Welcome to the ultimate guide on using Whales Auto Tracker—the premium feature that lets you automatically follow the top holdings of elite hedge funds (like ARK Invest) and U.S. Congress members. Built on real 13F filings and disclosures, this tool constructs simulated portfolios, rebalances them based on updates, and delivers performance insights with daily-updated net value curves. Whether you're a novice investor or a seasoned trader, Whales Auto Tracker simplifies "whale watching" so you can ride the waves of institutional moves.

In this tutorial, we'll walk you through everything: from subscribing and adding whales to your watchlist, to interpreting performance metrics, receiving trade alerts, and understanding the behind-the-scenes magic. Let's dive in!

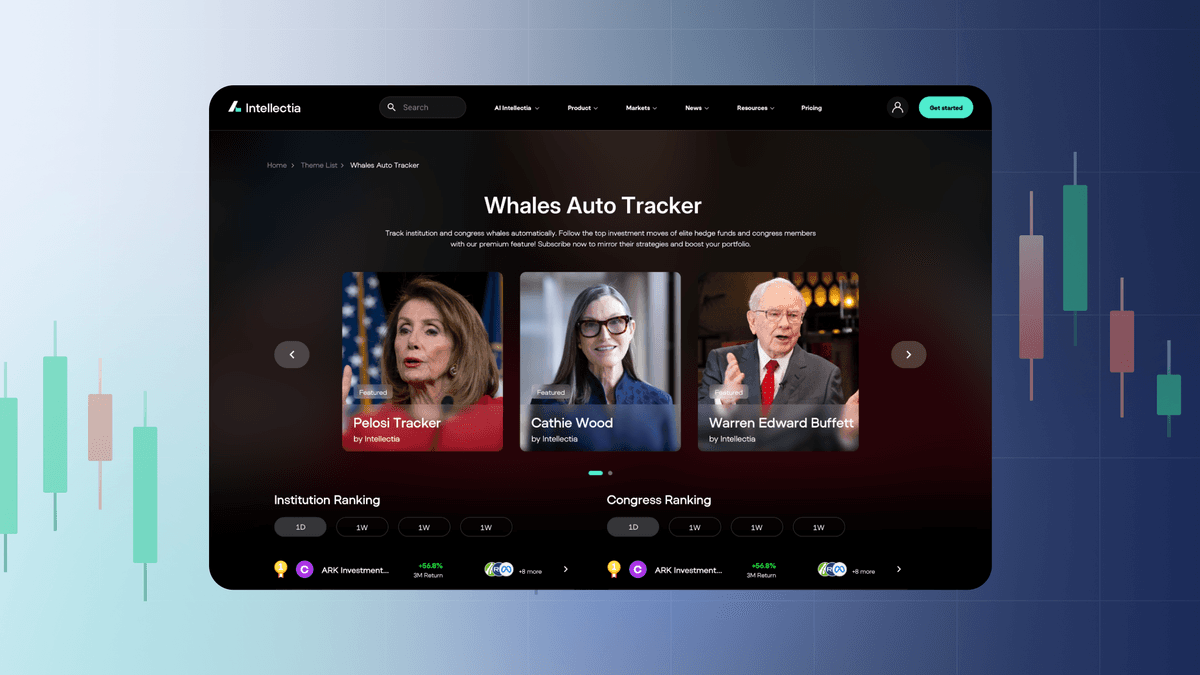

Step1: Find and Add Whales to Your Watchlist

Browse the Whales Tracker Page

- Navigate to Whales Tracker Page.

- Scroll or search for top funds like:

- ARK Investment Management LLC

- Berkshire Hathaway Inc.

- Soros Capital Management

- Renaissance Technologies

- Pershing Square Capital Management

- Or explore Congress Members (e.g., Nancy Pelosi).

View Whale Details

Click any whale to open its detail page:

- Free Content (All Users):

- Whale description

- Total Return, Annualized Return, 1D Return, Sharpe Ratio

- Net value curve (daily updated)

- Performance vs. S&P 500

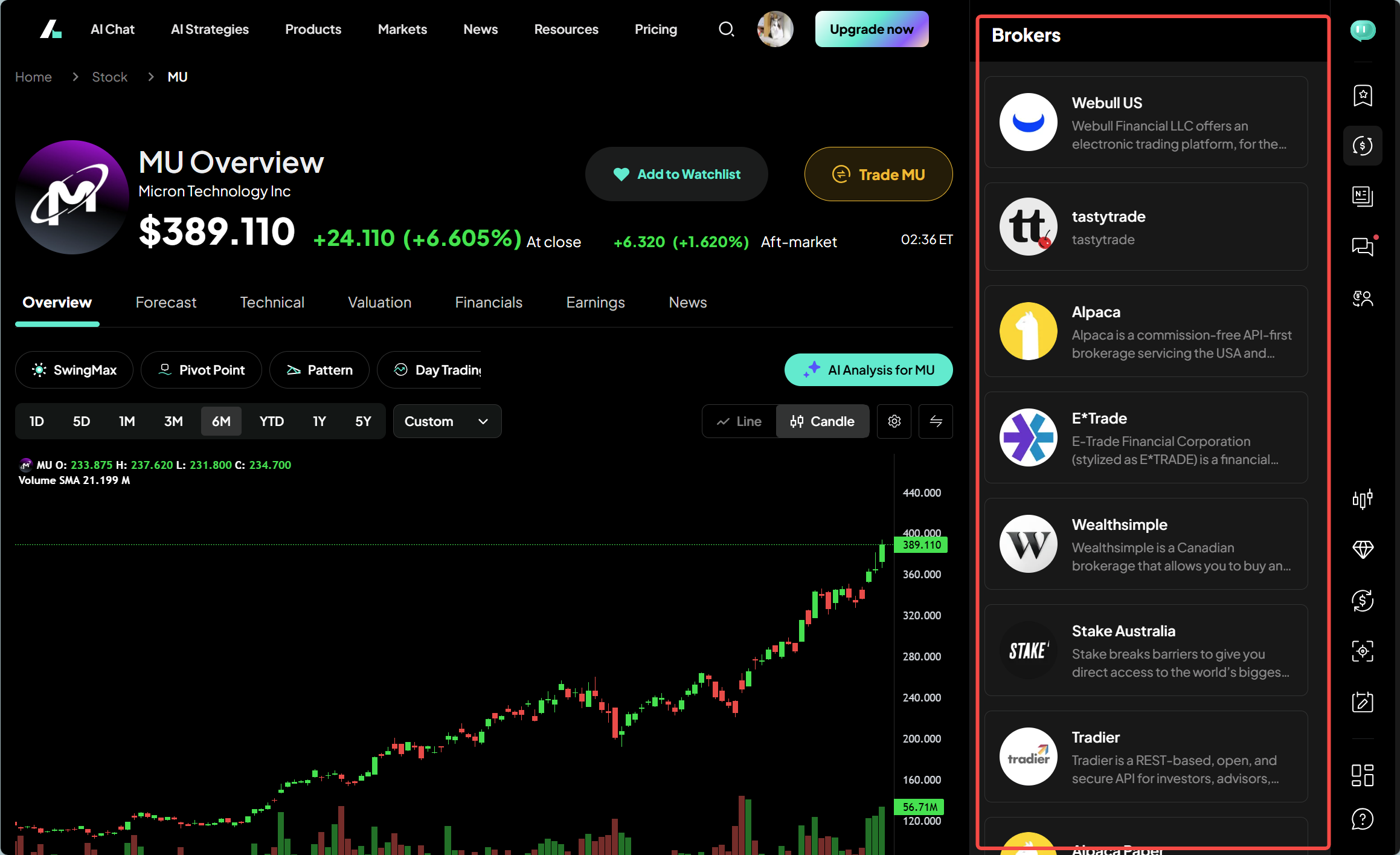

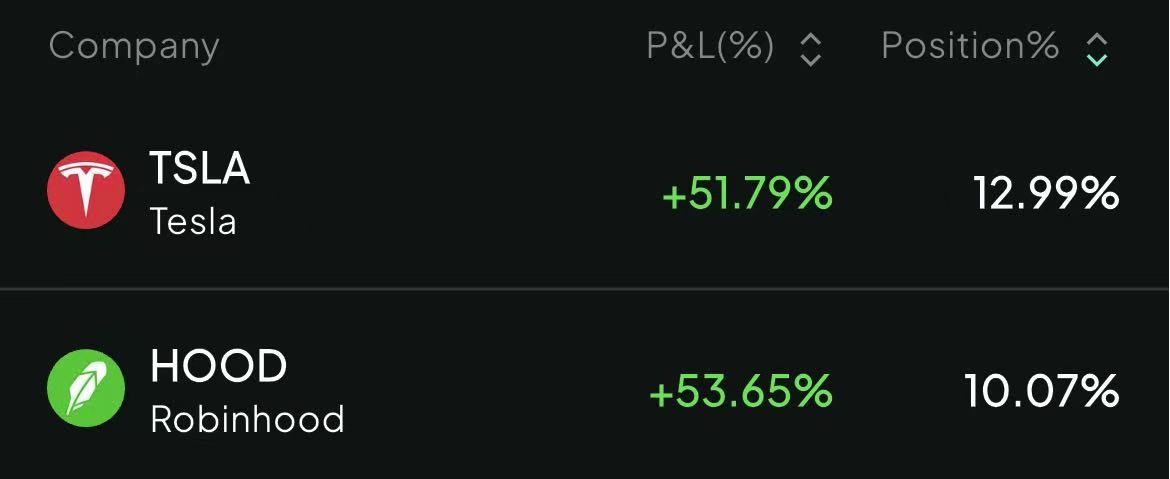

- Paid Content (Subscribers Only):

- Full holdings list (top 20) with P&L and position size

- Rebalance trade log with trade direction and trade price

- Adjusted % Position weights

- Trade alert notification

Add to Watchlist

- On the detail page, click the heart icon in the top-right corner to add this whale to your tracker list.

- Switch to the "Whale" tab in your watchlist to track all followed whales portfolios.

- You’ll now receive push/email notifications for rebalances (buy/sell alerts).

Step2: Monitor Performance & Trade Updates

Key Metrics

| Metric | Description |

| Total Return | Cumulative gain since inception |

| Annualized Return | CAGR |

| 1D / 1M / 3M / 6M Return | Short-term performance |

| Sharpe Ratio | Risk-adjusted return |

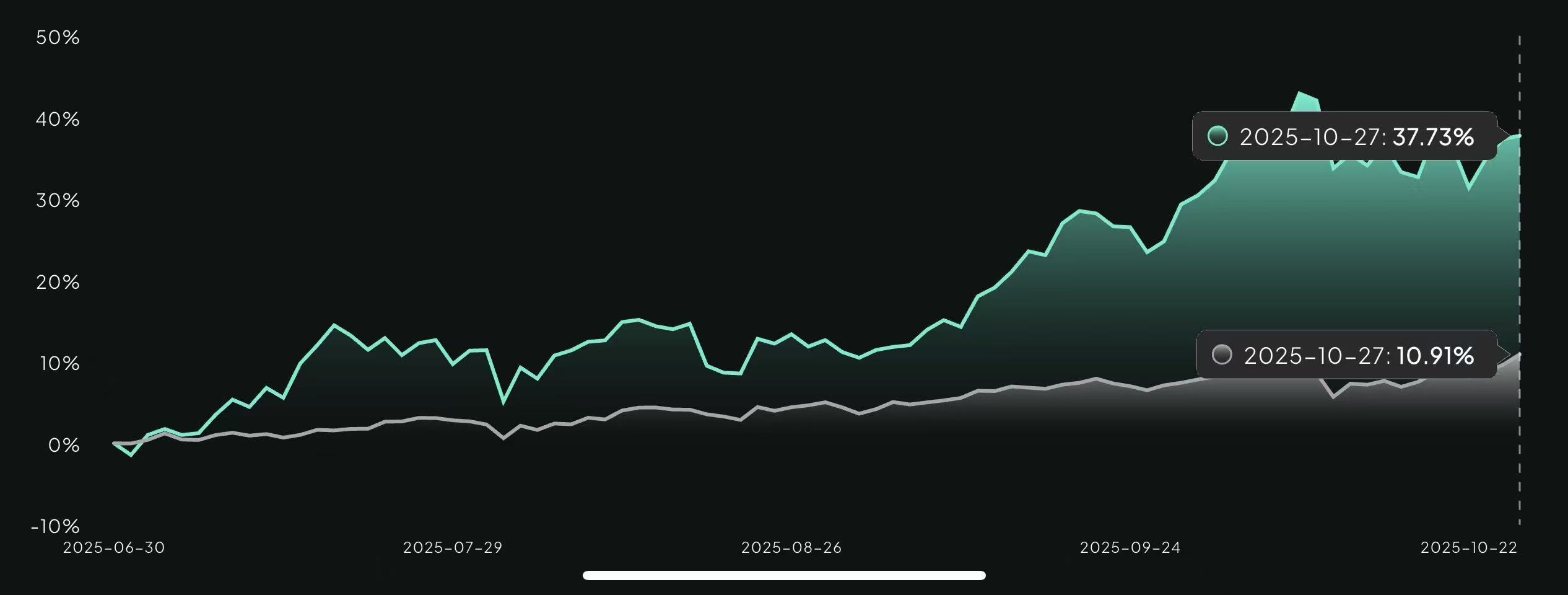

| Net Value Curve | Daily updated equity line vs. S&P 500 |

View Trade History

- Click “See More” → full-screen trade log (chronological).

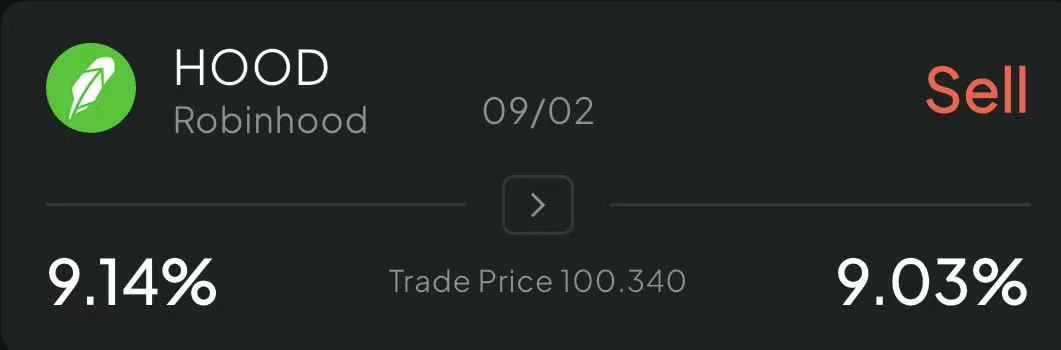

- Shows:

- Date

- Action (Buy/Sell)

- Stock, Fill Price, New Weight

- Example: “Sep 2: Sell HOOD @ $100.34 → 9.03% weight”

Step3: Receive Smart Notifications

Only for followed whales. Sample alerts:

-【Whales Tracker Alert】

ARK Investment Management LLC has bought TSLA in its tracker portfolio. Fill price: $432.10

-【Whales Tracker Alert】

Berkshire Hathaway has sold NVDA from its tracker portfolio. Fill price: $138.50

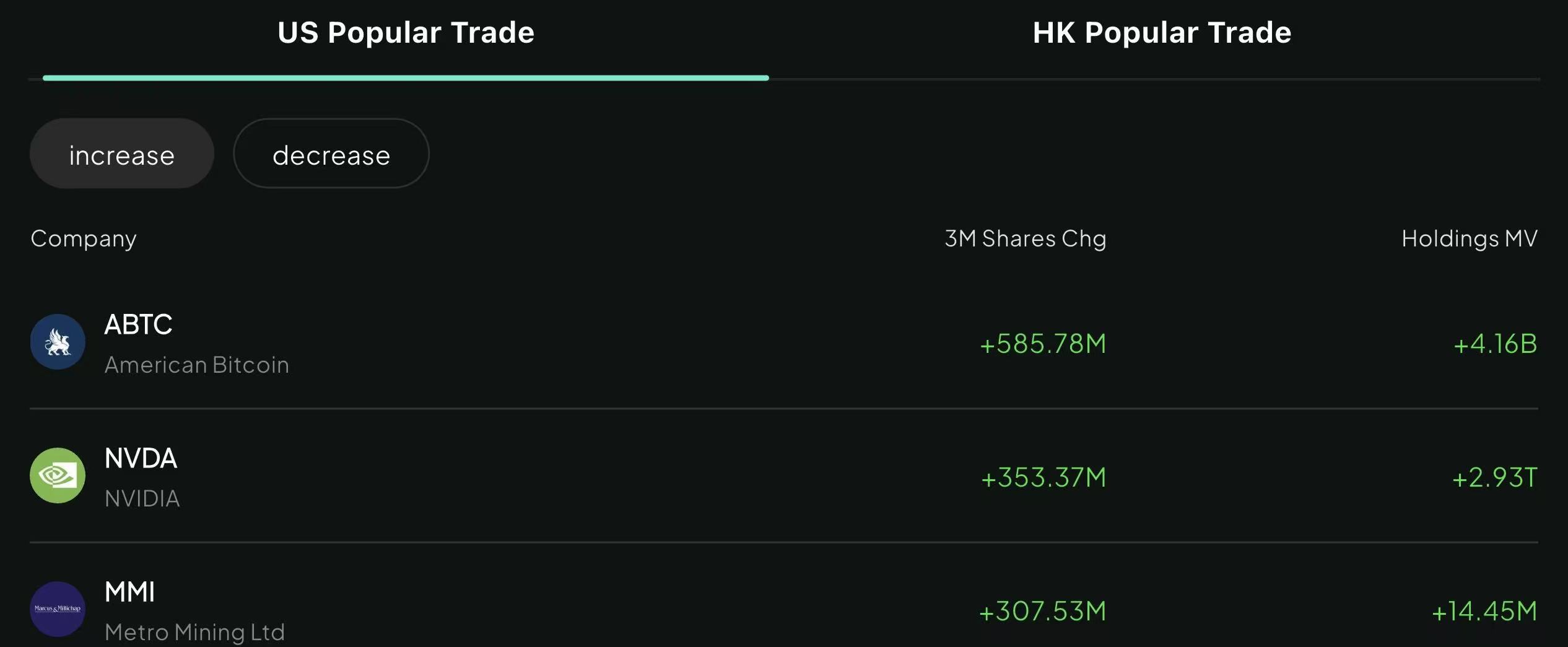

Step4: Popular Trades Dashboard (Split by Region)

Popular US Trade

- Top Increase and Decrease in U.S. stocks (3M Share Change)

Popular HK Trade

- Top Increase and Decrease in Hong Kong stocks

Step5: Subscribe to Whales Auto Tracker (Premium Add-On)

Whales Auto Tracker is not included in standard plans (Basic, Pro, Max, or Expert). It's a standalone premium subscription:

- Pricing Options:

- Semi-Annual: $199.99 (billed every 6 months)

- Annual: $319.99 (20% discount vs. two semi-annual payments)

- No free trial

Final Tips for Success

- Start with ARK to test the flow.

- Follow 3–5 whales—diversify strategies.

- Check daily for new trade alerts.

- Compare curves vs. S&P 500 to spot alpha.

- Upgrade annually to save 20%.

Ready to swim with the whales?

Subscribe today and let institutions do the heavy lifting—while you collect the gains.

Whales Auto Tracker: Because even minnows can follow giants. 🐳📈

Data delayed per SEC 13F rules. Past performance ≠ future results. Not investment advice.