Key Takeaways

Gold has surged 259.57% over the past year to $5,552.60 per ounce, driven by geopolitical tensions, monetary policy uncertainty, and safe-haven demand that could intensify in February 2026.

• February 2026 represents a critical inflection point with Trump's tariff threats, Fed independence concerns, and Middle East tensions converging to create unprecedented market volatility.

• Central bank gold purchases remain structurally supportive with institutions buying 25-30% of global production annually as part of ongoing de-dollarization strategies.

• Silver's 150% rally in 2025 compressed the Gold/Silver ratio to 46:1, signaling potential continued outperformance and broader precious metals momentum.

• Key resistance at $5,111 with support at $4,500-$4,550 provides technical framework for February price action amid record trading volumes.

• Monitor five critical catalysts: FOMC meeting outcomes, US election developments, China's monetary policy, Gold/Silver ratio movements, and technical levels for directional signals.

The convergence of these factors suggests February could determine whether gold's historic rally continues or faces its first major correction, making it essential for investors to closely watch central bank decisions and geopolitical developments.

Gold price today shows an incredible rise, as the precious metal has surged 259.57% in the last year. The price stands at $5,552.60 per ounce. Gold keeps breaking records since hitting its previous peak of $5,419.64 per troy ounce in January 2026.

The gold and silver prices today tell an interesting story. A complete analysis points to several factors driving this momentum. Economic uncertainty, weakening dollar, and higher safe-haven asset demand play crucial roles. The metal's natural lack of supply adds to its lasting value. Experts estimate only about 120,000 metric tons have existed throughout human history.

February 2026 could reshape gold's future performance. Major geopolitical events and upcoming central bank decisions loom ahead. These next few weeks might determine if gold maintains its impressive 7.78% long-term annual return or faces fresh challenges.

What Makes February 2026 a Pivotal Month for Gold

February 2026 looks like a turning point in the ongoing gold rally. Gold prices sit above $5300 and touched $5400. Several crucial factors might determine where precious metals head for the rest of the year.

Key geopolitical events on the horizon

The world stage has grown more unstable, creating ideal conditions for gold price movements. Markets felt the shock when President Trump threatened a 100% tariff on Canada. His new tariffs on South Korean imports point to a widening trade conflict. On top of that, U.S. ships stationed near Iran keep tensions high in the region.

The "Greenland situation" has become a major source of market worry. Gold prices hit record levels after Trump's tariff threats about Greenland. This news, combined with U.S. forces capturing Venezuela's president in January, has created what analysts call "a choppy geopolitical and economic outlook".

These combined tensions could either calm down or get worse in February, making it a crucial month for gold's direction.

Upcoming central bank decisions

The Federal Reserve's February meeting will be a game-changer. Market watchers are paying close attention to the two-day policy meeting that starts in late January. Rates should stay the same, but everyone's eyes are on Fed Chair Jerome Powell's press conference as doubts grow about the central bank's independence.

Key points to watch:

Trump keeps pushing Powell to cut interest rates

Markets are uneasy about Powell's criminal investigation by the Justice Department

Powell's replacement after his May term ends might be "less resistant to political pressure"

February's decisions could shape monetary policy through 2026. A new Fed leadership might take a softer stance.

Market sentiment and investor behavior

Gold's popularity has exploded among investors, shown by record-breaking trading numbers. CME Group saw 3,338,528 contracts traded on January 26, beating October 2025's previous record.

The market lacks depth now, which means small investments can cause big price swings. This explains why gold and silver keep breaking records even though they seem overpriced. One analyst noted that "the rally has been powerful, but it has also been grounded in fundamentals".

Private investors see gold as protection against currency weakness and global uncertainty. This growing support base means February could tell us if gold's rally will last or face a downturn.

Most market experts remain optimistic. Some think gold might hit $6000 per ounce earlier than expected if things stay the same. Societe Generale aims for $6000 by year-end, while UBP sees $5200 by Q4 2026.

How Recent History Set the Stage for February

The gold market's remarkable state didn't happen overnight. Gold prices took an amazing trip through 2025. This set up what many analysts think could be a defining moment this February.

Gold's record highs in late 2025

Gold made history last year. Prices shot up 64%, making it the second-best year since 1970. The precious metal kept breaking records and reached $5000 in late 2025.

Several factors pushed this unprecedented rally:

People rushed to gold's safety as global tensions rose

Central banks bought heavily, taking 25-30% of what the world produced each year

Money poured into exchange-traded funds at record levels

People worried more about currency values as money supply grew fast

Gold proved itself as the top defensive asset by December 2025. Investment demand hit an all-time high of 2,175 tons, up 84%. The momentum carried into 2026, with prices climbing another 22% by late January. Gold touched $5326 on January 29.

Impact of global rate cuts and inflation

Central bank decisions played a key role in gold's rise through 2025. The Federal Reserve cut interest rates even though the economy grew over 3%. This created perfect conditions for assets that don't yield returns. The U.S. money supply (M2) grew from $15.40 trillion in January 2020 to $22.00 trillion by early 2026 – a 42% jump.

Gold strengthened its position as a hedge against inflation as real yields dropped. History shows gold protects wealth when paper money loses value. A study found that while inflation didn't always affect gold prices, the two showed positive links during certain times.

Central banks worldwide doubled their gold buying after February 2022. They bought over 1,000 tons yearly, twice what they bought from 2010-2021. J.P. Morgan expects about 755 tons of central bank purchases in 2026. This is lower than recent years but still much higher than pre-2022 levels.

Silver's surge and its influence on gold

Silver's performance outshone even gold's impressive run. The white metal's price jumped nearly 150% in 2025. It broke $100 for the first time and reached $117.69 in January 2026. Citi raised its short-term price target from $100 to $150 per ounce.

Both investment and industry needs drove this amazing rise. Silver plays a vital role in tech industries, especially electric vehicles and AI data centers. Supply got tight as China's tracked inventories fell to their lowest in a decade.

The Gold/Silver Ratio changed a lot through 2025. It fell below 60x for the first time in over ten years. Earlier that year, it hit 100 to 1 before silver's rally closed the gap. By late January 2026, this relationship showed silver might keep outperforming gold, which could push both metals higher into February.

Factors Driving Gold Prices Right Now

Image Source: Vaulted

Gold prices are hitting unprecedented levels in early 2026. Several forces work together to create what analysts call a perfect storm for precious metals.

Interest rate expectations

The market's expectations about monetary policy play a huge role in gold prices. Markets expect up to 150 basis points of Federal Reserve rate cuts throughout 2026. This creates a better environment for non-yielding assets like gold. Lower interest rates make gold more attractive compared to interest-bearing assets.

Investors are watching the upcoming Fed meeting closely. They're paying special attention to Chair Powell's press conference because of growing concerns about central bank independence. These worries about political influence on future monetary policy make gold more appealing as a hedge against uncertainty.

US dollar strength and inflation

Gold and the US dollar share a critical relationship, though it's more complex than before. Gold and the dollar typically move in opposite directions - a stronger dollar means weaker gold and the other way around.

This relationship has changed lately. Both gold and the dollar showed remarkable strength at the same time during 2023-2024. This unusual pattern challenges what we typically know about markets. Gold now responds to many factors beyond just dollar movements.

Gold continues to serve as a hedge against inflation. People turn to gold when inflation rises because fiat currencies lose their purchasing power.

Geopolitical tensions and safe-haven demand

Gold's appeal grows stronger with current geopolitical risks. Middle East tensions have reached critical levels, and US naval forces are reportedly close to Iran. This uncertainty pushes investors toward safe-haven assets, sending gold prices to new records.

The conflict has sparked warnings about regional escalation. This adds fresh uncertainty to global markets and makes gold's role as a crisis hedge even stronger.

Central bank gold buying trends

Central banks keep buying gold steadily, which supports prices. Latest numbers show:

Net purchases of 45 tons in November 2025

Year-to-date purchases of 297 tons through November

National Bank of Poland (95t) leads as the largest reported official buyer

Expected central bank purchases of about 755 tons in 2026

Buying might slow down from recent record levels, but it's still much higher than pre-2022 averages. This shows central banks want to broaden their reserves beyond the US dollar.

Gold and silver price today: what it tells us

Gold trades at $5136.47 per ounce, up 18% since January 2026. Silver has shot up to $111.11 after hitting a record $117.69. It's gained over 55% this year, following a 146% surge in 2025.

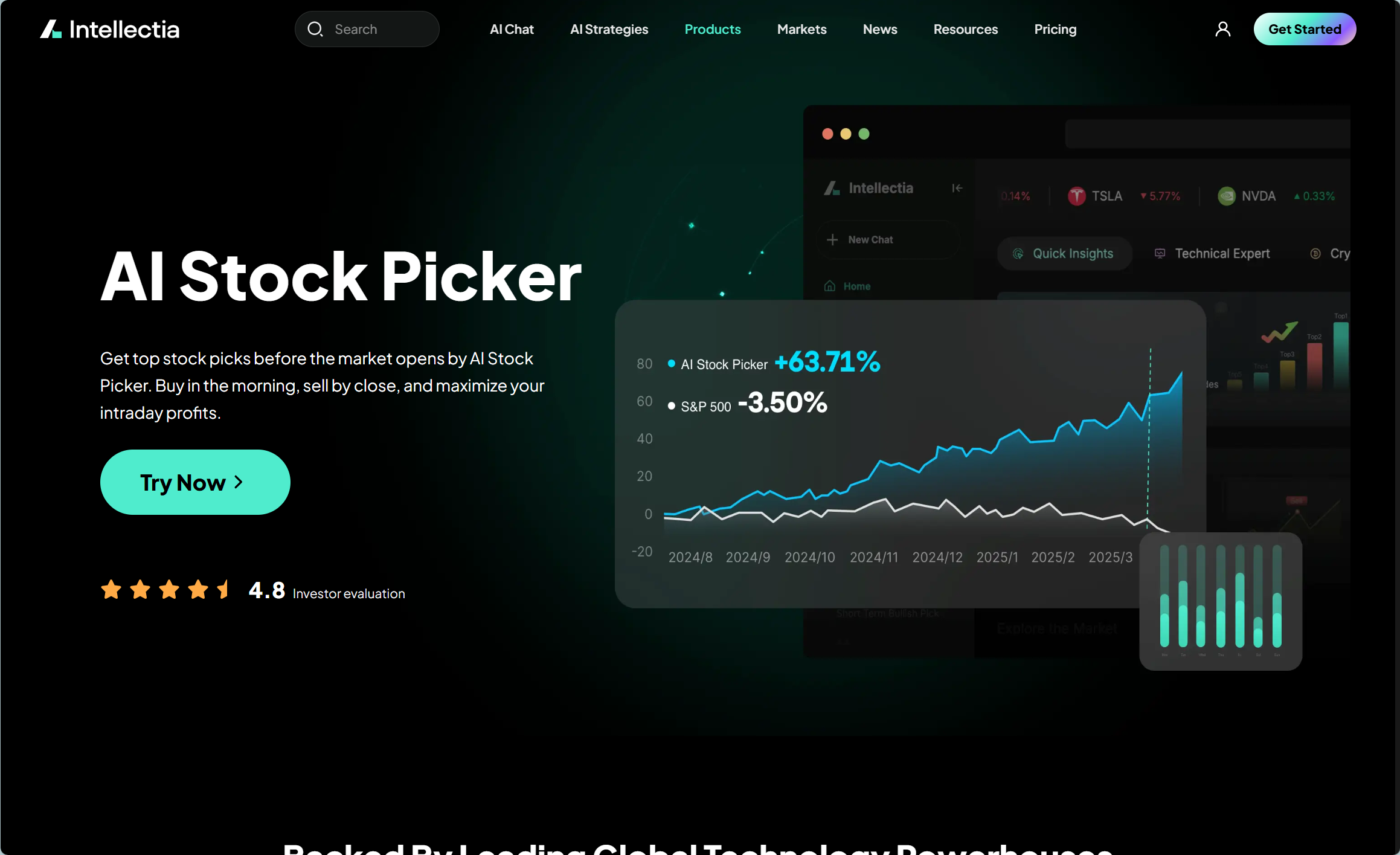

These remarkable gains show that investors see precious metals as key portfolio components in an uncertain world, not just crisis hedges. The Intellectia.ai AI Screener can help you spot market trends. You can filter the entire market to find companies that might benefit from the Gemini 3 trend—like Google's suppliers or competitors increasing their chip orders.

How Spot Prices Are Determined and Why They Matter

Image Source: Certified Gold Exchange

The gold price today moves based on a sophisticated global system. You need to understand how several key institutions and markets interact to determine gold's value, unlike stocks that trade on just one exchange.

Role of LBMA and COMEX

The London Bullion Market Association (LBMA) serves as the life-blood of global gold pricing. LBMA runs electronic auctions twice daily at 10:30 AM and 3:00 PM London time. Participants submit buy and sell orders until supply meets demand. This process sets the official LBMA Gold Price, which replaced the century-old "London Fix" in 2015. COMEX, a division of the CME Group, runs the world's busiest gold futures market in New York. The market trades contracts that represent 100-ounce gold bars. Daily trading volumes often reach over 200,000 contracts. This is a big deal as it means that COMEX shapes worldwide pricing, even though most contracts end in cash settlements rather than physical delivery.

Futures market influence

Futures contracts shape gold price analysis by responding to economic changes faster than physical markets. These contracts create the first price signals globally as traders make educated guesses about future values. Spot and futures prices connect through carrying costs and market sentiment. Arbitrage keeps futures prices lined up with LBMA-based spot pricing whenever futures drift too far from spot prices.

Arbitrage and global exchange dynamics

Traders buy gold where prices dip and sell where they rise. This arbitrage keeps prices consistent across global markets. The process gives gold and silver price today similar values worldwide, though regional differences exist. Price setting moves from Asia's Shanghai Gold Exchange to London's LBMA to New York's COMEX every 24 hours. Each region's market opening sparks new trading that affects spot prices right away. Beyond these major hubs, over-the-counter (OTC) trading between banks, bullion desks, and refineries adds physical demand patterns and regional premiums. This detailed price discovery system reflects both economic forces and real market conditions.

What Investors Should Watch in February 2026

Image Source: Yahoo Finance

Gold investors should watch these five key catalysts that could shape precious metal prices in the coming months.

FOMC meeting outcomes

The Fed will likely keep rates at 3.5%-3.75% at their January meeting. Markets are watching Powell's press conference closely for hints about future cuts. Political pressure for faster rate reductions has grown, and any signals could affect gold prices. This becomes more significant as questions about Fed independence surface.

US election developments

Market volatility continues to respond to President Trump's policy statements. Gold prices pushed past $5000 after his "liberation day" tariffs announcement and recent Greenland tensions. His stance on a weaker dollar has increased the appeal of precious metals as stores of value.

China's monetary policy shifts

Chinese buyers remain bullish on gold despite record prices. "There are still quite a lot of people buying it... it's still heading upwards," a Shanghai gold seller observed. The Chinese central bank's monthly gold purchases throughout 2025 point to ongoing de-dollarization efforts.

Gold/silver ratio signals

The ratio has dropped sharply to 46:1 from above 80:1 in early 2025. Such compression typically happens during times of monetary uncertainty and industrial expansion. The ratio might reach 32:1, matching 2011 lows.

Technical resistance and support levels

Gold tested resistance at $5111 before finding stability near $5000. Support levels lie between $4500-$4550, with additional backing at $4350-$4380.

Take your trading to the next level with Intellectia.AI today. Get daily AI stock picks, trading signals and in-depth market analysis to help you become a skilled trader.

Conclusion

February 2026 will be a defining moment for gold investors in these unprecedented market conditions. Gold prices have shot up by 259.57% in the last year and reached $5,552.60 per ounce. This remarkable surge wasn't random - it reflects a perfect storm of economic uncertainty, geopolitical tensions, and changing monetary policies.

Several vital factors make February stand out. Growing tensions around Greenland, Middle Eastern conflicts, and expanding trade disputes have created a strong need for safe-haven assets. The Federal Reserve's upcoming decisions could affect precious metals markets, especially with questions about its independence. These elements, along with strong central bank purchases and technical indicators, point to a possible turning point for gold.

Gold's stellar run through 2025 set the stage for today's market conditions. The precious metal gained 64% last year - its second-best yearly performance since 1970. Silver's amazing 150% rally shows strong market foundations rather than just speculation.

You should watch five key triggers as February draws near: FOMC meeting results, U.S. election progress, China's monetary policy changes, Gold/Silver ratio movements, and technical support/resistance levels. Each of these factors could affect gold's upward path or trigger a correction.

The AI Stock Picker offers evidence-based, applicable information to help with daily recommendations.

Gold prices have hit record highs, but past patterns hint at more growth potential if current conditions stay. The precious metal has shown its worth as both a safe-haven asset and inflation hedge when economic uncertainty rises. February 2026 might be more than just another month in gold's timeline - it could transform how investors view precious metals for years ahead.