Key Takeaways

Defense stocks present exceptional investment opportunities in January 2026, driven by geopolitical tensions and substantial government spending commitments that create predictable revenue streams for investors.

• Massive government backing drives stability: Defense contractors benefit from $1.50 trillion proposed 2027 defense budget and guaranteed government contracts spanning multiple years.

• Record backlogs ensure future revenue: Leading companies like Lockheed Martin ($179B backlog) and RTX ($251B backlog) provide exceptional revenue visibility through 2028.

• Diversification across company sizes maximizes returns: Combine established giants (Lockheed, General Dynamics) for stability with specialized players (AeroVironment) for growth potential.

• International exposure reduces single-country risk: BAE Systems offers geographic diversification beyond U.S. defense spending, protecting against regional budget fluctuations.

• Technology innovation creates competitive advantages: Companies focusing on AI, autonomous systems, and cybersecurity (Leidos, AeroVironment) position themselves for next-generation warfare demands.

The defense sector's resilience during economic uncertainty, combined with rising global tensions and military modernization initiatives, makes these stocks essential components of a well-balanced investment portfolio for 2026 and beyond.

Defense stocks have caught investors' eyes since January 2026 began. The U.S. government's invasion of Venezuela and capture of President Nicolás Maduro on January 3 sent global defense stocks soaring.

The numbers tell an impressive story. German defense companies Rheinmetall, Hensoldt, and Renk jumped about 8%, while Swedish fighter jet maker Saab climbed 6%. Japanese defense contractors showed strong gains too, as IHI and Mitsubishi Heavy Industries surged roughly 9% and 8%. American military stocks made notable moves - Lockheed Martin rose more than 2% and Northrop Grumman jumped over 4%.

Defense stocks can make your portfolio stronger. The U.S. government's stability will give a steady revenue stream to defense firms, which helps investors create reliable forecasts. The rising geopolitical uncertainty has led many financial professionals to zero in on the defense sector. Lockheed Martin stands out as the world's largest defense company and remains the U.S. government's biggest contractor, serving as a cornerstone of U.S. defense. Experts have picked companies like Huntington Ingalls Industries among their top defense stock choices for 2026, based on its long history of building ships for the U.S. Navy. Let's get into the seven best defense stocks you should think over adding to your portfolio this January.

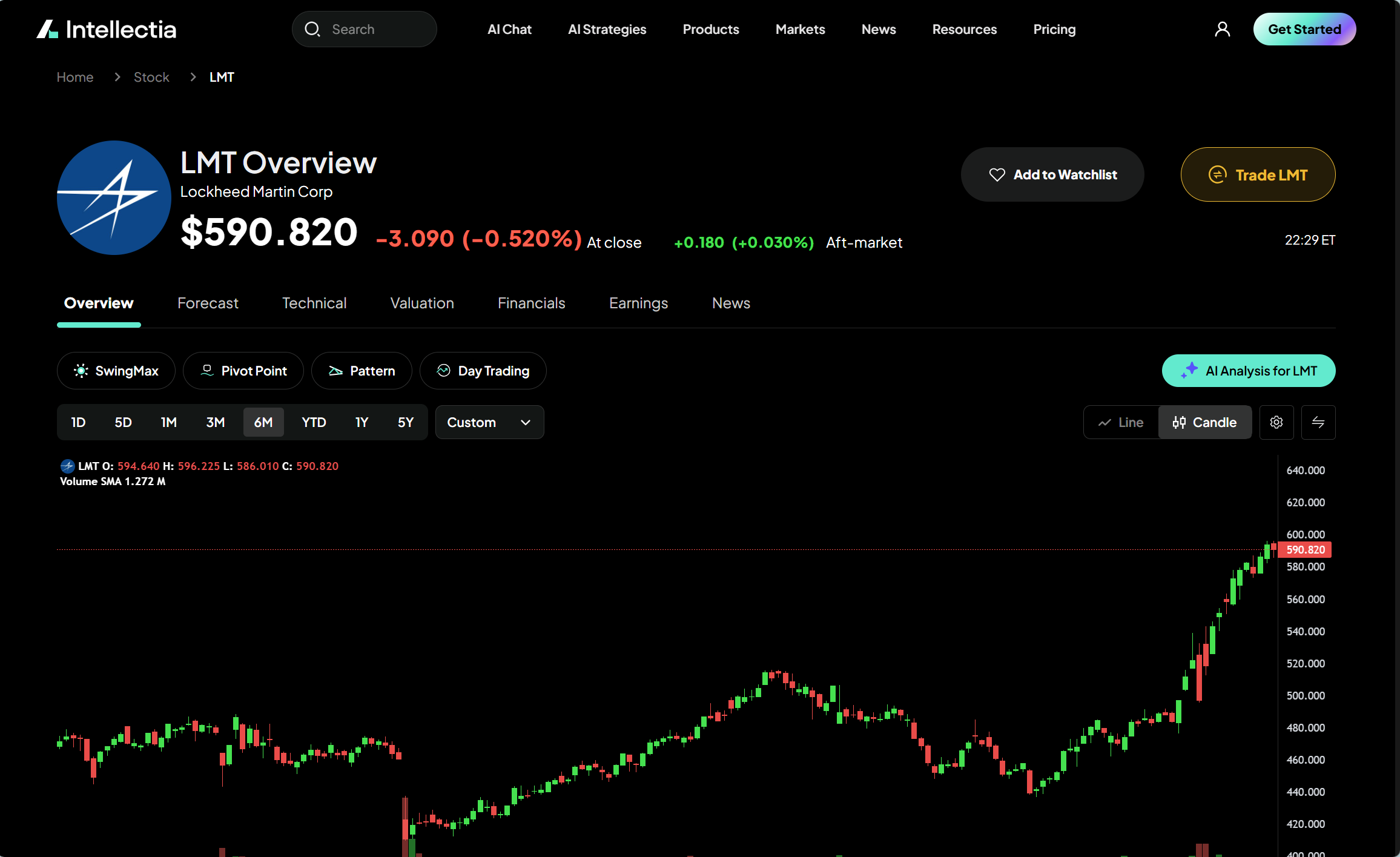

Lockheed Martin (LMT)

Lockheed Martin serves as the life-blood among defense stocks to buy. The company's stability comes from its broad operations and extensive government collaborations. This aerospace and defense powerhouse maintains its dominant market position as the largest defense contractor in the United States, though its stock has underperformed compared to industry peers.

Lockheed Martin key products and services

Lockheed Martin advances state-of-the-art solutions across four strategic business segments that form a detailed defense portfolio. The Aeronautics division generates approximately 40% of company revenue and focuses on the revolutionary F-35 Lightning II program—the most expensive weapons system in history. This division also produces other iconic aircraft like the C-130 Hercules transport aircraft and F-16 Fighting Falcon.

The Missiles and Fire Control (MFC) segment has grown substantially, particularly due to ongoing global conflicts. Key products include:

PAC-3 (Patriot) missiles, which received a major production boost agreement with the U.S. Department of War to increase from 600 to 2,000 units annually over seven years

HIMARS rocket systems see extensive deployment in current conflicts

Javelin anti-tank missiles prove vital in modern warfare scenarios

The Rotary and Mission Systems (RMS) division specializes in Sikorsky helicopters, including the Black Hawk and Seahawk models, along with naval combat systems such as the Aegis Combat System. The Space segment develops strategic missiles like the Trident II and spacecraft systems including the Orion spacecraft for NASA's Artemis missions.

Lockheed Martin also develops advanced technologies including artificial intelligence, autonomous systems, hypersonics, and directed energy weapons. This places the company at the vanguard of military technology advancement for years ahead.

Lockheed Martin financial performance

Lockheed Martin's financial strength makes it one of the most appealing military stocks available. The company reached record-high revenue of approximately $74.50 billion in 2025. Stock prices haven't fully reflected this solid performance due to concerns about the F-35 program and losses in classified business operations.

In spite of that, Lockheed Martin started 2026 with a historic $179.00 billion backlog, which represents more than 2.5 years of production capacity. The company's earnings per share hit an estimated $22.25 for 2025, while absorbing a one-time $1.60 billion pre-tax loss on a classified program earlier in the year.

Income investors find Lockheed Martin attractive. The company raised its quarterly dividend to $3.45 per share, yielding approximately 2.78%. The stock trades at a forward P/E of roughly 17x. Analysts at Truist Securities believe this is undervalued and upgraded it to "Buy" with a price target of $605.00, suggesting a 17% upside potential.

Lockheed Martin government contracts

Lockheed Martin secured $61.40 billion in government contracts during fiscal year 2023 as America's leading defense contractor, according to Pentagon data. The U.S. government remains the company's primary customer and accounts for 73% of sales, while international military sales contribute 26%.

Major recent contracts include two U.S. Navy awards worth approximately $3.30 billion combined for the Trident II D5 missile program. The company also won a $720.00 million contract to produce Joint Air-to-Ground Missiles (JAGM) and HELLFIRE missiles.

The company broadens its international reach through Foreign Military Sales. These include 160 JAGM missiles for the United Kingdom and HELLFIRE systems for Poland, Spain, Czech Republic, Italy, and Canada. Such overseas contracts create additional revenue streams while deepening global military collaborations.

Defense stocks, particularly Lockheed Martin, could benefit substantially from President Trump's plans for a massive $1.50 trillion defense budget for 2027. This might speed up contract awards in a variety of Lockheed's business segments.

General Dynamics (GD)

Image Source: Primary Ignition

General Dynamics stands out as another heavyweight among defense stocks to buy. The company operates in a variety of sectors from business jets to nuclear submarines. Analysts rate it as a "Buy", and its solid market position in the aerospace and defense industry keeps drawing investor attention at the beginning of 2026.

General Dynamics key products and services

The company runs four distinct business groups that serve critical defense and commercial needs:

Aerospace – This segment focuses on Gulfstream business jets and aviation services. It showed remarkable growth with a 30% year-over-year revenue increase in Q3 2025

Combat Systems – The group develops wheeled combat vehicles, battle tanks, munitions, and propellants. Revenue grew by 1.8%

Marine Systems – The team designs and manufactures nuclear-powered submarines and surface ships for the U.S. Navy. Growth reached 13.8%

Technologies – This division delivers command and control systems along with mission-critical information technology solutions. It saw a slight 1.5% decline

The company recently showed off its PERCH (Precision Effects & Reconnaissance, Canister-Housed) system at the U.S. Army's Machine Assisted Rugged Sapper event. They developed this system with AeroVironment, which highlights their ongoing breakthroughs in defense technologies.

General Dynamics financial performance

The company's second-quarter 2025 results were impressive. Revenue hit $13.04 billion - an 8.9% jump from last year that beat analyst expectations. Diluted earnings per share reached $3.74, up 14.7% from the prior year and better than the expected $3.59.

Q3 2025 brought strong performance across most segments. The consolidated book-to-bill ratio hit an exceptional 2.2-to-1, suggesting strong future demand. The total backlog grew to $109.80 billion, which gives clear revenue visibility for years ahead.

The stock trades at about $353.89 per share, near its 52-week high of $360.71 from January 2026. From an investment view, the returns look great - a $1,000 investment five years ago would now be worth about $2,351.

The company's P/E ratio sits at 22.65x, well below both the Aerospace & Defense industry average of 38.99x and its peer average of 38.62x. Based on discounted cash flow analysis, the stock seems undervalued with an estimated value of $369.26 per share.

General Dynamics government contracts

Several major government contracts strengthen the company's long-term revenue outlook. The Information Technology (GDIT) subsidiary landed a 10-year, $82.50 billion GSA Alliant 2 contract that lets any federal agency buy IT solutions.

GDIT won a huge $5.60 billion Air Force Mission Partner Capabilities Office contract in November 2025. This includes a five-year base period plus a five-year option. They also got a $580 million task order from the U.S. Army for Integrated Base Defense systems over five years.

The Marine Systems division secured key contracts too. They got a $532.90 million contract modification for U.S. Navy's Virginia-class attack submarines through October 2023. General Dynamics Mission Systems also landed a $272.90 million contract to develop submarine strategic weapons systems for both U.S. and UK navies.

The company might benefit from President Trump's proposed military budget increase to $1.50 trillion for fiscal year 2027. But there's a catch - the Trump administration wants defense contractors to cut back on stock buybacks and dividends to boost production efficiency.

Northrop Grumman (NOC)

Image Source: Nasdaq

Northrop Grumman stands out as a compelling defense stock to buy. The company ranks as the 5th largest U.S. federal government contractor and receives over 2% of total federal spending. This global aerospace and defense technology company leads innovation in multiple defense domains.

Northrop Grumman key products and services

Northrop Grumman delivers state-of-the-art defense solutions through four major business sectors. The Aeronautics Systems division generates 29% of 2024 revenues and develops essential aircraft. These include the B-21 Raider strategic bomber—expected to be ready by 2029—and the B-2 Spirit strategic bomber. The division also produces fuselage and radar components for the F-35 Lightning II and F/A-18 Super Hornet.

The Defense Systems division accounts for 19% of 2024 revenues and modernizes intercontinental ballistic missile systems. This includes the LGM-35 Sentinel and the Integrated Air and Missile Defense Battle Command System. The Mission Systems division contributes 25% of 2024 revenues by creating military radar systems, sensors, and related technologies. Notable products include the AN/APG-77 AESA radar for the F-22 Raptor and the AN/APG-81 AESA radar for the F-35 Lightning II.

The Space Systems division makes up 27% of 2024 revenues. This division develops communications satellites, Next-Generation Overhead Persistent Infrared satellites, and the Cygnus uncrewed spacecraft. Northrop Grumman's expertise extends to producing motors for NASA's Space Launch System and providing logistics support for the Lunar Gateway.

Northrop Grumman financial performance

Northrop Grumman stock trades near $618.82 as of January 9, 2026. The stock showed notable volatility in early January, reaching $638.84 on January 8 before settling at its current level. The company's market capitalization stands at approximately $83 billion.

The company's last 12-month operating income reached $4.10 billion with a 10.0% operating margin. Its cash flow margin hit 8.4%, generating $3.40 billion in operating cash flow during this period. Net income touched $4.00 billion, reflecting a net margin of about 9.8%.

The company's balance sheet shows $17.00 billion in debt with a 19.4% debt-to-equity ratio. Cash and cash equivalents total $2.00 billion out of $49.00 billion in total assets, resulting in a 4.0% cash-to-assets ratio.

Northrop Grumman's 2024 performance included $41.03 billion in revenue, $4.37 billion in operating income, and $4.17 billion in net income. The company will release its fourth quarter and full-year 2025 financial results on January 27, 2026.

Northrop Grumman government contracts

U.S. federal government contracts generate 87% of Northrop Grumman's revenues, while international sources contribute 12%. The company won two major contracts worth $1.40 billion in February 2025 to enhance air and missile defense capabilities for the U.S. Army and Poland.

The first five-year contract valued at $481.00 million expands IBCS software development. Poland's defense initiatives receive $347.60 million, while $133.70 million supports U.S. military and Guam Defense System needs. The second contract amounts to $899.60 million and delivers IBCS as the command and control system for Poland's WISŁA medium-range and NAREW short-range air defense programs.

Northrop Grumman maintains several major government contracts in homeland ballistic missile defense and next-generation adaptive propulsion programs. The company's contract vehicles and GSA schedules help government clients access its capabilities through efficient procurement processes.

RTX Corporation (RTX)

Image Source: Britannica

RTX Corporation stands among the top defense stocks to buy in January 2026. Based in Arlington, Virginia, RTX has grown into one of the world's largest aerospace and defense manufacturers by revenue and market capitalization. The company's strong presence in intelligence services has caught many investors' attention.

RTX key products and services

RTX Corporation, previously Raytheon Technologies, runs three efficient business divisions after its 2023 reorganization:

Collins Aerospace - Provides advanced aviation systems and components for commercial and military aircraft

Pratt & Whitney - Manufactures aircraft engines and propulsion systems

Raytheon - Develops defense systems including guided missiles, air defense networks, and cybersecurity solutions

RTX makes an impressive range of defense technologies. These include aircraft engines, avionics, aerostructures, guided missiles, air defense systems, satellites, and drones. The company's Advanced Technology business works on advanced components and full-scale solutions that "shape the systems and solutions that advance how tomorrow's battles are fought and won".

The Russian invasion of Ukraine helped RTX boost its revenue, as major arms manufacturers saw sharp increases in sales and profits. The company has built on this success with innovative products across air, land, sea, and space domains.

RTX financial performance

RTX Corporation's strong financial results show revenue of USD 80.74 billion in 2024. Here are other key financial metrics:

Operating income: USD 6.54 billion (2024)

Net income: USD 4.77 billion (2024)

Total assets: USD 162.90 billion (2024)

Total equity: USD 60.16 billion (2024)

The company grew stronger in 2025. Third quarter results led RTX to raise its full-year adjusted earnings outlook to USD 6.10-6.20 per share, up from USD 5.80-5.95. The adjusted sales expectations rose to USD 86.50-87.00 billion from USD 84.75-85.50 billion.

RTX's massive backlog of USD 251.00 billion (USD 148.00 billion commercial and USD 103.00 billion defense) gives investors clear revenue visibility.

RTX paid a USD 0.68 per share quarterly dividend on December 11, 2025. Based on the share count, this means an annual dividend cash cost of about USD 3.65 billion.

RTX government contracts

U.S. government contracts make up a large part of RTX's revenue. The company has won several major contracts that boost its position among defense stocks:

RTX's Collins Aerospace unit won a USD 438.00 million contract from the Federal Aviation Administration in January 2026. This contract supports the Radar System Replacement program to modernize the U.S. National Airspace System and improve air traffic control.

Late in 2025, RTX secured a USD 1.70 billion contract to provide Spain with four Patriot air and missile defense systems. The company also got a USD 168.00 million contract to supply Romania with Patriot air and missile defense system equipment.

RTX has earned many government contracts through various channels, including the GSA Multiple Award Schedule, which allows business transactions "with velocity and efficiency". These contracts have made RTX a vital supplier for all federal agencies.

Despite paying a USD 950.00 million settlement for federal investigations, RTX looks set for growth with its large backlog and strong government partnerships.

Leidos Holdings (LDOS)

Image Source: Leidos

Leidos Holdings stands out among defense stocks as a leading technology and engineering company that excels in national security, defense, intelligence, and civil government markets. The company delivers crucial IT solutions through its digital capabilities while building strong government partnerships.

Leidos Holdings key products and services

The company excels at delivering advanced technology solutions in four areas: trusted mission AI, full-spectrum cyber, digital modernization, and rapid prototyping & manufacturing. A team of nearly 3,000 cybersecurity professionals makes Leidos a leader in federal government cybersecurity.

The company's specialized products include ACAL (Advanced Complex Algebra Library), ADEPT (Assured Data Engine for Positioning and Timing), and the B220 explosive trace detection system. The Sea Hunter autonomous vessel showcases groundbreaking unmanned technology for anti-submarine warfare.

Leidos has several contract vehicles and GSA schedules that help government clients purchase efficiently. These include the Alliant 2 GWAC with a $75 billion program ceiling and OASIS+ across all eight domains.

Leidos Holdings financial performance

The company's third-quarter 2025 results show revenues of $4.50 billion, a 7% increase year-over-year, with 6% organic growth. Net income reached $369 million or $2.82 per diluted share. The adjusted EBITDA hit $616 million with margins of 13.8%.

Second quarter 2025 results were stellar. The company achieved record adjusted EBITDA of $647 million with a 15.2% margin. Non-GAAP diluted earnings per share hit a record $3.21, jumping 22% year-over-year.

Analysts project steady growth in free cash flow, reaching $1.61 billion in 2026 and $1.74 billion by 2028. The company's PE ratio sits at 16.5x, well below the Professional Services industry average of 24.2x and the peer group average of 40.9x.

Leidos Holdings government contracts

Leidos secured several major government contracts in 2025:

A $2.20 billion, seven-year contract in the intelligence community

A $760 million single award subcontract for NASA astronaut health services

A $540 million, seven-year contract for AI-enabled counter-terrorism software

A $331 million contract to modernize the U.S. Army's Global Unified Network

The federal government remains Leidos's main revenue source. The company manages key contract vehicles like Defense Enclave Services (DES), which modernizes networks for 22 fourth estate agencies, and DISA Encore III that supports IT modernization in DOD.

Stifel downgraded Leidos to "Hold" because of potential growth slowdown in the Department of Veterans Affairs C&P medical exams contract. This contract brings in over $5 billion yearly and makes up more than 30% of Leidos's consolidated earnings. Yet, 10 analysts maintain a "Buy" consensus rating.

BAE Systems (BAESY)

BAE Systems completes our list of top defense stocks worth buying. This British defense powerhouse gives global investors a chance to look beyond American defense contractors. The multinational corporation delivers military solutions in many domains with major operations in the United Kingdom, United States, Saudi Arabia, and Australia.

BAE Systems key products and services

BAE Systems runs five distinct segments that make up its detailed defense portfolio. The Air division made up almost 40% of total sales in 2025. It saw double-digit growth because of Eurofighter Typhoon support and F-35 production. The Maritime segment grew revenues by 7% and focuses on Type 26 frigate and Dreadnought submarine programs. The Electronic Systems division creates navigation systems, military communications, and precision guidance solutions.

The Cyber & Intelligence segment provides intelligence solutions mainly to government clients. The Platforms & Services division builds combat vehicles, munitions, and repairs ships for the U.S. Defense Department. The company's future looks bright with order backlogs especially strong in air and maritime businesses. These two segments alone exceed £50 billion, which means steady revenue for years to come.

BAE Systems financial performance

BAE Systems shows impressive financial strength. The order backlog hit a record £78.3 billion in 2025, growing 18% from the previous year. The first half of 2025 brought excellent results with sales up 10% to £13.1 billion. The underlying EBITA also rose 11% to £1.4 billion.

Analysts believe revenue will hit £28.4 billion in 2025 and grow about 8% in 2026. The adjusted EBITDA margins should stay steady at 14.5-14.8%. The company's stock has performed remarkably well. It jumped 49% in 2025 alone and grew 240% over five years.

The company plans to give back £1.5 billion to shareholders in 2025, with £500 million through share buybacks. Earnings per share should rise 40% between 2024 and 2027.

BAE Systems government contracts

BAE Systems keeps winning major government contracts that strengthen its position as a top defense stock. The company won a $138.5 million contract to provide engineering services and equipment integration for Navy airborne platforms. The Norfolk Ship Repair facility will finish work on the USS Sherman by August 2027. This contract could reach $139.1 million.

The company has built mutually beneficial alliances beyond the United States. Major programs run in the UK, Saudi Arabia, and Australia. This geographic spread helps protect the company from defense budget changes in different regions.

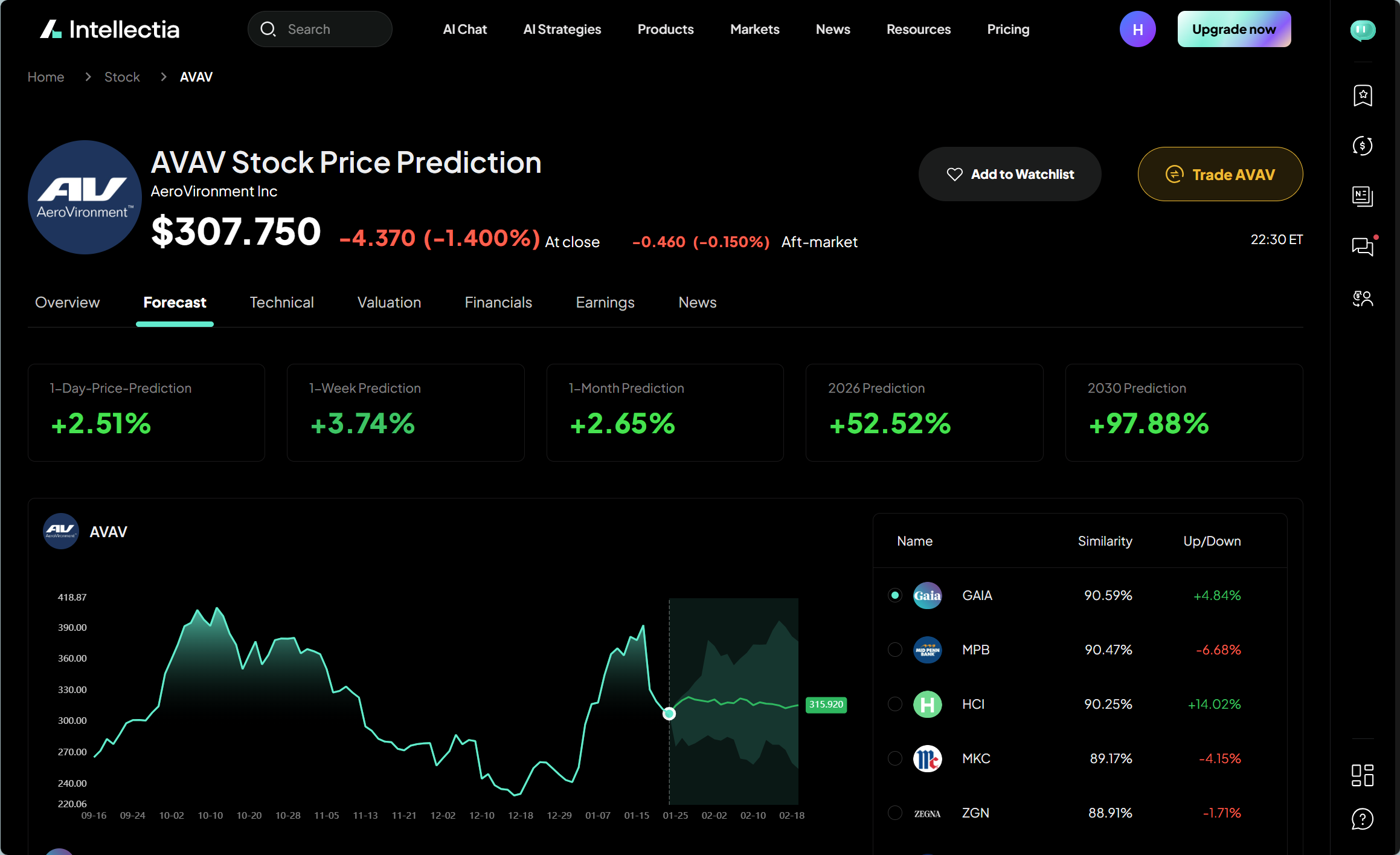

AeroVironment (AVAV)

Image Source: AeroVironment, Inc.

AeroVironment stands out as a specialized defense technology leader in the defense stocks market. The company delivers capabilities that work together across multiple domains. Unlike bigger defense giants, it puts all its focus on autonomous systems. This gives investors a unique chance to invest in innovative military technology.

AeroVironment key products and services

The company's impressive portfolio of unmanned systems plays a vital role in modern warfare. Their systems make up most of the uncrewed aircraft in the U.S. Department of Defense inventory. Their product lineup has:

The new P550™ uncrewed aircraft system with vertical take-off and landing capabilities, advanced AI, and autonomous functions

The battle-tested Switchblade® 300 loitering missile systems that the U.S. Army has used for over a decade and now supports Ukraine's defense efforts

Other platforms like JUMP® 20, Puma™, Raven®, and Titan C-UAS™ systems

AeroVironment financial performance

The company hit a record second quarter fiscal 2026 revenue of $472.50 million, growing by 151% from last year. Their purchase of BlueHalo on May 1, 2025, added $245.10 million to quarterly revenue. The company now has a strong funded backlog of $1.10 billion, which points to steady future revenue.

AeroVironment's market value has grown to about $18.22 billion. The stock went up for six straight days with total gains of 51%. These gains came after the company announced major government contracts.

AeroVironment government contracts

Early 2026 brought several big government contracts to AeroVironment. The U.S. Army Contracting Command awarded an $874.26 million five-year IDIQ contract. This deal supports foreign military sales to allied and partner forces for their full product range.

The company also got $64.57 million more for Switchblade 300 loitering missile systems through an existing U.S. Army contract. This brought the total funded amount to $231.33 million. The company then grew its international sales when Ukraine approved and France bought Switchblade 300 systems.

Comparison Table

| Company | Main Business Focus | Core Products/Services | Recent Financial Performance | Notable Government Contracts | Market Position/Recent Developments |

| Lockheed Martin (LMT) | Aerospace & Defense | F-35 Lightning II, PAC-3 missiles, HIMARS, Sikorsky helicopters | Revenue: $74.50B (2025), Backlog: $179.00B | $61.40B in government contracts (FY2023), $3.30B Navy contracts for Trident II | Largest U.S. defense contractor, 73% sales from U.S. government |

| General Dynamics (GD) | Aerospace & Defense | Gulfstream jets, combat vehicles, nuclear submarines | Revenue: $13.04B (Q2 2025), Backlog: $109.80B | $82.50B GSA Alliant 2 contract, $5.60B Air Force contract | Trading at $353.89/share, P/E ratio of 22.65x |

| Northrop Grumman (NOC) | Aerospace & Defense | B-21 Raider, missile systems, military radar systems | Revenue: $41.03B (2024), Operating Income: $4.37B | $1.40B in air/missile defense contracts (2025) | 5th largest U.S. federal contractor, 87% revenue from government |

| RTX Corporation (RTX) | Aerospace & Defense | Aircraft engines, guided missiles, defense systems | Revenue: $80.74B (2024), Backlog: $251.00B | $438M FAA contract, $1.70B Spain Patriot system contract | Major global aerospace/defense manufacturer |

| Leidos Holdings (LDOS) | Technology & Engineering | Cybersecurity, AI solutions, digital modernization | Revenue: $4.50B (Q3 2025), Net Income: $369M | $2.20B intelligence community contract, $760M NASA contract | Leading federal IT/cybersecurity provider |

| BAE Systems (BAESY) | Defense & Security | Combat aircraft, naval vessels, electronic systems | Backlog: £78.3B (2025), Sales: £13.1B (H1 2025) | $138.5M Navy engineering contract | Strong international presence, 49% stock growth in 2025 |

| AeroVironment (AVAV) | Unmanned Systems | Switchblade systems, P550 aircraft, drone technology | Revenue: $472.50B (Q2 FY2026), Backlog: $1.10B | $874.26M Army IDIQ contract, $231.33M Switchblade contract | Market cap: $18.22B, 51% recent stock growth |

Conclusion

Defense stocks are a compelling investment chance as 2026 unfolds. Geopolitical tensions have boosted valuations in the defense sector, especially after U.S. intervention in Venezuela. Lockheed Martin, General Dynamics, and Northrop Grumman show remarkable financial stability through their massive order backlogs and long-term government contracts. The newly announced $1.50 trillion defense budget for 2027 signals strong growth prospects for these companies.

Seven major defense companies show strong financial indicators. Lockheed Martin has a $179 billion backlog. General Dynamics boasts a favorable P/E ratio of 22.65x. RTX's order book stands at an impressive $251 billion - all signs point to sustained revenue streams. While large defense contractors provide stability, smaller players like AeroVironment offer focused exposure to innovative military technology. Their unmanned systems show remarkable growth potential.

Government contracts are the life-blood of these companies' revenue streams. They create predictable cash flows that attract investors during uncertain market conditions. BAE Systems brings valuable international diversification to your portfolio. This reduces your exposure to defense spending changes in any single country. The Intellectia.ai AI Screener helps you filter the market quickly. You can find companies that benefit from the Gemini 3 trend by spotting Google's suppliers or competitors increasing their chip orders.

A smart investment strategy should include both established defense giants and emerging specialists. Defense stocks perform well during economic downturns, thanks to guaranteed government spending whatever the economic conditions. The defense sector will remain vital to investment portfolios throughout 2026 and beyond. Global tensions continue to rise, warfare technology advances, and modernization initiatives expand worldwide.