PAGE NOT FOUND

Oops! It seems the page you are looking for does not exist...

Back to HomepageBlog

Get What You Are Looking For Here

Financial Analysis

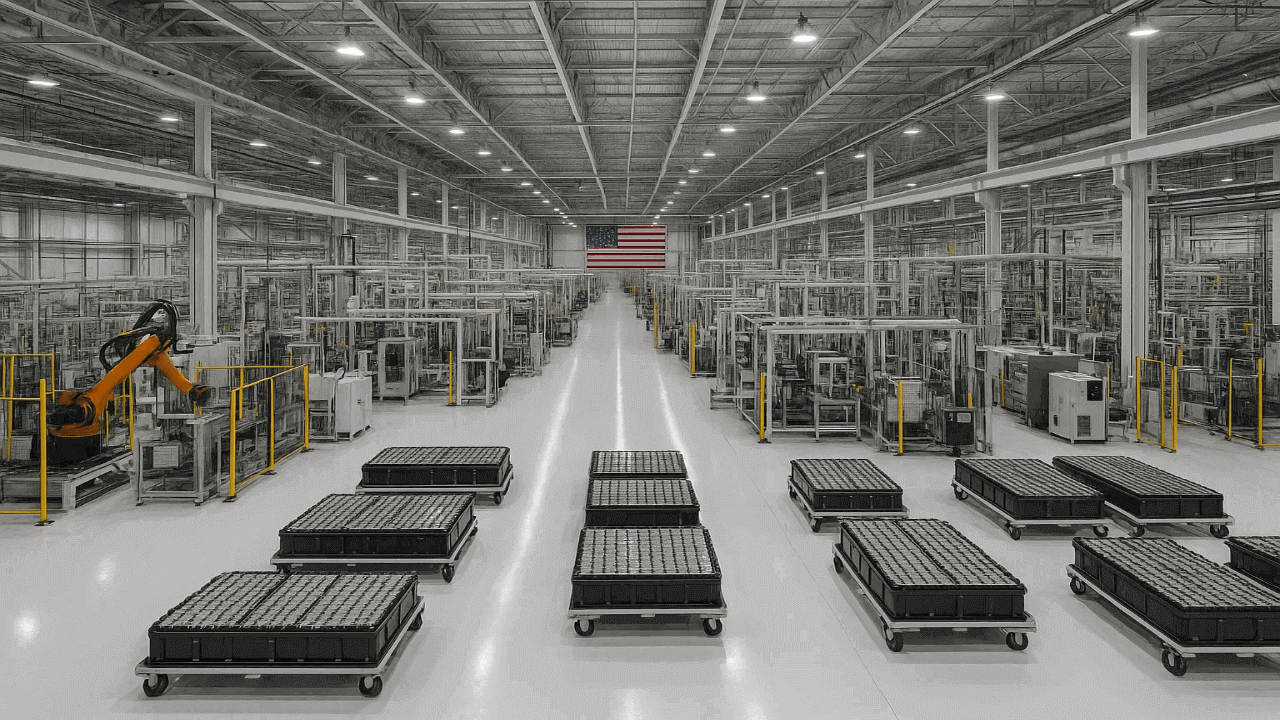

5 Best Battery Stocks To Power Your Portfolio in 2026 - Intellectia AI™

Jason Huang2 days ago

Financial Analysis

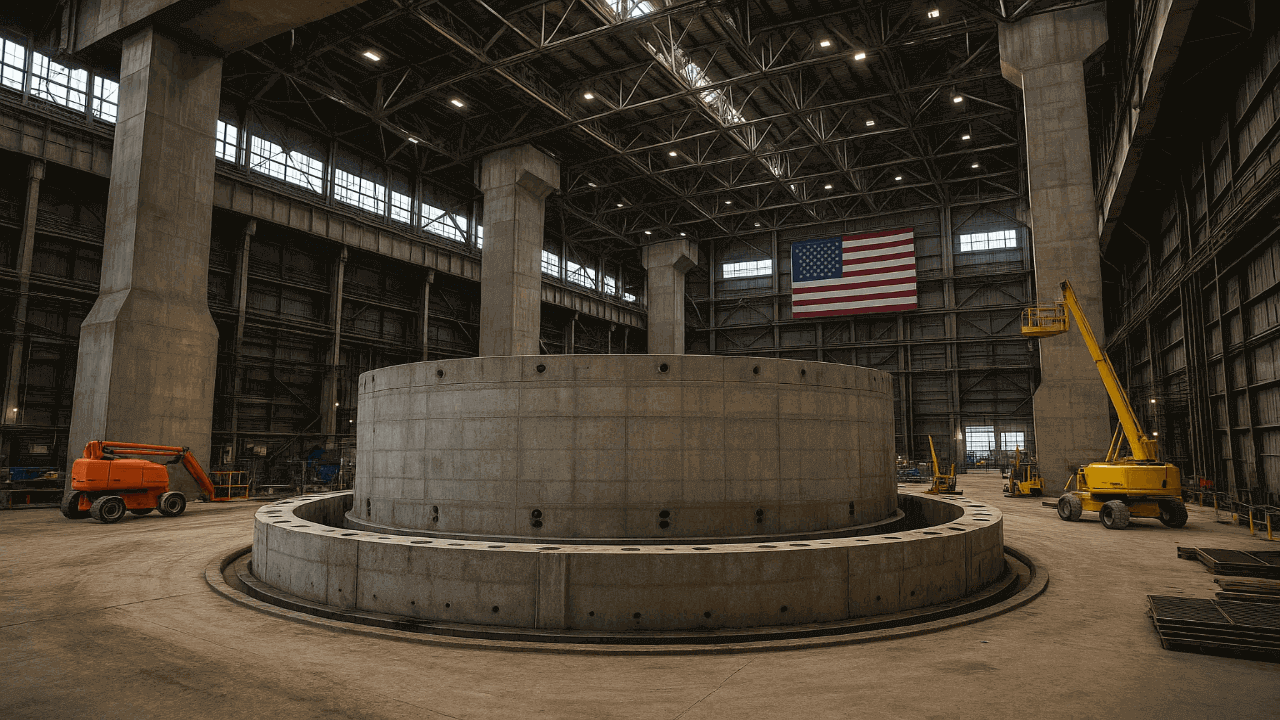

The 5 Best Infrastructure Stocks for 2026 - Intellectia AI™

Jason Huang2 days ago

Financial Analysis

Best Gold Mining Stock in 2026 - Intellectia AI™

Jason Huang3 days ago

Financial Analysis

Best Magnificent 7 ETFs 2026 - Intellectia AI™

Jason Huang3 days ago

People Also Watch

APVO

Aptevo Therapeutics Inc

1.55USD

10.71%

SBFG

SB Financial Group Inc

19.56USD

3.77%

CLGN

Collplant Biotechnologies Ltd

2.16USD

-1.37%

ET

Energy Transfer LP

16.83USD

0.36%

ABCB

Ameris Bancorp

71.62USD

-0.07%

ROCK

Gibraltar Industries Inc

62.39USD

-2.58%

UBFO

United Security Bancshares

9.165USD

0.16%

SNDR

Schneider National Inc

21.37USD

5.53%