Key Takeaways

- The best and most varied way for you to get in on the sector’s projected multi-billion-dollar growth by 2032 is to invest in a specialized quantum computing ETF.

- The transition from classical bits (0 or 1) to qubits will significantly impact drug discovery, materials science, and cryptography, making it a compelling long-term investment opportunity.

- Funds like Defiance Quantum ETF (QTUM) and WisdomTree Inc. (WT.N) offer a good mix of new companies (IonQ, Rigetti) and well-established companies that are well-positioned to help (Nvidia, IBM).

- Your criteria for choosing should include a low expense ratio (ideally below 0.70%), a high AUM for liquidity, and a focus on companies that are driving quantum innovation rather than just tech in general.

- You should use a disciplined Dollar-Cost Averaging (DCA) strategy and Intellectia AI tools to look at how well your funds are doing and take advantage of short-term price swings in your most important holdings.

Introduction

Have you thought of an investment that could fundamentally transform the healthcare and finance sectors in 2026? We’re talking about quantum computing, and it’s no longer based on speculation. However, picking the single company that will dominate this rapidly advancing market is nearly impossible, and that’s the problem. All the buzz can feel overwhelming, but savvy investors are finding a reliable way in. Experts suggest that specialized, thematic Exchange-Traded Funds (ETFs) are a fantastic tool for capturing broad growth in nascent sectors like this. That’s why we’ve analyzed the best quantum computing ETFs so you can easily add this revolutionary technology to your portfolio today and position yourself for massive future growth.

What Is a Quantum Computing ETF?

A quantum computing ETF is essentially a collection of stocks that allows you to invest in several companies that are developing and using quantum computing technology. Think of it as a single stock that grants you instant access to a wide range of related companies.

Before you begin, it's essential to understand the key concept, which is the technology itself. Bits (0 or 1) are the basic units of information that your computer uses. Qubits, which can be in superposition (0, 1, or both simultaneously), are used in quantum computers. This ability enables them to handle vast amounts of data thousands of times faster than any supercomputer, allowing them to solve intractable problems that today’s machines can't handle, such as developing new drugs or optimizing global logistics.

A thematic ETF is often the best and easiest way to invest, as the science behind it can be complicated, and the market is constantly evolving. It saves you the trouble of picking just one winning stock. It helps you diversify your investments by spreading your risk across different parts of the ecosystem, like hardware makers and software pioneers. This is crucial for navigating a new and rapidly growing field.

Why Invest in Quantum Computing ETFs in 2026

Now, if you’re a forward-thinking investor, 2026 is the ideal entry point to look at quantum computing ETFs. We are right at the cusp of commercialization breakthroughs, making this a crucial time for long-term positioning.

Exponential Growth Outlook

Recent research indicates that the quantum computing market is expected to grow from just over $1 billion in 2024 to potentially over $12 billion by 2032. That means a Compound Annual Growth Rate (CAGR) of more than 34.8% over the course of several years. If you invest your money early, in 2026, you can take advantage of most of this significant growth before the technology becomes a standard business tool. This high-growth potential is a significant opportunity for any long-term portfolio.

The Power of Diversification

No one knows which company, whether it’s IBM, IonQ, or a startup, will make the universal quantum computer. If you bet on one, you’re putting yourself at risk. You don’t have to guess when you’re buying a quantum computing ETF. The fund's portfolio naturally balances your risk by investing in a range of companies along the supply chain:

- Pure-play innovators: These companies develop either hardware or software, offering the highest profit potential but also the highest risk.

- Well-known tech companies, such as Microsoft and Alphabet, for example, spend billions on research and development, as well as cloud services, offering stability.

- Enabling companies: These are the essential suppliers of cryogenic equipment and specialized semiconductor components.

This approach ensures that your investment remains aligned with the broader growth of the quantum movement.

Powerful Technology Tailwinds

- AI and Machine Learning Integration: Quantum’s growth is accelerating due to the simultaneous emergence of technological trends. Quantum computers will enable faster training and modeling of complex AI, making them the ideal tool for next-generation analytics. Nvidia and other AI leaders are often significant holdings in these funds. This provides you with a double investment in two sectors that are revolutionizing the industry.

- Cloud-Based Quantum Services: Big companies are making quantum processing power available through the cloud. This makes it easier for businesses to start developing quantum applications today, accelerating commercial adoption and revenue generation for the companies that develop them.

- Government and Defense Spending: The global race for quantum supremacy is a matter of national security, leading to significant government contracts for research and development. This provides them with a steady stream of income and is a strong driver for many of the sector’s most significant players.

Criteria for Selecting the Best Quantum Computing ETF

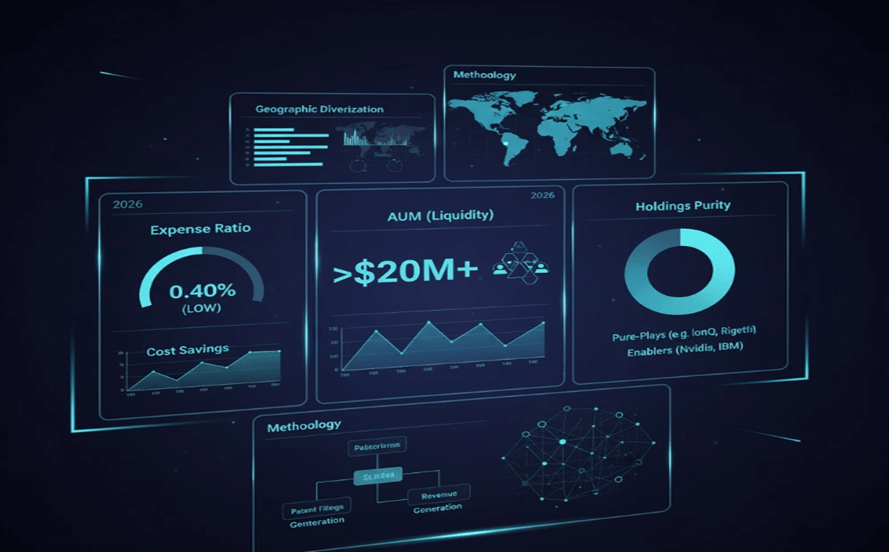

Expense Ratio & Fund Size (AUM)

The Expense Ratio is the fee that the fund manager charges every year. Thematic ETFs are more specialized so you can expect a range of 0.40% to 0.70%. Over a ten-year period, every basis point counts. The size of the fund (Assets Under Management or AUM) is significant for liquidity. It’s easier to buy and sell larger funds quickly. Most people think that a fund with more than $200 million in AUM is doing well. QTUM, the largest dedicated fund currently, has recently surpassed the $3 billion mark in AUM, indicating it has substantial liquidity.

Holdings

You need to find out how pure the fund is. Does it have a high concentration of pure-play quantum companies (such as IonQ and Rigetti), or is it primarily a broad tech fund with limited quantum exposure? The best funds have a mix of high-upside pure-plays and stable, large-cap enablers. Before you invest money, use Intellectia AI’s tools to look at the current holdings list.

Index Methodology and Geographic Diversification

Pay close attention to how the fund’s index is put together. Is it based on patent filings and R&D spending, or does it favor companies that make money from quantum technology? A method that prioritizes revenue indicates a fund is more advanced. Also, look for a good mix of companies from the US, Europe, and Asia to get a sense of global innovation.

Top Quantum Computing ETFs to Consider in 2026

Based on focus, liquidity, and holdings composition, here are the top quantum computing ETFs for your 2026 watchlist.

| Name | Ticker | Expense Ratio | AUM(Approx.) | Quantum Focus Level |

|---|---|---|---|---|

| Defiance Quantum ETF | QTUM | 0.40% | $2.1 Billion | High |

| WisdomTree AI & Innovation Fund | WTAI | 0.45% | $461.76 Million | Moderate-High (AI & Tech) |

| ARK Autonomous Tech & Robotics ETF | ARKQ | 0.75% | $1.82 Billion | Moderate (Indirect) |

| ROBO Global Artificial Intelligence ETF | THNQ | 0.68% | $301.94 Million | Moderate-High (AI/Robotics) |

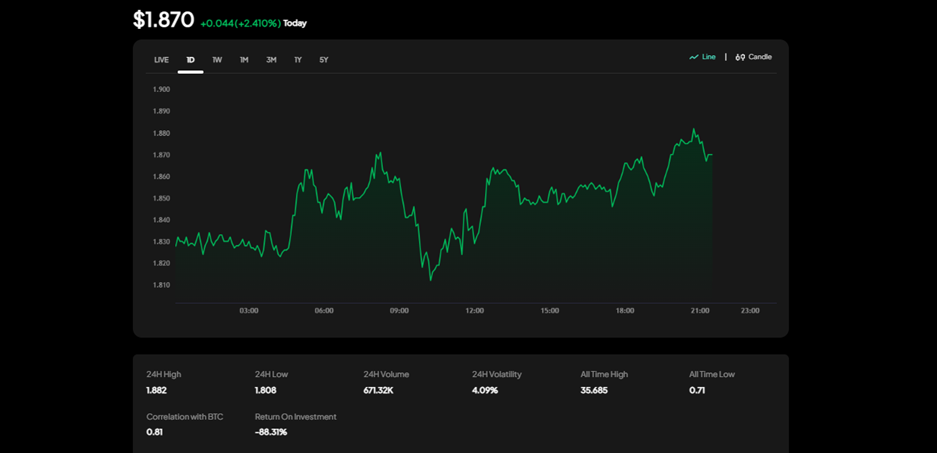

Defiance Quantum ETF (QTUM)

Defiance Quantum ETF (QTUM) is the clear winner because it gives you the most direct access to the quantum computing and machine learning ecosystem. It follows the BlueStar Index and features a mix of pure-play innovators, such as IonQ, Rigetti Computing, and D-Wave Quantum (QBTS), alongside established enablers, including Nvidia (NVDA) and Intel (INTC). It has a low expense ratio of $0.40% and over $3 billion in assets under management (AUM), making it easy to buy and sell, and the best way to invest in this new technology. If you want to put money into the best-known and most reliable quantum computing fund. QTUM has more information.

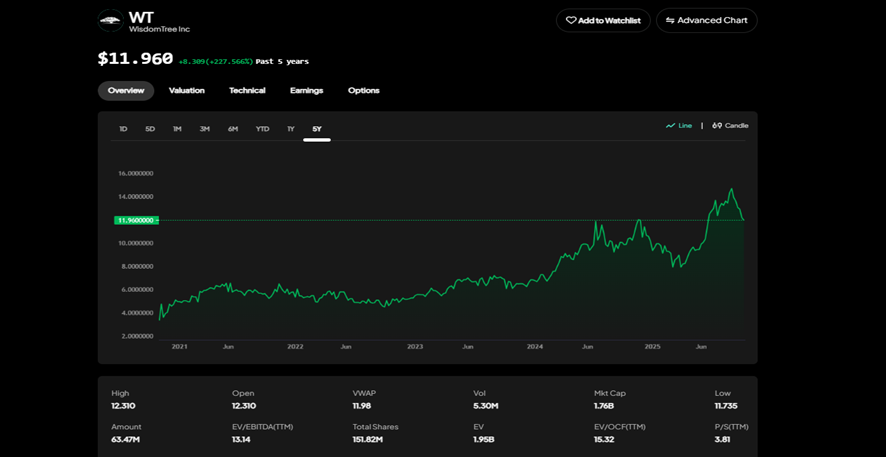

WisdomTree Inc (WTN)

WisdomTree Inc. is an investment in the technology of the future, including AI, robotics, and other technologies critical to the commercialization of quantum. The fund’s most significant assets are in cloud and AI companies, such as Alphabet (GOOGL) and Microsoft (MSFT), as well as quantum companies like IonQ and D-Wave. It is more stable and offers a broader range of investments because it is spread across the world, including big tech companies in Asia. It’s a strong play in two sectors with a low expense ratio of 0.45%. If you think that AI and quantum will come together to make the most money. More about WTAI.

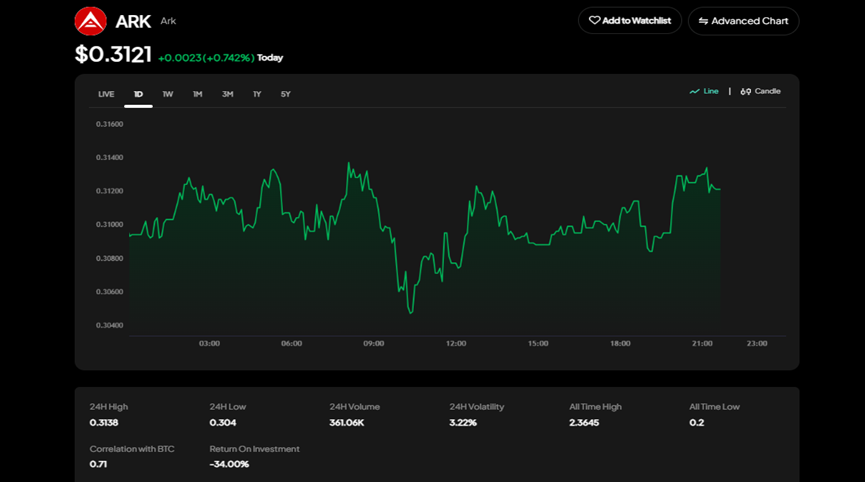

ARK (AK)

ARK is an actively managed fund that doesn’t directly invest in quantum. Instead, it focuses on technologies that could revolutionize the game, such as autonomous mobility, robotics, and 3D printing. It naturally includes companies that are making significant strides in quantum-related fields, such as Advanced Micro Devices (AMD), which develops advanced AI algorithms and specialized components. This is because it has a high-conviction strategy. Even though it has a higher 0.75% expense ratio due to its active management, its growth is linked to several future trends, providing it with a diversified growth buffer. If you want to invest in an actively managed fund with significant exposure to the entire technology disruption supply chain. Learn more about ARKQ.

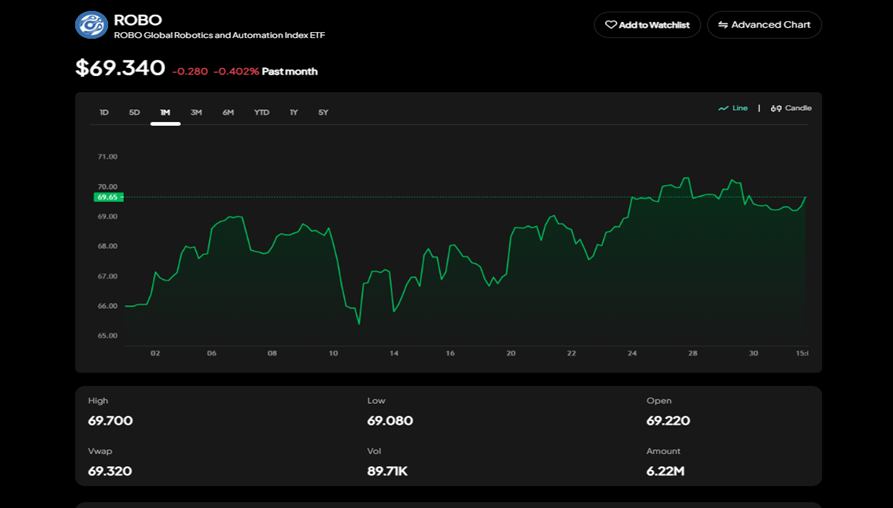

ROBO (ROBO Global Robotics and Automation Index ETF)

THNQ tracks the ROBO Global Robotics and Automation Index, which examines companies that are thriving due to the rise of AI, machine learning, and big data. Quantum computing will soon be a key part of these areas. IonQ (IONQ) and other pure-play quantum stocks are among the most significant holdings. Other important holdings include major suppliers such as IBM and ASML. The fund's portfolio is well-diversified globally, which effectively protects it from volatility in specific sectors. If you want to bet on the wide, global use of AI, with quantum as a strong, integrated growth catalyst, you want to ensure exposure across the entire AI ecosystem supply chain.

How to Invest in Quantum Computing ETFs Smartly

Investing in volatile quantum computing ETFs requires discipline and a long-term perspective (5-10 years) for the mass commercial adoption of this technology.

The foundation is Dollar-Cost Averaging (DCA): invest a fixed amount regularly (e.g., $500/month) to mitigate timing risk and reduce your average cost.

For an edge, leverage advanced tools:

- Use the ETF Screener to compare funds (QTUM, WT.N) based on real-time volatility and exposure.

- Employ Intellectia AI Trading Signals on key underlying stocks (Nvidia, IonQ) for tactical, short-term opportunities, ensuring decisions are based on data-driven price predictions.

Conclusion

Quantum computing is going to be one of the most disruptive things of the next decade, with the market expected to grow at a CAGR of more than 34.8%. A quantum computing ETF is the best way for an intelligent, long-term investor to get exposure without taking on extra risk by investing in just one stock. Funds like QTUM and WTAI are great places to start because they give you a balanced mix of established tech giants and new, fast-growing companies that are changing the game. To do well in this field, you need to be patient, stick to a disciplined DCA strategy, and use powerful analytical tools.

Don’t let the future of technology pass you by. Sign up for and subscribe to Intellectia AI today to get ahead in this high-tech market and go beyond traditional analysis. You’ll be able to use our ETF screener, daily AI stock picks, and real-time AI trading signals and strategies right away. This way, you’ll always be making investment decisions based on the most up-to-date AI technology.