Introduction

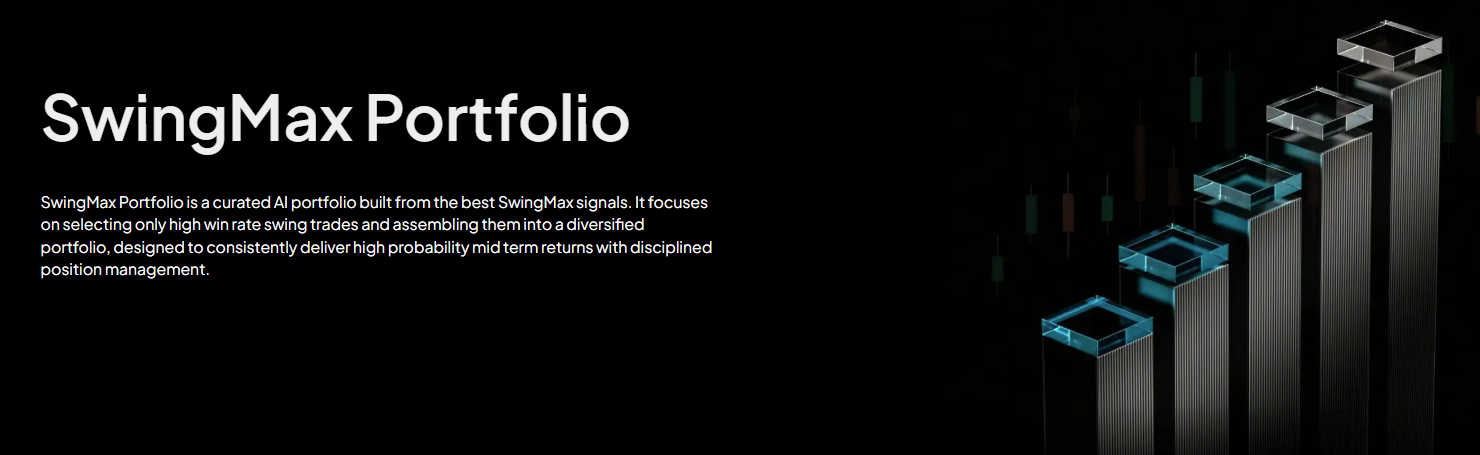

Welcome to SwingMax Portfolio, an AI curated swing trading portfolio designed to help investors follow SwingMax signals with clarity and confidence.

SwingMax generates dozens of new swing trading signals every trading day. While this depth is powerful, it can feel overwhelming for beginners who are unsure which signals to follow or how to manage multiple positions.

SwingMax Portfolio is built to solve this problem by turning raw signals into a structured, easy to follow portfolio.

What Is SwingMax Portfolio

SwingMax Portfolio is an AI managed swing trading portfolio derived directly from SwingMax Signals.

Instead of asking users to manually select from dozens of daily signals, the system automatically constructs a focused portfolio using only the highest quality opportunities.

Each position is selected and monitored by AI agents that combine technical timing with fundamental and liquidity screening, so users can focus on execution rather than knowing what to pick.

Why SwingMax Portfolio Is Different

Focused Holdings

The portfolio holds up to 5 positions at any time, helping investors avoid over diversification and decision fatigue.

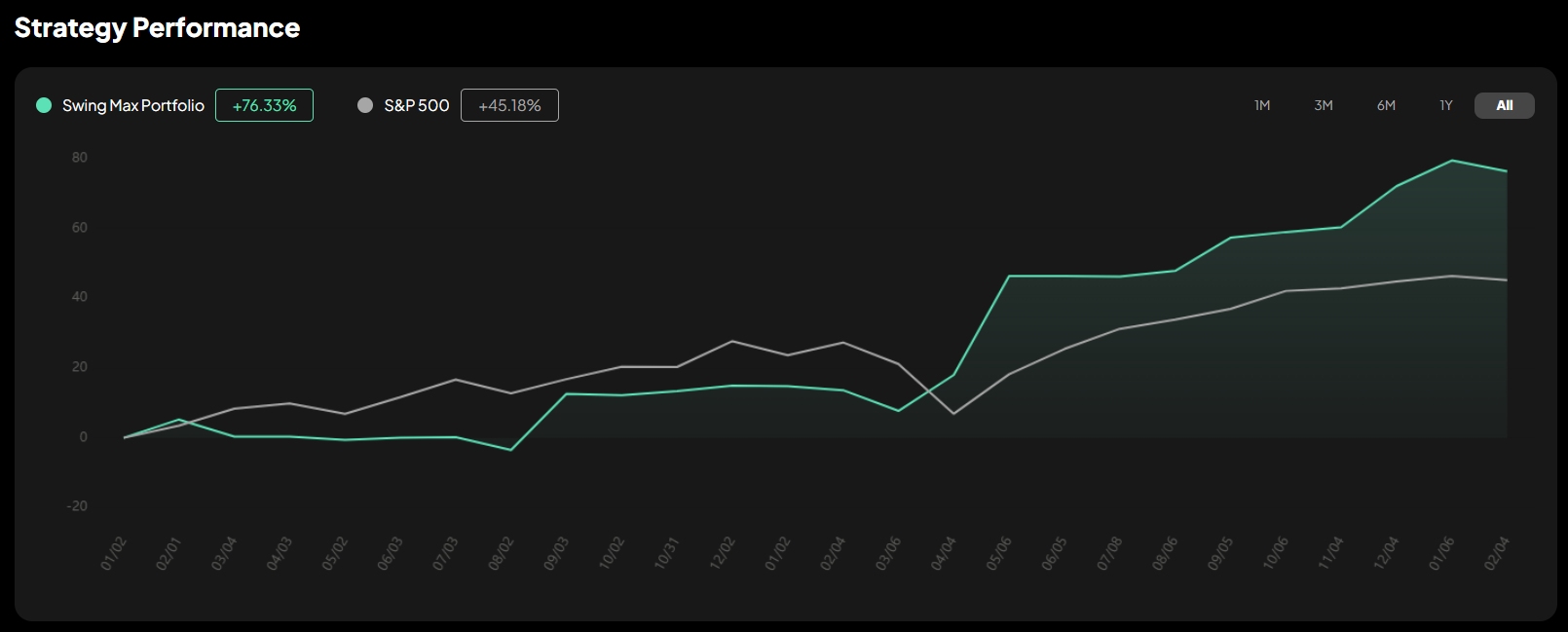

Proven Performance

Backtesting results show over 70 percent cumulative returns, based on historical simulations.

Easy to Follow

Clear buy and sell actions, limited positions, and portfolio level updates make it suitable even for first time swing traders.

Higher Quality Signals

All stocks included in the portfolio pass additional AI agent checks:

Fundamental due diligence to avoid structurally weak companies

Liquidity checks to ensure smooth entry and exit

Historical backtests showing over 75 percent trade win rate

How SwingMax Portfolio Works

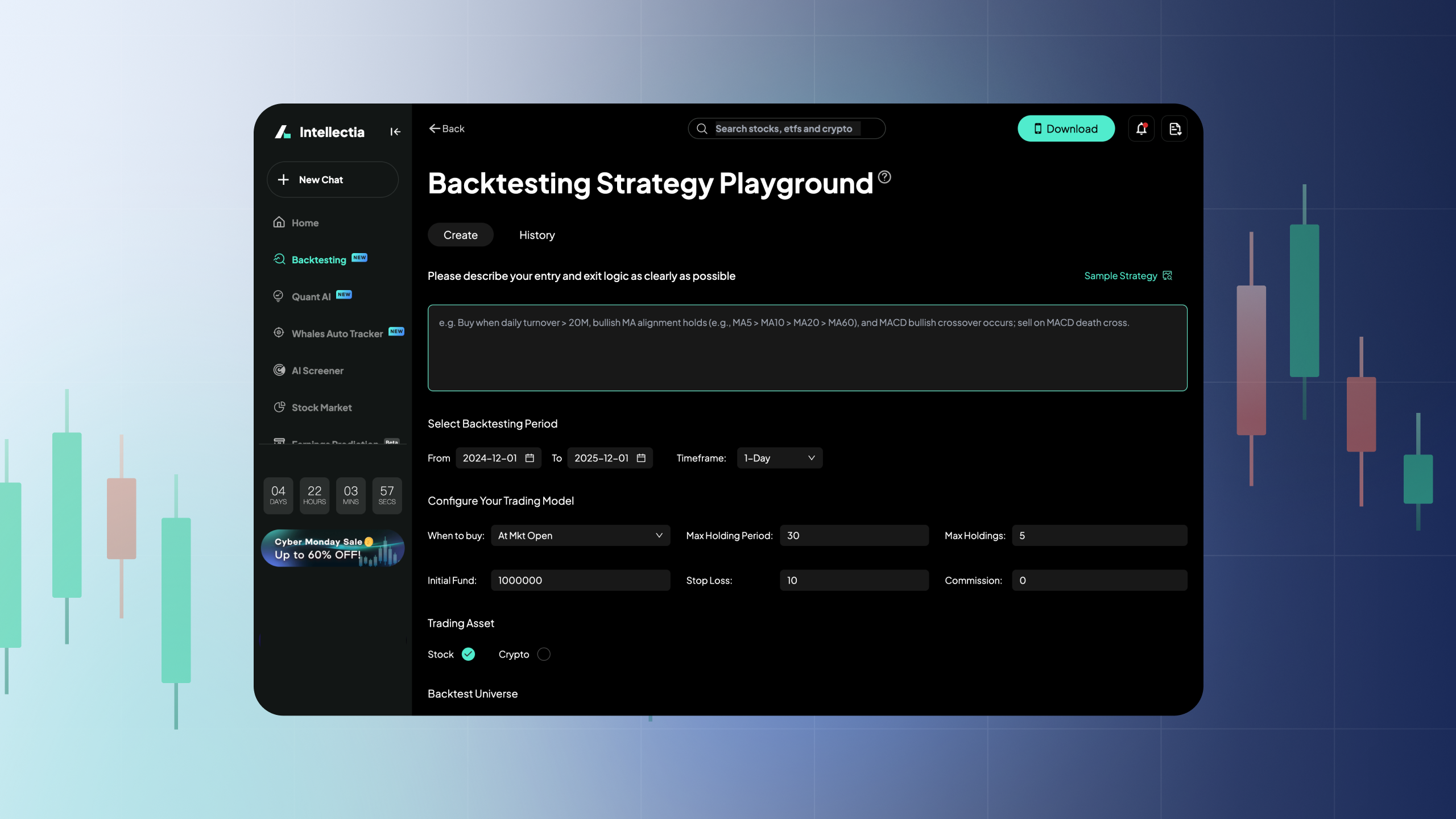

SwingMax Portfolio starts with the full universe of daily SwingMax signals.

From there, AI agents apply multiple layers of filtering:

Signal strength and technical confirmation

Fundamental health and earnings stability

Trading liquidity and execution feasibility

Portfolio balance and risk concentration

Only the strongest candidates are added to the portfolio, with a strict cap on total holdings.

The portfolio is continuously monitored and updated during market hours based on signal status changes.

How to Follow SwingMax Portfolio

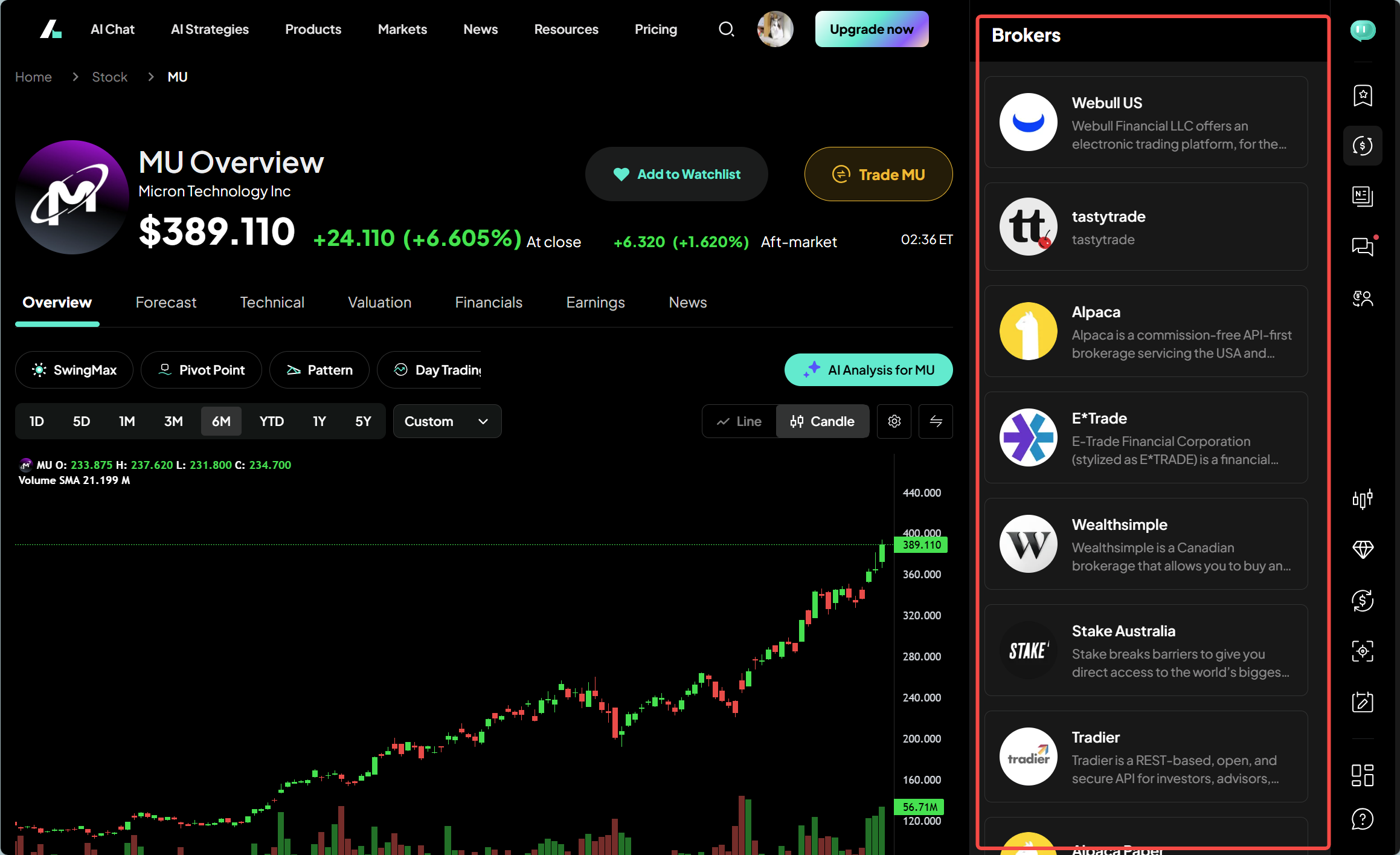

Step 1: Open the Portfolio

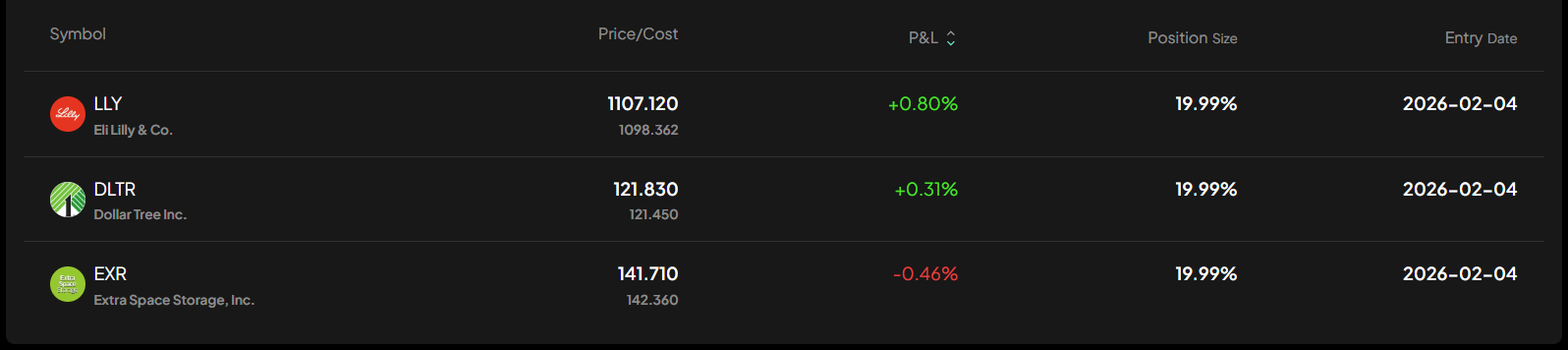

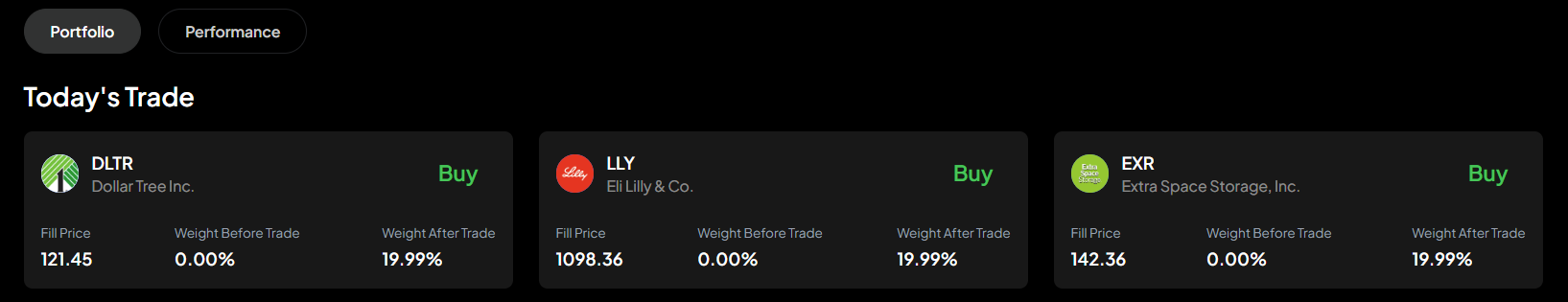

Navigate to SwingMax Portfolio in the app. You will see the current holdings, entry prices, position status, and unrealized PnL.

Step 2: Execute Buy Actions

When a new stock is added, follow the suggested entry during the indicated trading window.

Each position is designed to fit naturally within a small, concentrated portfolio.

Step 3: Monitor Portfolio Updates

The portfolio updates automatically as signals evolve.

If a position reaches its exit condition, you will see a clear sell instruction.

Step 4: Keep It Simple

You do not need to track every SwingMax signal.

Only follow actions shown inside the portfolio.

Risk and Portfolio Discipline

SwingMax Portfolio is designed to prioritize discipline and consistency.

Position count is strictly limited

All trades follow predefined entry and exit logic

No short selling is involved

Portfolio decisions are driven by data, not emotion

This structure helps reduce common beginner mistakes such as over trading or chasing late signals.

Who Is SwingMax Portfolio For

SwingMax Portfolio is ideal for:

Beginners who want to use swing trading signals without complexity

Investors who prefer a small number of high conviction trades

Users who want AI assisted selection with clear execution steps

Traders who value consistency over frequent decision making

Why It Works

SwingMax Portfolio works because it bridges the gap between powerful signal generation and real world usability.

By combining SwingMax timing signals with AI driven due diligence and portfolio construction, the strategy delivers a balance of performance, simplicity, and discipline that most retail investors struggle to achieve on their own.

Next Steps

Open the Intellectia app and explore SwingMax Portfolio to view current holdings and recent performance.

For best results, follow portfolio actions consistently and avoid mixing in unrelated trades.

Past performance does not guarantee future results. Trade responsibly.