PAGE NOT FOUND

Oops! It seems the page you are looking for does not exist...

Back to HomepageBlog

Get What You Are Looking For Here

Crypto Analysis

4 Best Quantum Computing ETFs to Buy in 2026 - Intellectia AI™

Jason Huang54 minutes ago

Financial Analysis

Top AI Healthcare Stocks to Buy Now - Intellectia AI™

Jason Huang47 minutes ago

Financial Analysis

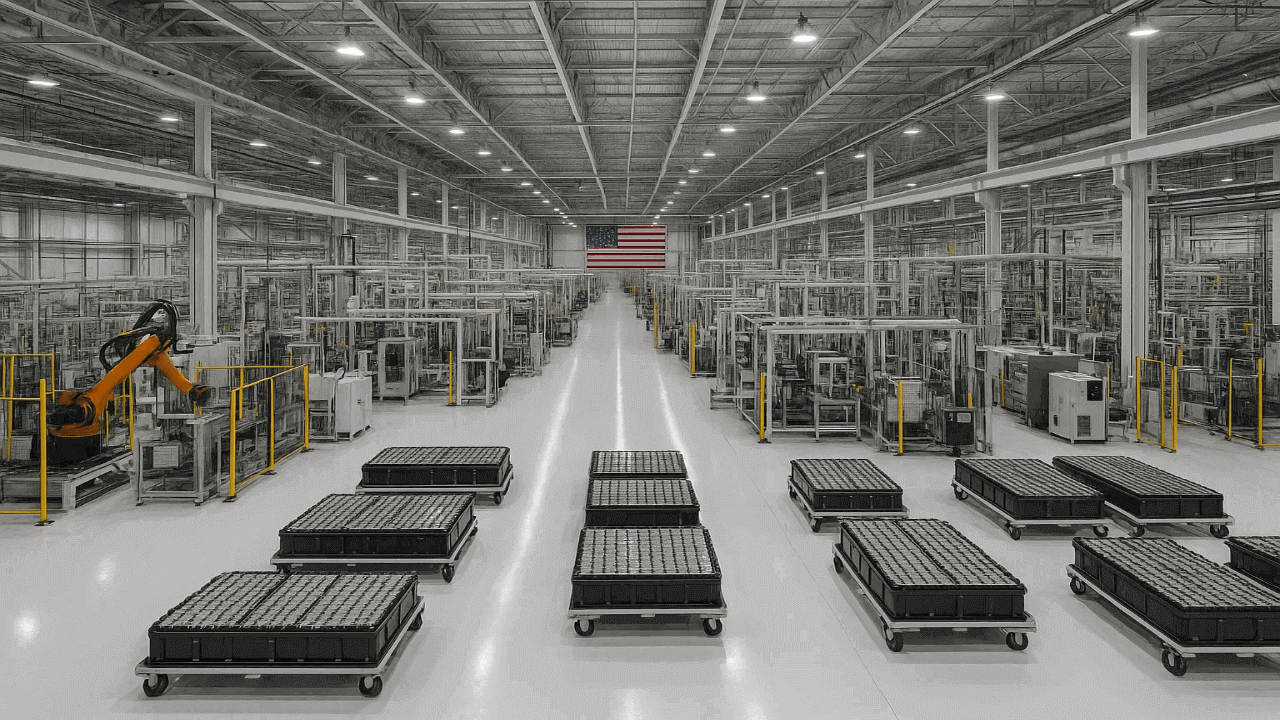

5 Best Battery Stocks To Power Your Portfolio in 2026 - Intellectia AI™

Jason Huang3 days ago

Financial Analysis

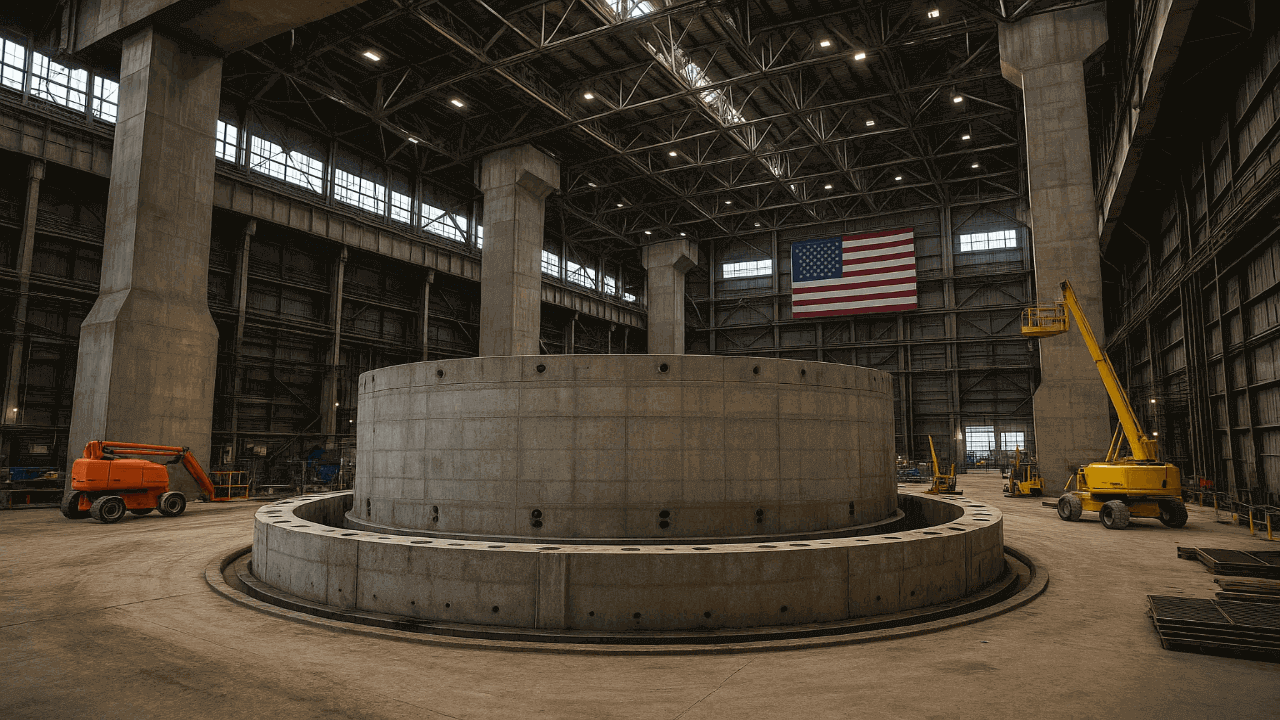

The 5 Best Infrastructure Stocks for 2026 - Intellectia AI™

Jason Huang3 days ago

People Also Watch

LOCO

El Pollo Loco Holdings Inc

10.22USD

12.80%

LAND

Gladstone Land Corp

9.06USD

1.00%

MODD

Modular Medical Inc

0.4949USD

-4.07%

TBLD

Thornburg Income Builder Opportunities Trust

20.2179USD

0.59%

LRE

Lead Real Estate Co Ltd

1.69USD

4.32%

AXTI

AXT Inc

7.95USD

8.61%

FSBC

Five Star Bancorp

35.51USD

-0.42%

AKRO

Akero Therapeutics Inc

54.2USD

-0.11%

HCSG

Healthcare Services Group Inc

17.87USD

-2.40%

NRXS

Neuraxis Inc

2.72USD

-2.51%