Key Takeaways

- The AI healthcare sector is poised for an inflection point in 2026, driven by disruptive innovations in drug discovery, diagnostics, and robotic surgery.

- Build a balanced portfolio with AI infrastructure providers (such as NVIDIA) and MedTech integrators (such as Intuitive Surgical).

- The most promising companies have a high AI patent portfolio and reinvest the profits in Research and Development (R&D).

- Use sophisticated analysis tools, such as Intellectia.ai AI Stock Picker, to pinpoint precise market entry points and manage volatility with AI-driven trading signals.

Introduction

How can drug development accelerate from a decade-long, multi-billion-dollar gamble into a fast and predictable science that can multiply your wealth? Here’s the thing: the entire global healthcare system is facing a critical bottleneck. Costs are soaring, and traditional R&D is too slow and capital-intensive. This is further exacerbated by the continually expanding volume of patient data that any human team is incapable of processing comprehensively. The world is in dire need of advanced AI-powered applications that can simulate billions of drug candidates, conduct virtual clinical trials, and diagnose diseases with the precision of a superhuman. The savvy move is to invest in companies building this proprietary digital infrastructure. That is why it’s essential to know which AI healthcare stocks to buy today so your portfolio can grow in the future.

What are AI Healthcare Stocks?

First of all, you need to know what an AI healthcare stock is before investing in the future of medicine. Think of it as a company in which Artificial Intelligence is an essential proprietary component of its core business, a primary source of revenue, and a competitive advantage. Four subsectors characterize this sector:

- AI diagnostics and imaging: Automatic detection of medical images in a more accurate and faster way.

- Drug discovery and genomics: Predicting reactions in drug development with AI models, reducing research and development times by decades.

- Healthcare IT and predictive analytics: Optimizing hospital operations, patient flow, and personalization using algorithms and AI trading signals.

- Robotic surgery and telehealth: AI is enabling surgical robots to become autonomous and more intelligent, thereby improving precision and patient care.

Why Invest in AI Healthcare Stocks?

Investing in the best AI healthcare stocks is a bet on structural change—not a trend—to address the most significant problems in medicine: speed, cost, and accuracy.

Increased Demand and Market Growth.

The need for customized, effective care worldwide is why AI is the final answer to accelerating R&D processes. The market dynamics in AI for healthcare are expected to deliver explosive growth, driven by AI’s quantifiable ROI for hospitals (e.g., lower operational costs, shorter time to diagnosis).

Institutional Acceptance and Long-Term Potential

Governments and agencies, such as the FDA, are creating clear regulatory pathways for AI, providing a strong tailwind for the AI healthcare stocks list. Furthermore, AI models form a powerful “data moat” as they ingest more proprietary data, becoming exponentially better and creating a highly durable competitive advantage for early platform leaders.

Criteria for Selecting AI Healthcare Stocks

To select the most suitable AI healthcare stocks, you should look beyond the hype and identify market leaders with sustainable, defensible growth.

- Innovation and Patent Portfolio: The key question is whether a company owns the AI. You should look for strong intellectual property, such as patents on algorithms, molecular modeling software, or robotic systems, as the primary signal of a true innovator.

- R&D Investment & Growth: An AI stock to be won must aggressively reinvest its profits into research and development. You should focus on companies whose revenue growth is steady or rapidly increasing and that have substantial R&D expenditures, far above the industry average.

- Strategic Partnerships: Collaboration is essential; thus, you must seek partnerships with technology giants (such as NVDA) and life sciences giants (e.g., Eli Lilly) to certify the technology and increase its market acceptance.

- Compliance and Regulatory Pathway: To be successful, you must navigate complex global patient data laws (such as HIPAA and GDPR). Firms whose pathway of regulatory success is clear and successful are less risky.

- Market Potential (TAM): Determine whether the company is targeting a niche market or disrupting a multi-billion-dollar market. The bigger the Total Addressable Market, the better the growth valuation.

Applying these filters manually is a challenging task. Use the Intellectia.ai AI Screener to instantly filter for high R&D-to-Revenue ratios, rapid revenue acceleration, and strong technical momentum, refining your list of AI healthcare stocks to a focused few.

Top AI Healthcare Stocks to Buy in 2026

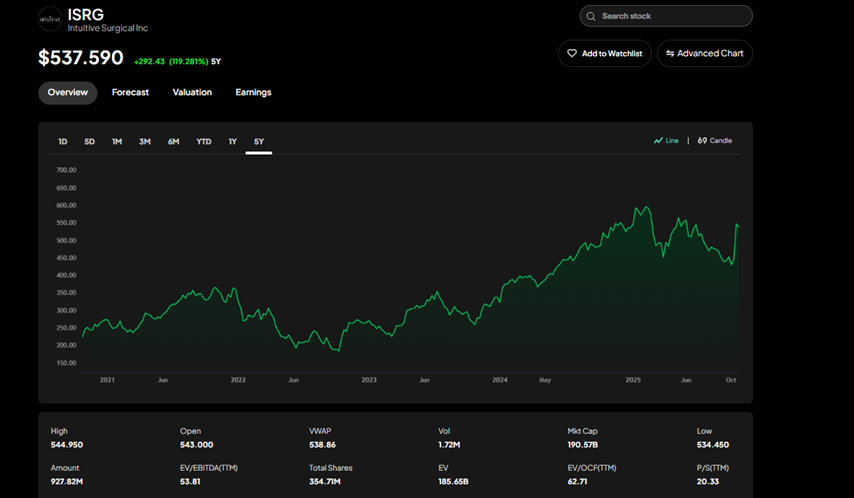

ISRG

Intuitive Surgical, Inc. (ISRG) is the global leader in robotic-assisted surgery with its da Vinci systems. AI has increasingly augmented its business moat. ISRG systems use machine learning to analyze data from millions of surgeries, providing surgeons with real-time insights and automating routine movements. This transforms the robot from a tool into an intelligent co-pilot, pioneering “physical AI” in the operating room. The growth potential lies in the highly sticky revenue model, which is based on decades of high-margin consumables and services following the initial sale. AI integration drives utilization rates higher, creating recurring, high-margin revenue growth. This makes ISRG one of the most reliable top healthcare AI stocks. If you want to own the indispensable surgical platform of the future, Intuitive Surgical, Inc. (ISRG) offers a sticky, high-margin revenue stream.

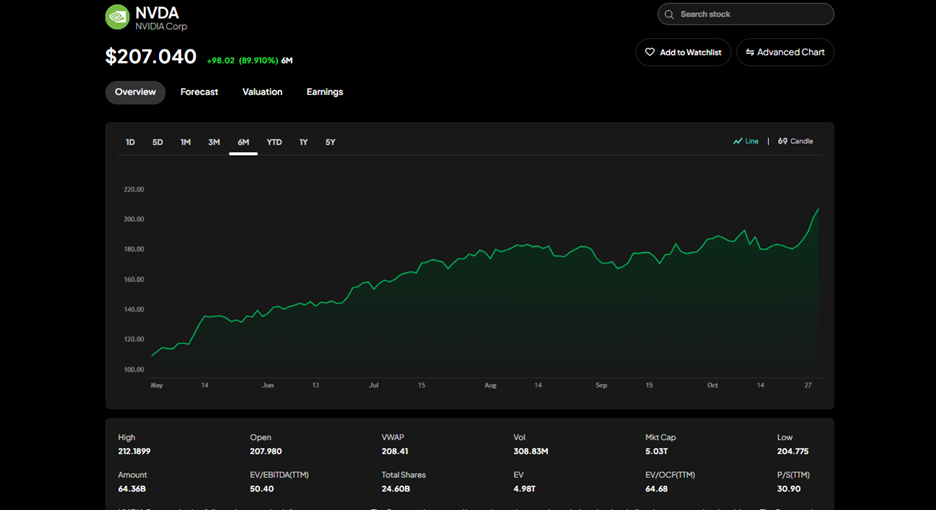

NVDA

Though a semiconductor and GPU giant, NVIDIA Corporation (NVDA) is the critical infrastructure stock for the AI healthcare sector, powering nearly every breakthrough. NVIDIA’s BioNeMo and MONAI frameworks are the gold standard for computational biology and medical imaging. They partner with pharmaceutical companies to build “AI factories” that leverage supercomputing power to dramatically accelerate drug discovery and genomic research. NVDA is a diversified, “picks-and-shovels” play on the entire revolution. As AI adoption deepens across diagnostics and drug discovery, demand for its chips and proprietary software (like NVIDIA AI Enterprise) will surge. Investing in NVDA is a foundational bet on the entire ecosystem of the best AI healthcare stocks. If you believe that AI is the definitive engine of growth for all life sciences research, NVIDIA Corporation (NVDA) is the critical infrastructure play.

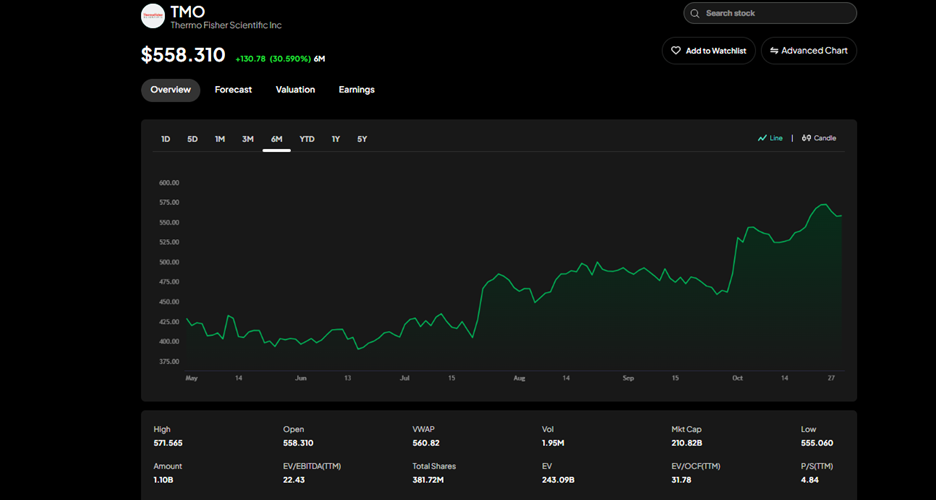

TMO

Thermo Fisher Scientific Inc. (TMO) is a global market leader in scientific instrumentation, reagents, and consumables, which has rapidly adopted AI across its extensive product range. Recent developments, such as TMO, utilize AI to optimize lab equipment, including machine learning for spectroscopic analysis and faster sequencing. TMO is an intelligent, interconnected data hub that integrates predictive AI in its tools. Growth Potential includes TMO benefits from substantial investment across the entire pharmaceutical and biotech industry, as all major drug discovery laboratories depend on its equipment. TMO has the physical infrastructure needed to support the digital revolution, offering investors a defensive moat in the AI drug development supply chain. If you're looking to gain exposure to AI integration in lab instruments and clinical trial supply chains, Thermo Fisher Scientific Inc. (TMO) is a reliable choice.

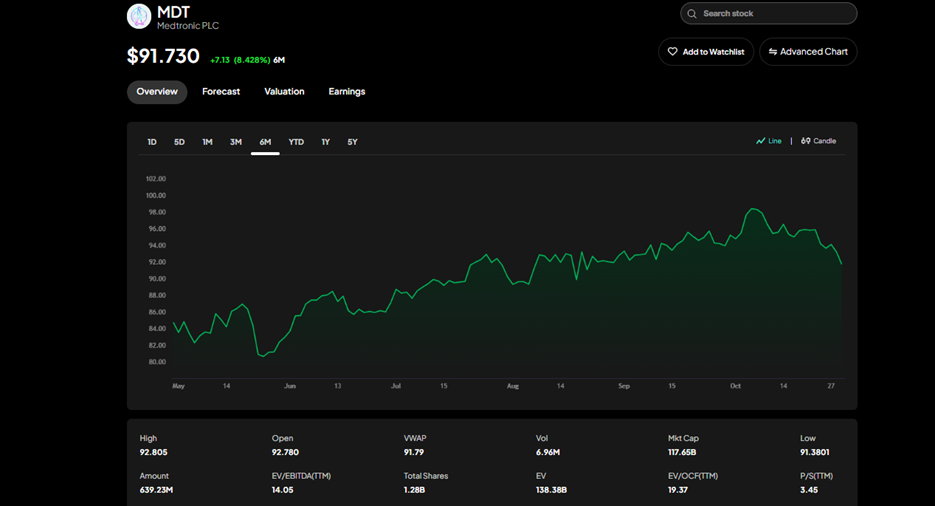

MDT

Medtronic Plc (MDT) is a global leader in medical devices (pacemakers, insulin pumps, surgical tools) and is focused on making existing interventions smarter through AI. Recent Highlights: MDT’s AI-enabled continuous glucose monitoring (CGM) systems use predictive algorithms to forecast blood sugar levels and automatically adjust insulin. They also use AI in cardiac monitoring to detect issues earlier. MDT has a strong position due to its large installed base of devices and is shifting to data-as-a-service models. Integrating AI takes proprietary patient information, which forms innovative feedback loops that lock providers in. This shift to innovative health solutions places MDT at the top of any list of AI healthcare stocks. If you plan to own a company with a strong moat built on proprietary patient data collected by smart devices, Medtronic Plc (MDT) is a top contender.

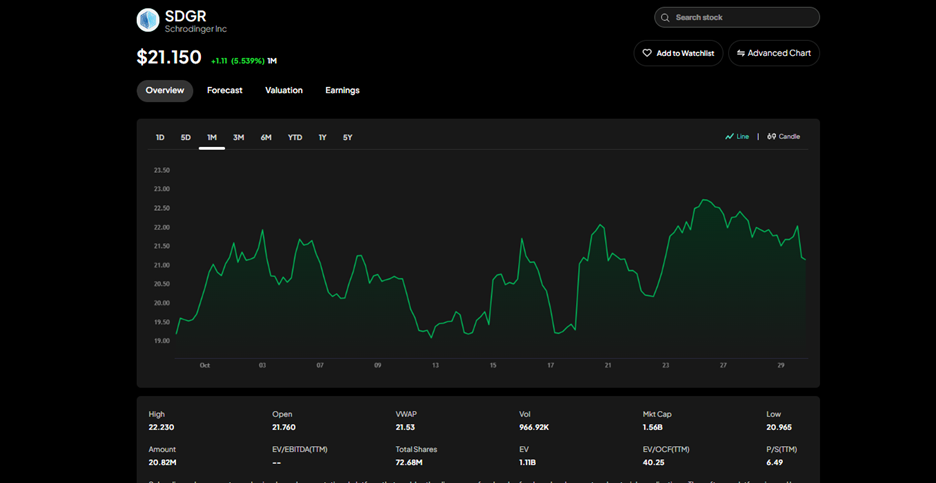

SDGR

Schrödinger, Inc. (SDGR) is an AI-only firm offering a physics-based computational molecular discovery platform. Its main asset is software that assists pharmaceutical companies in drastically accelerating the R&D process. Recent Highlights: The platform is based on molecular simulation and machine learning to predict the properties of compounds with high accuracy. The source of revenue is two-fold: steady software licenses and equity/milestone payments for drugs built on the platform. Growth Potential: SDGR has a smaller market capitalization than the titans, hence it has better growth potential. Its software-first model is highly scalable and capital-efficient, making the drug discovery process quicker and less expensive. To purchase a pure computational disruption, SDGR is an ideal company to invest in for aggressive entry into AI healthcare stocks and technology-oriented sectors. If you believe that computational platforms will fundamentally replace most traditional drug discovery r&d, Schrödinger, Inc. (SDGR) is the pure-play software leader.

How to Invest in AI Healthcare Stocks Smartly

This is a high-growth sector that must be navigated with a disciplined, technology-enhanced strategy.

Learn the Sector Fundamentals: Base your investment thesis on the practicality of the technology (e.g., to save time in clinical trials, to detect cancer better) rather than the buzzword AI.

Differentiate and Leverage Power: Since growth stocks carry high risk, diversification is essential. Mix your portfolio with: 1. Tech Enablers (e.g., NVDA), 2. MedTech Integrators (e.g., ISRG, MDT), and 3. Pure-Play Discovery (e.g., SDGR). Beginners can simplify analysis by using the Intellectia.ai AI Screener to curate a custom list of AI healthcare stocks based on criteria such as R&D-to-Revenue and momentum.

Using AI Trading Strategies: The sector is volatile due to regulatory and trial results. Gain an edge by adopting AI trading strategies and AI trading signals. The Intellectia.ai AI Stock Picker uses deep learning to generate clear signals for buying or selling, allowing you to execute long-term trends with algorithmic precision.

Conclusion

The AI healthcare industry is at an inflection point, offering a rare opportunity to invest in businesses radically changing the world. The growing trend of low-speed, human-centered medicine towards high-speed, high-accuracy, AI-based healthcare is not only unavoidable but also being pioneered by companies such as NVIDIA and Intuitive Surgical. Accuracy is your best as an investor. Take a profound knowledge of these long-term trends and the analytical capabilities of Intellectia.ai’s AI stock analysis and signals to ride the wave of explosive growth comfortably. Intellectia.ai offers AI stock picks and AI trading signals as a subscription service.