Key Takeaways

- Infrastructure stocks offer a compelling combination of defensive stability and significant growth potential, making them attractive in various market conditions.

- Global megatrends, including the artificial intelligence boom, the clean energy transition, and manufacturing reshoring, are fueling trillions of dollars in new infrastructure spending.

- When selecting top infrastructure stocks, prioritize companies with strong project backlogs, sustainable dividend growth, and direct exposure to these powerful secular trends.

- The analysis highlights Caterpillar (CAT), Vulcan Materials (VMC), Brookfield Infrastructure Partners (BIP), AECOM (ACM), and NextEra Energy (NEE) as top picks for 2026.

- Leveraging advanced AI-powered tools can give you an edge in identifying, analyzing, and diversifying your investments across the vast infrastructure landscape.

Why Infrastructure Stocks Are a Smart Bet for 2026

Looking for long-term investments that can weather volatility and capture today’s biggest growth themes? You’re not alone. Traditional growth sectors can be notoriously volatile, and finding companies with durable, long-term tailwinds is harder than ever. Meanwhile, a massive global transformation is underway. The push for new infrastructure—from power-hungry AI data centers and renewable energy grids to modernized transportation networks—represents a multi-trillion dollar opportunity you shouldn’t overlook.

Navigating this sprawling sector to pinpoint the best infrastructure stocks can feel overwhelming. This guide is designed to solve that problem through the use of insights from Intellectia.ai AI-tools. The article will break down the key market drivers for 2026 and introduce five of the most promising infrastructure stocks that are perfectly positioned for substantial growth.

What Are Infrastructure Stocks?

At its core, infrastructure refers to the fundamental physical and organizational structures essential for a modern society to function. Think of roads, bridges, power grids, airports, pipelines, and the data centers that power our digital world.

Infrastructure stocks represent the companies that own, operate, develop, and maintain these critical assets. They form the backbone of the economy and can be broadly categorized into several key types:

- Construction & Engineering Firms: These are the master builders and designers. Companies like AECOM (ACM) and Caterpillar (CAT) plan, engineer, and construct massive projects.

- Utilities & Energy Infrastructure: These companies keep the lights on and the energy flowing. This includes electric utilities, renewable energy producers like NextEra Energy (NEE), and pipeline operators.

- Transportation & Logistics: This group owns and operates the networks that move goods and people, such as toll roads, seaports, and railways, often found in diversified portfolios like Brookfield Infrastructure Partners (BIP).

- Materials Providers: These are essential suppliers. Companies like Vulcan Materials (VMC) provide the crushed stone, sand, and gravel required for nearly every construction project.

- Digital Infrastructure: A rapidly growing sub-sector that includes data centers, fiber optic networks, and cell towers—the physical foundation of the digital economy.

Why Invest in Infrastructure Stocks in 2026?

The case for investing in infrastructure has rarely been stronger. A convergence of powerful forces is creating a unique opportunity for long-term growth and stability.

Global Infrastructure Supercycle: Governments worldwide are injecting hundreds of billions into modernizing aging infrastructure through initiatives like the U.S. Infrastructure Investment and Jobs Act (IIJA). Simultaneously, the private sector is pouring trillions into building the infrastructure needed for the future.

Defensive Stability Meets Growth: Because infrastructure provides essential services, these companies benefit from consistent, predictable demand. This creates stable revenue streams, often secured by long-term contracts, making them resilient during economic downturns.

Fueled by Megatrends: Today’s infrastructure boom is supercharged by unstoppable trends:

Artificial Intelligence: The AI revolution requires a colossal amount of electricity and a massive build-out of data centers.

Decarbonization: The global shift to clean energy necessitates a complete overhaul of electrical grids and a massive expansion of renewable power sources.

Reshoring: Companies are moving manufacturing back to their home countries, driving the construction of new factories and supply chain infrastructure.

A Natural Hedge Against Inflation: Many infrastructure assets, like toll roads and utilities, have mechanisms that allow them to raise prices in line with inflation. This helps protect your investment’s purchasing power over time.

How to Spot the Top Infrastructure Stocks

Not all infrastructure stocks are created equal. To identify the companies with the highest potential, you should focus on a few key criteria that signal quality and future growth.

- Strong Project Backlog: For construction and engineering firms, a large and growing backlog of confirmed projects is a direct indicator of future revenue and profitability.

- Sustainable Dividend Growth: For mature utilities and asset owners, a healthy dividend yield is great, but a history of consistently growing that dividend is even better. It signals financial strength and management’s confidence in the future.

- Exposure to Megatrends: Look for companies that are directly benefiting from the AI, clean energy, and reshoring booms. Their services should be critical to these transformative shifts.

- Reasonable Valuation: While these stocks often command a premium for their quality, it’s still important to assess their valuation. Use metrics like Forward P/E and Price-to-Sales to compare them with industry peers and ensure you’re not overpaying.

- Financial Health: Building and maintaining infrastructure is capital-intensive. The best companies have strong balance sheets that allow them to fund major growth projects without taking on excessive risk.

5 Most Promising Infrastructure Stocks to Buy for 2026

After analyzing the market based on the criteria above, five standout companies are identified that represent some of the best infrastructure growth stocks right now.

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Caterpillar Inc. | CAT | Industrials | ~$241B | Picks & shovels for infrastructure, key supplier to data centers |

| Vulcan Materials Co. | VMC | Materials | ~$39B | Largest U.S. aggregates producer, direct beneficiary of public spending |

| Brookfield Infra. Partners | BIP | Utilities | ~$16B | Globally diversified assets, strong capital recycling, AI focus |

| AECOM | ACM | Industrials | ~$17B | Asset-light engineering leader, record project backlog, data center expert |

| NextEra Energy, Inc. | NEE | Utilities | ~$171B | Leading U.S. utility & world's largest renewables producer |

Caterpillar (CAT)

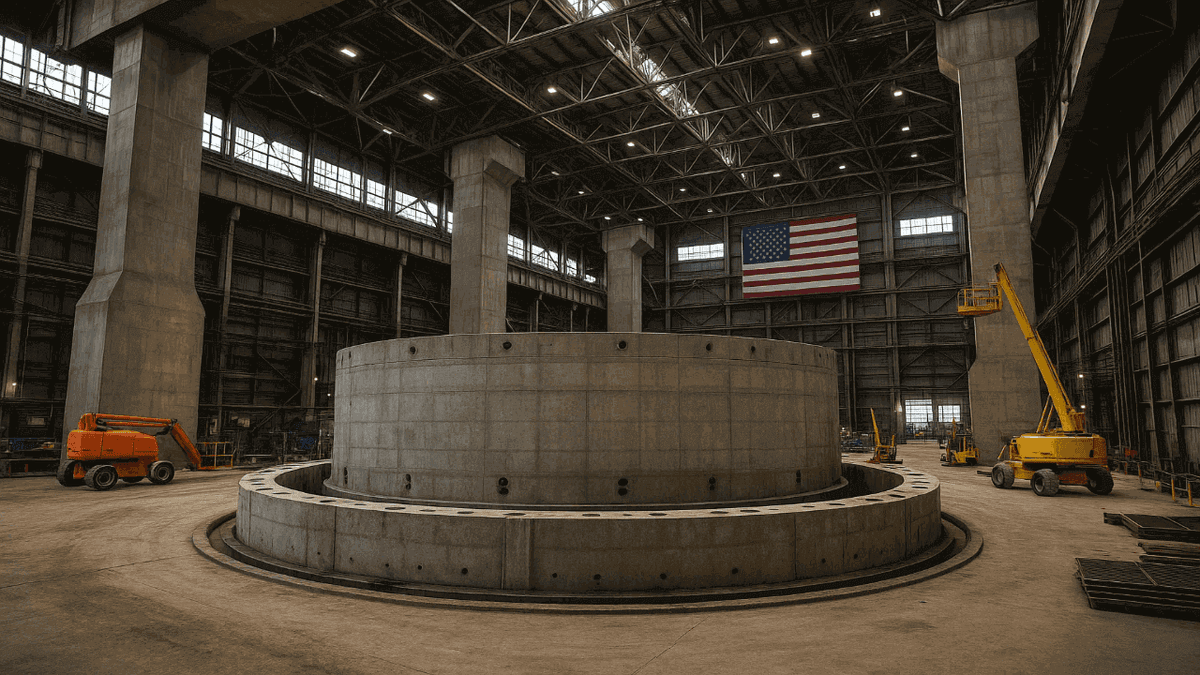

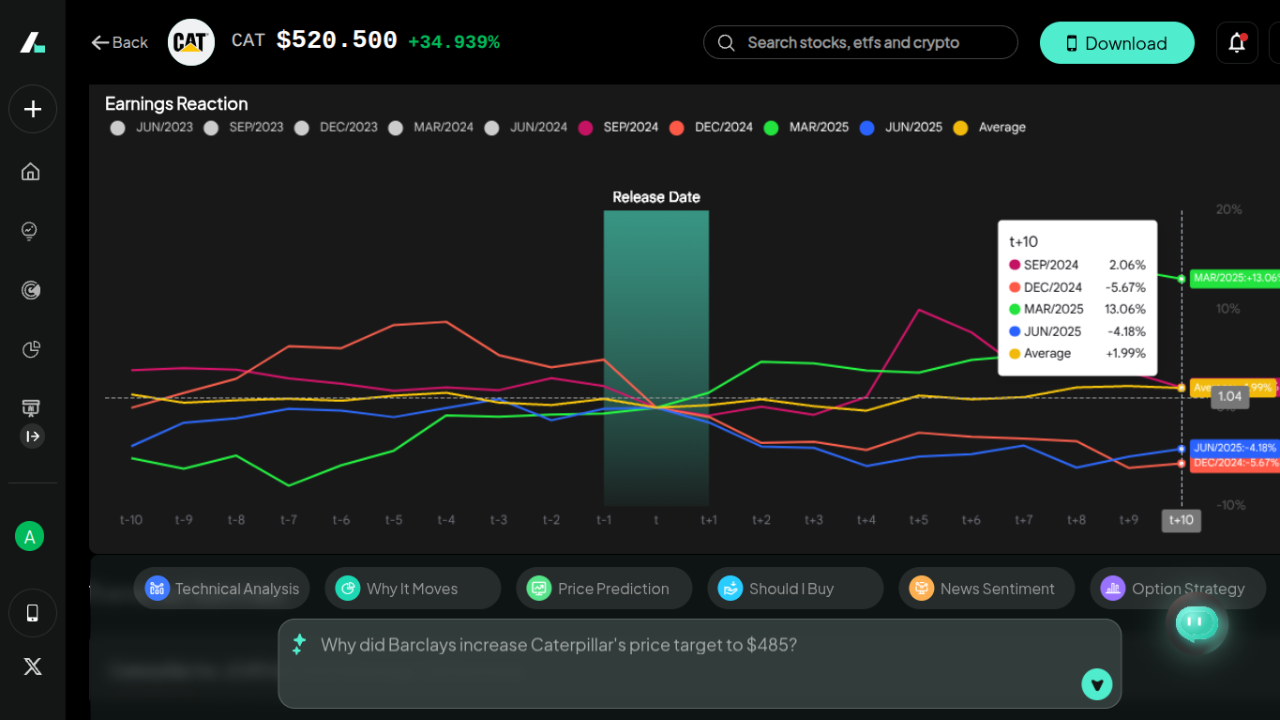

Caterpillar is the world's leading manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. It’s the quintessential "picks and shovels" play for any construction boom.

While CAT has always benefited from infrastructure spending, it has a powerful new growth driver: AI. The company's power generation division, which builds industrial-scale turbines and generators, is a critical supplier for energy-hungry data centers. Recent company reports highlight a record backlog of $37.5 billion, underscoring the immense demand for its products across all segments.

Caterpillar is uniquely positioned to profit from both the physical build-out of infrastructure and the digital revolution. As data centers and EV factories demand more power than the grid can supply, they are turning to on-site power solutions from companies like CAT, creating a massive and durable revenue stream for years to come.

Vulcan Materials Company (VMC)

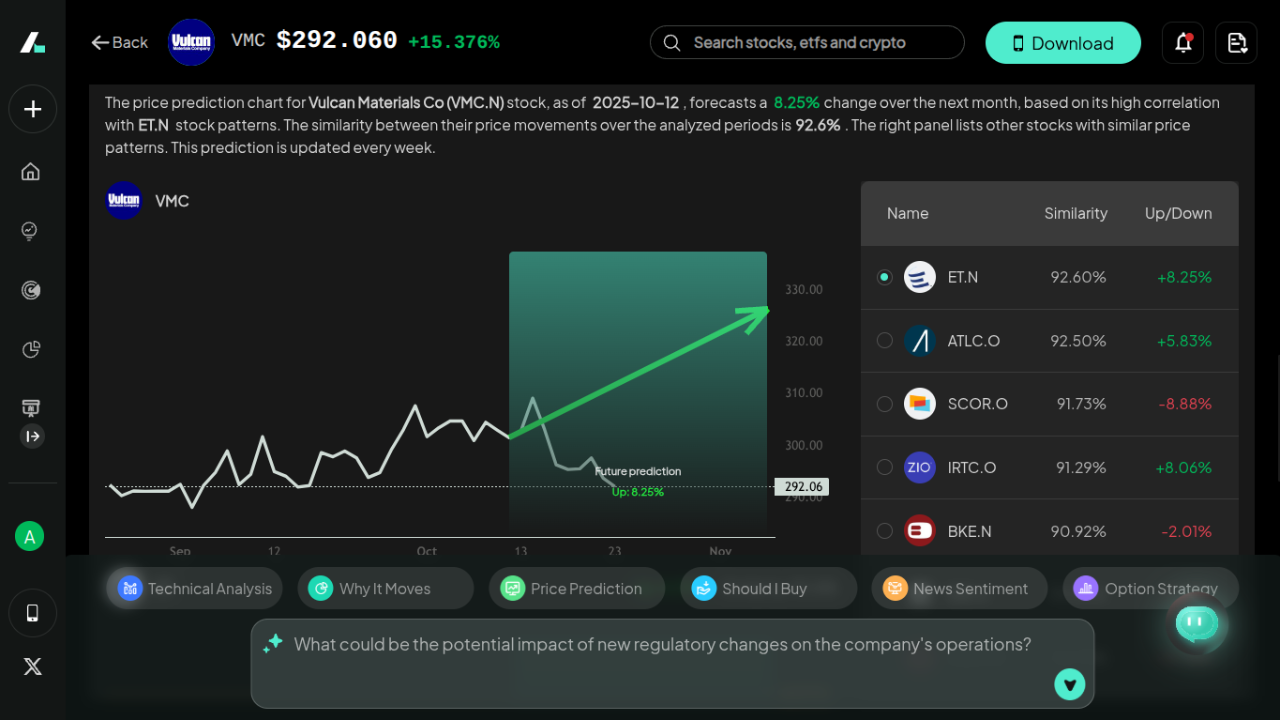

Vulcan Materials is the largest producer of construction aggregates—crushed stone, sand, and gravel—in the United States. These materials are the literal foundation for roads, bridges, commercial buildings, and data centers.

Vulcan's business is directly tied to construction activity. With the IIJA driving a surge in public works projects and the private sector building data centers at a record pace, demand for aggregates is booming. The company has highlighted that nearly 80% of planned data center activity is within 30 miles of a Vulcan operation, giving it a powerful logistical advantage.

As a domestic leader with strategically located quarries, Vulcan is an indispensable partner for America's infrastructure renewal. The company recently reaffirmed its robust full-year adjusted EBITDA guidance of $2.35 billion to $2.55 billion, reflecting its confidence in accelerating demand and strong pricing power through 2025 and beyond.

Brookfield Infrastructure Partners (BIP)

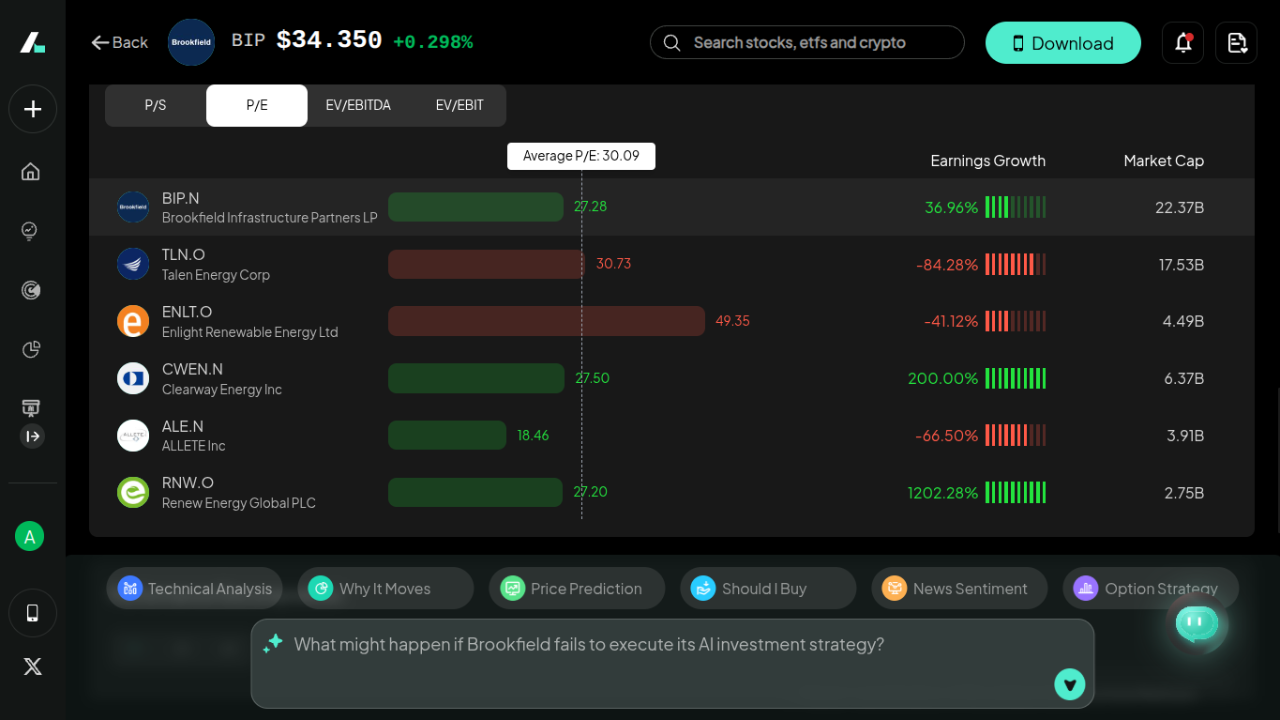

Brookfield Infrastructure Partners is a globally diversified owner and operator of high-quality infrastructure assets across utilities, transportation (toll roads, ports, rail), midstream energy, and data sectors.

BIP's key strength is its "capital recycling" strategy: it sells mature, stabilized assets at a premium and reinvests the proceeds into new, higher-growth opportunities. The company is aggressively targeting the AI boom, investing in what it calls "AI factories"—massive data infrastructure projects. In its Q2 2025 earnings, BIP reported strong Funds From Operations (FFO) growth and highlighted its successful capital recycling program, which has already generated $2.4 billion in proceeds this year.

BIP offers a unique combination of global diversification, a strong and growing dividend, and savvy exposure to the most exciting areas of infrastructure. Its proactive investment in digital infrastructure positions it as a key player in the next phase of global growth.

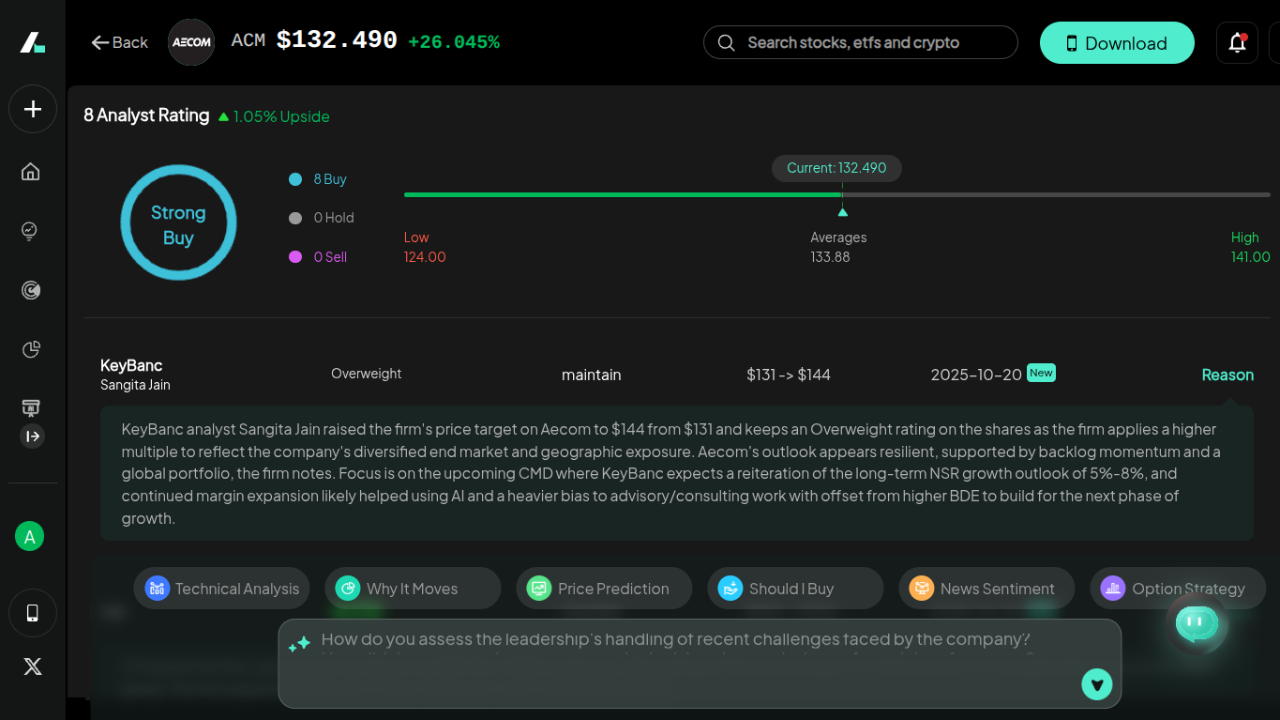

AECOM (ACM)

AECOM is a premier, fully integrated infrastructure firm that designs, builds, finances, and operates projects for public- and private-sector clients. Its asset-light consulting model makes it highly profitable and scalable.

AECOM is firing on all cylinders. The company has raised its 2025 financial guidance three times this year, driven by record-setting backlog, a robust project pipeline, and exceptional performance. It is a world leader in designing and managing complex projects, especially in high-growth areas like data centers, where its advisory practice has doubled its revenue in the last two years.

AECOM benefits from every stage of the infrastructure lifecycle, from initial planning to long-term management. Its expertise is in high demand as clients navigate the complexities of building sustainable and AI-ready infrastructure. With a stated goal of achieving 16% EPS growth, AECOM is primed for continued outperformance.

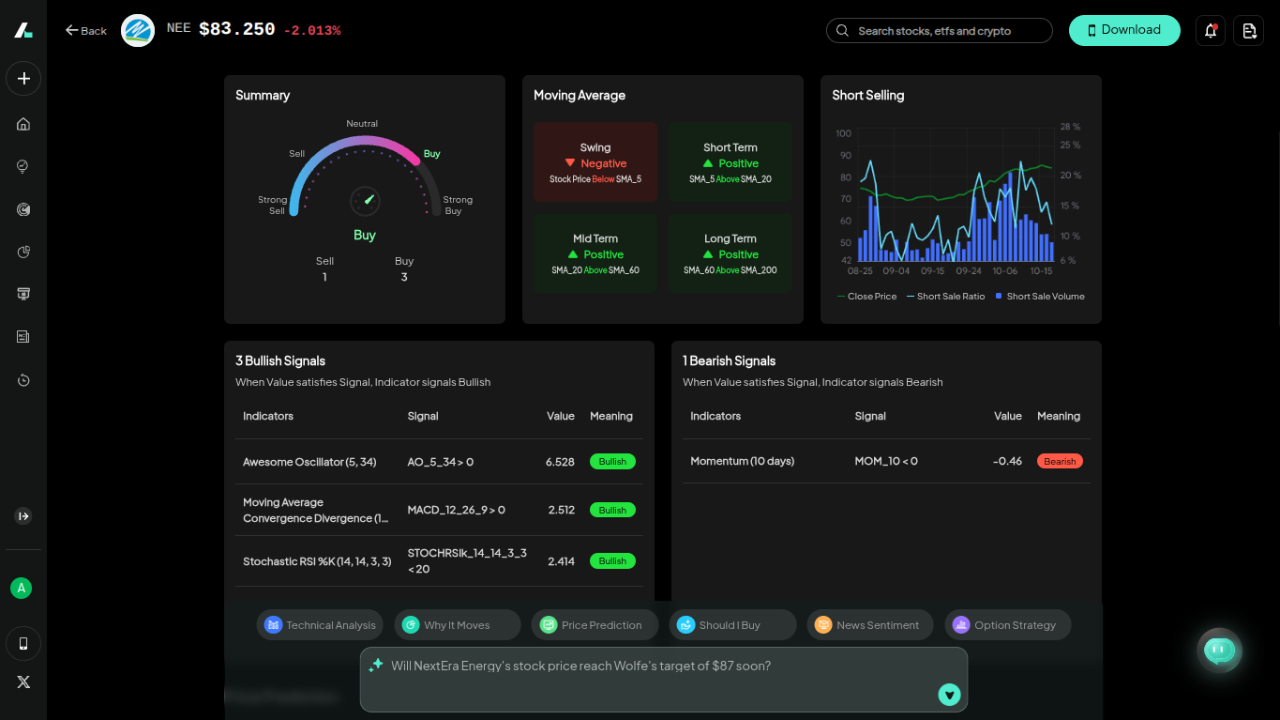

NextEra Energy (NEE)

NextEra Energy is a dual-threat powerhouse. It owns Florida Power & Light, the largest electric utility in the U.S., which provides stable, regulated returns. It also owns NextEra Energy Resources, the world's largest generator of renewable energy from wind and solar and a leader in battery storage.

NEE offers the best of both worlds: the safety of a regulated utility and the explosive growth potential of a clean energy leader. The company is perfectly positioned to benefit from the massive increase in electricity demand driven by data centers, EVs, and electrification. It recently outlined plans for an 8 GW expansion of solar and storage and maintains a massive backlog of nearly 30 GW in new energy projects.

As the U.S. electrifies its economy and transitions to clean energy, NextEra is the undisputed leader. The company projects dividend growth of roughly 10% per year through at least 2026, making it a top infrastructure stock for both growth and income.

How to Invest in Infrastructure Stocks Smartly

Investing in infrastructure is a powerful strategy, but you need the right approach to maximize your returns.

- Diversify Across Sub-Sectors: Avoid concentrating in just one area. A balanced portfolio might include a materials provider like VMC, an engineering firm like ACM, and an energy leader like NEE to capture different aspects of the boom.

- Use Thematic Investing: Focus on the powerful megatrends. You can use Intellectia.ai's powerful AI Screener to filter for infrastructure companies with direct exposure to AI, high revenue growth, or strong dividend track records. This helps you target the specific drivers you believe in.

- Think Long-Term: Infrastructure projects are multi-year endeavors. The real value in these stocks is typically unlocked over a long-term horizon, making them ideal for patient investors.

- Monitor Key Metrics: Stay on top of project backlogs, dividend payout ratios, and regulatory news. For identifying optimal entry and exit points, even for long-term positions, consider leveraging the data-driven insights from Intellectia.ai's AI Stock Picker and Swing Trading signals.

Conclusion

As infrastructure spending surges worldwide, investors have a once-in-a-generation opportunity to build wealth on solid ground.

Tools like Intellectia.ai can help you uncover hidden opportunities, identify undervalued leaders, and track market momentum in real time. Sign up for Intellectia.ai today to stay ahead of market shifts and access AI-powered insights that help you invest smarter in 2026 and beyond.