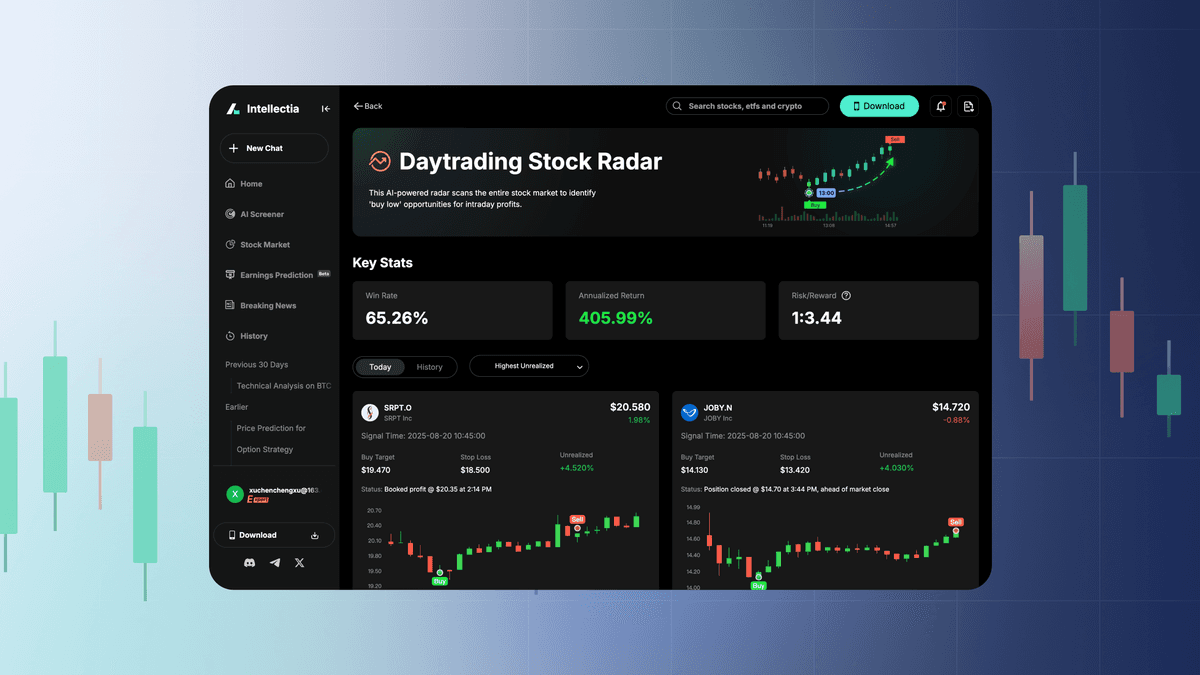

Intellectia’s Daytrading Stock Radar is your AI‑powered partner for intraday trading. Built to scan the entire U.S. market, it highlights “buy low, sell high” setups with clear entries, exits, and risk levels—so you can act fast without second‑guessing.

Let’s walk through what it does, why it matters, and how you can put it to work.

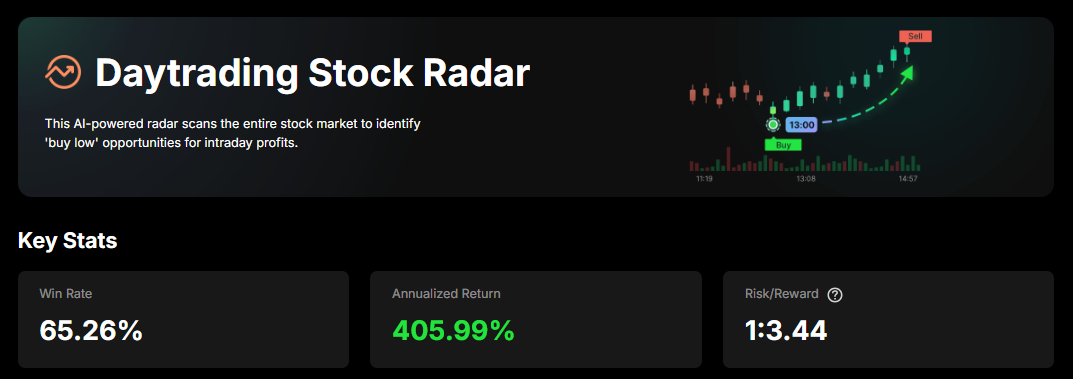

1. Key Stats: Your Performance Snapshot

At the top of the dashboard, you’ll see three headline numbers:

Win Rate – Percentage of closed trades that ended profitable.

Annualized Return – Normalized performance, giving you a sense of strategy potential (not a guarantee).

Risk/Reward – Example: 1:3.44 means for every $1 risked, the system expects ~$3.44 upside.

These metrics summarize the system’s overall effectiveness so you can track progress at a glance.

2.Signal Cards: Your Trade Compass

Each card is a complete trade idea:

Signal Time – When the opportunity was spotted.

Buy Target – Price zone to enter.

Stop Loss – Risk boundary for the trade.

Unrealized/Realized P&L – Live or closed performance.

Mini chart – With Buy (green) and Sell (red) markers.

Status – the trade suggestion for given signal, but for reference only.

Think of it as a ready‑made plan: entry, exit, and risk all pre‑mapped.

3.Why it was built

Daytrading is stressful—too many tickers, fast moves, and constant pressure for quick intraday profits. Stock Radar was designed to solve three trader pain points:

Timing entries – No more guessing, the Buy Target is given.

Managing losses – Stop Loss levels are predefined, keeping risk controlled and preventing outsized losses.

Capturing profits within the day – Trades are designed for intraday exits, often before the bell.

It’s all about clarity and discipline, helping you focus on seizing quick intraday opportunities without watching charts nonstop.

4.How to use it

Here’s your quick playbook:

Step 1: Open Today → Latest Signals Enable notifications so you never miss fresh setups.

Step 2: Pick a signal card Check the Signal Time, Buy Target, and Stop Loss.

Step 3: Plan your trade

Step 4: Exit

Follow the Sell marker, or

Close before market end (the tool does this automatically in backtests), or

Respect the Stop Loss if hit.

5.Best practices

Size by risk, not gut feel – Keep risk per trade consistent.

Don’t chase – Skip signals that already ran far above Buy Target.

Honor stops – A failed setup is part of the game.

Review History – Learn from past signals and refine your approach.

Final Thoughts: Trade the Day with Confidence

The Daytrading Stock Radar is here to simplify intraday decisions: it tells you what to buy, when to sell, and where to stop. Follow the signals, respect the risk, and let the AI do the heavy lifting.

Stay alert, stay disciplined, and use Radar as your edge in the fast‑moving market.

Happy trading!