Key Takeaways

Smart investors are gravitating toward low-cost index funds because they offer superior long-term wealth building through minimal fees, broad diversification, and consistent market-matching returns.

• Ultra-low fees compound massive savings: Index funds charge 0.02%-0.2% versus 0.5%-2% for active funds, potentially saving $15,000+ over 30 years on a $10,000 investment.

• Passive beats active long-term: 85% of actively managed funds underperform the S&P 500 over 10 years, while 93% fail to beat it over 20 years.

• Instant diversification reduces risk: Single index fund purchases provide exposure to hundreds or thousands of securities, spreading risk across entire markets.

• Dollar-cost averaging maximizes consistency: Regular automated investments remove emotion from decisions and naturally buy more shares when prices are lower.

• Dividend reinvestment drives 85% of returns: Automatically reinvesting dividends has generated the majority of S&P 500's cumulative returns since 1960.

The key to success lies in selecting funds with expense ratios under 0.1%, maintaining discipline during market downturns, and leveraging automation for consistent investing habits that compound wealth over decades.

Low-fee index funds low fees can generate much better returns over time - a fact many investors overlook. Most investors chase performance when the smartest strategy sits right under their nose. The average stock index mutual fund charged just 0.05% in 2023 (on an asset-weighted basis), which means $5 for every $10,000 invested.

Low-cost index funds differ significantly in their performance. The cheapest option might not deliver the best index fund returns. ETFs rank among the most affordable index funds available, and products like the Vanguard Total Stock Market Index Fund ETF give investors broad market exposure at a mere 0.03% expense ratio. The first index fund's launch in 1976 started a revolution that proved these investment vehicles cost less than actively managed funds consistently.

This piece will show you the best low-cost index funds for 2026. You'll learn what makes them smart investment choices and ways to add them to your portfolio strategy. The expert breakdown helps both new investors and experienced traders make better decisions about their financial future.

8 best low-cost index funds for 2026

Want to maximize your investment returns without getting hit by high fees? Here are eight outstanding low-cost index funds that should be on your radar for 2026. These funds give you great value through minimal expenses and broad market exposure.

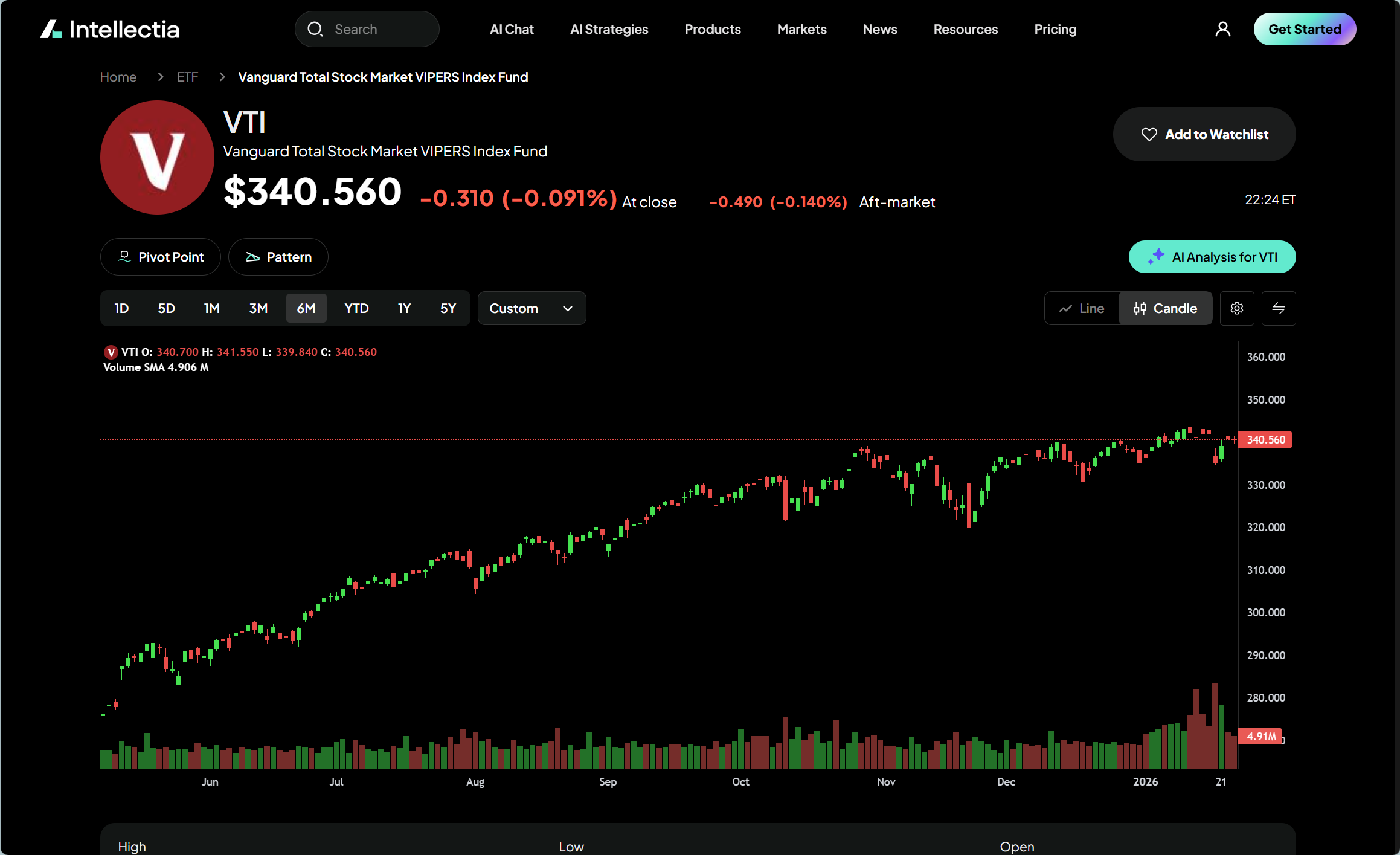

1. Vanguard Total Stock Market ETF (VTI)

VTI gives you complete access to the U.S. stock market at a remarkably low 0.03% expense ratio. The fund tracks the CRSP US Total Market Index and holds more than 3,500 stocks across large-, mid-, small-, and micro-cap companies. Its performance has been impressive with a 17.14% one-year return as of December 2025 and a steady 10-year return of 14.25%. Long-term investors will find VTI's diversified structure perfect as a core holding.

2. Fidelity ZERO Large Cap Index (FNILX)

FNILX stands out by charging zero expenses (0.00%), making it the most cost-effective choice available. The fund follows the Fidelity U.S. Large Cap Index and has generated strong returns of 17.82% for the one-year period ending December 2025. This 7-year old fund has quickly grown to manage assets worth approximately $6.5 billion.

3. Schwab S&P 500 Index Fund (SWPPX)

SWPPX tracks the S&P 500 index with a tiny 0.02% expense ratio. The fund manages 503 stocks and has produced excellent returns of 17.88% for the one-year period ending December 2025. Investors seeking core U.S. equity exposure will appreciate its substantial $133 billion asset base, which ensures great liquidity and stability.

4. iShares Core S&P 500 ETF (IVV)

IVV runs lean with a 0.03% expense ratio and stands among the world's largest ETFs, managing assets over $764 billion. This S&P 500 Index tracker has earned Morningstar's prestigious Gold medal rating. The fund has shown remarkable performance with 17.57% one-year returns and maintains strong sector diversity across technology (34.72%), financials (13.51%), and consumer discretionary (10.52%).

5. Vanguard S&P 500 ETF (VOO)

VOO lets you tap into the S&P 500 index with a minimal 0.03% expense ratio. The fund's five-year annualized return stands at an impressive 15.2%. VOO's position as one of the market's largest funds ensures exceptional liquidity and precise benchmark tracking.

6. Vanguard Total Bond Market ETF (BND)

BND emerges as a top fixed-income choice with its 0.03% expense ratio and comprehensive coverage of the U.S. investment-grade bond market. The fund currently manages over 11,480 bonds with an average yield to maturity of 4.3%. Bond returns are typically modest, yet BND achieved a solid 7.11% one-year return as of December 2025.

7. Vanguard FTSE All-World ex-US ETF (VEU)

VEU brings international diversity to your portfolio at just 0.04% expense ratio. The fund covers both developed and emerging markets outside the U.S. Its stellar one-year return of 32.34% shows why global diversification matters. U.S.-focused investors will find VEU an excellent portfolio addition.

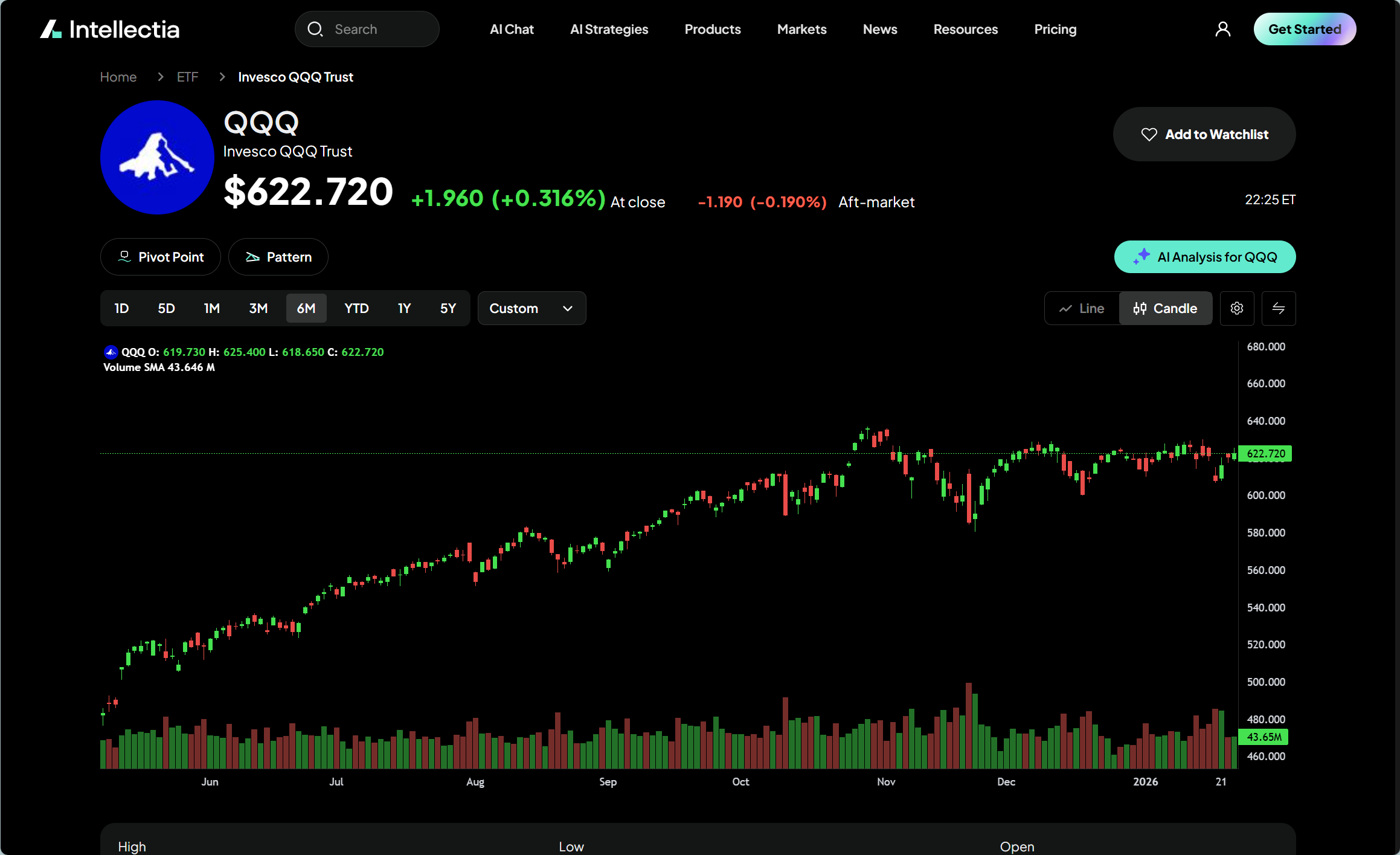

8. Invesco QQQ Trust ETF (QQQ)

QQQ charges a slightly higher 0.20% expense ratio but has more than justified this cost through its performance. The fund follows the NASDAQ-100 index and has outperformed the S&P 500 seven out of the last ten years. Technology makes up 53.06% of its holdings, featuring giants like NVIDIA (9.02%), Apple (7.55%), and Microsoft (7.06%).

What makes these funds smart choices?

Low-cost index funds pack a powerful punch. They build wealth through their affordability and several other key features. Let's explore what makes these investment tools worth adding to your portfolio.

Ultra-low expense ratios

Index funds' biggest advantage comes from their cost structure. These funds track an index instead of trying to beat it. This passive management leads to much lower expense ratios than actively managed funds. Active funds charge between 0.5%-2% each year. The best index funds cost just 0.02%-0.2%.

Small fee differences add up fast. Here's a clear example: A $10,000 investment growing at 7% yearly in an index fund with a 0.1% fee would reach about $72,000 after 30 years. The same money in an active fund charging 1% would only grow to $57,000. That's $15,000 lost to fees alone.

Broad market exposure

An index fund purchase gives you instant diversification across hundreds or thousands of securities in one trade. You're not gambling on single companies - you're buying entire markets or sectors.

This wide exposure protects your investment naturally. Some holdings might struggle, but others can make up for those losses. The result is steadier returns overall. The S&P 500 index fund shows this perfectly - one purchase lets you own pieces of America's 500 largest companies in various industries.

Strong long-term performance

Index funds deliver impressive results over time, despite their hands-off approach. Research shows they beat most actively managed funds over longer periods.

The numbers tell the story clearly. Over 10 years, 85.33% of active U.S. large-cap funds couldn't keep up with the S&P 500. Push that to 20 years, and 93.42% of active managers fell behind their benchmark indexes. The S&P 500 has returned about 10% yearly over extended periods.

High liquidity and fund size

The largest index funds manage hundreds of billions in assets. This size creates rock-solid stability and makes buying or selling shares easy without moving the fund's price.

ETF versions trade all day on stock exchanges, giving investors more flexibility. The massive scale helps providers keep costs tiny - just look at VEA, which handles $260 billion while charging only 0.03%.

These benefits create an investment opportunity that makes sense, especially if you want steady wealth growth instead of market speculation.

How to invest in low-cost index funds

Low-cost index funds are easy to start with and need just a few basic steps. You can build a resilient portfolio that gives solid long-term results without high fees eating into your returns.

Open a brokerage account

You need to pick a brokerage account that lets you buy the index funds you want. Mutual fund companies like Vanguard or Fidelity sell index funds directly. Discount brokers offer funds from multiple providers. The choice depends on whether you want access to funds of all types or prefer one provider.

Digital tools make finding suitable low-cost index funds much easier. Intellectia.ai's AI Screener serves as a great starting point. This tool helps you filter the entire market quickly. You can spot companies that show clear signs of gaining from the Gemini 3 trend—maybe even by finding Google's suppliers or competitors who increase their chip orders.

Decide between mutual fund and ETF

Mutual funds and ETFs are both quick ways to invest in index funds, but they work differently. You can trade ETFs like stocks throughout the day, while mutual funds price only at day's end. ETFs also need less money to start—some Vanguard ETFs need just $1, compared to mutual funds that often need $3,000.

Mutual funds work better if you invest regularly because they let you buy partial shares. This means all your money gets invested. ETFs might suit you better if you want to trade during the day or start with smaller amounts.

Set your investment amount and frequency

Figure out how much you can invest after paying bills and saving for emergencies. Most brokers now let you buy partial shares of ETFs and mutual funds, so you can invest exact dollar amounts whatever the share price.

Your platform likely offers automatic investment plans to schedule regular contributions to your funds. This feature helps you stay disciplined with investing without manual purchases each time.

Use dollar-cost averaging for consistency

Dollar-cost averaging means investing fixed amounts regularly whatever the market does. This way, you buy more shares at the time prices drop and fewer shares at the time prices rise.

This method does more than just cut costs. Regular contributions build good investing habits. The whole ordeal takes emotion out of market swings and stops you from trying to time market highs and lows. You also avoid common mistakes like chasing popular investments or selling in panic during downturns.

Risks and limitations of index fund investing

Index funds have great advantages, but they come with their share of limitations. You should know about these drawbacks to set realistic expectations for your investment strategy.

Market volatility still applies

Index funds won't protect you from market downturns. These funds simply follow their standards down when markets get rough. Unlike actively managed portfolios, index funds can't move to defensive positions or build cash reserves to soften market falls. To cite an instance, stock market volatility has doubled in the last seven decades—from about 10% to 20%. Daily volatility shows an even bigger change with an increase of about 130%.

No chance to outperform the market

Index funds want to match their standards—not beat them. This basic limit means your returns will never go above average market performance. Active fund managers try a different approach. They work to create alpha through careful stock selection. On top of that, index funds can't copy the methods of star managers like Peter Lynch, which might keep you from accessing better investment strategies.

Sector concentration in some indexes

Many popular indexes have unexpected concentration problems. The top ten stocks in the Russell 1000 (mostly tech companies) now control over 30% of the index's weight—the highest level in its 45-year history as of 2024. The "Magnificent Seven" stocks alone created more than half of the S&P 500's 26.3% gain in 2023. This heavy concentration gives you too much exposure to specific sectors, which could weaken your diversification benefits.

Tracking error and fund structure issues

Copying an index perfectly is harder than it seems. Tracking error—the gap between a fund's returns and its standard—comes from several sources. Management expense ratios cause most of these differences, but portfolio rebalancing costs and cash positions also play a role. Most funds keep 2-5% in cash for redemptions, so they don't match fully-invested indexes exactly. When indexes update their components, transaction costs will affect fund performance.

Tips to maximize returns with index funds

Your success in index investing depends on proven strategies that maximize returns over time. A disciplined investing approach makes a real difference to your long-term results.

Stick to your plan during downturns

Market declines will happen, but many investors react emotionally when they sell after losses and buy after gains. Active fund investors show this reactive behavior twice as often as index fund investors. Your long-term performance suffers when you sell after market drops, even with 5-10% declines. You should prepare for volatility with a solid plan and stay committed through market cycles.

Reinvest dividends automatically

Reinvested dividends shape your returns dramatically. The S&P 500's cumulative return since 1960 came 85% from reinvested dividends. Your broker's automatic dividend reinvestment programs (DRIPs) work without fees or commissions. This method lets you buy fractional shares, average your cost basis over time and benefit from compounding.

Review and rebalance annually

Your portfolio will drift from its target allocation as time passes. Annual rebalancing puts your original asset allocation and risk profile back in place. This method helps you sell high and buy low by reducing overweighted positions and adding to underweighted ones. Tax implications matter - rebalance in tax-advantaged accounts to avoid triggering taxes.

Avoid high-fee brokers or platforms

Small fees add up dramatically. An investor who chooses low-fee funds could retire with $300,000 more than someone paying higher fees over 40 years. Many major online brokerages now offer zero-commission stock and ETF trades.

The AI Stock Picker gives analytical, useful insights through daily recommendations.

Conclusion

Low-cost index funds are powerful wealth-building tools for 2026 and beyond. This piece shows how tiny expense ratios create huge advantages over time. Fees can be as low as 0.03% compared to the 1-2% that active managers typically charge. This difference alone could add tens of thousands of dollars to your investment returns over time.

The data shows that index funds beat most actively managed funds over long periods. These funds also give you instant diversification across hundreds or thousands of securities with just one purchase. You spread your risk while keeping strong growth potential.

Index funds have their limits though. Market swings affect these investments like any other, and heavy concentration in certain sectors can create unexpected risks. You need to understand both strengths and weaknesses to build a strong portfolio.

Your success with index investing depends on how well you stick to proven strategies. Following your investment plan during market drops, putting dividends back to work, rebalancing yearly, and avoiding extra fees all add substantially to your long-term results.

The financial world will definitely keep changing, but the core benefits of low-cost index funds stay the same. These investments are perfect for people who want simplicity, cost savings, and solid long-term returns. With what you've learned here, you can make smart investment choices that could change your financial future through low-cost index investing.