Key Takeaways

The memory semiconductor sector is experiencing explosive growth, with industry revenue surging 78% in 2024 to $170 billion, positioning these stocks for exceptional returns before the anticipated 2026 market boom.

• AI-driven demand creates unprecedented opportunity: High Bandwidth Memory (HBM) revenue is projected to reach $100 billion by 2028, with companies like Micron and SK Hynix already sold out through 2026.

• Supply constraints favor pricing power: Memory manufacturers expect supply-constrained markets through 2026, enabling robust profit margins and favorable pricing conditions across the sector.

• Diversified exposure maximizes potential: The seven featured stocks—Micron, Lam Research, Samsung, SK Hynix, Western Digital, Intel, and Marvell—offer complementary exposure to different memory ecosystem segments.

• Strategic positioning beats timing: Companies with technological leadership in HBM production and AI infrastructure are delivering exceptional returns, with some stocks gaining over 300% in the past year.

• 2026 represents inflection point: Industry forecasts predict a "supercycle" with global DRAM revenue surging 51% and NAND rising 45% year-over-year in 2026.

The convergence of AI infrastructure buildout, supply constraints, and technological advancement creates a rare investment opportunity where early positioning could yield substantial long-term gains as this multi-year trend unfolds.

Memory stocks show incredible momentum right now. The industry's revenue jumped 78% in 2024 to $170 billion. The memory sector should be on your radar if you're searching for the next big investment chance.

Memory manufacturers have a bright future ahead through 2026. Micron Technology, a leading computer memory maker, now projects its High Bandwidth Memory (HBM) revenue will reach $100 billion by 2028, up from $35 billion in 2025. The company shows its confidence through a bigger capital spending budget of $20 billion for fiscal 2026 - a 45% jump from fiscal 2025. Memory companies' stocks have already showed their strength. Lam Research proved this by delivering investors a remarkable 143% stock price gain in 2025.

Smart investors need to know which memory chip stocks will benefit most from this boom. This piece looks at seven top memory stocks you should consider adding to your portfolio before the predicted market surge in 2026.

Micron Technology

Micron Technology leads the memory industry as one of the world's biggest makers of computer memory and data storage solutions. This Idaho-based giant has positioned itself to tap into the massive demand for advanced memory technologies in the AI era.

Micron Technology business overview

Micron Technology started in 1978 in a Boise dental office basement and grew into a global leader in semiconductor memory manufacturing. The company makes various memory products like dynamic random-access memory (DRAM), NAND flash, and solid-state drives (SSDs). It runs four main units: Cloud Memory, Core Data Center, Mobile and Client, and Automotive and Embedded. By 2025, Micron had 53,000 employees worldwide and became one of the top 100 most valuable companies with a $175 billion market value.

Micron Technology growth drivers

AI-specific memory solutions drive Micron's growth. The company changed from a cyclical commodity memory maker to a vital infrastructure provider for the AI revolution. Micron made a bold move in December 2025 by ending its Crucial consumer brand to focus only on enterprise markets, data centers, and artificial intelligence.

Big investments propel Micron's development. The company put $15 billion into a new facility in Boise, Idaho, and $100 billion into expanding in Clay, New York. These projects, backed by the CHIPS and Science Act, show Micron's belief in long-term demand.

Micron Technology financial performance

Micron's numbers show remarkable results. For fiscal year 2025, the company posted:

Revenue of $37.40 billion, up 48.9% from last year

Net income of $8.54 billion, soaring 997.6% from the previous year

Operating income of $9.77 billion

Total assets of $82.80 billion

The company's gross margins jumped from 22% in fiscal year 2024 to over 50% in recent reports. This huge increase shows Micron's stronger pricing power and its move toward high-margin data center products.

Micron Technology AI and HBM relevance

Micron has become vital to the AI infrastructure ecosystem. The company's High-Bandwidth Memory (HBM) chips give the massive bandwidth needed to run AI workloads. Micron has sold all its HBM supply through 2026, including its new HBM4 generation.

Micron's HBM3E memory delivers over 1.2 TB/s bandwidth and uses 30% less power than competitors. The next-generation HBM4 memory samples are already with key partners, offering 11 gigabits per second data transfer speeds and total bandwidth above 2.8 terabytes per second.

Micron Technology stock valuation

Micron stock looks interesting despite its recent rise. The stock price jumped 278% in the last year thanks to revenue growth, better margins, and higher multiples. As of January 2026, Micron shows:

Market capitalization: $461.73 billion

Forward P/E ratio: 12.97

Price-to-sales ratio: 10.95

Micron looks relatively cheap compared to peers, trading at 8.9 times forward P/E - the lowest in its group.

Micron Technology investment outlook

Wall Street likes Micron's future, with 41 analysts giving it a "Strong Buy" rating. Experts think Micron's earnings per share will hit $32.19 in fiscal 2026, growing over 300% year-over-year.

The risks are real though. Micron has seen big drops before, falling 82% during the Dot-Com Bubble and 88% in the Global Financial Crisis. While demand looks strong now, past memory industry patterns suggest supply-demand balance could hurt margins later.

AI infrastructure growth gives Micron clear revenue visibility and pricing power. The company's tech leadership in HBM and smart capital use puts it in a great spot to benefit from the AI-driven memory boom through 2026 and beyond.

Lam Research

Image Source: Lam Research Newsroom

Lam Research Corporation is a vital equipment supplier to the semiconductor industry. The company provides sophisticated tools that help memory manufacturers produce next-generation chips. Their specialized fabrication equipment has become crucial to producing high-performance memory technologies in the AI-driven memory boom.

Lam Research business overview

This Fremont, California-based company started in 1980. Lam Research designs, manufactures, markets, and services semiconductor processing equipment used to make integrated circuits. The company's global operations span across the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe. Their product line has critical tools for thin film deposition, plasma etch, and wet processing technologies. The company's workforce reached about 19,400 people worldwide by 2025. They stand as the Bay Area's third-largest manufacturer, right behind Tesla and Intuitive Surgical.

Lam Research growth drivers

Several key factors propel Lam's development:

AI-centric chips and high-bandwidth memory see rising demand

Memory-intensive applications drive higher DRAM spending

Asian manufacturing expansion improves margins and cuts costs

Next-generation semiconductors need advanced packaging technologies

The company's 15 years of advanced packaging expertise helped create solutions vital for HBM production. They expanded geographically by building manufacturing facilities in Batu Kawan, Malaysia. Their India Center for Engineering in Bengaluru works closely with key customers to improve R&D capabilities.

Lam Research financial performance

The company's financial health shows impressive numbers. Their quarter ending September 28, 2025, revealed:

| Financial Metric | Value | Year-over-Year Change |

| Revenue | $5.32 billion | 28% increase |

| Gross Margin | 50.4% | 0.3% increase |

| Operating Income | 34.4% of revenue | Growth from 33.7% |

| Net Income | $1.57 billion | <citation index="58" link="https://finance.yahoo.com/quote/LRCX/key-statistics/" similar_text="### Financial Highlights ### Fiscal Year Fiscal Year Ends |

Lam's revenue reached $19.59 billion with earnings of $5.81 billion in the twelve months ending September 2025. Their strong balance sheet shows $6.69 billion in total cash and a current ratio of 2.21.

Lam Research AI and HBM relevance

Lam leads the industry in HBM manufacturing equipment. Their solutions create 3D stacked architecture that delivers 16x higher bandwidth than traditional memory. The company's specialized tools stand out:

Syndion® etch systems create precise microscopic TSV holes for HBM3. SABRE 3D® deposition tools handle copper filling and electrical connections. Striker® ALD products make film-coating layers just atoms thin. These state-of-the-art tools help manufacture memory chips that meet AI applications' demanding needs.

Lam Research stock valuation

Lam Research stock jumped 164.8% in the last year, beating the semiconductor industry's 41.6% gain. The company's market value hit roughly $280 billion by January 2026. Their forward P/E ratio of 40.19 tops the industry's 34.5 average. All the same, this value stays below ASML's 41.13 P/E multiple but exceeds Applied Materials' 30.42.

Lam Research investment outlook

Wall Street analysts give Lam Research a "Strong Buy" rating. They expect wafer fabrication equipment demand to stay strong. Industry forecasts predict 9% growth to $126 billion in 2026, followed by a 7.3% rise to $135 billion in 2027. Zacks Consensus Estimate projects 14.1% revenue growth for fiscal 2026 and 12.5% for fiscal 2027.

The stock's premium valuation makes sense given Lam's crucial role in AI-driven semiconductor manufacturing. Their technology leadership in advanced packaging and HBM fabrication tools puts them in a perfect spot to benefit from steady memory demand growth through 2026 and beyond.

Samsung Electronics

Image Source: Samsung Semiconductor

Samsung Electronics has taken back its crown as the world's largest semiconductor vendor. The tech giant surpassed Intel with revenue reaching $66.50 billion in 2024. Samsung's focus on memory technologies makes it a powerful force in the AI-driven semiconductor world.

Samsung Electronics business overview

Samsung Electronics runs its semiconductor operations through the Device Solutions (DS) Division. This division has three main business segments: Memory Business, System LSI Business, and Foundry Business. The company leads the memory technologies field for more than 30 years. They brought groundbreaking changes like extreme ultraviolet (EUV) technology and 3D V-NAND. The Memory Business creates DRAM and NAND flash products. System LSI develops logic semiconductors such as mobile processors and image sensors. The Foundry Business became an independent unit in 2017. It offers innovative process technologies from 5nm to advanced 2nm Gate-All-Around (GAA).

Samsung Electronics growth drivers

The booming AI industry powers Samsung's growth. It creates new market opportunities for both DS and DX (Device eXperience) Divisions. Samsung sells more high-value-added memory products designed for AI applications. They put special emphasis on growing their HBM (High Bandwidth Memory) sales. Samsung unveiled its 36GB HBM3E 12H in February 2024. This was the industry's first 12-stack HBM3E DRAM. HBM3E is now in mass production and reaches all related customers. The company also ships HBM4 samples to the core team of clients.

Samsung Electronics financial performance

The company posted strong financial results for 2025's third quarter. Consolidated revenue reached KRW 86.1 trillion—15.4% more than the previous quarter. Operating profit grew to KRW 12.2 trillion. The DS Division brought in KRW 7.0 trillion from revenue of KRW 33.1 trillion. The Memory Business hit record-high quarterly revenue. They expanded HBM3E sales and met strong demand across all applications. Samsung expects its Q4 2025 operating profit to triple to 20 trillion won, beating expectations by a lot.

Samsung Electronics AI and HBM relevance

Samsung became a key player in the AI memory space since 2016. Their relationship with NVIDIA goes back more than 25 years. It spans memory solutions and foundry services. They supply next-generation HBM4 for NVIDIA's upcoming Vera Rubin AI platform. Production of HBM4 will start in February 2026. Samsung will focus on mass-producing HBM4 products with unique performance while growing its HBM sales base.

Samsung Electronics stock valuation

Samsung's stock performance shines bright. Shares jumped 37% in the last month and 54% in the last three months. Total shareholder return for one year reached 188.9%. The stock's P/E ratio stands at 34.8x, above the Asian Tech industry average of 22.2x. KB Securities raised Samsung's target price from 200,000 won to 240,000 won. They believe earnings will exceed original forecasts.

Samsung Electronics investment outlook

Financial experts see big growth ahead for Samsung. KB Securities predicts first-quarter operating profit of 30 trillion won (up 355% year-on-year). Second-quarter operating profit could hit 39 trillion won (up 737%). The memory division might reach annual operating profit of 152 trillion won, 383% more than last year. Macquarie believes Samsung's comeback will rely heavily on memory. Operating profit growth in this segment should speed up in 2026. The semiconductor division should make up 55% of sales and 90% of operating profit in 2026.

SK Hynix

SK Hynix has become a powerhouse in high-bandwidth memory (HBM) production, leading the AI memory revolution and establishing itself as a crucial player in the global semiconductor world.

SK Hynix business overview

SK Hynix Inc. started its journey in 1949 with headquarters in Icheon, South Korea. The company manufactures and sells semiconductor products throughout Korea, China, Asia, the United States, and Europe. Memory semiconductors remain its core business, with products like DRAM, NAND storage, SSD, MCP, and CMM designed for servers, networks, mobile devices, personal computers, consumer goods, and automotive applications. The company employs 33,625 professionals worldwide as of 2025. The SK Group conglomerate welcomed Hynix Semiconductor Inc. in March 2012, which led to its current name SK Hynix.

SK Hynix growth drivers

AI infrastructure boom acts as SK Hynix's main catalyst. The company stands out as the only supplier that can deliver both HBM3E and next-generation HBM4 reliably, making it a key player in the semiconductor market transition. HBM memory chip demand could grow at an 82% annual rate through 2027, according to company estimates.

SK Hynix plans to invest 19 trillion won ($12.90 billion) in a new advanced chip packaging facility in Cheongju, South Korea. The project will break ground in April and should finish by 2027's end. This expansion will help address the tight global memory supply that could limit AI investment.

SK Hynix financial performance

Q3 2025 brought remarkable results for SK Hynix:

| Financial Metric | Value | Year-over-Year Change |

| Revenue | 24.45 trillion won | <citation index="3" link="https://news.skhynix.com/sk-hynix-announces-3q25-financial-results/" similar_text="■ 3Q25 Financial Results (K-IFRS) Unit: Billion KRW 3Q25 |

| Operating profit | 11.38 trillion won | 62% increase |

| Operating margin | 47% | 7 percentage points increase |

| Net profit | 12.60 trillion won | 119% increase |

The company's quarterly operating profit exceeded 10 trillion won for the first time. Cash and cash equivalents reached 27.9 trillion won by Q3 2025's end, jumping up by 10.9 trillion won from the previous quarter. The company moved to a net cash position of 3.8 trillion won, with interest-bearing debt at 24.1 trillion won.

SK Hynix AI and HBM relevance

SK Hynix dominates the AI memory ecosystem. Counterpoint Research shows the company leads with 62% of HBM shipments in Q2 2025 and 57% of revenue in Q3. Goldman Sachs notes that "SK hynix will maintain its dominant position in HBM3 and HBM3E until at least 2026, sustaining a total HBM market share of over 50%".

The company's early bet on HBM technology in 2013 paid off. They created a unique architecture that speeds up communication between processors powering ChatGPT and other leading AI models. SK hynix achieved another milestone by developing 12-layer HBM4 in September 2025. This innovation features 2,048 input/output channels - double the previous generation - which boosts bandwidth by a lot.

SK Hynix stock valuation

SK Hynix shares soared by 281.41% in the last year. The company's market value reached about 552.36 trillion won by January 2026. The stock trades at a P/E ratio of 17.01, much lower than Micron's 36.37. Other key metrics include:

Price-to-book ratio: 5.04

Price-to-sales ratio: 6.34

Price-to-cash flow ratio: 11.90

SK Hynix investment outlook

Analysts see bright prospects for SK Hynix in 2026. Morgan Stanley boosted its 2026 and 2027 earnings forecasts by 56% and 63% respectively, raising memory pricing assumptions. They now expect DRAM prices to jump 62% in 2026 while NAND prices could surge 75%.

World Semiconductor Trade Statistics predicts the global semiconductor market will grow over 25% in 2026, reaching about $975 billion. The memory segment should grow by 30%. Bank of America sees 2026 as a "supercycle similar to the boom of the 1990s," with global DRAM revenue rising 51% and NAND growing 45% year-over-year. The HBM market looks even more promising, with BofA projecting it to hit $54.60 billion in 2026, up 58% from the previous year.

Western Digital

Western Digital Corporation has become a dedicated hard disk drive (HDD) manufacturer after splitting off its Flash memory business in February 2025. This change makes the company a key provider of infrastructure that supports the data-heavy AI revolution.

Western Digital business overview

The company now puts all its focus on HDD technology after selling its Flash business. Its operations span three main areas: Cloud, Client, and Consumer. Cloud brought in most of the money during fiscal second quarter 2025, with $2.30 billion or 55% of total revenue. Client generated $1.20 billion (27%), while Consumer added $0.80 billion (18%). The company's focus on affordable high-capacity drives called Nearline storage has altered the map of its business. What was once a simple storage maker now provides vital AI infrastructure.

Western Digital growth drivers

Mass data storage for AI applications is the company's biggest growth engine. The management team has locked in firm orders from major hyperscale customers through 2026. One key client has even committed through 2027. The company plans to ship over 200 exabytes each quarter during 2026. AI, cloud, and data-heavy enterprise workloads will support this growth. Supply limitations should keep prices favorable through 2026.

Western Digital financial performance

The fiscal second quarter 2025 results show:

Revenue reached $4.29 billion, growing 5% from last quarter

GAAP earnings hit $1.63 per share, while Non-GAAP EPS reached $1.77

Cloud revenue grew 6% compared to last quarter

Gross margins should improve each quarter in 2026, reaching about 50%. Bank of America expects 2026 revenue to grow 25% to $11.90 billion. They also predict earnings per share will jump 56% to $7.87.

Western Digital AI and HBM relevance

High-capacity drives from Western Digital are now the foundations of AI infrastructure because AI models use massive datasets for training and storage. The company delivered 204 exabytes of storage last quarter, which was 23% more than the previous year. The company keeps pushing technology forward with advances like heat-assisted magnetic recording (HAMR) technology to create even larger capacity drives.

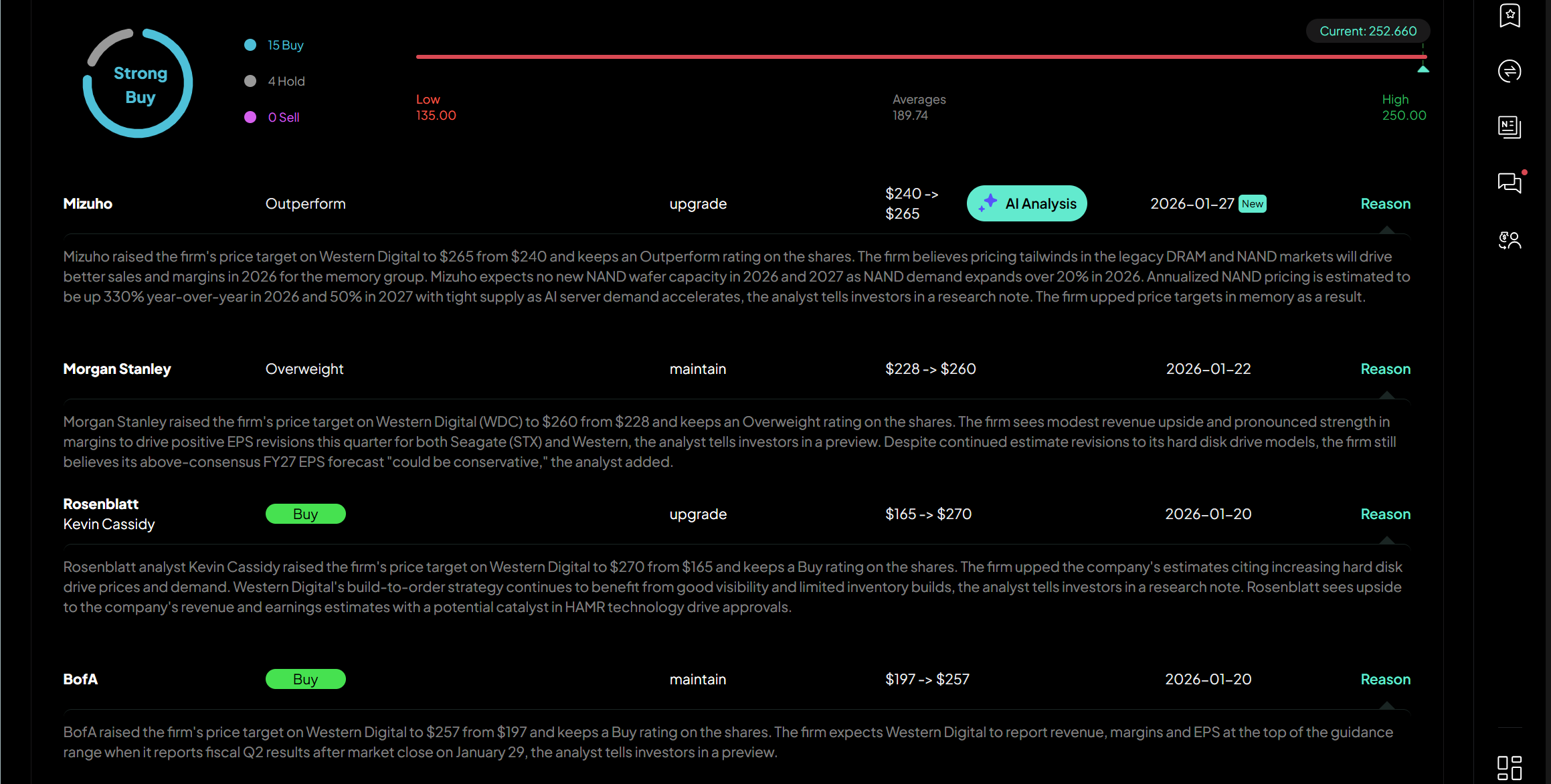

Western Digital stock valuation

The stock market has rewarded the company's new direction. The stock price has grown about 195% this year as of late 2025. Trading at $222.97, the stock has gained 23.1% in 30 days and 339.3% over the past year. Some analysts use discounted cash flow analysis to suggest the stock's true value is near $280.75 per share. This means it might be undervalued by 20.6%.

Western Digital investment outlook

Analysts see a bright future ahead. BofA thinks earnings per share could reach $9.91 in 2027 and $10.93 in 2028. Loop Capital has set an ambitious price target of $250.00, while Citigroup aims for $200.00. The Board of Directors showed their confidence by raising the quarterly dividend 25% to $0.12 per share.

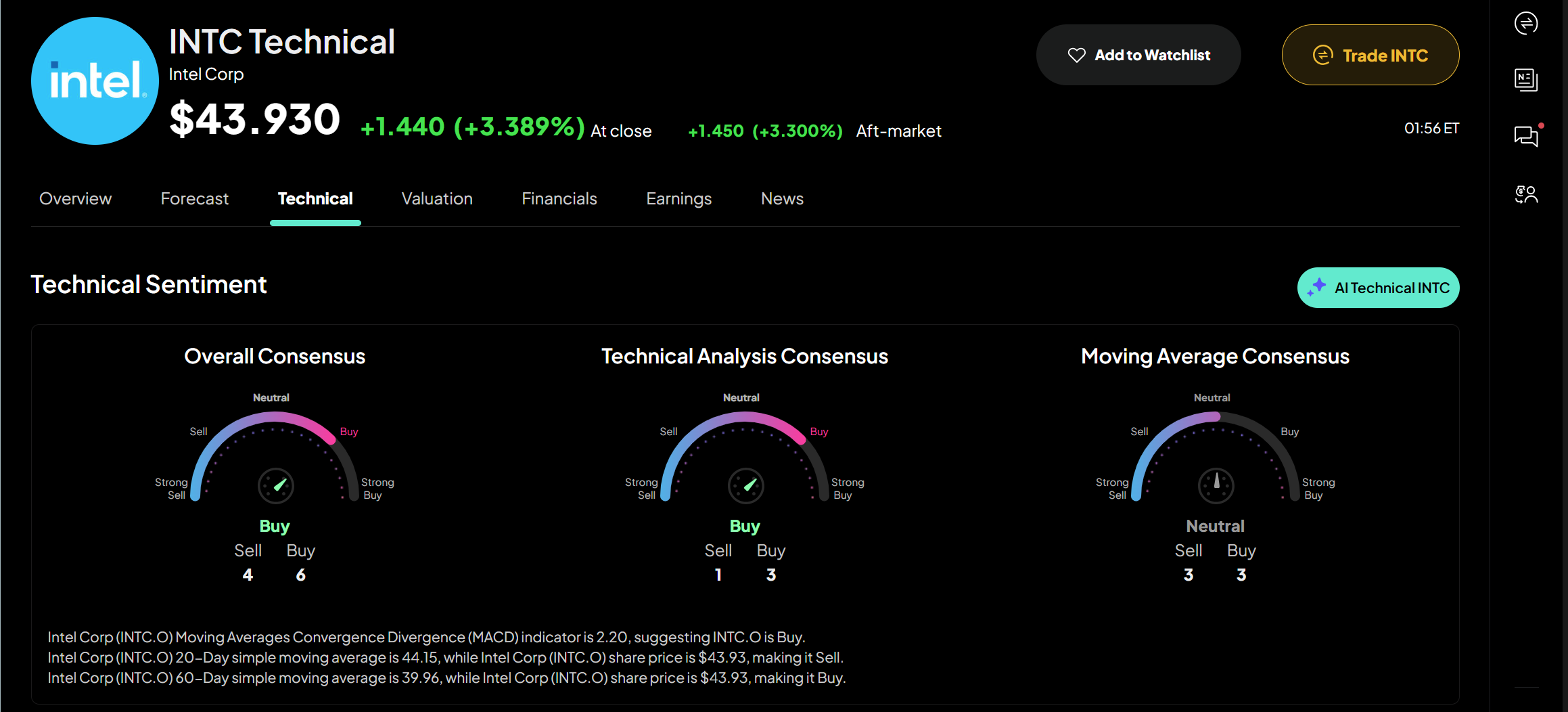

Intel Corporation

Image Source: Intellectia.ai

Intel Corporation, once a powerhouse in the semiconductor industry, has started a bold turnaround under CEO Lip-Bu Tan's leadership. The company's shift toward memory and AI technologies marks a turning point in its rich history.

Intel Corporation business overview

Intel stands as one of the world's biggest chip makers with its networking, memory, and communications products. The company has made some big changes after years of management mistakes led to AI product failures and job losses. Tan has rebuilt the chipmaking operations and simplified what he called a "bloated management structure". The restructuring brought Intel's Data Center and AI businesses under Kevork Kechichian to better align CPUs, GPUs, and platform strategy.

Intel Corporation growth drivers

Money from big players has helped Intel's financial strength. Nvidia put in $5.0 billion and SoftBank added $2.0 billion to help with the turnaround. The U.S. government's investment provides extra support. The company's future success depends on its manufacturing advances, especially the Intel 18A process—America's most advanced manufacturing technology. Intel has rolled out its "Panther Lake" PC chips, the first products using this critical 18A technology.

Intel Corporation financial performance

The company beat expectations with Q4 2025 revenue of $13.70 billion, higher than the predicted $13.37 billion. Non-GAAP earnings per share hit $0.15, which was almost twice the expected $0.08. The company generated $9.7 billion in cash from operations throughout the year. Money problems still exist though, as shown by recent figures:

| Metric | Value |

| Revenue (ttm) | <citation index="29" link="https://finance.yahoo.com/quote/INTC/key-statistics/" similar_text="### Financial Highlights ### Fiscal Year Fiscal Year Ends |

| Net Income | <citation index="29" link="https://finance.yahoo.com/quote/INTC/key-statistics/" similar_text="### Financial Highlights ### Fiscal Year Fiscal Year Ends |

| Diluted EPS | <citation index="29" link="https://finance.yahoo.com/quote/INTC/key-statistics/" similar_text="### Financial Highlights ### Fiscal Year Fiscal Year Ends |

| Operating Margin | <citation index="29" link="https://finance.yahoo.com/quote/INTC/key-statistics/" similar_text="### Financial Highlights ### Fiscal Year Fiscal Year Ends |

Intel Corporation AI and HBM relevance

The next-gen Xeon Scalable processors (code-named "Sapphire Rapids") will come with built-in High Bandwidth Memory. This gives a big boost to memory-hungry workloads. The technology has already won deals with the U.S. Department of Energy's Aurora supercomputer and the Crossroads supercomputer. Intel also unveiled "Crescent Island," a new energy-efficient AI chip coming in 2026. The company targets inference workloads instead of competing everywhere in AI, and positions itself as the key CPU supplier for AI systems.

Intel Corporation stock valuation

Intel's stock jumped 84% in 2025, beating the semiconductor index's 42% gain. The stock hit a 52-week high of $54.60 but dropped about 21% after Q4 earnings because of guidance concerns. This makes Intel's stock more reasonably priced despite its impressive 115% gain over 52 weeks. Before the recent drop, at least 10 brokerages had raised their targets or ratings as they expected more growth.

Intel Corporation investment outlook

Intel sees Q1 2026 revenue landing between $11.70 billion and $12.70 billion, which falls short of what analysts expected. Supply will be tightest in Q1 but should get better in Q2 and later. Higher memory costs create a big challenge since DRAM, NAND, and substrate price increases might "limit revenue opportunity in 2026". The company faces an odd situation—not enough supply despite strong demand, especially in data centers where AI makes x86 architecture more important. Analysts think the company will grow 3-7% each year over the next three years.

Marvell Technology

Image Source: Marvell Technology

Marvell Technology stands out from traditional memory manufacturers with its data infrastructure semiconductor solutions designed for AI applications. The company offers custom silicon and system-level connectivity platforms that help hyperscalers create optimized AI data-center architectures.

Marvell Technology business overview

Marvell Technology creates semiconductor solutions from data center core to network edge. The company now focuses on AI-centric data infrastructure, and data center workloads generate about 73% of its revenue.

Marvell Technology growth drivers

Strategic collaborations are the foundations of Marvell's growth strategy. The company acquired XConn Technologies for $540 million to improve its PCIe and CXL switching portfolio. They also bought Celestial AI for $3.25 billion to boost their photonic-fabric capabilities. Note that Marvell's custom silicon and electro-optics businesses drive its future expansion.

Marvell Technology financial performance

Marvell posted record fiscal 2026 third-quarter results:

Marvell Technology AI and HBM relevance

Marvell created a groundbreaking custom HBM compute architecture. This architecture allows up to 25% more area for compute, 33% greater memory capacity, and 70% reduction in memory interface power. Marvell works with leading memory manufacturers—Micron, Samsung, and SK hynix—to advance customization in cloud data center infrastructure.

Marvell Technology stock valuation

Marvell's market capitalization stands at approximately $70.40 billion with a P/E ratio of 29.0x. The company's shares have shown high volatility. Analyst fair value estimates range from $49.00 to $155.37, showing different viewpoints on the company's AI infrastructure potential.

Marvell Technology investment outlook

Marvell projects strong growth for fiscal 2026, with full-year revenue growth expected to top 40%. The Celestial AI acquisition could add about $500 million in annual revenue by FY28, deepening their commitment to AI datacenter infrastructure.

Comparison Table

| Company | Primary Focus | Recent Revenue | Key AI/Memory Products | Stock Growth (1-Year) | Notable Growth Driver | Market Cap |

| Micron Technology | DRAM & NAND Manufacturing | $37.40B (FY2025) | HBM3E, HBM4 Memory | 278% | AI-specific memory solutions | $461.73B |

| Lam Research | Semiconductor Equipment | $5.32B (Q3 2025) | HBM Manufacturing Equipment | 164.8% | AI chip fabrication tools | $280B |

| Samsung Electronics | Memory & Semiconductor Manufacturing | KRW 86.1T (Q3 2025) | HBM3E, HBM4 Memory | 188.9% | HBM production & AI memory | Not mentioned |

| SK Hynix | Memory Manufacturing | 24.45T won (Q3 2025) | HBM3E, HBM4 Memory | 281.41% | AI infrastructure & HBM | 552.36T won |

| Western Digital | HDD Manufacturing | $4.29B (Q2 2025) | High-capacity storage drives | 339.3% | AI data storage solutions | Not mentioned |

| Intel Corporation | Chip Manufacturing | $13.70B (Q4 2025) | Integrated HBM processors | 84% (2025) | Manufacturing technology (18A) | Not mentioned |

| Marvell Technology | Data Infrastructure Solutions | $2.08B (Q3 2026) | Custom HBM architecture | Not mentioned | AI-centric data infrastructure | $70.40B |

Conclusion

Memory stocks are on the verge of an unprecedented boom. AI applications fuel this growth. The seven companies show a clear pattern - each has positioned itself to excel in different parts of the memory ecosystem. Micron and SK Hynix lead high-bandwidth memory production. Samsung keeps its top spot across multiple semiconductor categories. Lam Research makes the essential equipment for next-generation memory manufacturing.

The memory sector's revenue jumped 78% in 2024, and this is just the beginning. HBM technology shines brightest in this space. Experts project it will reach $100 billion by 2028. Supply shortages will likely continue through 2026. This creates better pricing conditions and strong profit margins for companies in good positions.

Western Digital, Intel, and Marvell each tackle the memory boom differently. They focus on storage infrastructure, integrated processing solutions, and specialized data center connectivity. These companies build the foundation of AI infrastructure that will shape technology investments for years ahead.

You should evaluate their relative valuations and growth paths before buying these stocks. Sign up for Intellectia.AI to receive daily AI stock picks, trading signals and deep market analysis. This will help you progress from beginner to pro. The Intellectia.ai AI Screener serves as an excellent starting point. It helps you filter the entire market quickly to find companies that benefit from the Gemini 3 trend. You can spot Google's suppliers or competitors that increase their chip orders. The AI Stock Picker offers applicable information and clear recommendations daily.

The 2026 memory market boom offers a rare chance to invest wisely. Semiconductor stocks remain volatile. Yet, AI workloads create a fundamental change in demand that provides clear revenue visibility. Companies that lead in high-bandwidth memory technology and smart capital allocation will likely reward shareholders well. This trend will unfold over many years. Your timing matters - getting in now, before the market fully recognizes this potential, could lead to the best gains.