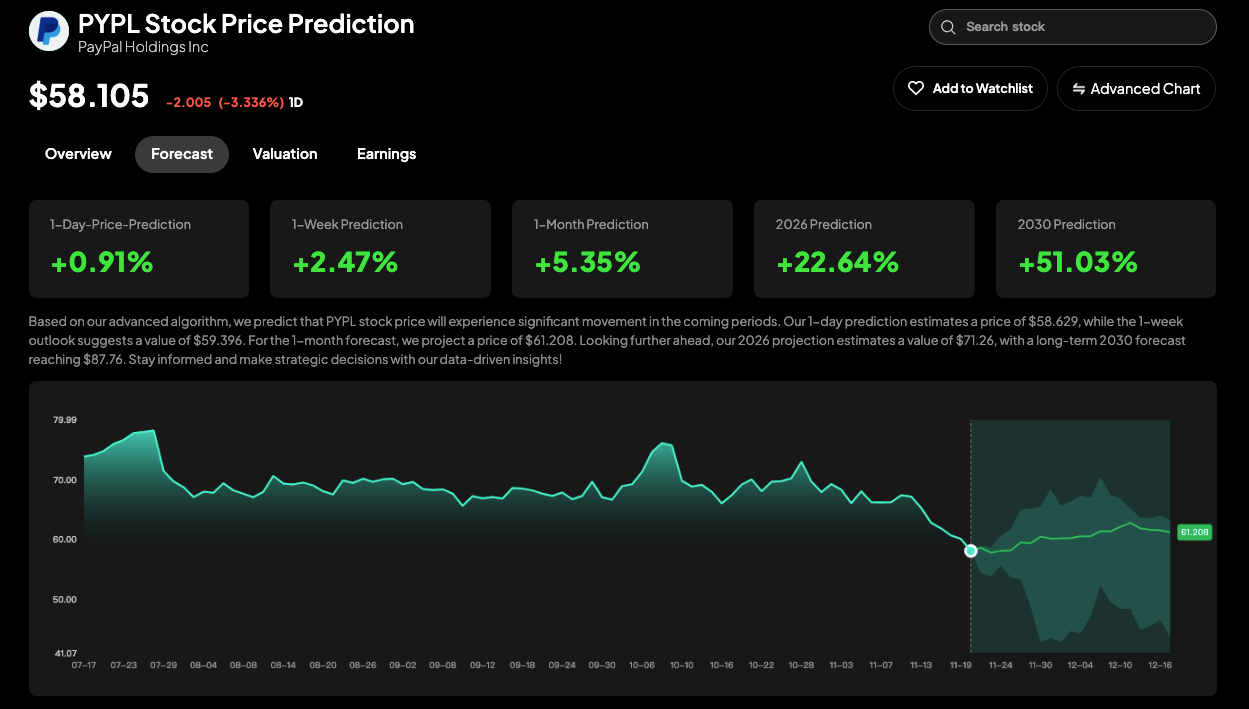

| PayPal Holdings | PYPL | Digital Payments, E-commerce | $56.24B | Massive global user base, strong merchant presence, Venmo growth |

| SoFi Technologies | SOFI | Digital Banking, Lending, Investing | $32.22B | "Financial Super App" model, bank charter advantage, tech platform ownership |

| Robinhood Markets | HOOD | Retail Brokerage, Investing | $106.25B | Commission-free trading, appealing to young investors, strong user engagement |

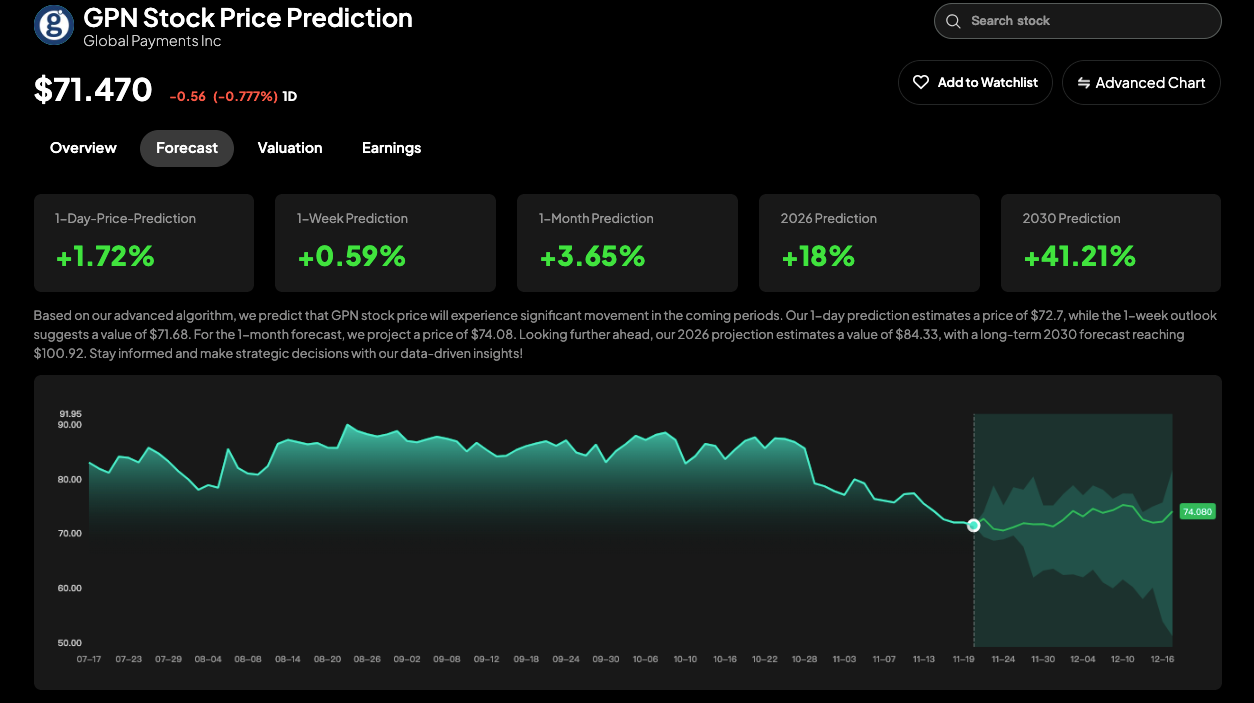

| Global Payments | GPN | Payment Technology and Services | $17.05B | B2B payment processing, reliable revenue, infrastructure stability |

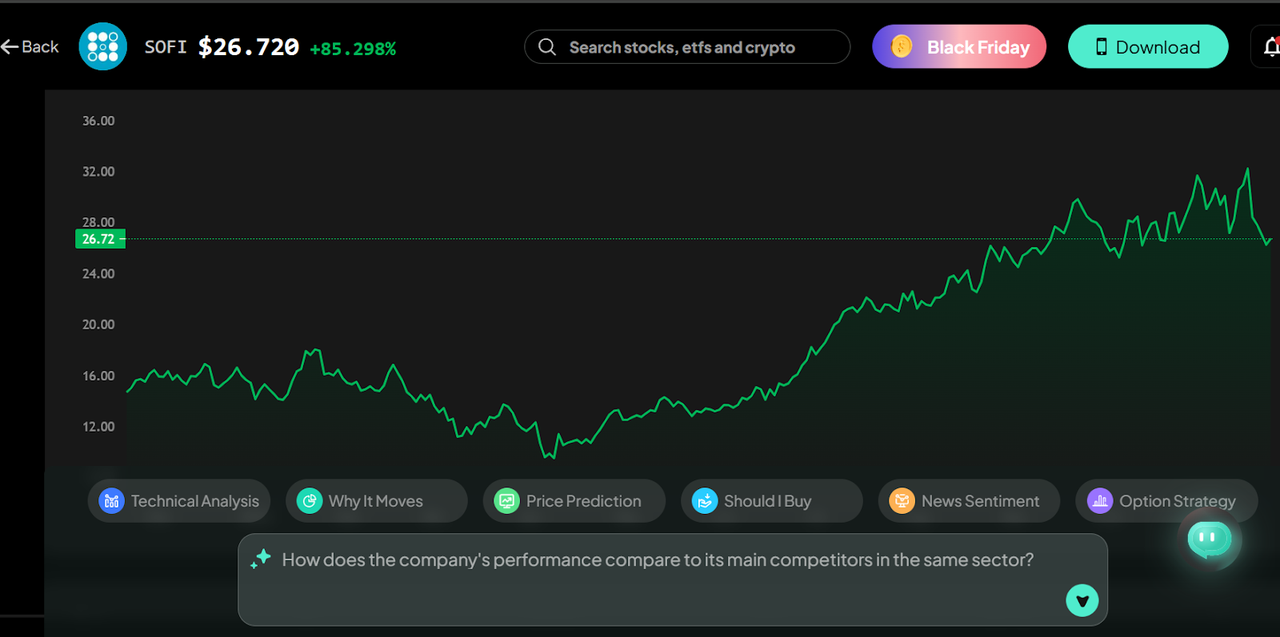

SoFi Technologies (SOFI)

SoFi has completely rebranded itself as a "Financial Super App." They started with student loans but have aggressively expanded to offer everything: checking accounts, investing, personal loans, and credit cards. Their major recent win was obtaining a bank charter, which allows them to use member deposits for lending, significantly lowering their cost of funding compared to competitors. This is a massive competitive advantage.

SoFi owns its entire technology stack, including its technology platform (Galileo and Technisys). This means they can innovate faster and more cheaply than rivals who have to rely on third-party services. They are truly an "all-in-one" platform.

If you're looking for a fintech company with a strong focus on high-earning consumers and the immense potential for increased profitability driven by its low cost of capital and maturing product ecosystem, SOFI could be a compelling long-term buy-and-hold.

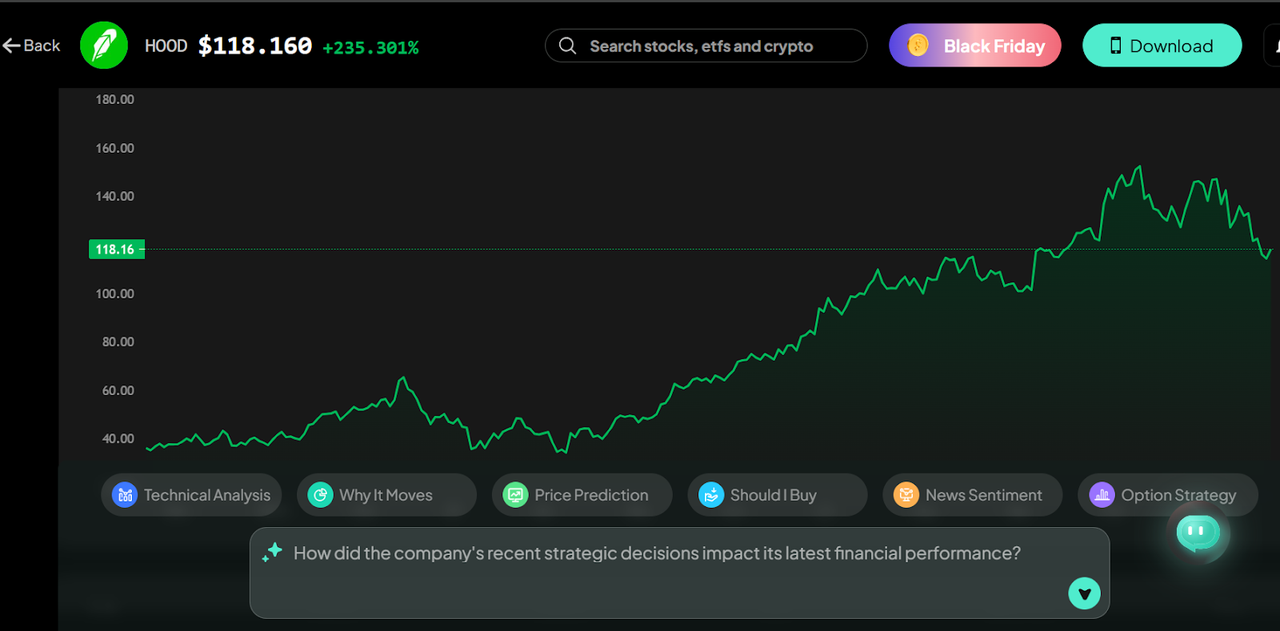

Robinhood Markets (HOOD)

Robinhood single-handedly "democratized" trading by introducing commission-free transactions, making it the favorite among younger, tech-savvy investors. While their growth has been volatile, recent highlights include expanding into retirement accounts (offering key tax advantages), building more robust educational and analytical tools, and maturing its user base.

Its sleek, mobile-first design and focus on the young, retail investor base give it an emotional connection with its users that no other brokerage can match. They are where the next generation starts their investing journey.

If you see strong, sustained engagement from the large retail investor base and believe in the stickiness of its user experience and the high margins it generates from other services like options and crypto, HOOD presents a high-growth, high-volatility opportunity.

Global Payments (GPN)

Unlike the other consumer-facing names, Global Payments operates mostly behind the scenes. They provide the B2B payment technology and software solutions that run commerce for merchants and financial institutions. Recent news has focused on its reliable recurring revenue from services and its strategic partnerships to integrate its tech into wider B2B ecosystems.

This is a more infrastructure-based, stable play. It is less vulnerable to unpredictable user adoption patterns in consumer applications and has a stable income stream from processing large volumes of global transactions.

If you believe the B2B sector will see significant, necessary digital infrastructure spending and you prefer a more stable investment focused on reliable merchant transaction volume, GPN offers stability in the high-growth payments industry.

PayPal Holdings (PYPL)

PayPal is the original digital payment powerhouse. It’s the checkout button that you find on millions of e-commerce websites worldwide. Its fundamental business is unbelievably strong, yet more recent activities are focused on profitability, offering greater visibility in merchant services and incorporating crypto functionality. Recent financial reports have shown a renewed focus on margin expansion and effective cost-cutting measures, which have pleased investors looking for stability.

It has the most valuable asset in the payments world: trust and scale. This brand recognition and massive, entrenched global user base give it a defensible moat against newer players.

If you think global e-commerce will continue its relentless expansion and you value a company with unmatched brand recognition and a solid, proven platform for transaction processing, PYPL provides reliable, large-scale exposure to the global payments movement.

Block (XYZ)

You might still call it Square, but this company has evolved into Block, encompassing both the small-business payment ecosystem (Square) and the consumer-facing powerhouse (Cash App). This is where its genius lies: a smooth transition between the seller and the buyer. One of the most recent highlights is its further expansion of Bitcoin integration with Cash App and the addition of Buy Now, Pay Later options, which puts the company squarely in the future of decentralized, installment-based finance.

Block isn't just a payment company; it's building a complete, vertically integrated economic system. It captures both the merchant's side and your digital wallet, making the ecosystem incredibly sticky.

If you believe in the long-term adoption of a decentralized financial future where digital wallets are king and small businesses need cutting-edge payment solutions, SQ offers you exposure to both commerce and cryptocurrency trends.

Investment Strategies for Fintech Stocks

Fintech stocks are exciting, but they can also be volatile. The same disruption that powers growth may also trigger sharp market corrections. It takes a disciplined, intelligent approach to invest successfully in this industry.

Diversify Your Stock Portfolio

You know the golden rule: never keep all your eggs in one basket. Fintech should be a core component of your portfolio because of its long-term growth potential, but it needs to be balanced. Make sure you have exposure to other, potentially less-volatile sectors to cushion you from any sudden drops in the tech market.

Long-Term vs. Short-Term Strategy

Are you looking for a marathon or a sprint?

- Long-Term: For this, focus on the disruptors—the companies with strong user growth, superior technology, and a clear path to profitability (like the ones we just discussed). You buy quality and ride out the market noise.

- Short-Term (Active Trading): Relying on gut feeling is risky. At Intellectia.ai, we believe in using technology to beat volatility. You must use data-driven insights to know when to make a move.

Use Technical Analysis to Identify Entry and Exit Points

Success in a volatile sector like fintech often comes down to precise timing. Trying to manually analyze complex stock charts, volume trends, and moving averages for five different stocks every day is impossible for you. That's why our platform's AI stock technical analysis features are so powerful. They process enormous amounts of market data in real-time to spot key support, resistance, and momentum shifts that human analysts might overlook.

Crucially, you can use Intellectia.ai’s AI trading signals to inform your moves. These signals don't just guess; they leverage predictive analytics to generate high-probability alerts for potential entry and exit points in the volatile fintech and crypto markets. If our AI spots a consolidation pattern in HOOD that precedes a predicted breakout, you’ll get the signal. In fact, our AI Stock Picker also lets you filter for fintech stocks with the highest quantitative scores based on metrics that indicate imminent growth potential.

Be Familiar with Regulatory Changes

Fintech is a highly regulated space, and that regulation is evolving fast. New EU rules on digital assets (MiCA) and US efforts to establish the legal status of stablecoins (as seen in the GENIUS Act in the news) can easily reshape a company's business model. You must stay on top of the news, not just the stock price. Intellectia’s News section can help you track these high-impact announcements.

Conclusion

New companies such as Block, PayPal, and SoFi are entirely drawing a red line in the financial world, and making smart investments in this sector can offer enormous payoffs to your portfolio. Whether you choose to be a patient, long-term investor, or an active trader, the key to success in fintech is to stay ahead of the trend and use the best and most advanced data. The digital finance revolution is moving forward rapidly, and your portfolio should be right there with it.

Don't miss out on the next big move in the market. Sign up and subscribe today to Intellectia.ai for daily, data-driven insights. Get access to our exclusive AI stock picks, reliable AI trading signals & strategies, and our cutting-edge market analysis. Let our powerful AI do the heavy lifting for your financial future.