Key Takeaways

- The “Magnificent 7” — Apple, Microsoft, Amazon, Google, Nvidia, Meta, and Tesla — continue to dominate most of the U.S. stock market growth through 2026.

- ETFs offer a balanced way to invest in these mega-cap tech stocks without taking on single-company risk.

- The most appropriate Magnificent 7 ETFs vary in weighting strategy, cost, and risk level, and thus, the correct choice is determined by your objectives.

- Savvy investors use tools like Intellectia.ai’s AI Stock Picker and AI Screener to analyze ETF performance in real-time.

- Diversifying your portfolio with AI-powered insights can help you stay ahead of the next market rotation

Introduction

If you’ve been watching the stock market over the past few years, you’ve probably heard of “The Magnificent 7.” These are the seven giant tech companies that have dominated headlines, portfolios, and returns — Apple, Microsoft, Amazon, Google (Alphabet), Nvidia, Meta, and Tesla. Together, they represent the beating heart of the modern stock market.

But here’s the thing: buying all seven individually is expensive, and managing them takes work. What if you could own them all — instantly, with one click? That’s exactly what Magnificent 7 ETFs do. They put these powerful companies into one fund so you may experience growth, diversification, and peace of mind without having to keep track of every earnings call or price change.

In this guide, we’ll explain what the Magnificent 7 are, why ETFs are a better method to invest in them, and which funds are the best in 2026. And we’ll also look at how AI platforms like Intellectia.ai can give you an advantage when deciding when to buy, sell, or hold.

What are the “Magnificent 7” Stocks?

The "Magnificent 7" stocks are simply the seven U.S. technology and mega-cap companies that have been responsible for the vast majority of the U.S. stock market's returns and overall growth in recent years. These aren't just big companies; they are market behemoths known for their enormous market capitalizations, robust earnings growth, and unprecedented influence over global technology trends. The group consists of Apple, Microsoft, Amazon, Alphabet, NVIDIA, Meta Platforms, and Tesla. They are, quite literally, moving the market.

Why Invest via an ETF Rather than Individual Stocks?

You might think you could just buy shares in all seven, but choosing an ETF that tracks the Magnificent 7 offers you several key advantages that are vital for long-term investing success:

- Diversification: An ETF instantly bundles these stocks together. While you are still concentrated in a sector, the fund structure shields you from the potentially devastating impact if just one of the seven has a massive, unexpected failure, like a major regulatory fine or a product flop.

- Simpler Exposure: Instead of managing seven individual stock trades, rebalances, and tax lots, you purchase one ticker symbol and instantly own a slice of all seven. This is the definition of low-maintenance, high-impact investing.

- Lower Single-Company Risk: The ETF structure forces you to spread your capital across the entire group. This inherently cushions the volatility of any of the seven stocks recording a negative earnings day or a product recall.

- Efficient Allocation: ETFs employ proprietary weighting (e.g., equal weighting or concentrated weighting) that is hard and expensive to manage manually, leading to efficient capital allocation.

If you’d like to see how AI can simplify this process even further, check out Intellectia.ai’s Swing Trading tools for real-time ETF timing signals.

Criteria for Selecting the Best Magnificent 7 ETF

Choosing the best ETF for Magnificent 7 exposure requires looking closely at the details. Since these funds are highly specialized and concentrated, you need to be very selective.

Expense Ratio and Cost Efficiency

Since the underlying holdings (the seven stocks) are practically identical across most of these funds, the expense ratio—the annual fee you pay the fund manager—is your primary enemy. A high fee will immediately eat into your explosive returns. You should always look for the lowest possible cost to maximize your long-term profit.

Holdings and Weighting of the Seven Stocks

This is the most critical factor. Does the ETF hold only the Magnificent 7, or does it try to include other large-cap tech stocks? More importantly, how are the seven weighted? Some funds are market-cap weighted (heaviest in the most prominent companies, often Apple and Microsoft), while others are equal-weighted (giving smaller names like Tesla and Meta the same dollar weight as Apple and Microsoft). Your choice here directly determines your risk/reward profile.

Rebalancing Frequency and Strategy

When and how often does the ETF rebalance its holdings? A frequent rebalance might force the fund to sell the winners and buy the laggards more often, which is an advantage if you believe market momentum is temporary. Understanding this frequency ensures the fund's strategy aligns with your long-term view of the market.

Launch Date / Track Record and Liquidity

Since many of these specialized funds are very new, their track records are short. A longer track record is always preferred, but you should also check the trading volume (liquidity). Low liquidity can make it difficult for you to buy or sell large shares without significantly moving the price, which negatively affects your execution.

Strategy Type: Pure “Magnificent 7” vs Broader Tech Exposure

Are you looking for a pure Magnificent 7 ETF (100% focused) or a fund that uses the seven as its core but adds exposure to 10-20 other high-growth tech firms? You need to know what you are truly buying to ensure you aren't getting unintended diversification, or, worse, unintended concentration in another speculative area.

Fit for Investor’s Goal (Growth vs Dividend vs Income)

Be absolutely clear on your goals. These funds are overwhelmingly focused on growth. If you are looking for dividend income, the low overall yield of these tech stocks means these ETFs are likely not the best Magnificent 7 ETF for you. In that case, you might need a special fund that generates income using covered calls.

Top Magnificent 7 ETFs to Consider in 2026

The landscape of magnificent 7 stocks ETF products is rapidly evolving, but here are four of the top-performing and most interesting options you should seriously consider for your 2026 portfolio.

| ETF | Focus | Expense Ratio | Strategy Type | Key Strengths |

|---|---|---|---|---|

| MAGS | Pure Magnificent 7 | 0.29% | Equal-weighted | Balanced exposure to all seven leaders |

| MAGY | Growth-oriented | 0.99% | Market-cap weighted | Heavier tilt toward Apple and Nvidia |

| XMAG | Tech + AI theme | 0.35% | Broader innovation | Adds exposure to AMD, AVGO, and cloud AI |

| QQQU | Tech-heavy index | 0.95% | Diversified | Includes Magnificent 7 plus next-gen leaders |

MAGS - Roundhill Magnificent Seven ETF

MAGS is widely considered the standard-bearer among the new generation of specialized funds. Its primary appeal is its equal-weighted structure, meaning it doesn't give Apple or Microsoft a disproportionate weight just because they have massive market caps. This structure gives you higher exposure to potentially faster-growing names like Meta and Tesla, which can lead to higher volatility but also potentially greater upside if the smaller Magnificent 7 members outperform the giants. If you want a straightforward, pure Magnificent 7 ETF with balanced weighting, MAGS is an excellent, low-cost starting point for you.

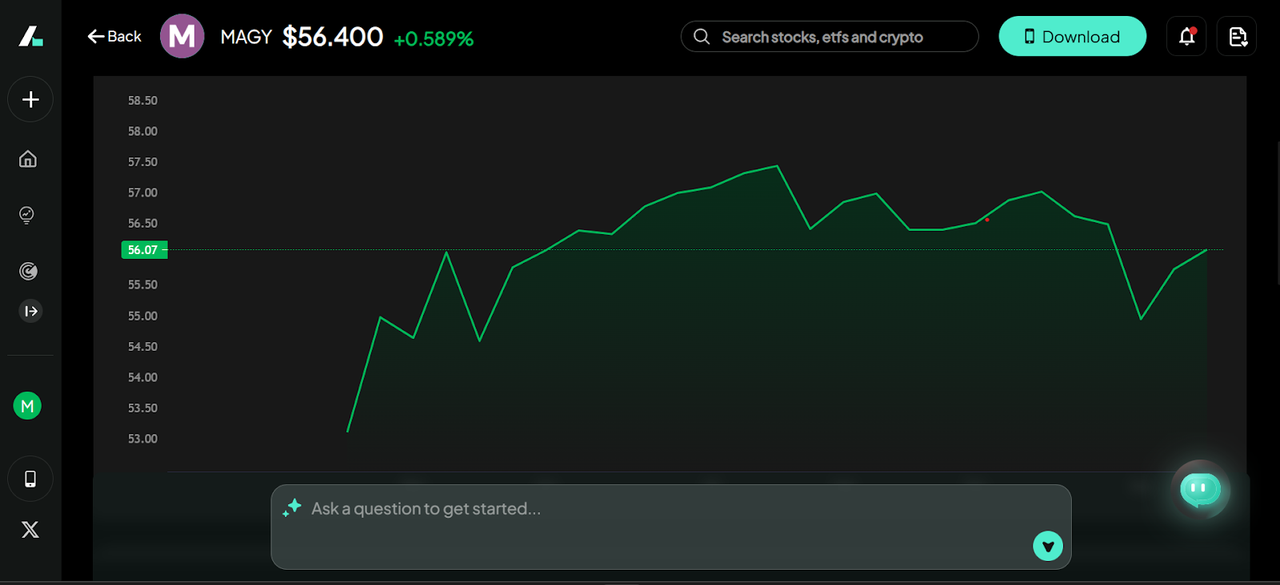

MAGY - Valkyrie Magnificent Seven ETF

MAGY is a key alternative for you to consider because it is an actively managed fund. Unlike the purely passive structure of MAGS, the managers of MAGY can tactically adjust the weighting of the seven stocks based on their market outlook. This means they might overweight NVIDIA if they believe AI growth is accelerating, or they might reduce exposure to a stock they feel is getting overvalued. While it comes with a slightly higher expense ratio, you are paying for professional oversight to potentially achieve better risk-adjusted returns than a purely passive index.

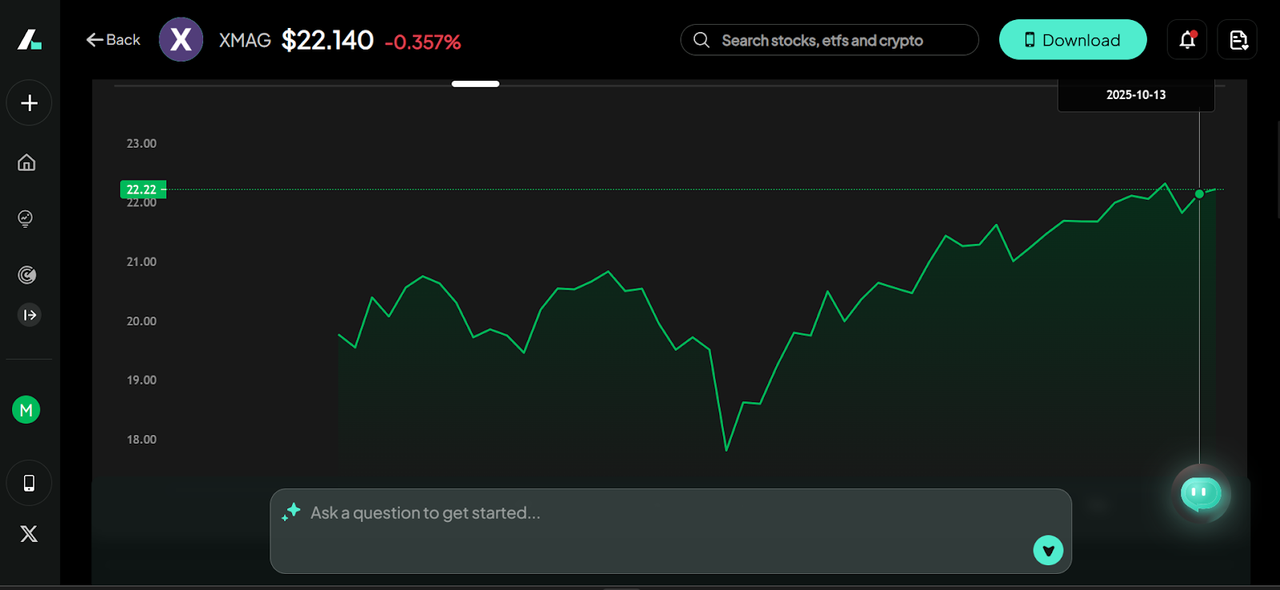

XMAG - GraniteShares 1.5x Long MAGS Daily ETF

Let me be clear: this fund is only for advanced investors with a very high-risk tolerance. XMAG is essentially a leveraged product, designed to provide 1.5 times the daily return of the equal-weighted Magnificent 7 basket. If the Magnificent 7 goes up 2%, XMAG should go up around 3%. However, if the stocks fall 2%, XMAG will fall around 3%. Leveraged funds come with significant, complex risks, and they are generally not suitable for long-term holding due to the destructive compounding effect of daily rebalancing. Consider this a Magnificent 7 ETF alternative for tactical, short-term speculation only.

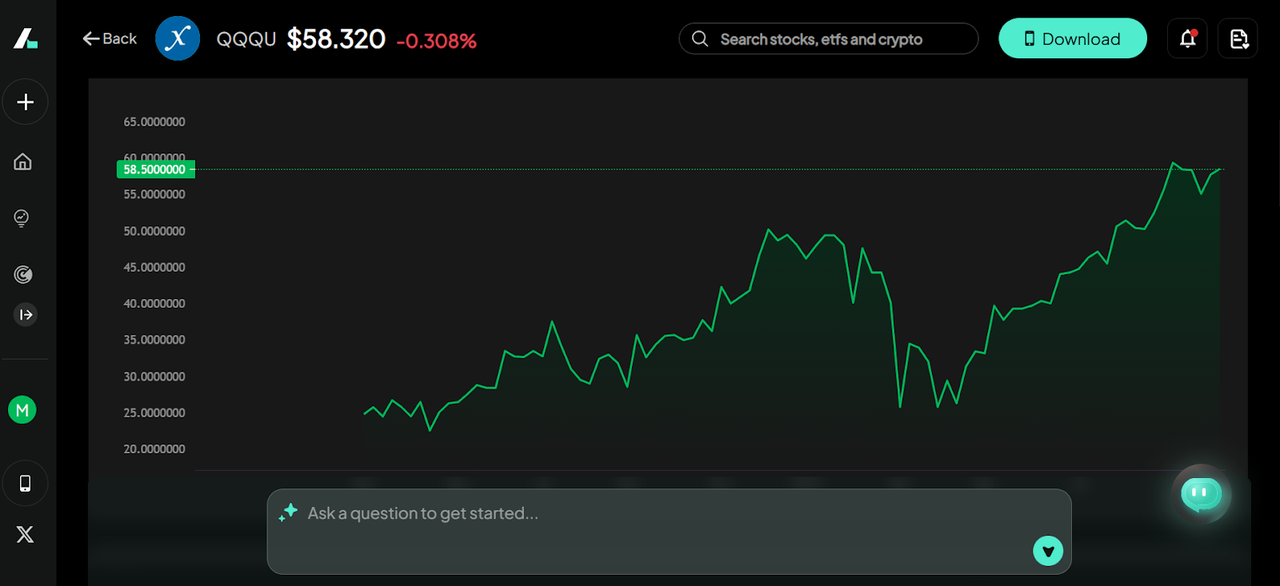

QQQU - T. Rowe Price Nasdaq 100 Covered Call ETF

While not a pure magnificent 7 stocks ETF, QQQU is a fantastic option if you are primarily an income-focused investor. Its holdings mirror the Nasdaq 100 (which is still massively weighted toward the Magnificent 7), but the fund strategy involves selling covered calls against those holdings. This generates income for the fund to pay out as a high-yield distribution. The trade-off is that you cap your potential upside when the stocks rise quickly. This fund is ideal if you are nearing retirement or are looking for a unique way to gain exposure while receiving a steady, high income.

How to Invest in Magnificent 7 ETFs Smartly

Understand the Magnificent 7 ETFs

Before you buy the Magnificent 7 ETF, you must internalize the risks involved. Although the companies themselves are stable, the overall basket is very concentrated in the tech industry. This means your portfolio is not diversified automatically between sectors such as utilities, consumer staples, or energy. You’re making a concentrated bet on the continued dominance of Big Tech.

Portfolio Allocation: How to Weight an ETF within a Broader Asset Mix

You should view any dedicated Magnificent 7 ETF as a growth satellite, not the core of your portfolio. Ideally, this type of concentrated growth exposure should make up a smaller, intentional percentage of your overall asset mix, complementing a much larger, more stable core of global equities, fixed income, and diverse assets. Don't let your satellite outweigh the main structure!

Dollar-Cost Averaging into the Fund

Given the volatility inherent in even mega-cap tech, the smartest, most stress-free way for you to invest is to use Dollar-Cost Averaging (DCA).

This means committing to investing a fixed amount of money at regular intervals (say, every month), regardless of the fund's price. This completely removes emotion from the equation, allowing you to purchase more shares when prices are low, which will substantially decrease your total average cost per share.

Monitoring Rebalancing Events and Tax Considerations

You should always keep an eye on the fund’s official announcements for rebalancing. If you hold the ETF in a taxable brokerage account, be aware that frequent rebalancing or active management (like in MAGY) can generate capital gains distributions that you will be taxed on at the end of the year. This is less of an issue if you hold the ETF inside a tax-advantaged account, like an IRA or 401(k).

Use Tools and Resources for Ongoing Monitoring

Do not simply purchase the ETF that tracks the Magnificent 7 and forget about it. To track the most important market and stock trends, you should leverage the robust platform of Intellectia.ai, as these seven stocks are the driving forces behind the fund's performance. For instance, configure an AI Agent to issue alerts when sudden changes in volatility or sentiment occur on the seven underlying stocks. You may also use our Stock Technical Analysis feature to identify favorable entry points to add to your position during dips.

Conclusion

The Magnificent 7 stocks are among the most dynamic, innovative, and profitable organizations in the world, and a focused ETF is an effective way to gain exposure to their further expansion. You can choose between the pure concentration of MAGS, the actively managed approach of MAGY, or the stream of income provided by a fund such as QQQU. The point is that you need to make an informed choice regarding the weighting of the fund and the expense ratio.

To maximize your success, you should integrate professional-grade intelligence into your investment process. Stop guessing when to enter the market and leverage data-driven insights. Sign up and Subscribe to Intellectia AI today to get real-time alerts, daily AI stock picks, AI trading signals & strategies, and the deep market analysis you need to optimize your investment in the best Magnificent 7 ETF. Your portfolio will thank you.