Key Takeaways

- Gold mining stocks are shares of companies that are involved in locating, exploring, processing gold ore, and operating mines.

- In 2025, the United States reached its highest level of debt amid inflation, interest rate cuts, and unpredictable monetary policy, driving the precious metal to an all-time high, a historic Year-over-year (YoY) gain.

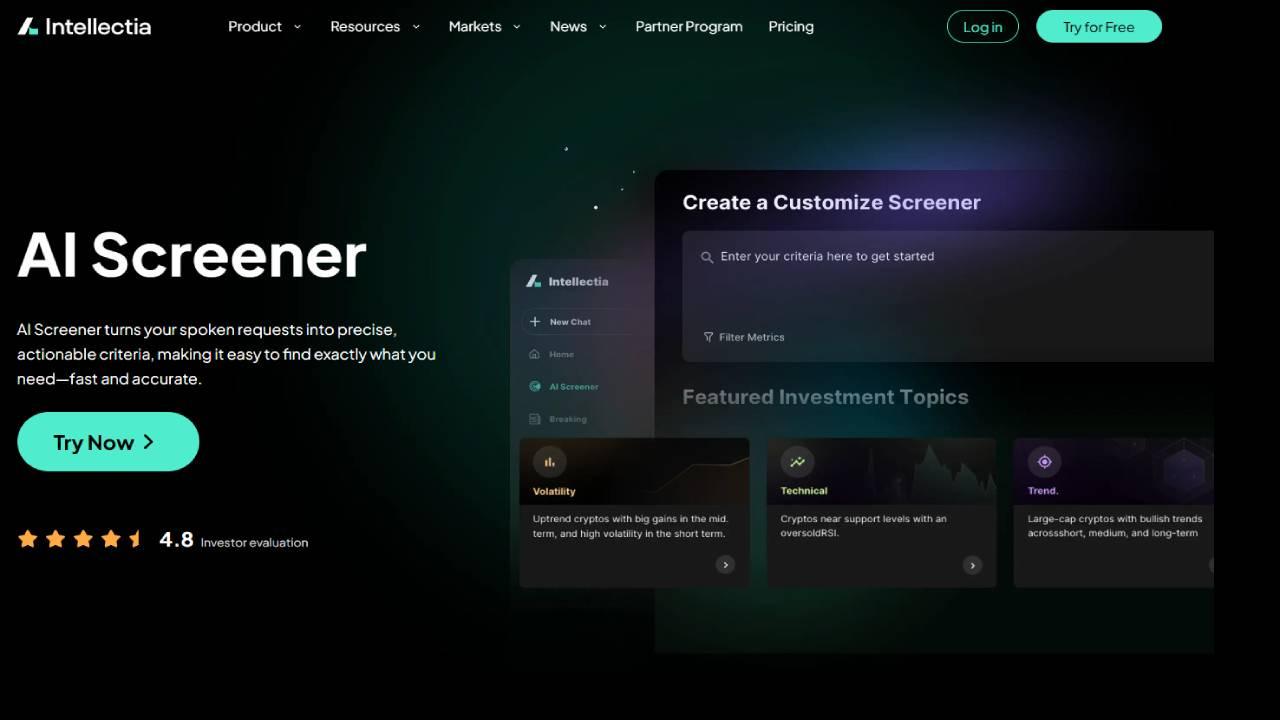

- A platform like Intellectia.ai helps investors through a range of efficient and practical features and tools for Gold stocks.

Introduction

Investors are currently facing numerous economic and geopolitical events, including an interest rate shakeout, weakening fiat currencies, and geopolitical shifts. That’s where Gold mining stocks become attractive, as they offer additional exposure through dividend earnings and operational leverage, unlike physical Gold and ETFs.

However, it requires some understanding and analysis to determine the best gold mining stocks to maximize profits. Intellectia.ai offers a data-driven approach utilizing AI analytical tools to evaluate the best Gold mining stocks.

In the following section, we introduce Gold mining stocks and explain why investors should invest in these assets, what the criteria are to choose the best gold mining stocks, and list the top five gold mining stocks in 2026.

What Are Gold Mining Stocks?

Gold mining stocks are shares of companies that are involved in locating, exploring, processing gold ore, and operating mines. Investing in these stocks means buying shares in companies that extract Gold. These companies make money by selling Gold, so profitability depends on the gold price, operating costs, and production rate.

Types Of Gold Mining Companies

There are several types of Gold mining companies, depending on several key factors, such as:

- Large “tier-1” producers: Companies under this category operate at a large scale, are geographically diversified, hold considerable reserves, and have extensive mining operations.

- Mid-tier producers: These are comparatively smaller companies than the industry's mega players, with significant growth potential but also higher risk.

- Junior Explorers/Developers: Small companies that are seeking Gold deposits and may be developing a single project. Investing in these companies is highly speculative, can offer considerable leverage, but involves higher risks.

- Royalty and Streaming Companies: These companies are often directly involved in mining but finance miners in exchange for a specific portion of future production or purchase gold at a fixed, lower price over a particular period. These companies involve lower operational risks and significant profit potential.

How Gold Mining Stocks Differ From Physical Gold Or Gold ETFs

Check the chart below to understand the difference at a glance.

| Feature | Physical Gold | Gold ETFs | Gold Mining Stocks |

| Asset Type | Physical Gold | Shares in funds that hold physical gold or derivatives | Shares in a company |

| Risk exposure | Low (only commodity price risk) | Medium (Tracking error risk, commodity price risk) | High (Geopolitical risk, equity risk, Operational risk, commodity price risk) |

| Cash flow | None (rely only on price appreciation) | None ( some are taxable as collectibles) | Enables generating corporate earnings and dividend income |

| Leverage to the Gold price | Low (1:1 exposure) | Low (1:1 exposure) | High ( Operational leverage) |

| Key risk factors | Liquidity of bars, storage, purification verification, and insurance | Tracking error, management fees (expense ratio), counterparty risks. | All-in Sustaining Cost (AISC), operational risks, management quality, and regulatory risk |

Why Invest in Gold Mining Stocks in 2026

Several factors support investing in gold mining stocks, especially in 2026, for instance,

- Inflation hedge & economic uncertainty: Gold serves as a defensive inflation hedge and a “safe haven” asset during periods of geopolitical or economic uncertainty. In 2025, the United States reached its highest level of debt amid inflation, interest rate cuts, and unpredictable monetary policy, driving the precious metal to an all-time high, a historic Year-over-year (YoY) gain.

- Increasing Gold price and Central banks' purchases: Central banks are accumulating Gold at a faster pace than ever, reflecting institutional confidence in reserve Gold, which in turn boosts the price of the precious metal. These factors trigger gold miners to profitability.

- Strong balance sheets and cash flow among top miners: Some significant gold mining companies benefit from rising Gold prices and disciplined cost management, helping maintain attractive financial health, strong balance sheets, and free cash flow to pay shareholders- this makes them attractive investment assets.

- Green mining initiatives and ESG-driven investment flows: Environmental, Social, and Governance (ESG) factors become prominent in mining. So, top-tier companies are adopting green mining initiatives to reduce carbon emissions, improve water management, prioritize community standards, and ensure miners' safety. These factors attract institutional investors and reflect potential sustainability in the longer term.

Criteria for Selecting the Best Gold Mining Stocks

Investors must consider some qualitative factors and key metrics while choosing the best gold mining stocks:

- Production volume, reserves, and geographic diversification: Higher production and reserves reflect stability and larger-scale operation, both of which are positive. Geographic diversification reduces regulatory and political risks.

- All-in Sustaining Cost (AISC): AISC is an essential metric for any mining company as it represents the “full cost” of producing an ounce of Gold. Lower AISC means a higher profit margin for every ounce of Gold sold.

- Dividend yield and consistency of payouts: Consistent dividend payouts indicate disciplined cash flow. Conservative investors recognize these companies as attractive investments.

- Management quality and exploration pipeline: Robust management quality is crucial when selecting the best gold mining stocks, thereby driving investor confidence. Meanwhile, the high-potential exploration pipeline indicates the company's future potential.

- Valuation vs. gold price performance: Investors must check or compare a miner's valuation metrics with its peers and its historical valuation relative to the current price of Gold. A good Gold stock must offer reasonable valuation and a solid operational profile.

- ESG and sustainability practices: Strong ESG scores reflect mitigated operational risks, enhanced worker safety, and avoiding regulatory fines and community opposition, among other benefits.

5 Top Gold Mining Stocks 2026

In the following section, we list the top Gold minion stocks in 2026.

| Company Name | Ticker | Sector | Market Capitalization | Key Strengths |

| Newmont Corporation | NEM | Senior Gold producer/Large Cap | $97.66B | Largest Gold mining company worldwide, strong balance sheet, diversified global operation, considerable reserves |

| Franco-Nevada Corp | FNV | Large Cap/royalty and streaming | $36.63B | Diversified portfolio, consecutive dividend payment |

| Agnico Eagle Mines Ltd | AEM | Large/mid-cap | $90.62B | Consistently the lowest AISC among similar companies, Geographical diversification, Strong ESG |

| Anglogold Ashanti PLC | AU | Mid cap | $34.63B | Solid operational improvement, sustainable growth potential |

| Kinross Gold Corp | KGC | Value/Mid cap | $30.75B | Gold price play, impressive recent performance |

Newmont Corporation (NEM)

Newmont Corporation (NEM) is the world's largest gold miner and currently operates in various regions, including the United States, Canada, Africa, and more. The company also produces Zinc, Copper, Silver, and Lead, in addition to Gold. NEM consistently operates in different regions of the Globe, reflecting sustainable strategic operational capacity. With headquarters in Denver, Colorado, NEM was founded in 1921 and has been a publicly traded company since 1925.

Key factors in focus:

- The company builds its reputation on following social, environmental, and governance (ESG) practices. NEM is committed to maintaining industry-grade ESG standards, making it an attractive choice for institutional investors.

- Newmont Corporation has a massive production capacity and considerable reserves, which have benefited from the rising gold price over many years.

- NEM's reliable dividend payouts over the decades make it an attractive choice for conservative investors.

Franco-Nevada Corp (FNV)

Franco-Nevada Corp (FNV) is a Canada-based company that operates in the “royalty and streaming” sector rather than mining Gold. The company has a diversified portfolio focused on precious metals in Central America, South America, Mexico, the United States, and more. FNV is publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX).

Key factors in focus:

- The company has a business model that supports mining companies by providing capital in exchange for royalties, enabling exposure to Gold and other metals while avoiding direct operational risks.

- The company declared a quarterly dividend of US $0.38 per share, up from US $0.36, marking the 18th consecutive annual dividend increase.

- Investors prioritizing making money from the Gold price and income with low risk and limited involvement in direct mining should consider FNV, given its business model and past performance.

Agnico Eagle Mines Ltd (AEM)

Agnico Eagle Mines Ltd (AEM) is a Canada-based gold mining company that operates in Canada, Australia, Finland, and Mexico. It is considered the world's second-largest gold producer, founded in 1972. The company is primarily involved in the exploration, development, and production of precious metals. AEM also produces silver, zinc, and copper, in addition to gold.

Key factors in focus:

- AEM shows strong operational performance and considerable earnings growth over many years.

- Agnico Eagle Mines Ltd maintains the lowest AISC, which helps the company make more profit, combined with the increasing Gold price.

- The company has remained growth-oriented for decades and, in addition to enhancing operational capacity and reserves, ensures positive cash flow for stakeholders.

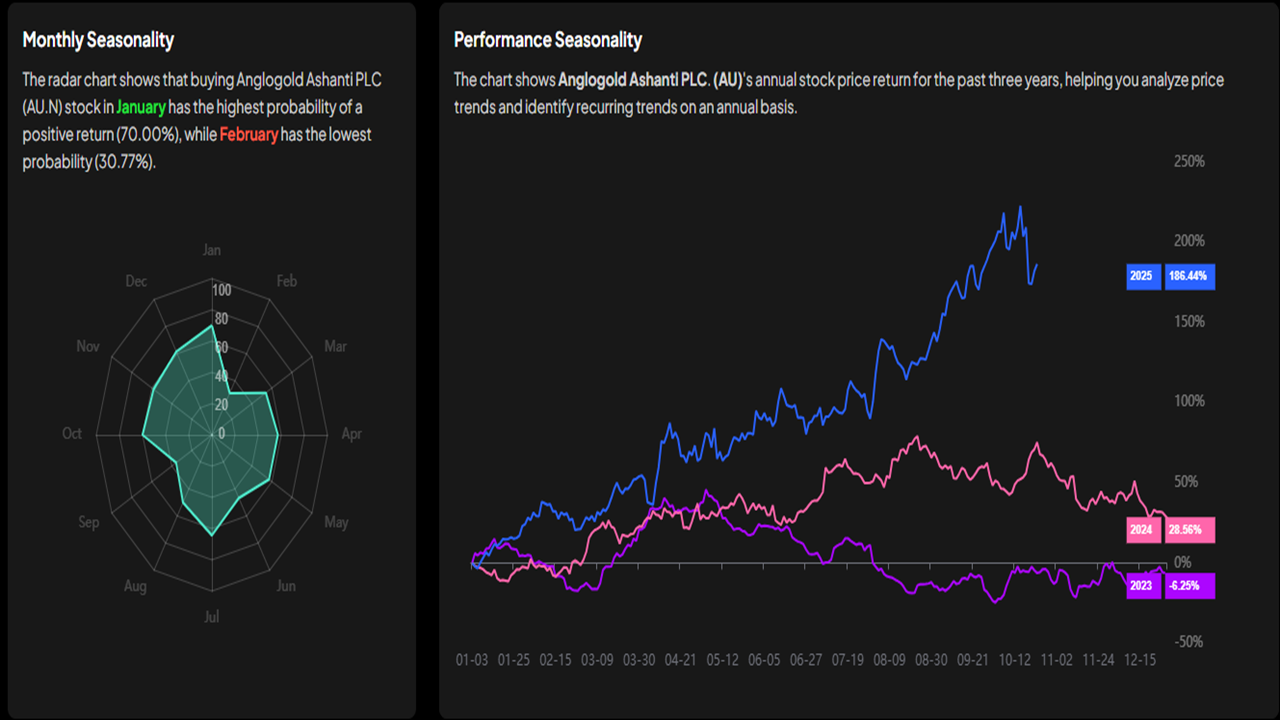

Anglogold Ashanti PLC (AU)

AngloGold Ashanti (AU) is a global gold mining company that operates in different continents, for instance, Australia, Africa, America, and more. The company primarily produces Gold and byproducts, like silver and sulphuric acid. AU has focused on high-grade, high-return assets and on avoiding non-core operations. AngloGold Ashanti somehow poses a high-risk/high-reward profile.

Key factors in focus:

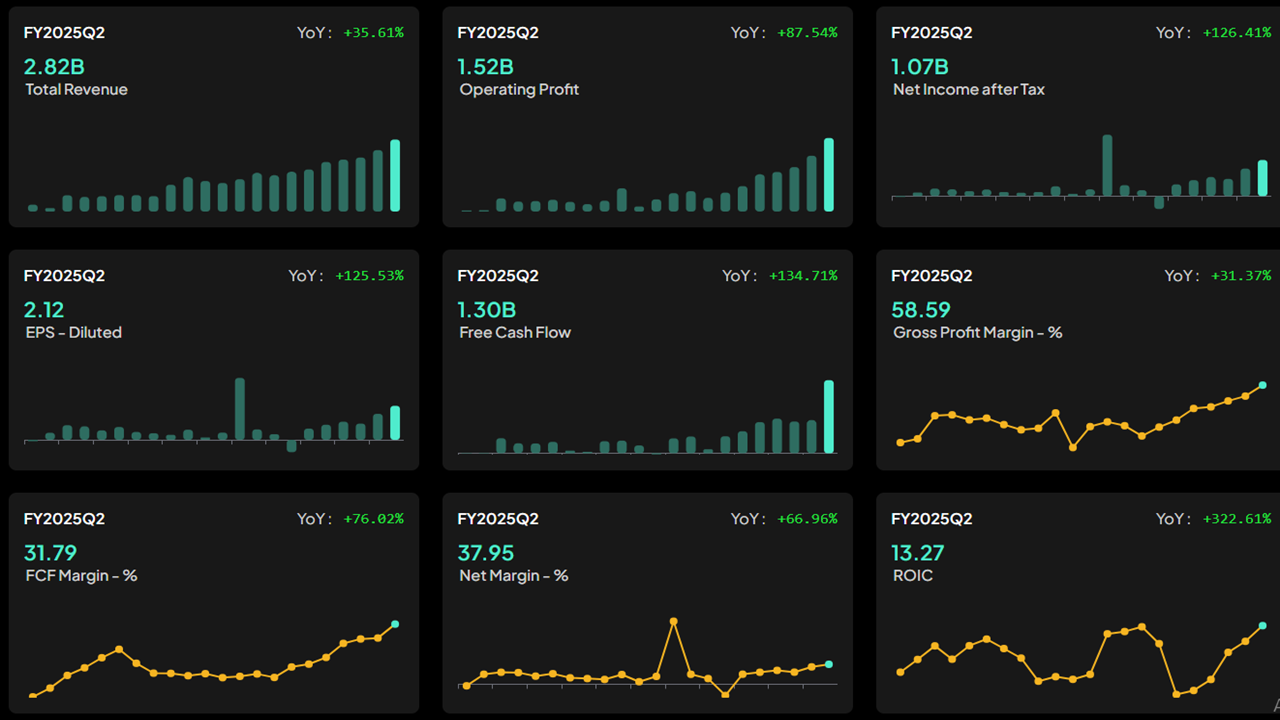

- AngloGold Ashanti's earnings growth estimate for 2025 is notable, at 57.5% year-over-year.

- The company has a primary listing in the US (NYSE), which reflects a strategic approach to allocating more funding and mitigating geopolitical risks.

- AngloGold Ashanti offers exposure to high-growth potential, a focus on addressing asset quality issues, and enhancing the portfolio.

Kinross Gold Corp (KGC)

Kinross Gold Corp (KGC) is a Gold mining company primarily based in Canada that operates in Africa, Brazil, Chile, and the United States. It currently belongs to the mid-tier gold producer category compared to mega caps, indicating the company has greater upside potential along with greater risks. KGC was founded in 1993 and is headquartered in Toronto, Canada.

Key factors in focus:

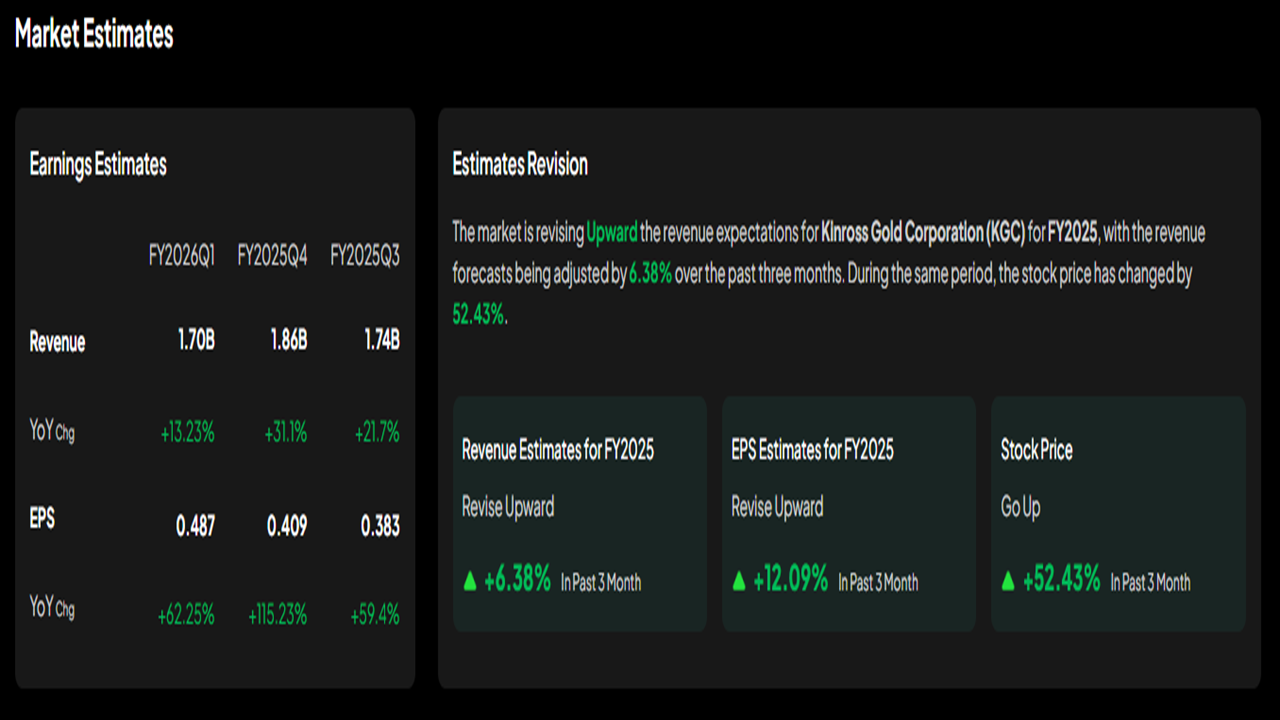

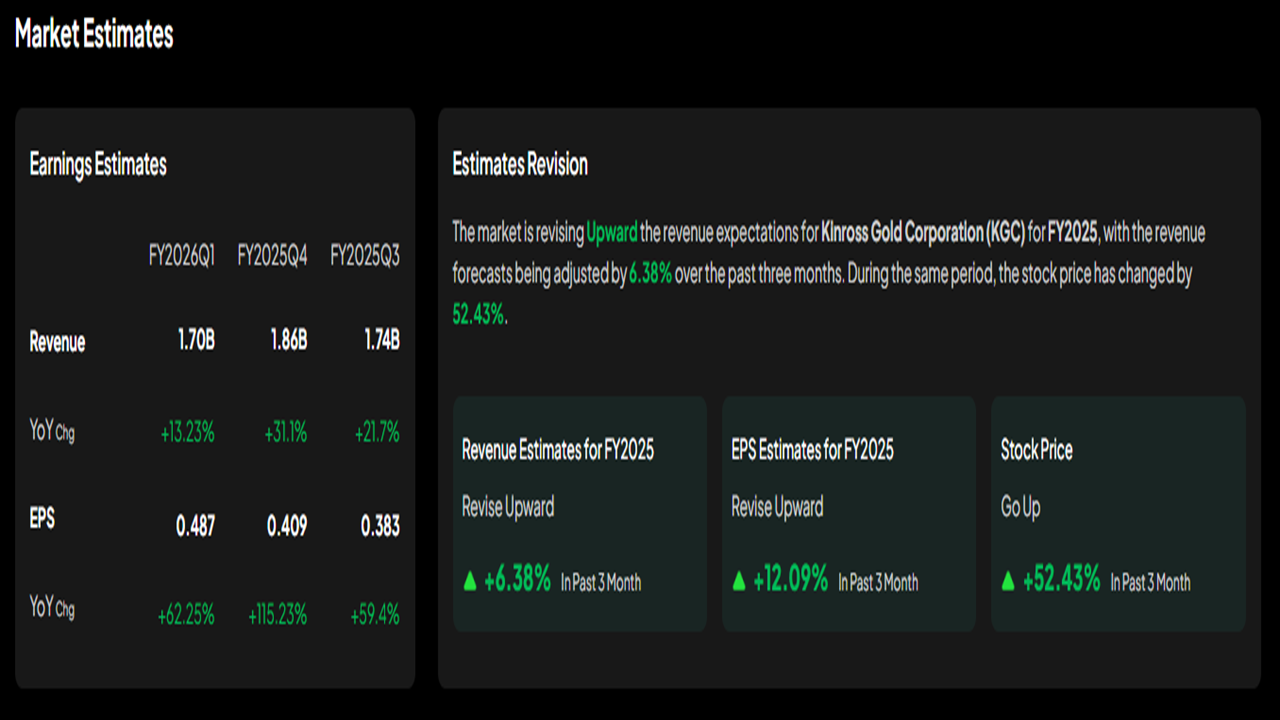

- Kinross Gold Corp has delivered solid cost discipline and production growth over the past few years.

- If you are an aggressive investor, willing to risk more for significant gain potential, KGC can be an attractive choice.

- The company focuses on bringing low-cost, new projects online, enabling opportunities to increase profitability.

Investment Strategies for Gold Mining Stocks

It requires following a specific trading approach to make money from investing in gold mining stocks. This section lists different trading methods, so you can choose the one that suits your profile.

Long-Term Growth Investing vs Short-Term Trading

Long-term Growth: You can select well-managed Gold mining stocks and simply follow the “buy and hold” method for years, allowing you to make money from dividends, value creation, and increasing gold prices.

Short-term trading: You can take advantage of mining stock momentum, short-term price fluctuations, macro events (interest rates, geopolitical tensions, government or central bank decisions, etc.). In that case, you can utilize the Swing trading or day trading center to generate short-term trading ideas or AI trading signals.

Leverage ETFs Investing

You can invest in leveraged gold mining ETFs, which amplify profits by tracking a basket of gold mining stocks. However, it is a risky approach, but it suits sophisticated investors willing to take on risk and achieve considerable returns through short-term price fluctuations. You can use the AI screener feature to generate trading ideas and determine current trends and volume, which might help you manage risk exposure.

Diversify holdings: mix large producers and small explorers

You can always diversify your investments to build a balanced portfolio rather than putting all your capital into a single asset. In that case, you can invest in large-cap producers for stability and reliability, and add some mid-cap or small-cap gold mining stocks with upside potential. This approach helps you to balance both stability and growth.

Set Entry/Exit Strategies Based On Gold Price Cycles And Interest Rate Trends

You can monitor the Gold price, government monetary policy, Central bank decisions, and other factors to determine appropriate trading positions, as these factors influence gold mining stock prices.

Set entry points at the levels where the valuation seems reasonable.

Set exit points or take-profit levels where you think the gold price may peak or the company's fundamentals may shift negatively.

Must follow risk management as the mining business is cyclical.

You can utilize stock chart patterns, stock technical analysis, stock monitor, and AI screener features from Intelectia.ai to generate efficient trading ideas on gold mining stocks and make adequate decisions.

Conclusion

Gold mining stocks are attractive investment assets for making money, combining a rising Gold price, corporate-level leverage, dividends, and operational factors. The sector becomes especially attractive in 2026, driven by factors such as central banks' policies, government policies, and economic and geopolitical uncertainties.

A platform like Intellectia.ai helps investors through a range of efficient and practical features and tools. Don’t hesitate to sign up and enjoy all premium features to make your investment decisions more efficient through data-driven approaches.