Key Takeaways

- Discover why 2026 is shaping up to be a pivotal year for silver, driven by a structural supply deficit, surging green technology demand, and its potential to outperform gold.

- Learn the crucial differences between physically backed, miners, and futures-based silver ETFs, and understand how their structures impact risk, reward, and even your tax bill.

- The article provides an in-depth analysis of the top 5 silver ETFs for 2026, including their unique structures, holdings, costs, and ideal investor profiles.

- Move beyond simple metrics and learn to evaluate silver ETFs based on tracking error, liquidity, tax implications (the "collectibles" tax), and fund transparency.

- Explore how you can use powerful AI-driven tools to analyze market sentiment, track key holdings, and enhance your silver ETF trading strategy for better results.

Introduction

Feeling uneasy about inflation, market volatility, and geopolitical risks? You’re not alone — traditional stock-and-bond portfolios often fail to hold up when uncertainty strikes.

That’s why more investors are turning to silver ETFs, a simple yet powerful way to hedge against inflation and participate in industrial growth trends. With AI-driven insights from Intellectia.ai, you can cut through the noise and identify the smartest opportunities. In this article, we’ll explore why 2026 could be a breakout year for silver, and how to position your portfolio before the market catches on.

What Is a Silver ETF? An Analytical Breakdown

Silver ETFs come in several types, each offering different exposure and risk levels — understanding these distinctions helps you choose the right one for your strategy.

1. Physically Backed Silver ETFs

These funds are the most straightforward and popular way for you to gain direct exposure to the price of silver. Reputable funds like the iShares Silver Trust (SLV) and abrdn Physical Silver Shares ETF (SIVR) operate on a simple principle: they purchase and hold large, investment-grade physical silver bars in highly secure, audited vaults (typically in financial hubs like London or Zurich). Each share you purchase in the ETF corresponds to a fractional ownership of the actual silver held by the trust.

2. Silver Miners ETFs

These ETFs, exemplified by the Global X Silver Miners ETF (SIL), offer a completely different form of exposure. They do not hold any physical silver. Instead, they hold a portfolio of stocks from companies engaged in the business of silver mining. This introduces the powerful, and risky, concept of operational leverage.

3. Futures-Based Silver ETFs

A third, less common category for retail investors uses financial derivatives—specifically, futures contracts—to simulate exposure to silver's price. These funds don't own the physical metal but instead hold contracts for the future delivery of silver. They are primarily used by sophisticated traders for short-term speculation.

Why Invest in Silver ETFs in 2026? The Fundamental Case

The investment thesis for silver in 2026 is not based on fleeting market sentiment but on powerful, converging macroeconomic and industrial trends.

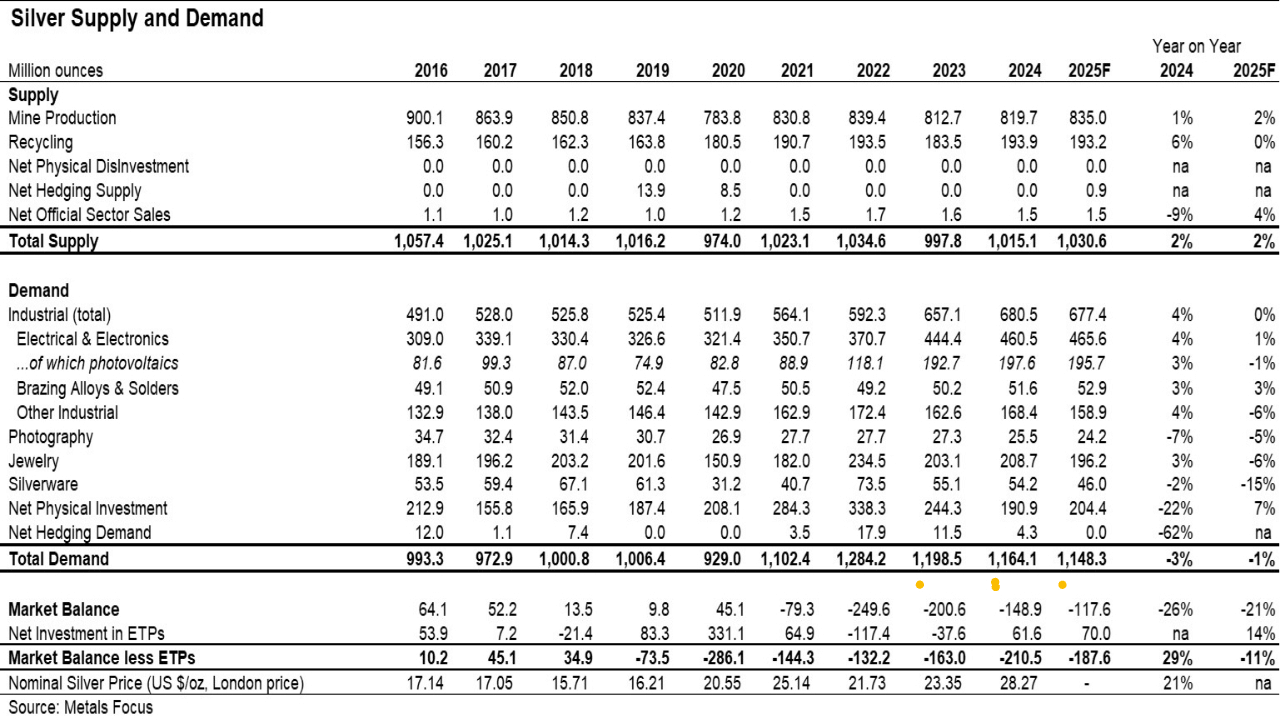

- Silver’s Surging and Inelastic Industrial Demand: Unlike gold, over half of all silver demand is industrial. This demand is largely inelastic, meaning it will persist even if prices rise, because silver's unique properties are irreplaceable.

- The Green Energy Revolution: Silver possesses the highest electrical and thermal conductivity of any element. This makes it indispensable in the manufacturing of photovoltaic cells for solar panels. Global solar capacity is projected to nearly triple by 2027, and with each panel containing a significant amount of silver, this single sector creates a massive and growing demand base.

- The Electric Vehicle (EV) Tsunami: The automotive industry's shift to electric is another huge catalyst. A standard internal combustion engine vehicle contains 15-28 grams of silver. As EV adoption moves from a niche to the mainstream, this will place immense pressure on silver supply.

- 5G, AI, and Advanced Electronics: The backbone of our modern digital world runs on silver. It is a critical component in semiconductors, circuit boards, and the infrastructure needed for 5G networks and data centers powering the AI revolution.

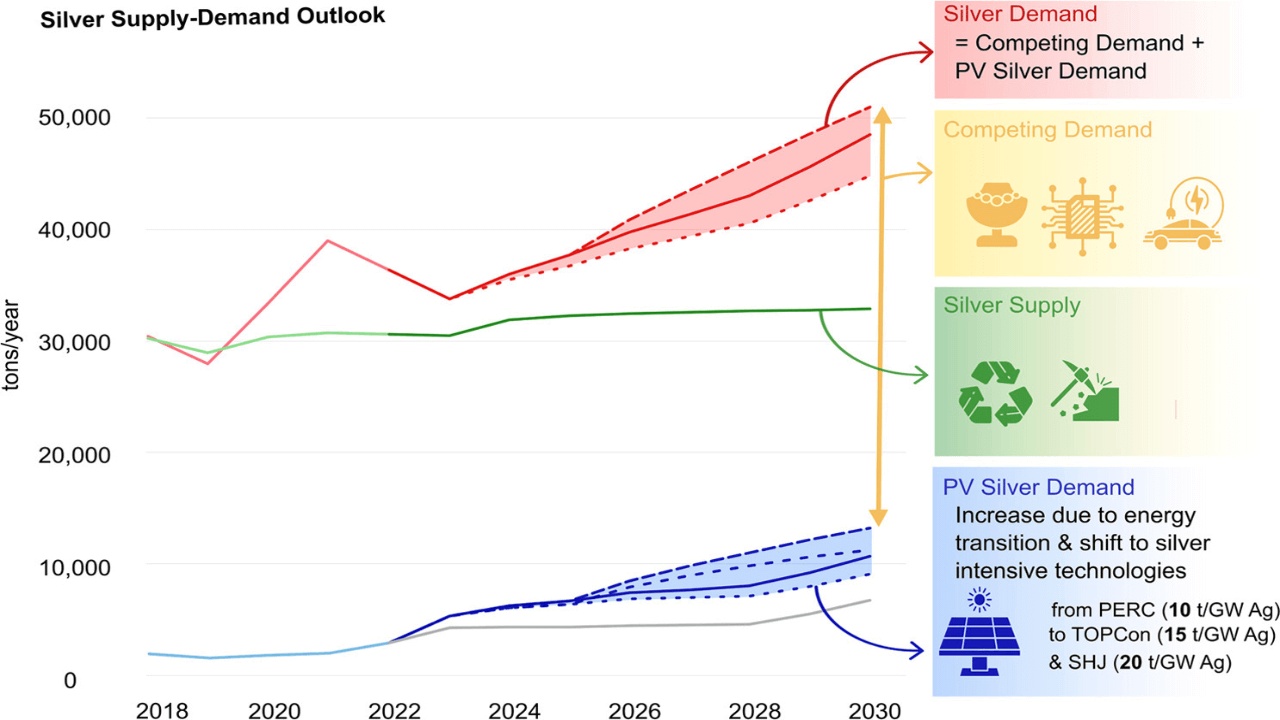

The Deepening and Structural Supply Deficit

For several consecutive years, the world has been in a structural silver deficit, meaning world consume far more than it produce.

Over 70% of mined silver comes as a byproduct of other metals, making its supply largely inelastic. Combined with years of underinvestment and declining ore grades, this structural shortfall means new production can’t easily respond to rising demand — a setup for a long-term supply deficit.

Recycling helps, but it only accounts for a fraction of the total supply and cannot bridge the widening gap.

The Gold-to-Silver Ratio: A Powerful Historical Indicator

Historically, when the gold-to-silver ratio exceeds 80:1, silver is considered undervalued compared to gold. In 2025, the ratio remains above this level — a strong signal that silver may still have room to run as investors rotate into undervalued metals.

Criteria for Selecting the Best Silver ETFs

A sophisticated investor looks beyond the ticker symbol. To choose the optimal ETF for your portfolio, you must conduct a thorough analysis of several key factors that will directly impact your net returns.

1.Expense Ratio: While a difference of 0.20% may seem negligible, on a $50,000 investment held for a decade, it can result in over a thousand dollars in lost gains due to the power of compounding. For long-term holdings, minimizing this fee is paramount.

2. Tracking Error: This metric reveals how effectively a fund is doing its job. For a physically backed ETF, you expect it to mirror the spot price of silver with near-perfect precision. Any significant deviation, or high tracking error, is a red flag. It can be caused by the fund's fees, cash drag (holding a small amount of cash), or the timing of its transactions, and it indicates inefficient management.

3. Liquidity (AUM & The Bid-Ask Spread): High Assets Under Management (AUM) and robust daily trading volume are essential. In a liquid ETF like SLV, this spread is pennies. In an illiquid fund, it can be much wider, representing a hidden, immediate cost to you every time you trade.

4. Tax Implications (The "Collectibles" Trap): This is a critical, advanced consideration for U.S. investors. Gains from physically backed precious metal ETFs structured as grantor trusts (like SLV and SIVR) are typically taxed as "collectibles" at a maximum federal rate of 28%. This is significantly higher than the standard 15-20% long-term capital gains rate applied to most stocks and other ETFs.

Focusing on these fundamentals ensures your ETF choice aligns with both performance and after-tax efficiency.

Best Silver ETFs for 2026: A Comparative Overview

| ETF Name | Ticker | Expense Ratio | AUM(Net Assets) | YTD Return In 2025 | Key Feature |

|---|---|---|---|---|---|

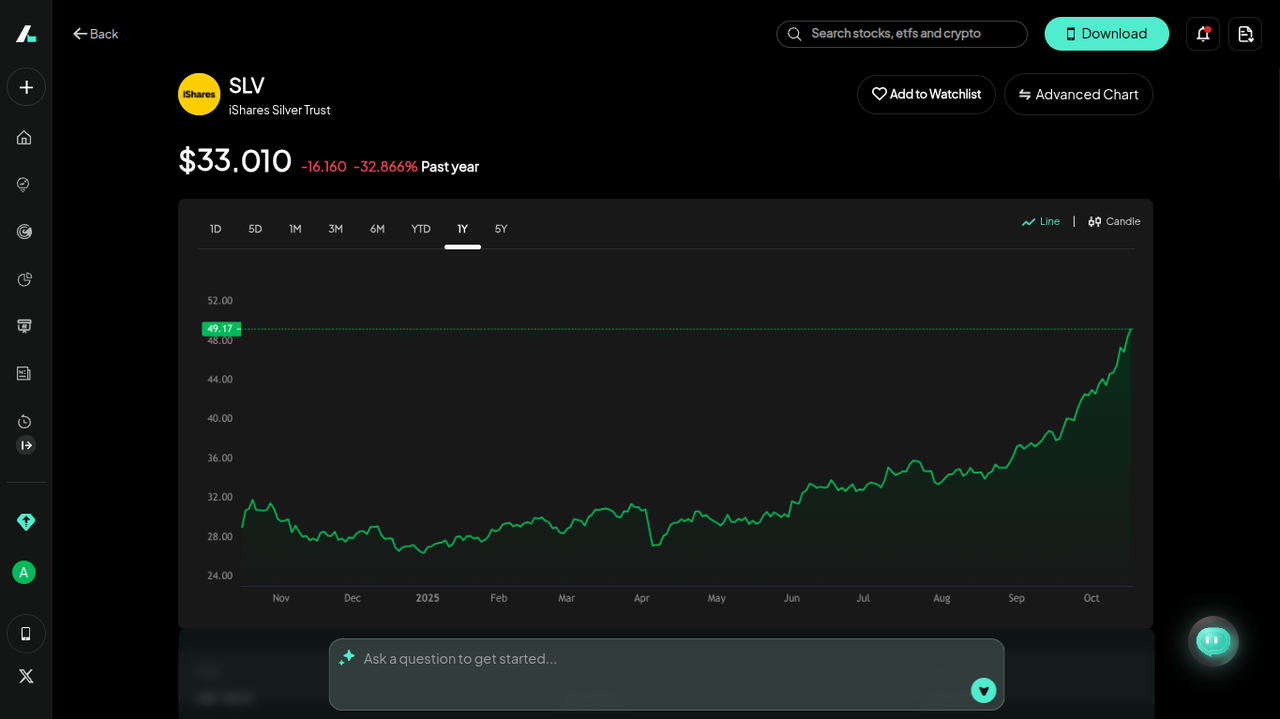

| iShares Silver Trust | SLV | 0.50% | ~$26.1 Billion | 84% | Unmatched Liquidity & Options Market |

| abrdn Physical Silver Shares ETF | SIVR | 0.30% | ~$3.5 Billion | 84% | Lowest Cost for Physical Exposure |

| Sprott Physical Silver Trust | PSLV | 0.58% | ~$9.3 Billion | 84% | Physically Redeemable & Secure |

| Global X Silver Miners ETF | SIL | 0.65% | ~$4 Billion | 146% | Leveraged Large-Cap Miner Exposure |

| Amplify Junior Silver Miners ETF | SILJ | 0.69% | ~$2.9 Billion | 163% | High-Octane Small-Cap Miner Play |

1. iShares Silver Trust (SLV)

As the undisputed giant in the silver ETF space, SLV offers unparalleled liquidity. It is designed to track the daily price movement of silver by holding allocated physical silver bullion in a London vault, custodied by JPMorgan.

Its sheer size and trading volume make it the instrument of choice for large institutions and active traders. A key advantage of SLV is its highly active options market, which allows sophisticated investors to generate income or hedge their positions using advanced strategies, an option not readily available with smaller funds.

If you need to execute large orders with minimal price impact, SLV is the go-to vehicle.

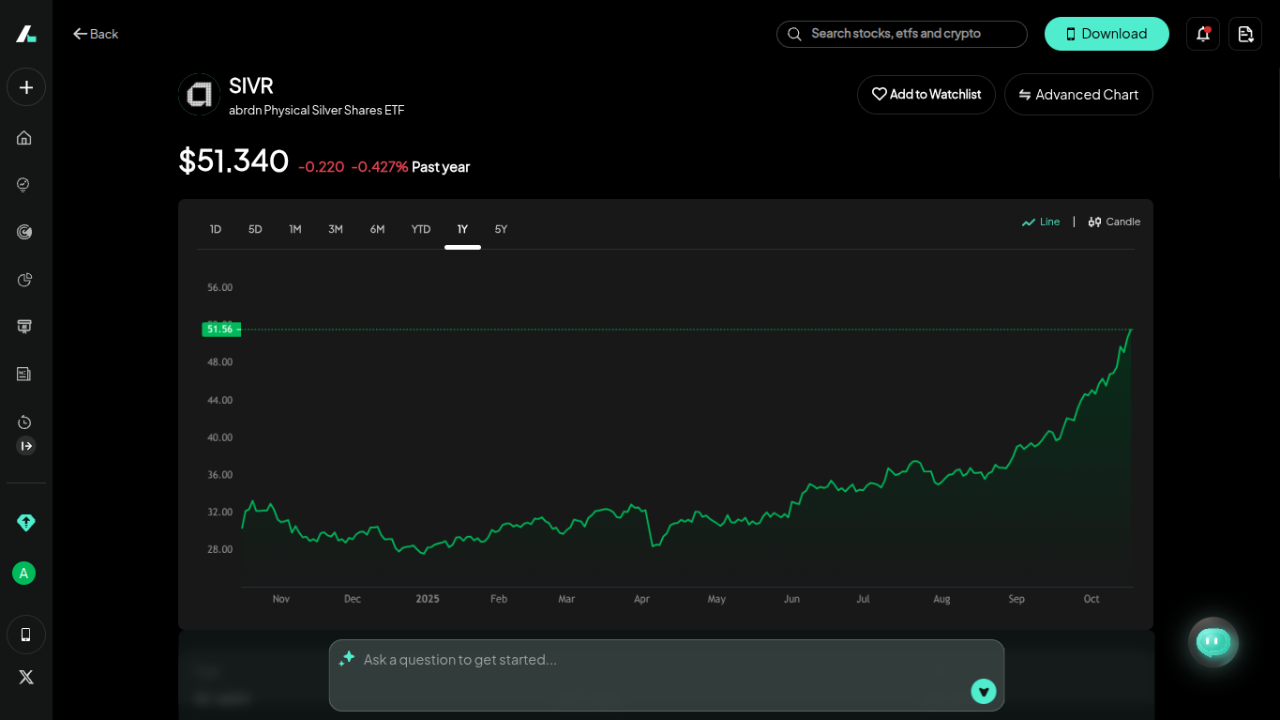

2. abrdn Physical Silver Shares ETF (SIVR)

The SIVR ETF is a direct and formidable competitor to SLV, offering the same core proposition: direct exposure to the price of silver through physically held bullion. Its primary and most compelling advantage is its substantially lower expense ratio.

This cost difference becomes increasingly significant over a multi-year holding period. SIVR also offers geographic diversification in its vaulting, holding its silver in both London and Zurich, which can be seen as a minor risk mitigation factor against country-specific issues.

If you plan to build a strategic position in silver over many years, the compounding effect of SIVR's lower fees makes it the analytically superior choice.

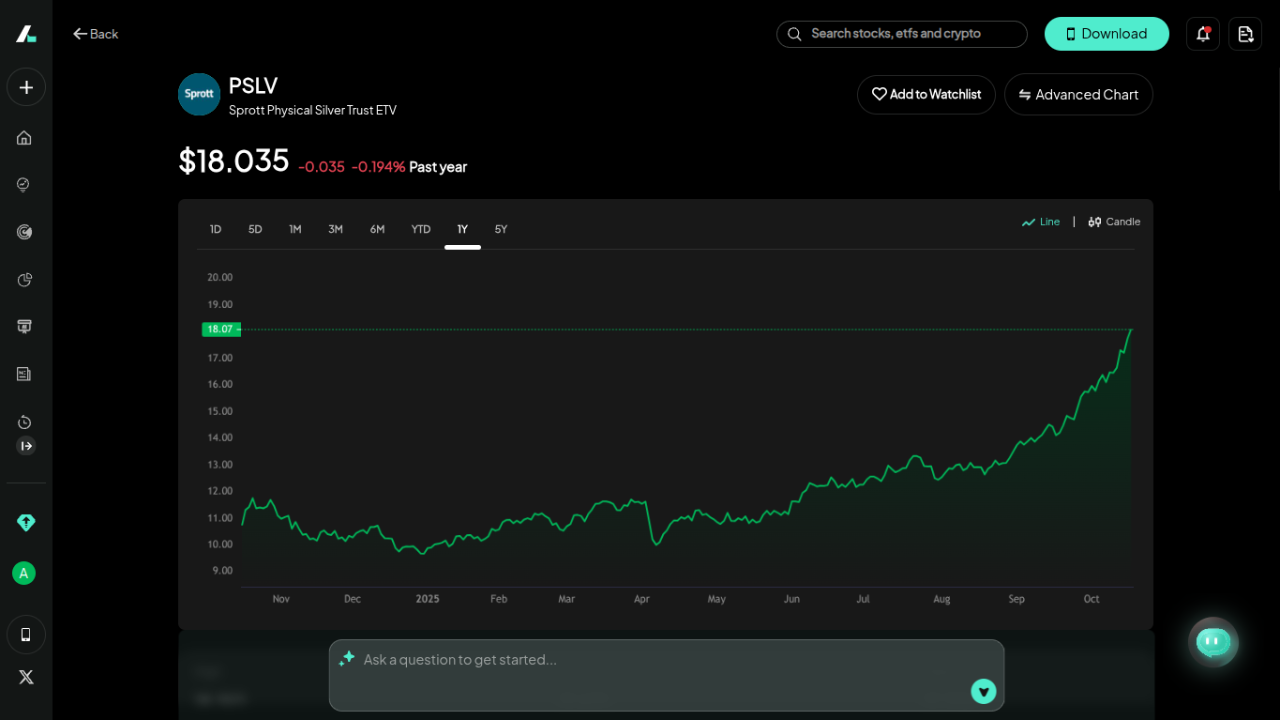

3. Sprott Physical Silver Trust (PSLV)

The Sprott Physical Silver Trust is not a traditional ETF; it's a closed-end trust. This structural difference is its key feature. PSLV holds fully allocated, segregated silver bars in custody at the Royal Canadian Mint. This means the silver is specifically identified and stored in the trust's name, not on a bank's balance sheet, which is a crucial distinction for investors concerned about counterparty risk.

Its standout feature is the ability for unitholders (with a sufficient number of shares) to redeem their holdings for physical delivery of the silver bars, a feature that ensures the share price rarely deviates significantly from its net asset value.

If you want the assurance that your investment is backed by real, deliverable metal held outside the traditional banking system, PSLV is the gold standard.

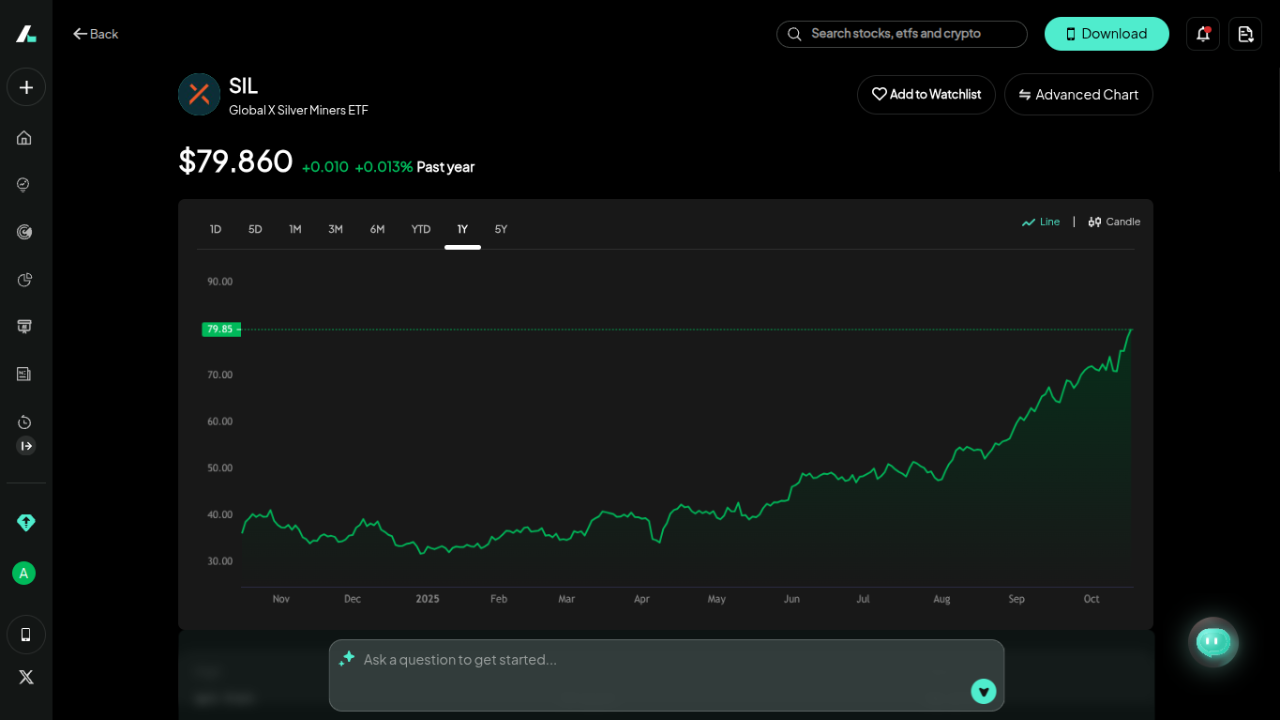

4. Global X Silver Miners ETF (SIL)

The SIL ETF provides diversified exposure to the largest and most established silver mining companies globally. This fund is your one-click solution to investing in industry titans, offering significant operational leverage to the underlying price of silver.

The fund is globally diversified but does have a heavy concentration in its top holdings, such as Wheaton Precious Metals and Pan American Silver. Astute investors should use tools like Intellectia.ai's AI Stock Picker to independently analyze the strength of these key components.

If you believe silver prices are poised to move significantly higher and are comfortable with the added volatility of equities, SIL is a core holding.

5. Amplify Junior Silver Miners ETF (SILJ)

The SILJ ETF dramatically ramps up the risk-reward spectrum by focusing on small-cap "junior" silver miners. These are often speculative companies focused on exploration and development rather than established production. Their success is often a binary outcome; a major discovery can lead to astronomical returns, while a failed drilling program can render the stock worthless. Their viability hinges on metrics like their "all-in sustaining costs" (AISC) and their ability to secure financing.

SILJ is designed for those seeking maximum leverage to the silver price and who believe a powerful bull market is imminent. This is not a core holding for most, but rather a satellite position designed for explosive growth potential.

Conclusion

The powerful confluence of surging industrial demand and a constrained supply chain has set the stage for a potentially historic move in silver in 2026. Whether you prefer the low-cost exposure of SIVR, the security of PSLV, or the growth potential of SIL and SILJ, silver ETFs can be a smart addition to a resilient portfolio.

Looking ahead to 2026, these silver ETFs remain strong choices for investors seeking real asset exposure and portfolio diversification. Use Intellectia.ai’s AI Screener to uncover top-performing silver ETFs, track market sentiment in real time, and receive AI Trading Signals before the crowd. Turn insight into action — start your AI-powered silver strategy today.