Key Takeaways

The energy sector presents unique opportunities in 2026 despite market volatility, with strategic investments requiring focus on fundamentals over Wall Street hype.

• Oil oversupply vs. gas balance: Oil faces 3.85M barrel/day surplus pushing prices to $55, while natural gas shows stronger fundamentals at $4.00/MMBtu with growing LNG exports.

• AI drives power demand surge: Data center electricity consumption grows 15% annually, creating opportunities for energy stocks with power generation exposure.

• Wall Street hides critical risks: Analyst ratings ignore environmental litigation, political risks, and accelerating field decline rates that can devastate returns.

• Top picks balance value and growth: Exxon (XOM), Cheniere (LNG), SLB, Devon (DVN), and Sunoco (SUN) offer strong fundamentals with 4-32% discounts to fair value.

• Focus on sustainable dividends and low debt: Evaluate payout ratios, debt-to-equity levels, and geographic diversification rather than chasing high yields from overleveraged companies.

The most successful energy investments through 2026 will combine current financial strength with strategic positioning for emerging trends like LNG growth, carbon capture technology, and the shift toward flexible contracting structures.

Energy markets rarely move in straight lines. These markets react strongly to global shockwaves and political upheaval, which affects the best energy stocks. The Morningstar US Energy Index has risen 6.70% year-to-date but substantially lags behind the broader US Market Index's 18.91% gain.

This gap in performance creates new opportunities for your portfolio. Recent U.S. military action has thrown Venezuela—owner of the world's largest proven oil reserves—into chaos. As a result, crude-linked stocks have started moving up while investors fine-tune their expectations for tighter supply. Companies like GeoPark Limited, Sunoco, and Cenovus Energy could be wise additions to your portfolio for 2026. Devon Energy, a well-established player, now trades at an attractive 32% discount to fair value estimates. The sector also offers good dividend prospects. Energy Transfer, a diversified midstream firm, provides a forward dividend yield of 8.11%.

This piece will help you learn about energy investments that Wall Street analysts overlook. You'll find truly valuable opportunities beyond the hype and become skilled at assessing energy stocks like a pro.

Understanding the 2026 Energy Market Landscape

The energy landscape of 2026 shows a strange contrast: we have plenty of liquid fuels but face growing power constraints. This creates both challenges and opportunities for energy stocks in a variety of subsectors.

Oil vs. natural gas: key differences in demand and pricing

The oil market in 2026 has big supply problems. The International Energy Agency reports that global supply will be higher than demand by 3.85 million barrels per day - about 4% of what the world needs. This extra supply pushes Brent crude oil prices down to around $55 per barrel in early 2026. Brazil and Guyana now make up nearly half of expected global production growth, which helps vary supply beyond the usual producers.

Natural gas looks more balanced, making related stocks potentially good investments. Henry Hub prices should average about $4.00/MMBtu in 2026 after jumping to $4.30/MMBtu in winter. LNG shows real strength as U.S. export capacity grows with new facilities like Golden Pass in Texas and Plaquemines in Louisiana. On top of that, U.S. liquefied natural gas exports should rise from 15 billion cubic feet per day in 2025 to about 16 billion cubic feet per day in 2026.

The role of energy in inflation and economic cycles

Energy prices shape economic cycles, though less than most people think. When inflation peaked in May 2022, gas price shocks added only 1.2 percentage points to the 12-month headline Consumer Price Index inflation rate of 8.5%. This small direct effect happens because motor fuel makes up just 4% of what U.S. consumers typically buy.

In spite of that, energy costs affect the economy in hidden ways. Higher diesel prices raise transportation costs for many goods and services. Food supply chains feel this effect strongly, as food inflation comes directly from energy inflation. Then, the highest inflation categories after energy in May's CPI data were meat and eggs (14% year-over-year), beverages (12%), dairy products (12%), cereals and bakery products (12%), and fruits and vegetables (9%).

How AI and data centers are influencing energy demand

2026's most important energy trend involves power use by data centers, especially those running AI applications. This surge in demand creates opportunities for energy stocks connected to electricity generation and distribution.

Data centers used about 415 terawatt-hours (TWh) in 2024, about 1.5% of global electricity use. This number should double to around 945 TWh by 2030. Yes, it is worth noting that data centers' electricity use grows 15% each year—four times faster than all other sectors combined.

AI's power demand stands out. Electricity use in accelerated servers (mainly from AI) should grow 30% yearly, while regular servers grow slower at 9% per year. A typical AI data center uses as much power as 100,000 homes.

This surge affects U.S. electricity generation, which should grow 2.4% in 2025 and another 1.7% in 2026. Natural gas powers over 40% of U.S. data centers' electricity, while renewables provide 24%, nuclear 20%, and coal about 15%. Investors looking for the best energy stocks might want to consider companies that provide reliable power to data centers, as our economy depends more on constant electricity.

What Wall Street Won’t Tell You About Energy Stocks

Wall Street's rosy predictions about energy stocks often hide key facts that could affect your investment returns. The glossy quarterly reports and confident analyst calls mask important details you won't see in headlines.

Short-term hype vs. long-term fundamentals

Wall Street rewards quarterly performance in the energy sector but overlooks long-term industry trends. This myopic view creates gaps between stock values and actual business health.

Analysts focus on the next year instead of looking at trends that shape a company's success. Energy businesses run on decade-long investment cycles that rarely match Wall Street's quarterly fixation.

Oil discoveries worldwide have hit historic lows. Companies found only 4.9 billion barrels of conventional oil resources in 2022—the lowest since the 1930s. Companies like ExxonMobil struggle with reserve replacement ratios. They managed to keep just 80% replacement lately, down from over 100% in past years.

Wall Street tends to ignore these key metrics:

Return on capital employed (ROCE)

Free cash flow generation across commodity price cycles

Reserve replacement costs per barrel

Capital discipline throughout market fluctuations

Top institutional investors look at these basics rather than chase quick price gains or production growth.

The hidden risks in overvalued oil stocks

Some energy stocks might look good based on price-to-earnings ratios, but many hidden risks lurk below. Standard analyst reports miss these factors that can hurt long-term results.

Environmental litigation poses a growing threat. Major oil companies face over 40 climate-related lawsuits in the U.S. alone, with possible costs in billions. Many smaller energy companies lack enough reserves for such cases.

Political risk comes at a high price. International oil companies in Nigeria, Iraq, and Venezuela might face nationalization, contract changes, or sudden taxes that wipe out profits.

Many oil stocks trade at high values based on current production but ignore faster field decline rates. Traditional oil fields now deplete at 8-10% yearly, up from 5-7% ten years ago. This requires more capital just to keep production steady.

Higher capital costs create more challenges. Investors now want 15-20% returns for oil and gas projects, compared to 8-10% for renewable energy work.

Why analyst ratings can be misleading

Conflicts of interest often make energy stock ratings unreliable. Investment banks that say "buy" often want business from these same companies.

Research shows analysts kept "buy" or "hold" ratings on 82% of energy stocks during major price drops, even as values fell by half. Only 14% of recommendations changed to "sell" during the 2014-2016 oil crash, despite widespread industry problems.

Analysts tend to follow the crowd. The top 20 energy stocks get mostly "buy" ratings (76%), yet only 30% beat market averages historically.

Wall Street's record of predicting major energy market changes remains weak. Analysts missed all five major oil price drops since 2000. They kept forecasting stable or rising prices before big crashes. Few saw the natural gas price jump of 2021-2022 coming until prices had doubled.

Note that Wall Street's goals might not match yours when picking energy stocks for your portfolio. You might do better by analyzing fundamentals yourself or choosing low-cost index funds instead of following analyst tips.

Top 5 Best Energy Stocks for 2026

The real performance metrics of energy stocks tell a more interesting story than market forecasts for 2026. Several stocks show promising growth potential, backed by both analyst confidence and solid business fundamentals.

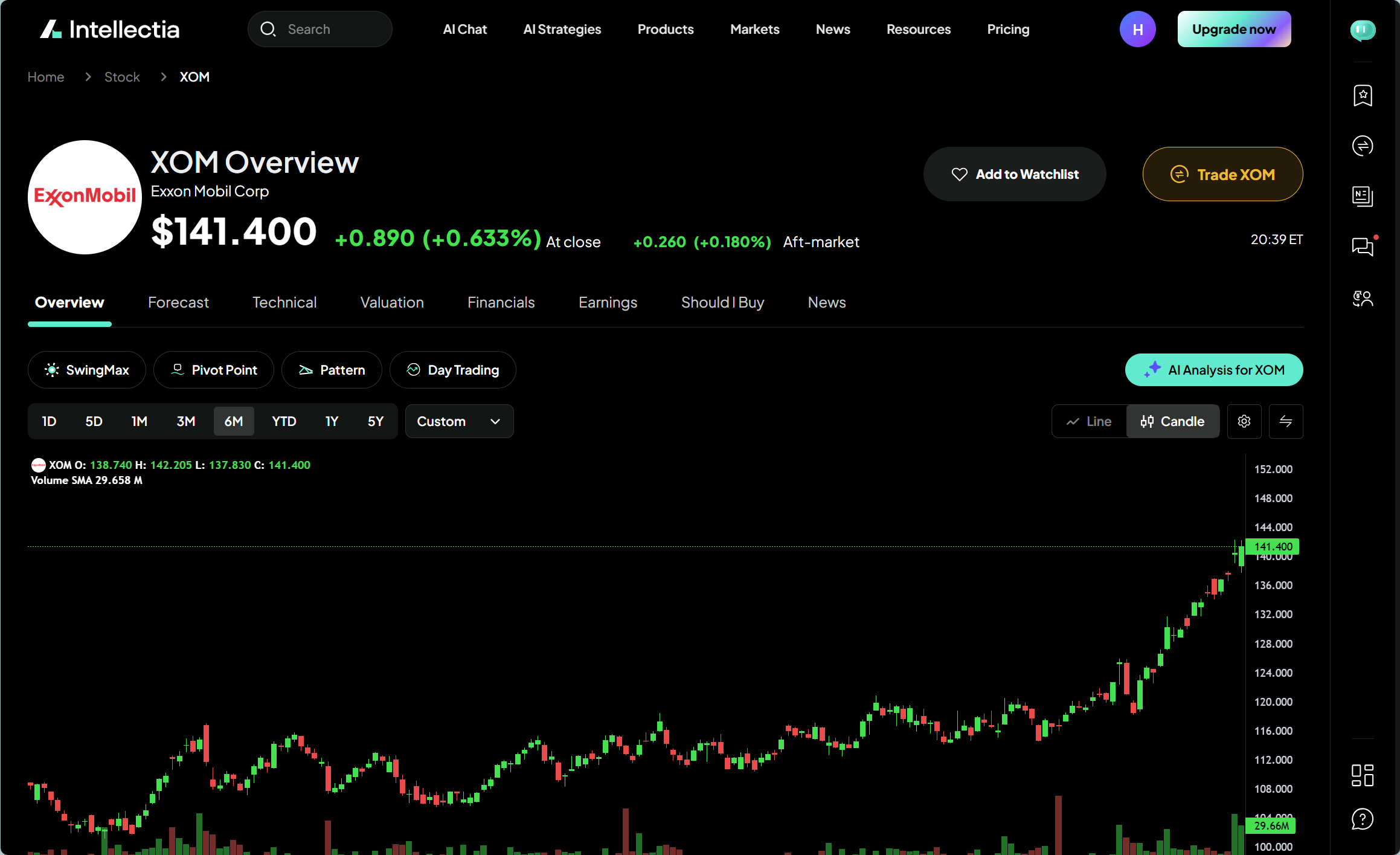

1. Exxon Mobil (XOM)

Twenty-one analysts give Exxon Mobil a strong "Buy" rating, with their average price target of $130.57 suggesting a 4.78% upside potential. The company's diversified portfolio attracts investors despite current challenges. Projections show revenue hitting $333.22 billion in 2025, while earnings per share should bounce back to $7.17 in 2026—up 2.53% from the previous year. Exxon's stability makes it the life-blood of many energy portfolios, though revenue might drop 2.16% from 2024 levels.

2. Cheniere Energy (LNG)

Cheniere Energy leads America's LNG production and ranks second worldwide. The company's liquefaction platform is among the world's largest, with about 45 million tons of LNG capacity yearly and 10+ million more tons under construction. Their smart move toward single-train expansions helps them bring capacity online faster and grab market share from competitors. This strategy helps Cheniere compete better in a crowded market while staying the go-to supplier for quality buyers.

3. SLB Ltd (SLB)

SLB, previously Schlumberger, stands out as the world's top oilfield-services company. Its shares trade 24% below fair value estimates. Wall Street speaks clearly here—16 analysts rate it a "Strong Buy" with a $48.62 price target, suggesting a 9.43% upside. The company grows through core services, digital solutions, and new energy ventures. SLB's global reach shines through with over 75% of business outside North America, protecting it from U.S. market swings.

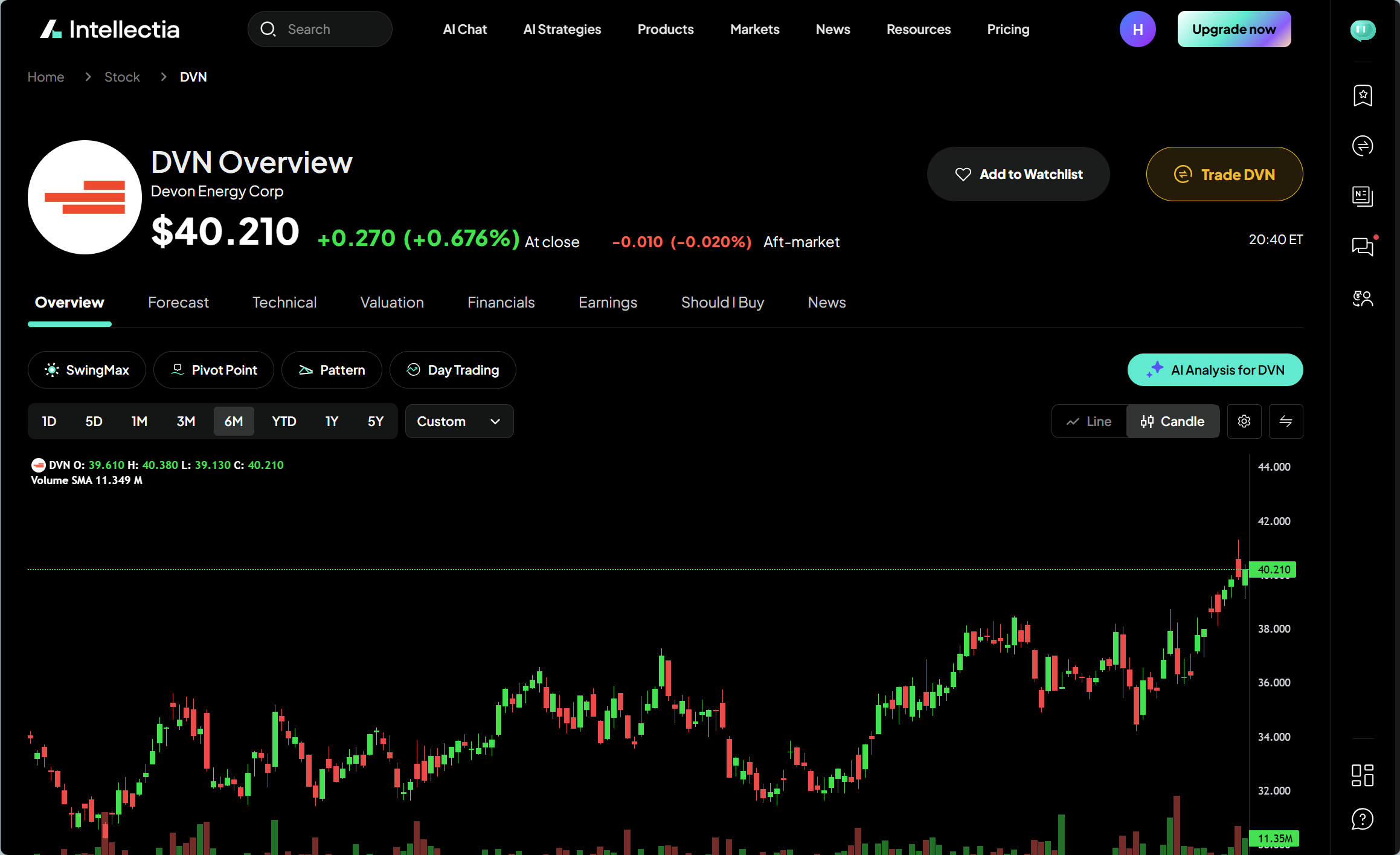

4. Devon Energy (DVN)

Devon Energy's new business plan aims to boost annual pre-tax free cash flow by $1 billion before 2026 ends. The company trades at a 32% discount to its $53.00 fair value and ranks among the most cost-efficient U.S. shale producers. Their optimization strategy targets $300 million in capital efficiency gains, $250 million from better production, $300 million through commercial deals, and $150 million in corporate savings.

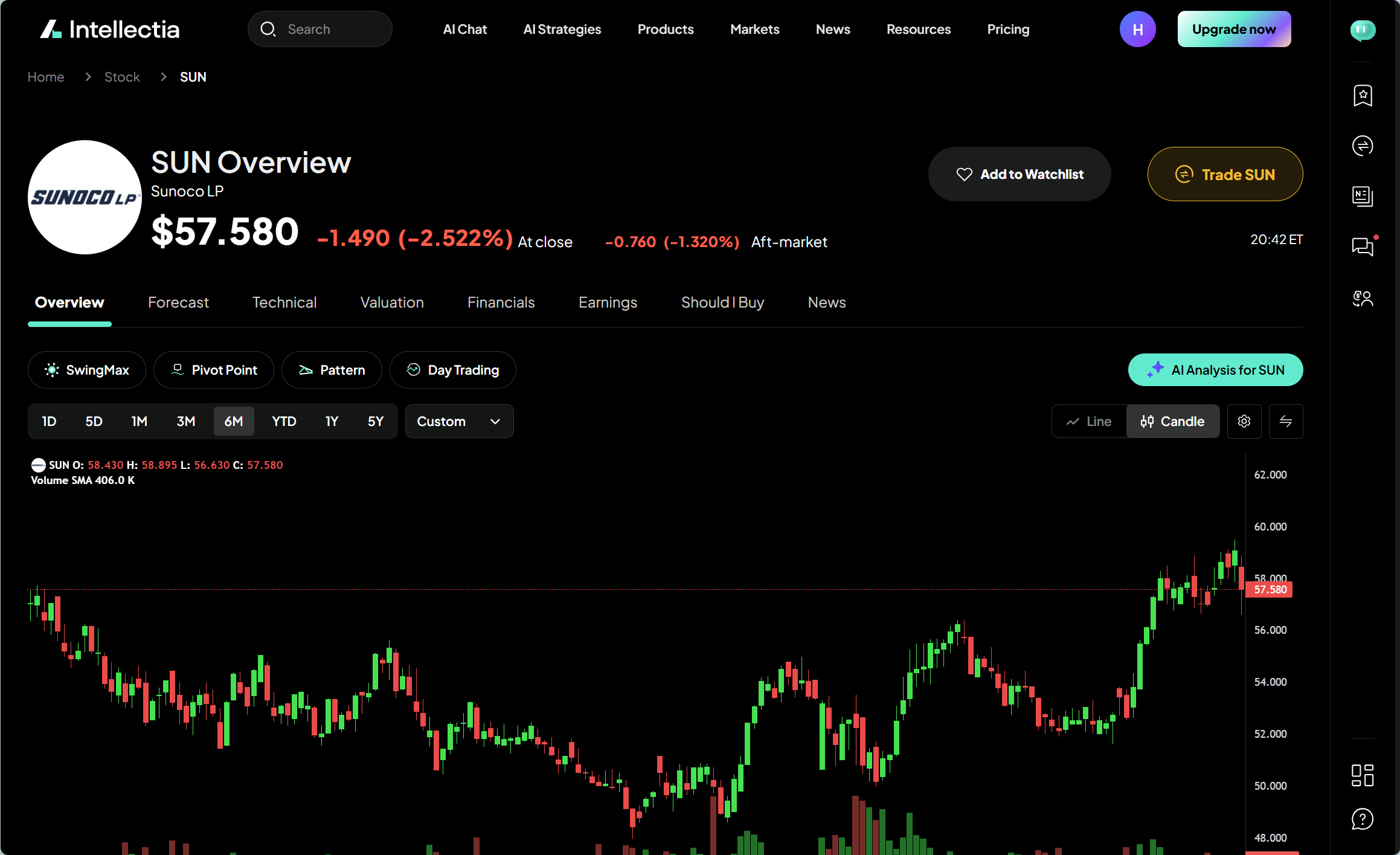

5. Sunoco (SUN)

Analysts love Sunoco with a "Strong Buy" rating and a $65.00 price target that points to a possible 15.84% gain. The company offers an attractive 8.2% yield and strong distribution coverage at nearly 1.7x based on last quarter's cash flow. Fee-based operations make up 90% of Sunoco's business, ensuring steady income whatever energy prices do.

Advanced tools can help you spot tomorrow's winners. The Intellectia.ai AI Screener lets you quickly scan the market to find companies that might benefit from the Gemini 3 trend—maybe by spotting Google's suppliers or competitors increasing their chip orders.

How to Evaluate Energy Stocks Like a Pro

Smart energy investing requires looking beyond simple metrics to understand a company's financial health. Successful investors consider several key factors before putting their money into the sector.

Dividend yield and payout sustainability

A company's payout ratios help determine dividend reliability. Many energy majors offer generous yields. ExxonMobil increased its dividend by 4%, which extends its growth streak to 43 consecutive years. Chevron has raised its payment for 38 straight years and delivers peer-leading growth with a current yield of 4.6%. The [AI Stock Picker](https://intellectia.ai/features/ai-stock-picker) provides analytical insights and daily recommendations.

Debt levels and capital efficiency

Debt-to-equity ratios show potential vulnerabilities in energy companies. E&P companies took on USD 72.00 billion in new debt in a single quarter during market volatility, which pushed average debt-to-equity ratios to almost 60%. Capital efficiency shows how well a business uses investments to generate revenue. Companies that emphasize "clean capital efficiency" maximize existing infrastructure instead of expensive new projects.

Geographic and operational diversification

Risk exposures balance better with geographic diversification in portfolios. Industry experts point out that "prices across geographies are increasingly uncorrelated". Portfolios with diverse holdings can eliminate 50-80% of market risks. Midstream MLPs in the Alerian MLP Infrastructure Index provide stability through fee-based business models that depend less on commodity prices.

Exposure to renewables and carbon capture

Progressive energy companies invest in carbon capture technologies. The United States has over 270 publicly announced carbon capture projects that represent USD 77.50 billion in capital investment. Investment in the carbon capture sector reached more than USD 11.00 billion last year—nearly twice the amount from 2022. Carbon management projects can generate up to four dollars in economic activity for every dollar of federal support.

Emerging Trends That Could Reshape the Sector

Major changes are quietly reshaping energy markets beyond what typical analysts cover. These changes could affect which energy stocks perform better through 2026 and beyond.

The rise of LNG and global gas trade

The demand for global LNG keeps growing steadily. U.S. exports will likely grow from 15 billion cubic feet per day in 2025 to 16 billion in 2026. Natural gas trades much like oil now. Global market forces determine supply flows while regional price indices come closer together. U.S. LNG was once seen as a niche export. It has now reshaped global trading patterns by adding substantial liquidity to markets.

Geopolitical flashpoints to watch

Geopolitical risks now matter as much as traditional supply indicators. Maduro's capture has caused immediate operational problems in Venezuela. Crude oil is backing up and exports are harder to handle. Meanwhile, Yemen-related tensions have made Red Sea shipping riskier. This expands uncertainty around key energy routes.

The move from long-term to short-term contracts

Market uncertainty has pushed contracting trends toward more flexibility and options. More spot market activity leads LNG stakeholders to use sophisticated risk management strategies. Companies need better systems and risk models to handle this progress.

Carbon capture and low-emission technologies

Carbon capture utilization and storage (CCUS) makes progress despite tough policy environments. The United States now has over 270 publicly announced carbon capture projects. These represent $77.5 billion in capital investment. The IPCC has CCUS in every pathway that aims to limit global warming enough.

Conclusion

Energy markets will stay volatile through 2026, driven by oil oversupply and growing power constraints. All the same, this volatility opens up substantial opportunities for strategic investors who look beyond Wall Street's quarterly obsessions.

Smart energy investing needs a focus on fundamentals rather than hype. Wall Street analysts promote overvalued stocks with hidden environmental liabilities and political risks. Your research should focus on metrics like return on capital, free cash flow generation, and reserve replacement costs.

The five highlighted stocks—Exxon Mobil, Cheniere Energy, SLB Ltd, Devon Energy, and Sunoco—show strong fundamentals despite market challenges. Each stock brings unique advantages, from Exxon's diversified portfolio to Cheniere's LNG leadership. These make them solid picks for your 2026 investment strategy.

You should assess potential investments through multiple lenses. A company's dividend sustainability signals its financial health, and debt-to-equity ratios reveal potential weak spots. On top of that, spreading investments across regions helps balance risks, especially with regional energy prices becoming less correlated.

Forward-thinking investors must track emerging trends closely. LNG's steady growth, geopolitical hotspots like Venezuela, changes in contract structures, and carbon capture technologies will substantially affect which energy companies succeed. These elements, often missed by mainstream analysis, could separate winners from losers in the energy sector through 2026 and beyond.

The best energy stocks for 2026 will blend strong current financials with strategic positioning for future challenges. Wall Street might overlook these long-term fundamentals, but finding companies that can handle both current market realities and emerging industry changes is key to your investment success.