Key Takeaways

Rivian presents a high-risk, high-reward investment opportunity as the company transitions from luxury to mass-market electric vehicles with significant catalysts ahead.

• R2 launch in 2026 is the critical catalyst - The $45,000 R2 SUV targets mass-market appeal, potentially driving volume needed for profitability with 155,000 annual production capacity.

• Financial momentum building despite challenges - Three consecutive quarters of positive gross profit and 78% Q3 revenue growth, but cash burn continues with break-even not expected until 2027.

• Strong balance sheet provides runway - $7 billion cash position offers approximately three years of operational funding through the R2 ramp-up period.

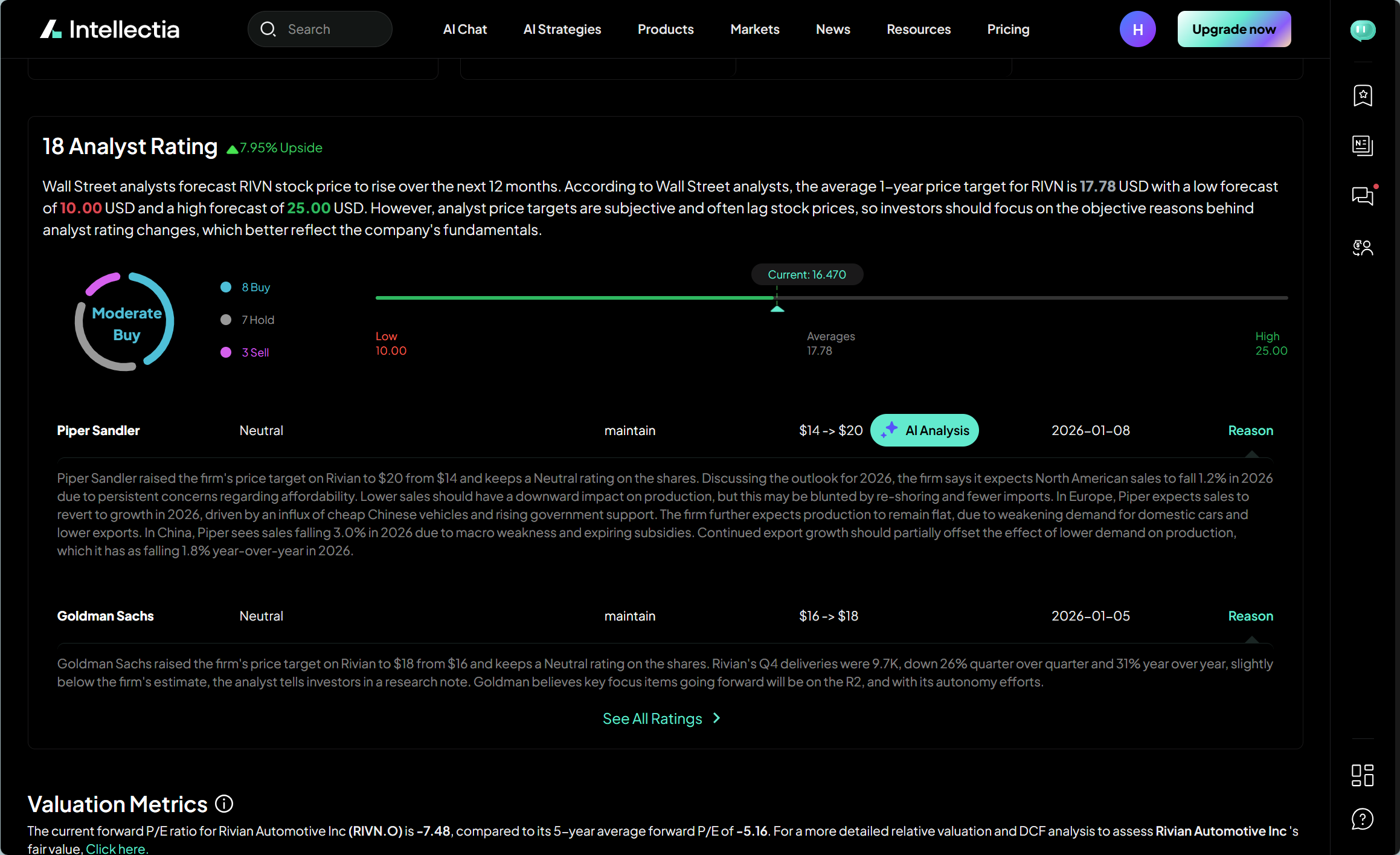

• Wall Street remains divided on outlook - Consensus "Hold" rating with price targets suggesting potential downside, while some analysts project 54% upside over three months.

• Best suited for risk-tolerant growth investors - Limit allocation to 2-5% of portfolio given high volatility, premium valuation, and execution risks in competitive EV market.

The company's success hinges on executing the R2 launch effectively while managing cash burn and competing against established players like Tesla and Ford in an increasingly crowded electric vehicle marketplace.

Rivian's stock has dropped more than 80% from its peak. The U.S. EV market faces its most important challenges, with sales dropping by more than 41% in November 2025. However, Rivian demonstrates remarkable resilience. The company's third-quarter revenue jumped 78% year over year to $1.56 billion.

The EV sector struggles with ongoing challenges, yet Rivian's stock showed new signs of life in 2025. The stock climbed 46% last year after its extended post-IPO decline. Analysts remain positive about Rivian's stock forecast and expect a 54.49% rise over the next 3 months. The company plans to launch more affordable midsize SUVs in 2026. Rivian's R2 price will start around $45,000, which could transform this all-electric truck and delivery van manufacturer's future. The company's balance sheet shows approximately $7 billion in cash as of Q3 2025. Their ambitious plans include delivering up to 155,000 vehicles annually starting in 2026. These factors make Rivian an interesting investment opportunity right now.

Understanding Rivian’s Business Model

You need to understand Rivian's three-pronged business strategy to decide if Rivian is a good stock to buy. These strategies are the foundations of the company's revenue.

Consumer vehicles: R1T and R1S

Rivian builds two flagship consumer vehicles: the R1T pickup truck and R1S SUV. These premium electric vehicles appeal to wealthy outdoor enthusiasts and eco-conscious buyers. The R1T pickup costs $73,000, while the R1S SUV starts at $78,000. Both vehicles sit firmly in the luxury EV market segment.

The vehicles use Rivian's skateboard platform architecture. This design places the battery, drive units, suspension, and thermal systems under the vehicle's body. Their innovative approach enables excellent off-road performance through a quad-motor system that delivers precise torque to each wheel.

Rivian's Normal, Illinois plant can make 150,000 vehicles yearly. The company hasn't reached full capacity yet as it builds up operations. Rivian delivered about 18,000 vehicles in Q3 2025, which shows steady improvements in manufacturing efficiency.

Commercial delivery vans and Amazon partnership

Rivian's Electric Delivery Van (EDV) program and its partnership with Amazon form its second major business segment. Amazon ordered 100,000 custom-designed electric delivery vans for delivery by 2030 - one of the biggest EV orders ever made.

Amazon already uses thousands of these vans in more than 50 U.S. cities. They plan to operate 100,000 vehicles by 2030. This partnership gives Rivian steady revenue and production volume as they grow.

The company started offering commercial vans to other enterprise customers in early 2025. These vans come in different sizes (EDV 500, 700, and 900) to meet various delivery needs. They can travel 150-200 miles on a single charge.

Technology licensing and software services

Rivian's third business pillar focuses on technology licensing and software services. This strategy creates higher-margin revenue streams alongside vehicle sales.

The company has invested heavily in proprietary technologies:

Advanced battery management systems

Electric drivetrain architecture

Vehicle-to-grid integration capabilities

Autonomous driving features

Rivian Cloud powers their software ecosystem, enabling over-the-air updates that improve vehicle performance without dealer visits. They also offer subscription services that generate recurring revenue:

Enhanced driver assistance packages

Adventure network charging subscriptions

Fleet management tools for commercial customers

Rivian owns more than 1,000 patents for its EV technologies. These patents could lead to licensing deals with other manufacturers. This intellectual property portfolio remains an untapped asset on Rivian's balance sheet.

Analysts watching the rivian stock forecast pay close attention to how well the company uses these three segments to reach profitability. The upcoming rivian R2 price of $45,000 will show if Rivian can bring its premium vehicle technologies to the mass market while maintaining good profit margins.

Financial Performance and Forecast

A close look at Rivian's financial journey shows both bright spots and hurdles for anyone thinking about investing in this EV maker.

2025 revenue and margin trends

Rivian showed impressive revenue growth in 2025. Q3 numbers hit $1.56 billion, which is a big deal as it means a 78% jump from last year. This success came from two areas: car sales reached $1.14 billion (up 47% YoY) while software and services brought in $416 million (a massive 324% increase YoY).

The company hit another milestone by earning $24 million in gross profit during Q3 2025. This marks their third straight quarter in the black. All the same, cars still lost $130 million, but software and services saved the day with $154 million in profit. The deal with Volkswagen Group helped boost these numbers.

Looking at the full year 2025, Rivian expects to bring in $4.7-$4.9 billion. This is actually a small step down from $4.97 billion last year. The company delivered 9,745 vehicles in Q4, which is 31% less than last year. Full-year deliveries came to 42,247 vehicles - an 18% drop from 2024.

Rivian stock forecast for 2026

Market experts predict Rivian will deliver about 66,000 EVs in 2026, with sales likely hitting $6.9 billion. Based on these numbers, some analysts think Rivian stock could trade at 7 times sales, maybe even reaching $39.27 per share.

Wall Street can't seem to agree on Rivian's future. Most analysts set a one-year target at $17.68, showing possible losses ahead. 24/7 Wall St. takes an even darker view, predicting $14.57 by the end of 2026 - a potential 25.4% drop. They blame this mostly on a weaker EV market after federal tax credits ended.

The R2's arrival in early 2026 could change everything. Wedbush Securities analysts call 2026 a turning point for Rivian. They believe this more affordable R2 model might completely change the company's financial path.

Break-even timeline and profitability outlook

Rivian's road to making money looks promising as margins get better. The company aims to hit positive adjusted EBITDA by 2027, with big goals ahead:

25% gross margin

High teens adjusted EBITDA margin

10% free cash flow margin

Market watchers expect Rivian's revenue to grow from $4.8 billion in 2025 to $9.6 billion by 2030. Losses should shrink from $4.69 per share in 2025 until they break even in 2030. Some even predict stronger growth at 20% yearly from 2026 through 2030, possibly reaching $14.5 billion by 2030.

Rivian's biggest strength is its $7.1-7.2 billion cash pile. This gives them about three years to fund operations and R2 development. While this cushion helps avoid immediate money worries, they might still need more funding later.

If you're wondering whether Rivian is a good stock to buy, it really depends on how much risk you can handle and how long you plan to invest. The company looks set for growth through better costs, improving profits, and the new R2. But experts warn this should only be a speculative buy if you're comfortable with risk and believe in Rivian's long-term role in the EV market.

Before putting money into Rivian stock, make sure you get a full picture from multiple sources. The Intellectia.ai AI Screener is a great way to get started. It helps you find companies in any industry that are tapping into the full potential of new tech trends - like EV suppliers or competitors ramping up production.

Technical Indicators and Market Sentiment

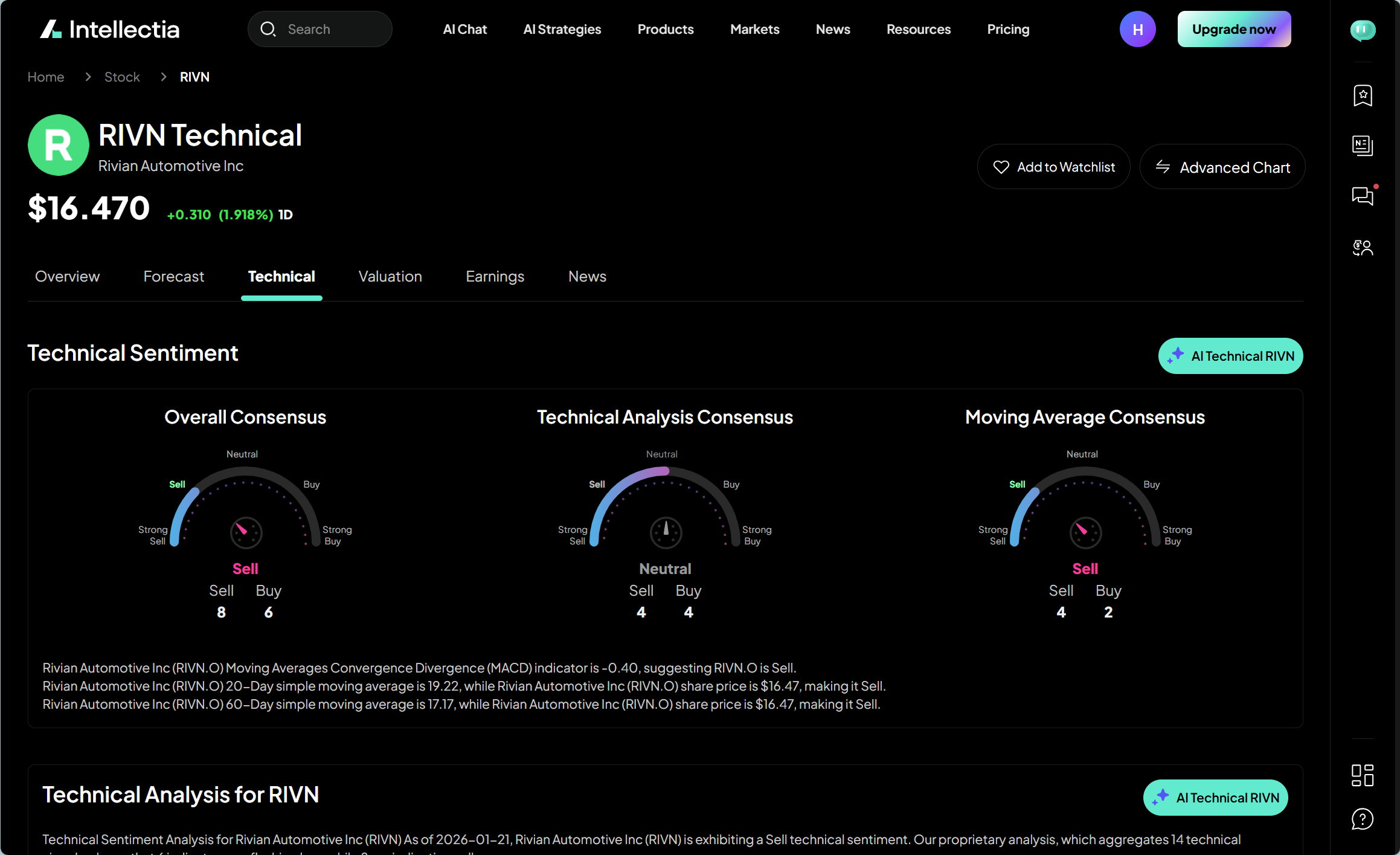

The technical analysis of is Rivian a good stock to buy shows mixed signals from indicators of all types.

RSI, MACD, and Bollinger Bands

Rivian's Relative Strength Index (RSI) stands at 51.03, which suggests the stock might be slightly overbought. A different analysis reveals an RSI of 42.929, which shows potential selling pressure instead. This contradiction highlights why investors shouldn't rely on single indicators.

The Moving Average Convergence Divergence (MACD) readings paint both a promising and concerning picture. Some analyzes show a positive MACD of 0.56 that generates a buy signal, while others report a negative MACD of -0.15 that suggests selling pressure. The MACD histogram has grown positively in recent weeks. The MACD line sits above the signal line, which reflects growing bullish momentum.

Bollinger Bands analysis reveals similar mixed signals. The 25-day Bollinger Bands range between 17.9 and 20.84, and the 100-day bands span from 13.01 to 18.21. Both ranges suggest buy signals technically. The 20-day Bollinger Bands have widened by a lot after a recent 10.70% surge in a single session. The price sits near the upper band now, which typically suggests an overbought condition.

Support and resistance levels

The price charts show key support zones around $18.26-18.40, where previous sell-offs couldn't push prices lower. More support levels appear at $18.02, $16.41, and $15.42 based on accumulated trading volume.

Rivian faces three major resistance hurdles: $22.83 as immediate resistance, $24.86 next, and $28.05 as the final major resistance level. The stock trades well above all major moving averages (50-day, 100-day, 200-day), which typically points to sustained bullish momentum.

Insider trading activity and sentiment

The insider trading data raises some concerns. In the last 90 days, Rivian has seen insiders sell shares worth about $710,767 with no matching buy activity from executives.

CEO Robert Scaringe sold shares worth $339,100 just seven days ago. Both Scaringe and CFO Claire McDonough have made multiple planned sales throughout 2025. Scaringe's largest transaction reached $3.96 million on January 6, 2026.

Of course, these insider sales happened while the stock price jumped 47.2% during the same period. This might show profit-taking rather than a lack of confidence in the Rivian stock forecast.

The R2 Series and Market Expansion

The R2 series shows how Rivian is shifting from luxury vehicles to ones that are accessible to more people. This move could change everything for investors who wonder is Rivian a good stock to buy.

Rivian R2 price and affordability

Rivian's R2 comes with a price tag of about $45,000, which is nowhere near the cost of their current models. The price is less than half of what their first-generation vehicles cost, especially when compared to R1T and R1S models that start at $73,000+. The company plans to launch special editions first, likely priced between $52,000 and $60,000. They promise the actual $45,000 base model will arrive once production gets going smoothly.

The R2's affordable price comes from its efficient design, compact size, and better deals with suppliers. Company leaders call it their "most promising product to date". This new model keeps Rivian's adventure-loving spirit while staying affordable.

Mass-market appeal and competition with Tesla

The R2 matches the size of popular compact crossovers like the BMW X3 and Hyundai Tucson. It goes head-to-head with the Ford Mustang Mach-E and Tesla Model Y. Tesla's Model Y starts at $48,200 for Premium and $56,700 for Performance, and Rivian wants to compete directly with these prices.

R2's specs pack quite a punch. The single-motor version delivers over 300 miles of range, and it can zoom from 0-60 mph in about 3.0 seconds. Buyers can choose between single-, dual-, and tri-motor setups. This is a big deal as it means that Rivian can keep its performance reputation while reaching many more customers.

Production capacity and delivery targets

Customers should see their first R2s in early 2026, with production numbers climbing through late 2026 and into 2027. Rivian's Normal, Illinois plant is getting bigger by 1.1 million square feet. They're also building a 1.2-million-square-foot supplier park to make the supply chain more efficient.

The expanded Normal facility should pump out 215,000 vehicles yearly. Once everything runs at full speed, Rivian expects to make up to 155,000 R2s each year.

This move into mass-market vehicles could make all the difference for the rivian stock forecast. Tesla became profitable by making lots of Model 3s and Model Ys. Now analysts think the R2's higher production numbers could help Rivian do the same.

Should You Buy Rivian Stock Now?

Making a decision about investing in Rivian requires careful evaluation of mixed signals from analysts and market indicators.

Is Rivian a good stock to buy?

Wall Street can't seem to agree on Rivian's future. The stock currently has a consensus "Hold" rating based on 8 buy ratings, 7 hold ratings, and 4 sell ratings. Recent analysis shows an average 12-month price target of $16.15, which points to a potential drop from current prices. Some analysts place fair value at $14.48, while others see a possible 54.49% rise in the next three months.

The company's price-to-sales ratio stands at 3.1x, much higher than both the US auto industry average of 1.3x and peer average of 1.5x. This premium valuation tells us investors expect substantial future growth despite current challenges.

Risk factors and volatility

Rivian's stock price has been on a roller coaster ride lately. It dropped 16.7% in one month but gave investors 24.2% returns in the last year. The biggest problem is the ongoing cash burn - analysts think the company might lose $2.10 billion in EBITDA by 2026. Supply chain disruptions and production issues keep affecting deliveries, which fell 31% compared to last year.

Competition is fierce from prominent automakers like Tesla and Ford, among new players such as Lucid Motors. Changes in policies like tariff adjustments or reduced tax credits could quickly derail positive forecasts.

Long-term investor considerations

Rivian might be a good fit for investors who can handle risk and have patience. The AI Stock Picker gives analytical insights daily to help with quick decisions.

A $7 billion cash reserve gives the company about three years to operate as it works toward launching the R2. Smart investors should limit Rivian to 2-5% of a well-laid-out portfolio.

Conclusion

Rivian faces a defining moment as 2026 begins. The stock has dropped over 80% from its peak, yet recovery signs are emerging for this EV manufacturer. The company shows meaningful progress toward financial stability through its three-pronged business strategy, steady revenue growth, and three straight quarters of positive gross profit.

The upcoming R2 launch will be the most important catalyst for Rivian's future. This $45,000 vehicle could open up new markets beyond wealthy customers and drive the volume needed for sustained profitability. A strategic shift from luxury to mass-market appeal looks promising with expanded production capacity that targets 155,000 R2 units each year.

The road ahead has its share of obstacles. Technical indicators tell conflicting stories, insiders are selling shares, and competition from established automakers creates uncertainty. The company also continues to burn cash, and positive adjusted EBITDA isn't expected until 2027.

Your risk tolerance and time horizon will determine if Rivian fits your portfolio. Growth-oriented investors who can handle market swings might find Rivian attractive as it rolls out its expansion strategy. The company's $7 billion cash reserve provides roughly three years of operational coverage against market headwinds.

Smart investors should limit Rivian to 2-5% of a diversified portfolio. The company shows promise in operations and market growth, but its premium valuation deserves careful analysis. A full review of multiple data sources helps build confidence before investing in this evolving EV manufacturer.