Key Takeaways

- Battery stocks represent companies involved in the entire lifecycle of battery technology, from mining raw materials to manufacturing electric vehicles and energy storage systems.

- The global shift towards clean energy, propelled by electric vehicle adoption and grid-scale storage needs, creates a massive growth opportunity for the battery sector.

- Investing in top battery stocks like Tesla, Albemarle, and QuantumScape can offer significant long-term growth potential and portfolio diversification.

- When choosing battery stocks, it's crucial to analyze financial health, technological advantages, supply chain stability, and global market presence.

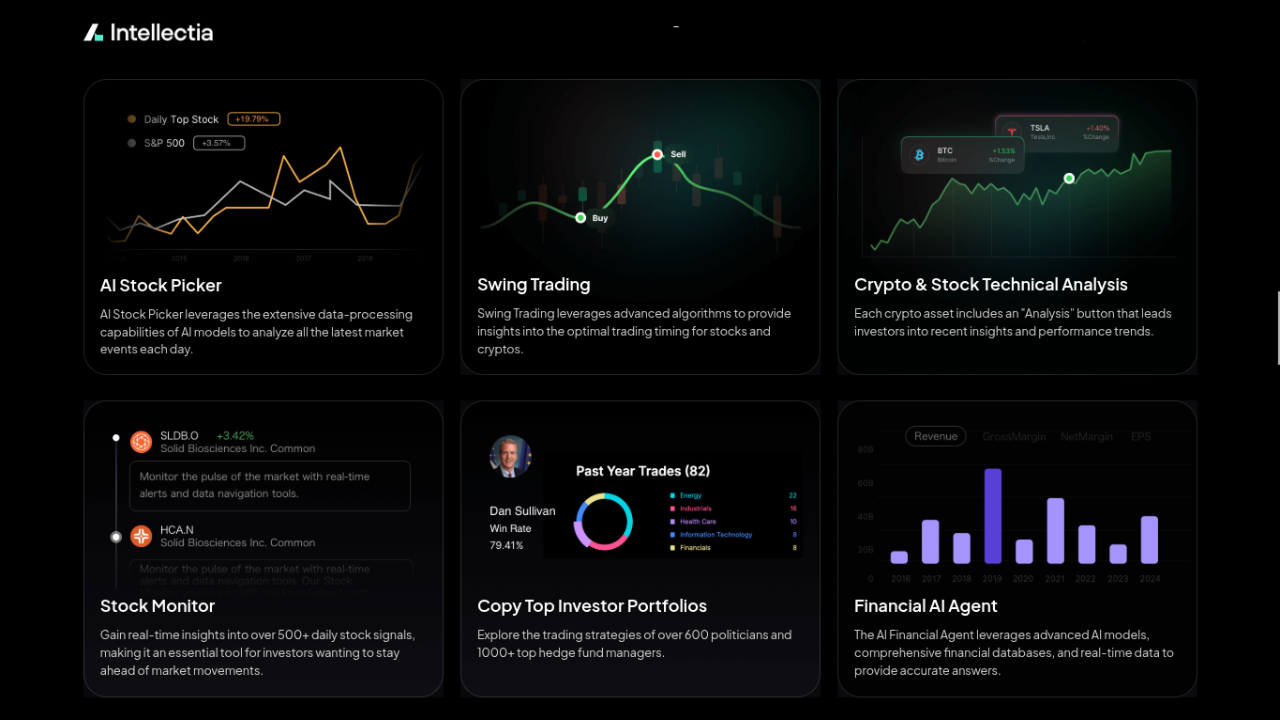

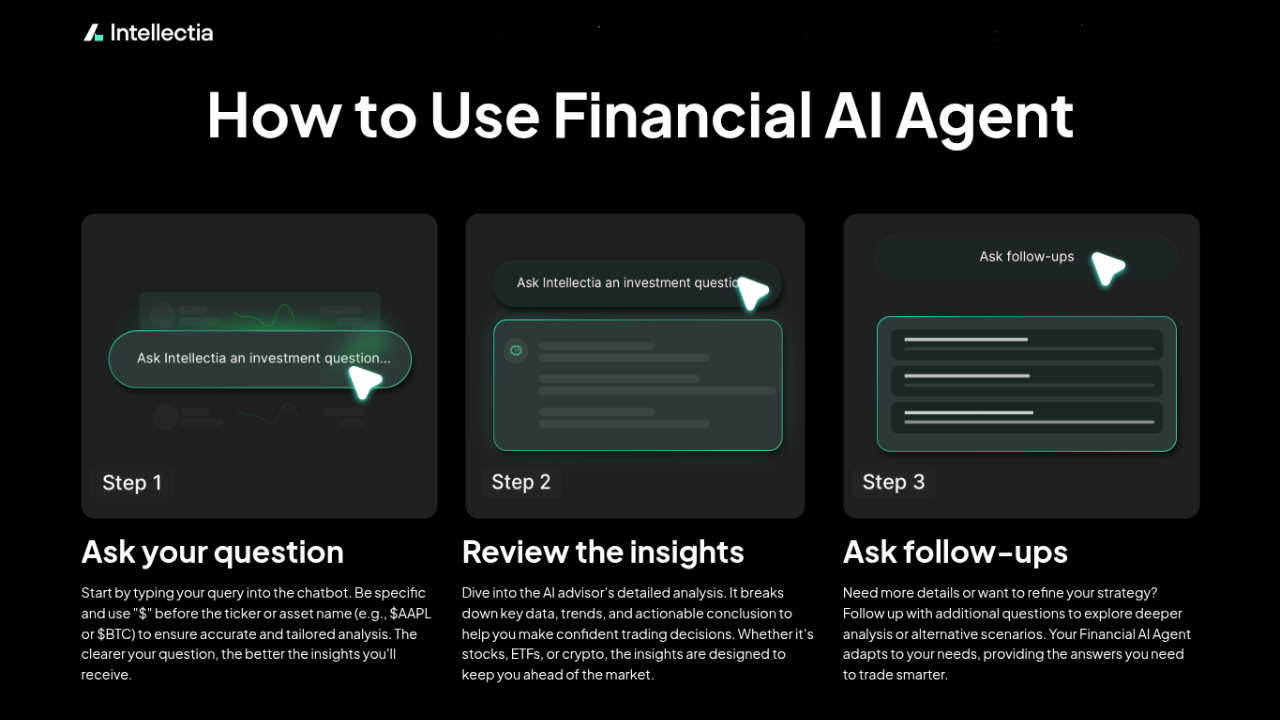

- Using AI-powered tools for stock screening and trading signals can provide you with a competitive edge in navigating the dynamic and fast-evolving battery market.

Introduction

Have you watched the electric vehicle market explode and wondered if you missed the boat on the next big investment wave? The constant headlines about new battery technology and the global push for green energy can be overwhelming, making it hard to pinpoint real opportunities.

Many investors get lost in technical jargon and hype, unsure which companies have the innovation and financial strength to deliver lasting returns.

By focusing on key sectors within the battery industry and applying clear criteria, you can cut through noise. Understanding the fundamentals—from of raw material suppliers to solid-state innovators—is the first step toward building a powerful investment strategy. The arcticle here breaks down intellectia.ai’s AI tools and essential information you need to confidently capitalize on this sector.

What are battery stocks?

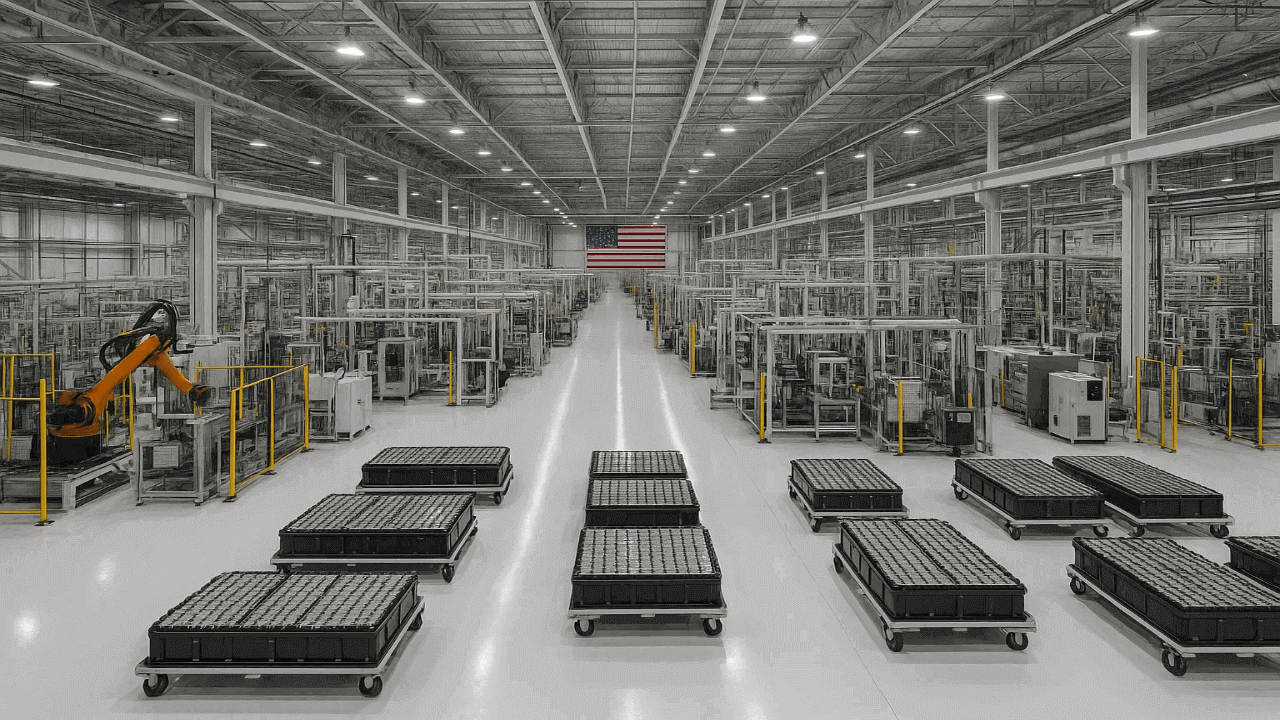

Battery stocks represent shares in companies involved in the battery supply chain. This isn't just one industry; it's a complex ecosystem crucial for powering world’s future. Investing here gives you a stake in the transition to clean energy and next-generation technology. The battery sector can be broken down into several key areas:

- Raw Material and Mining: These are the companies at the very beginning of the supply chain. They mine and process essential materials like lithium, cobalt, and nickel. Companies like Albemarle (ALB) are giants in this space, providing the foundational elements for nearly all modern batteries.

- Battery Manufacturing: This segment includes companies that produce battery cells and packs. They are at the heart of the electric vehicle (EV) and energy storage revolutions. While some are pure-play manufacturers, others, like Tesla (TSLA), are vertically integrated, designing and producing their own batteries for their products.

- Solid-State and Next-Gen Technology: This is the research-and-development frontier of the battery world. Companies like QuantumScape (QS) and Solid Power (SLDP) are working on solid-state batteries, which promise greater energy density, faster charging, and improved safety over traditional lithium-ion batteries.

- Energy Storage and Renewable Integration: Beyond EVs, batteries are critical for stabilizing power grids. Companies in this space, including Brookfield Renewable Corporation (BEPC), develop and manage large-scale energy storage solutions that support renewable energy sources like wind and solar.

- Recycling and End-of-Life Management: As millions of EV batteries reach the end of their lifespan, recycling becomes crucial. This emerging sector focuses on recovering valuable materials from used batteries, creating a sustainable, closed-loop supply chain.

Why invest in battery stocks?

Investing in battery stocks positions you at the center of a global energy revolution. The demand for efficient, powerful, and sustainable energy storage has never been higher, driven by several powerful trends that show no signs of slowing down.

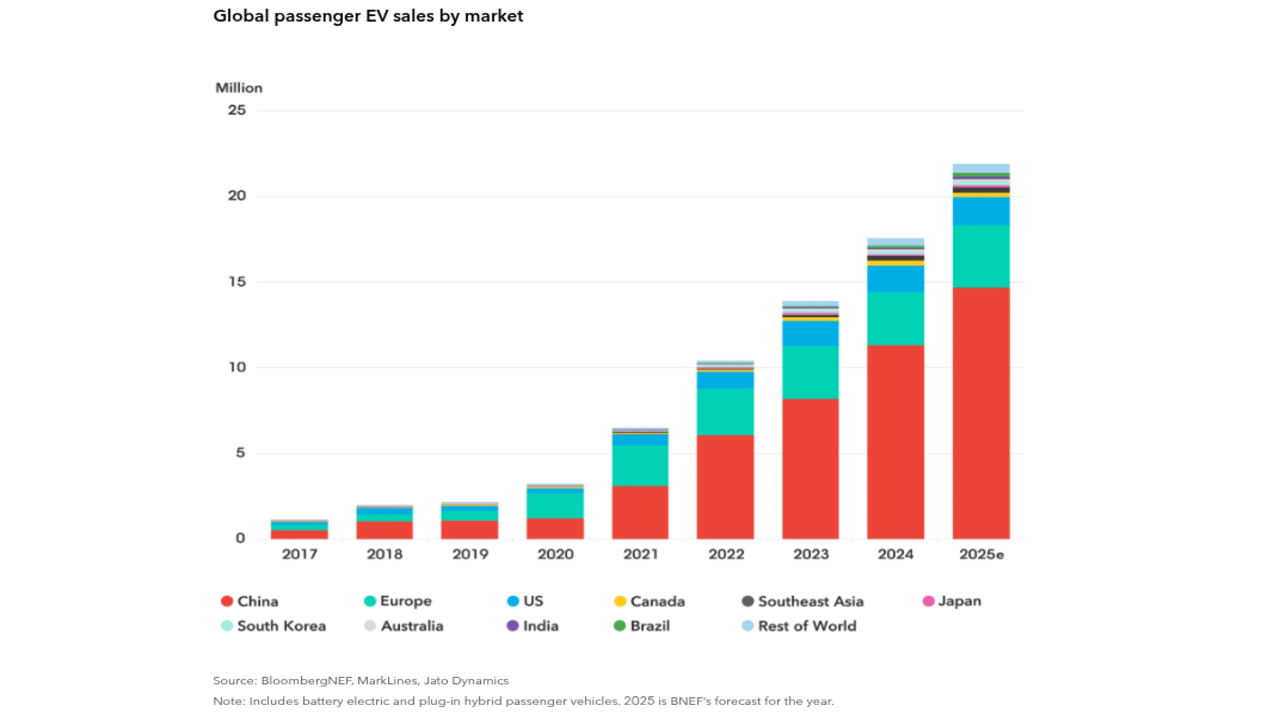

First and foremost is the exponential growth of the electric vehicle (EV) market. Governments worldwide are setting ambitious targets to phase out internal combustion engines, and consumers are rapidly adopting EVs. Every EV requires a massive battery pack, making this the single largest driver of battery demand.

EV adoption remains the single biggest driver, with global sales projected to exceed 17 million units in 2026. Governments are phasing out combustion engines, while automakers are racing to expand battery capacity.

Beyond cars, grid-scale storage is another game changer. As renewables like solar and wind grow, energy storage becomes essential for balancing supply and demand. This shift turns battery companies into key enablers of a carbon-neutral future.

Combined with rapid R&D progress, institutional investment, and policy support, battery stocks present a multi-decade growth story few other sectors can match.

Criteria for selecting top battery stocks

Navigating the battery stock market takes a sharp eye for detail. With so many players in the space, how do you spot the real winners? Here are four key factors to focus on before investing.

1. Financial Health and Growth Start by checking the company’s financial stability — strong balance sheets, manageable debt, and steady revenue growth are good signs. It’s even better if the business is already generating positive cash flow instead of burning capital.

2. Technological Advantage Innovation drives this industry. Look for companies with unique patents, proprietary battery technology, or major breakthroughs in areas like solid-state or lithium-iron phosphate (LFP) batteries. A strong R&D pipeline is a clear indicator of long-term potential.

3. Supply Chain and Market Position A company’s ability to secure raw materials and maintain solid relationships with automakers can make or break its success. Global players with diverse customer bases are usually better positioned to handle market disruptions.

4. Valuation Even a great company can be a bad investment if it’s overpriced. Compare valuation metrics like P/E, EV/EBITDA, or P/S ratios to industry peers before you buy.

5 Best battery stocks

Finding the right battery stocks for your portfolio can be a game-changer. Below is a detailed look at five companies that stand out for their market leadership, technological innovation, and strategic positioning for future growth.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Tesla, Inc. | TSLA | Electric Vehicles & Energy | ~$1.44T | Vertical integration, brand leadership, autonomous driving tech |

| Albemarle Corporation | ALB | Specialty Chemicals (Lithium) | ~$12.43B | Global lithium production leader, cost-efficiency focus |

| Brookfield Renewable | BEPC | Renewable Power & Storage | ~$13.78B | Diversified global assets, strong dividend history |

| Solid Power, Inc. | SLDP | Solid-State Batteries | ~$1.11B | Key partnerships (BMW, SK On), electrolyte technology |

| QuantumScape Corp. | QS | Solid-State Batteries | ~$10.11B | Strong financial backing, milestone-driven progress |

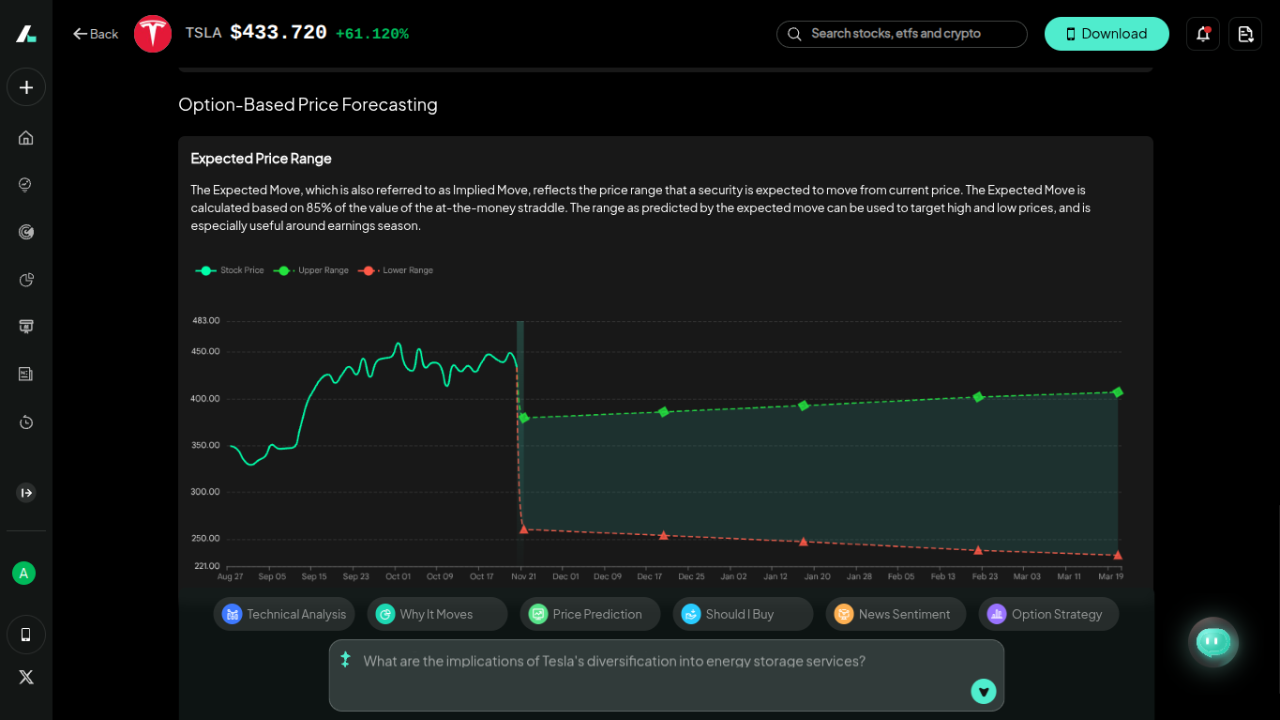

Tesla, Inc. (TSLA)

Tesla is more than just a car company; it's a technology powerhouse driving the future of transportation and energy. As the undisputed leader in the EV market, its demand for batteries is immense. The company's vertical integration, which includes battery R&D and manufacturing, gives it a significant competitive advantage.

In its latest earnings call, Tesla reported a decline in quarterly profit but achieved a record number of deliveries, showcasing resilient demand. CEO Elon Musk emphasized the company's focus on scaling full self-driving (FSD) technology and expanding production, with an aspirational goal of hitting a 3 million vehicle annual rate within 24 months. The energy storage division also saw record deployments, with its Megapack and Powerwall products driving grid transformation.

Tesla's ecosystem—spanning EVs, autonomous driving software, charging infrastructure, and energy storage—creates multiple revenue streams and locks in customers. While analysts express concern over its high valuation, its relentless innovation and clear vision for an AI-driven future make it a core holding for any investor bullish on battery technology.

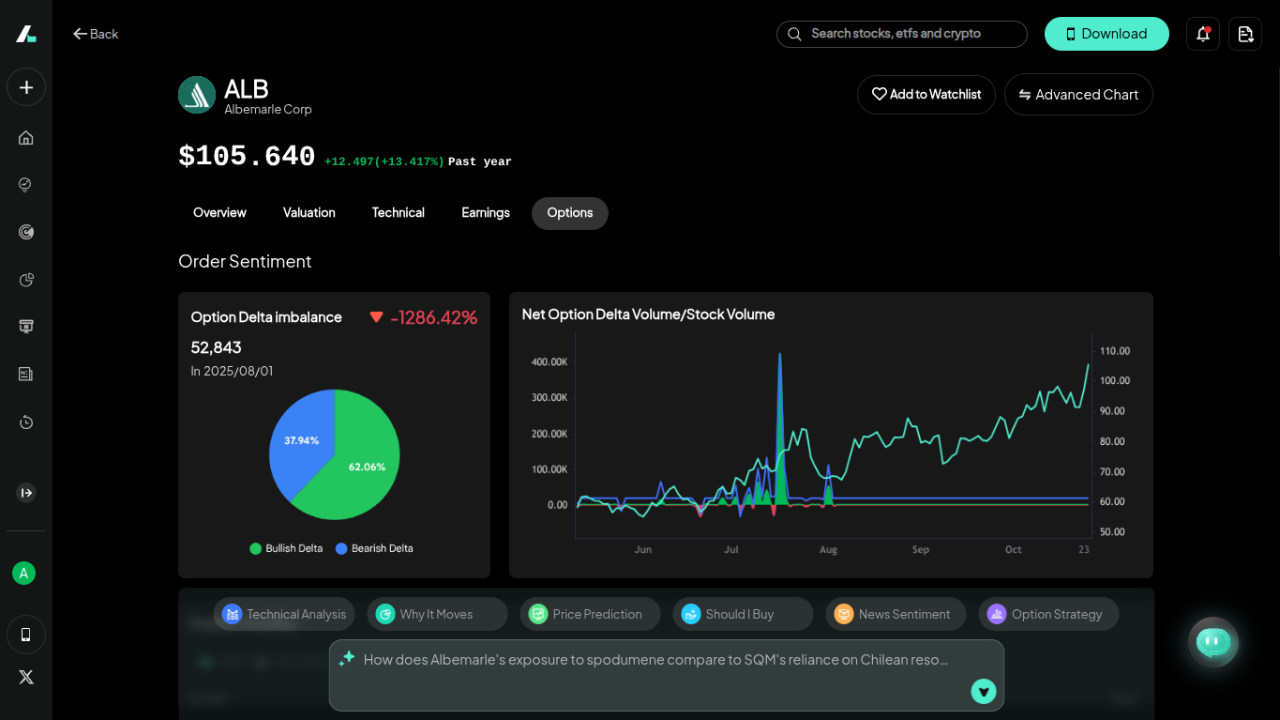

Albemarle Corporation (ALB)

As one of the world's largest lithium producers, Albemarle is a foundational player in the battery supply chain. The company supplies high-purity lithium to major battery and automotive manufacturers, making it an essential partner for the entire EV industry. Its vast, low-cost operations give it a durable competitive moat.

Albemarle has been navigating a period of low lithium prices by focusing on operational efficiency. The company successfully executed cost-reduction measures, achieving a $400 million cost and productivity improvement target ahead of schedule. Despite market headwinds, management is maintaining its 2026 outlook and now expects to achieve positive free cash flow, signaling confidence in its strategy and a stabilizing market.

Investing in Albemarle is a direct bet on the continued growth of lithium demand. As a top supplier with a global footprint, it is well-positioned to benefit as EV production ramps up and the market balance tightens. Its focus on financial discipline makes it a resilient choice in a sometimes-volatile commodities market.

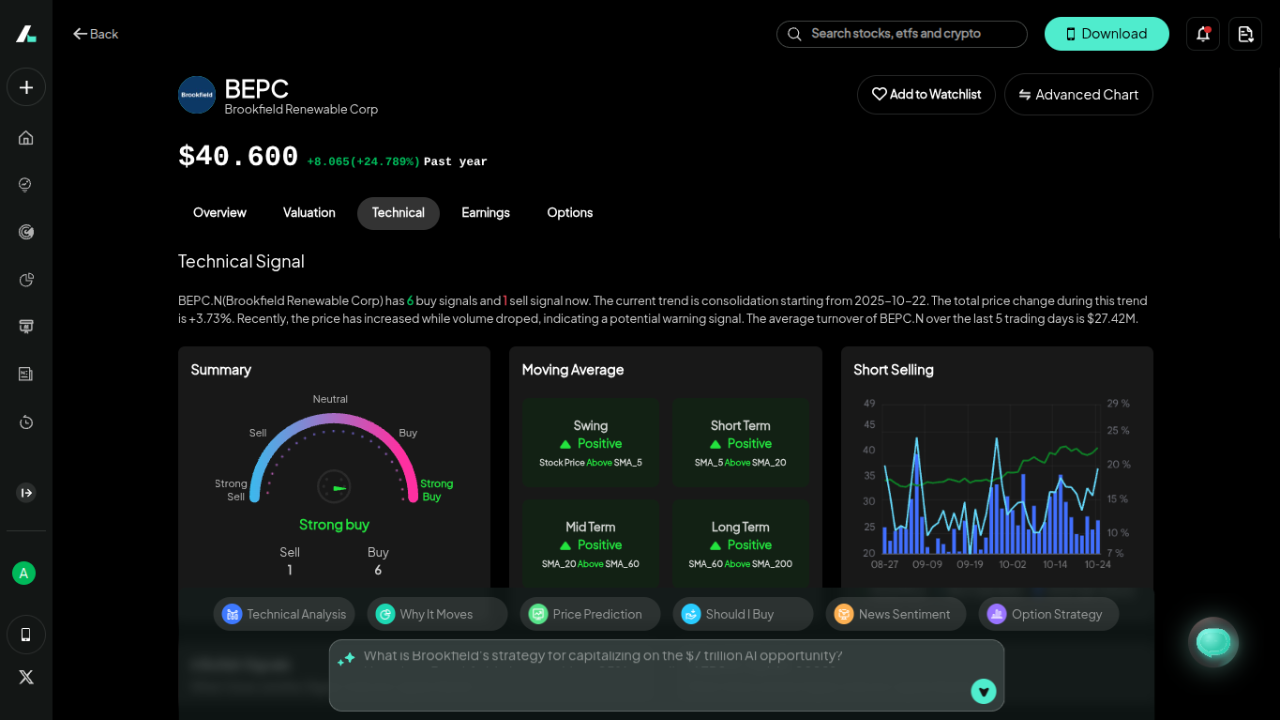

Brookfield Renewable Corporation (BEPC)

Brookfield Renewable is a global leader in renewable power and energy transition assets. While not a pure-play battery company, its massive portfolio of hydro, wind, and solar facilities is increasingly integrated with battery storage solutions to ensure grid stability. This makes BEPC a crucial player in the broader energy ecosystem.

The company recently reported strong Q2 results, with a 10% year-over-year increase in funds from operations (FFO). It declared a quarterly dividend of $0.373 per share, underscoring its commitment to shareholder returns. BEPC is also expanding its battery storage capabilities, most notably through its acquisition of Neoen, a leading global developer.

BEPC offers a unique combination of growth and stability. Its diversified, high-quality assets generate predictable cash flows, funding a reliable dividend. As demand for 24/7 renewable power grows, its strategic investments in hydro, nuclear services, and battery storage position it as a key partner for large corporations and utilities.

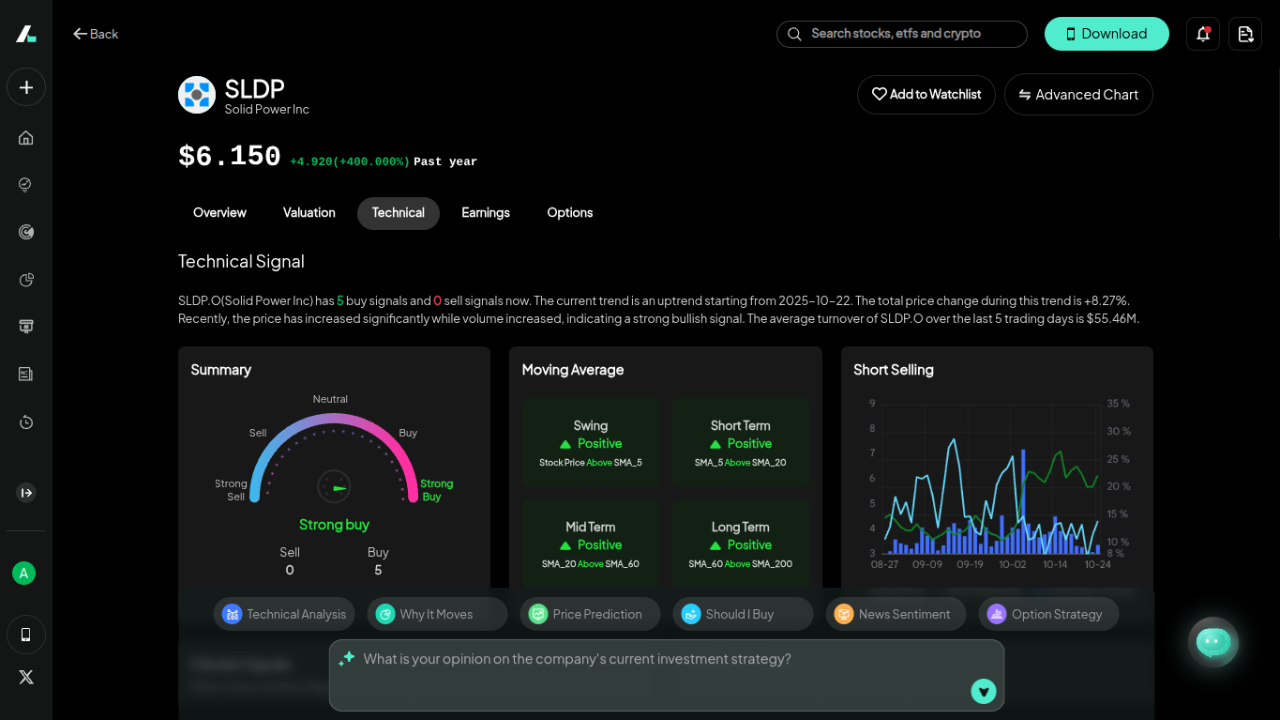

Solid Power, Inc. (SLDP)

Solid Power is an emerging leader in the development of all-solid-state batteries for EVs. Its core focus is on producing sulfide-based solid electrolytes, which it believes will enable safer and more energy-dense batteries. The company operates on a partnership-centric model, collaborating with automotive giants to integrate its technology.

Solid Power has made significant progress with its strategic partners. BMW introduced an i7 test vehicle powered by Solid Power's cells, a major milestone that validates its technology. The company also completed factory acceptance testing of a pilot line for its partner SK On and is on track to commission its own 75-metric-ton electrolyte production line in 2026.

Solid Power offers a targeted investment in the future of battery technology. Its "arms dealer" model, where it supplies core electrolyte material to partners, is capital-efficient and scalable. While still in the pre-revenue stage, its deep relationships with major players like BMW provide a clear path to commercialization and de-risk the investment.

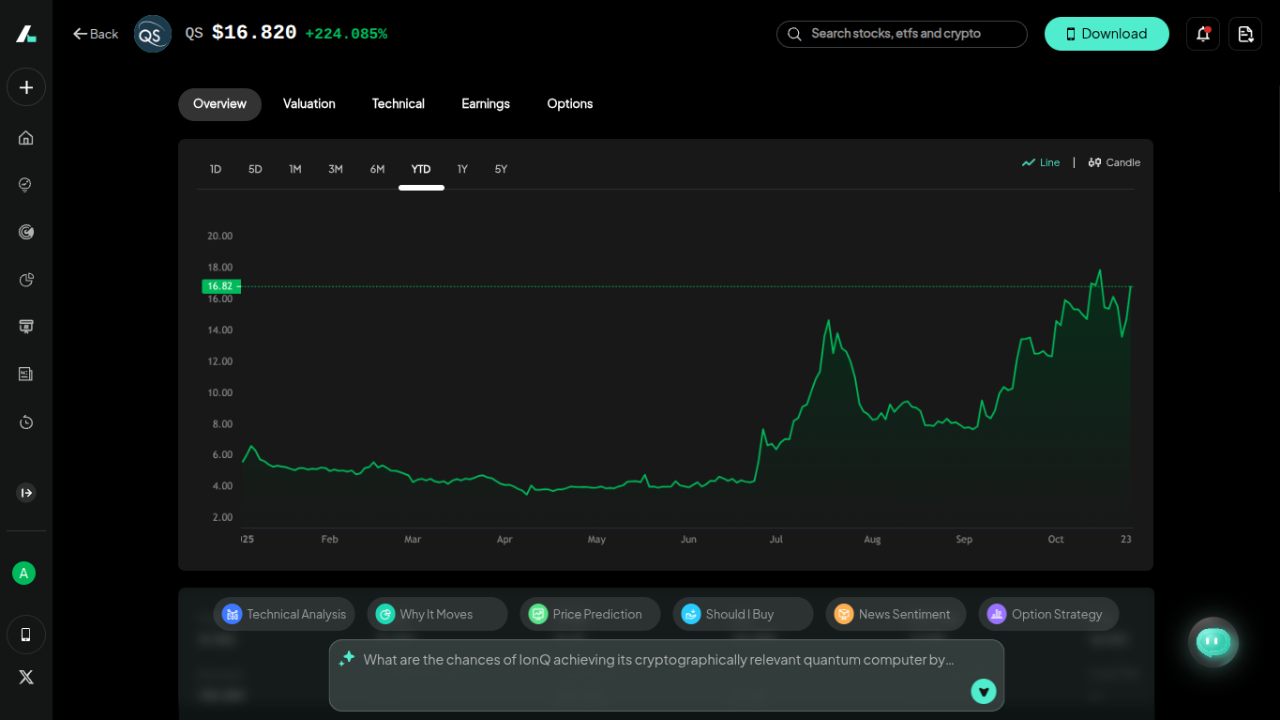

QuantumScape Corporation (QS)

QuantumScape is another key contender in the race to commercialize solid-state batteries. Backed by Volkswagen, the company is developing a lithium-metal solid-state battery that aims to revolutionize the EV industry. Its anode-free design promises higher energy density, a longer lifecycle, and dramatically faster charging times.

QuantumScape recently surged after reporting a smaller-than-expected Q3 loss and raising its full-year adjusted EBITDA guidance. The company achieved a major milestone by shipping its first Cobra-based QSE-5 B1 samples, which were showcased in a Ducati V21L race motorcycle. It also announced over $12 million in customer billings, signaling the start of its capital-light development and licensing model.

QuantumScape is a high-risk, high-reward play on a potentially game-changing technology. Its strong financial position, deep partnership with the Volkswagen Group, and consistent execution against its technical roadmap make it one of the most credible players in the solid-state space. Recent progress and improved guidance suggest its path to commercialization is becoming clearer.

Ready to find your next winning trade? Intellectia.ai offers powerful AI stock picking tools and AI agent that analyze thousands of data points to help you identify top-performing stocks in the battery sector and beyond.

Investment strategies for battery stocks

Investing in battery stocks requires a strategy that matches your risk tolerance and goals. This dynamic sector offers opportunities for both long-term growth investors and nimble short-term traders.

For long-term investors, the focus should be on industry leaders with proven technology and strong market positions. A buy-and-hold strategy centered on companies like Tesla and Albemarle allows you to ride the powerful secular trends of EV adoption and energy transition over many years. The key is to look past short-term volatility and focus on the fundamentals.

If you're more interested in short-term trading, the volatility in this sector can be your friend. Emerging technology breakthroughs, earnings reports, and shifts in commodity prices can create significant price swings. To capitalize on these, using advanced tools is essential. Intellectia.ai's AI swing trading signals can help you identify optimal entry and exit points by analyzing market sentiment and technical indicators in real time.

Another effective strategy is to diversify across the entire battery value chain. Instead of betting on a single company, you can build a portfolio that includes a lithium producer, a battery manufacturer, a solid-state innovator, and a renewable energy utility. This approach spreads your risk and gives you exposure to different facets of the industry's growth.

For those who prefer a broader, more hands-off approach, investing in ETFs is an excellent option. ETFs like the Global X Lithium & Battery Tech ETF (LIT) hold a basket of battery-related companies, providing instant diversification. You can use an AI Screener to filter and find ETFs that align with your specific investment criteria, such as those with heavy exposure to U.S.-based companies or solid-state technology.

Conclusion

The battery revolution isn’t slowing down — and neither should your investment strategy.

Whether you’re building a long-term portfolio or looking for high-potential trades, the right data makes all the difference. Join Intellectia.ai today and get instant access to AI-powered stock picks, trading signals, and market insights tailored to your goals. Stay ahead of the curve — let Intellectia’s intelligence work for you.